|

市场调查报告书

商品编码

1420453

物联网商业化及商业模式介绍:2024IoT Commercialization & Business Model Adoption Report 2024 |

|||||||

本报告从六个主要部分分析了智慧互联物联网产品的商业化过程,重点介绍了成功的特征和模式、常见陷阱和案例研究。 本报告中包含的资讯是基于 2023 年第三季对 100 家智慧互联产品 OEM 进行的广泛调查。

个案研究强调成功的专案和获得的经验教训

上市公司

|

|

目录

第 1 章执行摘要/研究亮点

第 2 章简介

第 3 章互连设备:支援案例

- 互联产品对 OEM 收入的贡献 (1/3) - 整体/区域

- 互联产品对 OEM 收入的贡献 (2/3) - 产业

- 互联产品对 OEM 收入的贡献 (3/3) 规模/顾客类型

- 物联网产品的价值 (1/5) - 总体

- 物联网产品的价值 (2/5) - 范例:从客户那里获取见解

- 物联网产品的价值 (3/5) - 按行业

- 物联网产品的价值 (4/5) - 按地区、公司规模和客户类型划分

- 物联网产品的价值 (5/5) - 按部门和资历划分

- 物联网产品如何增强业务运作 (1/7) - 概述

- 物联网产品如何增强企业营运 (2/7) - 按细分市场

- 物联网产品如何增强业务运作 (3/7):实体产品的产品设计/工程

- 物联网产品如何增强企业营运 (4/7):软体产品设计/工程

- 物联网产品如何增强公司的营运 (5/7):现场服务营运与製造。 过程

- 物联网产品如何增强业务运作 (6/7):售后服务与客户支持

- 物联网产品如何增强业务运作 (7/7):销售软体/服务的销售/行销流程

- 范例:原始设备製造商 (OEM) 连接设备的三大好处

- 将物联网产品使用资料整合到业务系统中 (1/2) - 概述

- 将物联网产品使用资料整合到业务系统中 (2/2) 范例

第四章物联网产品开发

- 智慧连网产品的预算 (1/3) - 整体成本

- 智慧连网产品的预算 (2/3) - 按组件

- 智慧连网产品的预算 (3/3) - 按组件/细分市场

- 智慧型互联产品组件的预算分配

- 每个技术堆迭层的采购来源

- 受访者使用的顶级物联网供应商 (1/3) - 概述

- 受访者使用的顶级物联网供应商 (2/3) - 按技术堆迭

- 提到的开源工具/供应商

- 上市时间 (1/5) - 概述

- 上市时间 (2/5) - 按行业和地区

- 上市时间 (3/5) - 按发布年份、商业模式和公司规模

- 上市时间 (4/5) - 3 年比较

- 上市时间 (5/5) - 结果解读

- 基本功能开发 - 概述

- 提供自助服务选项

- 提供使用资讯中心 (1/2)

- 无线 (OTA) 更新 (1/2)

