|

市场调查报告书

商品编码

1440568

RF弹性波滤波器:专利状况分析(2024年)RF Acoustic Wave Filters - Patent Landscape Analysis 2024 |

|||||||

在本报告中,我们分析了全球射频声波滤波器市场的最新专利状况,包括已公布专利随时间的变化、主要技术(SAW、BAW等)和专利申请国家的趋势以及专利趋势. 我们彙编并提供知识产权趋势等信息,例如法律状况、主要公司的知识产权概况以及中国境内的详细趋势。

主要功能

- PDF:110 多张投影片

- Excel 文件:超过 11,300 个同族专利

- 全球专利趋势:专利公布数量、专利申请国家等的时间趋势。

- 主要专利权人与新进者:依供应链细分领域

- 主要公司智慧财产权地位和专利组合的相对丰富度

- 关注中国生态系统

- 关键技术IP分析

- SAW(表面声波)滤波器

- BAW(体声波)滤波器

- LBAW 滤波器(包括 XBAR)

- 多工器和带有声学滤波器的 RF FEM(前端模组)

- 重点在于近期关键创新:SAW、BAW、复合压电基板等。

- 领导企业与中国新进业者的智慧财产权概况(专利组合概览、技术覆盖范围、地理覆盖范围等)

- 包含本报告中分析的所有专利的 Excel 资料库,包括专利类别和最新线上资料库的超连结。

需要新的宽频解决方案

自 1990 年代以来,声学滤波器产业已分为两种主要技术:低频段声表面波 (SAW) 滤波器和高频段声表面波 (BAW) 滤波器。 该市场和公司都很成熟,其产品、技术和专有技术受到庞大且强大的智慧财产权 (IP) 组合的保护。 Murata Manufacturing 和 Skyworks 在 SAW 专利方面领先,而 Broadcom 在 BAW 专利方面领先。 随着行动电话服务和网路的扩展,频段逐渐变得更宽、更高。 例如,在5G应用中,除了sub-6GHz频段(例如3.3-3.8GHz(B78)、3.3-4.2GHz(B77)、4.4-5.0GHz(B79))之外,毫米波频段(例如24.25-29.5GHz ) (B257、B258、B261)、37-40GHz (B260))。 达到更高的频率是挑战的一部分;另一个挑战是提供不仅在更高频率下工作,而且还提供更宽的绝对和相对频宽的射频滤波器。

目前,SAW 和 BAW 装置符合 3GHz 以下频段的要求。 然而,当涉及到3-5GHz频段时,就出现了许多问题。 SAW 装置需要越来越窄的电极宽度,从而导致更高的损耗、较差的功率处理能力以及更高的光刻成本。 BAW 装置同样具有相对较低的压电耦合,并且缺乏支援急需的高频宽的能力。 因此,解决损耗、功耗和散热问题以及 3 GHz 以上频宽需求的新解决方案变得很有吸引力。

为了克服这些限制,公司正在寻找新技术。 新的解决方案包括开发具有 ScAlN 或 Sc 掺杂 AlN 压电薄膜的 BAW,以增强电声耦合性能。 同时,新型复合基板的开发为SAW领域开启了新的大门。 最后,横向激励体声波(LBAW)技术也进入了竞争。

许多公司将这种演变视为进入这个利润丰厚的市场的机会,并明确希望成为 5G 下一代射频滤波器的下一个供应商。 这样,不仅是新进者,现有公司也都进入了激烈的竞争,而智慧财产权可以成为支持其策略的关键工具。 此外,中美技术竞争带动了中国国家供应链的发展。 这些因素共同构成了一个高度动态和竞争的产业。

在此背景下,射频声波滤波器专利态势报告旨在了解当前的智慧财产权活动以及它们如何支持公司的市场策略。 透过分析 25,000 多项专利,可以为公司如何利用其智慧财产权来确保自己的地位或获得新的市场份额提供独特的见解。

了解主要趋势、主要公司的智慧财产权地位以及智慧财产权策略

本报告手动提取了超过 11,000 个与 SAW 滤波器、BAW 滤波器以及多路復用器和 RF 前端模组相关的专利族(发明),以概述当前全球 IP 格局。趋势和概述事态发展。 透过专利分析,我们解释每家公司在供应链上的地位,揭示加强其智慧财产权组合的策略,强调其限制其他公司专利活动和营运自由的能力,并识别有前途的新公司,识别和预测未来的知识产权领导者。 此外,该报告还可以让您了解每家公司在有前途的技术方面的智慧财产权地位。 它确定了参与开发新技术的关键公司,并描述了应对这些挑战的主要解决方案。

