|

市场调查报告书

商品编码

1537092

再生能源技术的全球市场:2024-2029Global Renewable Energy Technology Market: 2024-2029 |

||||||

| 主要统计 | |

|---|---|

| 2024年再生能源发电总量: | 9,603.3TWh |

| 2029年再生能源发电总量: | 11,980.6TWh |

| 2029年再生能源在电力容量中所占的比例: | 7% |

| 预测週期: | 2024-2029 |

本报告对再生能源技术市场进行了深入分析,以帮助再生能源技术製造商和供应商了解主要趋势、潜在的快速成长驱动因素和机会以及使其成为可能的竞争格局。

取得再生能源技术部署和再生能源技术市场未来成长率的资料,深入研究揭示市场、再生能源供应商的最新机会和趋势,并提供对供应商、市场占有率的广泛分析细节等等。

提供了解再生能源市场的有效工具,使再生能源技术製造商和提供者能够制定未来策略。

主要功能

- 市场动态:深入了解再生能源市场(包括离岸风电专案)的主要趋势和市场扩张挑战。除了分析再生能源技术的演变、技术进步以及采用再生能源技术的商业和消费者障碍所带来的挑战外,还分析了多种再生能源技术用例。再生能源技术市场占有率分析还包括国家就绪指数,该指数分析了 60 个市场的现状和成长前景,并提供了未来前景。

- 主要要点和策略建议:详细分析再生能源技术市场的主要发展机会和发现,并为再生能源技术供应商提供了重要的策略建议。

- 基准产业预测:预测包括显示再生能源硬体支出、营运成本、再生能源装置容量和发电量的预测,依再生能源划分,如风能、太阳能、水力发电、生物能源等。还包括化石燃料和年度排放预测,包括煤炭、天然气和石油发电厂。

- Juniper Research竞争排行榜:评估 15 家再生能源公司的能力。

范例视图

市场资料与预测报告

市场趋势与策略报告

Juniper Research 互动式预测 Excel 有以下功能:

