|

市场调查报告书

商品编码

1411918

环氧乙烷市场:按衍生物、最终用户划分 - 全球预测 2024-2030 年Ethylene Oxide Market by Derivatives (Ethanolamines, Ethoxylates, Ethylene Glycols), End-User (Agrochemical, Automotive, Detergent) - Global Forecast 2024-2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

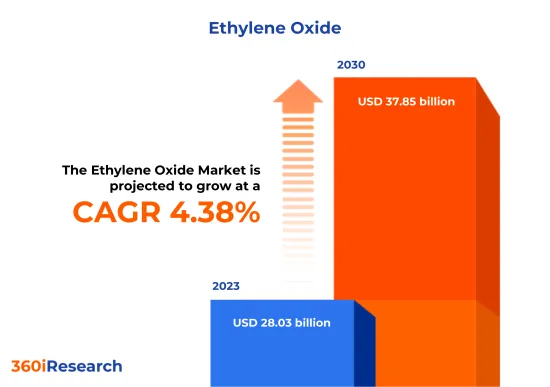

预计2023年环氧乙烷市场规模为280.3亿美元,预计2024年将达292.5亿美元,2030年将达378.5亿美元,复合年增长率为4.38%。

世界环氧乙烷市场

| 主要市场统计 | |

|---|---|

| 基准年[2023] | 280.3亿美元 |

| 预测年份 [2024] | 292.5亿美元 |

| 预测年份 [2030] | 378.5亿美元 |

| 复合年增长率(%) | 4.38% |

FPNV定位矩阵

FPNV定位矩阵对于评估环氧乙烷市场至关重要。我们检视与业务策略和产品满意度相关的关键指标,以对供应商进行全面评估。这种深入的分析使用户能够根据自己的要求做出资讯的决策。根据评估,供应商被分为四个成功程度不同的像限:前沿(F)、探路者(P)、利基(N)和重要(V)。

市场占有率分析

市场占有率分析是一种综合工具,可以对环氧乙烷市场供应商的现状进行深入而详细的研究。全面比较和分析供应商在整体收益、基本客群和其他关键指标方面的贡献,以便更好地了解公司的绩效及其在争夺市场占有率时面临的挑战。此外,该分析还提供了对该行业竞争特征的宝贵考察,包括在研究基准年观察到的累积、分散主导地位和合併特征等因素。这种详细程度的提高使供应商能够做出更资讯的决策并制定有效的策略,从而在市场上获得竞争优势。

该报告对以下几个方面提供了宝贵的见解:

1-市场渗透率:提供有关主要企业所服务的市场的全面资讯。

2-市场开拓:我们深入研究利润丰厚的新兴市场并分析其在成熟细分市场的渗透率。

3- 市场多元化:提供有关新产品发布、开拓地区、最新发展和投资的详细资讯。

4-竞争力评估与资讯:对主要企业的市场占有率、策略、产品、认证、监管状况、专利状况、製造能力等进行全面评估。

5- 产品开发与创新:提供对未来技术、研发活动和突破性产品开发的见解。

本报告解决了以下关键问题:

1-环氧乙烷市场的市场规模和预测是多少?

在 2-环氧乙烷市场预测期内,需要考虑投资哪些产品、细分市场、应用和领域?

3-环氧乙烷市场的技术趋势和法律规范是什么?

4-环氧乙烷市场主要厂商的市场占有率是多少?

进入5-环氧乙烷市场有哪些合适的型态与策略手段?

目录

第一章 前言

第二章调查方法

第三章执行摘要

第四章市场概况

第五章市场洞察

- 市场动态

- 促进因素

- 食品和饮料行业越来越多地采用 PET

- 对家庭和个人保健产品的需求增加

- 全球工业的潜在成长

- 抑制因素

- 大量接触对健康和环境造成的不利影响

- 机会

- 环氧乙烷生产的创新浪潮

- 介绍高性价比且环保的环氧乙烷灭菌解决方案

- 任务

- 复杂的监管环境和急剧上升的油价

- 促进因素

- 市场区隔分析

- 市场趋势分析

- 高通膨的累积效应

- 波特五力分析

- 价值炼和关键路径分析

- 法律规范

第六章环氧乙烷市场衍生性商品

- 乙醇胺

- 乙氧基化物

- 乙二醇

- 二伸乙甘醇(DEG)

- 单乙二醇 (MEG)

- 三甘醇 (TEG)

