|

市场调查报告书

商品编码

1928996

电动推动卫星市场机会、成长要素、产业趋势分析及2026年至2035年预测Electric Propulsion Satellites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

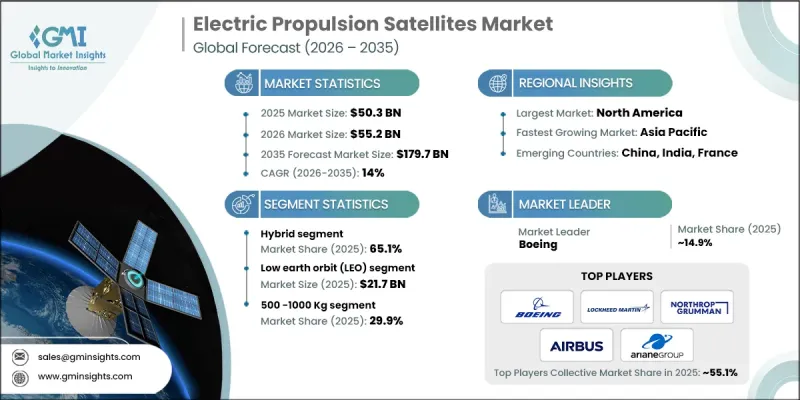

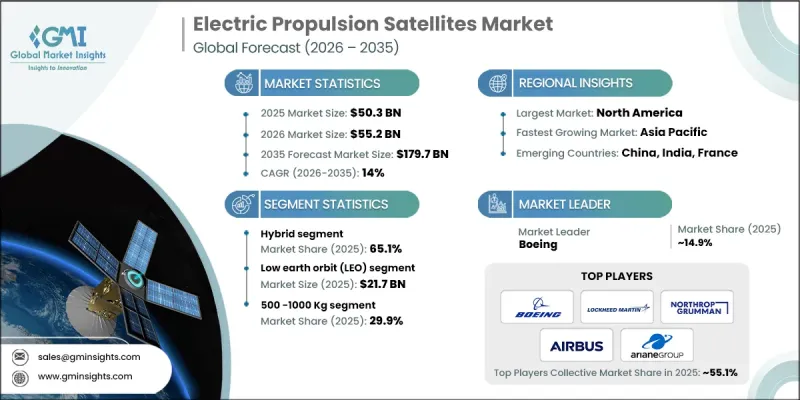

全球电力推进卫星市场预计到 2025 年将价值 503 亿美元,到 2035 年达到 1,797 亿美元,年复合成长率为 14%。

市场成长得益于对大型卫星星系需求的加速成长、电力推进效率的持续提升以及对成本优化型发射和在轨运行解决方案日益增长的需求。通讯、观测和安全卫星部署的不断增加,推动了对能够延长任务寿命并降低运行成本的推进系统的需求。电力推进技术的进步提高了推力效率和运作柔软性,使卫星能够以更少的燃料品质执行复杂的任务。人们对环境友善太空运作日益增长的兴趣也推动了更清洁推进系统的应用。商业航太生态系统的扩展,以及公共和私营相关人员参与度的提高,进一步刺激了市场需求。成本效益仍然是卫星专案的关键优先事项,这促使人们专注于能够平衡效能、扩充性和长期任务经济性的推进架构,从而支持市场的持续扩张。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 503亿美元 |

| 预测金额 | 1797亿美元 |

| 复合年增长率 | 14% |

到2025年,混合动力推进系统市占率将达到65.1%。此细分市场受惠于电力推进和化学推进系统的结合,能够满足多样化的任务需求。随着卫星营运商寻求既能保证机动性、续航力又能兼顾成本效益的可靠推进解决方案,对混合动力配置的需求持续成长。

预计到 2025 年,低地球轨道 (LEO) 卫星市场规模将达到 217 亿美元。对 LEO 卫星的强劲需求源于其适用于需要频繁部署的大型卫星群、高效的推进性能以及在广泛应用领域中可靠的运行覆盖。

