|

市场调查报告书

商品编码

1435151

兽医诊断影像市场:按产品、动物类型、应用和最终用户 - 全球预测 2023-2030Veterinary Imaging Market by Product (Instrument, Reagents, Services), Animal Type (Large Animals, Small Companion Animals), Application, End-user - Global Forecast 2023-2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

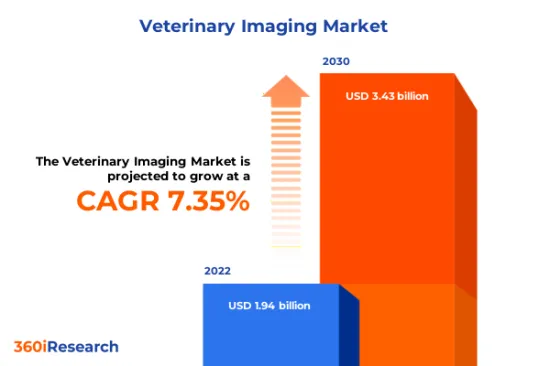

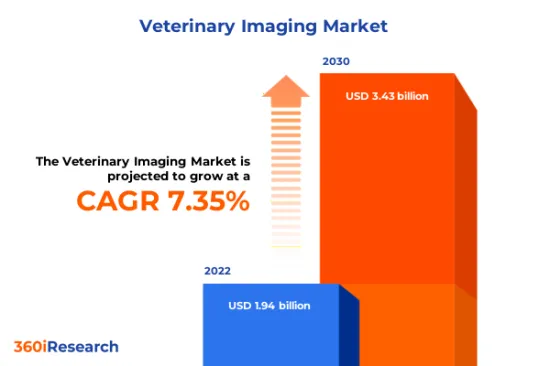

预计2022年兽医诊断影像市场规模为19.4亿美元,预计2023年将达20.7亿美元,2030年将达到34.3亿美元,复合年增长率为7.35%。

全球兽医诊断影像市场

| 主要市场统计 | |

|---|---|

| 基准年[2022] | 19.4亿美元 |

| 预测年份 [2023] | 20.7亿美元 |

| 预测年份 [2030] | 34.3亿美元 |

| 复合年增长率(%) | 7.35% |

兽医影像包括用于可视化和诊断动物健康问题的各种技术。这包括 X 光、超音波、 电脑断层扫描、MRI 和内视镜检查等方法,可帮助兽医检查您的宠物或大型动物的内臟、骨骼、组织和整体健康状况。它支持整形外科、心臟病学、肿瘤学和神经病学等专业领域,并用于各种环境,包括兽医医院、诊所和研究机构。由于多种因素,包括宠物拥有量的增加、动物医疗保健支出的增加以及成像技术的进步,兽医诊断影像市场正在成长。然而,与先进成像方式相关的高成本以及缺乏具有准确解释复杂成像结果专业知识的兽医专业人员阻碍了市场潜力。此外,兽医成像设备的进步和政府对改善兽医诊断服务的投资预计将为兽医诊断成像市场提供显着的成长机会。

区域洞察

美洲地区是一个成熟的兽医诊断影像市场,由于宠物保有量高、医疗基础设施先进以及兽医医疗保健法规完善等因素,市场动态强劲。欧洲、中东和非洲国家,包括德国、法国和英国,在严格的动物健康法规、高标准的兽医护理和全面的宠物保险的推动下,兽医影像服务的采用率很高。阿联酋、沙乌地阿拉伯等国家正逐步完善动物医疗保健体系,鼓励进口优质兽医诊断影像产品。对综合宠物护理服务的日益关注正在推动市场开拓。此外,由于宠物拥有量的增加、可自由支配收入的增加以及动物健康意识的增强,亚太地区正在经历快速增长。中国、日本和印度等国家拥有先进技术基础设施和强大经济支持的利润丰厚的市场。亚太地区对高端诊断影像模式的需求庞大,因为他们优先考虑为宠物提供优质的医疗保健。此外,亚太地区私人和公共机构在兽医诊断影像领域的政府投资旨在改善服务提供,预计将促进市场成长。

