|

市场调查报告书

商品编码

1328023

AGV(自动导引车)和 AMR(自主运输机器人)的市场机会(第四版):在物流和製造业的推动下,到 2028 年将达到 200 亿美元和 270 万台安装量AGV (Automated Guided Vehicles) and AMR (Autonomous Mobile Robots) Market Opportunity worth ~$20B by 2028 with an installed base of 2.7 Million Robots - Driven by Logistics & Manufacturing (4th Edition) |

||||||

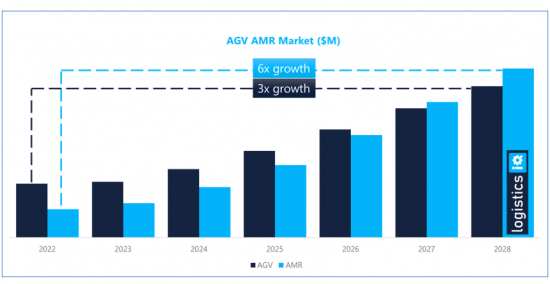

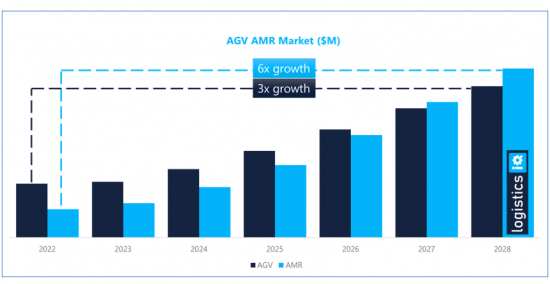

儘管客户资本支出减少、通胀压力、供应链中断和地缘政治不确定性,AGV(自动导引车)和AMR(自动导引车)市场在2022 年仍将表现良好,2022 年销售额将达到约50 亿美元。 预计到 2028 年,该市场规模将增长至约 200 亿美元。 AGV 和 AMR 预计将分别增长约 22% 和 37%。 此外,到2028年,移动机器人(AGV和AMR)的出货量将达到约67万台,安装量将达到270万台。

移动机器人(AGV 和 AMR 市场)可以优化物流和製造领域的仓库设施空间,减少对昂贵的新建履行和配送中心的需求。Masu。 正在建设中的新中心的建设考虑了机器人和其他自动化技术。 这些机器人系统非常灵活,可以根据您的要求添加或删除。 此外,人工智能、机器视觉、自动拾取和放置操作能力以及机器人技术的进步正在为 AMR 和 AGV 在物流和製造之外创造新的应用。

本报告调查了全球AGV(自动导引车)和AMR(自主运输机器人)市场,并提供了AGV 和AMR 的定义和概述、类型和应用、市场规模趋势和预测以及各种分类。□详细编译区域分析、竞争格局、主要企业概况等

目录

第一章简介

第 2 章执行摘要

- 增长驱动因素

- 作业

第三章 AGV(自动导引车)

- AGV类型及特点

- 叉车AGV

- 托盘AGV

- 标籤器/牵引式 AGV

- 单AGV

- 装配线AGV

- 重载AGV

- 迷你AGV

- 户外AGV

第 4 章 AGV 和 AMR 市场规模:按外形尺寸

- 甲板负载

- 标籤拉动

- 自动叉车

第五章 AGV 和 AMR 市场规模:按导航技术划分

- 胶带/电线/磁铁

- 反射器(2D/3D 激光)

- 二维码/二维码

- 骑手

- 相机/视觉传感器

- 传感器融合

第 6 章 AGV 和 AMR 市场规模:按功能划分

- 运输(500公斤以下)

- 运输(500公斤以上)

- 单次运输

- 牵引力

- 调色板运动

第 7 章按最终用户行业划分的 AGV 和 AMR 市场规模

- 製造业

- 物流

- 户外/送货

- 医疗保健

- 独家

- 消毒

- 清洁

- 网真/远程控制

- 安全/检查

- 农业

- 零售/库存管理

- 医院支持

- 室内配送

- 户外送货

- 数据平台/遥感

第 8 章 AGV 和 AMR 市场规模:按地区划分

- 北美

- 欧洲

- 亚太地区

- 其他领域

第9章 AGV/AMR商业模式

- 系统集成业务模式

- 直销/OEM

- RaaS(机器人即服务)