本报告强调,SAW 与 BAW 之间的智慧财产权格局存在重大差异。 一方面,SAW滤波器的发展已经达到高度成熟,IP公司开始转向模组化设计和滤波器架构。 特定产业的创新者在智慧财产权领域占据主导地位,很难挑战他们。 另一方面,BAW IP 格局的特征是竞争激烈。 最近博通和太阳诱电的专利活动下降,加上 AlScN 压电层的兴起,正在创造许多中国和老牌 SAW 公司不容错过的新机会。

中国IP企业的定位与策略是什么?

这份报告让您了解中国主要企业的智慧财产权现况。

本报告首次确定了最着名的中国专利持有者,并分析了他们如何开发智慧财产权以建立国内供应链。 此外,透过智慧财产权分析,我们发现正在透过向海外拓展专利来实施国际智慧财产权策略的中国企业。 最后,我们全面调查了最着名的中国公司的专利活动,并分析了他们近年来的技术进步。

IP 如何支援新滤波器技术的开发?

5G 需求催生了多项新技术的发展。 最值得注意的是过滤器中使用的基材和材料。 复合压电基板和AlScN已成为满足要求的两种最有前途的技术。 为了确保未来 10 年的技术安全,必须申请与这些技术相关的专利。 KnowMade 首次分析了这个特定智慧财产权领域的格局,并调查了哪些公司拥有最强大的智慧财产权组合。

主要公司的IP概况

本版块涵盖主要公司(Murata/Resonant、Skyworks、Qualcomm、Taiyo Yuden、Samsung Electro-Mechanics、ROFS Microsystem、Akoustis、Qorvo、Kyocera、Wisol)和新的中国IP 公司(MEMSonics、EpicMEMS、StarShine、Sanansol)和新的中国IP 公司(MEMSonics、EpicMEMS、StarShine、Sanan IC) ,Sappland Microelectronics)。

有用的 Excel 专利资料库

该报告还包括一个内容广泛的 Excel 资料库,其中包含分析中分析的所有专利。 这个方便的专利资料库可进行多标准搜索,包括专利公开号、更新的线上资料库的超连结(来源文字、法律状态等)、优先权日期、标题、摘要、专利受让人、片段(SAW、BAW 、LBAW/XBAR) 、多工器和使用它们的 RF FEM)。

本报告中提及的公司(部分)

Murata、Taiyo Yuden、TDK Epcos、Skyworks、Kyocera、Qualcomm、Broadcom、Hitachi、Toshiba、Toyo Communication Equipment、Samsung Electro Mechanics、Qorvo、Seiko Epson、Oki Electric Industry、LG Innotek、NDK、NEC、Epson Toyocom、Sanyo Electric、Samsung Electronics、NGK Insulators、Philips、Intel、Japan Radio、Nokia、Thales、Advanced Saw Products、Motorola、Wisol、Ube Industries、Mitsubishi Electric、Sumitomo Electric Industries、LG Electronics、China Electronics Technology (CETC)、Alps Electric、Tianjin University、Toko、Sappland Microelectronics Technology、Zenith Radio、Texas Instruments、Sony、Intellectual Ventures Holding、Resonant、STMicroelectronics、Institute of Acoustics - Chinese Academy of Sciences、Mitsubishi Materials、CEA、Shoulder Electronics等。

目录

简介

执行摘要

专利状况:概述

- 声表面波滤波器

- 摘要

- 专利公开数量:时间序列变化

- 主要专利权人排名

- 主要知识产权公司:时间表

- 专利的当前法律地位:以主要知识产权公司划分

- 有效专利的地理覆盖范围:以主要知识产权公司划分

- 专利权人的智慧财产权领先地位以及 2019 年后的演变

- BAW 滤波器(FBAR/SMR)

- 摘要

- 专利公开数量:时间序列变化

- 主要专利权人排名

- 主要知识产权公司:时间表

- 当前专利法律状态:主要知识产权公司

- 有效专利的地理覆盖范围:以主要知识产权公司划分

- 专利权人的智慧财产权领先地位以及 2019 年后的演变

- 专利诉讼

- LBAW 滤波器(包括 XBAR)

- 定义

- 专利公开数量:时间序列变化

- 主要专利权人排名

- 主要知识产权公司:时间表

- 专利的当前法律地位:以主要知识产权公司划分

- 有效专利的地理覆盖范围:以主要知识产权公司划分

- 射频滤波器电路和架构(例如多路復用器)