FPNV定位矩阵

FPNV定位矩阵对于评估兽医诊断影像市场至关重要。我们检视与业务策略和产品满意度相关的关键指标,以对供应商进行全面评估。这种深入的分析使用户能够根据自己的要求做出明智的决策。根据评估,供应商被分为四个成功程度不同的像限:前沿(F)、探路者(P)、利基(N)和重要(V)。

市场占有率分析

市场占有率分析是一种综合工具,可以对兽医诊断成像市场供应商的现状进行深入而深入的研究。全面比较和分析供应商在整体收益、基本客群和其他关键指标方面的贡献,以便更好地了解公司的绩效及其在争夺市场占有率时面临的挑战。此外,该分析还提供了对该行业竞争特征的宝贵见解,包括在研究基准年观察到的累积、分散主导地位和合併特征等因素。这种详细程度的提高使供应商能够做出更明智的决策并制定有效的策略,从而在市场上获得竞争优势。

该报告对以下几个方面提供了宝贵的见解:

1-市场渗透率:提供有关主要企业所服务的市场的全面资讯。

2-市场开拓:我们深入研究利润丰厚的新兴市场,并分析它们在成熟细分市场中的渗透率。

3- 市场多元化:提供有关新产品发布、开拓地区、最新发展和投资的详细资讯。

4-竞争力评估与资讯:对主要企业的市场占有率、策略、产品、认证、监管状况、专利状况、製造能力等进行全面评估。

5- 产品开发与创新:提供对未来技术、研发活动和突破性产品开发的见解。

本报告解决了以下关键问题:

1-兽医诊断影像市场的市场规模和预测是多少?

2-在兽医诊断影像市场的预测期内,有哪些产品、细分市场、应用和领域需要考虑投资?

3-兽医诊断影像市场的技术趋势和法律规范是什么?

4-兽医诊断影像市场主要供应商的市场占有率是多少?

5-进入兽医诊断影像市场的合适型态和策略手段是什么?

