|

市场调查报告书

商品编码

1381916

苯乙烯聚合物市场:按产品、最终用户划分 - 2023-2030 年全球预测Styrenic Polymers Market by Product (Acrylonitrile Butadiene Styrene (ABS), Expanded Polystyrene (EPS), Polystyrene (PS)), End-user (Automotive, Construction, Electrical & Electronics) - Global Forecast 2023-2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

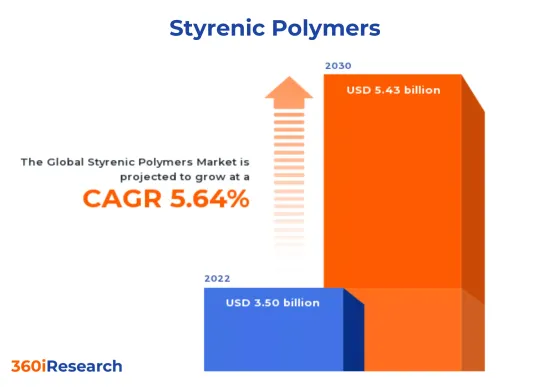

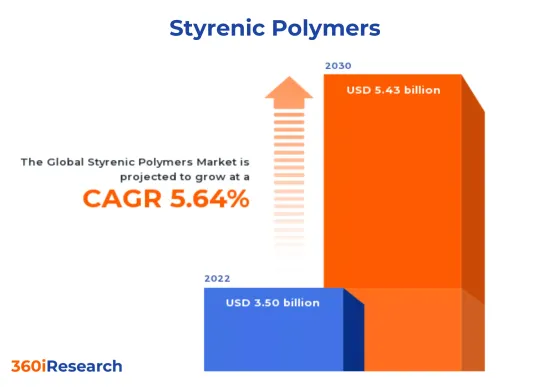

苯乙烯聚合物市场预计将从 2022 年的 35 亿美元增加到 2030 年的 54.3 亿美元,预测期内年复合成长率为 5.64%。

苯乙烯聚合物的全球市场

| 主要市场统计 | |

|---|---|

| 市场金额:基准年 [2022] | 35亿美元 |

| 预计市场金额[2023] | 36.8亿美元 |

| 预计市场金额[2030] | 54.3亿美元 |

| 年复合成长率(%) | 5.64% |

FPNV定位矩阵

FPNV定位矩阵是评估苯乙烯聚合物市场的重要工具。透过分析与业务策略和产品满意度相关的关键指标来全面评估供应商。这使得使用者能够根据自己的具体资讯做出明智的决策。进阶分析将供应商分为四个像限,每个象限都有不同程度的成功:前沿 (F)、探路者 (P)、利基 (N) 和重要 (V)。这个富有洞察力的框架使决策者能够充满信心地驾驭市场。

市场占有率分析

市场占有率分析为供应商的市场形势提供了宝贵的见解。评估对整体收益、客户群和其他关键指标的影响可以全面了解公司的业绩及其面临的竞争环境。该分析还揭示了研究期间的竞争水平,例如市场占有率增长、碎片化、主导地位和行业整合。

该报告对以下几个方面提供了宝贵的见解:

1.市场渗透:提供有关市场动态和主要企业产品的全面资讯。

2. 市场开拓:详细分析新兴和成熟细分市场的渗透情况,以突显利润丰厚的商机。

3. 市场多元化:有关新产品发布、开拓地区、最新发展和投资的详细资讯。

4.竞争评估与资讯:对主要企业的市场占有率、策略、产品、认证、法规状况、专利状况、製造能力等进行综合评估。

5. 产品开发与创新:对未来技术、研发活动和突破性产品开发的智慧洞察。

本报告解决了以下关键问题:

1.苯乙烯聚合物市场规模及预测如何?

2. 苯乙烯聚合物市场中哪些产品、细分市场、应用和领域具有最高的投资潜力?

3.苯乙烯聚合物市场竞争策略的窗口是什么?

4.苯乙烯聚合物市场的最新技术趋势和法律规范是什么?