- 统计分析:优点是可以搜寻资料期间所有地区和国家显示的特定指标。可以轻鬆修改图表并将其汇出到剪贴簿。

- 国家/地区资料工具:此工具可查看预测期间内的所有区域和国家指标。使用者可以缩小搜寻栏中显示的指标范围。

- 国家比较工具:此国家报告可选择和比较特定国家。该工具包括汇出图表的功能。

- 假设分析:五个互动式场景让使用者比较预测假设。

目录

市场趋势/策略

第1章 要点/策略建议

- 要点

- 策略建议

第2章 市场状况

- 定义

- 再生能源市场

- 再生能源的类型

- 风能

- 太阳能

- 水力发电

- 生物能源

- 氢气

- 地热能

- 核能

- 再生能源和电网

- 再生能源的类型

- 再生能源中使用的方法和技术

- 风能技术与方法

- 陆域风力涡轮机

- 离岸风力涡轮机

- 太阳能发电技术与方法

- 太阳能板

- 太阳能热板

- 水力发电技术与方法

- 水力发电厂

- 水轮机

- 生物能源技术与方法

- 生物质燃烧

- 细菌分解

- 转换为气体燃料

- 转换为液体燃料

- 氢技术与方法

- 蒸气甲烷重整

- 电解

- 部分氧化

- 生物质气化

- 热化学的水分解

- 光解作用的分解水

- 地热技术与方法

- 核子技术与方法

- 风能技术与方法

- 潜在的能量储存

- 抽水蓄能储能

- 热和相变储能

- 机械储能

- 储氢

- 电化学/电储存

- 锂离子电池储存

- 液流电池储存

- 主要趋势、市场驱动因素与限制因素

- 政府政策与奖励措施

- 国际贸易

- 太阳能发电供过于求

- 离岸专案面临威胁

- 未来展望

第3章 细分分析

- 个案研究

- 创新

第4章 国家储备指数

- 国家储备指数简介

- 优先市场

- 不断成长的市场

竞争排行榜

第1章 Juniper Research 再生能源技术竞争排行榜

第2章 再生能源技术供应商简介

- 再生能源技术供应商

- Brookfield Renewable

- Canadian Solar Incorporated

- China Three Gorges Corporation

- Eletrobras

- Envision

- First Solar

- General Electric Vernova

- Goldwind

- Iberdrola

- JinkoSolar Holding Company

- NextEra Energy

- Orsted

- Siemens Gamesa

- Sonnedix

- Vestas Wind Systems A/S

资料/预测

第1章 预测再生和不再生能源技术:调查方法

第2章 风能预测

- 陆域风能

- 发电装置容量

- 陆上风力涡轮机的年度总支出

- 总营运成本

- 陆域风能的总批发成本

- 海上风能

- 发电装置容量

- 离岸风力涡轮机的总支出

- 总营运成本

- 离岸风能的总批发成本

- 风能

- 风力发电占发电量的百分比

- 风力发电带来的二氧化碳排放总量减少

第3章 太阳能预测

- 太阳能

- 发电装置容量

- 太阳能模组总支出

- 太阳能模组的总营运成本

- 太阳能批发总成本

- 太阳能发电所占发电量的百分比

- 太阳能发电带来的二氧化碳排放总量减少

第4章 水力发电能源预测

- 水力发电

- 发电装置容量

- 安装水力发电厂的总支出

- 总营运成本

- 水力发电的总批发成本

- 水力发电占发电量的百分比

- 水力发电带来的二氧化碳排放总量减少

第5章 生物能源预测

- 生物能源

- 发电装置容量

- 生物能源工厂安装总支出

- 总营运成本

- 总批发成本

- 生物能源发电量的百分比

- 透过生物能源减少二氧化碳排放总量

第6章 煤炭能源预测

- 煤炭能源

- 发电装置容量

- 总营运成本

- 总批发成本

- 燃煤发电量占比

- 燃煤发电的二氧化碳排放总量

第7章 天然气能源预测

- 气体能源

- 发电装置容量

- 总营运成本

- 总批发成本

- 天然气发电占发电量的百分比

- 瓦斯发电CO2排放总量

第8章 石油能源预测

- 石油能源

- 发电装置容量

- 每年的总营运成本

- 总批发成本

- 石油发电占发电量的百分比

- 石油能源发电CO2排放总量

第9章 核能预测

- 核能

- 发电装置容量

- 总营运成本

- 核能总批发成本

- 核电发电量占发电量的百分比

'Renewable Energy Technology to Save Over 2.4 Gigatonnes of CO2 Globally by 2029.'

| KEY STATISTICS | |

|---|---|

| Total renewable energy generated in 2024: | 9,603.3 TWh |

| Total renewable energy generated in 2029: | 11,980.6 TWh |

| Proportion of electricity capacity attributable to renewable energy in 2029: | 7% |

| Forecast period: | 2024-2029 |

Overview

Our "Renewable Energy Technology" research suite provides detailed analysis of the renewable energy technology market; allowing renewable energy technology manufacturers and renewable energy suppliers to gain an understanding of key trends, potential rapid growth factors and opportunities, and the competitive environment.

Providing multiple options that can be purchased separately, major factors of the research suite include access to data mapping the deployment of renewable energy technologies and the future growth rate of the renewable energy technologies market, a detailed study revealing the latest opportunities and trends within the market, and an insightful document containing an extensive analysis of 15 renewable energy vendors and providers within the space; detailing largest market share. The coverage can also be purchased as a Full Research Suite, containing all of these elements, at a substantial discount.

Collectively, these elements provide an effective tool for understanding this constantly evolving sources of energy market, enabling renewable energy technology manufacturers and providers to set out their future strategies. The renewable energy market report's unparalleled coverage makes this research suite an incredibly useful resource for gauging the future of the demand of electricity in this complex renewable energy sector.

