|

市场调查报告书

商品编码

1928880

空中消防市场机会、成长要素、产业趋势分析及2026年至2035年预测Aerial firefighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

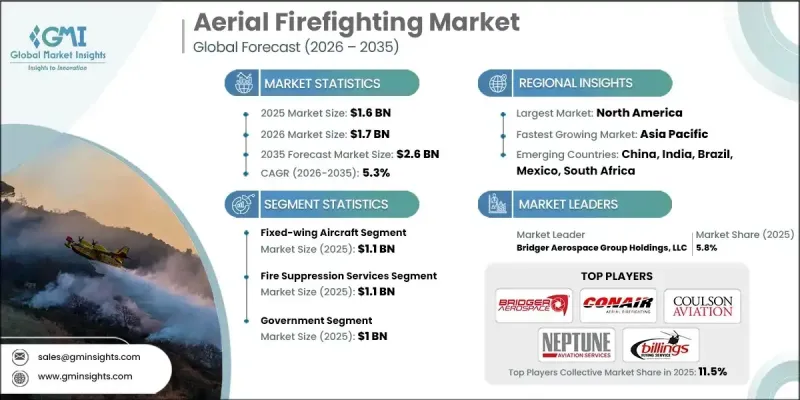

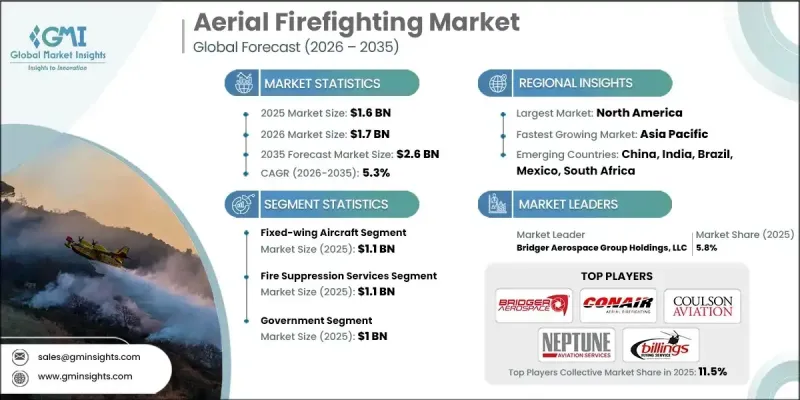

全球空中消防市场预计到 2025 年将达到 16 亿美元,预计到 2035 年将达到 26 亿美元,年复合成长率为 5.3%。

市场成长主要受气候变迁驱动,气候变迁导致野火愈发严重且频繁,同时,公共和私人部门对紧急应变基础设施的投资也不断增加。世界各国政府正优先考虑机队更新和采用先进的航空解决方案,以提高野火防备和回应效率。区域和国际合作的加强,以及长期灾害管理策略的实施,持续支撑市场需求。空中灭火在控制野火方面发挥着至关重要的作用,它能够快速部署消防资源,并为难以到达地区的地面行动提供支援。这些能力有助于减缓火势蔓延,保护社区,并挽救关键资产。航空平台、操作技术和任务规划系统的持续创新进一步提升了空中灭火的效能。随着全球野火风险的增加,空中灭火仍是综合火灾管理策略中不可或缺的工具。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 16亿美元 |

| 预测金额 | 26亿美元 |

| 复合年增长率 | 5.3% |

预计2025年,固定翼飞机市场规模将达到11亿美元,成为整体市场的主要贡献者。由于这些平台能够有效覆盖大面积区域并在消防行动中运送高负载容量,因此仍被广泛部署。它们的航程和单次任务的成本效益支持大规模野火应对,尤其是在广阔区域。公共机构和服务供应商的长期使用将持续推动对固定翼解决方案的需求。

预计到2025年,消防服务业的市场规模将达到11亿美元。该行业的优势在于其在野火应对中的核心作用,并得益于持续的公共资金支持和多年合约。野火强度不断增加的趋势持续提升了对快速空中救援的需求,从而推动了以消防为核心业务的长期成长。

预计2025年,北美空中消防市占率将达到44.2%。强大的政府资金支持体系、先进的航空基础设施以及频繁的大规模野火事件,巩固了该地区的主导地位。美国拥有高度发展的空中消防生态系统,能够支援快速部署、持续的机队现代化以及先进紧急技术的整合。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 野火发生频率和严重性增加

