|

市场调查报告书

商品编码

1891760

季度趋势报告:2025 年第四季 CEO 关注话题Quarterly Trend Report: What CEOs Talked About in Q4 2025 |

||||||

这份 60 页的报告分析了 2025 年第四季财报电话会议中所揭示的趋势。报告根据 2019 年第一季至 2025 年第四季期间,美国上市公司举行的超过 115,000 次财报电话会议的数据。

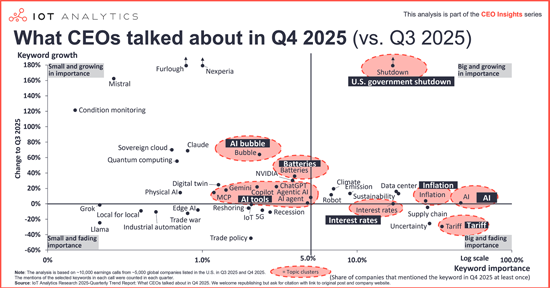

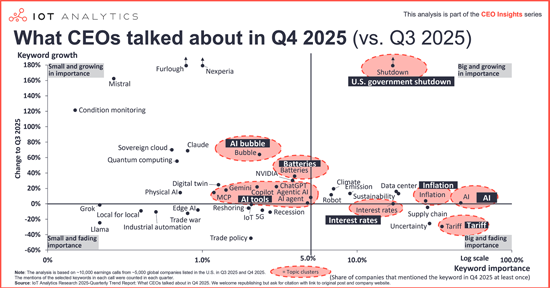

2025 年第四季主要上行主题

- 人工智慧

- 人工智慧泡沫

- 美国政府停摆

2025 年第四季主要下行主题

- 关税

- 不确定性

范例预览

CEO们需要思考的五个关键问题

1. 如果 "人工智慧泡沫" 破裂,贵公司是否会受到负面影响?

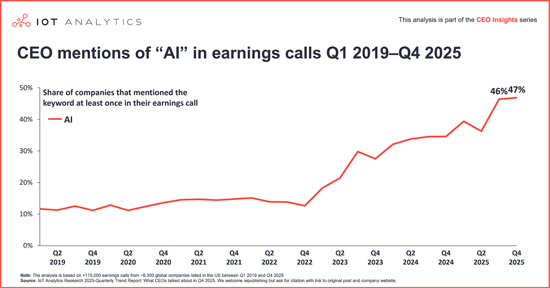

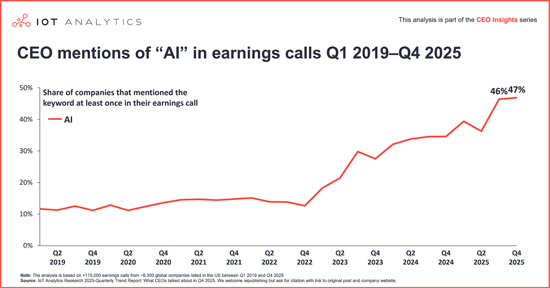

提及人工智慧的人数高峰约为47%,人们对泡沫破裂的担忧日益加剧。确保投资重点放在基础设施和长期价值上,而非一时热情,并密切关注资料中心及相关投资停滞时专案可能面临的风险。

2. 您是否已准备好应对美国政府在1月可能再次停摆?

随着提及政府停摆的呼声飙升至17%,而关税谈判的呼声降至35%,这代表着一种新的、快速成长的风险。各公司应评估其对政府合约的依赖程度以及对消费者信心的影响。

3. 您是否已准备好应对从生成式人工智慧转向主动式人工智慧的过渡?

NVIDIA已将 "基于代理的人工智慧" 定位为一个新的类别。您的路线图需要从简单的内容产生转向能够自主执行任务的代理人。

4. 您的基础架构是否已准备好满足主权云端的需求?

关于欧洲、中东和非洲资料中心的讨论正在超越北美。您应该考虑制定一项云端策略,以满足欧洲对主权资料处理的 "超大规模" 需求。

5. 您是否已做好充分的资金准备,迎接IT产业的成长浪潮?