Key Features

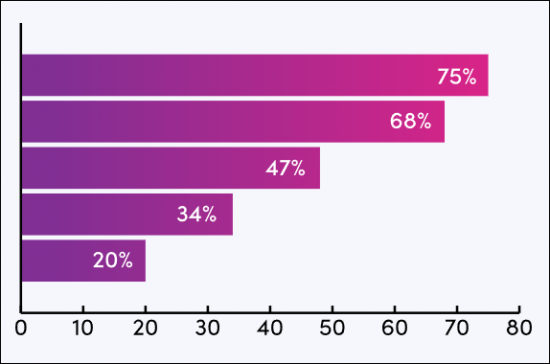

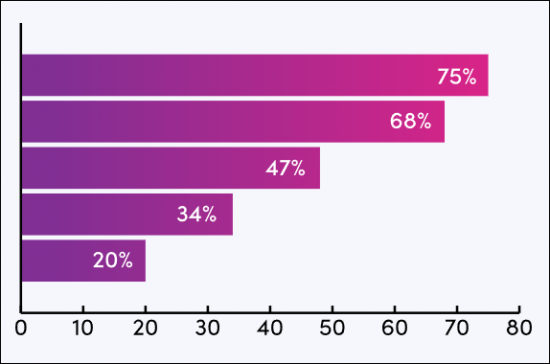

- Market Dynamics: Insights into key trends and market expansion challenges within the renewable energy market such as offshore wind projects; addressing the challenges posed by the evolving nature of renewable energy technologies, technological advancements, commercial and consumer barriers to renewable energy technology adoption, in addition to analysis of multiple renewable energy technology use cases. The renewable energy technology market share research also includes a Country Readiness Index; analysing the current development and growth of the renewable energy technology market in 60 countries, as well as providing a future outlook.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and key findings within the renewable energy technology market, accompanied by key strategic recommendations for renewable energy technology vendors.

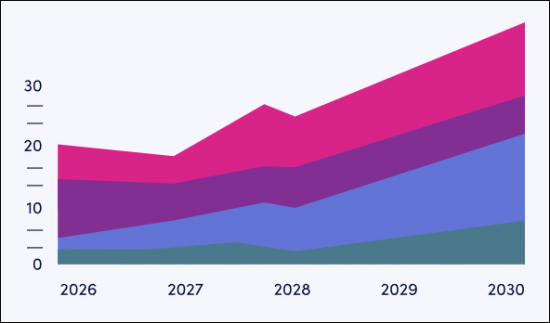

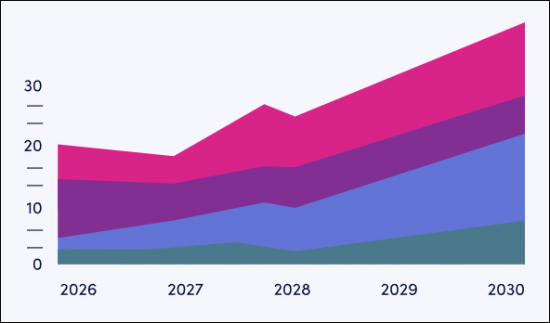

- Benchmark Industry Forecasts: This clean electricity overview into renewable energy technology includes forecasts presenting renewable energy hardware spend, operational costs, and installed renewable energy capacity and generation; split by different renewable energy sources including wind energy, solar energy, hydro, and bioenergy. The forecast also includes accompanying forecasts for fossil fuels and annual emissions, including coal, gas, and oil power plants.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 15 renewable energy companies, via the Juniper Research Competitor Leaderboard, featuring renewable energy market size for major players in the renewable energy technology industry.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

The market-leading research suite for the "Renewable Energy Technology" market includes access to the full set of forecast data, consisting of 127 tables and over 57,900 datapoints. Metrics in the research suite include:

- Total Installed Energy Capacity

- Total Operational Costs of Energy Technology

- Total Wholesale Cost of Energy

- Proportion Attributable to Total Electricity Generation

- Amount of Carbon Emissions Avoided/Produced

These metrics are provided for the following key market verticals:

- Renewable Energy Sources & Technology

- Wind Turbines Power

- Onshore Wind Power

- Offshore Wind Power

- Solar Power

- Hydroelectric Power

- Bioenergy Power

- Non-renewable Energy Sources & Technology

- Coal Power

- Gas Power

- Oil Power

- Nuclear Power

The Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets the user look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via the search bar.

