|

市场调查报告书

商品编码

1827022

季度趋势报告:CEO们在2025年第三季谈了什么Quarterly Trend Report: What CEOs Talked About in Q3 2025 |

|||||||

本报告分析了2025年第三季美国上市公司财报电话会议中所出现的趋势。 数据基于2019年第一季至2025年第三季超过11万场财报电话会议。

样品预览

样品预览

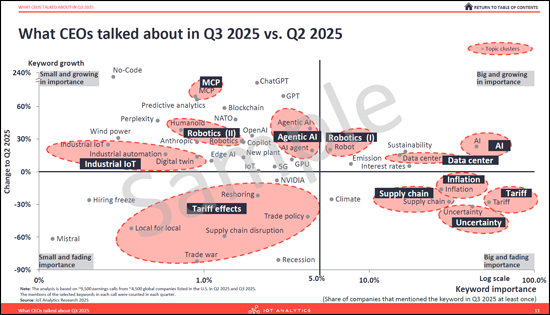

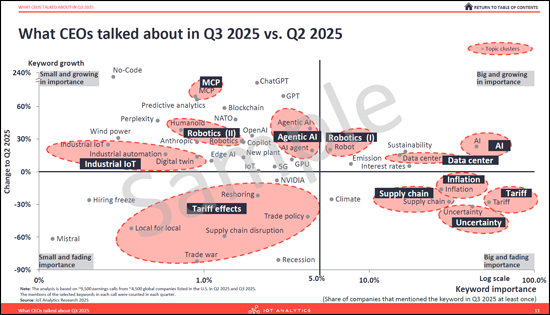

2025年第3季新兴的主要主题

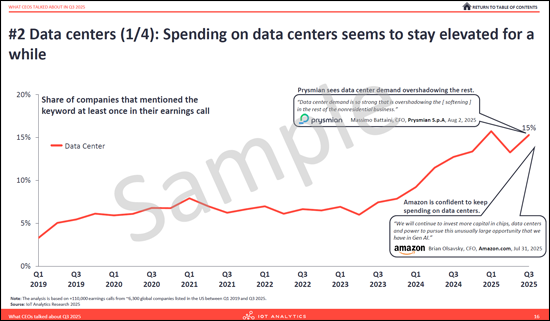

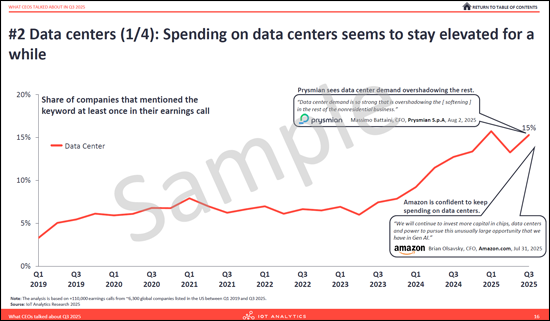

- 资料中心

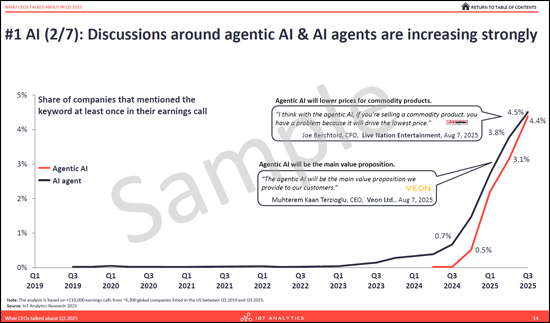

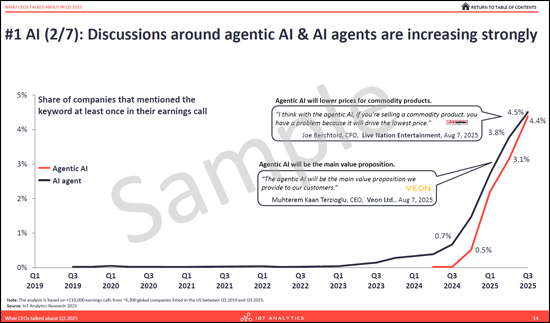

- 代理商型AI和AI代理商

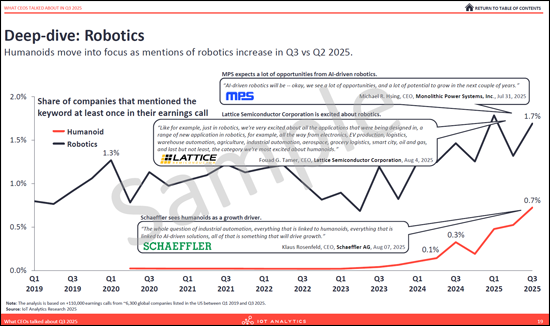

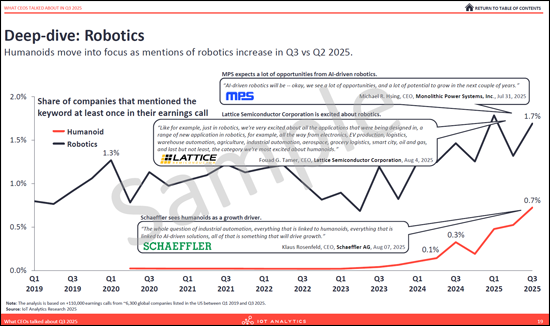

- 机器人工学

2025年第3季衰退的主要主题