目录

第一章 前言

第二章调查方法

第三章执行摘要

第四章市场概况

第五章市场洞察

- 市场动态

- 促进因素

- 拥有的宠物和牲畜数量增加

- 动物慢性疾病和意外伤害发生率上升,动物保健支出迅速增加

- 抑制因素

- 资本密集型兽医诊断影像产品

- 机会

- 政府大力投资并努力改善兽医诊断服务

- 兽医影像工具的不断进步

- 任务

- 新兴经济体兽医短缺的限制

- 促进因素

- 市场区隔分析

- 产品:由于超音波成像比大多数其他成像方法易于使用且成本更低,因此越来越多地采用超音波成像

- 动物类型:主要用于小动物诊断中的兽医影像诊断

- 应用:扩大兽医影像在兽医整形外科和创伤诊断的应用

- 最终用户:兽医院对兽医影像诊断的需求快速成长

- 市场趋势分析

- 美洲兽医影像产品系列的演变

- 亚太地区宠物护理设施扩建导致牲畜数量增加

- 政府为因应欧洲、中东和非洲通用感染疾病的增加而采取的动物福利倡议

- 高通膨的累积效应

- 波特五力分析

- 价值炼和关键路径分析

- 法律规范

第六章兽医诊断影像市场:副产品

- 装置

- CT影像处理

- 多切面CT

- 单切片电脑断层扫描器

- X射线摄影

- 电脑X射线摄影

- 直接放射线照相

- 基于胶卷的放射线照相

- 超音波影像诊断

- 二维超音波成像

- 3D/4D超音波影像诊断

- 多普勒成像

- 影像内视镜影像处理

- CT影像处理

- 试剂

- MRI显影剂

- 核子造影

- 超音波显影剂

- X射线/CT显影剂

- 服务

- 售后服务

- 安装和整合服务

- 软体和解决方案

第七章兽医诊断影像市场:依动物类型

- 大型动物

- 小伴侣动物

第八章兽医诊断影像市场:依应用分类

- 心臟病学

- 神经病学

- 肿瘤学

- 整形外科和创伤学

第九章兽医诊断影像市场:依最终用户分类

- 学术机构

- 兽医医院和诊断中心

第十章北美和南美兽医诊断影像市场

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美国

第十一章亚太兽医诊断影像市场

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 台湾

- 泰国

- 越南

第十二章欧洲、中东和非洲兽医诊断影像市场

- 丹麦

- 埃及

- 芬兰

- 法国

- 德国

- 以色列

- 义大利

- 荷兰

- 奈及利亚

- 挪威

- 波兰

- 卡达

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公国

- 英国

第十三章竞争格局

- FPNV定位矩阵

- 市场占有率分析:主要企业

- 主要企业竞争情境分析

- 併购

- 合约、合作和伙伴关係

- 新产品发布和功能增强

- 投资、资金筹措

- 奖项/奖励/扩展

第14章竞争产品组合

- 主要公司简介

- Agfa-Gevaert Group

- Antech Diagnostics, Inc.

- BMV MEDTECH GROUP CO., LTD

- Canon Inc.

- Carestream Health, Inc.

- CHISON Medical Technologies Co., Ltd.

- Clarius Mobile Health Corp.

- Covetrus, Inc.

- Dentalaire, International

- DRAMINSKI SA

- EI Medical Imaging

- Edan Instruments, Inc.

- Esaote SpA

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies Inc.

- Hallmarq Veterinary Imaging Limited

- Heska Corporation by Mars, Incorporated

- IDEXX Laboratories, Inc.

- IM3 Inc.

- IMV Imaging(UK)Ltd.

- Interson Corporation

- Konica Minolta, Inc.

- Leltek Inc.

- Lepu Medical Technology(Beijing)Co.,Ltd.

- MinXray, Inc.

- Promed Technology Co., Ltd.

- ReproScan

- Samsung Electronics Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens AG

- SonoScape Medical Corp.

- Xoran Technologies LLC

- 主要产品系列

第十五章附录

- 讨论指南

- 关于许可证和定价

[187 Pages Report] The Veterinary Imaging Market size was estimated at USD 1.94 billion in 2022 and expected to reach USD 2.07 billion in 2023, at a CAGR 7.35% to reach USD 3.43 billion by 2030.

Global Veterinary Imaging Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 1.94 billion |

| Estimated Year [2023] | USD 2.07 billion |

| Forecast Year [2030] | USD 3.43 billion |

| CAGR (%) | 7.35% |

Veterinary imaging involves various techniques used to visualize and diagnose animal health issues. It includes methods including X-rays, ultrasound, CT scans, MRIs, and endoscopy, which help veterinarians examine internal organs, bones, tissues, and overall health in pets and larger animals. It caters to applications in orthopedics, cardiology, oncology, and neurology, among other specialties, and is employed in different settings such as veterinary hospitals & clinics, and research institutions. The veterinary imaging market is experiencing growth due to various factors, including increased pet adoption, rising veterinary healthcare expenditure, and advancements in imaging technology. However, high costs associated with advanced imaging modalities and a shortage of veterinary professionals with the expertise to interpret complex imaging results accurately can hinder the market's potential. Furthermore, advancements in veterinary imaging instruments and government investments to improve veterinary diagnostic services are expected to offer significant growth opportunities for the veterinary imaging market.