- Country Comparison Tool: Users can select and compare specific countries in this country-level report. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This energy efficiency report examines the "Renewable Energy Technology" market landscape in detail; assessing market trends and factors shaping the evolution of this growing market, such as offshore wind technology and pyramidal solar lenses. The report delivers comprehensive analysis of the strategic opportunities for renewable energy technology providers and market participants; addressing key verticals and developing challenges, and how vendors should navigate these. As well as looking into renewable technology use cases, it also includes evaluation of key country-level opportunities for renewable energy growth.

Competitor Leaderboard Report

The renewable sources Competitor Leaderboard report provides a detailed evaluation and market positioning for 15 leading vendors in the renewable energy space. These renewable electricity vendors are positioned as an established leader, leading challenger, or disruptor and challenger, based on capacity and capability assessments.

The 15 renewable energy technology vendors consist of:

|

|

This document is centred around the Juniper Research Competitor Leaderboard, a vendor positioning tool that provides an at a glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. Definitions

- 2.3. Renewable Energy Market

- Figure 2.1: Renewable Energy Market Landscape

- 2.3.1. Types of Renewable Energy

- i. Wind Energy

- Figure 2.2: Onshore & Offshore Wind Turbines

- ii. Solar Energy

- Figure 2.3: Solar PV Farm

- iii. Hydroelectric Energy

- Figure 2.4: Hydroelectric Power Plant with a Reservoir

- iv. Bioenergy

- v. Hydrogen

- vi. Geothermal Energy

- Figure 2.5: Geothermal Energy Generated from the Earth's Core

- vii. Nuclear Energy

- i. Wind Energy

- 2.3.2. Renewable Energy and the Grid

- Figure 2.6: Renewable Energy Generation & Distribution to the Grid

- 2.4. Methods & Technologies Used in Renewable Energy

- 2.4.1. Wind Technologies & Methods

- i. Onshore Wind Turbine

- ii. Offshore Wind Turbine

- 2.4.2. Solar Technologies & Methods

- i. Solar PV Panel

- ii. Solar Thermal Panel

- Figure 2.7: Evacuated Tube Collector Solar Thermal Panel

- 2.4.3. Hydroelectric Technologies & Methods

- i. Hydroelectric Power Plants

- ii. Hydroelectric Turbines

- Figure 2.8: Francis Hydroelectric Turbine

- 2.4.4. Bioenergy Technologies & Methods

- i. Biomass Combustion

- ii. Bacterial Decomposition

- iii. Conversion to a Gas Fuel

- iv. Conversion to a Liquid Fuel

- 2.4.5. Hydrogen Technologies & Methods

- i. Steam-methane Reforming

- ii. Electrolysis

- iii. Partial Oxidation

- iv. Biomass Gasification

- v. Thermochemical Water Splitting

- vi. Photolytic Water Splitting

- 2.4.6. Geothermal Technologies & Methods

- 2.4.7. Nuclear Technologies & Methods

- 2.4.1. Wind Technologies & Methods

- 2.5. Potential Energy Storage

- 2.5.1. Pumped Hydroelectricity Energy Storage

- Figure 2.9: Closed-loop Pumped Hydroelectric Energy Storage Diagram

- 2.5.2. Thermal & Phase Transition Energy Storage

- i. Liquid-to-air Transition Energy Storage

- ii. Thermal Sand Batteries

- 2.5.3. Mechanical Energy Storage

- i. Compressed Air Energy Storage

- ii. Gravitational Energy Storage

- iii. Flywheel Energy Storage

- iv. Pumped Heat Electrical Storage

- 2.5.4. Hydrogen Storage

- 2.5.5. Electrochemical/Electricity Storage

- i. Lithium-ion Battery Storage

- ii. Flow Battery Storage

- 2.5.1. Pumped Hydroelectricity Energy Storage

- 2.6. Key Trends, Market Drivers, and Constraints

- 2.6.1. Government Policies & Incentives