- 无线 (OTA) 更新 (2/2) - 范例

第 5 章商业模式开发

- 新产品与现有产品的比较 (1/2) - 概述

- 新产品和现有产品 (2/2) - 按行业和地区

- 互联产品功能的价值 (1/3) - 概述

- 互联产品功能的价值 (2/3) - 详细视图

- 互联产品功能的价值 (3/3) - 按细分市场

- 金属加工机械连接产品

- 远端服务/远端控制:Grupo Cimbali

- 状态监测:通快

- 营运仪表板:König & Bauer

- 营运仪表板:利勃海尔 (1/3):概述

- 操作仪表板:利勃海尔 (2/3):机器资讯

- 操作仪表板:利勃海尔 (3/3):报告讯息

- 能源监测:利勃海尔

- 监控客户使用情况 (1/2):概述

- 监控顾客使用情况 (2/2):很好的例子

- 每个产品部分的收入贡献 (1/2) - 几年

- 每个产品部分的获利贡献 (2/2) - 按细分市场

- 商业模式创新 (1/3) - 概述

- 商业模式创新 (2/3) - 详细概述

- 商业模式创新 (3/3) - 产业视角

- 其他商业模式见解 - 概述

- 提供软体附加元件并从中获利 - 例如 UNOX

- 向客户租赁设备 - 例如利乐

- 提供具体的绩效保证 - 例:江森自控

- EaaS OEM 采用状况 (1/2) - 概述

- EaaS OEM 采用状况 (2/2) - 按细分市场

- 企业实施EaaS的四个典型例子

- 客户实施 EaaS

- 客户为何采用 EaaS

- 客户不愿意引入 EaaS 的原因

- 确保成功转向 EaaS 所需采取的行动

- 受访者对成功转向 EaaS 的其他见解

- 范例:拥有明确的价值主张

- 迁移到 EaaS 时的常见错误

- 迁移到支援 EaaS 的见解时的常见错误

第六章物联网产品商业化

- 获利与额外保证 (1/2) - 概述

- 创造收入与额外保证 (2/2) - 按细分市场

- 透过各种解决方案元素获利 (1/3) - 今天

- 各种解决方案元素的货币化 (2/3) - 2 年内

- 透过各种解决方案元素获利 (3/3) - 预期变化

- 概述:资料所有权与隐私

- 范例:影响互联产品的隐私和安全法范例

- 推动客户采用的因素

- 客户实施问题/障碍 (1/2) - 概述

- 客户实施问题/障碍 (2/2) - 自 2020 年以来的变化

第 7 章成功商业化的经验教训

- 成功 OEM 的五个特征

- 成功物联网商业化的识别

- 成功的 OEM:透过免费增值模式专注于软体插件

- 成功的 OEM:帮助客户优化工作流程

- 范例:通快工作流程最佳化

- 成功的原始设备製造商:优先了解客户采用服务的障碍

- 成功的 OEM:将 IoT 资料整合到 CRM 和 ERP 系统中

- 成功的 OEM:有效利用 IoT 数据来推动销售和行销

第 8 章个案研究

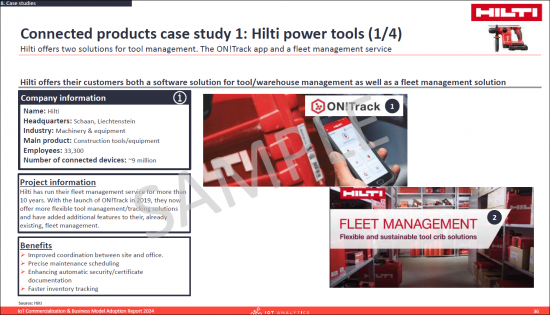

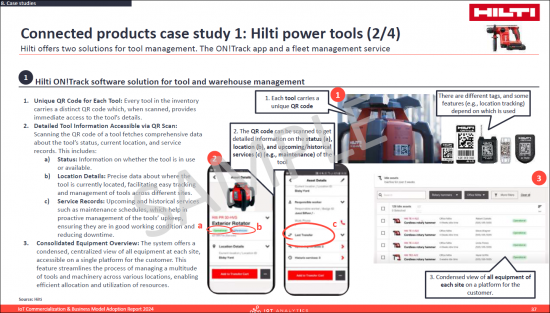

- 连网产品案例研究 1:Hilti power tools

- 互联产品案例研究 2:John Deere

- 连网产品案例研究 3:Schindler elevators

- 互联产品案例研究 4:BMW cars

- 连网产品案例研究 5:UNOX ovens

- 设备即服务案例研究 1:Heller

- 设备即服务案例研究 2:Carrier

- 设备即服务案例研究 3:Mitsubishi

第 9 章附录

第十章研究方法

第 11 章关于 IoT 分析

206-page report that analyzes how companies commercialize smart connected IoT products, including success characteristics and patterns, possible pitfalls, case studies, and more.

