|

市场调查报告书

商品编码

1479768

世界功率半导体市场、材料与技术Power Semiconductors: Markets, Materials and Technologies |

||||||

简介

在从汽车和工业到消费性电子产品和再生能源系统等各个领域对节能解决方案的需求不断增长的推动下,功率半导体领域正在经历重大转型。 随着世界走向更永续和电气化的未来,功率半导体在实现高效能能源管理、功率转换和控制方面的作用变得越来越重要。

趋势

宽频隙材料(尤其是 SiC 和 GaN)的出现代表了功率半导体产业的重大典范转移。 这些材料与传统的硅基半导体相比具有明显的优势,包括高耐压、快速开关和改进的导热性,使其成为高性能、节能电力电子的理想选择。

碳化硅 (SiC) 因其优异的电气特性而脱颖而出,例如比硅更宽的带隙和更高的临界电场强度。 这些特性使碳化硅基设备能够在更高的温度和电压下运行,同时保持高效的性能。 SiC 装置具有较低的通态和开关损耗,可提高电动车、再生能源系统和工业电源转换器等各种应用的效率并降低能耗。

同样,氮化镓 (GaN) 因其出色的电气性能(包括宽频隙和高电子迁移率)而引起人们的注意。 GaN基底元件在功率密度、开关速度和效率方面具有显着优势,使其适用于高频、高功率应用。 GaN 装置具有低开关损耗,可实现更高的开关频率和更小、更轻的电力电子系统,使其特别有利于汽车和航空航天应用中更小、更轻的设计。

由于材料生长方法、製造流程和装置架构的进步,SiC/GaN 材料在功率半导体装置中的采用正在加速。 随着产量的增加和製造成本的下降,SiC/GaN 装置在更广泛的应用中与硅基元件相比变得更具竞争力。

此外,为了进一步加速 SiC/GaN 技术的采用,研发工作的重点在于优化装置性能、提高可靠性和降低成本。 这包括设备设计、封装技术和热管理解决方案的创新,以解决与宽频隙材料相关的独特课题。

总体而言,SiC/GaN 材料的广泛采用预示着节能电力电子的新时代,旨在提高效率、减少排放并推广可持续能源解决方案,为产业转型提供了机会。 随着这些材料的成熟并在市场上获得关注,对功率半导体产业的影响将是深远的。

