|

市场调查报告书

商品编码

1552965

量子技术的全球市场:2024-2030年Global Quantum Technology Market: 2024-2030 |

||||||

| 主要统计 | |

|---|---|

| 量子技术的总收益:2024年 | 27亿美元 |

| 量子技术的总收益:2030年 | 94亿美元 |

| 市场成长率:2024~2030年 | 243% |

| 预测期间 | 2024-2030年 |

量子运算:到 2030 年全球商业收入将接近 100 亿美元

该研究包对这个新兴市场进行了详细而富有洞察力的分析,使政府、量子计算服务提供商和技术供应商能够了解市场的未来成长。我们讨论了混合运算和量子云端解决方案等关键趋势以及量子市场的竞争格局,考虑到私人投资放缓导致政府资金增加的影响。

该套件提供了八个主要地区的 60 个国家的市场规模和关键预测数据,包括北美、西欧和远东/中国的主要投资地区。我们也按量子市场的技术领域提供数据,包括量子计算、量子感测和量子通讯。它还为利益相关者提供了量子生态系统的主要趋势、行业机会、课题以及关键建议。这些内容将成为了解快速发展的市场的重要工具,并使量子技术供应商能够规划其未来策略。

主要功能

- 市场动态:量子力学的复杂性所带来的课题、人工智慧在量子运算中的潜在优势、关键产业(医疗保健、物流、金融、製造、安全和国防)对主要趋势的洞察以及量子市场的市场扩张课题,包括对量子用例的分析市场研究还包括对供应商的关键货币化机会的分析,例如将混合量子运算解决方案实施到量子云端解决方案中。它还建议供应商在市场成熟之前应采取的关键步骤,以便在市场竞争中获利。

- 关键要点和策略建议:详细分析量子市场的关键发展机会和见解,包括为政府和产业领导者等利害关係人提供的关键策略建议。

- 基准产业预测:量子供应商的业务概览包括到 2030 年的预测期,并预测未来六年的量子收入、量子投资和量子硬体部署。具体来说,它不仅提供了全球市场的概况,还提供了量子计算、量子感测、量子通讯等量子技术的数据。

- Juniper Research 未来领导者指数:评估 10 家量子运算技术供应商的公司概况和能力,列出他们的目标产业、创新和未来前景。

市场资料·预测

我们的研究套件包括对包含 55 个表格和超过 29,000 个资料点的完整预测期资料集的存取。研究套件包括以下指标:

- 采用量子技术的企业数

- 量子技术硬体设备的引进数

- 量子软体的引进收益

- 量子技术事业的投资额

样品view

市场趋势·预测 (PDF报告):

目录

第1章 重要点和策略性推荐事项

- 量子市场:重要点

- 量子市场:策略性推荐事项

第2章 目前的市场情势·促进因素·课题

- 量子是什么吗?

- 目前的市场情势

- 量子运算

- 量子感测

- 量子通讯

- 产业市场区隔分析

- 製造

- 财政

- 安全保障·防卫

- 医疗保健

- 物流

- 量子冬天

- 量子监管状况

- 课题

- 量子退相干

- 初始成本高

- 可扩充性

- 缺乏人力资源技能

第3章 未来市场趋势与主要技术分析

- 简介

- AI与机器学习

- 混合运算

- 云端解决方案

- 耐量子密码

- 量子的实践

- 量子感测器

- 量子运算

- 量子通讯

- 主要的收益化和投资机会

- 主要的产业机会

- 地区的机会

第4章 Future Leaders Index

- Amazon Web Services

- D-Wave Systems

- IBM

- Intel

- IonQ

- Microsoft Corporation

- Quantinuum

- Rigetti

- Xanadu

- Juniper Research排行榜评估手法

- 限制与解释

第5章 市场预测和重要点

- 量子市场概论及未来展望

- 安装的量子硬体数量

- 量子科技总收入

- 量子科技总投资

- 量子运算总投资

- 量子通讯总投资

- 量子感测器的总投资

- 其他量子技术的总投资

| KEY STATISTICS | |

|---|---|

| Total quantum technology revenue in 2024: | $2.7bn |

| Total quantum technology revenue in 2030: | $9.4bn |

| 2024 to 2030 market growth: | 243% |

| Forecast period: | 2024-2030 |

'Quantum Computing: Commercial Revenue to Near $10bn Globally by 2030'

Overview

Our "Quantum Market" research suite provides a detailed and insightful analysis of this emerging market, enabling governments, quantum computing service providers, and technology vendors to understand future growth in the market. Given the impact of increased funding from governments in the wake of a slow-down on private investments, key trends such as hybrid computing and quantum cloud solutions are discussed, as well as the competitive nature of the quantum market.

The suite includes a data deliverable, sizing the market and providing key forecast data across 60 countries in 8 key regions, including regions of major investment, namely North America, West Europe and Far East & China. Data is also spilt by several different technology segments in the quantum market, including quantum computing, quantum sensing and quantum communications. In addition, the suite provides a Strategy and Trends document, which gives a complete assessment of the key trends, industry opportunities, challenges and key recommendations for stakeholders in the quantum ecosystem. Collectively, these provide a critical tool for understanding this rapidly evolving market, allowing quantum technology vendors to shape their future strategy.

