|

市场调查报告书

商品编码

1512212

工业连接市场:2024-2028Industrial Connectivity Market Report 2024-2028 |

|||||||

全球工业连结市场规模预计将从 2023 年的 890 亿美元成长到 2028 年的 1,040 亿美元,未来四年的复合年增长率为 5%。

虽然工业连接硬体领域预计将继续主导整个工业连接市场,但成长预计最慢,而软体领域预计将成长最快。在软体领域,工业连接协定转换软体市场预计将以超过10%的复合年增长率成长,而较小的讯息代理(MQTT代理)软体市场预计将以更快的速度成长。工业数据营运市场正在迅速兴起。由数据品质管理和数据建模组成的 DataOps 软体市场预计将在未来四年内以最快的速度成长。

本报告对工业连接市场进行了全面调查,包括硬体、软体、架构、协议、技术、市场预测和采用驱动因素,以帮助您做出明智的决策和策略,并对驱动因素进行了深入分析。

上市公司

报告中提到的一些公司

|

|

目录

第一章简介

第 2 章执行摘要

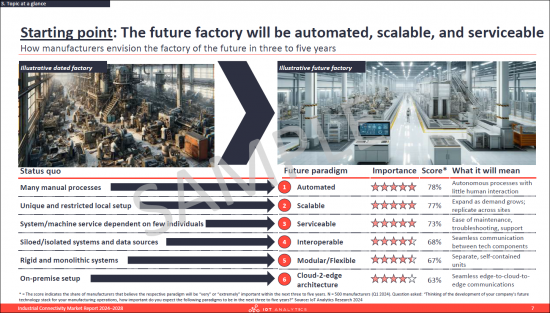

第 3 章主题概述

- 章节概述

- 製造商如何展望其工厂 3 至 5 年后的未来?

- 影响工业互联的 7 个关键变化

- 流行工业连接技术的当前搜寻趋势

- 例证 - Equinor 的连接驱动的数位转型

- 工业连结的定义 - 7 个要素和 5 个维度

第 4 章总体趋势与问题

- 章节概述

- 一般工业连接趋势

- 常见的工业连接课题

第五章市场规模与前景

- 章节概述

- 全球工业连结市场规模与市场驱动因素/阻碍因素

- 全球工业连接市场:依细分市场:硬体/软体:协定转换器、讯息代理、资料操作

- 全球工业连结市场:依行业(离散、製程、混合)

- 全球工业连结市场:依地区

第 6 章工业连接硬体

- 章节概述

- 技术概述

- 全球市场规模与驱动因素

- 技术概况:现场设备

- 依类型(市场规模/主要供应商)划分的市场概览:现场设备

- 趋势-现场设备

- 技术概述:远端 I/O

- 依类型(市场规模/主要供应商)划分的市场概览:远端 I/O

- 趋势-远端 I/O

- 技术概述:控制器

- 依类型(市场规模/主要供应商)划分的市场概览:控制器

- 趋势控制器

- 技术概述:网关

- 依类型(市场规模/主要供应商)划分的市场概览:网关

- 趋势网关

第 7 章工业连接软体:协定转换器

- 章节概述

- OT-OT 和 OT-IT 协定转换器的技术概述

- 全球市场规模与驱动因素

- 技术概述 OT-OT 协定转换器

- 依 OPC/非 OPC 类型划分的市场概览(市场规模/主要供应商)

- OT-IT协定转换器技术概述

- 依细分市场概述(特定于云端/应用程式/独立于云端/应用程式)以及每个细分市场的 OPC/非 OPC 类型(市场规模/主要供应商)