- i. Solar PV Policies

- ii. Wind Energy Policies

- iii. Hydroelectric Energy Policies

- 2.6.2. International Trading

- 2.6.3. Solar PV Oversupply

- 2.6.4. Offshore Projects Under Threat

- 2.6.1. Government Policies & Incentives

- 2.7. Future Outlook

3. Segment Analysis

- 3.1. Case Studies

- 3.1.1. Solar AquaGrid Solar Canal Project

- 3.1.2. Whitelee Windfarm

- 3.1.3. Red Rock Hydroelectric Project

- 3.1.4. Attero & Peka Kroef

- 3.2. Innovations

- 3.2.1. Solar Innovations

- i. Floatovoltaics

- ii. Pyramidal Lenses

- Figure 3.1: Pyramidal Lens in Three Stages of Development

- iii. Solar Cells

- 3.2.2. Wind Innovations

- i. Bladeless Wind Turbines

- ii. Floating Wind Turbines

- iii. Flying Wind Power

- 3.2.3. Hydroelectric Innovations

- i. Helicoid Penstocks

- ii. VIVACE (Vortex Induced Vibration for Aquatic Clean Energy)

- 3.2.1. Solar Innovations

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: Renewable Energy Technology Country Readiness Index Regional Definitions

- Table 4.2: Juniper Research Country Readiness Index Scoring Criteria: Renewable Energy Technology

- Figure 4.3: Juniper Research Country Readiness Index: Renewable Energy Technology

- Figure 4.4: Renewable Energy Technology Country Readiness Index: Market Segments

- 4.1.1. Focus Markets

- i. Offshore Wind Investment

- ii. Easing International Trading

- iii. Renewable Energy Is Not Yet the Primary Energy Source

- 4.1.2. Growth Markets

- i. Large Potential for Increased Renewable Energy Generation

- ii. Markets with Great Investment Opportunities

- 4.1.3. Saturated Markets

- 4.1.4. Developing Markets

- Table 4.11: Juniper Research's Country Readiness Index Heatmap: North America

- Table 4.12: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 4.13: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 4.14: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 4.15: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 4.16: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.17: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.18: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Renewable Energy Technologies Competitor Leaderboard

- 1.1. Why Read this Report

- Table 1.1: Juniper Research Competitor Leaderboard: Renewable Energy Technology Vendors Included & Product Profiles

- Figure 1.2: Juniper Research Competitor Leaderboard: Renewable Energy Technology Vendors

- Table 1.3: Juniper Research Competitor Leaderboard Vendors & Positioning: Renewable Energy Technologies

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Renewable Energy Technology Vendors

2. Renewable Energy Technology Vendor Profiles

- 2.1. Renewable Energy Technology Vendors

- 2.1.1. Brookfield Renewable

- i. Corporate

- Table 2.1: Brookfield Renewable Revenue for 2022 & 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.2: Brookfield Renewable's Holtwood Hydroelectric Facility

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.2. Canadian Solar Incorporated

- i. Corporate

- Table 2.3: Canadian Solar Revenue for 2022 & 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.3. China Three Gorges Corporation

- i. Corporate

- Table 2.4: CTG Revenue for 2022 & 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.4. Eletrobras

- i. Corporate

- Table 2.5: Eletrobras Revenue for 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.5. Envision

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- 2.1.6. First Solar

- i. Corporate

- Table 2.6: First Solar Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.7. General Electric Vernova

- i. Corporate

- Table 2.7: GE Vernova Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.8. Goldwind