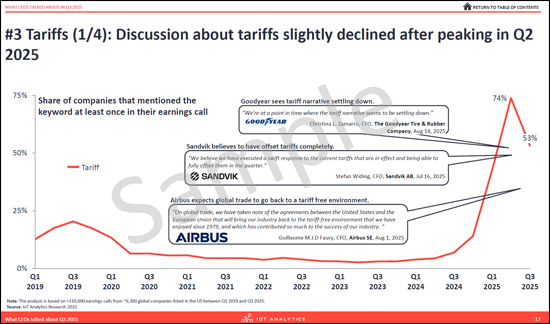

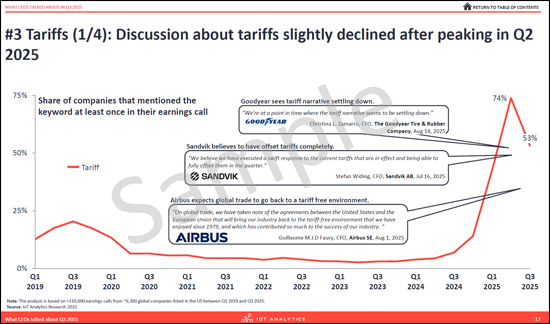

- 关税

- 不确定性

- 景气衰退

CEO 的五个关键问题

- 您的关税应对措施是否与第三季一致? 关税仍然是最常被提及的话题。定价、供应商组合和缓解策略(双重采购、近岸选项等)请重新评估您的策略。

- 您在 AI 人才争夺战中是否胜出? 需求正在快速成长。重新审视您招募、提升技能和留住 AI 工程师、资料科学家和产品负责人的计画。确定哪些职位需要立即填补。确定可以填补当前潜在空缺的合作伙伴关係。

- 您是否从人工智慧和代理商中获得了可衡量的投资回报率 (ROI)? 人工智慧的提及率达到了历史最高水平,代理人工智慧也正在迅速崛起。请优先考虑成功的用例,加强治理,并规划所需的技能和招募。

- 您未来 12 个月的自动化和机器人策略路线图是什么? 人们对机器人(包括人形机器人)的兴趣日益浓厚。请确定试点生产线,定义安全和变更管理步骤,并确定简单的投资报酬率 (ROI) 指标以进行扩展。

- 您是否应该重新评估需求计画和生产能力,以应对波动风险? 每週领先指标(订单、取消订单、库存)我们将引入灵活的生产系统,并预先批准加班规则。我们将精简长尾 SKU,并建立一个快速反应价格波动的系统。