本报告审视了全球功率半导体市场,并对市场、材料和技术提供了详细的分析和见解。

目录

第一章简介

- IGBT晶片结构的演变

- IGBT晶片小型化的影响

- 与 DMOSFET 相比,沟槽型 SiC MOSFET 的电阻较低

- 平面和垂直(沟槽)MOSFET

- FinFET 电路图

- MOSFET与超级接面MOSFET的电路图

- SiC U MOSFET

第二章功率半导体应用

- 太阳能发电预测

- 全桥 IGBT 拓朴

- 基于微控制器的逆变器框图

- 全球风力涡轮机出货量

- 主要风力发电能力:依国家划分

- 典型 30-50kW 逆变器的零件清单

- HEV牵引驱动系统示意图

- 插电式混合动力车 (PHEV) 的 PEEM 复杂图

- 逆变器传导和开关损耗

- 功率半导体单价趋势

- 宽频隙半导体系统和组件的成本

- 垂直/水平HEMT

- 电动车中的 GaN 水平/GaN 垂直 HEMT

- LED 业务和应用的市场驱动因素

- SSL 与传统技术

- LED性能与传统光源的比较

- 能源生产与使用的比较

- 通用LED驱动电路

- 使用 TSV 整合 LED 和 LED 驱动器

- 简单功率 MOSFET 马达控制器

- 逆变器的基本运作原理

- 太阳能发电预测

- 全桥 IGBT 拓朴

- 基于微控制器的逆变器框图

- 全球风力涡轮机出货量

- 主要风力发电能力:依国家划分

- 典型 30-50kW 逆变器的零件清单

- HEV牵引驱动系统示意图

- 插电式混合动力车 (PHEV) 的 PEEM 复杂图

- 逆变器传导和开关损耗

- 功率半导体单价趋势

- 宽频隙半导体系统与元件成本

第三章市场分析

- 功率半导体在半导体市场的地位

- IGBT与功率MOSFET的成长潜力

- IGBT市场

- IGBT技术趋势

- IGBT TAM

- IGBT 市场成长:依应用分类

- IGBT竞争格局

- MOSFET 的 TAM

- MOSFET TAM调查方法

- MOSFET 市场成长:依应用分类

- MOSFET的竞争状况

- 新的最终用途市场

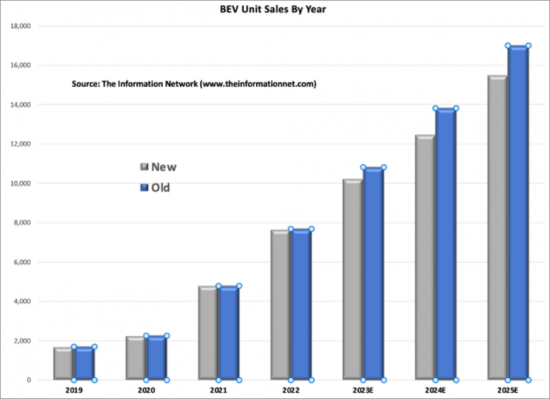

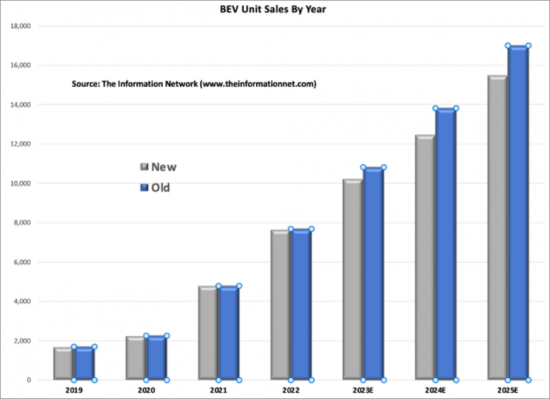

- 电动车

- 5G基础设施

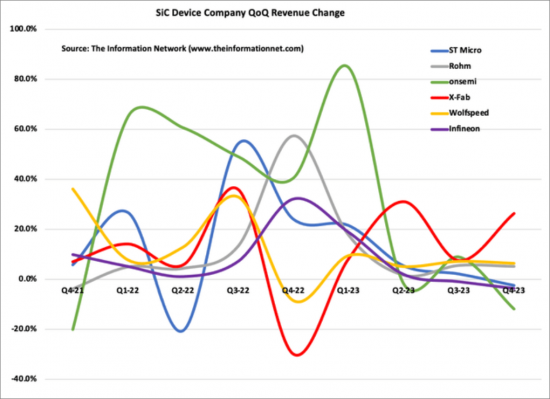

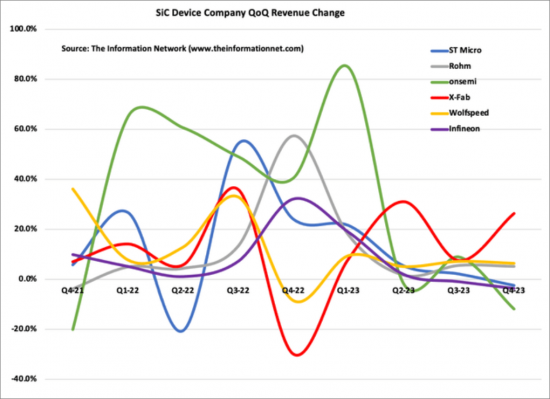

- 宽禁频功率半导体市场

第 4 章新一代功率半导体

- 对克服硅的限制的期望

- 对 SiC 和 GaN 作为下一代基板的期望

- 宽频隙半导体的优点

- 碳化硅和氮化镓

- 碳化硅设备製造

- GaN元件的製造

- 包装

第五章公司简介

- 功率半导体公司

- Infineon

- Mitsubishi

- Toshiba

- STMicroelectronics

- Vishay

- Fuji Electric

- Renesas

- Semikron

- NXP Semiconductors

- Hitachi Power Semiconductor Device

- X-Rel Semiconductor

- Advanced Linear Devices

- Nexperia

- Rohm

- Sanken Electric

- Shindengen Electric 5+

- Microchip Technology

- GeneSiC Semiconductor

- Semisouth Laboratories

- United Silicon Carbide

- MicroGaN

- Powerex

- Nitronix

- Transform

- Allegro Microsystems

- GaN Systems

- Navitas Semiconductor

- Alpha and Omega Semiconductor

- ON Semiconductor

- Jilin Sino-Microelectronics

- BYD Microelectronics

- Yangzhou Yangjie Electronic Technology

- StarPower

- Sino Micro

- Yangjie

- Jiejie

- GoodArk

- NCE Power

Introduction

The landscape of power semiconductors is undergoing a profound transformation driven by the escalating demand for energy-efficient solutions across various sectors, ranging from automotive and industrial to consumer electronics and renewable energy systems. As the world transitions towards a more sustainable and electrified future, the role of power semiconductors becomes increasingly pivotal in enabling efficient energy management, power conversion, and control.

The "Power Semiconductors: Markets, Materials, Technologies" report provides a comprehensive analysis of the dynamic power semiconductor market, delving into key trends, emerging materials, and cutting-edge technologies shaping the industry's trajectory. With a focus on market dynamics, material innovations, and technological advancements, the report offers valuable insights into the evolving landscape of power semiconductor devices and their applications across diverse sectors.