- 仓库机器人

- 送货机器人

- 安全机器人

- 清洁机器人

第 10 章 AGV/AMR 组件和功能

- 导航与安全

- 安全

- 电机控制

- AGV能源供应

- 电池/充电器

- 无线通讯

- 软件/控制

第十一章竞争态势

- 主要公司

- 创新创业公司

- 竞争状况/趋势

- 公司简介

第一章系统集成商

- Daifuku

- Dematic (KION Group)

- SSI-Schaefer

- Vanderlande (Toyota Advanced Logistics)

- Swisslog (KUKA)

- Knapp AG

- Murata Machinery Ltd.

- Elettric 80

- Beumer Group

- Witron Logistik + Informatik

- TGW Logistics

- Grenzebach GmbH

- FIVES Group

- Honeywell Intelligrated

- Bastian Solutions (Toyota Advanced Logistics)

- Wayzim Technology

- Material Handling System - MHS (FORTNA)

- Jungheinrich AG

- LODIGE Industries

- ViaStore Systems (Toyota Advanced Logistics)

- Interlake Macalux

- Kardex

- AutoStore

- DMW&H

- Westfalia

- Dambach AG

- PSB intralogistics GmbH

- SIASUN Robot Automation Co., Ltd.

- KPI Integrated Solutions

- SAVOYE

- OPEX Corporation

- System Logistics (Krones Group)

- Addverb Technologies

- Lodamaster Group

- G?DEL

第 2 章 AGV 和 AMR:主要公司

- Geek+

- Quicktron (Flashhold)

- ForwardX Robotics

- Huaxiao Precision (Suzhou) Co., Ltd. - (CSG Huaxiao)

- GreyOrange

- HIKROBOT (HIKVISION)

- Mobile Industrial Robots - MiR (Teradyne)

- inVia Robotics

- 6 River Systems (Ocado Group)

- Fetch Robotics (Zebra Technologies)

- John Bean Technologies (JBT Corporation)

- JATEN

- IAM Robotics

- Locus Robotics

- Vecna Robotics

- BALYO

- SEEGRID

- Waypoint Robotics (Locus Robotics)

- Tompkins Robotics

- Scallog

- OTTO Motors (Clearpath Robotics)

- GIDEON Brothers

- Magazino GmbH

- NextShift Robotics (JASCI Robotics)

- AutoGuide Mobile Robots (MiR, Teradyne)

- EiraTech Robotics

- Aethon (ST Engineering)

- Prime Robotics (BLEUM)

- HAI Robotics

- Bionic HIVE

- Oppent

- PAL Robotics

- Matthews Automation Solutions (Matthews International)

- GUOZI Robotics

- CAJA Robotics

- Omron (Adept Technology)

- Guidance Automation (Matthews International)

- Syrius Robotics

- MALU Innovation

- Eurotec (Lowpad)

- DS Automotion GmbH (SSI Schaefer)

- Rocla (Mitsubishi Logisnext Europe Oy)

- Neobotix

- Transbotics (SCOTT Group)

- ek-robotics (EK Automation)

- OCEANEERING MOBILE ROBOTICS

- Wellwit Robotics

- Logistic-Jet

- Mushiny

- T?NKERS Maschinenbau GmbH

- CPM - D?rr Group

- Shanghai Seer Intelligent Technology Corporation (SEER)

- FlexQube

- Continental Mobile Robots

- IDEALworks GmbH

第 3 章自主服务提供商 (ASP)

- Brain Corporation

- Bluebotics (Zapi Group)

- Kollmorgen (Altra Industrial Motion Corp)

- Autonomous Solutions, Inc. (ASI)

- MOVEL AI

- MOV AI

- FREEDOM ROBOTICS

- ROBOMINDS

- PERCEPTIN

- Hangzhou Coevolution Technology Co., Ltd.