样品预览

目录

第1章 摘要整理

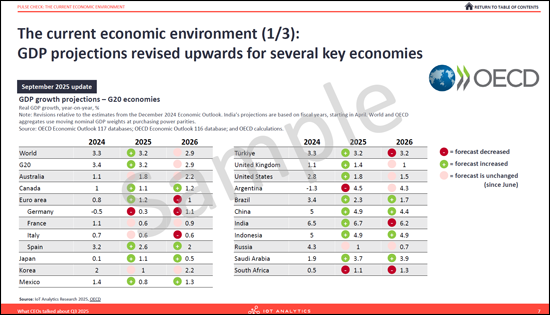

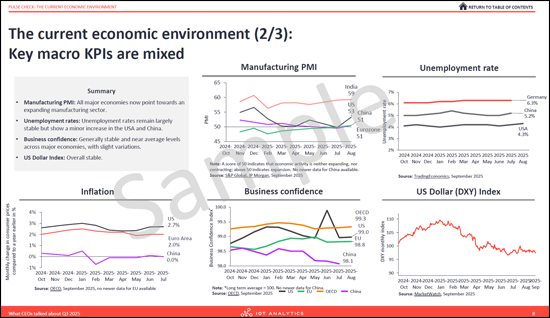

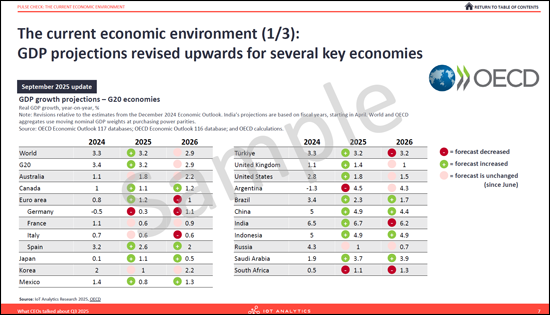

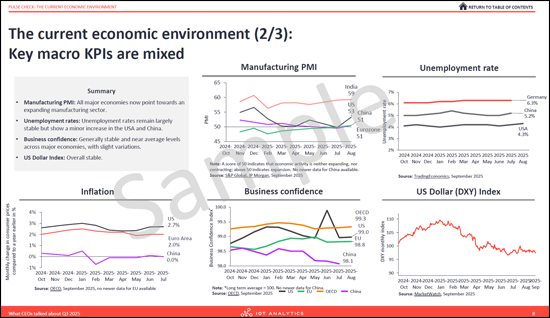

第2章 脉衝检查:目前经济环境

第3章 2025年第3季的CEO的话题

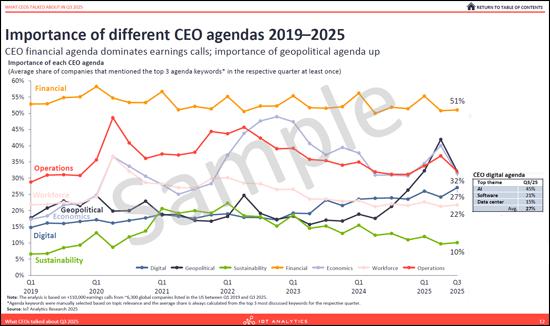

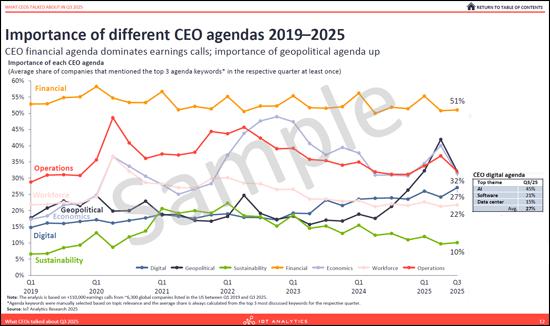

- 自 2019 年第一季以来财报电话会议中讨论的关键议题重要性的变化

- AI

- 资料中心

- 关税

- 详细内容:部门概要

- 详细内容:主要专题

製造业的详细分析

- 製造业 CEO 语录

- 当前课题

第5章 产业·各地区感情与展望

第6章 附录

A 60-page report on the trends that emerged in Q3 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q3 2025.

Sample preview

The "Quarterly trend report: What CEOs talked about in Q3 2025" is part of IoT Analytics' ongoing coverage of the IoT and related technology markets. The information presented in this report is based on a database of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q3 2025. Every quarter, IoT Analytics analyzes some trends that emerge in the earnings calls and presents some findings for the most recent quarter. The purpose is to inform other market participants about the current focus of CEOs and companies. To ensure objectivity, IoT Analytics did not alter or supplement any results and did not exclude any earnings calls deliberately.

Sample preview

Key rising themes in Q3 2025

- Data centers

- Agentic AI and AI agents

- Robotics

Key declining themes in Q3 2025

- Tariffs

- Uncertainty

- Recession

5 critical questions for CEOs

- Are our tariff responses still fit for Q3 conditions? Tariffs remain the most cited topic. Recheck pricing, supplier mix, and mitigation strategies (e.g., dual sourcing, nearshore options).

- Are we set to win the AI talent race? Demand is rising fast. Check on the plan to hire, upskill, and retain AI engineers, data scientists, and product owners. Identify which roles need to be filled immediately. Do we have partnerships that can fill a potential gap at this time?

- Do we have measurable ROI from AI and agents today? AI mentions hit a new high, with agentic AI rising fast. Prioritize use cases with tracked outcomes, tighten governance, and plan skills and hiring where needed.

- What is our automation and robotics roadmap for 12 months? Interest in robotics (including humanoids) is growing. Identify pilot lines, define safety and change management steps, and establish simple ROI gates for scale-up.

- Should we stress-test demand planning and capacity to handle sudden demand fluctuations now? Add weekly leading indicators (orders, cancellations, and channel inventory). Pre-approve flex capacity and overtime rules. Trim long-tail SKUs. Tighten pricing guardrails for rapid moves up or down.

Sample preview

Questions answered:

- How is the overall economic environment in Q3 2025?

- What are some of the upcoming trends that CEOs talk about?

- What keywords were most prevalent in the earnings calls in the last quarter?

- What are the key themes that CEOs discuss related to the main keywords?

- Which themes have lost importance in the last few years?

- What are upcoming trends in different sectors?

- How did the sentiment change in earnings calls in Q3 2025?

Table of Contents

1. Executive summary

2. Pulse check: The current economic environment

3. What CEOs talked about in Q3 2025

- 3.1. Importance of selected topics in earnings calls since Q1 2019

- 3.2. AI

- 3.3. Data Centers

- 3.4. Tariffs

- 3.5. Deep-dive: Sector overview

- 3.6. Deep-dive: Selected topics

Manufacturing deep-dive

- 4.1. What manufacturing CEOs talked about

- 4.2. Current challenges