Amidst the evolving energy landscape and the imperative for energy conservation, the demand for power semiconductors continues to soar, driven by the need for high-performance, energyefficient solutions. From advanced silicon-based devices to emerging wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN), the report explores the evolving material landscape and its impact on the performance and efficiency of power semiconductor devices.

Moreover, the report examines the latest technological developments and innovations in power semiconductor design, packaging, and integration techniques. From discrete circuits to integrated modules and advanced packaging solutions, the report elucidates the technological trends driving efficiency enhancements, miniaturization, and reliability improvements in power semiconductor devices.

In addition to analyzing market trends and technological advancements, the report also provides insights into the competitive landscape of the power semiconductor industry, profiling key players, their strategies, and market positioning. Furthermore, it assesses regional dynamics, regulatory frameworks, and emerging market opportunities, offering stakeholders a comprehensive understanding of the global power semiconductor ecosystem.

Trends

The emergence of wide-bandgap materials, particularly SiC and GaN, represents a significant paradigm shift in the power semiconductor industry. These materials offer distinct advantages over traditional silicon-based semiconductors, including higher breakdown voltages, faster switching speeds, and improved thermal conductivity, making them ideal candidates for highperformance and energy-efficient power electronic devices.

Silicon carbide (SiC) stands out for its superior electrical properties, including a wider bandgap and higher critical electric field strength compared to silicon. These properties enable SiC-based devices to operate at higher temperatures and voltages while maintaining efficient performance. SiC devices exhibit lower on-state losses and switching losses, translating into higher efficiency and reduced energy consumption in various applications, such as electric vehicles, renewable energy systems, and industrial power converters.

Similarly, gallium nitride (GaN) has garnered attention for its exceptional electrical characteristics, including a wide bandgap and high electron mobility. GaN-based devices offer significant advantages in terms of power density, switching speed, and efficiency, making them well-suited for high-frequency and high-power applications. GaN devices exhibit lower switching losses, enabling higher switching frequencies and reduced size and weight of power electronic systems, which is particularly beneficial for compact and lightweight designs in automotive and aerospace applications.

The adoption of SiC and GaN materials in power semiconductor devices is accelerating, driven by advancements in material growth techniques, manufacturing processes, and device architectures. As production volumes increase and manufacturing costs decline, SiC and GaN devices are becoming increasingly competitive with silicon-based counterparts across a wide range of applications.