- 乙二醇醚

- 聚乙二醇

第七章环氧乙烷市场:依最终用户分类

- 农药

- 车

- 清洁剂

- 食品和饮料

- 个人护理

- 药品

- 纤维

第八章美洲环氧乙烷市场

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美国

第九章亚太地区环氧乙烷市场

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 台湾

- 泰国

- 越南

第十章欧洲、中东和非洲环氧乙烷市场

- 丹麦

- 埃及

- 芬兰

- 法国

- 德国

- 以色列

- 义大利

- 荷兰

- 奈及利亚

- 挪威

- 波兰

- 卡达

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公国

- 英国

第十一章竞争形势

- FPNV定位矩阵

- 市场占有率分析:按主要企业划分

- 主要企业竞争情境分析

第12章竞争产品组合

- 主要公司简介

- Akzo Nobel NV

- Azbil Corporation

- BASF SE

- China Petroleum & Chemical Corporation

- Clariant AG

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Huntsman International LLC

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Indorama Ventures Public Company Limited

- INEOS Group

- Linde PLC

- LOTTE Chemical Corporation

- LyondellBasell Industries Holdings BV

- Nippon Shokubai Co., Ltd.

- PAMA Manufacturing and Sterilization

- PTT Global Chemical Public Company Limited

- Reliance Industries Limited

- Sasol Limited

- Saudi Basic Industries Corporation

- Shell PLC

- The Dow Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- 主要产品系列

第十三章附录

- 讨论指南

- 关于许可证和定价

[199 Pages Report] The Ethylene Oxide Market size was estimated at USD 28.03 billion in 2023 and expected to reach USD 29.25 billion in 2024, at a CAGR 4.38% to reach USD 37.85 billion by 2030.

Global Ethylene Oxide Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 28.03 billion |

| Estimated Year [2024] | USD 29.25 billion |

| Forecast Year [2030] | USD 37.85 billion |

| CAGR (%) | 4.38% |

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Ethylene Oxide Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Ethylene Oxide Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Ethylene Oxide Market, highlighting leading vendors and their innovative profiles. These include Akzo Nobel N.V., Azbil Corporation, BASF SE, China Petroleum & Chemical Corporation, Clariant AG, Eastman Chemical Company, Exxon Mobil Corporation, Formosa Plastics Corporation, Huntsman International LLC, India Glycols Limited, Indian Oil Corporation Ltd., Indorama Ventures Public Company Limited, INEOS Group, Linde PLC, LOTTE Chemical Corporation, LyondellBasell Industries Holdings B.V., Nippon Shokubai Co., Ltd., PAMA Manufacturing and Sterilization, PTT Global Chemical Public Company Limited, Reliance Industries Limited, Sasol Limited, Saudi Basic Industries Corporation, Shell PLC, The Dow Chemical Company, and Tokyo Chemical Industry Co., Ltd..

Market Segmentation & Coverage

This research report categorizes the Ethylene Oxide Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Derivatives

- Ethanolamines

- Ethoxylates

- Ethylene Glycols

- Diethylene Glycol (DEG)

- Monoethylene Glycol (MEG)

- Triethylene Glycol (TEG)

- Glycol Ethers

- Polyethylene Glycol

- End-User

- Agrochemical

- Automotive

- Detergent

- Food & Beverage

- Personal Care

- Pharmaceutical

- Textile

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Ethylene Oxide Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Ethylene Oxide Market?

3. What are the technology trends and regulatory frameworks in the Ethylene Oxide Market?

4. What is the market share of the leading vendors in the Ethylene Oxide Market?

5. Which modes and strategic moves are suitable for entering the Ethylene Oxide Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Ethylene Oxide Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Rising adoption of PET in the food and beverage industry

- 5.1.1.2. Increasing demand for household and personal care products

- 5.1.1.3. Potential growth of the chemical sector across the world

- 5.1.2. Restraints

- 5.1.2.1. Adverse health and environmental effects over high exposure

- 5.1.3. Opportunities

- 5.1.3.1. Surge in innovations in ethyl oxide production

- 5.1.3.2. Introduction of cost-effective and eco-friendly ethylene oxide sterilisation solution

- 5.1.4. Challenges

- 5.1.4.1. Complicated regulatory scenario and high price of crude oil

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Ethylene Oxide Market, by Derivatives

- 6.1. Introduction

- 6.2. Ethanolamines

- 6.3. Ethoxylates

- 6.4. Ethylene Glycols

- 6.5.1. Diethylene Glycol (DEG)

- 6.5.2. Monoethylene Glycol (MEG)

- 6.5.3. Triethylene Glycol (TEG)

