|

市场调查报告书

商品编码

1479760

VLSI 製造中的测量、检验和製程控制Metrology, Inspection, and Process Control in VLSI Manufacturing |

||||||

半导体计量和检测在确保半导体装置的品质、可靠性和性能方面发挥着至关重要的作用。 该领域的进展和投资是由多个驱动因素推动的。

总体而言,半导体产业对技术创新的不断追求,加上对性能和品质不断提高的期望,正在推动计量和检测技术的不断进步。 这些工具对于开发和生产为现代电子产品提供动力的尖端半导体装置至关重要。

随着半导体製造製程变得越来越复杂,对即时製程控制的需求也随之增加。 先进的测量和检测系统使製造商能够密切监控流程并即时进行调整,以确保最佳的性能和产量。 这种即时回馈迴路对于维持精密製造和生产效率之间的微妙平衡至关重要。

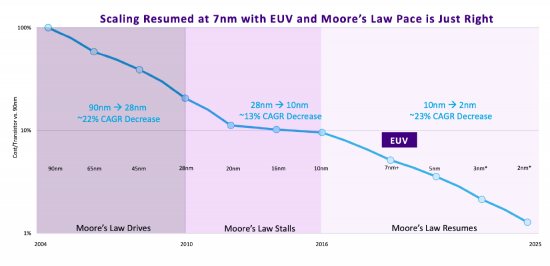

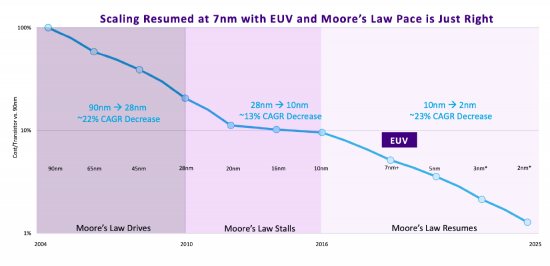

摩尔定律的追求,即微晶片上的电晶体大约每两年增加一倍,同时成本下降,促使了半导体装置的持续小型化。 这种小型化需要先进的测量和检测技术来评估 1 奈米或更小的特征。 随着装置变得越来越小,精确和准确的测量对于品质和良率控制至关重要,因为即使是很小的缺陷和变化□□也会对装置性能产生重大影响。

半导体计量和检测技术的最新创新对于应对半导体装置尺寸越来越小和製造流程日益复杂所带来的课题至关重要。 这些进步对于确保半导体元件(现代电子产品的支柱)的品质、性能和可靠性至关重要。

人工智慧 (AI) 和机器学习 (ML) 透过提高缺陷检测和分类的速度、准确性和效率,正在彻底改变半导体计量和检测。 这些技术可以分析检查过程中产生的大量数据,识别可能表明潜在缺陷或品质问题的模式和异常情况。 人工智慧演算法可以从历史数据中学习来预测和识别缺陷,从而减少手动检查的时间和成本并提高产量。

本报告对半导体检测和计量市场进行了全面、详细的分析。 基于广泛的研究、行业专业知识和市场洞察,我们对测试和计量行业的现状和未来前景提供全面的瞭解。

目录

第一章简介

第 2 章执行摘要

第三章测量与侦测技术

- 简介

- 影像技术

- 扫瞄探针显微镜

- 光学技术

- 薄膜厚度和粗糙度

第 4 章缺陷审查/晶圆检定

- 简介

- 缺陷审查

- 图案化晶圆检测

- 无图案晶圆侦测

- 宏观缺陷检查

第五章薄膜测量

- 简介

- 金属薄膜测量

- 非金属薄膜测量

- 基板/其他薄膜测量

第六章光刻测量

第七章市场预测

- 简介

- 市场预测的假设

- 市场预测

- 全过程控制市场预测

- 光刻计量市场预测

- 晶圆检测/缺陷审查市场

- 薄膜测量市场预测

- 其他製程控制系统市场预测

- 后端测量/侦测市场预测

第 8 章整合/现场测量/检查趋势

- 简介

- 原位测量

- 综合测量

第九章主要推动因素

- 3D

- 后端测量检查

- 300mm/450mm晶圆

- 铜测量

- 低介电常数电介质

- 化学机械平化 (CMP)

- 离子注入

Driving Forces

Semiconductor metrology and inspection play crucial roles in ensuring the quality, reliability, and performance of semiconductor devices. Several driving forces propel advancements and investments in this field.