Key Features

- Market Dynamics: Insights into key trends and market expansion challenges within the quantum market; addressing the challenges posed by the highly complex nature of quantum mechanics, the potential benefits of AI in quantum computing, and analysing quantum use cases in key industries (healthcare, logistics, finance, manufacturing, and security and defence). The quantum market research also includes an analysis of key monetisation opportunities for vendors, such as the implementation hybrid quantum computing solutions into quantum cloud solutions. It also recommends key steps that vendors must take to be profitable in the market until it reaches maturity.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and key findings within the quantum market, accompanied by key strategic recommendations for stakeholders, such as governments and industry leaders.

- Benchmark Industry Forecasts: The business overview into quantum providers includes a forecast period until 2030, covering total quantum revenue, quantum investment and quantum hardware deployments over the next six years. Specifically, this data set not only provides a global market overview, but data is also split by quantum technology, including quantum computing, quantum sensing and quantum communications.

- Juniper Research Future Leader Index: Key player capability and capacity assessment for 10 quantum computing technology vendors, including company profiles, via the Juniper Research Future Leader Index, featuring segment coverage, innovation and future prospects for each major player:

- AWS

- D-Wave Systems

- IBM

- Intel

- IonQ

- Microsoft

- Quantinuum

- Rigetti Computing

- Xanadu

Market Data & Forecasts

This market-leading research suite for the quantum market includes access to the full set of forecast period data of 55 tables and over 29,000 datapoints. Metrics in the research suite include:

- Total Number of Businesses Adopting Quantum Technology

- Total Number of Quantum Technology Hardware Deployments

- Total Quantum Software Deployments Revenue

- Total Quantum Technology Business Investments

These metrics are provided for the following key market verticals:

- Quantum Computing

- Quantum Sensing

- Quantum Communications

- Other Quantum Technology

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select countries and compare each of them. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions via 5 interactive scenarios.

SAMPLE VIEW

Market Trends & Forecasts PDF Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Table of Contents

1. Key Takeaways and Strategic Recommendations

- 1.1. The Quantum Market: Key Takeaways

- 1.2. The Quantum Market: Strategic Recommendations

2. Current Market Landscape, Drivers & Challenges

- 2.1. Introduction

- 2.2. What is Quantum?

- Figure 2.1: Summary of the Main Differences Between Quantum Computing and Classical Computing

- 2.3. Current Market Landscape

- 2.3.1. Quantum Computing

- Figure 2.2: Total Quantum Computers Deployed, Split by 8 Key Regions, 2024-2030

- Figure 2.3: Total Number of Businesses Adopting Quantum Computing Software, Split by 8 Key Regions, 2024-2030

- Figure 2.4: Total Cumulative Investment in Quantum Computers ($m), split by Key Regions, 2024-2030

- 2.3.2. Quantum Sensing

- Figure 2.5: Total Number of Quantum Sensors Deployed, Split by 8 Key Regions, 2024-2030

- 2.3.3. Quantum Communications

- Figure 2.6: Total Cumulative Investment in Quantum Communications ($m), split by 8 Key Regions, 2024-2030

- 2.3.1. Quantum Computing

- 2.4. Industry Segment Analysis

- 2.4.1. Manufacturing

- 2.4.2. Finance

- 2.4.3. Security and Defence

- 2.4.4. Healthcare

- 2.4.5. Logistics

- 2.5. Quantum Winter

- 2.6. Quantum Regulatory Landscape

- Table 2.7: Summary of the Current Institutions/Regulatory Bodies Releasing Standards and Regulations on Quantum Technologies

- 2.7. Challenges

- 2.7.1. Quantum Decoherence

- 2.7.2. High Initial Cost

- 2.7.3. Scalability

- 2.7.4. Unskilled Workforce

3. Future Market Trends & Key Technology Analysis

- 3.1. Introduction

- 3.1.1. AI and Machine Learning

- 3.1.2. Hybrid Computing

- Figure 3.1: Workflow of a Hybrid Quantum System

- 3.1.3. Cloud Solutions

- 3.1.4. Post-quantum Cryptography

- 3.2. Quantum in Action

- 3.2.1. Quantum Sensors

- Figure 3.2: Total Number of Businesses Deploying Quantum Sensors, Split by 8 Key Regions, 2024-2030

- 3.2.2. Quantum Computing

- 3.2.3. Quantum Communications

- Figure 3.3: Total Number of Businesses Deploying Quantum Communication Devices, Split by 8 Key Regions, 2024-2030