- 6.5. Glycol Ethers

- 6.6. Polyethylene Glycol

7. Ethylene Oxide Market, by End-User

- 7.1. Introduction

- 7.2. Agrochemical

- 7.3. Automotive

- 7.4. Detergent

- 7.5. Food & Beverage

- 7.6. Personal Care

- 7.7. Pharmaceutical

- 7.8. Textile

8. Americas Ethylene Oxide Market

- 8.1. Introduction

- 8.2. Argentina

- 8.3. Brazil

- 8.4. Canada

- 8.5. Mexico

- 8.6. United States

9. Asia-Pacific Ethylene Oxide Market

- 9.1. Introduction

- 9.2. Australia

- 9.3. China

- 9.4. India

- 9.5. Indonesia

- 9.6. Japan

- 9.7. Malaysia

- 9.8. Philippines

- 9.9. Singapore

- 9.10. South Korea

- 9.11. Taiwan

- 9.12. Thailand

- 9.13. Vietnam

10. Europe, Middle East & Africa Ethylene Oxide Market

- 10.1. Introduction

- 10.2. Denmark

- 10.3. Egypt

- 10.4. Finland

- 10.5. France

- 10.6. Germany

- 10.7. Israel

- 10.8. Italy

- 10.9. Netherlands

- 10.10. Nigeria

- 10.11. Norway

- 10.12. Poland

- 10.13. Qatar

- 10.14. Russia

- 10.15. Saudi Arabia

- 10.16. South Africa

- 10.17. Spain

- 10.18. Sweden

- 10.19. Switzerland

- 10.20. Turkey

- 10.21. United Arab Emirates

- 10.22. United Kingdom

11. Competitive Landscape

- 11.1. FPNV Positioning Matrix

- 11.2. Market Share Analysis, By Key Player

- 11.3. Competitive Scenario Analysis, By Key Player

12. Competitive Portfolio

- 12.1. Key Company Profiles

- 12.1.1. Akzo Nobel N.V.

- 12.1.2. Azbil Corporation

- 12.1.3. BASF SE

- 12.1.4. China Petroleum & Chemical Corporation

- 12.1.5. Clariant AG

- 12.1.6. Eastman Chemical Company

- 12.1.7. Exxon Mobil Corporation

- 12.1.8. Formosa Plastics Corporation

- 12.1.9. Huntsman International LLC

- 12.1.10. India Glycols Limited

- 12.1.11. Indian Oil Corporation Ltd.

- 12.1.12. Indorama Ventures Public Company Limited

- 12.1.13. INEOS Group

- 12.1.14. Linde PLC

- 12.1.15. LOTTE Chemical Corporation

- 12.1.16. LyondellBasell Industries Holdings B.V.

- 12.1.17. Nippon Shokubai Co., Ltd.

- 12.1.18. PAMA Manufacturing and Sterilization

- 12.1.19. PTT Global Chemical Public Company Limited

- 12.1.20. Reliance Industries Limited

- 12.1.21. Sasol Limited

- 12.1.22. Saudi Basic Industries Corporation

- 12.1.23. Shell PLC

- 12.1.24. The Dow Chemical Company

- 12.1.25. Tokyo Chemical Industry Co., Ltd.

- 12.2. Key Product Portfolio

13. Appendix

- 13.1. Discussion Guide

- 13.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. ETHYLENE OXIDE MARKET RESEARCH PROCESS

- FIGURE 2. ETHYLENE OXIDE MARKET SIZE, 2023 VS 2030

- FIGURE 3. ETHYLENE OXIDE MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. ETHYLENE OXIDE MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. ETHYLENE OXIDE MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. ETHYLENE OXIDE MARKET DYNAMICS

- FIGURE 7. ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2023 VS 2030 (%)

- FIGURE 8. ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2023 VS 2030 (%)