- 协定转换器市场趋势

第 8 章工业连接软体:讯息代理程式

- 章节概述

- MQTT 代理的技术概述

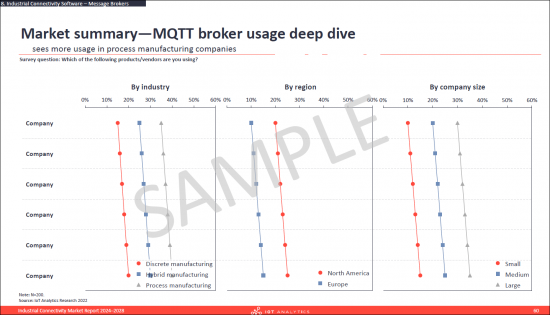

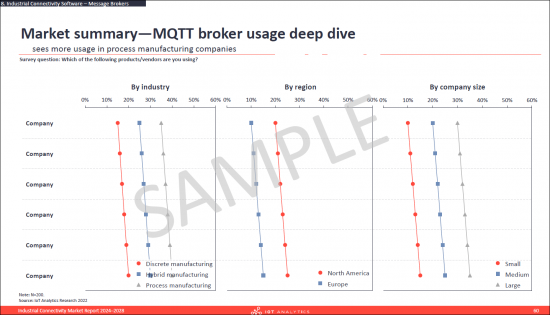

- 市场概况:MQTT 经纪商

- 讯息代理市场的趋势

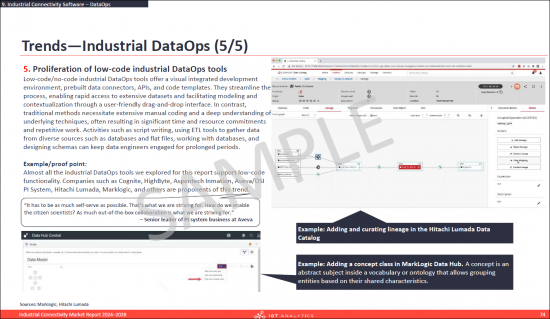

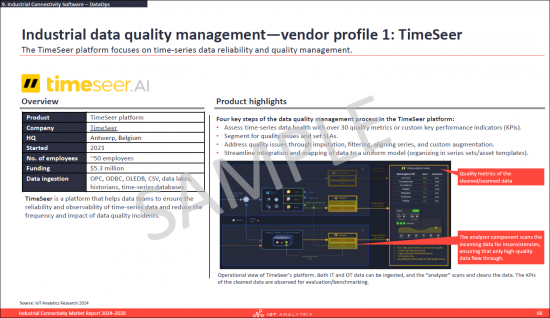

第 9 章工业连接软体:DataOps

- 章节概述

- 定义与要素:工业资料品质控制/资料建模

- 全球市场规模与驱动因素:整体、依行业、依地区

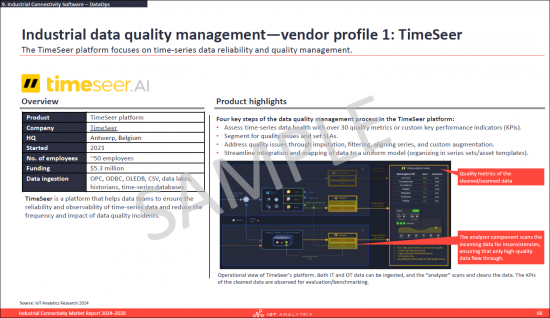

- 工业资料品质管理:定义、资料品质管理程序、市场概览、供应商简介

- 资料建模:定义、市场概览、建模程序

- 资料建模概述

- 资料模型类型:资产模型/用例模型

- 标准资料模型(ISA-95设备模型、CESMII SM设定檔、PackML、PA-DIM)

- 资料建模标准(OPC-UA・Sparkplug B・AAS・DTDL・WoT)

- 资料模型的操作化

- 资料建模治理

- 资料建模供应商简介

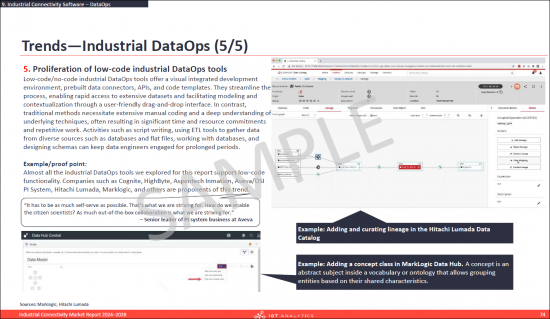

- 数据营运市场趋势

第10章资料传输

- 章节概述

- 定义与元素(通讯模式与资料交换格式)