- 机队现代化和飞机投资

- 引进通用和水陆两用飞机

- 利用先进的航空电子设备和即时监控

- 支持性的政府政策和倡议

- 产业潜在风险与挑战

- 先进封装技术高成本且复杂

- 回收和监管合规方面的挑战

- 市场机会

- 整合数位技术和物联网包装

- 拓展在製药和医疗包装领域的应用范围

- 司机

- 成长潜力分析

- 监管环境

- 波特分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 定价策略

- 新兴经营模式

- 合规要求

- 国防预算分析

- 全球国防费用趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 主要国防现代化项目

- 预算预测(2025-2034 年)

- 对产业成长的影响

- 各国国防预算

- 按部门分類的国防预算分配

- 人员

- 运作/维护

- 采购

- 研究与发展、测试与评估

- 基础设施和建筑

- 技术与创新

- 对永续性的承诺

- 供应链韧性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 併购和策略联盟

- 风险评估与管理

- 赢得的主要合约(2021-2024)

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线的广度

- 科技

- 创新

- 地理分布比较

- 全球扩张分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导企业

- 受让人

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 依车辆类型分類的市场估计与预测,2022-2035年

- 固定翼飞机(飞机)

- 超大型空中洒水机(VLAT)

- 大型高空灭火器(LAT)

- 中型空中灭火器

- 单引擎空中消防飞机(SEAT)

- 两栖水上飞机

- 固定翼支援和指挥飞机

- 旋翼机(直升机)

- 重型运输直升机

- 中型直升机

- 轻型直升机

- 直升机支援和机组人员作业

- 无人机系统(UAS/无人机)

第六章 依服务类型分類的市场估算与预测,2022-2035年

- 消防服务

- 空中侦察/监视

- 物流、运输和支持

7. 依最终用途分類的市场估计与预测,2022-2035 年

- 政府

- 政府间合作组织

- 军事/民防组织

- 私人消防承包商

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第九章:公司简介

- 10 Tanker Air Carrier

- Aero Air LLC

- Aero Flite, Inc.

- Air Resources Helicopters Inc.

- Airstrike Firefighters LLC

- Billings Flying Service

- Bridger Aerospace Group Holdings, LLC

- CO Fire Aviation

- Conair Group Inc.

- Coulson Aviation

- Dauntless Air, Inc.

- Fire Colorado

- Global SuperTanker

- Grayback Forestry

- Heli-1 Corporation

- Helicopter Transport Services

- Neptune Aviation Services

- SILLER HELICOPTERS INC.

- Titan-Firefighting

The Global Aerial firefighting Market was valued at USD 1.6 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 2.6 billion by 2035.

Market expansion is driven by the growing severity and frequency of wildfires linked to changing climate conditions, alongside rising public and private investment in emergency response infrastructure. Governments worldwide are prioritizing fleet upgrades and advanced aviation solutions to improve wildfire preparedness and response efficiency. Increased coordination between regions and countries, combined with long-term disaster management strategies, continues to support demand. Aerial firefighting plays a vital role in wildfire containment by enabling rapid deployment of suppression resources and supporting ground operations in hard-to-reach areas. These capabilities help slow fire progression, safeguard communities, and protect vital assets. Continuous innovation in aviation platforms, operational technologies, and mission planning systems further enhances effectiveness. As wildfire risks escalate globally, aerial firefighting remains an essential tool within integrated fire management strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 billion |

| Forecast Value | $2.6 billion |

| CAGR | 5.3% |

The fixed-wing aircraft segment generated USD 1.1 billion in 2025, making this segment the leading contributor to the market. These platforms remain widely deployed due to their ability to cover extensive areas efficiently and deliver high payload volumes during suppression operations. Their operational range and cost efficiency per mission support large-scale wildfire response, particularly in expansive regions. Long-standing use by public agencies and service providers reinforces continued demand for fixed-wing solutions.

The fire suppression services segment recorded USD 1.1 billion in 2025. This segment's strength is tied to its central role in active wildfire response, supported by sustained public funding and multi-year service contracts. Rising wildfire intensity continues to reinforce the need for rapid aerial intervention, supporting long-term growth for suppression-focused operations.

North America Aerial firefighting Market accounted for 44.2% share in 2025. Strong government funding frameworks, advanced aviation infrastructure, and frequent large-scale wildfire events underpin regional leadership. The United States maintains a highly developed aerial firefighting ecosystem that supports rapid deployment, ongoing fleet modernization, and integration of advanced response technologies.