Regional Insights

The American region exhibits a mature veterinary imaging market owing to factors such as high pet ownership rates, advanced healthcare infrastructure, and well-established animal healthcare regulations that contribute to robust market dynamics. The EMEA countries, including Germany, France, and the UK, show significant adoption rates of veterinary imaging services fueled by stringent animal health regulations, high standards of veterinary practice, and substantial pet insurance coverage. Countries, including the UAE and Saudi Arabia, are progressively improving their animal healthcare systems, encouraging the import of high-quality veterinary imaging products. They are increasingly focused on comprehensive pet care services, which boosts market development. Moreover, the Asia-Pacific region is witnessing rapid growth due to rising pet adoption, increasing discretionary income, and expanding awareness about animal health. Countries including China, Japan, and India present a lucrative market underpinned by advanced technological infrastructure and a strong economy. There is a significant demand for high-end imaging modalities in the APAC region due to the prioritization of quality healthcare for pets. Additionally, government investments in the veterinary imaging sector from private and public sources in the APAC region aimed to improve service delivery are expected to boost the market growth.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Veterinary Imaging Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Veterinary Imaging Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Veterinary Imaging Market, highlighting leading vendors and their innovative profiles. These include Agfa-Gevaert Group, Antech Diagnostics, Inc., BMV MEDTECH GROUP CO., LTD, Canon Inc., Carestream Health, Inc., CHISON Medical Technologies Co., Ltd., Clarius Mobile Health Corp., Covetrus, Inc., Dentalaire, International, DRAMINSKI S. A., E.I. Medical Imaging, Edan Instruments, Inc., Esaote S.p.A, FUJIFILM Holdings Corporation, GE HealthCare Technologies Inc., Hallmarq Veterinary Imaging Limited, Heska Corporation by Mars, Incorporated, IDEXX Laboratories, Inc., IM3 Inc., IMV Imaging (UK) Ltd., Interson Corporation, Konica Minolta, Inc., Leltek Inc., Lepu Medical Technology(Beijing)Co.,Ltd., MinXray, Inc., Promed Technology Co., Ltd., ReproScan, Samsung Electronics Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Siemens AG, SonoScape Medical Corp., and Xoran Technologies LLC.

Market Segmentation & Coverage

This research report categorizes the Veterinary Imaging Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Product

- Instrument

- CT Imaging

- Multi-Slice CT

- Single-Slice CT

- Radiography X-ray

- Computed Radiography

- Direct Radiography

- Film-Based Radiography

- Ultrasound Imaging

- 2-D Ultrasound Imaging

- 3-D/4-D Ultrasound Imaging

- Doppler Imaging

- Video Endoscopy Imaging

- CT Imaging

- Reagents

- MRI Contrast Regents

- Nuclear Imaging

- Ultrasound Contrast Regents

- X-Ray/CT Contrast Reagents

- Services

- After-sales Services

- Installation & Integration Services

- Software & Solutions

- Instrument

- Animal Type

- Large Animals

- Small Companion Animals

- Application

- Cardiology

- Neurology

- Oncology

- Orthopedics & Traumatology

- End-user

- Academic Institutions

- Veterinary Clinics & Diagnostic Centers

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Veterinary Imaging Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Veterinary Imaging Market?

3. What are the technology trends and regulatory frameworks in the Veterinary Imaging Market?

4. What is the market share of the leading vendors in the Veterinary Imaging Market?

5. Which modes and strategic moves are suitable for entering the Veterinary Imaging Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Veterinary Imaging Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing number of companion animal and livestock ownership

- 5.1.1.2. Rising incidence of chronic diseases and accidental injuries in animals coupled with surge in expenditure on animal health

- 5.1.2. Restraints

- 5.1.2.1. Capital-intensive veterinary imaging instruments

- 5.1.3. Opportunities

- 5.1.3.1. Significant government investment and initiatives to improve veterinary diagnostic services

- 5.1.3.2. Ongoing advancements in veterinary imaging instruments

- 5.1.4. Challenges

- 5.1.4.1. Limitations associated with dearth of veterinary practitioners in developing economies

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Product: Growing adoption of ultrasound imaging due to its ease of use, and less expensive than most other imaging methods

- 5.2.2. Animal Type: Significant use of veterinary imaging for diagnosing small animals

- 5.2.3. Application: Expanding use of veterinary imaging for diagnosing orthopedics & traumatology in animals

- 5.2.4. End-Users: Burgeoning demand for veterinary imaging from veterinary clinics

- 5.3. Market Trend Analysis

- 5.3.1. Advancing product portfolios for veterinary imaging in the Americas

- 5.3.2. Rising livestock population with expanding pet care facilities in the Asia-Pacific

- 5.3.3. Government initiatives for animal welfare coupled with growing zoonotic disease in the EMEA region

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Veterinary Imaging Market, by Product