Overall, the semiconductor industry's relentless pursuit of innovation, coupled with increasing performance and quality expectations, drives continuous advancements in metrology and inspection technologies. These tools are essential for enabling the development and production of cutting-edge semiconductor devices that power modern electronics.

Process Control and Throughput: As semiconductor manufacturing processes become more complex, the need for real-time process control increases. Advanced metrology and inspection systems enable manufacturers to monitor processes closely and make immediate adjustments to ensure optimal performance and throughput. This real-time feedback loop is essential for maintaining the delicate balance between precision manufacturing and production efficiency.

Technological Advancements and Miniaturization: The pursuit of Moore's Law, which predicts a doubling of transistors on a microchip approximately every two years while decreasing cost, has led to the continual miniaturization of semiconductor devices. This miniaturization necessitates advanced metrology and inspection techniques capable of characterizing features at the nanometer scale and below. As devices shrink, even the smallest defects or variations can have a significant impact on device performance, making precise and accurate measurements critical for quality control and yield management.

Complex 3D Structures and New Materials: The evolution of semiconductor devices includes not just shrinking sizes but also increasing complexity in device architecture, such as 3D NAND flash memory and FinFET transistors. These complex structures improve performance and storage capacity but introduce new challenges in measurement and inspection. Additionally, the integration of new materials with unique properties necessitates the development of novel metrology tools capable of accurately assessing material characteristics without damaging the delicate structures.

Yield Optimization: In the highly competitive semiconductor industry, optimizing yield-the percentage of devices on a wafer that function correctly-is crucial for economic viability. Metrology and inspection are integral to identifying process variations and defects early in the manufacturing process, allowing for adjustments that minimize waste and improve yield. The ability to precisely measure and control the production process leads to significant cost savings and higher profitability.

Quality and Reliability Standards: The end applications of semiconductor devices, particularly in critical areas such as automotive, medical, and aerospace industries, demand the highest levels of quality and reliability. This demand requires stringent quality control measures throughout the manufacturing process, supported by sophisticated metrology and inspection techniques. These tools ensure that devices meet the rigorous standards required for their intended applications, minimizing the risk of failures that could have severe consequences.

Innovation in Metrology and Inspection Technologies

Recent innovations in semiconductor metrology and inspection technologies have been pivotal in addressing the challenges posed by the ever-decreasing size of semiconductor devices and the complexity of their manufacturing processes. These advancements are critical for ensuring the quality, performance, and reliability of semiconductor components, which are the backbone of modern electronics. Here's an overview of some of the significant innovations in this field:

Artificial intelligence (AI) and machine learning (ML) are revolutionizing semiconductor metrology and inspection by improving the speed, accuracy, and efficiency of defect detection and classification. These technologies enable the analysis of vast amounts of data generated during the inspection process, identifying patterns and anomalies that may indicate potential failures or quality issues. AI algorithms can learn from historical data to predict and identify defects, reducing the time and cost associated with manual inspection and increasing yield rates.

High-resolution imaging techniques have seen substantial advancements, including electron microscopy (EM), atomic force microscopy (AFM), and X-ray tomography. These methods provide detailed views of semiconductor devices at the nanometer scale, allowing for precise characterization of features and defects. For instance, electron beam microscopy can now offer images at resolutions sufficient to inspect the atomic structure of materials, crucial for understanding complex 3D device architectures.

Multi-beam inspection systems use multiple electron beams simultaneously to inspect semiconductor wafers. This approach significantly increases throughput compared to traditional single-beam systems, enabling more comprehensive and faster inspections. Multibeam systems are particularly effective in identifying defects in complex patterns and multilayer structures, essential for ensuring the quality of advanced semiconductor devices.

Three-dimensional metrology technologies have become increasingly important for measuring the dimensions and profiles of complex 3D structures in semiconductor devices, such as FinFETs and 3D NAND flash memory. Techniques such as 3D X-ray microscopy (XRM) and 3D scanning electron microscopy (SEM) provide detailed volumetric measurements, offering insights into the quality and integrity of these structures.

The integration of metrology equipment directly into semiconductor fabrication tools allows for real-time process monitoring and control. This inline metrology approach enables immediate feedback and adjustments, reducing the cycle time for process optimization and significantly improving the efficiency of the manufacturing process. Integrated metrology systems utilize various measurement techniques, including optical, electrical, and material characterization methods, to ensure process stability and performance.

Advanced spectroscopic techniques, such as Raman spectroscopy and ellipsometry, have been refined for semiconductor metrology, providing non-destructive ways to analyze material properties, including composition, thickness, and refractive index. These techniques are invaluable for characterizing thin films, multi-layer stacks, and new materials being introduced in semiconductor manufacturing.

