|

市场调查报告书

商品编码

1381214

製程安全系统市场:按组件、产品和最终用户划分 - 2023-2030 年全球预测Process Safety Systems Market by Component (Hardware, Service, Software), Product (Burner Management System (BMS), Emergency Shutdown (ESD), High Integrity Pressure Protection System (HIPPS)), End-User - Global Forecast 2023-2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

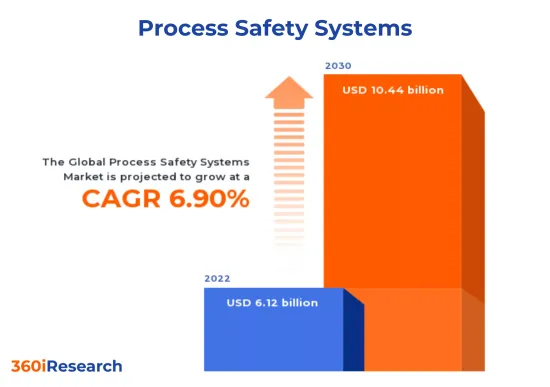

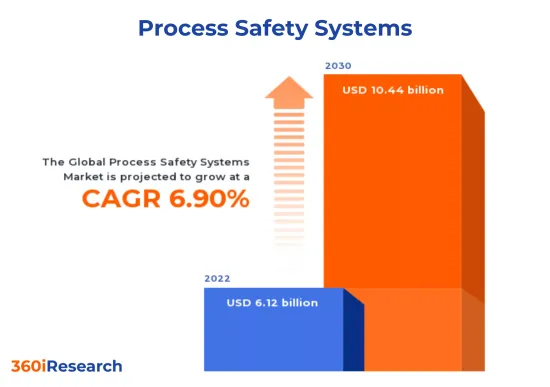

製程安全系统市场预计将从 2022 年的 61.2 亿美元增至 2030 年的 104.4 亿美元,预测期内年复合成长率为 6.90%。

全球製程安全系统市场

| 主要市场统计 | |

|---|---|

| 市场金额:基准年 [2022] | 61.2亿美元 |

| 预计市场金额[2023] | 65.3亿美元 |

| 预计市场金额[2030] | 104.4亿美元 |

| 年复合成长率(%) | 6.90% |

FPNV定位矩阵

FPNV 定位矩阵是评估製程安全系统市场的重要工具。透过分析与业务策略和产品满意度相关的关键指标来全面评估供应商。这使得使用者能够根据自己的具体资讯做出明智的决策。进阶分析将供应商分为四个像限,每个象限都有不同程度的成功:前沿 (F)、探路者 (P)、利基 (N) 和重要 (V)。这个富有洞察力的框架使决策者能够充满信心地驾驭市场。

市场占有率分析

市场占有率分析为供应商的市场形势提供了宝贵的见解。评估对整体收益、客户群和其他关键指标的影响可以全面了解公司的业绩及其面临的竞争环境。该分析还揭示了研究期间的竞争水平,例如市场占有率增长、碎片化、主导地位和行业整合。

该报告对以下几个方面提供了宝贵的见解:

1.市场渗透:提供有关市场动态和主要企业产品的全面资讯。

2. 市场开拓:详细分析新兴和成熟细分市场的渗透情况,以突显利润丰厚的商机。

3. 市场多元化:有关新产品发布、开拓地区、最新发展和投资的详细资讯。

4.竞争评估与资讯:对主要企业的市场占有率、策略、产品、认证、法规状况、专利状况、製造能力等进行综合评估。

5. 产品开发与创新:对未来技术、研发活动和突破性产品开发的智慧洞察。

本报告解决了以下关键问题:

1.製程安全系统市场的市场规模与预测是多少?

2. 製程安全系统市场中哪些产品、细分市场、应用和领域具有最高的投资潜力?

3.製程安全系统市场的竞争策略窗口是什么?

4.製程安全系统市场的最新技术趋势和法律规范是什么?

5.製程安全系统市场主要供应商的市场占有率是多少?

6. 进入製程安全系统市场的适当型态和策略手段是什么?

