|

市场调查报告书

商品编码

1928969

液压马达市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Hydraulic Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

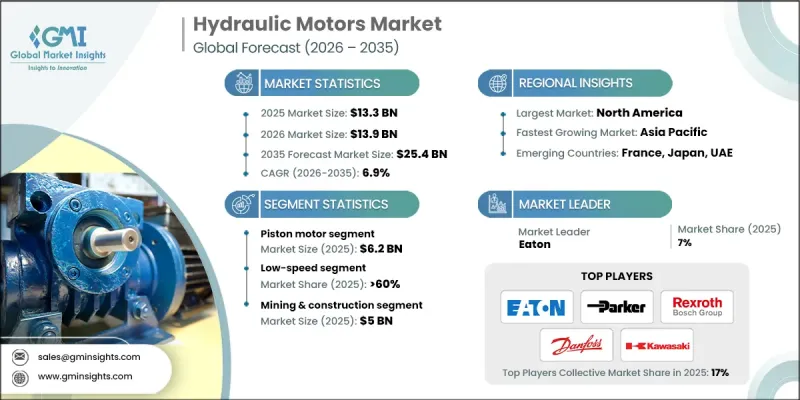

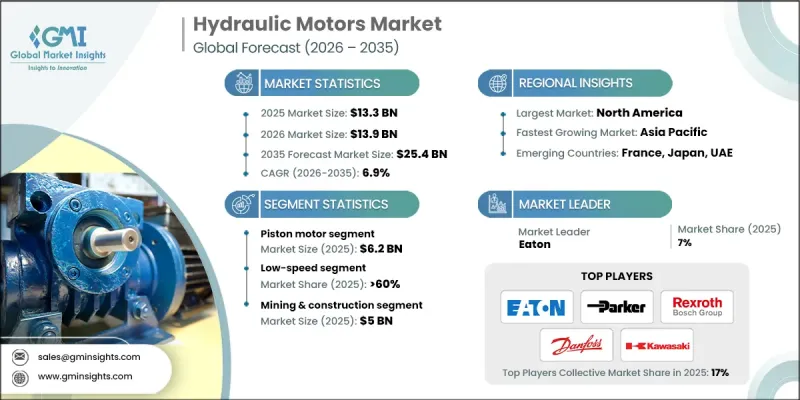

全球液压马达市场预计到 2025 年将达到 133 亿美元,到 2035 年将达到 254 亿美元,年复合成长率为 6.9%。

全球建筑、农业和采矿业的成长推动了这项需求的成长。政府对交通基础设施、住宅和工业计划的投资,带动了对装载机、起重机和挖掘机等重型设备的需求,这些设备依赖液压马达在恶劣条件下提供高扭矩和可靠的性能。在采矿业,液压驱动装置继续用于钻孔、矿物运输、破碎和物料输送,进一步推动了市场需求。在农业领域,机械化和向更高效设备的转变正在加速液压马达的普及,使企业能够降低人事费用、提高可靠性并提升生产效率。这些行业重型机械化的趋势为液压马达创造了强劲的成长机会,因为它们能够提供精确的控制、高功率密度和耐用性,适用于多个行业的长期运作。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 133亿美元 |

| 预测金额 | 254亿美元 |

| 复合年增长率 | 6.9% |

预计到2025年,活塞式液压马达的销售额将达到62亿美元。与其他液压马达相比,活塞式液压马达具有更高的功率密度、更好的可控性和更大的最大压力容量。它们透过径向或轴向排列的往復式活塞将液压能转化为旋转机械能,从而在低转速下产生极高的扭矩。

预计到2025年,低速液压马达市占率将达到60%。这类马达转速低于500转/分,能够以低能耗和最小系统负载提供高扭力。它们主要用于需要精密运动和精确定位的重型应用,是许多工业液压系统不可或缺的组成部分。

预计到2025年,美国液压马达市场将占据79.4%的市场份额,市场规模达36亿美元。这主要得益于建筑、采矿、农业、製造业和物料输送等行业需求的成长。联邦和州政府的基础设施发展项目,包括公路维护、桥樑建设、可再生能源计划和工业设施改造,也推动了液压马达的应用。此外,美国製造业在机器人、自动化和精密机械领域对大容量液压马达的需求不断增长,也进一步促进了市场发展。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 建筑业、农业和采矿业的扩张

- 工业自动化和工业4.0

- 技术进步

- 产业潜在风险与挑战

- 较高的初始投资和维护成本

- 与电动机的竞争

- 机会

- 智慧/数位化液压系统

- 开发环保液压油和低洩漏系统

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 波特分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 齿轮马达

- 叶片马达

- 活塞式马达

第六章 依成长速度分類的市场估计与预测,2022-2035年

- 低速(低于500转/分)

- 高速(>500 转/分)

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 采矿和建筑

- 石油和天然气

- 农业/林业

- 车

- 包装

- 工具机

- 物料输送

- 航太/国防

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第九章:公司简介

- Bosch Rexroth AG

- Bucker Hydraulics GmbH

- Casappa

- Concentric AB

- Daikin

- Danfoss Group

- Eaton

- Fluitronics GmbH

- SAI Group

- KYB

- Kawasaki Heavy Industries

- Linde Hydraulics

- Moog

- Nachi-Fujikoshi

- Parker Hannifin

The Global Hydraulic Motors Market was valued at USD 13.3 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 25.4 billion by 2035.

