|

市场调查报告书

商品编码

1928972

嵌入式厨房电器市场机会、成长要素、产业趋势分析及2026年至2035年预测Built-in Kitchen Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

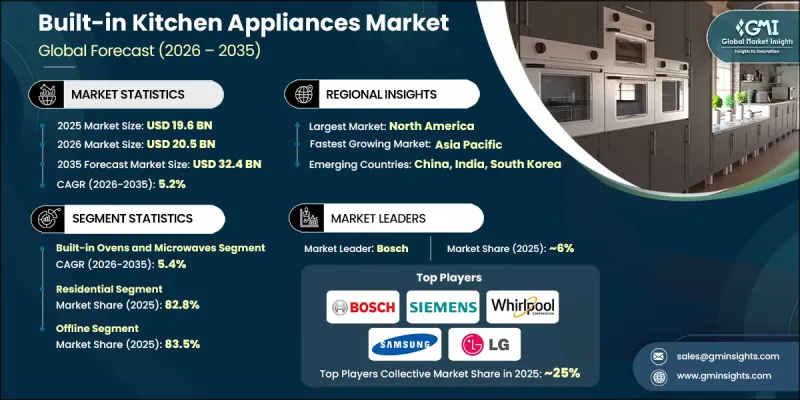

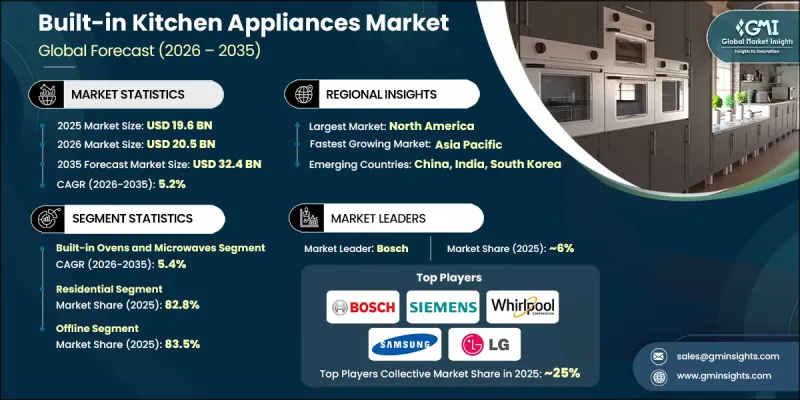

全球嵌入式厨房电器市场预计到 2025 年将达到 196 亿美元,到 2035 年将达到 324 亿美元,年复合成长率为 5.2%。

市场扩张与加速的城市发展密切相关,城市发展不断重塑各大城市的住宅模式。随着生活空间日益紧凑,住宅越来越重视高效的布局,力求在不牺牲设计的前提下最大限度地提升功能性。这种转变推动了整体式厨房解决方案的广泛应用,这类方案能够打造出统一且节省空间的视觉效果。内建家电与模组化厨房结构完美融合,与现代室内设计风格相得益彰。可支配收入的增加和偏好的转变也在影响消费者的购买行为,他们明显倾向于选择能够体现现代生活水准的高端厨房解决方案。此外,消费者对卓越性能、精緻设计和持久耐用性的追求也进一步推动了市场需求。这些因素正将厨房转变为以设计为主导的生活空间,而内建家电也已成为现代住宅环境中不可或缺的组成部分。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 196亿美元 |

| 预测金额 | 324亿美元 |

| 复合年增长率 | 5.2% |

预计到 2025 年,嵌入式烤箱和微波炉市场规模将达到 50 亿美元,2026 年至 2035 年的复合年增长率将达到 5.4%。此细分市场表现优异,因为亲和性,能够有效利用空间,提供先进的操作功能,同时保持视觉上的连贯性。

预计到 2025 年,住宅应用领域将占 82.8% 的市场份额,到 2035 年将以 5.3% 的复合年增长率成长。都市区住宅趋势和不断变化的生活方式期望持续推动对提供井然有序、高效便捷环境的整合式厨房解决方案的需求。

美国嵌入式厨房电器市场预计到 2025 年将达到 52 亿美元,从 2026 年到 2035 年的复合年增长率为 5.1%。消费者对高端整合电器的强劲需求,使其能够与现代住宅设计和奢华生活方式相得益彰,从而巩固了其市场主导地位。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 都市化与模组化厨房的兴起

- 优质化和生活方式提升

- 智慧家庭集成

- 挑战与困难

- 初始成本高,安装复杂。

- 维修选择有限。

- 机会

- 住宅建造和维修成长

- 关注永续性和能源效率

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 监管环境

- 北美洲

- 美国:消费品安全委员会(CPSC)联邦法规(CFR)第16篇第1512部分

- 加拿大:国际标准化组织(ISO)4210

- 欧洲

- 德国:德国标准化协会 (DIN) 欧洲标准 (EN) ISO 4210

- 英国:欧洲标准 (EN) ISO 4210/英国合格评定 (UKCA)

- 法国:欧洲标准 (EN) ISO 4210

- 亚太地区

- 中国:国家标准(GB)3565

- 印度:印度标准 (IS) 10613

- 日本:日本工业标准(JIS)D 9110

- 拉丁美洲

- 巴西:巴西技术标准协会 (ABNT) 巴西标准 (NBR) ISO 4210

- 墨西哥:国际标准化组织(ISO)4210

- 中东和非洲

- 南非:南非国家标准 (SANS) 311

- 沙乌地阿拉伯:沙乌地阿拉伯标准、计量和品质组织 (SASO) 海湾标准组织 (GSO) ISO 4210

- 北美洲

- 贸易统计(HS编码-8516)