目录

第1章前言

第2章调查方法

第3章执行摘要

第4章市场概况

第5章市场洞察

- 市场动态

- 促进因素

- 工业流程和工人安全的严格国际标准

- 工厂里的火灾、爆炸和瓦斯外洩事件不断增加。

- 提高流程工业安全操作实务的意识

- 抑制因素

- 实施和维护过程安全系统的成本高昂

- 机会

- 整合先进的数位技术进行即时风险评估和预测性维护

- 商业和工业领域快速过渡到自动化

- 任务

- 缺乏训练有素且经验丰富的专业人员

- 促进因素

- 市场区隔分析

- 市场趋势分析

- 高通膨的累积效应

- 波特五力分析

- 价值炼和关键路径分析

- 法律规范

第6章过程安全系统市场:按组成部分

- 硬体

- 服务

- 软体

第7章製程安全系统市场:副产品

- 燃烧器管理系统 (BMS)

- 紧急关闭(ESD)

- 高可靠性压力保护系统(HIPPS)

- 涡轮机械控制 (TMC)

第8章製程安全系统市场:依最终使用者分类

- 化学品

- 能源和电力

- 食品加工

- 石油天然气

- 纸浆

- 药品

第9章美洲製程安全系统市场

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美国

第10章亚太製程安全系统市场

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 台湾

- 泰国

- 越南

第11章欧洲、中东和非洲製程安全系统市场

- 丹麦

- 埃及

- 芬兰

- 法国

- 德国

- 以色列

- 义大利

- 荷兰

- 奈及利亚

- 挪威

- 波兰

- 卡达

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公国

- 英国

第12章竞争形势

- FPNV定位矩阵

- 市场占有率分析:主要企业

- 主要企业竞争情境分析

第13章竞争产品组合

- 主要公司简介

- ABB Ltd.

- Anderson Dahlen, Inc.

- Blackstone Industrial Group

- Bureau Veritas UK Limited

- CFE Media LLC

- DEKRA India Private Limited

- Deskera US Inc.

- Emerson Electric Co.

- Esoteric Automation & Control Technologies

- General Electric Company

- Hexagon AB

- HIMA Paul Hildebrandt GmbH

- Honeywell International Inc.

- Intertek Group PLC

- Johnson Controls International PLC

- Merck KGaA

- Milliken & Company

- Omron Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- SGS SA

- Siemens AG

- The Integration Group of Americas Inc.

- TUV SUD AG

- Yokogawa Electric Corporation

- 主要产品系列

第14章附录

- 讨论指南

- 关于许可证和定价

The Process Safety Systems Market is projected to reach USD 10.44 billion by 2030 from USD 6.12 billion in 2022, at a CAGR of 6.90% during the forecast period.

Global Process Safety Systems Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year Value [2022] | USD 6.12 billion |

| Estimated Year Value [2023] | USD 6.53 billion |

| Forecast Year Value [2030] | USD 10.44 billion |

| CAGR (%) | 6.90% |

Market Segmentation & Coverage:

This research report analyzes various sub-markets, forecasts revenues, and examines emerging trends in each category to provide a comprehensive outlook on the Process Safety Systems Market.

Based on Component, market is studied across Hardware, Service, and Software. The Service is projected to witness significant market share during forecast period.

Based on Product, market is studied across Burner Management System (BMS), Emergency Shutdown (ESD), High Integrity Pressure Protection System (HIPPS), and Turbo Machinery Control (TMC). The Burner Management System (BMS) is projected to witness significant market share during forecast period.

Based on End-User, market is studied across Chemical, Energy & Power, Food Processing, Oil & Gas, Paper & Pulp, and Pharmaceutical. The Food Processing is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa is projected to witness significant market share during forecast period.

Market Statistics:

The report provides market sizing and forecasts across 7 major currencies - USD, EUR, JPY, GBP, AUD, CAD, and CHF; multiple currency support helps organization leaders to make well-informed decisions. In this report, 2018 to 2021 are considered as historical years, 2022 is base year, 2023 is estimated year, and years from 2024 to 2030 are considered as forecast period.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is an indispensable tool for assessing the Process Safety Systems Market. It comprehensively evaluates vendors, analyzing key metrics related to Business Strategy and Product Satisfaction. This enables users to make informed decisions tailored to their specific needs. Through advanced analysis, vendors are categorized into four distinct quadrants, each representing a different level of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V). Be assured that this insightful framework empowers decision-makers to navigate the market with confidence.