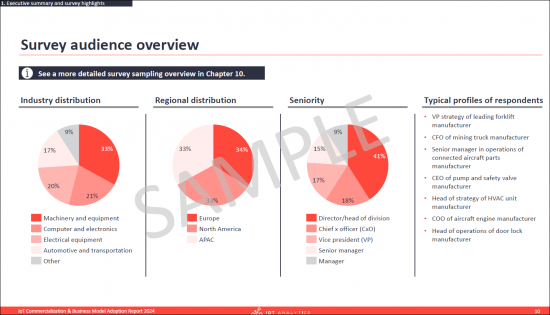

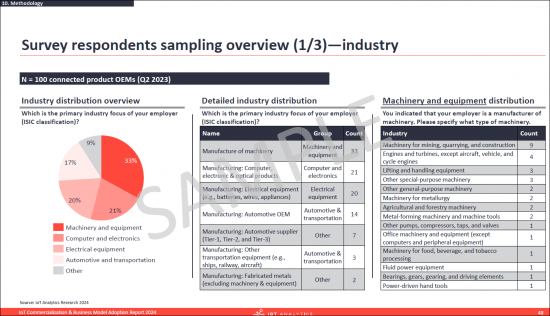

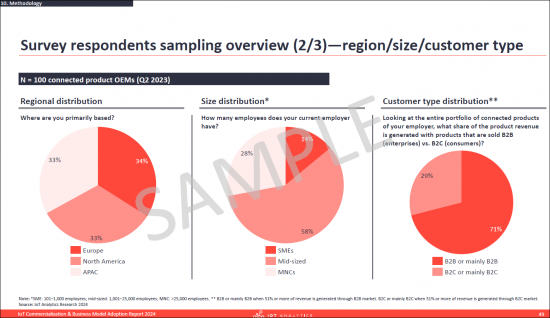

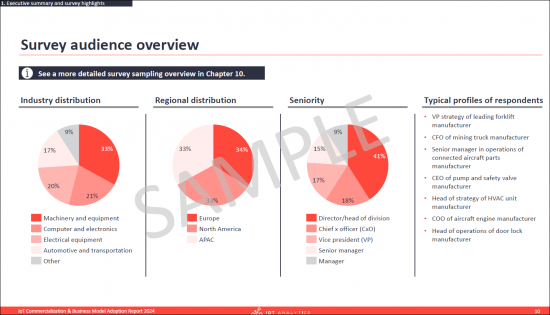

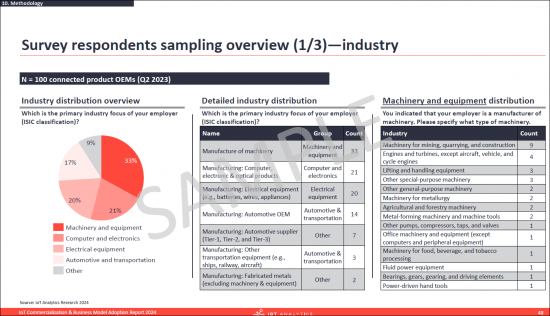

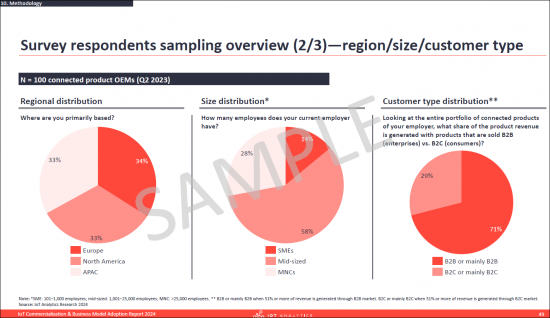

About the report

The “IoT Commercialization & Business Model Adoption Report 2024” is part of IoT Analytics' ongoing coverage of Industrial IoT and Industry 4.0. The information presented in this report is based on an extensive survey, conducted in Q3 2023, of 100 OEMs of smart, connected products. The purpose of the report is to inform other market participants, most notably other OEMs that start developing their own connected IoT product and their vendors, of the process for creating such products, as well as the benefits they provide. Survey participants were selected randomly, and their knowledge was verified independently. To ensure complete objectivity, IoT Analytics did not alter or supplement any survey results and did not accept participants that were suggested by third parties. The IoT Analytics team added a number of examples to make some of the survey results more "real" for the reader (e.g., pricing examples and examples of specific connected product features introduced by some OEMs).