- 通讯模式和通讯模式类型的描述

- 资料交换格式描述与资料交换格式类型

- 资料/事件流详细信息

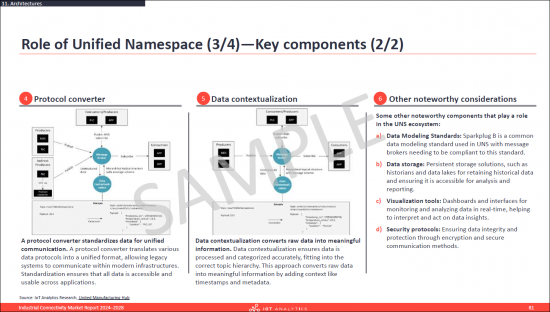

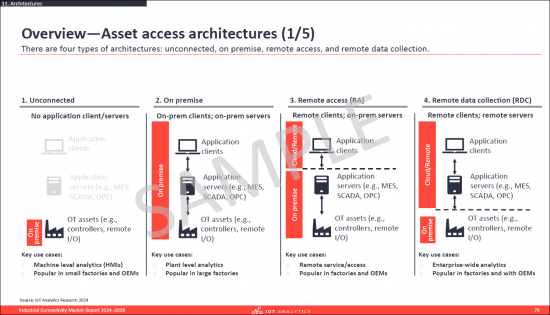

第 11 章架构

- 章节概述

- 架构概述

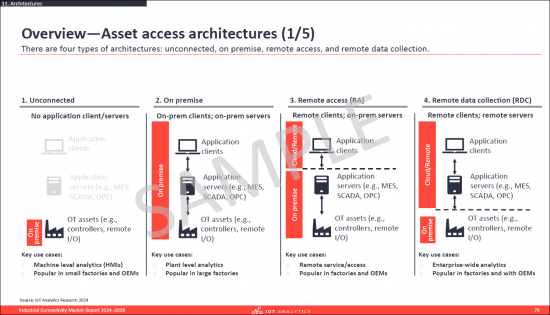

- 资产架构/选择标准概述

- 资产架构概述/优点/缺点

- 网路拓朴概述

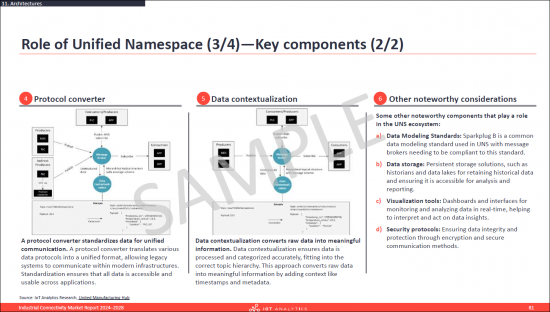

- 统一命名空间:概述、主要元件、实作范例

- 架构趋势

第12章协定

- 章节概述

- 工业连接协定的三种主要类型

- 协定-OSI 模型

- 技术概述 - 专注于 L1 的 OT 协议

- 市场概览 - 专注于 L1 的 OT 协议

- 主要协议详细资讯 - 重点关注 L1 的 OT 协议

- 趋势 - 专注于 L1 的 OT 协议

- 技术概述:常见 OT 协议

- 市场概览:常见 OT 协议

- 主要协定详细资讯:常见 OT 协议

- 趋势 - 常见 OT 协议

- 技术概述 - IT 协议

- 市场概览 - IT 协议

- 两个主要协议的详细资讯 - IT 协议

- 趋势-IT 协议

- 协议调查结果

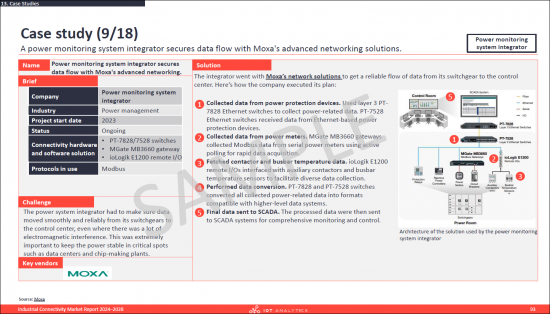

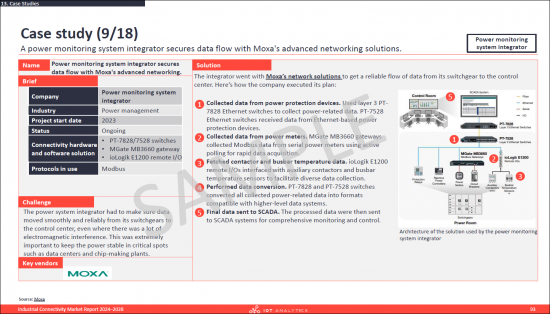

第 13 章案例研究

- 案例研究:概述

- 7个要点

- 18 个案研究

第14章定义/调查方法

第 15 章关于 IoT 分析

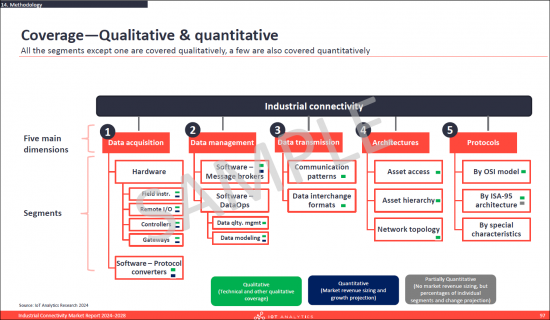

The "Industrial Connectivity Market Report 2024-2028" is part of IoT Analytics' comprehensive coverage of industrial and connectivity topics. The content presented in this report is based on a combination of primary and secondary research, including 35+ interviews with industrial connectivity vendors and system integrators conducted between June 2023 and June 2024.