Market Share Analysis:

The Market Share Analysis offers invaluable insights into the vendor landscape Process Safety Systems Market. By evaluating their impact on overall revenue, customer base, and other key metrics, we provide companies with a comprehensive understanding of their performance and the competitive environment they confront. This analysis also uncovers the level of competition in terms of market share acquisition, fragmentation, dominance, and industry consolidation during the study period.

Key Company Profiles:

The report delves into recent significant developments in the Process Safety Systems Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Anderson Dahlen, Inc., Blackstone Industrial Group, Bureau Veritas UK Limited, CFE Media LLC, DEKRA India Private Limited, Deskera US Inc., Emerson Electric Co., Esoteric Automation & Control Technologies, General Electric Company, Hexagon AB, HIMA Paul Hildebrandt GmbH, Honeywell International Inc., Intertek Group PLC, Johnson Controls International PLC, Merck KGaA, Milliken & Company, Omron Corporation, Rockwell Automation Inc., Schneider Electric SE, SGS S.A., Siemens AG, The Integration Group of Americas Inc., TUV SUD AG, and Yokogawa Electric Corporation.

The report offers valuable insights on the following aspects:

1. Market Penetration: It provides comprehensive information about key players' market dynamics and offerings.

2. Market Development: In-depth analysis of emerging markets and penetration across mature market segments, highlighting lucrative opportunities.

3. Market Diversification: Detailed information about new product launches, untapped geographies, recent developments, and investments.

4. Competitive Assessment & Intelligence: Exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of leading players.

5. Product Development & Innovation: Intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast for the Process Safety Systems Market?

2. Which products, segments, applications, and areas hold the highest investment potential in the Process Safety Systems Market?

3. What is the competitive strategic window for identifying opportunities in the Process Safety Systems Market?

4. What are the latest technology trends and regulatory frameworks in the Process Safety Systems Market?

5. What is the market share of the leading vendors in the Process Safety Systems Market?

6. Which modes and strategic moves are suitable for entering the Process Safety Systems Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Process Safety Systems Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Stringent international standards for the industrial process and worker safety

- 5.1.1.2. Rising cases of fire explosion and gas leaks in factory

- 5.1.1.3. Growing awareness about safe operational practices in process industries

- 5.1.2. Restraints

- 5.1.2.1. High implementation and maintenance cost of process safety systems

- 5.1.3. Opportunities

- 5.1.3.1. Integration of advanced digital technologies for real-time risk assessment and predictive maintenance

- 5.1.3.2. Rapid shift towards the automation in commercial and industrial area

- 5.1.4. Challenges

- 5.1.4.1. Lack of trained and experienced professionals

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Process Safety Systems Market, by Component

- 6.1. Introduction

- 6.2. Hardware

- 6.3. Service

- 6.4. Software

7. Process Safety Systems Market, by Product

- 7.1. Introduction

- 7.2. Burner Management System (BMS)

- 7.3. Emergency Shutdown (ESD)

- 7.4. High Integrity Pressure Protection System (HIPPS)

- 7.5. Turbo Machinery Control (TMC)