- 6.1. Introduction

- 6.2. Instrument

- 6.3.1. CT Imaging

- 6.3.2.1. Multi-Slice CT

- 6.3.2.2. Single-Slice CT

- 6.3.2. Radiography X-ray

- 6.3.3.1. Computed Radiography

- 6.3.3.2. Direct Radiography

- 6.3.3.3. Film-Based Radiography

- 6.3.3. Ultrasound Imaging

- 6.3.4.1. 2-D Ultrasound Imaging

- 6.3.4.2. 3-D/4-D Ultrasound Imaging

- 6.3.4.3. Doppler Imaging

- 6.3.4. Video Endoscopy Imaging

- 6.3.1. CT Imaging

- 6.3. Reagents

- 6.4.1. MRI Contrast Regents

- 6.4.2. Nuclear Imaging

- 6.4.3. Ultrasound Contrast Regents

- 6.4.4. X-Ray/CT Contrast Reagents

- 6.4. Services

- 6.5.1. After-sales Services

- 6.5.2. Installation & Integration Services

- 6.5. Software & Solutions

7. Veterinary Imaging Market, by Animal Type

- 7.1. Introduction

- 7.2. Large Animals

- 7.3. Small Companion Animals

8. Veterinary Imaging Market, by Application

- 8.1. Introduction

- 8.2. Cardiology

- 8.3. Neurology

- 8.4. Oncology

- 8.5. Orthopedics & Traumatology

9. Veterinary Imaging Market, by End-user

- 9.1. Introduction

- 9.2. Academic Institutions

- 9.3. Veterinary Clinics & Diagnostic Centers

10. Americas Veterinary Imaging Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Veterinary Imaging Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Veterinary Imaging Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. Merger & Acquisition

- 13.3.1.1. Mars Completes Acquisition of SYNLAB Vet, a European Provider of Specialist Veterinary Laboratory Diagnostics

- 13.3.1.2. The IMV Technologies Group Acquires Veterinary Solutions

- 13.3.1.3. Probo Medical Completes Acquisition of National Ultrasound

- 13.3.2. Agreement, Collaboration, & Partnership

- 13.3.2.1. Probo Medical Partners with Mindray Animal

- 13.3.2.2. Sound Technologies and GE HealthCare Announce Collaboration to Bring Vscan Air Handheld Ultrasound to Veterinary Practices Across the United States

- 13.3.2.3. Multi Radiance Veterinary Partners with Digatherm Thermal Imaging as the Worldwide Exclusive Distributor of Leading-Edge Veterinary Thermography Products

- 13.3.3. New Product Launch & Enhancement

- 13.3.3.1. Antech Launches First Comprehensive Veterinary Diagnostics Offering in the UK, Including a New State-Of-The-Art Reference Laboratory

- 13.3.3.2. vTRON Delivers Detailed Diagnostic Imaging to Singapore's Bird Paradise

- 13.3.3.3. Sunset Vet Launches First CT Scanner for Pets in Indonesia

- 13.3.3.4. Hallmarq Launches World's First Veterinary-Specific, Zero-Helium Small Animal 1.5T MRI

- 13.3.4. Investment & Funding

- 13.3.4.1. Bond Vet Receives USD 50 Million Funding Round to Further Expansion

- 13.3.5. Award, Recognition, & Expansion

- 13.3.5.1. Luxvet Group Expands Into Romanian Veterinary Market

- 13.3.5.2. Hallmarq Veterinary Imaging's New U.S. Facility Meets Rising Demand For Equine MRI And CT Systems

- 13.3.5.3. Cutting-Edge Diagnostic Imaging Facility To Detect And Prevent Injuries In WA Horses

- 13.3.1. Merger & Acquisition

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. Agfa-Gevaert Group

- 14.1.2. Antech Diagnostics, Inc.

- 14.1.3. BMV MEDTECH GROUP CO., LTD

- 14.1.4. Canon Inc.

- 14.1.5. Carestream Health, Inc.

- 14.1.6. CHISON Medical Technologies Co., Ltd.

- 14.1.7. Clarius Mobile Health Corp.

- 14.1.8. Covetrus, Inc.