- FORT Robotics

- Romb Technologies

第 4 章机器视觉成像

- Basler AG

- Keyence

- Omron Microscan Systems

- Cognex

第五章擦除毒机器人

- UVD Robotics (Blue Ocean Robotics)

- Sarcos Robotics

- Techmetics Robotics

- Wellwit Disinfection Robotics

第六章零售机器人

- Bossa Nova Robotics

- Simbe Robotics

- Badger Technologies

- Lowe's - LoweBot (Powered by Fellow AI)

第七章室内送货机器人

- Bear Robotics

- Keenon Robotics

- Relay Robotics (Savioke Inc.)

- Rice Robotics

第八章安检机器人

- Cobalt Robotics

- Knightscope Robotics

- OTSAW Digital

- SMP Robotics

第九章远程控制/智真机器人

- Diligent Robotics

- Ohmni Labs

- AVA Robotics

- GoBe Robotics (Blue Ocean Robotics)

第10章清洁机器人

- Softbank Robotics

- Avidbots

- Gaussian Robotics

- LionsBot

第十一章医院支持机器人

- Revotonix L.L.C

- Jetbrain

第十二章农业机器人

- Bogaerts

- Harvest Automation

第 13 章电池和充电器

- LG Chem (LG Energy Solutions)

- Crown Equipment Corporation

- East Penn Manufacturing

- EnerSys

- Conductix-Wampfler

第14章主要组成部分

- Advance Motion Control

- Kollmorgen

- Energid (Teradyne)

- Harmonic Drive System

- Murrelektronik

第十五章 拣货机器人

- Berkshire Grey

- Righthand Robotics

- KINDRED (Ocado Group)

- OSARO

- Plus One Robotics

第十六章仓库管理系统提供商

- Blue Yonder (JDA)

- Infor (Koch Industries)

- Oracle

- SAP

- Manhattan Associates

- HighJump (K?rber AG)

第 17 章自动识别和数据捕获 (AIDC)

- Zebra Technologies

- Honeywell AIDC

- Data Logic

- SATO

- SICK AG

第十八章仓库无人机

- Eyesee (HARDIS Group)

- UVL ROBOTICS

- AirMap (DroneUp)

第十九章送货机器人

- Starship Technologies

- NURO AI

- Tele Retail

- Kiwibot

- Robby Technologies

AGV and AMR Market worth ~$20 Billion by 2028 - First and Exclusive Market Research Study Covering All Traditional and New Applications like Logistics, Manufacturing, Healthcare, Shipping, Disinfection, Retail and Inventory Management, Security and Inspection, Agriculture, Hospital Assistance, Indoor and Outdoor Delivery, Cleaning, Tele-presence and Tele-operation, and Data Platforms & Remote Sensing.

Introduction

Mobile Robots (AGV and AMR Market) are enabling the optimization of space in warehouse facilities in logistics and manufacturing and can reduce the need for new and costly green field fulfillment and distribution centers. While new centers are still being built, they are being built with robots and other automation in mind. Even these robotic systems are flexible and can be added or removed as per the requirement. But we are witnessing new applications of Autonomous Mobile Robots (AMR) and Automated Guided Vehicles (AGV) apart from logistics and manufacturing due to advancement in Artificial Intelligence (AI), Machine Vision, manipulation capabilities for automatic picking and placing, and robotic mechanics.

SAMPLE VIEW

As per LogisticsIQ™ latest market research study (4th Edition), AGV and AMR Market is expected to reach ~$20B Billion by 2028 with a growth rate of around 22% and 37% for AGV and AMR respectively. Both AGVs and AMRs collectively are going to cross the installed base of 2.7 million in 2028 to make the mobile robots a new normal in our day-to-day operational activities.