- FIGURE 10. ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. AMERICAS ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 12. AMERICAS ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. UNITED STATES ETHYLENE OXIDE MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 14. UNITED STATES ETHYLENE OXIDE MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. ASIA-PACIFIC ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 16. ASIA-PACIFIC ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. EUROPE, MIDDLE EAST & AFRICA ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 18. EUROPE, MIDDLE EAST & AFRICA ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. ETHYLENE OXIDE MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 20. ETHYLENE OXIDE MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. ETHYLENE OXIDE MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. ETHYLENE OXIDE MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL ETHYLENE OXIDE MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 6. ETHYLENE OXIDE MARKET SIZE, BY ETHANOLAMINES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. ETHYLENE OXIDE MARKET SIZE, BY ETHOXYLATES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 10. ETHYLENE OXIDE MARKET SIZE, BY DIETHYLENE GLYCOL (DEG), BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. ETHYLENE OXIDE MARKET SIZE, BY MONOETHYLENE GLYCOL (MEG), BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. ETHYLENE OXIDE MARKET SIZE, BY TRIETHYLENE GLYCOL (TEG), BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. ETHYLENE OXIDE MARKET SIZE, BY GLYCOL ETHERS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. ETHYLENE OXIDE MARKET SIZE, BY POLYETHYLENE GLYCOL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 16. ETHYLENE OXIDE MARKET SIZE, BY AGROCHEMICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. ETHYLENE OXIDE MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. ETHYLENE OXIDE MARKET SIZE, BY DETERGENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. ETHYLENE OXIDE MARKET SIZE, BY FOOD & BEVERAGE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. ETHYLENE OXIDE MARKET SIZE, BY PERSONAL CARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. ETHYLENE OXIDE MARKET SIZE, BY PHARMACEUTICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. ETHYLENE OXIDE MARKET SIZE, BY TEXTILE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. AMERICAS ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 24. AMERICAS ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 25. AMERICAS ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 26. AMERICAS ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 27. ARGENTINA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 28. ARGENTINA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 29. ARGENTINA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 30. BRAZIL ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 31. BRAZIL ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 32. BRAZIL ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 33. CANADA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 34. CANADA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 35. CANADA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 36. MEXICO ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 37. MEXICO ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 38. MEXICO ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 39. UNITED STATES ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 40. UNITED STATES ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 41. UNITED STATES ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 42. UNITED STATES ETHYLENE OXIDE MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 43. ASIA-PACIFIC ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 44. ASIA-PACIFIC ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 45. ASIA-PACIFIC ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 46. ASIA-PACIFIC ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 47. AUSTRALIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 48. AUSTRALIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 49. AUSTRALIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 50. CHINA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 51. CHINA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 52. CHINA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 53. INDIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 54. INDIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 55. INDIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 56. INDONESIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 57. INDONESIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 58. INDONESIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 59. JAPAN ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 60. JAPAN ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 61. JAPAN ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 62. MALAYSIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 63. MALAYSIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 64. MALAYSIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 65. PHILIPPINES ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 66. PHILIPPINES ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 67. PHILIPPINES ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 68. SINGAPORE ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 69. SINGAPORE ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 70. SINGAPORE ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 71. SOUTH KOREA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 72. SOUTH KOREA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 73. SOUTH KOREA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 74. TAIWAN ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 75. TAIWAN ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 76. TAIWAN ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 77. THAILAND ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 78. THAILAND ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 79. THAILAND ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 80. VIETNAM ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 81. VIETNAM ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 82. VIETNAM ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 83. EUROPE, MIDDLE EAST & AFRICA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 84. EUROPE, MIDDLE EAST & AFRICA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 85. EUROPE, MIDDLE EAST & AFRICA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 86. EUROPE, MIDDLE EAST & AFRICA ETHYLENE OXIDE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 87. DENMARK ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 88. DENMARK ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 89. DENMARK ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 90. EGYPT ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 91. EGYPT ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 92. EGYPT ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 93. FINLAND ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 94. FINLAND ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 95. FINLAND ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 96. FRANCE ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 97. FRANCE ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 98. FRANCE ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 99. GERMANY ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 100. GERMANY ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 101. GERMANY ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 102. ISRAEL ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 103. ISRAEL ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 104. ISRAEL ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 105. ITALY ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 106. ITALY ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 107. ITALY ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 108. NETHERLANDS ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 109. NETHERLANDS ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 110. NETHERLANDS ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 111. NIGERIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 112. NIGERIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 113. NIGERIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 114. NORWAY ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 115. NORWAY ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 116. NORWAY ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 117. POLAND ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 118. POLAND ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 119. POLAND ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 120. QATAR ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 121. QATAR ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 122. QATAR ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 123. RUSSIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 124. RUSSIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 125. RUSSIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 126. SAUDI ARABIA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 127. SAUDI ARABIA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 128. SAUDI ARABIA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 129. SOUTH AFRICA ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 130. SOUTH AFRICA ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 131. SOUTH AFRICA ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 132. SPAIN ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 133. SPAIN ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 134. SPAIN ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 135. SWEDEN ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 136. SWEDEN ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 137. SWEDEN ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 138. SWITZERLAND ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 139. SWITZERLAND ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 140. SWITZERLAND ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 141. TURKEY ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 142. TURKEY ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 143. TURKEY ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 144. UNITED ARAB EMIRATES ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 145. UNITED ARAB EMIRATES ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 146. UNITED ARAB EMIRATES ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 147. UNITED KINGDOM ETHYLENE OXIDE MARKET SIZE, BY DERIVATIVES, 2018-2030 (USD MILLION)

- TABLE 148. UNITED KINGDOM ETHYLENE OXIDE MARKET SIZE, BY ETHYLENE GLYCOLS, 2018-2030 (USD MILLION)

- TABLE 149. UNITED KINGDOM ETHYLENE OXIDE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 150. ETHYLENE OXIDE MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 151. ETHYLENE OXIDE MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 152. ETHYLENE OXIDE MARKET LICENSE & PRICING

![环氧乙烷市场(应用:单乙二醇[MEG]、乙氧基化物、乙醇胺、二乙二醇和三乙二醇以及多元醇)- 全球产业分析、规模、份额、成长、趋势和预测, 2023-2031 年](/sample/img/cover/42/1402802.png)