Furthermore, ongoing research and development efforts are focused on optimizing device performance, enhancing reliability, and reducing costs to further accelerate the adoption of SiC and GaN technology. This includes innovations in device design, packaging technologies, and thermal management solutions to address the unique challenges associated with wide-bandgap materials.

Overall, the widespread adoption of SiC and GaN materials heralds a new era of energyefficient power electronics, offering transformative opportunities for industries seeking to improve efficiency, reduce emissions, and advance sustainable energy solutions. As these materials continue to mature and gain traction in the market, their impact on the power semiconductor industry is poised to be profound and far-reaching.

About This Report

This comprehensive report delves into various aspects of the power semiconductor industry, providing in-depth analysis and insights into markets, materials, and technologies shaping the landscape. Here's an expanded overview of what the report covers:

Market Analysis: The report offers a detailed examination of the global power semiconductor market, including historical trends, current market dynamics, and future growth prospects. It assesses market size, revenue forecasts, and key drivers and challenges influencing market growth. Additionally, the report provides insights into market segmentation by product type, end-user industry, and geographic region.

Material Trends: It explores the latest advancements and trends in semiconductor materials, with a particular focus on wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN). The report discusses the properties and benefits of these materials, their applications across various industries, and their impact on the performance and efficiency of power semiconductor devices.

Technology Insights: The report delves into emerging technologies and innovations in power semiconductor devices, including silicon-based and wide-bandgap devices. It covers developments in device architectures, manufacturing processes, packaging technologies, and thermal management solutions aimed at enhancing device performance, reliability, and costeffectiveness.

Market Segmentation: An in-depth analysis of the power semiconductor market segmentation is provided, highlighting key product categories such as discrete circuits, module circuits, and power integrated circuits (ICs). The report examines market trends and growth opportunities across different end-user industries, including automotive, consumer electronics, industrial, and power distribution.

Regional Analysis: It offers a comprehensive assessment of the power semiconductor market across major geographic regions, including North America, Europe, and Asia including China. The report analyzes regional market trends, competitive landscapes, and regulatory frameworks shaping the industry landscape in each region.

Competitive Landscape: The report profiles leading companies and key players in the power semiconductor industry, providing insights into their market share, product portfolios, strategic initiatives, and competitive strategies. It assesses the competitive intensity and market positioning of major players, along with their strengths, weaknesses, opportunities, and threats.

Market Opportunities and Challenges: The report identifies and analyzes emerging market opportunities, growth prospects, and challenges facing the power semiconductor industry. It explores factors such as technological advancements, regulatory trends, investment opportunities, and competitive dynamics shaping the market landscape.

Regional Analysis: It offers a comprehensive assessment of the power semiconductor market across major geographic regions, including North America, Europe, and Asia including China. The report analyzes regional market trends, competitive landscapes, and regulatory frameworks shaping the industry landscape in each region.

Competitive Landscape: The report profiles leading companies and key players in the power semiconductor industry, providing insights into their market share, product portfolios, strategic initiatives, and competitive strategies. It assesses the competitive intensity and market positioning of major players, along with their strengths, weaknesses, opportunities, and threats.

Market Opportunities and Challenges: The report identifies and analyzes emerging market opportunities, growth prospects, and challenges facing the power semiconductor industry. It explores factors such as technological advancements, regulatory trends, investment opportunities, and competitive dynamics shaping the market landscape.