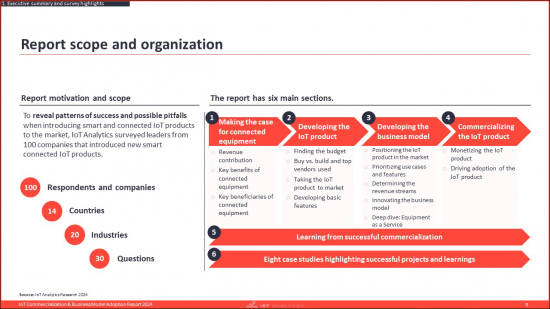

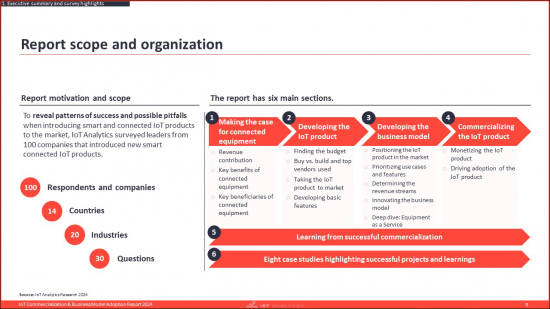

This publication analyses the process of commercializing smart connected IoT products along 6 main sections:

1. Making the case for connected equipment

- Revenue contribution

- Key benefits of connected equipment

- Key beneficiaries of connected equipment

2. Developing the IoT product

- Finding the budget

- Buy vs. build and top vendors used

- Taking the IoT product to market

- Developing basic features

3. Developing the business model

- Positioning the IoT product in the market

- Prioritizing the use cases and features

- Determining the revenue streams

- Innovating the business model

- Deep dive: Equipment as a Service

4. Commercializing the IoT product

- Monetizing the IoT product

- Driving adoption of the IoT product

5. Learning from successful commercialization

6. Case studies highlighting successful projects and learnings

SAMPLE VIEW

Questions answered:

- How much are connected products contributing to OEM revenue, and how is this expected to change in the future?

- How are OEMs sourcing their tech stack?

- Which vendors are being used most often for each part of the tech stack?

- How valuable have the connected products been for the organization, and which company activities are they improving upon?

- What is the necessary budget for a company to create smart, connected products from scratch?

- How are OEMs innovating their business model?

- What are the biggest factors for driving customer adoption of connected products, and what are the most important concerns/roadblocks?

- How are OEMs monetizing their solutions?

- What is the state of Equipment as a Service (EaaS) , including adoption, necessary actions to be successful when pivoting to the model, and common pitfalls to avoid?

- Which business systems are integrated with the IoT product usage data?

- What extra features are OEMs offering to their customers on top of their connected products?

- What are the six main factors that differentiate companies with more successful IoT commercializations?

- What are some connected product and EaaS case studies?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

Table of Contents

1. Executive summary and survey highlights

- Report scope and organization

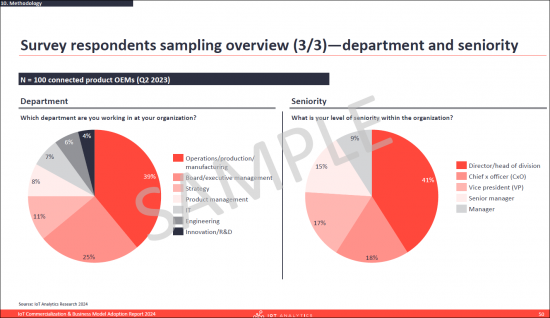

- Who participated in this research (selection)?