8. Process Safety Systems Market, by End-User

- 8.1. Introduction

- 8.2. Chemical

- 8.3. Energy & Power

- 8.4. Food Processing

- 8.5. Oil & Gas

- 8.6. Paper & Pulp

- 8.7. Pharmaceutical

9. Americas Process Safety Systems Market

- 9.1. Introduction

- 9.2. Argentina

- 9.3. Brazil

- 9.4. Canada

- 9.5. Mexico

- 9.6. United States

10. Asia-Pacific Process Safety Systems Market

- 10.1. Introduction

- 10.2. Australia

- 10.3. China

- 10.4. India

- 10.5. Indonesia

- 10.6. Japan

- 10.7. Malaysia

- 10.8. Philippines

- 10.9. Singapore

- 10.10. South Korea

- 10.11. Taiwan

- 10.12. Thailand

- 10.13. Vietnam

11. Europe, Middle East & Africa Process Safety Systems Market

- 11.1. Introduction

- 11.2. Denmark

- 11.3. Egypt

- 11.4. Finland

- 11.5. France

- 11.6. Germany

- 11.7. Israel

- 11.8. Italy

- 11.9. Netherlands

- 11.10. Nigeria

- 11.11. Norway

- 11.12. Poland

- 11.13. Qatar

- 11.14. Russia

- 11.15. Saudi Arabia

- 11.16. South Africa

- 11.17. Spain

- 11.18. Sweden

- 11.19. Switzerland

- 11.20. Turkey

- 11.21. United Arab Emirates

- 11.22. United Kingdom

12. Competitive Landscape

- 12.1. FPNV Positioning Matrix

- 12.2. Market Share Analysis, By Key Player

- 12.3. Competitive Scenario Analysis, By Key Player

13. Competitive Portfolio

- 13.1. Key Company Profiles

- 13.1.1. ABB Ltd.

- 13.1.2. Anderson Dahlen, Inc.

- 13.1.3. Blackstone Industrial Group

- 13.1.4. Bureau Veritas UK Limited

- 13.1.5. CFE Media LLC

- 13.1.6. DEKRA India Private Limited

- 13.1.7. Deskera US Inc.

- 13.1.8. Emerson Electric Co.

- 13.1.9. Esoteric Automation & Control Technologies

- 13.1.10. General Electric Company

- 13.1.11. Hexagon AB

- 13.1.12. HIMA Paul Hildebrandt GmbH

- 13.1.13. Honeywell International Inc.

- 13.1.14. Intertek Group PLC

- 13.1.15. Johnson Controls International PLC

- 13.1.16. Merck KGaA

- 13.1.17. Milliken & Company

- 13.1.18. Omron Corporation

- 13.1.19. Rockwell Automation Inc.

- 13.1.20. Schneider Electric SE

- 13.1.21. SGS S.A.

- 13.1.22. Siemens AG

- 13.1.23. The Integration Group of Americas Inc.

- 13.1.24. TUV SUD AG

- 13.1.25. Yokogawa Electric Corporation

- 13.2. Key Product Portfolio

14. Appendix

- 14.1. Discussion Guide

- 14.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. PROCESS SAFETY SYSTEMS MARKET RESEARCH PROCESS

- FIGURE 2. PROCESS SAFETY SYSTEMS MARKET SIZE, 2022 VS 2030

- FIGURE 3. PROCESS SAFETY SYSTEMS MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. PROCESS SAFETY SYSTEMS MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. PROCESS SAFETY SYSTEMS MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. PROCESS SAFETY SYSTEMS MARKET DYNAMICS

- FIGURE 7. PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2022 VS 2030 (%)

- FIGURE 8. PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2022 VS 2030 (%)

- FIGURE 10. PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2022 VS 2030 (%)