- 14.1.9. Dentalaire, International

- 14.1.10. DRAMINSKI S. A.

- 14.1.11. E.I. Medical Imaging

- 14.1.12. Edan Instruments, Inc.

- 14.1.13. Esaote S.p.A

- 14.1.14. FUJIFILM Holdings Corporation

- 14.1.15. GE HealthCare Technologies Inc.

- 14.1.16. Hallmarq Veterinary Imaging Limited

- 14.1.17. Heska Corporation by Mars, Incorporated

- 14.1.18. IDEXX Laboratories, Inc.

- 14.1.19. IM3 Inc.

- 14.1.20. IMV Imaging (UK) Ltd.

- 14.1.21. Interson Corporation

- 14.1.22. Konica Minolta, Inc.

- 14.1.23. Leltek Inc.

- 14.1.24. Lepu Medical Technology(Beijing)Co.,Ltd.

- 14.1.25. MinXray, Inc.

- 14.1.26. Promed Technology Co., Ltd.

- 14.1.27. ReproScan

- 14.1.28. Samsung Electronics Co., Ltd.

- 14.1.29. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 14.1.30. Siemens AG

- 14.1.31. SonoScape Medical Corp.

- 14.1.32. Xoran Technologies LLC

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. VETERINARY IMAGING MARKET RESEARCH PROCESS

- FIGURE 2. VETERINARY IMAGING MARKET SIZE, 2022 VS 2030

- FIGURE 3. VETERINARY IMAGING MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. VETERINARY IMAGING MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. VETERINARY IMAGING MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. VETERINARY IMAGING MARKET DYNAMICS

- FIGURE 7. VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2022 VS 2030 (%)

- FIGURE 8. VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2022 VS 2030 (%)

- FIGURE 10. VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2022 VS 2030 (%)

- FIGURE 12. VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. VETERINARY IMAGING MARKET SIZE, BY END-USER, 2022 VS 2030 (%)