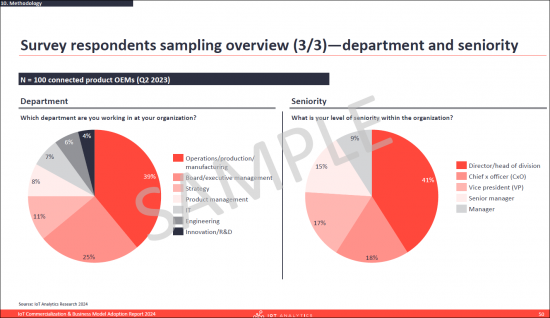

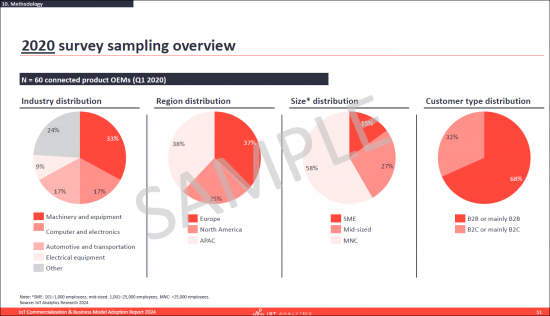

- Survey audience overview

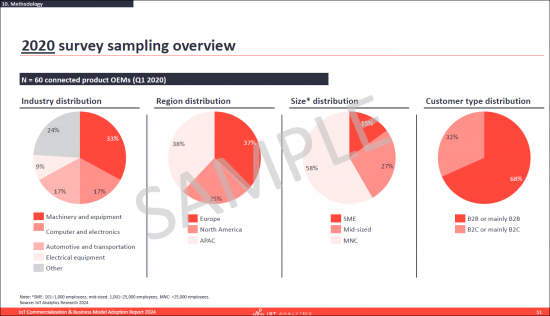

- This report is an update of the "IoT Commercialization & Business Model Adoption Report 2020"

- Executive Summary

- Highlight: 6 key insights from the analysis performed in the report

- Highlight: 5 characteristics of successful OEMs

2. Introduction

- Starting point: OEMs can tap into nine potential sources of revenue

- Search terms related to new OEM business models are slowly but steadily trending upwards

- Conceptual approach-the more connected, the higher the value potential

- IoT enables OEMs to develop new competitive advantages

- Universal Robots-an OEM journey in six years

- Connected products drive an OEM's services business

- This report takes the reader through the journey of an OEM

3. Making the case for connected equipment

- Contribution of connected products to OEM revenue (1/3)-overall/regions)

- Contribution of connected products to OEM revenue (2/3)-industry

- Contribution of connected products to OEM revenue (3/3)-size/customer type

- Value of IoT products (1/5)-overall

- Value of IoT products (2/5)-example: getting insights from customers

- Value of IoT products (3/5)-by industry

- Value of IoT products (4/5)-by region, company size, and customer type

- Value of IoT products (5/5)-by department and seniority

- How IoT products enhance a company's operations (1/7)-overview

- How IoT products enhance a company's operations (2/7)-by segment

- How IoT products enhance a company's operations (3/7): product design/engineering of the physical product

- How IoT products enhance a company's operations (4/7): product design/engineering of software

- How IoT products enhance a company's operations (5/7): field service operations and mfg. processes

- How IoT products enhance a company's operations (6/7): after-sales services and customer support

- How IoT products enhance a company's operations (7/7): sales/marketing processes to sell SW/services

- Example: Three main benefits when OEMs connect their equipment

- Integrating IoT product usage data into business systems (1/2)-overview

- Integrating IoT product usage data into business systems (2/2)-example

4. Developing the IoT product

- Budgeting for smart, connected products (1/3)-overall cost

- Budgeting for smart, connected products (2/3)-by component

- Budgeting for smart, connected products (3/3)-by component/segment

- Budget distribution for the components of smart, connected products

- Procurement sources for each technology stack layer

- Top IoT vendors used by respondents (1/3)-overview

- Top IoT vendors used by respondents (2/3)-by tech stack (1/2)

- Top IoT vendors used by respondents (3/3)-by tech stack (2/2)

- Open-source tools/vendors mentioned

- Time to market (1/5)-overview

- Time to market (2/5)-by industry and region

- Time to market (3/5)-by launch year, business model, and company size

- Time to market (4/5)-three-year comparison

- Time to market (5/5)-our interpretation of the results

- Developing basic features-overview

- Providing self-service options

- Offering a usage dashboard (1/2)

- Over-the-air (OTA) updates (1/2)