- 专利公开数量:时间序列变化

- 主要专利权人排名

- 专利的当前法律地位:以主要知识产权公司划分

- 有效专利的地理覆盖范围:以主要知识产权公司划分

- 专利权人的智慧财产权领先地位以及 2019 年后的演变

- 中国的生态系统

- 摘要

- 中国IP企业在SAW滤波器供应链中的地位

- 中国主要专利权人

- 有海外智慧财产权策略的中国企业和有国内智慧财产权战略的中国企业

- 中国最知名的外国IP玩家

最近的重大创新

- SAWRF 滤波器的最新创新

- BAWRF 过滤器的最新创新

- 复合压电基板

- 主要智慧财产权公司:依专利申请国家划分

- 专利中所描述的主要黏合製程(Smart Cut、黏合剂、有机黏合剂等)

- 专利中所描述的主要支撑基材

- 用于 BAW 滤波器的 lScN 压电层

- 有关 Sc 掺杂和 AlScN 生长的主要专利权人

- 知识产权动态和专利的当前法律地位

主要公司的IP概况

- Murata/Resonant、Skyworks、Qualcomm、Taiyo Yuden、Samsung Electro-Mechanics、ROFS Microsystem、Akoustis、Qorvo、Kyocera、Wisol、新中国 IP 公司(MEMSonics、EpicMEMS、StarShine、Sanan IC、Sappland Micro electronics)

结论

KEY FEATURES:

- PDF>110 slides

- Excel file>11,300 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments of the supply chain.

- Key players' IP position and the relative strength of their patent portfolio.

- Focus on the Chinese ecosystem.

- IP analysis of the main technologies:

- SAW filters

- BAW filters

- LBAW filters (incl. XBAR)

- Multiplexers & RF FEM using acoustic filters

- Focus on recent key innovations for SAW, BAW, composite piezoelectric substrates, etc.

- IP profile of key players and Chinese newcomers (patent portfolio overview, technical coverage, geographical coverage, etc.)

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

The need of new solutions for high bands

Since the 1990's, the acoustic filter industry has been divided into two main technologies: surface acoustic wave (SAW) filters for the lower bands and bulk acoustic wave (BAW) filters for the higher bands. This market and the players were well-established, and their products, technologies, and know-how were protected by large and strong intellectual property (IP) portfolios. Murata and Skyworks were leading the SAW patent landscape, while Broadcom was leading the BAW one. The expansion of cell phone services and networks drove the need for progressively wider and higher frequency bands. 5G applications, for instance, require frequencies in the sub-6GHz range (e.g., 3.3-3.8 GHz (B78), 3.3-4.2 GHz (B77), 4.4-5.0 GHz (B79)) as well as mm-wave bands (e.g., 24.25-29.5 GHz (B257, B258, B261), 37-40 GHz (B260)). While reaching higher frequencies is one part of the challenge, the other part is to provide RF filters that not only work at higher frequencies, but also offer wider absolute and relative bandwidths.

Currently, SAW and BAW devices fulfill the requirements for bands below 3GHz. However, when it comes to the 3-5 GHz range, numerous issues arise. SAW devices require increasingly narrower electrodes, which result in higher losses, reduced power handling, and more expensive lithography. BAW devices likewise have relatively small piezoelectric coupling and lack the capacity to support the wider bandwidths required. Therefore, new solutions that address losses, power, thermal issues, and bandwidth needs above 3 GHz will be attractive.