The use of big data analytics in semiconductor metrology and inspection involves processing and analyzing the vast amounts of data generated during the manufacturing process. This analysis helps identify trends, predict failures, and optimize manufacturing processes. Big data tools enable the correlation of data across different stages of production, improving overall yield and device performance.

Non-contact inspection methods, such as terahertz imaging and ultrasonic scanning, are being developed to inspect semiconductor wafers and devices without risking damage. These methods are particularly useful for inspecting delicate structures and materials, offering a safer alternative to traditional contact-based inspection techniques.

Need For This Report

In today's semiconductor industry, where innovation and precision are paramount, the importance of inspection and metrology cannot be overstated. As semiconductor devices continue to evolve at a rapid pace, with shrinking feature sizes, increasing complexity, and growing demands for reliability and performance, the need for robust inspection and metrology solutions has never been greater. These technologies serve as the cornerstone of quality assurance in semiconductor manufacturing, enabling the detection of defects, measurement of critical dimensions, and characterization of materials at the nanoscale level.

As the semiconductor landscape undergoes profound transformations driven by technological advancements, shifting market dynamics, and evolving customer requirements, staying abreast of the latest trends, developments, and challenges in inspection and metrology is essential for industry stakeholders. Whether you are a semiconductor manufacturer striving to optimize production processes, a supplier seeking to develop innovative solutions, a researcher exploring cutting-edge technologies, or an investor evaluating market opportunities, a comprehensive understanding of the semiconductor inspection and metrology landscape is indispensable.

Against this backdrop, this report offers a comprehensive and in-depth analysis of the semiconductor inspection and metrology market. Drawing on extensive research, industry expertise, and market insights, this report provides a holistic view of the current state and future prospects of the inspection and metrology sector. From emerging trends and technological innovations to competitive dynamics and growth opportunities, this report covers a wide range of topics essential for industry professionals and decision-makers.

Key areas of focus include the latest advancements in inspection and metrology technologies, market trends and drivers shaping industry growth, competitive landscape and key players' strategies, regulatory and standards landscape, and future outlook and growth prospects. By leveraging actionable insights and strategic recommendations provided in this report, stakeholders can gain a competitive edge, identify growth opportunities, mitigate risks, and make informed decisions to drive success in the dynamic and fast-paced semiconductor inspection and metrology market.

In summary, this report serves as an indispensable resource for anyone looking to navigate the complexities of the semiconductor inspection and metrology landscape. Whether you are seeking to understand market dynamics, evaluate competitive positioning, identify growth opportunities, or formulate strategic plans, this report equips you with the insights and analysis needed to succeed in the ever-evolving semiconductor industry.

About This Report

This 300-page report offers a complete analysis of the Process Control market, segmented as:

- Lithography Metrology

- Overlay (standalone)

- CD Measurement

- Mask Inspection

- Mask Metrology

- Wafer Insp/Defect

- Patterned Wafer Insp

- E-beam Patterned

- Optical Patterned

- Defect Review

- SEM Defect Review

- Optical Defect Review

- Other Defect Review

- Unpatterned Wafer Insp

- Macro Defect Detection

- Patterned Wafer Insp

- Thin Film Metrology

- Non-Metal Thin Film

- Non-Metal Standalone

- Non-Metal Integrated

- Substrate Metrology

- Non-Metal Thin Film

- Other Process Systems

- Other Process

- Software

- Back End

Includes excel spreadsheet of market revenues of each competitor in 22 segments from 2012 to 2023.

Table of Contents

Chapter 1. Introduction

Chapter 2. Executive Summary

Chapter 3. Metrology/Inspection Technologies

- 3.1. Introduction

- 3.2. Imaging Techniques

- 3.2.1. Scanning Electron Microscope (SEM)

- 3.2.2. Transmission Electron Microscope (TEM)

- 3.3. Scanning Probe Microscopes

- 3.3.1. Atomic Force Microscopy (AFM)

- 3.3.2. Scanning Tunneling Microscopy (STM)

- 3.3.3. Scanning Probe Microscopy (SPM)

- 3.3.4. AFM Types

- 3.3.4.1. Contact AFM

- 3.3.4.2. Dynamic Force Mode AFM Techniques

- 3.3.5. Scanning Surface Potential Microscopy (SSPM)

- 3.4. Optical Techniques

- 3.4.1. Scatterometry

- 3.4.1.1. Ellipsometry

- 3.4.1.2. Reflectometry

- 3.4.1.3. Scatterometry Developments

- 3.4.2. Total Reflection X-Ray Fluorescence (TXRF)