- i. Corporate

- Table 2.8: Goldwind Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.9. Iberdrola

- i. Corporate

- Table 2.9: Iberdrola Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.10. JinkoSolar Holding Company

- i. Corporate

- Table 2.10: JinkoSolar Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.11. NextEra Energy

- i. Corporate

- Table 2.11: NextEra Energy Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.12 Orsted

- i. Corporate

- Table 2.12: Orsted Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.13. Siemens Gamesa

- i. Corporate

- Table 2.13: Siemens Gamesa Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- i. Corporate

- 2.1.14. Sonnedix

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- 2.1.15. Vestas Wind Systems A/S

- i. Corporate

- Table 2.14: Vestas Wind Systems A/S Revenue for 2022 & 2023 ($m)

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research Strategic Recommendations & Key Opportunities

- Table 2.15: Juniper Research Competitor Leaderboard Scoring Criteria: Renewable Energy Technology Vendors

- i. Corporate

- 2.1.1. Brookfield Renewable

Data & Forecasting

1. Renewable and Non-renewable Energy Technology Forecast Methodology

- 1.1. Methodology & Assumptions

- Figure 1.1: Onshore Wind Energy Forecast Methodology

- Figure 1.2: Offshore Wind Energy Forecast Methodology

- Figure 1.3: Solar Energy Forecast Methodology

- Figure 1.4: Hydroelectric Energy Forecast Methodology

- Figure 1.5: Bioenergy Energy Forecast Methodology

- Figure 1.6: Coal Energy Forecast Methodology

- Figure 1.7: Gas Energy Forecast Methodology

- Figure 1.8: Oil Energy Forecast Methodology

- Figure 1.9: Nuclear Energy Forecast Methodology

2. Wind Energy Forecasts

- 2.1. Onshore Wind Energy

- 2.1.1. Total Installed Onshore Wind Capacity

- Figure & Table 2.1: Total Global Installed Onshore Wind Capacity (GW), Split by 8 Key Regions, 2024-2029

- 2.1.2. Total Spend on Onshore Wind Turbines per annum

- Figure & Table 2.2: Total Spend on Onshore Wind Turbines ($m), Split by 8 Key Regions, 2024-2029

- 2.1.3. Total Onshore Wind Operating Costs

- Figure & Table 2.3: Total Global Onshore Wind Operating Costs ($m), Split by 8 Key Regions, 2024-2029

- 2.1.4. Total Wholesale Cost of Onshore Wind Energy

- Figure & Table 2.4: Total Global Price of Wholesale Onshore Wind Energy ($m), Split by 8 Key Regions, 2024-2029

- 2.1.1. Total Installed Onshore Wind Capacity

- 2.2. Offshore Wind Energy

- 2.2.1. Total Installed Offshore Wind Capacity

- Figure & Table 2.5: Total Installed Offshore Wind Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 2.2.2. Total Spend on Offshore Wind Turbines

- Figure & Table 2.6: Total Spend on Offshore Wind Turbines Globally ($m), Split by 8 Key Regions, 2024-2029

- 2.2.3. Total Offshore Wind Turbine Operating Costs

- Figure & Table 2.7: Total Offshore Wind Turbine Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 2.2.4. Total Wholesale Cost of Offshore Wind Energy

- Figure & Table 2.8: Total Wholesale Cost of Offshore Wind Energy Globally ($m), Split by 8 Key Regions, 2024-2029

- 2.2.1. Total Installed Offshore Wind Capacity

- 2.3. Wind Energy

- 2.3.1. Proportion of Electricity Capacity Attributable to Wind

- Figure & Table 2.9: Proportion of Global Electricity Capacity Attributable to Wind Energy (%), Split by 8 Key Regions, 2024-2029

- 2.3.2. Total CO2 Equivalent Avoided Through Wind

- Figure & Table 2.10: Total CO2e Avoided by Wind Energy Globally (Gt), Split by Key Regions, 2024-2029