- 主要进口国

- 主要出口国

- 波特分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 内建烤箱和微波炉

- 嵌入式冷藏库

- 嵌入式炉灶

- 内置式油烟机

- 其他的

第六章 2022-2035年按价格区间分類的市场估计与预测

- 低价位

- 中号

- 高价位范围

7. 按最终用户分類的市场估计和预测,2022-2035 年

- 住宅

- 商业的

- 餐饮(饭店、餐厅、咖啡厅)

- 酒吧和酒馆

- 其他(办公室等)

第八章 按分销管道分類的市场估算与预测,2022-2035年

- 线上管道

- 电子商务

- 公司网站

- 离线频道

- 专卖店

- 大型零售商店

- 其他(百货公司、合约销售等)

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

第十章:公司简介

- Bosch

- Electrolux

- Elica

- Faber

- Gaggenau

- Haier

- Hindware

- IFB

- KitchenAid

- LG

- Miele

- Panasonic

- Samsung

- Siemens

- Whirlpool

The Global Built-in Kitchen Appliances Market was valued at USD 19.6 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 32.4 billion by 2035.

Market expansion is linked to accelerated urban development, which continues to reshape residential construction patterns in major cities. As living spaces become more compact, homeowners increasingly prioritize efficient layouts that maximize functionality without compromising design. This shift has supported strong adoption of integrated kitchen solutions that deliver a cohesive and space-efficient appearance. Built-in appliances align well with modern interior planning by blending seamlessly into modular kitchen structures. Rising disposable income levels and changing lifestyle preferences are also influencing purchasing behavior, with consumers showing a clear inclination toward premium kitchen solutions that reflect modern living standards. Demand is further reinforced by the desire for advanced performance, refined design, and long-term durability. Together, these factors are transforming kitchens into design-focused living spaces and positioning built-in appliances as essential components of contemporary residential environments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $19.6 Billion |

| Forecast Value | $32.4 Billion |

| CAGR | 5.2% |

The built-in ovens and microwaves category generated USD 5 billion in 2025 and is forecast to grow at a CAGR of 5.4% from 2026 to 2035. This segment benefits from strong alignment with modular kitchen layouts, offering efficient space utilization and advanced operational capabilities while maintaining visual continuity.

The residential application segment accounted for 82.8% share in 2025 and is projected to grow at a CAGR of 5.3% through 2035. Urban housing trends and evolving lifestyle expectations continue to drive demand for integrated kitchen solutions that deliver organized, streamlined environments.

United States Built-in Kitchen Appliances Market reached USD 5.2 billion in 2025 and is expected to grow at a CAGR of 5.1% from 2026 to 2035. Market leadership is supported by strong consumer demand for high-end integrated appliances that align with contemporary home designs and premium living preferences.

Key participants operating in the Global Built-in Kitchen Appliances Market include Whirlpool, Samsung, LG, Bosch, Siemens, Miele, Electrolux, Panasonic, Haier, KitchenAid, Gaggenau, IFB, Hindware, Elica, and Faber. Companies in the Built-in Kitchen Appliances Market strengthen their competitive position through continuous product innovation, premium brand positioning, and expanded distribution networks. Investment in energy-efficient technologies, smart connectivity, and design-led engineering helps manufacturers meet evolving consumer expectations. Firms emphasize customization options and seamless integration capabilities to align with modern kitchen layouts. Strategic partnerships with real estate developers and interior designers support early product adoption in residential projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Market estimates & forecasts parameters

- 1.4 Forecast Model

- 1.4.1 Key trends for market estimates

- 1.4.2 Quantified market impact analysis

- 1.4.2.1 Mathematical impact of growth parameters on forecast

- 1.4.3 Scenario analysis framework

- 1.5 Primary research and validation

- 1.5.1 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Paid Sources

- 1.7 Primary research and validation

- 1.7.1 Primary sources

- 1.8 Research Trail & confidence scoring

- 1.8.1 Research trail components

- 1.8.2 Scoring components

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Price range

- 2.2.4 End use

- 2.2.5 Distribution channels

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and modular kitchen adoption

- 3.2.1.2 Premiumization and lifestyle upgrades

- 3.2.1.3 Smart home integration

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High initial cost and installation complexity

- 3.2.2.2 Limited retrofit options

- 3.2.3 Opportunities

- 3.2.3.1 Growth in residential construction and renovation

- 3.2.3.2 Sustainability and energy efficiency focus

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.7.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.7.2 Europe

- 3.7.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.7.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.7.2.3 France: European Norm (EN) ISO 4210

- 3.7.3 Asia Pacific

- 3.7.3.1 China: Guobiao (GB) 3565

- 3.7.3.2 India: Indian Standard (IS) 10613

- 3.7.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.7.4 Latin America

- 3.7.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.7.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.7.5 Middle East & Africa

- 3.7.5.1 South Africa: South African National Standard (SANS) 311

- 3.7.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.7.1 North America

- 3.8 Trade statistics (HS Code - 8516)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Built-in ovens & microwaves

- 5.3 Built-in refrigerator

- 5.4 Built-in hob

- 5.5 Built-in hoods

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Price Range, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End User, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 HoReCa

- 7.3.2 Bars & pubs

- 7.3.3 Others (offices, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online channels

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline channels

- 8.3.1 Specialty stores

- 8.3.2 Mega retail stores

- 8.3.3 Others (departmental stores, contract sales, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bosch

- 10.2 Electrolux

- 10.3 Elica

- 10.4 Faber

- 10.5 Gaggenau

- 10.6 Haier

- 10.7 Hindware

- 10.8 IFB

- 10.9 KitchenAid

- 10.10 LG

- 10.11 Miele

- 10.12 Panasonic

- 10.13 Samsung

- 10.14 Siemens

- 10.15 Whirlpool