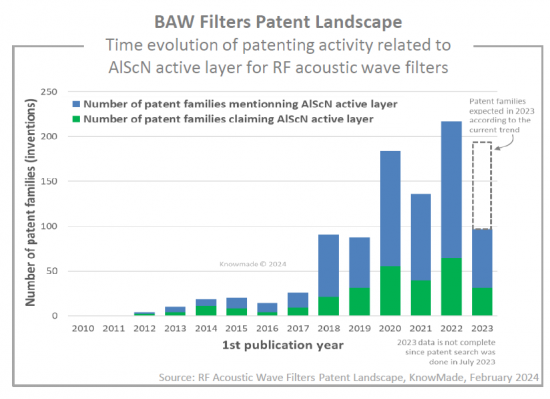

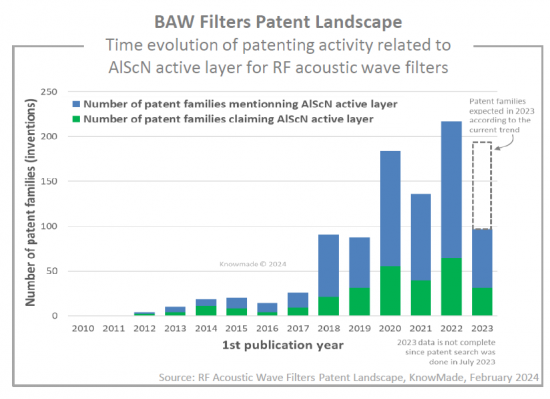

To overcome these limitations, players are looking for new technologies. New solutions include the development of BAW with a ScAlN or Sc-doped AlN piezoelectric film in order to enhance the electroacoustic coupling characteristic. On the other hand, the development of new composite substrates has opened new doors for the SAW segment. Last, laterally excited BAW (LBAW) technology has also entered the race.

Many players have seen this evolution as a good opportunity to enter this lucrative market and explicitly desire to be the upcoming provider of the next generation of RF filters for 5G. Newcomers as well as established players have thus entered a fierce race in which IP can be a major tool to support their strategy. Furthermore, the US vs. China technology battle has led to the development of a national supply chain in China. All these elements are adding up to result in a very dynamic and competitive industry.

In this context, the RF Acoustic Wave Filters Patent Landscape report aims to understand the current IP activities and how they can support the market strategies of players. The analysis of more than 25,000 patents offers a unique view of how players can leverage their IP to secure their position or conquer new market shares.

Understanding the main trends, the key players' IP position and IP strategy

In this report, we have manually selected more than 11,000 patent families (inventions) related to SAW filters, BAW filters, and multiplexers and RF front-end modules using them, and provide a general overview of today's IP landscape global trends and dynamics. Through patent analysis, we describe the position of players along the supply chain, unveil their strategies to strengthen their IP portfolio, highlight their capability to limit other firms' patenting activity and freedom-to-operate, identify promising new players, and forecast what would be the future IP leaders. Furthermore, this report provides an understanding of players' IP position on promising technologies. The main players involved in the development of new technologies are identified, and the main solutions to address these challenges are described.

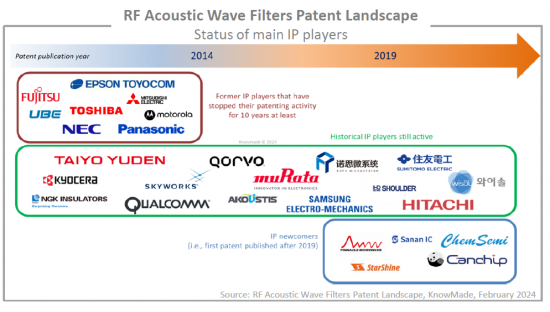

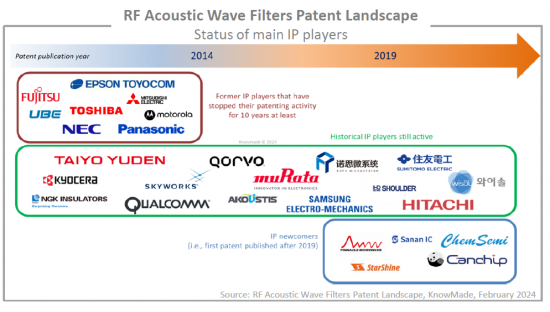

The analysis highlights a significant difference between the SAW and BAW IP landscape. On one hand, the development of SAW filters has reached a high level of maturity, and IP players have started to look at module design and filters architecture. Vertical innovators are controlling the IP landscape and will be difficult to challenge. On the other hand, the BAW IP landscape is characterized by intense competition. The recent decline in patent activity from Broadcom and Taiyo Yuden, paired with the rise of the AlScN piezoelectric layer, has created new opportunities that numerous Chinese players and established SAW players are not going to miss!

What is the position and strategy of Chinese IP players?

The report provides an understanding of the current IP positions of major Chinese players.

We have identified the most noticeable Chinese patent owners and provide a first view of how they are developing their IP in order to establish a national supply chain. Additionally, the IP analysis allows us to pinpoint Chinese players who are implementing a global IP strategy by extending their patents abroad. Lastly, the report offers a comprehensive overview of the patent activity of the most noticeable Chinese players, providing insight into their recent technological advancements.

How can IP support the development of new filter technologies?