- Over-the-air (OTA) updates (2/2)-example

5. Developing the business model

- New vs. existing product (1/2)-overview

- New vs. existing product (2/2)-by industry and region

- Value of connected product features (1/3)-overview

- Value of connected product features (2/3)-detailed view

- Value of connected product features (3/3)-by segment

- Connected products in metalworking machines

- Remote service / Remote control: Grupo Cimbali

- Condition monitoring: Trumpf

- Operational dashboard: König & Bauer

- Operational dashboard: Liebherr (1/3): Overview

- Operational dashboard: Liebherr (2/3): Machine info

- Operational dashboard: Liebherr (3/3): Report info

- Energy monitoring: Liebherr

- Monitoring customer usage (1/2): overview

- Monitoring customer usage (2/2): case in point

- Revenue contribution of each product part (1/2)-through the years

- Revenue contribution of each product part (2/2)-by segment

- Business model innovations (1/3)-overview

- Business model innovations (2/3)-detailed overview

- Business model innovations (3/3)-industry view

- Additional business model insights-overview

- Offering and monetizing software add-ons-example: UNOX

- Letting the customer lease the equipment-example: Tetra Pak

- Offering specific performance guarantees-example: Johnson Controls

- EaaS OEM adoption status (1/2)-overview

- EaaS OEM adoption status (2/2)-by segment

- Four prominent examples of companies that have introduced EaaS

- Customer adoption of EaaS

- Reasons why customers adopt EaaS

- Reasons why customers are reluctant to adopt EaaS

- Necessary actions to guarantee a successful pivot to EaaS

- Additional respondent insights for a successful pivot to EaaS

- Example: Having a clear value proposition

- Common mistakes when transitioning to EaaS

- Common mistakes when transitioning to EaaS-respondent insights

6. Commercializing the IoT product

- Monetization and additional guarantees (1/2)-overview

- Monetization and additional guarantees (2/2)-by segment

- Monetization of different solution elements (1/3)-today

- Monetization of different solution elements (2/3)-in two years

- Monetization of different solution elements (3/3)-expected change

- Overview-data ownership and privacy

- Example-privacy and security laws affecting connected products

- Factors that drive customer adoption (1/2)

- Factors that drive customer adoption (2/2)

- Customer adoption concerns/roadblocks (1/2)-overview

- Customer adoption concerns/roadblocks (2/2)-changes since 2020

7. Learning from successful commercialization

- Five characteristics of successful OEMs

- Identifying a successful IoT commercialization

- Successful OEMs focus on software add-ons with a freemium model

- Successful OEMs help their customers optimize the workflow

- Example: Trumpf workflow optimization

- Successful OEMs prioritize understanding customer hurdles in service adoption

- Successful OEMs integrate IoT data with CRM and ERP systems

- Successful OEMs effectively utilize IoT data to boost sales and marketing

8. Case studies

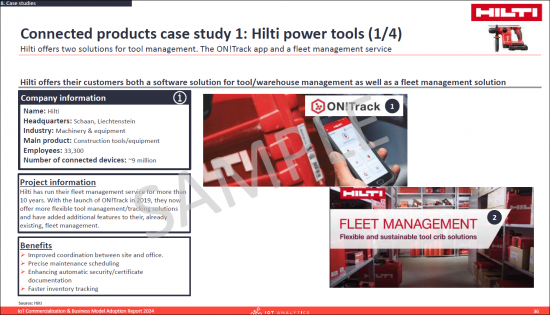

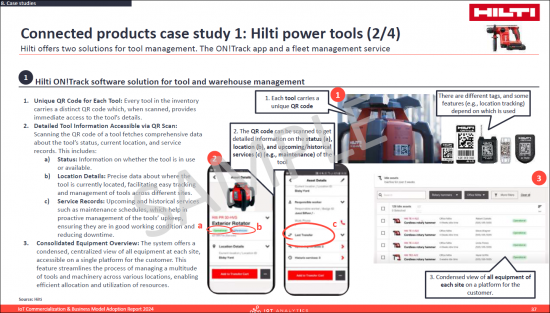

- Connected products case study 1: Hilti power tools

- Connected products case study 2: John Deere

- Connected products case study 3: Schindler elevators

- Connected products case study 4: BMW cars

- Connected products case study 5: UNOX ovens

- Equipment-as-a-Service case study 1: Heller

- Equipment-as-a-Service case study 2: Carrier

- Equipment-as-a-Service case study 3: Mitsubishi