|

市场调查报告书

商品编码

1759928

季度趋势报告:2025 年第二季 CEO 热门话题Quarterly Trend Report: What CEOs Talked About in Q2 2025 |

|||||||

这份 61 页的报告总结了 2025 年第二季财报电话会议中所出现的趋势。该报告是根据 2019 年第一季至 2025 年第二季美国上市公司超过 11 万场财报电话会议的数据。

样品预览

本报告是 IoT Analytics 对物联网及相关技术市场持续通报的一部分。报告提供的资讯是根据一个包含 2019 年第一季至 2025 年第二季超过 110,000 份美国上市公司财报电话会议的资料库。 IoT Analytics 每季都会分析财报电话会议中出现的一些趋势,并显示最近一个季度的调查结果。其目的是让其他市场参与者了解 CEO 和公司目前关注的重点。为了确保客观性,IoT Analytics 不会更改或补充其任何结果,也不会故意排除任何财报电话会议。

样品预览

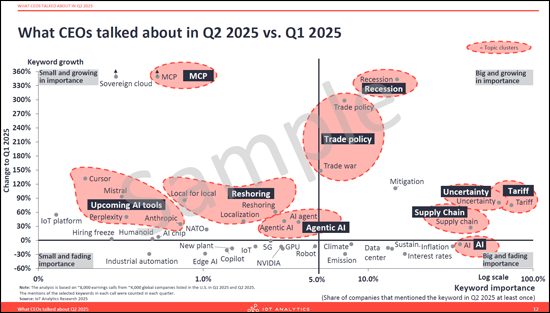

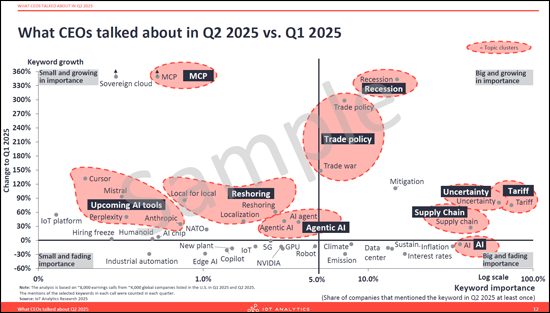

2025年第2季受到关注高涨了的主要的题目:

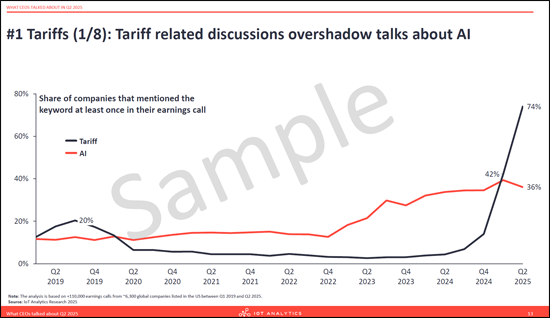

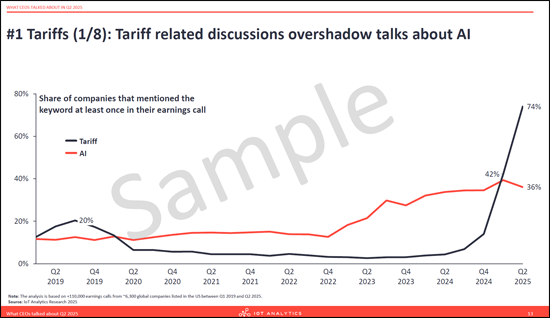

- 关税

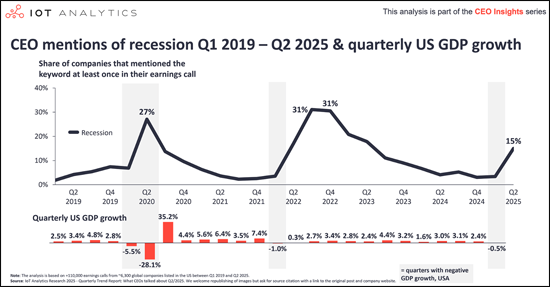

- 景气衰退的可能性

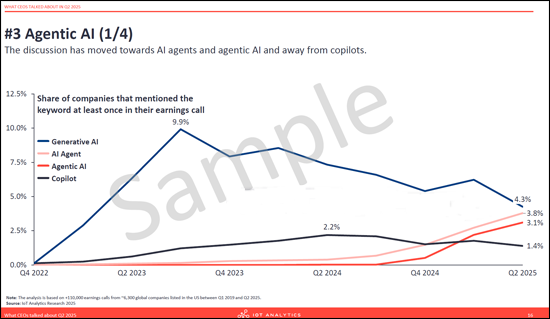

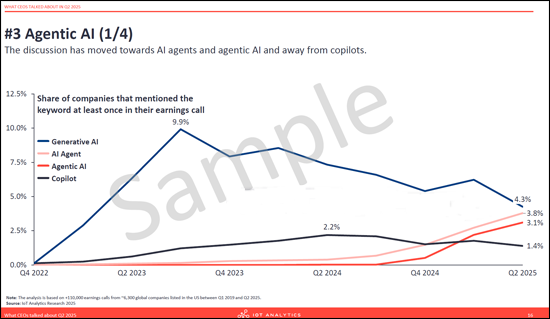

- 代理商型AI

2025年第2季受到关注降低了的主要的题目:

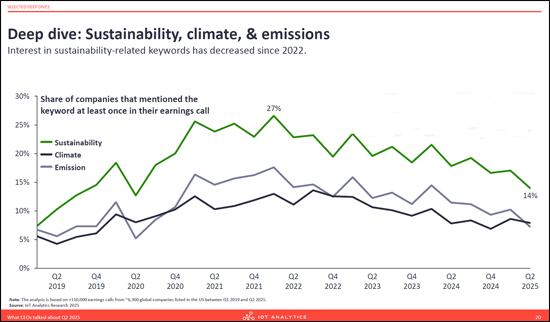

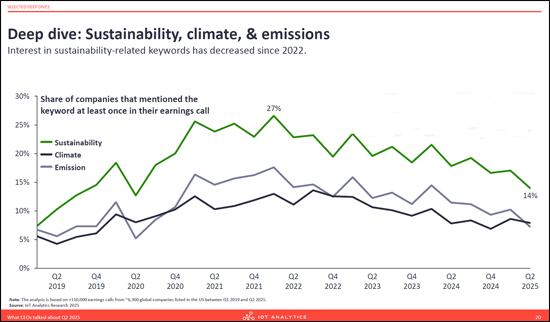

- 永续性

- 有关AI的一般的专题

样品预览

CEO 的五个关键问题:

- 关税的影响:关税是 CEO 们讨论最多的议题-我们如何重新思考我们的定价策略、供应链配置和采购决策最大限度地降低风险?

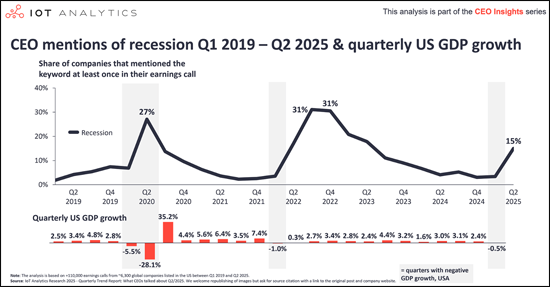

- 经济衰退准备:随着宏观经济不确定性持续存在,以及经济衰退讨论的增多,我们是否已为潜在的经济衰退做好准备?

- 贸易政策:随着各国政府继续就贸易协定和关税进行谈判,我们是否已掌握决策流程,并为各种情况做好准备?

- 代理AI准备:随着基于代理的AI技术日益普及,我们的组织是否已准备好将这些技术整合到我们的业务流程中?在采用AI方面,我们如何与竞争对手脱颖而出?

- 市场情绪下滑:随着全球市场情绪下滑,我们是否已准备好帮助我们的客户和业务伙伴应对他们面临的具体课题?

问题解答:

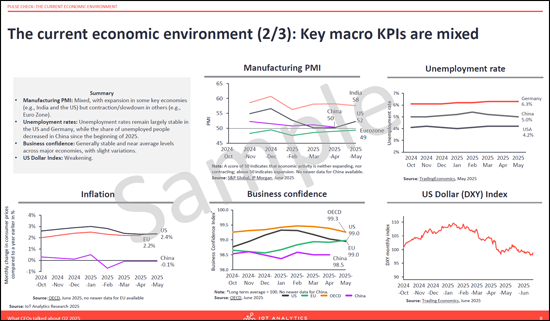

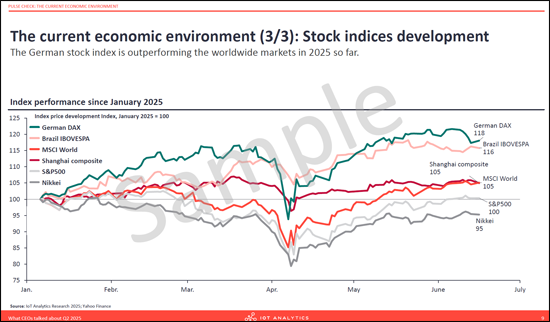

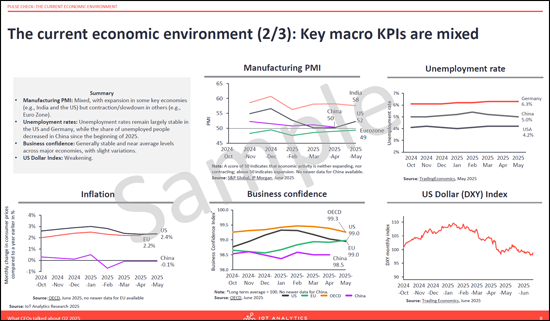

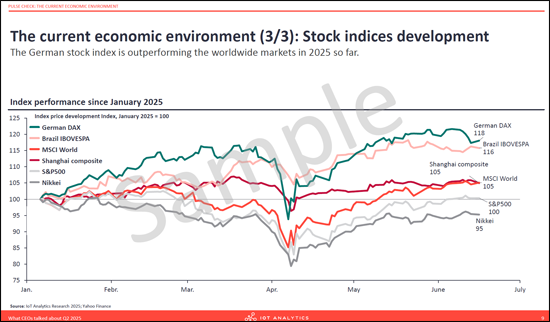

- 2025年第二季的整体经济环境如何?

- 执行长们正在讨论哪些未来趋势?

- 上季财报电话会议上最热门的关键字是什么?

- CEO们讨论的与关键字相关的关键主题是什么?

- 近年来哪些主题变得不再重要?

- 各行业的未来趋势是什么?

- 2025 年第二季财报电话会议的市场情绪有何变化?

目录

第1章 摘要整理

第2章 脉衝检查:目前经济环境

第3章 2025年第2季的CEO的话题

- 2019年第一季以后的决算说明会被选择了的专题的重要性

- 关税

- 不景气

- 代理商AI

第4章 关键深度分析

- 行业概览

- 工业部门

- 人工智慧

- 回流

- 其他

第5章 各业界的感情与展望

第6章 附录

A 61-page report on the trends that emerged in Q2 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q2 2025.

Sample preview

The "Quarterly trend report: What CEOs talked about in Q2 2025" is part of IoT Analytics' ongoing coverage of the IoT and related technology markets. The information presented in this report is based on a database of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q2 2025. Every quarter, IoT Analytics analyzes some trends that emerge in the earnings calls and presents some findings for the most recent quarter. The purpose is to inform other market participants about the current focus of CEOs and companies. To ensure objectivity, IoT Analytics did not alter or supplement any results and did not exclude any earnings calls deliberately.

Sample preview

Key rising themes in Q2 2025:

- Tariffs

- Possibility of recession

- Agentic AI

Key declining themes in Q2 2025:

- Sustainability

- General topics around AI

Sample preview

5 critical questions for CEOs:

- Tariff impact: With tariffs being the most discussed topic among CEOs, how should we adjust our pricing strategies, supply chain setup, and sourcing decisions to minimize risks?

- Recession preparation: Given ongoing macroeconomic uncertainty and increasing discussions about recessions, are we prepared for a potential recession?

- Trade policy: Governments worldwide are involved in ongoing negotiations on trade deals and tariff agreements. Are we monitoring the decision-making process and preparing for various eventualities?

- Agentic AI readiness: As agentic AI gains traction, is our organization equipped to integrate these capabilities into our business processes, and how do we differentiate from competitors in AI adoption?

- Decreasing sentiment: With global sentiment declining, are we ready to help our customers and business partners in addressing their specific pain points?

Questions answered:

- How is the overall economic environment in Q2 2025?

- What are some of the upcoming trends that CEOs talk about?

- What keywords were most prevalent in the earnings calls in the last quarter?

- What are the key themes that CEOs discuss related to the main keywords?

- Which themes have lost importance in the last few years?

- What are upcoming trends in different sectors?

- How did the sentiment change in earnings calls in Q2 2025?

Table of Contents

1. Executive summary

2. Pulse check: The current economic environment

3. What CEOs talked about in Q2 2025

- Importance of selected topics in earnings calls since Q1 2019

- 3.1. Tariffs

- 3.2. Recession

- 3.3. Agentic AI

4. Selected deep-dives

- 4.1. Sector overview

- 4.2. Industrial sector

- 4.3. AI

- 4.4. Reshoring

- 4.5. Other