5.苯乙烯聚合物市场主要供应商的市场占有率为何?

6.进入苯乙烯聚合物市场的合适型态和策略手段是什么?

目录

第1章前言

第2章调查方法

第3章执行摘要

第4章市场概况

第5章市场洞察

- 市场动态

- 促进因素

- 扩大低排放气体汽车的引进和对更轻汽车零件的需求

- 对即食食品的需求不断增加以及苯乙烯聚合物在食品包装中的应用

- 人们越来越偏好永续建筑和建筑材料

- 抑制因素

- 苯乙烯聚合物的成本相对较高

- 机会

- 扩大并开发新型苯乙烯聚合物

- 苯乙烯聚合物在3D列印技术中的巨大潜力

- 任务

- 与保持苯乙烯聚合物的品质和性能相关的挑战

- 促进因素

- 市场区隔分析

- 市场趋势分析

- 高通膨的累积效应

- 波特五力分析

- 价值炼和关键路径分析

- 法律规范

第6章苯乙烯聚合物市场:副产品

- 丙烯腈丁二烯苯乙烯 (ABS)

- 发泡聚苯乙烯 (EPS)

- 聚苯乙烯(PS)

- 丁苯橡胶 (SBR)

- 不饱和聚酯树脂(UPR)

第7章苯乙烯聚合物市场:依最终用户分类

- 汽车

- 建造

- 电力/电子

- 医学

第8章美洲苯乙烯聚合物市场

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美国

第9章亚太地区苯乙烯聚合物市场

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 台湾

- 泰国

- 越南

第10章欧洲、中东和非洲苯乙烯聚合物市场

- 丹麦

- 埃及

- 芬兰

- 法国

- 德国

- 以色列

- 义大利

- 荷兰

- 奈及利亚

- 挪威

- 波兰

- 卡达

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公国

- 英国

第11章竞争形势

- FPNV定位矩阵

- 市场占有率分析:主要企业

- 主要企业竞争情境分析

第12章竞争产品组合

- 主要公司简介

- Acrilex Inc.

- Americas Styrenics LLC

- BASF SE

- Boedeker Plastics, Inc.

- Chevron Phillips Chemical Company LLC

- CHIMEI Corporation

- DIC Corporation

- ELIX Polymers SLU

- Engineering Laboratories, Inc.

- Evonik Industries AG

- Greenchemicals Srl

- INEOS AG

- KOHLSCHEIN GmbH & Co. KG

- Korrex Company

- Kraton Polymers LLC by DL Chemical Co., Ltd.

- Krishna Antioxidants Pvt. Ltd.

- Merck KGaA

- Nova Chemicals Corporation

- Polymet SA

- RAPAC/a Ring Company

- Saudi Basic Industries Corporation

- The Dow Chemical Company

- TotalEnergies SE

- Trinseo PLC

- 主要产品系列

第13章附录

- 讨论指南

- 关于许可证和定价

The Styrenic Polymers Market is projected to reach USD 5.43 billion by 2030 from USD 3.50 billion in 2022, at a CAGR of 5.64% during the forecast period.

Global Styrenic Polymers Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year Value [2022] | USD 3.50 billion |

| Estimated Year Value [2023] | USD 3.68 billion |

| Forecast Year Value [2030] | USD 5.43 billion |

| CAGR (%) | 5.64% |

Market Segmentation & Coverage:

This research report analyzes various sub-markets, forecasts revenues, and examines emerging trends in each category to provide a comprehensive outlook on the Styrenic Polymers Market.

Based on Product, market is studied across Acrylonitrile Butadiene Styrene (ABS), Expanded Polystyrene (EPS), Polystyrene (PS), Styrene-Butadiene Rubber (SBR), and Unsaturated Polyester Resin (UPR). The Unsaturated Polyester Resin (UPR) is projected to witness significant market share during forecast period.

Based on End-user, market is studied across Automotive, Construction, Electrical & Electronics, and Medical. The Medical is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa is projected to witness significant market share during forecast period.