- 3.2.1. Quantum Sensors

- 3.3. Key Monetisation and Investment Opportunities

- 3.3.1. Key Industry Opportunities

- 3.3.2. Regional Opportunities

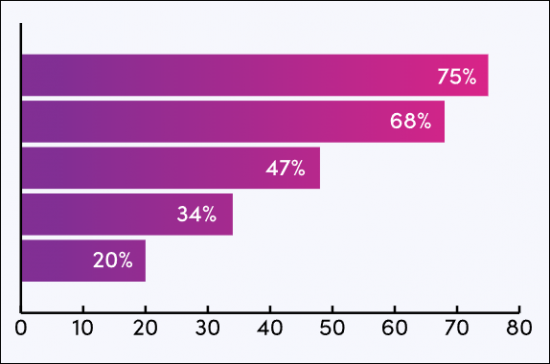

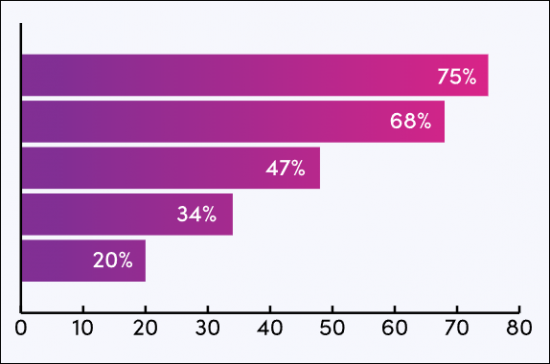

- Figure 3.4: Cumulative Investment in Quantum Technologies by 2029 ($m), Split by 10 Leading Countries

- Figure 3.5: Total Cumulative Investment and Revenue in Quantum Technologies ($), 2021-2030

- Figure 3.6: Quantum Commercialisation Roadmap and Key Monetisation Opportunities

4. Future Leaders Index

- 4.1. Why Read This Report

- Table 4.1: Juniper Research Future Leader Index: Quantum Vendor Solutions

- Figure 4.2: Juniper Research Future Leader Index: Quantum Market Vendors

- Source: Juniper Research Table 4.3: Juniper Research Quantum Vendors Ranking

- Table 4.4: Juniper Research Future Leader Index Heatmap: Quantum Market Vendors

- 4.2. Amazon Web Services

- i. Corporate

- Table 4.5: AWS Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.3. D-Wave Systems

- i. Corporate

- Table 4.4: D-Wave Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.4. Google

- i. Corporate

- Table 4.4: Google Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.5. IBM

- i. Corporate

- Table 4.5: IBM's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.6. Intel

- i. Corporate

- Table 4.6: Intel's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.7. IonQ

- i. Corporate

- Table 4.7: IonQ's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.8. Microsoft Corporation

- i. Corporate

- Table 4.7: Microsoft's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.9. Quantinuum

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.10. Rigetti

- i. Corporate

- Table 4.8: Rigetti's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.11. Xanadu

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.1. Juniper Research Leaderboard Assessment Methodology

- 4.2. Limitations & Interpretations

- Table 4.6: Juniper Research Future Leader Index Criteria Table: The Quantum Market

5. Market Forecast & Key Takeaways

- 5.1. Quantum Market Summary & Future Outlook

- 5.1.1. Methodology

- Figure 5.1: The Quantum Market Methodology

- 5.1.1. Methodology

- 5.2. Total Number of Quantum Hardware Deployments

- Figure and Table 5.2: Number of Quantum Hardware Deployments, Split by 8 Key Regions, 2024-2030

- Table 5.3: Number of Quantum Hardware Deployments, Split by Technology, 2024-2030

- 5.3. Total Quantum Technology Revenue

- Figure and Table 5.4: Total Quantum Technology Revenue ($m), Split by 8 Key Regions, 2024-2030

- Table 5.5: Total Quantum Technology Revenue ($m), Split by Technology, 2024-2030

- 5.4. Total Investment in Quantum Technology

- Figure and Table 5.6: Total Investment in Quantum Technology ($m), Split by 8 Key Regions, 2024-2030

- Table 5.7: Total Cumulative Investment in Quantum Technology ($m), Split by 8 Key Regions, 2024-2030

- 5.5. Total Investment in Quantum Computing

- Figure and Table 5.8: Total Investment in Quantum Computing ($m), Split by 8 Key Regions, 2024-2030

- Table 5.9: Total Cumulative Investment in Quantum Computing ($m), Split by 8 Key Regions, 2024-2030

- 5.5.1. Total Investment in Quantum Communications

- Figure and Table 5.10: Total Investment in Quantum Communications ($m), by 8 Key Regions, 2024-2030

- Figure 5.11: Total Cumulative Investment in Quantum Communications ($m), Split by 8 Key Regions, 2024-2030

- 5.6. Total Investment in Quantum Sensors

- Figure and Table 5.12: Total Investment in Quantum Sensors ($m), Split by 8 Key Regions, 2024-2030

- Table 5.13: Total Cumulative Investment in Quantum Sensors ($m), Split by 8 Key Regions, 2024-2030

- 5.7. Total Investment in Other Quantum Technology

- Figure and Table 5.14: Total Investment in Other Quantum Technology ($m), Split by 8 Key Regions, 2024-2030

- Figure 5.15: Total Cumulative Investment in Other Quantum Technology ($m), Split by 8 Key Regions, 2024-2030