到 2025 年,北美电力推进卫星市场将占 36.7% 的份额。该地区的市场领先地位得益于对卫星技术的持续投资、对先进通讯基础设施的强劲需求,以及在公共和私人资金的推动下推动技术不断创新的发展。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 对全球卫星星系的需求日益增长

- 电力推进技术效率的进步

- 对经济实惠的发射解决方案的需求日益增长

- 国防和商业航太发射数量激增

- 增加太空基础建设发展的投资

- 产业潜在风险与挑战

- 高昂的初始开发和实施成本

- 技术限制和性能问题

- 市场机会

- 对永续空间技术的需求日益增长

- 卫星零件小型化技术的进步

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 新兴经营模式

- 合规要求

- 国防预算分析

- 全球国防费用趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 供应链韧性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 併购和策略联盟趋势

- 风险评估与管理

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线的广度

- 科技

- 创新

- 地理分布比较

- 全球扩张分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导企业

- 受让人

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 重大进展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 Orbit 的市场估算与预测,2022-2035 年

- 低地球轨道(LEO)

- 中轨道(MEO)

- 地球静止轨道(GEO)

第六章 依卫星类型分類的市场估算与预测,2022-2035年

- 纯电动

- 杂交种

7. 2022-2035年按卫星品质分類的市场估算与预测

- 体重低于100公斤

- 100~500 kg

- 500~1000 kg

- 超过1000公斤

第八章 2022-2035年按推进方式分類的市场估算与预测

- 电暖型

- 静电

- 电磁

- 其他的

第九章 按应用领域分類的市场估算与预测,2022-2035年

- 地球观测

- 导航

- 沟通

- 天气监测

- 其他的

第十章 依最终用途分類的市场估计与预测,2022-2035年

- 政府

- 军队

- 其他的

- 商业的

第十一章 2022-2035年各地区市场估计与预测

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十二章:公司简介

- 主要企业

- Boeing

- Lockheed Martin

- Northrop Grumman

- Airbus

- ArianeGroup

- 按地区分類的主要企业

- 北美洲

- Aerojet Rocketdyne

- Busek Co. Inc.

- L3Harris Technologies

- 亚太地区

- Bellatrix Aerospace

- 欧洲

- OHB System

- Safran Group

- Sitael Spa

- Thales Alenia Space

- ThrustMe

- 北美洲

- 小众玩家/干扰者

- Accion Systems Inc.

- Ad Astra Rocket

The Global Electric Propulsion Satellites Market was valued at USD 50.3 billion in 2025 and is estimated to grow at a CAGR of 14% to reach USD 179.7 billion by 2035.

Market growth is supported by accelerating demand for large-scale satellite constellations, continuous improvements in electric propulsion efficiency, and rising preference for cost-optimized launch and in-orbit operation solutions. Increased deployment of satellites for communication, observation, and security purposes is reinforcing the need for propulsion systems that offer extended mission life and reduced operational costs. Advancements in electric propulsion technologies are enhancing thrust efficiency and operational flexibility, enabling satellites to perform complex missions with lower fuel mass. Growing emphasis on environmentally responsible space operations is also encouraging the adoption of cleaner propulsion alternatives. Expansion of the commercial space ecosystem, combined with rising participation from both public and private stakeholders, is further stimulating demand. Cost efficiency remains a key priority across satellite programs, driving interest in propulsion architectures that balance performance, scalability, and long-term mission economics, thereby supporting sustained market expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $50.3 Billion |

| Forecast Value | $179.7 Billion |

| CAGR | 14% |

The hybrid propulsion segment accounted for 65.1% share in 2025. This segment benefits from combining electric and chemical propulsion systems to meet diverse mission requirements. Demand for hybrid configurations continues to grow as satellite operators seek reliable propulsion solutions that support both maneuverability and endurance while maintaining cost efficiency.