Market Statistics:

The report provides market sizing and forecasts across 7 major currencies - USD, EUR, JPY, GBP, AUD, CAD, and CHF; multiple currency support helps organization leaders to make well-informed decisions. In this report, 2018 to 2021 are considered as historical years, 2022 is base year, 2023 is estimated year, and years from 2024 to 2030 are considered as forecast period.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is an indispensable tool for assessing the Styrenic Polymers Market. It comprehensively evaluates vendors, analyzing key metrics related to Business Strategy and Product Satisfaction. This enables users to make informed decisions tailored to their specific needs. Through advanced analysis, vendors are categorized into four distinct quadrants, each representing a different level of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V). Be assured that this insightful framework empowers decision-makers to navigate the market with confidence.

Market Share Analysis:

The Market Share Analysis offers invaluable insights into the vendor landscape Styrenic Polymers Market. By evaluating their impact on overall revenue, customer base, and other key metrics, we provide companies with a comprehensive understanding of their performance and the competitive environment they confront. This analysis also uncovers the level of competition in terms of market share acquisition, fragmentation, dominance, and industry consolidation during the study period.

Key Company Profiles:

The report delves into recent significant developments in the Styrenic Polymers Market, highlighting leading vendors and their innovative profiles. These include Acrilex Inc., Americas Styrenics LLC, BASF SE, Boedeker Plastics, Inc., Chevron Phillips Chemical Company LLC, CHIMEI Corporation, DIC Corporation, ELIX Polymers S.L.U., Engineering Laboratories, Inc., Evonik Industries AG, Greenchemicals S.r.l., INEOS AG, KOHLSCHEIN GmbH & Co. KG, Korrex Company, Kraton Polymers LLC by DL Chemical Co., Ltd., Krishna Antioxidants Pvt. Ltd., Merck KGaA, Nova Chemicals Corporation, Polymet SA, RAPAC/a Ring Company, Saudi Basic Industries Corporation, The Dow Chemical Company, TotalEnergies SE, and Trinseo PLC.

The report offers valuable insights on the following aspects:

1. Market Penetration: It provides comprehensive information about key players' market dynamics and offerings.

2. Market Development: In-depth analysis of emerging markets and penetration across mature market segments, highlighting lucrative opportunities.

3. Market Diversification: Detailed information about new product launches, untapped geographies, recent developments, and investments.

4. Competitive Assessment & Intelligence: Exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of leading players.

5. Product Development & Innovation: Intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast for the Styrenic Polymers Market?

2. Which products, segments, applications, and areas hold the highest investment potential in the Styrenic Polymers Market?

3. What is the competitive strategic window for identifying opportunities in the Styrenic Polymers Market?

4. What are the latest technology trends and regulatory frameworks in the Styrenic Polymers Market?

5. What is the market share of the leading vendors in the Styrenic Polymers Market?

6. Which modes and strategic moves are suitable for entering the Styrenic Polymers Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Styrenic Polymers Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Growing adoption of low emission vehicles and demand for lightweight vehicle components

- 5.1.1.2. Rising demand for convenience food products and application of styrenic polymers in food packaging

- 5.1.1.3. Inclining preferences for sustainable building and construction materials

- 5.1.2. Restraints

- 5.1.2.1. Relative high costs associated with styrenic polymers

- 5.1.3. Opportunities

- 5.1.3.1. Growing expansion and development new styrenic polymers

- 5.1.3.2. Higher potential of styrenic polymers in 3D printing technology

- 5.1.4. Challenges

- 5.1.4.1. Challenges associated with maintaining quality and performance of styrenic polymers

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Styrenic Polymers Market, by Product

- 6.1. Introduction

- 6.2. Acrylonitrile Butadiene Styrene (ABS)

- 6.3. Expanded Polystyrene (EPS)

- 6.4. Polystyrene (PS)

- 6.5. Styrene-Butadiene Rubber (SBR)

- 6.6. Unsaturated Polyester Resin (UPR)

