|

市场调查报告书

商品编码

1383536

GaN 电子专利格局分析:2023 年GaN Electronics Patent Landscape Analysis 2023 |

|||||||

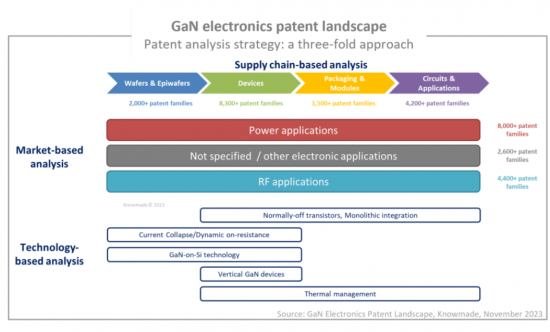

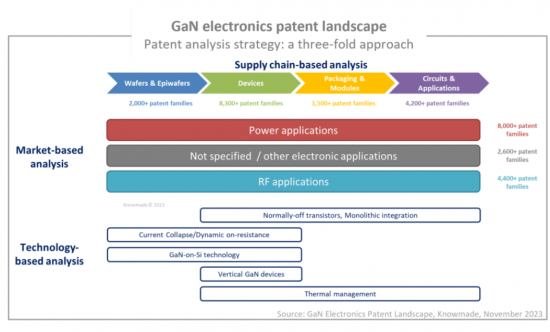

本报告调查了全球主要国家GaN电子产品的专利趋势,分为两个应用类别(射频/功率)和四个供应链类别(晶圆与外延片、装置、封装与模组、电路与应用),以六大技术类别(电流崩塌、e-mode、GaN-on-Si、单晶片整合、热管理、垂直装置)和主要公司的专利组合进行分析。

该报告还包括一个广泛的 Excel 资料库,其中包含本研究中分析的 15,000 多个同族专利。 此专利资料库可进行多条件检索,包括专利公开号、最新线上资料库的超连结(例如原文、法律状态)、优先权日期、标题、摘要、专利受让人、专利包括当前法律状态、申请分类、供应连锁分类等

部分上市公司

Mitsubishi Electric, Toshiba, Toyota Group, Panasonic, Sumitomo Electric, Infineon, Fujitsu, CETC, Sharp, Furukawa Electric, Intel, Rohm, Wolfspeed, Fuji Electric, Innoscience, Samsung, Sanken Electric, Renesas Electronics, NTT - Nippon Telegraph & Telephone, Hitachi, Transphorm, Qorvo, TSMC, Texas Instruments, NXP, Vanguard International, Midea, Macom, Dynax Semiconductor, LG Group, San'an, Enkris Semiconductor, Onsemi , Sumitomo Chemical, Delta Electronics, Ancora Semiconductors, HiWAFER, NexGen Power, NEC, Raytheon Technologies, Huawei, CorEnergy, NGK Insulators, Seoul Semiconductor, STMicroelectronics, Murata, General Electric, UMC, Siemens, Oki Electric, JRC, EPC, Power Integrations, Bosch, Akoustis, HC Semitek, Northrop Grumman, Shenzhen Gancom Technologies, RFHIC, YASC, Navitas, Shindengen Electric, Nuvoton, Shin Etsu, Hanhua Semiconductor, Jiangsu Broadwave Electric Technology, Qualcomm, Zhejiang Jimaike Microelectronics, GaN Systems, WIN Semiconductors, Nexperia, Epistar, Analog Devices, GlobalWafers, CoorsTek, IQE, Richtek Technology, Hatchip, Soitec, SETi, Ingacom Semiconductor, Nichia, BAE Systems, Comba Telecom, ABB, NPP Pulsar, NEXGO, Ampleon, Silan, General Motors, CR Micro, Broadcom, Thales, DOWA, SGCC, GaN Power Tech, Powdec, Kyocera, Qromis, GaNPower, ZTE, Chip Foundation Technology, Daikin Industries, Lattice Power, Taiyo Yuden, SDSX , Runxin Microelectronics, Nokia, Akash Systems, GaNext, GlobalFoundries, Schneider Electric等。