- 2.3.1. Proportion of Electricity Capacity Attributable to Wind

3. Solar Energy Forecasts

- 3.1. Solar Energy

- 3.1.1. Total Installed Solar Capacity

- Figure & Table 3.1: Total Installed Solar Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 3.1.2. Total Spend on Solar Modules

- Figure & Table 3.2: Total Spend on Solar Modules Globally ($m), Split by 8 Key Regions, 2024-2029

- 3.1.3. Total Solar Module Operating Costs

- Figure & Table 3.3: Total Solar Module Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.4. Total Wholesale Cost of Solar Energy

- Figure & Table 3.4: Total Wholesale Cost of Solar Energy ($m), Split by 8 Key Regions, 2024-2029

- 3.1.5. Proportion of Electricity Capacity Attributable to Solar

- Figure & Table 3.5: Proportion of Electricity Capacity Attributable to Solar Globally (%), Split by 8 Key Regions, 2024-2029

- 3.1.6. Total CO2 Equivalent Avoided Through Solar

- Figure & Table 3.6: Total CO2e Avoided Through Solar Globally (Gt), Split by 8 Key Regions, 2024-2029

- 3.1.1. Total Installed Solar Capacity

4. Hydroelectric Energy Forecasts

- 4.1. Hydroelectric Energy

- 4.1.1. Total Installed Hydroelectric Energy Capacity

- Figure & Table 4.1: Total Installed Hydroelectric Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 4.1.2. Total Spend on Hydroelectric Plant Installation

- Figure & Table 4.2: Total Spend on Hydroelectric Power Plant Installation Globally ($m), Split by 8 Key Regions, 2024-2029

- 4.1.3. Total Hydroelectric Plant Operating Costs

- Figure & Table 4.3: Total Hydroelectric Plant Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 4.1.4. Total Wholesale Cost of Hydroelectric Energy

- Figure & Table 4.4: Total Wholesale Cost of Hydroelectric Energy Globally ($m), Split by 8 Key Regions, 2024-2029

- 4.1.5. Proportion of Electricity Generated Attributable to Hydro

- Figure & Table 4.5: Proportion of Electricity Generated Attributable to Hydro Globally (%), Split by 8 Key Regions, 2024-2029

- 4.1.6. Total CO2 Equivalent Avoided Through Hydro

- Figure & Table 4.6: Total CO2e Avoided Through Hydro Globally (Gt), Split by 8 Key Regions, 2024-2029

- 4.1.1. Total Installed Hydroelectric Energy Capacity

5. Bioenergy Forecasts

- 5.1. Bioenergy

- 5.1.1. Total Installed Bioenergy Capacity

- Figure & Table 5.1: Total Installed Bioenergy Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 5.1.2. Total Spend on Bioenergy Plant Installation

- Figure & Table 5.2: Total Spend on Bioenergy Plant Installation Globally ($m), Split by 8 Key Regions, 2024-2029

- 5.1.3. Total Bioenergy Plant Operating Costs

- Figure & Table 5.3: Total Bioenergy Plant Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 5.1.4. Total Wholesale Cost of Bioenergy

- Figure & Table 5.4: Total Wholesale Cost of Bioenergy Globally ($m), Split by 8 Key Regions, 2024-2029

- 5.1.5. Proportion of Electricity Capacity Attributable to Bioenergy

- Figure & Table 5.5: Proportion of Electricity Capacity Attributable to Bioenergy Globally (%), Split by 8 Key Regions, 2024-2029

- 5.1.6. Total CO2 Equivalent Avoided Through Bioenergy

- Figure & Table 5.6: Total CO2e Avoided Through Bioenergy Globally (Gt), Split by 8 Key Regions, 2024-2029

- 5.1.1. Total Installed Bioenergy Capacity

6. Coal Energy Forecasts

- 6.1. Coal Energy

- 6.1.1. Total Installed Coal Capacity

- Figure & Table 6.1: Total Installed Coal Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 6.1.2. Total Coal Plant Operating Costs