7. Styrenic Polymers Market, by End-user

- 7.1. Introduction

- 7.2. Automotive

- 7.3. Construction

- 7.4. Electrical & Electronics

- 7.5. Medical

8. Americas Styrenic Polymers Market

- 8.1. Introduction

- 8.2. Argentina

- 8.3. Brazil

- 8.4. Canada

- 8.5. Mexico

- 8.6. United States

9. Asia-Pacific Styrenic Polymers Market

- 9.1. Introduction

- 9.2. Australia

- 9.3. China

- 9.4. India

- 9.5. Indonesia

- 9.6. Japan

- 9.7. Malaysia

- 9.8. Philippines

- 9.9. Singapore

- 9.10. South Korea

- 9.11. Taiwan

- 9.12. Thailand

- 9.13. Vietnam

10. Europe, Middle East & Africa Styrenic Polymers Market

- 10.1. Introduction

- 10.2. Denmark

- 10.3. Egypt

- 10.4. Finland

- 10.5. France

- 10.6. Germany

- 10.7. Israel

- 10.8. Italy

- 10.9. Netherlands

- 10.10. Nigeria

- 10.11. Norway

- 10.12. Poland

- 10.13. Qatar

- 10.14. Russia

- 10.15. Saudi Arabia

- 10.16. South Africa

- 10.17. Spain

- 10.18. Sweden

- 10.19. Switzerland

- 10.20. Turkey

- 10.21. United Arab Emirates

- 10.22. United Kingdom

11. Competitive Landscape

- 11.1. FPNV Positioning Matrix

- 11.2. Market Share Analysis, By Key Player

- 11.3. Competitive Scenario Analysis, By Key Player

12. Competitive Portfolio

- 12.1. Key Company Profiles

- 12.1.1. Acrilex Inc.

- 12.1.2. Americas Styrenics LLC

- 12.1.3. BASF SE

- 12.1.4. Boedeker Plastics, Inc.

- 12.1.5. Chevron Phillips Chemical Company LLC

- 12.1.6. CHIMEI Corporation

- 12.1.7. DIC Corporation

- 12.1.8. ELIX Polymers S.L.U.

- 12.1.9. Engineering Laboratories, Inc.

- 12.1.10. Evonik Industries AG

- 12.1.11. Greenchemicals S.r.l.

- 12.1.12. INEOS AG

- 12.1.13. KOHLSCHEIN GmbH & Co. KG

- 12.1.14. Korrex Company

- 12.1.15. Kraton Polymers LLC by DL Chemical Co., Ltd.

- 12.1.16. Krishna Antioxidants Pvt. Ltd.

- 12.1.17. Merck KGaA

- 12.1.18. Nova Chemicals Corporation

- 12.1.19. Polymet SA

- 12.1.20. RAPAC/a Ring Company

- 12.1.21. Saudi Basic Industries Corporation

- 12.1.22. The Dow Chemical Company

- 12.1.23. TotalEnergies SE

- 12.1.24. Trinseo PLC

- 12.2. Key Product Portfolio

13. Appendix

- 13.1. Discussion Guide

- 13.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. STYRENIC POLYMERS MARKET RESEARCH PROCESS

- FIGURE 2. STYRENIC POLYMERS MARKET SIZE, 2022 VS 2030

- FIGURE 3. STYRENIC POLYMERS MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. STYRENIC POLYMERS MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. STYRENIC POLYMERS MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. STYRENIC POLYMERS MARKET DYNAMICS

- FIGURE 7. STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2022 VS 2030 (%)

- FIGURE 8. STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2022 VS 2030 (%)