目录(例)

简介

执行摘要

功率 GaN:专利状况

简介

专利状况概览

- 专利获取活动的推动者

- 从专利角度看全球供应链

- 最活跃的智慧财产权公司/组织和新进者

- 主要技术挑战

专利状况分析:依国家划分

- 美国

- 日本

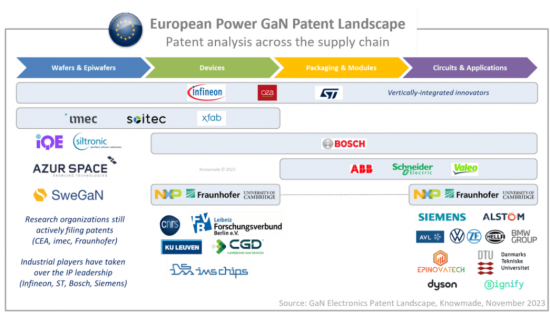

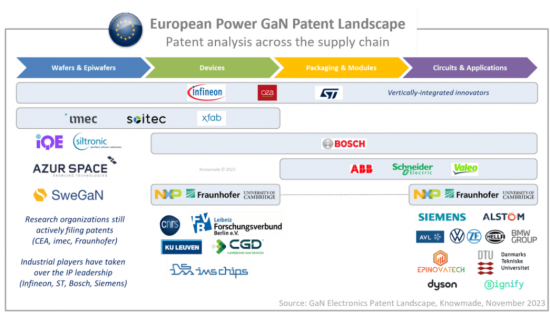

- 欧洲

- 中国

- 台湾

- 韩国

专利状况分析:依供应链类别

- 用于电力应用的晶圆和外延晶圆

- GaN功率元件

- 电源模组及封装

- 电源电路及应用

RF GaN:专利状况

简介

专利状况概览

- 专利获取活动的推动者

- 从专利角度看全球供应链

- 最活跃的智慧财产权公司/组织和新进者

- 主要技术挑战

专利状况分析:依国家划分

- 美国

- 日本

- 欧洲

- 中国

- 台湾

- 韩国

专利状况分析:依供应链类别

- 用于射频应用的晶圆和外延晶圆

- GaN射频元件

- 射频模组和封装

- 射频电路与应用

附录

Figure out the IP strategy of main players and newcomers in the emerging power and RF GaN ecosystems.

Focus on national and regional IP adaptation strategies to deal with geopolitical uncertainties.

Review and analyze the global IP competition across the power and RF GaN supply chains.

Report's Key Features:

- PDF>400 slides

- Excel database containing all patents analyzed in the report (>15,000 patent families), including segmentations + hyperlink to updated online database (legal status, documents etc.)

- Describing the global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active/inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Providing a detailed picture of the different GaN ecosystems focusing on the patenting activity of US, Japanese, Chinese, European, South Korean and Taiwanese entities.

- Patents categorized in 2 application segments, 4 main supply chain segments and 6 main technical segments: RF, power, wafers and epiwafers, devices, packaging and modules, circuits and applications, current collapse, e-mode, GaN-on-Si, monolithic integration, thermal management, vertical devices.

- IP profile of main players: Patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.)

Power GaN

- The power GaN industry landscape has been reshaped by acquisitions of startup companies and partnerships between well-established players in the power electronics industry.

- The application base for GaN technology is widening. The adoption of GaN power devices in replacement for Si power devices is accelerating, especially in consumer applications.

- Well-established GaN players and newcomers announced the development of high-voltage GaN technology to compete with Si IGBT and SiC MOSFET in EV applications.

- New companies have entered the power GaN market recently or announced their intention to enter this market shortly.