- Figure & Table 6.2: Total Coal Plant Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 6.1.3. Total Wholesale Cost of Coal Energy

- Figure & Table 6.3: Total Wholesale Cost of Coal Energy Globally ($m), Split by 8 Key Regions, 2024-2029

- 6.1.4. Proportion of Electricity Capacity Attributable to Coal Power

- Figure & Table 6.4: Proportion of Electricity Capacity Attributable to Coal Power Globally (%), Split by 8 Key Regions, 2024-2029

- 6.1.5. Total CO2 Produced by Coal Energy Generation

- Figure & Table 6.5: Total Amount of CO2 Produced From Coal Energy Generation Globally (Gt), Split by 8 Key Regions, 2024-2029

- 6.1.1. Total Installed Coal Capacity

7. Gas Energy Forecasts

- 7.1. Gas Energy

- 7.1.1. Total Installed Gas Power Capacity

- Figure & Table 7.1: Total Installed Gas Power Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 7.1.2. Total Gas Plant Operating Costs

- Figure & Table 7.2: Total Gas Plant Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 7.1.3. Total Wholesale Cost of Gas Energy

- Figure & Table 7.3: Total Wholesale Cost of Gas Energy Globally ($m), Split by 8 Key Regions, 2024-2029

- 7.1.4. Proportion of Electricity Capacity Attributable to Gas Power

- Figure & Table 7.4: 7.1.4. Proportion of Electricity Capacity Attributable to Gas Power Globally (%), Split by 8 Key Regions, 2024-2029

- 7.1.5. Total CO2 Produced From Gas Energy Generation

- Figure & Table 7.5: 7.1.5. Total CO2 Produced From Gas Energy Generation Globally (Gt), Split by 8 Key Regions, 2024-2029

- 7.1.1. Total Installed Gas Power Capacity

8. Oil Energy Forecasts

- 8.1. Oil Energy

- 8.1.1. Total Installed Oil Power Capacity

- Figure & Table 8.1: Total Installed Oil Power Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 8.1.2. Total Oil Plant Operating Costs per annum

- Figure & Table 8.2: Total Oil Plant Operating Costs Globally per annum ($m), Split by 8 Key Regions, 2024-2029

- 8.1.3. Total Wholesale Cost of Oil Energy

- Figure & Table 8.3: Total Wholesale Cost of Oil Energy Globally ($m), Split by 8 Key Regions, 2024-2029

- 8.1.4. Proportion of Electricity Capacity Attributable to Oil Power

- Figure & Table 8.4: Proportion of Electricity Capacity Attributable to Oil Power (%), Split by 8 Key Regions, 2024-2029

- 8.1.5. Total CO2 Produced From Oil Energy Generation

- Figure & Table 8.5: Total CO2 Produced From Oil Energy Generation Globally (Gt), Split by 8 Key Regions, 2024-2029

- 8.1.1. Total Installed Oil Power Capacity

9. Nuclear Energy Forecasts

- 9.1. Nuclear Energy

- 9.1.1. Total Installed Nuclear Power Capacity

- Figure & Table 9.1: Total Installed Nuclear Power Capacity Globally (GW), Split by 8 Key Regions, 2024-2029

- 9.1.2. Total Nuclear Plant Operating Costs

- Figure & Table 9.2: Total Nuclear Power Plant Operating Costs Globally ($m), Split by 8 Key Regions, 2024-2029

- 9.1.3. Total Wholesale Cost of Nuclear Energy

- Figure & Table 9.3: Total Wholesale Cost of Nuclear Energy Globally ($m), Split by 8 Key Regions, 2024-2029

- 9.1.4. Proportion of Electricity Capacity Attributable to Nuclear Power

- Figure & Table 9.4: Proportion of Electricity Capacity Attributable to Nuclear Power Globally (%), Split by 8 Key Regions, 2024-2029

- 9.1.1. Total Installed Nuclear Power Capacity