- FIGURE 14. VETERINARY IMAGING MARKET SIZE, BY END-USER, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 16. AMERICAS VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 18. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 23. VETERINARY IMAGING MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 24. VETERINARY IMAGING MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. VETERINARY IMAGING MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. VETERINARY IMAGING MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL VETERINARY IMAGING MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 6. VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 8. VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 10. VETERINARY IMAGING MARKET SIZE, BY MULTI-SLICE CT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. VETERINARY IMAGING MARKET SIZE, BY SINGLE-SLICE CT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 14. VETERINARY IMAGING MARKET SIZE, BY COMPUTED RADIOGRAPHY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. VETERINARY IMAGING MARKET SIZE, BY DIRECT RADIOGRAPHY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. VETERINARY IMAGING MARKET SIZE, BY FILM-BASED RADIOGRAPHY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 19. VETERINARY IMAGING MARKET SIZE, BY 2-D ULTRASOUND IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. VETERINARY IMAGING MARKET SIZE, BY 3-D/4-D ULTRASOUND IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. VETERINARY IMAGING MARKET SIZE, BY DOPPLER IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. VETERINARY IMAGING MARKET SIZE, BY VIDEO ENDOSCOPY IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. VETERINARY IMAGING MARKET SIZE, BY REAGENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 25. VETERINARY IMAGING MARKET SIZE, BY MRI CONTRAST REGENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. VETERINARY IMAGING MARKET SIZE, BY NUCLEAR IMAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND CONTRAST REGENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. VETERINARY IMAGING MARKET SIZE, BY X-RAY/CT CONTRAST REAGENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. VETERINARY IMAGING MARKET SIZE, BY SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 31. VETERINARY IMAGING MARKET SIZE, BY AFTER-SALES SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. VETERINARY IMAGING MARKET SIZE, BY INSTALLATION & INTEGRATION SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. VETERINARY IMAGING MARKET SIZE, BY SOFTWARE & SOLUTIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 35. VETERINARY IMAGING MARKET SIZE, BY LARGE ANIMALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 36. VETERINARY IMAGING MARKET SIZE, BY SMALL COMPANION ANIMALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 37. VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 38. VETERINARY IMAGING MARKET SIZE, BY CARDIOLOGY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 39. VETERINARY IMAGING MARKET SIZE, BY NEUROLOGY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 40. VETERINARY IMAGING MARKET SIZE, BY ONCOLOGY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 41. VETERINARY IMAGING MARKET SIZE, BY ORTHOPEDICS & TRAUMATOLOGY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 42. VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 43. VETERINARY IMAGING MARKET SIZE, BY ACADEMIC INSTITUTIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 44. VETERINARY IMAGING MARKET SIZE, BY VETERINARY CLINICS & DIAGNOSTIC CENTERS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 45. AMERICAS VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 46. AMERICAS VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 47. AMERICAS VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 48. AMERICAS VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 49. AMERICAS VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 50. AMERICAS VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 51. AMERICAS VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 52. AMERICAS VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 53. AMERICAS VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 54. AMERICAS VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 55. AMERICAS VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 56. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 57. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 58. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 59. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 60. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 61. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 62. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 63. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 64. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 65. ARGENTINA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 66. BRAZIL VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 67. BRAZIL VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 68. BRAZIL VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 69. BRAZIL VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 70. BRAZIL VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 71. BRAZIL VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 72. BRAZIL VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 73. BRAZIL VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 74. BRAZIL VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 75. BRAZIL VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 76. CANADA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 77. CANADA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 78. CANADA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 79. CANADA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 80. CANADA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 81. CANADA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 82. CANADA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 83. CANADA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 84. CANADA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 85. CANADA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 86. MEXICO VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 87. MEXICO VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 88. MEXICO VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 89. MEXICO VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 90. MEXICO VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 91. MEXICO VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 92. MEXICO VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 93. MEXICO VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 94. MEXICO VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 95. MEXICO VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 96. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 97. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 98. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 99. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 100. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 101. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 102. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 103. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 104. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 105. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 106. UNITED STATES VETERINARY IMAGING MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 107. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 108. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 109. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 110. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 111. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 112. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 113. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 114. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 115. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 116. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 117. ASIA-PACIFIC VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 118. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 119. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 120. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 121. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 122. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 123. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 124. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 125. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 126. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 127. AUSTRALIA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 128. CHINA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 129. CHINA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 130. CHINA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 131. CHINA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 132. CHINA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 133. CHINA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 134. CHINA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 135. CHINA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 136. CHINA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 137. CHINA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 138. INDIA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 139. INDIA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 140. INDIA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 141. INDIA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 142. INDIA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 143. INDIA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 144. INDIA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 145. INDIA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 146. INDIA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 147. INDIA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 148. INDONESIA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 149. INDONESIA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 150. INDONESIA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 151. INDONESIA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 152. INDONESIA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 153. INDONESIA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 154. INDONESIA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 155. INDONESIA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 156. INDONESIA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 157. INDONESIA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 158. JAPAN VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 159. JAPAN VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 160. JAPAN VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 161. JAPAN VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 162. JAPAN VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 163. JAPAN VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 164. JAPAN VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 165. JAPAN VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 166. JAPAN VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 167. JAPAN VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 168. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 169. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 170. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 171. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 172. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 173. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 174. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 175. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 176. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 177. MALAYSIA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 178. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 179. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 180. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 181. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 182. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 183. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 184. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 185. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 186. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 187. PHILIPPINES VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 188. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 189. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 190. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 191. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 192. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 193. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 194. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 195. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 196. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 197. SINGAPORE VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 198. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 199. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 200. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 201. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 202. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 203. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 204. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 205. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 206. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 207. SOUTH KOREA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 208. TAIWAN VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 209. TAIWAN VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 210. TAIWAN VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 211. TAIWAN VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 212. TAIWAN VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 213. TAIWAN VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 214. TAIWAN VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 215. TAIWAN VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 216. TAIWAN VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 217. TAIWAN VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 218. THAILAND VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 219. THAILAND VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 220. THAILAND VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 221. THAILAND VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 222. THAILAND VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 223. THAILAND VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 224. THAILAND VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 225. THAILAND VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 226. THAILAND VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 227. THAILAND VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 228. VIETNAM VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 229. VIETNAM VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 230. VIETNAM VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 231. VIETNAM VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 232. VIETNAM VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 233. VIETNAM VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 234. VIETNAM VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 235. VIETNAM VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 236. VIETNAM VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 237. VIETNAM VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 238. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 239. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 240. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 241. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 242. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 243. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 244. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 245. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 246. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 247. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 248. EUROPE, MIDDLE EAST & AFRICA VETERINARY IMAGING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 249. DENMARK VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 250. DENMARK VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 251. DENMARK VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 252. DENMARK VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 253. DENMARK VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 254. DENMARK VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 255. DENMARK VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 256. DENMARK VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 257. DENMARK VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 258. DENMARK VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 259. EGYPT VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 260. EGYPT VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 261. EGYPT VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 262. EGYPT VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 263. EGYPT VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 264. EGYPT VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 265. EGYPT VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 266. EGYPT VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 267. EGYPT VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 268. EGYPT VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 269. FINLAND VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 270. FINLAND VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 271. FINLAND VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 272. FINLAND VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 273. FINLAND VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 274. FINLAND VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 275. FINLAND VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 276. FINLAND VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 277. FINLAND VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 278. FINLAND VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 279. FRANCE VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 280. FRANCE VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 281. FRANCE VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 282. FRANCE VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 283. FRANCE VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 284. FRANCE VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 285. FRANCE VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 286. FRANCE VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 287. FRANCE VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 288. FRANCE VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 289. GERMANY VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 290. GERMANY VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 291. GERMANY VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 292. GERMANY VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 293. GERMANY VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 294. GERMANY VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 295. GERMANY VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 296. GERMANY VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 297. GERMANY VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 298. GERMANY VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 299. ISRAEL VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 300. ISRAEL VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 301. ISRAEL VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 302. ISRAEL VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 303. ISRAEL VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 304. ISRAEL VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 305. ISRAEL VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 306. ISRAEL VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 307. ISRAEL VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 308. ISRAEL VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 309. ITALY VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 310. ITALY VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 311. ITALY VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 312. ITALY VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 313. ITALY VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 314. ITALY VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 315. ITALY VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 316. ITALY VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 317. ITALY VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 318. ITALY VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 319. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 320. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 321. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 322. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 323. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 324. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 325. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 326. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 327. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 328. NETHERLANDS VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 329. NIGERIA VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 330. NIGERIA VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 331. NIGERIA VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 332. NIGERIA VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 333. NIGERIA VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 334. NIGERIA VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 335. NIGERIA VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 336. NIGERIA VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 337. NIGERIA VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 338. NIGERIA VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 339. NORWAY VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 340. NORWAY VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 341. NORWAY VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 342. NORWAY VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 343. NORWAY VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 344. NORWAY VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 345. NORWAY VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 346. NORWAY VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

- TABLE 347. NORWAY VETERINARY IMAGING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 348. NORWAY VETERINARY IMAGING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 349. POLAND VETERINARY IMAGING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 350. POLAND VETERINARY IMAGING MARKET SIZE, BY INSTRUMENT, 2018-2030 (USD MILLION)

- TABLE 351. POLAND VETERINARY IMAGING MARKET SIZE, BY CT IMAGING, 2018-2030 (USD MILLION)

- TABLE 352. POLAND VETERINARY IMAGING MARKET SIZE, BY RADIOGRAPHY X-RAY, 2018-2030 (USD MILLION)

- TABLE 353. POLAND VETERINARY IMAGING MARKET SIZE, BY ULTRASOUND IMAGING, 2018-2030 (USD MILLION)

- TABLE 354. POLAND VETERINARY IMAGING MARKET SIZE, BY REAGENTS, 2018-2030 (USD MILLION)

- TABLE 355. POLAND VETERINARY IMAGING MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 356. POLAND VETERINARY IMAGING MARKET SIZE, BY ANIMAL TYPE, 2018-2030 (USD MILLION)

TABLE 3