The rising demand is fueled by the global growth of construction, agriculture, and mining sectors. Government investments in transportation infrastructure, housing, and industrial projects are driving the need for heavy machinery such as loaders, cranes, and excavators, all of which rely on hydraulic motors for high torque and reliable performance in demanding conditions. Mining operations continue to depend on hydraulic-powered equipment for drilling, mineral transport, crushing, and material handling, further boosting market demand. In agriculture, mechanization and the shift toward high-efficiency equipment are accelerating adoption, allowing companies to reduce manual labor, increase reliability, and enhance productivity. The growing trend of large-scale machinery in these industries is creating a strong growth opportunity for hydraulic motors, as they provide precise control, high power density, and durability for long-term operations across multiple sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $13.3 Billion |

| Forecast Value | $25.4 Billion |

| CAGR | 6.9% |

In 2025, the piston motors segment generated USD 6.2 billion. Piston motors offer higher power density, improved controllability, and greater maximum pressure capacity than other hydraulic motors. By converting hydraulic energy into rotational mechanical energy through reciprocating pistons arranged radially or axially, they provide exceptionally high torque at low rotational speeds.

The low-speed hydraulic motors segment accounted for 60% share in 2025. These motors, operating below 500 RPM, deliver substantial torque with low energy consumption and minimal stress on the system. They are primarily used in heavy-duty applications requiring precise movement and accurate positioning, making them essential for many industrial hydraulic systems.

U.S. Hydraulic Motors Market held 79.4% share, generating USD 3.6 billion in 2025. Rising demand is driven by industries such as construction, mining, agriculture, manufacturing, and material handling. Federal and state infrastructure initiatives, including highway maintenance, bridge construction, renewable energy projects, and industrial facility upgrades, are boosting hydraulic motor adoption. The U.S. manufacturing sector is increasingly incorporating high-capacity hydraulic motors into robotics, automation, and precision machinery, further supporting market growth.

Key players in the Global Hydraulic Motors Market include KYB, Casappa, Concentric AB, Eaton, Bosch Rexroth AG, Linde Hydraulics, Moog, Bucker Hydraulics, Parker Hannifin, Daikin, Fluitronics GmbH, Nachi-Fujikoshi, Kawasaki Heavy Industries, Danfoss Group, and SAI Group. Companies in the Global Hydraulic Motors Market strengthen their foothold by focusing on technological innovation, product diversification, and high-performance solutions. Emphasizing high-torque, low-speed, and piston motor offerings allows manufacturers to address heavy-duty applications across multiple industries. Expanding presence through strategic partnerships, global distribution networks, and local service centers enhances market access. R&D investments drive the development of energy-efficient, durable, and precision-controlled motors, while the adoption of predictive maintenance and smart hydraulic systems improves client satisfaction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Speed

- 2.2.4 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of construction, agriculture & mining sectors

- 3.2.1.2 Industrial automation & industry 4.0

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment & maintenance costs

- 3.2.2.2 Competition from electric motors

- 3.2.3 Opportunities

- 3.2.3.1 Smart / digitized hydraulic systems

- 3.2.3.2 Development of eco-friendly hydraulic fluids & low-leak systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Gear motor

- 5.3 Vane motor

- 5.4 Piston motor

Chapter 6 Market Estimates and Forecast, By Speed, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low-speed (< 500 Rpm)

- 6.3 High-speed (>500 Rpm)

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Mining & construction

- 7.3 Oil & gas

- 7.4 Agriculture & forestry

- 7.5 Automotive

- 7.6 Packaging

- 7.7 Machine tool

- 7.8 Material handling

- 7.9 Aerospace & defense

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bosch Rexroth AG

- 9.2 Bucker Hydraulics GmbH

- 9.3 Casappa

- 9.4 Concentric AB

- 9.5 Daikin

- 9.6 Danfoss Group

- 9.7 Eaton

- 9.8 Fluitronics GmbH

- 9.9 SAI Group

- 9.10 KYB

- 9.11 Kawasaki Heavy Industries

- 9.12 Linde Hydraulics

- 9.13 Moog

- 9.14 Nachi-Fujikoshi

- 9.15 Parker Hannifin