- Early market players look to consolidate their leadership amid growing competition worldwide and geopolitical tensions escalating between US and China.

- As a countermeasure to US trade sanctions, China is driving the development of a domestic supply chain to serve its own market.

RF GaN

- The RF GaN industry landscape has been reshaped by acquisitions and partnerships (IP, manufacturing) between well-established players in the RF industry.

- The deployment of 5G base stations is driving the RF GaN market, with GaN-on-SiC RF devices progressively replacing Si LDMOS in the telecom infrastructure.

- There is a growing interest for RF GaN-on-Si devices as the telecom infrastructure evolves toward lower power and higher frequencies (e.g., 6G applications).

- The opportunity to offer RF GaN technology at lower cost by leveraging the existing Si manufacturing lines and the GaN-on-Si platform is expected to drive the emergence of new players in the RF GaN market.

- RF GaN-on-Si technology is now close to enter the market. Yet many technical challenges remain to be solved for the large-scale adoption of the RF GaN-on-Si platform (incl. reliability, process maturity and scalability).

- Regardless of the platform, innovations at all levels - from epitaxy to devices, packaging and circuits - are still strongly required to fully unlock the potential of GaN technology in RF applications.

- In the field of telecommunications, US government has recently banned new equipment from Chinese players such as Huawei and ZTE, citing national security risk.

In this context, the “GaN Electronics Patent Landscape” report aims to understand what is the strategy of players to consolidate their position in the emerging power and RF GaN markets and to limit the risks and uncertainties related to the adoption, industrialization and commercialization of a new power and RF semiconductor technologies (investment, geopolitical and IP risks).

What's more, the report identifies well-established IP players, IP challengers and newcomers, which are not yet in the power or RF GaN markets and thereby may represent either a threat (future IP and market challengers) or an opportunity to access external innovation (M&A targets, partnerships, IP licensing), depending on the perspective.

Eventually, the report positions early market players in the global IP competition, as these players are the most likely to assert their patents against new players entering the power or RF GaN markets, to maintain and expand their market leadership.

Methodology for GaN electronics patent selection and patent analysis

The patent search covers inventions across the whole GaN value chain, from materials (wafers and epiwafers) to circuits, targeting any kind of electronic applications. The selection is mainly based on the analysis patent claims:

- In the upstream supply chain (wafers, epiwafers, devices), relevant inventions are required to focus specifically on GaN materials and devices. A generic invention, i.e., applicable to different power or RF semiconductors, is not be considered as relevant.

- In the downstream supply chain (packaging, modules, circuits, applications), generic inventions, applicable to GaN or SiC or Si in power applications or applicable to GaN or GaAs or Si in RF applications, are considered as relevant.

The patent categorization has then been performed following:

- The application scope of the patent (power, RF)

- The position of the patent in the supply chain

- The technical challenges addressed by the patent, selected among common issues in power and RF GaN technologies

- The headquarters of patent applicants

In recent years, more and more IP players started disclosing high number of generic inventions where the application scope is not limited to a single field of application (e.g., RF, power). This growing IP trend arose from IP players' adaptation strategy in the GaN electronics landscape, aiming to address different markets (power, RF) with a single technology platform (e.g., GaN-on-Si). Such generic inventions were categorized as "Not specified" and were analyzed in both power and RF GaN IP landscapes:

- In the power GaN IP landscape, we analyzed all power GaN patents and generic GaN electronics patents from IP players owning power GaN patents, resulting in a corpus of more than 10,000 patent families (inventions).

- In the RF GaN IP landscape, we analyzed all RF GaN patents and generic GaN electronics patents from IP players owning RF GaN patents, resulting in a corpus of more than 6,500 patent families (inventions).