The low Earth orbit segment generated USD 21.7 billion in 2025. Strong demand for LEO satellites is being driven by their suitability for large constellations requiring frequent deployment, efficient propulsion performance, and reliable operational coverage across a wide range of applications.

North America Electric Propulsion Satellites Market held 36.7% share in 2025. Market leadership in the region is supported by sustained investment in satellite technology, strong demand for advanced communication infrastructure, and continued development of propulsion innovations backed by public and private funding.

Key companies operating in the Global Electric Propulsion Satellites Market include Airbus, Boeing, Lockheed Martin, Northrop Grumman, Thales Alenia Space, Safran Group, Aerojet Rocketdyne, L3Harris Technologies, ArianeGroup, OHB System, Accion Systems, Bellatrix Aerospace, Busek, ThrustMe, Sitael, and Ad Astra Rocket. Companies in the Electric Propulsion Satellites Market are strengthening their competitive position through technology innovation, strategic partnerships, and capacity expansion. Many players are investing in advanced propulsion systems that improve efficiency, reduce mass, and extend satellite operational life. Expanding hybrid propulsion portfolios is a key strategy to address diverse mission profiles and customer requirements. Firms are also collaborating with satellite manufacturers and launch providers to integrate propulsion solutions early in spacecraft design.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Orbit trends

- 2.2.2 Satellite type trends

- 2.2.3 Satellite mass trends

- 2.2.4 Propulsion trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Regional

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for global satellite constellations

- 3.2.1.2 Progress in electric propulsion technology efficiency

- 3.2.1.3 Increasing demand for affordable launch solutions

- 3.2.1.4 Surge in space launches for defense, commercial

- 3.2.1.5 Increased investment in space infrastructure development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial development and implementation costs

- 3.2.2.2 Technical limitations and performance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for sustainable space technologies

- 3.2.3.2 Advancements in miniaturization of satellite components

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense Budget Analysis

- 3.11 Global Defense Spending Trends

- 3.12 Regional Defense Budget Allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Supply Chain Resilience

- 3.14 Geopolitical Analysis

- 3.15 Workforce Analysis

- 3.16 Digital Transformation

- 3.17 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.18 Risk Assessment and Management

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Orbit, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Low earth orbit (LEO)

- 5.3 Medium earth orbit (MEO)

- 5.4 Geostationary orbit (GEO)

Chapter 6 Market Estimates and Forecast, By Satellite Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Full electric

- 6.3 Hybrid

Chapter 7 Market Estimates and Forecast, By Satellite Mass, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Less than 100 kg

- 7.3 100 -500 KG

- 7.4 500 -1000 Kg

- 7.5 Above 1000 Kg

Chapter 8 Market Estimates and Forecast, By Propulsion, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Electrothermal

- 8.3 Electrostatic

- 8.4 Electromagnetic

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Earth observation

- 9.3 Navigation

- 9.4 Communication

- 9.5 Weather monitoring

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Government

- 10.2.1 Military

- 10.2.2 Others

- 10.3 Commercial

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Boeing

- 12.1.2 Lockheed Martin

- 12.1.3 Northrop Grumman

- 12.1.4 Airbus

- 12.1.5 ArianeGroup

- 12.2 Regional key players

- 12.2.1 North America

- 12.2.1.1 Aerojet Rocketdyne

- 12.2.1.2 Busek Co. Inc.

- 12.2.1.3 L3Harris Technologies

- 12.2.2 Asia Pacific

- 12.2.2.1 Bellatrix Aerospace

- 12.2.3 Europe

- 12.2.3.1 OHB System

- 12.2.3.2 Safran Group

- 12.2.3.3 Sitael Spa

- 12.2.3.4 Thales Alenia Space

- 12.2.3.5 ThrustMe

- 12.2.1 North America

- 12.3 Niche Players/Disruptors

- 12.3.1 Accion Systems Inc.

- 12.3.2 Ad Astra Rocket