SAMPLE VIEW

The primary objective of this document is to provide our readers with a comprehensive understanding of the current industrial connectivity market landscape. It offers in-depth analysis of industrial connectivity hardware, software, architectures, protocols, technologies, market projections, factors driving adoption, notable trends, and insightful case studies to facilitate informed decision-making and strategic planning.

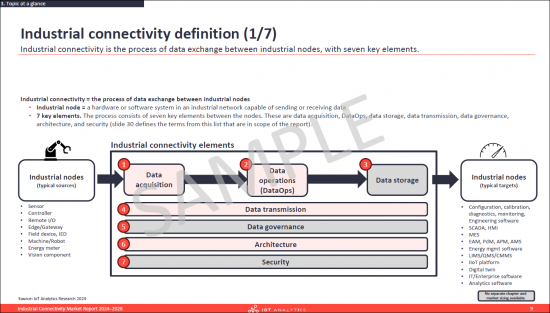

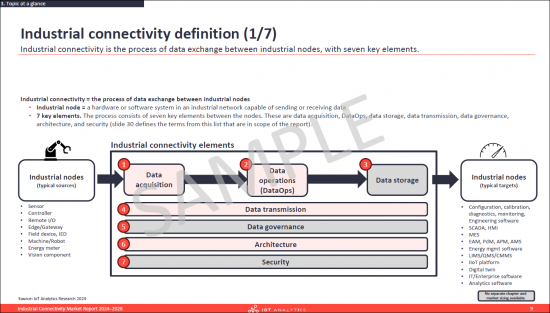

Industrial connectivity definition

Industrial connectivity is the process of data exchange between industrial nodes, with seven key elements. These are data acquisition, DataOps, data storage, data transmission, data governance, architecture, and security.

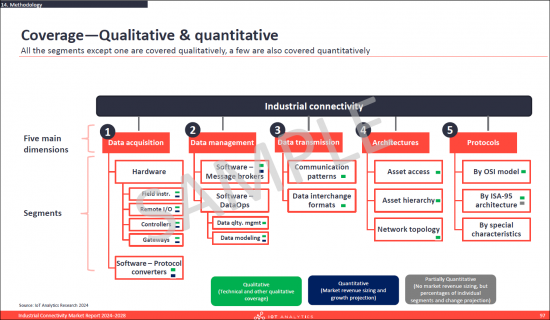

Overview of the industrial connectivity market

According to the "Industrial Connectivity Market Report 2024-2028" by IoT Analytics, the global industrial connectivity market is projected to grow from $89 billion in 2023 to $104 billion by 2028 at a CAGR of 5% over the next 4 years.