Focus on national and regional IP strategies to address geopolitical uncertainties

The GaN electronics patenting activities from Japanese players in the 2000s and then from the Chinese players since 2015, have been massive. As such, they mask important IP trends occurring in other countries with significant market opportunities and stand-out companies advancing GaN technology. What's more, IP has become an important component in the adaption strategies of companies and countries to a geopolitical context that can cause volatility. This report unveils these new IP trends and IP strategies by providing a separated analysis of each national or regional ecosystems emerging for power and RF GaN technologies.

For each region are detailed: Time evolution of IP activities, Supply chain from a patent perspective, Status of players' IP activity, Most active IP players and new entrants, Main technical challenges addressed by IP players, IP strategies of players, Recent IP collaborations and IP transfers, and Key players' patent portfolio.

In-depth analysis of the global IP competition across the power and RF GaN supply chains

Generally, IP strategies should focus on what a company has identified as most critical to impact the power and RF GaN markets, in terms of logistics (supply), technology (barriers), volatility (regulations, geopolitics) and economics (costs, margins). Accordingly, IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the power and RF GaN markets. Interestingly, new players looking to a vertical integration strategy may be identified based on their patenting activity, expanding into new parts of the supply chain. What's more, such strategies may leverage different partnerships and acquisitions that involve the IP of other players and that have important implications for the complete ecosystem. This report unveils the IP strategies of main players in the GaN electronics landscape and the potential implications of acquisitions and partnerships between the GaN electronics IP players, leveraging a combined market, supply chain and technology-based analysis.

For each segment of the supply chain are detailed: Time evolution of IP activities, Main patent assignees, most active IP players, and new entrants, IP leadership, Current legal status of their patents, Technical challenges addressed by IP players, Main patent assignees and new entrant by technical challenge.

As the competition grows in the power and RF markets, players may leverage their IP to assert their market position, providing that they have built strong patent portfolios in strategic IP spaces of the technology. The report aims to identify such strategic IP spaces based on the analysis of the IP competition related to critical aspects of the technology. For instance, the realization of e-mode transistors has been a critical issue for the commercialization of GaN technology in power applications. In the GaN Electronics Patent Landscape report, this is one of the most competitive IP space that has been identified in the power GaN supply chain.

Recently, e-mode GaN patents have been at the center of a US-China patent dispute between two of the main IP players in the power GaN patent landscape. EPC is a well-established IP player in this space, while Innoscience is one of the main IP challengers. Such dispute reminds the threat represented by the IP of tiers companies in a particular geopolitical and economic context. It should support the establishment of more IP licensing agreements and partnerships between GaN electronics IP players in the next few years. The report details the complex relationships between GaN electronics IP players (patent co-filings, patent transfers and patent litigations).

Useful Excel patent database

This report also includes an extensive Excel database with the 15,000+ patent families (inventions) analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to an updated online database (original documents, legal status, etc.), priority date, title, abstract, patent assignees, patent's current legal status, and segments (wafers and epiwafers, devices, packaging and modules, circuits and applications, current collapse, e-mode transistor, GaN-on-Si, etc.).

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Toshiba, Toyota Group, Panasonic, Sumitomo Electric, Infineon, Fujitsu, CETC, Sharp, Furukawa Electric, Intel, Rohm, Wolfspeed, Fuji Electric, Innoscience, Samsung, Sanken Electric, Renesas Electronics, NTT - Nippon Telegraph & Telephone, Hitachi, Transphorm, Qorvo, TSMC, Texas Instruments, NXP, Vanguard International, Midea, Macom, Dynax Semiconductor, LG Group, San'an, Enkris Semiconductor, Onsemi , Sumitomo Chemical, Delta Electronics, Ancora Semiconductors, HiWAFER, NexGen Power, NEC, Raytheon Technologies, Huawei, CorEnergy, NGK Insulators, Seoul Semiconductor, STMicroelectronics, Murata, General Electric, UMC, Siemens, Oki Electric, JRC, EPC, Power Integrations, Bosch, Akoustis, HC Semitek, Northrop Grumman, Shenzhen Gancom Technologies, RFHIC, YASC, Navitas, Shindengen Electric, Nuvoton, Shin Etsu, Hanhua Semiconductor, Jiangsu Broadwave Electric Technology, Qualcomm, Zhejiang Jimaike Microelectronics, GaN Systems, WIN Semiconductors, Nexperia, Epistar, Analog Devices, GlobalWafers, CoorsTek, IQE, Richtek Technology, Hatchip, Soitec, SETi, Ingacom Semiconductor, Nichia, BAE Systems, Comba Telecom, ABB, NPP Pulsar, NEXGO, Ampleon, Silan, General Motors, CR Micro, Broadcom, Thales, DOWA, SGCC, GaN Power Tech, Powdec, Kyocera, Qromis, GaNPower, ZTE, Chip Foundation Technology, Daikin Industries, Lattice Power, Taiyo Yuden, SDSX , Runxin Microelectronics, Nokia, Akash Systems, GaNext, GlobalFoundries, Schneider Electric, etc.