Major companies active in the Global Aerial firefighting Market include Coulson Aviation, Conair Group Inc., Bridger Aerospace Group Holdings, LLC, Neptune Aviation Services, 10 Tanker Air Carrier, Global SuperTanker, Titan-Firefighting, Grayback Forestry, Aero Flite, Inc., Billings Flying Service, Heli-1 Corporation, Dauntless Air, Inc., Air Resources Helicopters Inc., CO Fire Aviation, Airstrike Firefighters LLC, Helicopter Transport Services, SILLER HELICOPTERS INC., Fire Colorado, and Aero Air LLC. Companies operating in the Global Aerial firefighting Market focus on fleet modernization, service diversification, and long-term government partnerships to strengthen their market position. Investment in next-generation aircraft conversions and advanced mission systems improves operational efficiency and response speed. Many players pursue multi-year service contracts to secure stable revenue and long-term deployment opportunities. Geographic expansion supports participation in international firefighting programs and seasonal demand balancing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Vehicle type trends

- 2.2.3 Service type trends

- 2.2.4 End Use Industry trends

- 2.2.5 Regional trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Executive decision points

- 2.3.2 Critical success factors

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising frequency and severity of wildfires

- 3.2.1.2 Investments in fleet modernization and aircraft

- 3.2.1.3 Adoption of multi-role and amphibious aircraft

- 3.2.1.4 Use of advanced avionics and real-time monitoring

- 3.2.1.5 Supportive government policies and initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of advanced packaging technologies

- 3.2.2.2 Recycling and regulatory compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of digital technologies and iot-enabled packaging

- 3.2.3.2 Expansion in pharmaceutical and healthcare packaging applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By Region

- 3.8.2 By Product

- 3.9 Pricing Strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Defense budget analysis

- 3.13 Global defense spending trends

- 3.14 Regional defense budget allocation

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Middle East and Africa

- 3.14.5 Latin America

- 3.15 Key defense modernization programs

- 3.16 Budget Forecast (2025-2034)

- 3.16.1 Impact on industry growth

- 3.16.2 Defense budgets by country

- 3.16.3 Defense budget allocation by segment

- 3.16.3.1 Personnel

- 3.16.3.2 Operations and maintenance

- 3.16.3.3 Procurement

- 3.16.3.4 Research, development, test and evaluation

- 3.16.3.5 Infrastructure and construction

- 3.16.3.6 Technology and innovation

- 3.17 Sustainability initiatives

- 3.18 Supply chain resilience

- 3.19 Geopolitical analysis

- 3.20 Workforce analysis

- 3.21 Digital transformation

- 3.22 Mergers, acquisitions, and strategic partnerships landscape

- 3.23 Risk assessment and management

- 3.24 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 1.1.1 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Vehicle Type, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Fixed-Wing Aircraft (Planes)

- 5.2.1 Very Large Air Tankers (VLAT)

- 5.2.2 Large Air Tankers (LAT)

- 5.2.3 Medium air tankers

- 5.2.4 Single Engine Air Tankers (SEAT)

- 5.2.5 Amphibious scooper aircraft

- 5.2.6 Fixed-wing support & command aircraft

- 5.3 Rotary-wing aircraft (helicopters)

- 5.3.1 Heavy-lift helicopters

- 5.3.2 Medium helicopters

- 5.3.3 Light helicopters

- 5.3.4 Helicopter support & crew operations

- 5.4 Unmanned Aerial Systems (UAS / Drones)

Chapter 6 Market Estimates and Forecast, By Service Type, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Fire suppression services

- 6.3 Aerial reconnaissance & surveillance

- 6.4 Logistics, transport & support

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Government

- 7.2.1 Inter-governmental & cooperative bodies

- 7.2.2 Military & civil defense organizations

- 7.3 Private firefighting contractors

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 10 Tanker Air Carrier

- 9.2 Aero Air LLC

- 9.3 Aero Flite, Inc.

- 9.4 Air Resources Helicopters Inc.

- 9.5 Airstrike Firefighters LLC

- 9.6 Billings Flying Service

- 9.7 Bridger Aerospace Group Holdings, LLC

- 9.8 CO Fire Aviation

- 9.9 Conair Group Inc.

- 9.10 Coulson Aviation

- 9.11 Dauntless Air, Inc.

- 9.12 Fire Colorado

- 9.13 Global SuperTanker

- 9.14 Grayback Forestry

- 9.15 Heli-1 Corporation

- 9.16 Helicopter Transport Services

- 9.17 Neptune Aviation Services

- 9.18 SILLER HELICOPTERS INC.

- 9.19 Titan-Firefighting