- 3.4.3. Energy Dispersive X-Ray Analysis (EDX)

- 3.4.4. Secondary Ion Mass Spectrometry (SIMS)

- 3.4.4.1. Surface Imaging Using SIMS

- 3.4.4.2. SIMS Depth Profiling

- 3.4.5. Auger Electron Spectroscopy

- 3.4.6. Focused Ion Beam (FIB)

- 3.4.7. X-Ray Reflectometry (XRR)

- 3.4.8. X-Ray Photoelectron Spectroscopy (XPS)

- 3.4.9. Rutherford Backscattering (RBS)

- 3.4.10. Optical Acoustics Metrology

- 3.4.11. Fourier Transform Infrared Spectroscopy (FTIR)

- 3.4.12. Thermally-Induced Voltage Alteration (TIVA)

- 3.4.1. Scatterometry

- 3.5. Film Thickness And Roughness

- 3.5.1. Surface Inspection Technology

- 3.5.2. Dimensional Technology

- 3.5.3. Stylus Profilometer

Chapter 4. Defect Review/Wafer Inspection

- 4.1. Introduction

- 4.2. Defect Review

- 4.2.1. SEM Defect Review

- 4.2.2. Optical Defect Review

- 4.2.3. Other Defect Review

- 4.3. Patterned Wafer Inspection

- 4.3.1. E-Beam Patterned Wafer Inspection

- 4.3.2. Optical Patterned Wafer Inspection

- 4.4. Unpatterned Wafer Inspection

- 4.5. Macro-Defect Inspection

Chapter 5. Thin Film Metrology

- 5.1. Introduction

- 5.1.1. Front End Applications

- 5.1.2. Back End Applications

- 5.2. Metal Thin-Film Metrology

- 5.3. Non-Metal Thin-Film Metrology

- 5.4. Substrate/Other Thin Film Metrology

Chapter 6. Lithography Metrology

- 6.1. Overlay

- 6.2. CD

- 6.3. Mask (Reticle) Metrology/Inspection

Chapter 7. Market Forecast

- 7.1. Introduction

- 7.2. Market Forecast Assumptions

- 7.3. Market Forecast

- 7.3.1. Total Process Control Market Forecast

- 7.3.2. Lithography Metrology Market Forecast

- 7.3.2.1. Overlay Market Forecast

- 7.3.2.2. CD Measurement Market Forecast

- 7.3.2.3. Mask Inspection Market Forecast

- 7.3.2.4. Mask Metrology Market Forecast

- 7.3.3. Wafer Inspection / Defect Review Market

- 7.3.3.1. Patterned Wafer Inspection Market Forecast

- E-Beam Patterned Wafer Inspection Market Forecast

- Optical Patterned Wafer Inspection Market Forecast

- 7.3.3.2. Defect Review Market Forecast

- SEM Defect Review Market Forecast

- Optical Defect Review Market Forecast

- Other Defect Review Market Forecast

- 7.3.3.3. Unpatterned Wafer Inspection Market Forecast

- 7.3.3.4. Macro Defect Detection Market Forecast

- 7.3.3.1. Patterned Wafer Inspection Market Forecast

- 7.3.4. Thin Film Metrology Market Forecast

- 7.3.4.1. Non-Metal Thin Film Metrology Market Forecast

- Non-Metal Standalone Thin Film Metrology Market Forecast

- Non-Metal Integrated Thin Film Metrology Market Forecast

- 7.3.4.2. Substrate / Other Thin Film Metrology Market Forecast

- 7.3.4.1. Non-Metal Thin Film Metrology Market Forecast

- 7.3.5. Other Process Control Systems Market Forecast

- 7.3.6. Back-End Metrology/Inspection Market Forecast

Chapter 8. Integrated/In-Situ Metrology/Inspection Trends

- 8.1. Introduction

- 8.2. In-Situ Metrology

- 8.3. Integrated Metrology

- 8.3.1. Benefits

- 8.3.2. Limitations

Chapter 9. Key Drivers

- 9.1. 3D

- 9.2. Back End Metrology Inspection

- 9.3. 300mm/450mm Wafers

- 9.4. Copper Metrology

- 9.5. Low-K Dielectrics

- 9.6. Chemical Mechanical Planarization (CMP)

