|

市场调查报告书

商品编码

1928931

水瓶市场机会、成长要素、产业趋势分析及2026年至2035年预测Water Bottle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

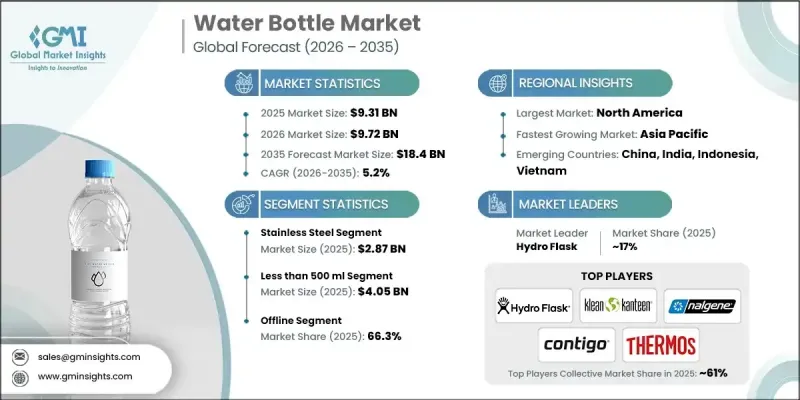

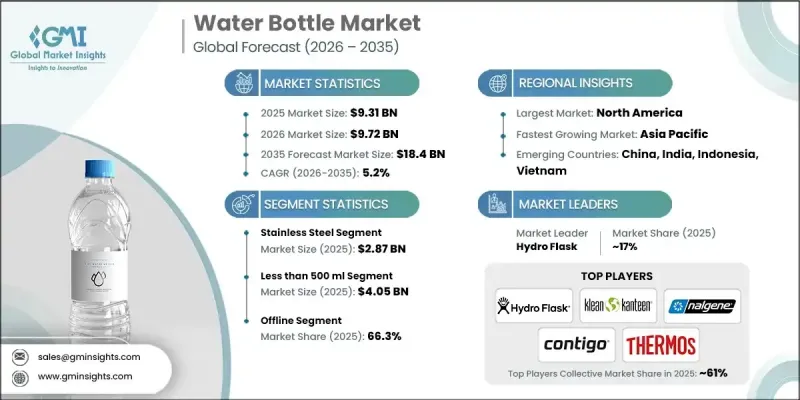

全球水瓶市场预计到 2025 年价值 93.1 亿美元,到 2035 年达到 184 亿美元,年复合成长率为 5.2%。

市场成长的驱动力在于消费者对可重复使用产品的广泛需求,而这种需求的驱动力又源自于意识提升对环境影响和长期减少废弃物的不断增强。人们对塑胶污染日益增长的担忧促使他们用符合永续生活方式的可重复填充容器取代一次性容器。公共意识宣传活动和有组织的永续性项目正在强化重复填充的习惯,并推动对耐用水瓶的稳定需求。消费者越来越倾向选择兼具环保责任和长期经济价值的产品。这种转变也影响零售策略,经销商正在扩大可重复使用水瓶的供应范围,以满足不断变化的偏好。同时,积极生活方式的普及也促进了携带式饮水解决方案需求的成长。消费者优先考虑耐用、便利、保温和防漏的水瓶。专注于材料性能、保温性和设计的产品创新持续增强日常和外出旅行市场的活力。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 93.1亿美元 |

| 预测金额 | 184亿美元 |

| 复合年增长率 | 5.2% |

预计到 2025 年,不銹钢市场规模将达到 28.7 亿美元,2026 年至 2035 年的复合年增长率将达到 6.3%。这种材料的需求源自于其强度高、耐腐蚀、隔热性能优异,使其适用于各种环境下的重复使用。

预计到 2025 年,容量小于 500 毫升的水瓶市场规模将达到 40.5 亿美元,到 2035 年将以 4.6% 的复合年增长率成长。由于其体积小巧、便于携带,并且适合快速补水,尤其是在都市区,因此这一细分市场仍然很受欢迎。

预计到 2025 年,美国水瓶市场规模将达到 20.2 亿美元,2026 年至 2035 年的复合年增长率将达到 4.3%。健康意识的增强、对永续性的追求以及对高品质隔热产品的需求,将继续推动美国市场的扩张。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 推广使用可重复使用产品,以减少一次性塑胶废弃物。

- 拓展健身、运动和户外休閒活动

- 公司和机构越来越多地使用品牌水瓶

- 挑战与困难

- 激烈的竞争和产品同质化

- 耐用性问题(低成本塑胶和金属瓶)