The 4th edition of this post-pandemic AGV and AMR business research is first and exclusive market study covering new emerging applications like Healthcare, Disinfection, Retail and Inventory Management, Security and Inspection, Agriculture, Hospital Assistance, Indoor and Outdoor Delivery, Cleaning, Tele-presence and Tele-operation, and Data Platforms & Remote Sensing apart from old revenue sources like Logistics and Manufacturing. AGV and AMR market study is having a market analysis of more than 650 players (part of our exclusive AGV/AMR Market Map), Key Navigation Technologies, Major Form factors & Functions, Targeted Industry Verticals & Applications, and 20+ geographical regions. Analysis is validated through 100+ in-depth interviews across the value chain with components and technology providers, system integrators, robot manufacturers (OEM/ODM), robotic software & service providers, and end-user industry verticals. Apart this, study also focuses on different components and integral parts of AGV/AMR like Motion Control, Batteries & Chargers, Cameras / Vision Sensor, LiDAR, Sensor Fusion, QR Code and Wireless Communication. Market size and forecast database is also available in excel format to analyse and strategize further along with 156 market tables. It is a best reference to analyse the market attractiveness, to identify the partner, customer or supplier, to check the competitive landscape, to benchmark the new technologies and to select the right geography & industry vertical for your products and services. Voice and opinion of end-users have been taken as the key parameter for this market forecast.

AGV and AMR Market - Highlights:

- Industry witnessed a good growth in 2022 despite of customers' capex cut, inflationary pressure, supply chain disruption & geopolitical uncertainties and registered approximate USD 5 Billion sales in 2022. Around 670,000 mobile robots (AGVs & AMRs) are expected to be shipped in 2028 only with an installed base of 2.7 million

- AMRs are supposed to grow with a CAGR of ~37% between 2023 and 2028 and are going to be more attractive market as compared to AGVs by 2028 with relatively more shipment and TAM share.

- United States, Germany, U.K., and China are going to lead the market with an annual demand of more than 350,000 mobile robots (AGV & AMR) by 2028.

- Goods to Person (G2P) and Person to Goods (P2G), both type of AMRs are having their own market with some advantages and disadvantage. It depends on what exactly can be more efficient and cost-effective solution for your existing or new warehouse.

- Picking Robots, Manipulator Robots, Case Handling Robots, and Sortation Robots are going to emerge as a new important category by 2028, specially in micro-fulfillment space.

- China is supposed to be hub for Autonomous Mobile Robots, both in terms of demand and supply as it is expected that Made in China AMRs will be 30%-40% more economical due to labour cost advantages and huge volume consumption in China itself.

- After QR code, LiDAR, Vision Cameras and Sensor Fusions are the key navigation technologies to be commercialized in this space due to flexibility, safety concerns and higher accuracy. Even Sensor Fusion AMRs are expected to grow with ~70% growth rate. There are dedicated companies (Autonomy Service Providers) for navigation technology and software who are supporting mobile robot manufacturers to build such capabilities with the help of AI and Machine Vision.

- Delivery, Security, and Cleaning are the emerging applications to target with an attractive growth of ~30% apart from logistics and manufacturing although absolute market size is relatively low.

Key Players Analyzed:

- AGV & AMR: Geek+, Quicktron (Flashhold), ForwardX Robotics, GreyOrange, HikRobot (HikVision), Mobile Industrial Robots - MiR (Teradyne), inVia Robotics, 6 River Systems - 6RS (Ocado Group), Fetch Robotics (Zebra), JATEN, IAM Robotics, Locus Robotics, Vecna Robotics, Waypoint Robotics (Locus Robotics), Tompkins Robotics, Scallog, OTTO Motors (Clearpath Robotics), GIDEON Brothers, Magazino GmbH, NextShift Robotics (JASCI), AutoGuide Mobile Robots (MiR, Teradyne), EiraTech Robotics, Aethon (ST Engineering), Prime Robotics (BLEUM), HAI Robotics, Bionic HIVE, Oppent, PAL Robotics, Matthews Automation Solutions (Matthews International), GUOZI Robotics, CAJA Robotics, Omron (Adept Technology), Guidance Automation (Matthews International), Syrius Robotics, MALU Innovation (JD), Eurotec (Lowpad), Mitsubishi Logisnext Europe Oy (Rocla), NeoBotix, John Bean Technologies (JBT Corporation), Transbotics (Scott Group), CSG Huaxiao, EK-Robotics (EK Automation), OCEANEERING, Wellwit Robotics, Logistic-Jet, SEEGRID, BALYO, Mushiny, TÜNKERS Maschinenbau GmbH, CPM - Dürr Group, SEER, FlexQube, IDEALworks GmbH, Continental Mobile Robots, SEER, DS Automotion (SS Schaefer)