商业信心正在增强,预计IT产业将成长15.4%。这要求销售策略从能源等萎缩产业转向高成长产业。

常见问题

- 2025年第四季的整体经济环境如何?

- CEO们正在谈论哪些即将到来的趋势?

- 上一季财报电话会议中最常使用的关键字是什么?

- CEO们围绕关键关键字讨论的主要主题是什么?

- 近年来哪些主题的重要性下降?

- 各行业的未来趋势是什么?

- 2025年第四季财报电话会议期间,市场情绪发生了哪些变化?

目录

第一章:摘要整理

第二章:脉搏侦测:当前经济环境

第三章:CEO对2025年第四季的讨论

- 自2019年第一季以来财报电话会议讨论主题的重要性

- 人工智慧

- 对人工智慧泡沫的担忧

- 政府停摆

- 详情:行业概览

- 详情:关键议题

第四章:製造业分析

- 製造业:製造业CEO的观点

- 製造业:当前挑战

第五章:市场情绪与展望依产业与地区划分

第六章:附录

A 60-page report on the trends that emerged in Q4 2025 earnings calls. The report is based on data of 115,000+ earnings calls of US-listed companies from Q1 2019 through Q4 2025.

The Quarterly trend report: What CEOs talked about in Q4 2025 is part of IoT Analytics' ongoing coverage of the IoT and related technology markets. The information presented in this report is based on a database of 115,000+ earnings calls of US-listed companies from Q1 2019 through Q4 2025. Every quarter, IoT Analytics analyzes trends emerging from earnings calls and presents findings for the most recent quarter. The purpose is to inform other market participants about the current focus of CEOs and companies. To ensure objectivity, IoT Analytics did not alter or supplement any results and did not deliberately exclude any earnings calls.

Key rising themes in Q4 2025

- AI

- AI bubble

- US government shutdown

Key declining themes in Q4 2025

- Tariffs

- Uncertainty

Sample preview

5 critical questions for CEOs

1. Are we negatively affected in case the "AI bubble" bursts?

AI mentions hit a peak of ~47%, but bubble fears are rising. Validate that investments focus on infrastructure and long-term value rather than hype and check for potential abrupt project cancellations in case data center or related investments come to a halt.

2. Are we prepared for another U.S. government shutdown in January?

Shutdown mentions surged to 17%, becoming a fast-growing risk even as tariff talks dipped to 35%. Assess exposure to government contracts and potential hits to consumer confidence.

3.Are we preparing for the shift from Generative to Agentic AI?

NVIDIA identifies "Agentic AI" as a brand-new category. Shift roadmaps from simple content generation to agents capable of executing autonomous tasks.

4. Does our infrastructure account for sovereign cloud demands?

EMEA data center discussions have surpassed North America's. Assess if cloud strategies meet the "super big" demand for sovereign data handling in Europe.

5 Are we capitalized to ride the IT sector's growth wave?

Business sentiment is up, with IT projected to grow 15.4%. Pivot sales strategies toward high-growth sectors and away from contracting industries like Energy.

Questions answered

- How is the overall economic environment in Q4 2025?

- What are some of the upcoming trends that CEOs talk about?

- What keywords were most prevalent in the earnings calls in the last quarter?

- What are the key themes that CEOs discuss related to the main keywords?

- Which themes have lost importance in the last few years?

- What are upcoming trends in different sectors?

- How did the sentiment change in earnings calls in Q4 2025?

Table of Contents

1. Executive summary

2. Pulse check: The current economic environment

3. What CEOs talked about in Q4 2025

- Importance of selected topics in earnings calls since Q1 2019

- 3.1 AI

- 3.2 AI bubble fears

- 3.3 Shutdown

- 3.4 Deep dive: Sector overview

- 3.5 Deep dive: Selected topics

4. Manufacturing deep dives

- 4.1 Manufacturing: What manufacturing CEOs talked about

- 4.2 Manufacturing: Current challenges