- 9.7. Ion Implant

List of Tables

- 3.1. Comparison Of Derivative AFM Techniques

- 5.1. Comparison Of White-Light With Multiple-Angle Laser Ellipsometry

- 7.1. Total Process Control Market Forecast

- 7.2. Lithography Metrology Market Forecast

- 7.3. Overlay Market Forecast

- 7.4. CD Measurement Market Forecast

- 7.5. Mask Inspection Market Forecast

- 7.6. Mask Metrology Market Forecast

- 7.7. Wafer Inspection / Defect Review Market Forecast

- 7.8. Patterned Wafer Inspection Market Forecast

- 7.9. E-Beam Patterned Wafer Inspection Market Forecast

- 7.10. Optical Patterned Wafer Inspection Market Forecast

- 7.11. Defect Review Market Forecast

- 7.12. SEM Defect Review Market Forecast

- 7.13. Optical Defect Review Market Forecast

- 7.14. Other Defect Review Market Forecast

- 7.15. Unpatterned Wafer Inspection Market Forecast

- 7.16. Macro Defect Detection Market Forecast

- 7.17. Thin Film Metrology Market Forecast

- 7.18. Non-Metal Thin Film Metrology Market Forecast

- 7.19. Non-Metal Standalone Thin Film Metrology Market Forecast

- 7.20. Non-Metal Integrated Thin Film Metrology Market Forecast

- 7.21. Substrate / Other Thin Film Metrology Market Forecast

- 7.22. Other Process Control Systems Market Forecast

- 9.1. Dielectric Film Challenges

List of Figures

- 3.1. Schematic Of Scanning Electron Microscope

- 3.2. Schematic Of Transmission Electron Microscope

- 3.3. Schematic Of Atomic Force Microscopy

- 3.4. Schematic Of Scanning Tunneling Microscopy

- 3.5. Interaction Between Two Atoms In AFM

- 3.6. Schematic Of Lateral Force Microscopy

- 3.7. Schematic Of Dynamic Force Mode AFM

- 3.8. Schematic Of Scanning Surface Potential Microscopy

- 3.9. Principle Of Scatterometry

- 3.10. Schematic Of Ellipsometer

- 3.11. Principles Of CD Scatterometry

- 3.12. Conventional TXRF Analysis Geometry

- 3.13. Schematic Of Secondary Ion Mass Spectrometry

- 3.14. Principle Of Auger Electron Emission

- 3.15. Schematic Of Auger Electron Spectroscopy

- 3.16. Schematic Of Focused Ion Beam Technology

- 3.17. Schematic Of X-Ray Reflectometry

- 3.18. Schematic Of X-Ray Photoelectron Spectroscopy

- 3.19. Schematic Of Rutherford Backscattering

- 3.20. Schematic Of Optical Acoustics Metrology

- 3.21. Spatial Wavelength Of Nanotopography

- 3.22. Schematic Of Non-Contact Capacitive Gauging

- 3.23. Schematic Of Stylus Profilometer

- 5.1. Spectroscopic Ellipsometry Diagram

- 6.1. ITRS Overlay Technology Roadmap

- 6.2. Illustration Of 3D Structure

- 6.3. ITRS Metrology Roadmap

- 6.4. Schematic Of OCD Optics

- 7.1. Total Process Control Market Forecast

- 7.2. Total Process Control Market By Geographic Region

- 7.3. Total Process Control Market Vs. Overall Equipment Market

- 7.4. Lithography Metrology Market Shares

- 7.5. Overlay Market Shares

- 7.6. CD Measurement Market Shares

- 7.7. Mask Inspection Market Shares

- 7.8. Mask Metrology Market Shares

- 7.9. Wafer Inspection / Defect Review Market Shares

- 7.10. Patterned Wafer Inspection Market Shares

- 7.11. E-Beam Patterned Wafer Inspection Market Shares

- 7.12. Optical Patterned Wafer Inspection Market Shares

- 7.13. Defect Review Market Shares

- 7.14. SEM Defect Review Market Shares

- 7.15. Optical Defect Review Market Shares

- 7.16. Other Defect Review Market Shares

- 7.17. Unpatterned Wafer Inspection Market Shares

- 7.18. Macro Defect Detection Market Shares

- 7.19. Thin Film Metrology Market Shares

- 7.20. Non-Metal Thin Film Metrology Market Shares

- 7.21. Non-Metal Standalone Thin Film Metrology Market Shares

- 7.22. Non-Metal Integrated Thin Film Metrology Market Shares

- 7.23. Substrate / Other Thin Film Metrology Market Shares

- 7.24. Other Process Control Systems Market Shares

- 7.25. Other Process Software Market Shares

- 8.1. Integrated Control In A Fab

- 9.1. Polish Endpoint Control