- System Integrators (SI): Daifuku, Dematic (KION Group), SSI-Schaefer, Vanderlande (Toyota Advanced Logistics), Swisslog (KUKA), Knapp, Murata Machinery Ltd., Elettric 80, Beumer Group, Witron Logistik + Informatik, TGW Logistics, Grenzebach GmbH, FIVES Group, Honeywell Intelligrated, Bastian Solutions (Toyota Advanced Logistics), Material Handling System (MHS), Jungheinrich AG, LODIGE Industries, ViaStore Systems, Interlake Macalux, Kardex, AutoStore, DMW&H, Westfalia, Dambach AG, PSB intralogistics GmbH, SIASUN Robot Automation Co., Ltd., SAVOYE, OPEX Corporation, System Logistics (Krones Group), GÜDEL, Addverb Technologies, Lodamaster Group, KPI Integrated Solutions, Wayzim Technology

- Autonomy Service Providers (ASP): Brain Corporation, Bluebotics, KOLLMORGEN, Autonomous Solutions, Inc. (ASI), MOVEL AI, MOV AI, FREEDOM ROBOTICS, ROBOMINDS, PERCEPTIN, ROMB Technologies, Balyo, Seegrid, Vecna Robotics

- Machine Vision & Imaging: Basler AG, Keyence, Omron Microscan, Cognex

- Disinfection Robots: UVD Robotics, Sarcos Robotics, Techmetics Robotics, Wellwit, Geek+, Fybots, Sherpa, Akara, MiR, Sesto, LionsBot, SmartGuardUV, Milvus, Revotonix, YouiBot

- Retail & Inventory Management Robots: Bossa Nova Robotics, Simbe Robotics, Badger Technologies, Lowe's - LoweBot (Powered by Fellow AI), Fetch Robotics, Brain Corporation

- Indoor Delivery Robots: Bear Robotics, Keenon Robotics, Savioke Inc., Rice Robotics, Pudu, PAL Robotics, Keenon, Savioke, Segway Robotics, Anscer, Aethon

- Security and Inspection Robots: Cobalt Robotics, Knightscope Robotics, OTSAW Digital, SMP Robotics, Enova, Secom, AgileX

- Tele-operated / Telepresence Robots: Diligent Robotics, Ohmni Labs, AVA Robotics, GoBe Robotics, Double Robotics, Temi Robotics

- Cleaning Robots: Softbank Robotics, Avidbots, Gaussian Robotics, LionsBot

- Hospital Support Robots: Revotonix L.L.C, Jetbrain, Aethon, MiR, MeanWhile, Keenon, Savioke, ABB, Diligent

- Agriculture Robots: Bogaerts, Harvest Automation, AIS, Katif, Naio Technologies, Robotnik

- Delivery Robots (Last Mile Delivery Robots): STARSHIP, NURO AI, Tele Retail, Kiwibot, Robby Technologies, Postmates, Eliport, Hello World Robotics, OTSAW, JD.com, Scout

- Battery & Chargers: LG Chem (LG Energy Solutions), Crown Equipment Corporation, East Penn Manufacturing, EnerSys, SBS, iN2Power, Wiferion, Inventus Power, Toshiba SCiB, Conductix-Wampfler

- Motion Control: Advance Motion Control, Kollmorgen, Energid (Teradyne), Harmonic Drive System, Parker, Elmo Motion, CGI, Brother, Nidec, Allied Motion, SEW Eurodrive, Pilz, Nord

What will you get in this report?

- 500 Pages and 160+ Exhibits Market Report for 18+ Industry Verticals or Applications

- A bottom-up analysis of AGV AMR market for 20+ countries and regions

- In-depth analysis of 650 companies in the ecosystem with more than 165 company profiles

- Focus Group Discussion with 100+ key industry stakeholders across the value chain to collect the first-hand information to validate our analysis

- Excel file with a proper modelling and 150+ market tables including forecast till 2028

- 2 Analyst Sessions to brainstorm further

- Investment details excel file with 150+ M&A and 750+ funding deals

- LogisticsIQ™ Exclusive Market Map (650+ Players across more than 15 categories)