- FIGURE 12. PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 14. AMERICAS PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 16. UNITED STATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. ASIA-PACIFIC PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 18. ASIA-PACIFIC PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. PROCESS SAFETY SYSTEMS MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 22. PROCESS SAFETY SYSTEMS MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. PROCESS SAFETY SYSTEMS MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. PROCESS SAFETY SYSTEMS MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL PROCESS SAFETY SYSTEMS MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 6. PROCESS SAFETY SYSTEMS MARKET SIZE, BY HARDWARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. PROCESS SAFETY SYSTEMS MARKET SIZE, BY SERVICE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. PROCESS SAFETY SYSTEMS MARKET SIZE, BY SOFTWARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 10. PROCESS SAFETY SYSTEMS MARKET SIZE, BY BURNER MANAGEMENT SYSTEM (BMS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. PROCESS SAFETY SYSTEMS MARKET SIZE, BY EMERGENCY SHUTDOWN (ESD), BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. PROCESS SAFETY SYSTEMS MARKET SIZE, BY HIGH INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. PROCESS SAFETY SYSTEMS MARKET SIZE, BY TURBO MACHINERY CONTROL (TMC), BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 15. PROCESS SAFETY SYSTEMS MARKET SIZE, BY CHEMICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. PROCESS SAFETY SYSTEMS MARKET SIZE, BY ENERGY & POWER, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. PROCESS SAFETY SYSTEMS MARKET SIZE, BY FOOD PROCESSING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. PROCESS SAFETY SYSTEMS MARKET SIZE, BY OIL & GAS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. PROCESS SAFETY SYSTEMS MARKET SIZE, BY PAPER & PULP, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. PROCESS SAFETY SYSTEMS MARKET SIZE, BY PHARMACEUTICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. AMERICAS PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 22. AMERICAS PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 23. AMERICAS PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 24. AMERICAS PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 25. ARGENTINA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 26. ARGENTINA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 27. ARGENTINA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 28. BRAZIL PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 29. BRAZIL PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 30. BRAZIL PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 31. CANADA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 32. CANADA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 33. CANADA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 34. MEXICO PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 35. MEXICO PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 36. MEXICO PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 37. UNITED STATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 38. UNITED STATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 39. UNITED STATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 40. UNITED STATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 41. ASIA-PACIFIC PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 42. ASIA-PACIFIC PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 43. ASIA-PACIFIC PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 44. ASIA-PACIFIC PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 45. AUSTRALIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 46. AUSTRALIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 47. AUSTRALIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 48. CHINA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 49. CHINA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 50. CHINA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 51. INDIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 52. INDIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 53. INDIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 54. INDONESIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 55. INDONESIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 56. INDONESIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 57. JAPAN PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 58. JAPAN PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 59. JAPAN PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 60. MALAYSIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 61. MALAYSIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 62. MALAYSIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 63. PHILIPPINES PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 64. PHILIPPINES PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 65. PHILIPPINES PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 66. SINGAPORE PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 67. SINGAPORE PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 68. SINGAPORE PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 69. SOUTH KOREA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 70. SOUTH KOREA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 71. SOUTH KOREA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 72. TAIWAN PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 73. TAIWAN PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 74. TAIWAN PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 75. THAILAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 76. THAILAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 77. THAILAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 78. VIETNAM PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 79. VIETNAM PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 80. VIETNAM PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 81. EUROPE, MIDDLE EAST & AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 82. EUROPE, MIDDLE EAST & AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 83. EUROPE, MIDDLE EAST & AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 84. EUROPE, MIDDLE EAST & AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 85. DENMARK PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 86. DENMARK PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 87. DENMARK PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 88. EGYPT PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 89. EGYPT PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 90. EGYPT PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 91. FINLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 92. FINLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 93. FINLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 94. FRANCE PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 95. FRANCE PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 96. FRANCE PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 97. GERMANY PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 98. GERMANY PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 99. GERMANY PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 100. ISRAEL PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 101. ISRAEL PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 102. ISRAEL PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 103. ITALY PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 104. ITALY PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 105. ITALY PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 106. NETHERLANDS PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 107. NETHERLANDS PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 108. NETHERLANDS PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 109. NIGERIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 110. NIGERIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 111. NIGERIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 112. NORWAY PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 113. NORWAY PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 114. NORWAY PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 115. POLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 116. POLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 117. POLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 118. QATAR PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 119. QATAR PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 120. QATAR PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 121. RUSSIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 122. RUSSIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 123. RUSSIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 124. SAUDI ARABIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 125. SAUDI ARABIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 126. SAUDI ARABIA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 127. SOUTH AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 128. SOUTH AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 129. SOUTH AFRICA PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 130. SPAIN PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 131. SPAIN PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 132. SPAIN PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 133. SWEDEN PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 134. SWEDEN PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 135. SWEDEN PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 136. SWITZERLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 137. SWITZERLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 138. SWITZERLAND PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 139. TURKEY PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 140. TURKEY PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 141. TURKEY PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 142. UNITED ARAB EMIRATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 143. UNITED ARAB EMIRATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 144. UNITED ARAB EMIRATES PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 145. UNITED KINGDOM PROCESS SAFETY SYSTEMS MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 146. UNITED KINGDOM PROCESS SAFETY SYSTEMS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 147. UNITED KINGDOM PROCESS SAFETY SYSTEMS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 148. PROCESS SAFETY SYSTEMS MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 149. PROCESS SAFETY SYSTEMS MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 150. PROCESS SAFETY SYSTEMS MARKET LICENSE & PRICING