- FIGURE 10. STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. AMERICAS STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 12. AMERICAS STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. UNITED STATES STYRENIC POLYMERS MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 14. UNITED STATES STYRENIC POLYMERS MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. ASIA-PACIFIC STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 16. ASIA-PACIFIC STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. EUROPE, MIDDLE EAST & AFRICA STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 18. EUROPE, MIDDLE EAST & AFRICA STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. STYRENIC POLYMERS MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 20. STYRENIC POLYMERS MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. STYRENIC POLYMERS MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. STYRENIC POLYMERS MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL STYRENIC POLYMERS MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 6. STYRENIC POLYMERS MARKET SIZE, BY ACRYLONITRILE BUTADIENE STYRENE (ABS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. STYRENIC POLYMERS MARKET SIZE, BY EXPANDED POLYSTYRENE (EPS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. STYRENIC POLYMERS MARKET SIZE, BY POLYSTYRENE (PS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. STYRENIC POLYMERS MARKET SIZE, BY STYRENE-BUTADIENE RUBBER (SBR), BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. STYRENIC POLYMERS MARKET SIZE, BY UNSATURATED POLYESTER RESIN (UPR), BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 12. STYRENIC POLYMERS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. STYRENIC POLYMERS MARKET SIZE, BY CONSTRUCTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. STYRENIC POLYMERS MARKET SIZE, BY ELECTRICAL & ELECTRONICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. STYRENIC POLYMERS MARKET SIZE, BY MEDICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. AMERICAS STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 17. AMERICAS STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 18. AMERICAS STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 19. ARGENTINA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 20. ARGENTINA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 21. BRAZIL STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 22. BRAZIL STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 23. CANADA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 24. CANADA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 25. MEXICO STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 26. MEXICO STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 27. UNITED STATES STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 28. UNITED STATES STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 29. UNITED STATES STYRENIC POLYMERS MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 30. ASIA-PACIFIC STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 31. ASIA-PACIFIC STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 32. ASIA-PACIFIC STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 33. AUSTRALIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 34. AUSTRALIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 35. CHINA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 36. CHINA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 37. INDIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 38. INDIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 39. INDONESIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 40. INDONESIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 41. JAPAN STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 42. JAPAN STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 43. MALAYSIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 44. MALAYSIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 45. PHILIPPINES STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 46. PHILIPPINES STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 47. SINGAPORE STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 48. SINGAPORE STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 49. SOUTH KOREA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 50. SOUTH KOREA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 51. TAIWAN STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 52. TAIWAN STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 53. THAILAND STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 54. THAILAND STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 55. VIETNAM STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 56. VIETNAM STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 57. EUROPE, MIDDLE EAST & AFRICA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 58. EUROPE, MIDDLE EAST & AFRICA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 59. EUROPE, MIDDLE EAST & AFRICA STYRENIC POLYMERS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 60. DENMARK STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 61. DENMARK STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 62. EGYPT STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 63. EGYPT STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 64. FINLAND STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 65. FINLAND STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 66. FRANCE STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 67. FRANCE STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 68. GERMANY STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 69. GERMANY STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 70. ISRAEL STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 71. ISRAEL STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 72. ITALY STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 73. ITALY STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 74. NETHERLANDS STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 75. NETHERLANDS STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 76. NIGERIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 77. NIGERIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 78. NORWAY STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 79. NORWAY STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 80. POLAND STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 81. POLAND STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 82. QATAR STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 83. QATAR STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 84. RUSSIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 85. RUSSIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 86. SAUDI ARABIA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 87. SAUDI ARABIA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 88. SOUTH AFRICA STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 89. SOUTH AFRICA STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 90. SPAIN STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 91. SPAIN STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 92. SWEDEN STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 93. SWEDEN STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 94. SWITZERLAND STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 95. SWITZERLAND STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 96. TURKEY STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 97. TURKEY STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 98. UNITED ARAB EMIRATES STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 99. UNITED ARAB EMIRATES STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 100. UNITED KINGDOM STYRENIC POLYMERS MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 101. UNITED KINGDOM STYRENIC POLYMERS MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 102. STYRENIC POLYMERS MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 103. STYRENIC POLYMERS MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 104. STYRENIC POLYMERS MARKET LICENSE & PRICING