The 5G requirements led to the development of several new technologies. The most noticeable being related to the substrate and materials used in the filters. Composite piezoelectric substrates and AlScN have become two of the most promising technologies to fulfill the requirements. Filing patents related to these technologies seems necessary to secure the technology for the next 10 years. KnowMade provides a first status of this specific IP segment to understand which players have the strongest IP portfolio that can be used to hamper the freedom to operate of the competition in the coming years.

IP profile of key players

In a dedicated section, we focus on the IP portfolios held by key players (Murata/Resonant, Skyworks, Qualcomm, Taiyo Yuden, Samsung Electro-Mechanics, ROFS Microsystem, Akoustis, Qorvo, Kyocera, Wisol) and Chinese IP newcomers (MEMSonics, EpicMEMS, StarShine, Sanan IC, Sappland Microelectronics).

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to an updated online database (original documents, legal status, etc.), priority date, title, abstract, patent assignees, and segments (SAW, BAW, LBAW/XBAR, multiplexer & RF FEM using them).

Companies mentioned in the report (non-exhaustive)

Murata, Taiyo Yuden, TDK Epcos, Skyworks, Kyocera, Qualcomm, Broadcom, Hitachi, Toshiba, Toyo Communication Equipment, Samsung Electro Mechanics, Qorvo, Seiko Epson, Oki Electric Industry, LG Innotek, NDK, NEC, Epson Toyocom, Sanyo Electric, Samsung Electronics, NGK Insulators, Philips, Intel, Japan Radio, Nokia, Thales, Advanced Saw Products, Motorola, Wisol, Ube Industries, Mitsubishi Electric, Sumitomo Electric Industries, LG Electronics, China Electronics Technology (CETC), Alps Electric, Tianjin University, Toko, Sappland Microelectronics Technology, Zenith Radio, Texas Instruments, Sony, Intellectual Ventures Holding, Resonant, STMicroelectronics, Institute of Acoustics - Chinese Academy of Sciences, Mitsubishi Materials, CEA, Shoulder Electronics, and more.

TABLE OF CONTENTS

INTRODUCTION

- Definitions

- Context of the report: 2019 IP landscape conclusions

- Scope of the report 2024

- Methodology

EXECUTIVE SUMMARY

- Status of main IP players

- Position of IP players in acoustic wave filter supply chain

- Main IP players evolution from 2019 to today

- IP newcomers

- IP landscape evolution from 2019 to today

PATENT LANDSCAPE OVERVIEW

- SAW filters

- Summary

- Time evolution of patent publications

- Ranking of main patent assignees

- Timeline of main IP players

- Current legal status of patents per main IP players

- Geographical coverage of alive patents per main IP players

- IP leadership of patent assignees and evolution since 2019

- BAW filters (FBAR and SMR)

- Summary

- Time evolution of patent publications

- Ranking of main patent assignees

- Timeline of main IP players

- Current legal status of patents per main IP players

- Geographical coverage of alive patents per main IP players

- IP leadership of patent assignees and evolution since 2019

- Patent litigations

- LBAW filters (including XBAR)

- Definition

- Time evolution of patent publications

- Ranking of main patent assignees

- Timeline of main IP players

- Geographical coverage of alive patents per main IP players

- RF filter circuit and architecture (multiplexers, etc.)

- Time evolution of patent publications

- Ranking of main patent assignees

- Current legal status of patents per main IP players

- Geographical coverage of alive patents per main IP players

- IP leadership of patent assignees and evolution since 2019

- China ecosystem

- Summary

- Position of Chinese IP players in acoustic wave filter supply chain

- Leading patent assignees in China

- Chinese players with global IP strategy and those with domestic IP strategy

- Most established foreign IP players in China

RECENT KEY INNOVATIONS

- Recent innovations for SAWRF filters

- Recent innovations for BAWRF filters

- Composite piezoelectric substrate

- Main IP players per country of origin

- Main bonding processes mentioned in patents (SmartCut, bonding, organic adhesive, etc.)

- Main support substrate mentioned in patents

- AlScN piezoelectric layer for BAW filters

- Main patent assignees for Sc doping and for AlScN growth

- IP dynamics and current legal status of patents

IP PROFILE OF KEY PLAYERS

- Murata/Resonant, Skyworks, Qualcomm, Taiyo Yuden, Samsung Electro-Mechanics, ROFS Microsystem, Akoustis, Qorvo, Kyocera, Wisol, and Chinese IP newcomers: MEMSonics, EpicMEMS, StarShine, Sanan IC, Sappland Microelectronics