Table of Contents

Chapter 1. Introduction

- 1.1. Evolution Of IGBT Chip Structure

- 1.2. Effects Of Miniaturization Of IGBT Chip

- 1.3. SiC Trench-Type MOSFET And Resistance Reduction As Compared With DMOSFET

- 1.4. Planar And Vertical (Trench) MOSFET

- 1.5. Schematic Of A FinFET

- 1.6. Schematic Of A MOSFET And Super Junction MOSFET

- 1.7. SiC U MOSFET

Chapter 2. Applications of Power Semiconductors

- 2.1. Forecast Of Solar Power

- 2.2. Full Bridge IGBT Topology

- 2.3. Block Diagram Of Microcontroller-Based Inverter

- 2.4. Worldwide Wind Turbine Shipments

- 2.5. Top Wind Power Capacity by Country

- 2.6. Bill Of Materials For A Typical 30-50kw Inverter

- 2.7. A Simple Diagram Of A HEV Traction Drive System.

- 2.8. A More Complex Diagram Of PEEM In A Plug-In Hybrid Electric Vehicle (PHEV)

- 2.9. Conducting And Switching Loses For Inverter

- 2.10. Unit Pricing Trends In Power Semiconductors

- 2.11. System And Component Costs For Wide Bandgap Semiconductors

- 2.12. Vertical And Lateral HEMT

- 2.13. GaN Lateral And GaN Vertical HEMTs In EVs

- 2.14. Market Drivers For LED Biz And Applications

- 2.15. SSL Vs. Classical Technologies

- 2.16. LED Performance Vs. Traditional Light Sources

- 2.17. Energy Production And Use Comparison

- 2.18. Typical LED Drive Circuit

- 2.19. Integration Of LED And LED Driver Using TSV

- 2.20. Simple Power MOSFET Motor Controller

- 2.21. Basic Operating Principle Of Inverter

- 2.1. Forecast Of Solar Power

- 2.2. Full Bridge IGBT Topology

- 2.3. Block Diagram Of Microcontroller-Based Inverter

- 2.4. Worldwide Wind Turbine Shipments

- 2.5. Top Wind Power Capacity by Country

- 2.6. Bill Of Materials For A Typical 30-50kw Inverter

- 2.7. A Simple Diagram Of A HEV Traction Drive System

- 2.8. A More Complex Diagram Of PEEM In A Plug-In Hybrid Electric Vehicle (PHEV)

- 2.9. Conducting And Switching Loses For Inverter

- 2.10. Unit Pricing Trends In Power Semiconductors

- 2.11. System And Component Costs For Wide Bandgap Semiconductors

Chapter 3. Market Analysis

- 3.1. Position of Power Semiconductors in Semiconductor Market

- 3.2. Growth Potential of IGBTs and Power MOSFETs

- 3.3. IGBT Market

- 3.3.1. IGBT Technology Trends

- 3.3.2. IGBT TAM

- 3.3.3. IGBT Market Growth By Applications

- 3.3.3.1. Automotive

- 3.3.3.2. Power Generation And Grid

- 3.3.3.3. Consumer Electronics

- 3.3.3.4. Industrial Controls

- 3.3.3.5. Railway/Train

- 3.3.3.6. EV Charging Systems

- 3.3.4. IGBT Competitive Landscape

- 3.3.4.1. Global And China Market Share

- 3.3.4.2. IGBT Business Model

- 3.3.4.3. Technology Gap Between China And Global Players

- 3.4. MOSFET TAM

- 3.4.1. MOSFET TAM Methodology

- 3.4.2. MOSFET Market Growth By Applications

- 3.4.2.1. Automotive

- 3.4.2.2. EV Charging

- 3.4.2.3. Industrial And Medical

- 3.4.2.4. Consumer

- 3.4.2.5. Telecom Network

- 3.4.3.6. Computing

- 3.4.4. MOSFET Competitive Landscape

- 3.4.4.1. Global And China Market Share

- 3.4.4.2. China Suppliers' Technology/Product Gaps Vs Global Peers

- 3.5. Emerging End Application Markets

- 3.5.1. Electric Vehicles

- 3.5.2 5G Infrastructure

- 3.4. Wide Bandgap Power Semiconductor Market

Chapter 4. Next-Generation Power Semiconductors

- 4.1. Expectations for Overcoming Silicon's Limitations

- 4.2. Expectations Of SiC and GaN as Next-Generation Substrates

- 4.3. Benefits of Wide Band Gap Semiconductors

- 4.4. SiC versus GaN

- 4.4.1. Material Properties

- 4.4.2. Material Quality

- 4.4.3. SiC Lateral Devices:

- 4.4.4. SiC Vertical Devices

- 4.4.5. GaN Lateral Devices

- 4.5. Fabrication of SiC devices

- 4.5.1. Bulk and Epitaxial Growth of SiC

- 4.5.1.1. Bulk Growth

- 4.5.1.2. Epitaxial Growth

- 4.5.1.3. Defects

- 4.5.2. Surface Preparation

- 4.5.3. Etching

- 4.5.4. Lithography

- 4.5.5. Ion Implantation

- 4.5.6. Surface Passivation

- 4.5.7. Metallization

- 4.5.1. Bulk and Epitaxial Growth of SiC

- 4.6. Fabrication of GaN devices

- 4.6.1. GaN Challenges

- 4.6.1.1. Costs

- 4.6.1.2. Reliability

- 4.6.1.3. Component Packaging and Thermal Reliability

- 4.6.1.4. Control

- 4.6.1.5. Device Modeling

- 4.6.1. GaN Challenges

- 4.7. Packaging

Chapter 5. Company Profiles

- 5.1. Power Semiconductor Companies

- 5.1.1. Infineon

- 5.1.2. Mitsubishi

- 5.1.3. Toshiba

- 5.1.4. STMicroelectronics

- 5.1.5. Vishay

- 5.1.6. Fuji Electric

- 5.1.7. Renesas

- 5.1.8. Semikron

- 5.1.9. NXP Semiconductors

- 5.1.10. Hitachi Power Semiconductor Device

- 5.1.11. X-Rel Semiconductor

- 5.1.12. Advanced Linear Devices

- 5.1.13. Nexperia

- 5.1.14. Rohm

- 5.1.15. Sanken Electric

- 5.1.16. Shindengen Electric 5+

- 5.1.17. Microchip Technology

- 5.1.18. GeneSiC Semiconductor

- 5.1.19. Semisouth Laboratories

- 5.1.20. United Silicon Carbide

- 5.1.21. MicroGaN

- 5.1.22. Powerex

- 5.1.23. Nitronix

- 5.1.24. Transform

- 5.1.25. Allegro Microsystems

- 5.1.26. GaN Systems

- 5.1.27. Navitas Semiconductor

- 5.1.28. Alpha and Omega Semiconductor

- 5.1.29. ON Semiconductor

- 5.1.30. Jilin Sino-Microelectronics

- 5.1.31. BYD Microelectronics

- 5.1.32. Yangzhou Yangjie Electronic Technology

- 5.1.33. StarPower

- 5.1.34. Sino Micro

- 5.1.35. Yangjie

- 5.1.36. Jiejie

- 5.1.37. GoodArk

- 5.1.38. NCE Power

List of Figures

- 1.1. Evolution Of IGBT Chip Structure

- 1.2. Effects Of Miniaturization Of IGBT Chip

- 1.3. SiC Trench-Type MOSFET And Resistance Reduction As Compared With DMOSFET

- 1.4. Planar And Vertical (Trench) MOSFET

- 1.5. Schematic Of A FinFET

- 1.6. Schematic Of A MOSFET And Super Junction MOSFET

- 1.7. Process Flow For Super Junction MOSFET

- 2.1. Forecast Of Solar Power

- 2.2. Full Bridge IGBT Topology

- 2.3. PV Inverter Market Distribution

- 2.4. Block Diagram Of Microcontroller-Based Inverter

- 2.5. Worldwide Wind Turbine Shipments

- 2.6. Top Wind Power Capacity by Country

- 2.7. Bill Of Materials For A Typical 30-50kw Inverter

- 2.8. A Simple Diagram Of A HEV Traction Drive System.