SAMPLE VIEW

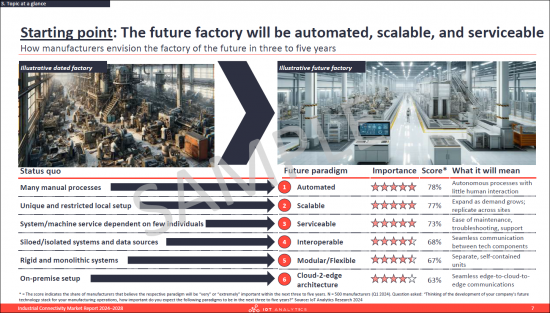

As manufacturers get ready for the factory of the future, industrial connectivity is changing. Emerging shifts include widespread data availability enabled by smart nodes, streamlined data management through DataOps, and flexible architectures facilitated by edge and cloud advancements.

SAMPLE VIEW

Industrial connectivity hardware will continue to have the dominant share of the overall industrial connectivity market but is expected to grow the slowest, with the software segments growing the fastest. Within the software segments. the industrial connectivity protocol converter software market is projected to grow at above 10% CAGR, while the smaller segment of message brokers (MQTT brokers) software is expected to grow at much faster pace. The industrial DataOps market is emerging rapidly. The DataOps software market, which consists of data quality management and data modeling, is expected to grow at the fastest pace in the next four years.

Seven key shifts are emerging with an impact on industrial connectivity:

| In the past | In the future |

| Limited data availability | Widespread data availability-enabled by smart nodes, protocols, converters |

| Rigid, siloed architectures | Flexible, scalable architectures-enabled by edge and cloud advancements |

| Poor data management | Streamlined data management-enabled by industrial DataOps practices |

| Slow and fragmented connectivity | Fast connectivity-enabled by interoperable Ethernet-based networks |

| Restrictive wired connections | Flexible wireless networks-enabled by wireless mediums and protocols |

| Basic hardware capabilities | Advanced hardware-enabled by integration of powerful CPUs/GPUs |

| Hardware dependent computing | Distributed computing-enabled by edge and software-defined hardware |

Questions answered:

- What is industrial connectivity (i.e., an industrial connectivity definition)?

- What is the size of the overall industrial connectivity market by component, region, and industry?

- What are some key trends and challenges in the industrial connectivity space?

- What types of hardware are used for data acquisition, who are the leading suppliers, and how might the landscape change in the future?

- What types of protocol converters software are used for data acquisition, who are the leading suppliers, and how will the landscape change in the future?

- What is the role of message broker software in industrial connectivity, who are the leading vendors, and how will the market change in the future?

- What are the elements of the quickly evolving space of industrial data operations (DataOps) software, who are the leading suppliers, and what changes are anticipated in the future?

- What technologies are involved in transmitting the data from source to destination?

- What are the most common architectures for achieving industrial connectivity, and how might this change in the future?

- What are the most common protocols used between each layer of the connectivity stack, and how could this change in the future?

- What are some examples of factories and original equipment manufacturers (OEMs) using industrial connectivity to create value (i.e., industrial connectivity case studies)?

SAMPLE VIEW

Companies mentioned:

A selection of companies mentioned in the report.

|

|

Table of Contents

1. Introduction

2. Executive Summary

3. Topic at a glance

- 3.1. Chapter overview

- 3.2. How manufacturers envision the factory of the future in three to five years

- 3.3. Seven key shifts are emerging that are impacting industrial connectivity

- 3.4. Current search trends for trending industrial connectivity technologies

- 3.5. Case in point - Equinor's connectivity-driven digital transformation

- 3.6. Industrial connectivity definition - 7 elements (4 covered in this report) and 5 dimensions

4. Overarching Trends and Challenges

- 4.1. Chapter summary

- 4.2. General industrial connectivity trends

- 4.3. General industrial connectivity challenges

5. Market Size & Outlook

- 5.1. Chapter overview

- 5.2. Global overall industrial connectivity market size and market drivers/inhibitors

- 5.3. Global industrial connectivity market - overall by segments: Hardware, Software - protocol converter, message broker, dataops