TABLE OF CONTENTS (SAMPLE)

INTRODUCTION

- Context and objectives of the report

- Patent search strategy and methodology

EXECUTIVE SUMMARY

- Take away messages

- IP activities in the different ecosystems (Japan, China, US, Europe, etc.)

- IP activities across the supply Chain

POWER GaN PATENT LANDSCAPE

Introduction

Patent landscape overview

- Who is driving the patenting activity?

- The global supply chain from a patent perspective

- Most active IP players and new entrants

- Main technical challenges (dynamic on-resistance, e-mode, GaN-on-Si, vertical devices, monolithic integration, thermal management, etc.)

Patent landscape analysis by country/geographical area

- US patent landscape

- Japanese patent landscape

- European patent landscape

- Chinese patent landscape

- Taiwanese patent landscape

- South Korean patent landscape

For each country: time evolution of patenting activity, supply chain from a patent perspective, status of players' IP activity, main patent assignees, most active IP players, new entrants, main technical challenges addressed by IP players, IP strategies of players, current legal status of their patents (pending, granted, protected countries, etc.), recent IP collaborations (patent co-filings) and IP transfers (change in ownership), focus on key players' patent portfolio.

Patent landscape analysis by supply chain segments

- Wafers & epiwafers for power applications

- GaN power devices

- Power modules & packaging

- Power circuits & applications

For each segment: Time evolution of patent publications from US players, Japanese players, European players, etc., main patent assignees, most active IP players, new entrants, current legal status of their patents (pending, granted), technical challenges addressed by IP players, main patent assignees and new entrant by technical challenge, recent patent litigation.

RF GaN PATENT LANDSCAPE

Introduction

Patent landscape overview

- Who is driving the patenting activity?

- The global supply chain from a patent perspective

- Most active IP players and new entrants

- Main technical challenges (dynamic on-resistance, e-mode, GaN-on-Si, vertical devices, monolithic integration, thermal management, etc.)

Patent landscape analysis by country/geographical area

- US patent landscape

- Japanese patent landscape

- European patent landscape

- Chinese patent landscape

- Taiwanese patent landscape

- South Korean patent landscape

For each country: time evolution of patenting activity, supply chain from a patent perspective, status of players' IP activity, main patent assignees, most active IP players, new entrants, main technical challenges addressed by IP players, IP strategies of players, current legal status of their patents (pending, granted, protected countries, etc.), recent IP collaborations (patent co-filings) and IP transfers (change in ownership), focus on key players' patent portfolio.

Patent landscape analysis by supply chain segments

- Wafers & epiwafers for RF applications

- GaN RF devices

- RF modules & packaging

- RF circuits & applications

For each segment: Time evolution of patent publications from US players, Japanese players, European players, etc., main patent assignees, most active IP players, new entrants, current legal status of their patents (pending, granted), technical challenges addressed by IP players, main patent assignees and new entrant by technical challenge.

ANNEX

- Terminology