- 机会

- 具备饮水追踪功能的智慧水瓶需求上升

- 扩大永续材料的应用,例如再生塑胶和生物基聚合物

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 波特分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 按材料分類的市场估算与预测,2022-2035年

- 塑胶

- 不銹钢

- 玻璃

- 其他的

第六章 依产能分類的市场估计与预测,2022-2035年

- 少于500毫升

- 500毫升等于1升

- 1公升或更多

7. 2022-2035年按分销管道分類的市场估算与预测

- 在线的

- 离线

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

第九章:公司简介

- Aquasana

- CamelBak Products

- Chilly's Bottles

- Contigo

- GobiLab

- HydraPak

- Hydro Flask

- Klean Kanteen, Inc.

- Nalgene

- Pacific Market International

- S'well

- SIGG Switzerland

- Thermos

- Tupperware Brands Corporation

- YETI Holdings

The Global Water Bottle Market was valued at USD 9.31 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 18.4 billion by 2035.

Market growth is supported by a broad shift toward reusable products as consumers become more conscious of environmental impact and long-term waste reduction. Rising concern over plastic pollution is encouraging people to replace disposable containers with refillable alternatives that align with sustainable living practices. Public awareness campaigns and institutional sustainability programs are reinforcing refill habits and driving consistent demand for durable bottles. Consumers are increasingly drawn to products that combine environmental responsibility with long-term economic value. This shift is also influencing retail strategies, as sellers expand reusable bottle assortments to meet evolving preferences. In parallel, growing participation in active lifestyles is contributing to higher demand for portable hydration solutions. Consumers are prioritizing bottles that offer durability, convenience, temperature retention, and leak resistance. Product innovation focused on material performance, insulation, and design continues to strengthen market momentum across both everyday and on-the-go usage.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.31 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 5.2% |

The stainless steel category generated USD 2.87 billion in 2025 and is expected to grow at a CAGR of 6.3% from 2026 to 2035. Demand for this material is driven by its strength, corrosion resistance, and superior thermal insulation, making it suitable for repeated use across diverse environments.

The bottles with a capacity of less than 500 milliliters accounted for USD 4.05 billion in 2025 and are projected to grow at a CAGR of 4.6% through 2035. This segment remains popular due to its compact form, ease of transport, and suitability for short-duration hydration needs, particularly in urban settings.

United States Water Bottle Market reached USD 2.02 billion in 2025 and is forecast to grow at a CAGR of 4.3% between 2026 and 2035. Rising health awareness, sustainability preferences, and demand for high-quality insulated products continue to support market expansion in the country.

Key companies operating in the Global Water Bottle Market include Hydro Flask, YETI Holdings, Thermos, CamelBak Products, Klean Kanteen, Inc., S'well, SIGG Switzerland, Nalgene, Contigo, Pacific Market International, Tupperware Brands Corporation, Aquasana, HydraPak, Chilly's Bottles, and GobiLab. Companies in the Global Water Bottle Market are strengthening their market position by focusing on material innovation, product differentiation, and sustainability messaging. Many brands are investing in advanced insulation technologies, lightweight designs, and long-lasting materials to improve user experience. Expanding product lines across multiple sizes and price segments helps capture a wider consumer base. Firms are also increasing visibility through digital platforms and direct-to-consumer channels to build stronger brand engagement. Strategic collaborations, limited-edition designs, and emphasis on eco-friendly credentials support customer loyalty and long-term market competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Capacity

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of reusable products to reduce single-use plastic waste

- 3.2.1.2 Expansion of fitness, sports, and outdoor recreation activities

- 3.2.1.3 Increasing corporate and institutional use of branded water bottles

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Intense price competition and product commoditization

- 3.2.2.2 Durability concerns low-cost plastic and metal bottles

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for smart water bottles with hydration tracking

- 3.2.3.2 Expansion of sustainable materials such as recycled plastics and bio-based polymers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Material, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Stainless steel

- 5.4 Glass

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 500 ml

- 6.3 500 ml - 1 L

- 6.4 More than 1 L

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aquasana

- 9.2 CamelBak Products

- 9.3 Chilly’s Bottles

- 9.4 Contigo

- 9.5 GobiLab

- 9.6 HydraPak

- 9.7 Hydro Flask

- 9.8 Klean Kanteen, Inc.

- 9.9 Nalgene

- 9.10 Pacific Market International

- 9.11 S’well

- 9.12 SIGG Switzerland

- 9.13 Thermos

- 9.14 Tupperware Brands Corporation

- 9.15 YETI Holdings