- 5.4. Global industrial connectivity market - by industry (discrete, process, hybrid)

- 5.5. Global industrial connectivity market - by region

6. Industrial Connectivity Hardware

- 6.1. Chapter overview

- 6.2. Technical overview

- 6.3. Global market size and drivers

- 6.4. Technical summary - Field Instruments

- 6.5. Market summary by type (market size, leading vendors) - Field Instruments

- 6.6. Trends - Field Instruments

- 6.7. Technical summary - Remote I/O

- 6.8. Market summary by type (market size, leading vendors) - Remote I/O

- 6.9. Trends - Remote I/O

- 6.10. Technical summary - Controllers

- 6.11. Market summary by type (market size, leading vendors) -Controllers

- 6.12. Trends - Controllers

- 6.13. Technical summary - Gateways

- 6.14. Market summary by type (market size, leading vendors) - Gateways

- 6.15. Trends - Gateways

7. Industrial Connectivity Software - Protocol Converters

- 7.1. Chapter overview

- 7.2. Technical overview of OT-OT and OT-IT protocol converters

- 7.3. Global market size and drivers

- 7.4. Technical summary OT-OT protocol converter

- 7.5. Market summary by type OPC/Non-OPC (market size, leading vendors)

- 7.6. Technical summary OT-IT protocol converter

- 7.7. Market summary by segment (cloud/app specific, cloud/app agnostic) and by type OPC/Non-OPC for each segment (market size, leading vendors)

- 7.8. Trends in protocol converter market

8. Industrial Connectivity Software - Message Brokers

- 8.1. Chapter overview

- 8.2. Technical overview MQTT brokers

- 8.3. Market summary MQTT brokers

- 8.4. Trends in message broker market

9. Industrial Connectivity Software - DataOps

- 9.1. Chapter overview

- 9.2. Definition and elements (industrial data quality management and data modeling)

- 9.3. Global market size and drivers (overall, by industry, by region)

- 9.4. Industrial data quality management: definition, data quality management steps, market summary, vendor profiles

- 9.5. Data modeling: definition, market summary, modeling steps

- 9.6. Data modeling overview

- 9.7. Data model types: asset model, use-case model

- 9.8. Standard data models (ISA-95 equipment model, CESMII SM profile, PackML, PA-DIM)

- 9.9. Data modeling standards (OPC-UA, Sparkplug B, AAS, DTDL, WoT)

- 9.10. Operationalizing data models

- 9.11. Data modeling governance

- 9.12. Data modeling vendor profiles

- 9.13. Trends in the DataOps market

10. Data Transmission

- 10.1. Chapter overview

- 10.2. Definition and elements (Communication Pattern and Data Interchange Format)

- 10.3. Communication pattern description and types of communication patterns

- 10.4. Data interchange format description and types of data interchange formats

- 10.5. Data/Event streaming deep-dive

11. Architectures

- 11.1. Chapter overview

- 11.2. Architectures overview

- 11.3. Asset architectures overview, selection criteria

- 11.4. Asset hierarchies overview, advantages/disadvantages

- 11.5. Network topologies overview

- 11.6. Unified Namespace - overview, key components, implementation examples

- 11.7. Trends in architectures

12. Protocols

- 12.1. Chapter overview

- 12.2. 3 main types of industrial connectivity protocols

- 12.3. Protocols - OSI model

- 12.4. Technical summary - L1-focused OT protocols

- 12.5. Market summary - L1-focused OT protocols

- 12.6. Deep dive of selected protocols - L1-focused OT protocols

- 12.7. Trends - L1-focused OT protocols

- 12.8. Technical summary - General OT protocols

- 12.9. Market summary - General OT protocols

- 12.10. Deep dive of selected protocols - General OT protocols

- 12.11. Trends - General OT protocols

- 12.12. Technical summary - IT protocols

- 12.13. Market summary - IT protocols

- 12.14. Deep dive of two selected protocols - IT protocols

- 12.15. Trends - IT protocols

- 12.16. Protocol survey results

13. Case Studies

- 13.1. Case studies summary

- 13.2. Seven key takeaways

- 13.3. 18 individual industrial connectivity case studies