- 2.9. A More Complex Diagram Of PEEM In A Plug-In Hybrid Electric Vehicle (PHEV)

- 2.10. Conducting And Switching Loses For Inverter

- 2.11. Unit Pricing Trends In Power Semiconductors

- 2.12. HEV/EV Shipment Forecast

- 2.13. System And Component Costs For Wide Bandgap Semiconductors

- 2.14. Vertical And Lateral HEMY

- 2.15. GaN Lateral And GaN Vertical HEMTs In EVs

- 2.16. Market Drivers For LED Biz And Applications

- 2.17. SSL Vs. Classical Technologies

- 2.18. LED Performance Vs. Traditional Light Sources

- 2.19. Energy Production And Use Comparison

- 2.20. Typical LED Drive Circuit

- 2.21. Integration Of LED And LED Driver Using TSV

- 2.22. Simple Power MOSFET Motor Controller

- 2.23. Basic Operating Principle Of Inverter

- 2.24. System Block Diagram Of An Air Conditioner

- 3.1. Mitsubishi's IGBT (Insulated Gate Bipolar Transistor) Generations

- 3.2. Infineon's MOSFET Generations

- 3.3. Intel's FinFET Design

- 3.4. Fuji's MOSFET versus Super Junction MOSFET

- 3.5. NEC's GaN-on-Si Power Transistor

- 3.6. Fujitsu's GaN-on-SiC HEMT Transistor

- 3.7. Power Semiconductor Market Forecast

- 3.8. Power Semiconductor Market Shares

- 3.9. Market Forecast For Super Junction MOSFET

- 3.10. SJ MOSFETs as an Interim Solution

- 3.11. Global IGBT Shares By Application

- 3.12. China IGBT Shares By Application

- 3.13. Global And China Automotive IGBT Forecast

- 3.14. Global And China Power Generation IGBT Forecast

- 3.15. Global And China Consumer IGBT Forecast

- 3.16. Global And China Industrial IGBT Forecast

- 3.17. Global And China Industrial IGBT Forecast

- 3.18. Global And China EV Charging IGBT Forecast

- 3.19. Global IGBT Module Market Shares

- 3.20. Global IGBT Discrete Market Shares

- 3.21. Global MOSFET Shares By Application

- 3.22. China MOSFET Shares By Application

- 3.23. Global And China Automotive MOSFET Forecast

- 3.24. Global And China EV Charging MOSFET Forecast

- 3.25. Global And China Industrial MOSFET Forecast

- 3.26. Global And China Consumer MOSFET Forecast

- 3.27. Global And China Telecom MOSFET Forecast

- 3.28. Global And China Telecom MOSFET Forecast

- 3.29. MOSFET Market Shares

- 3.30. Power Demands For ICE And EV

- 3.31 5G Demand for Power Semiconductors

- 3.32. Forecast of Wide Bandgap Semiconductor Market

- 4.1. Silicon-Based Devices Reaching Maturity

- 4.2. Enhancement Mode GaN On Si Transistor

- 4.3. AlGaN/GaN HEMT, GaN MOSFET, MOS-HEMT

- 4.4. GaN HEMT Material Structure On Si Substrate

- 4.5. Power Package Integration Roadmap

List of Tables

- 2.1. Product Families And The Principal End Uses Of Power Products

- 2.2. Forecast Of On-Grid Inverters By Type

- 2.3. EV Shipment Forecast

- 2.4. Advantages And Disadvantages Of GaN Lateral HEMTs

- 2.5. Light Source Comparison

- 2.6. Forecast Of GaN And SiC Power Devices By End Applications

- 3.1. Power Semiconductor Forecast for Electric Vehicles

- 3.2. 5G Semiconductor Total Available Market Forecast

- 4.1. Physical Properties Of Select Semiconductor Materials

- 4.2. Wide Bandgap Material Properties

- 4.3. Lattice Constant And CTE Of Semiconductor Starting Material

- 4.4. GaN FET Vs Si MOSFET Characteristics

- 4.5. Standard Chemical Solution For Surface Preparation Of SiC Substrates

- 4.6. Interface Trap Densities For 4H-SiC Under Different Process Conditions