Table of Contents

1. Introduction

- 1.1. A brief history of AGVs and AMRs

- 1.1.1. Applications for AGVs

- 1.1.2. Types of AGVs

- 1.1.2.1. Automated Guided Carts

- 1.1.2.2. Forklift AGVs

- 1.1.2.3. Towing/Tugger AGVs

- 1.1.2.4. Unit Load Handlers/Single-Piece conveying

- 1.1.2.5. Heavy Burden Carriers

- 1.1.2.6. Autonomous Mobile Robots

- 1.1.3. Working Principles of AGVs and AMRs

- 1.1.3.1. Navigation

- 1.1.3.2. Steering

- 1.1.3.3. Traffic control

- 1.2. Current state of the industry

- 1.3. AMR Definition

2. Executive Summary

- 2.1. Drivers & Challenges

- 2.1.1. Drivers

- 2.1.1.1. Increase efficiency and productivity

- 2.1.1.2. RaaS and leasing options reducing upfront investment

- 2.1.1.3. Flexibility

- 2.1.1.4. Less space required

- 2.1.1.5. Improved safety

- 2.1.1.6. E-commerce order fulfilment

- 2.1.1.7. Robotics & Automation: Key success factors for order fulfilment

- 2.1.1.8. Ultrafast Delivery Services are demanding more automation

- 2.1.1.9. Online grocery is set to be the next disruption and may be the prime candidate for warehouse automation

- 2.1.1.10. Labour Cost and Safety Concerns

- 2.1.1.11. Technology improvements

- 2.1.1.12. Increasing supply and lowering of costs

- 2.1.1.13. Emerging use cases, pave way for more adoption and less dependence on industrial business cycle

- 2.1.1. Drivers

- 2.2. Challenges

- 2.2.1. Order Picking Remains a Robotic Challenge

- 2.2.2. Technology Challenges related to Safety

- 2.2.3. Slowdown and recessionary fears delaying expansion plans and limiting investment

3. Automated Guided Vehicle Technology

- 3.1. AGV Types and Features

- 3.1.1. Forklift AGV

- 3.1.2. Pallet AGV

- 3.1.3. Tugger/Towing AGV

- 3.1.4. Single piece AGV

- 3.1.5. Assembly Line AGV

- 3.1.6. Heavy Load AGV

- 3.1.7. Mini-AGV

- 3.1.8. Outdoor AGV

4. Market Size of AGV/AMR by Form Factor (Units and USD Million) - Forecast to 2028

- 4.1. Deck-load

- 4.2. Tugger-Pull

- 4.3. Automated Forklift

5. Market Size of AGV/AMR by Navigation Technology (Units and USD Million) - Forecast to 2028

- 5.1. Tape/Wire/Magnet

- 5.2. Reflector (2D/3D Laser)

- 5.3. QR/2D Codes

- 5.4. LIDAR

- 5.5. Camera/Vision Sensor

- 5.6. Sensor Fusion

6. Market Size of AGV/AMR by Function (Units and USD Million) - Forecast to 2028

- 6.1. Conveying (<500kg)

- 6.2. Conveying (>=500kg)

- 6.3. Single Piece Conveying

- 6.4. Towing

- 6.5. Pallet Moving

7. Market Size of AGV /AMR by End-use Industry (Units and USD Million) - Forecast to 2028

- 7.1. Manufacturing

- 7.1.1. AGVs as a Means of Organization

- 7.1.2. Taxi Operations

- 7.1.3. Flow Line Organisation and the Focus on Series Production

- 7.1.4. Automotive and Auto Components Industry

- 7.1.4.1. AGVs in Transparent Manufacturing in Dresden (Volkswagen)

- 7.1.4.2. Production of the BMW 300 Series in the New Leipzig Plant

- 7.1.4.3. Logistics Tasks at Deutz AG in Cologne-Porz

- 7.1.4.4. Assembly Line for Cockpits at VW in Wolfsburg

- 7.1.4.5. Use of AGVs in Automotive Seat Manufacturing

- 7.1.4.6. Use of AGVs as a Mobile Final Assembly Platform

- 7.1.4.7. Improving Production Efficiency at Denso in the Czech Republic

- 7.1.5. Paper Manufacturing and Processing

- 7.1.5.1. Transport and Handling of Paper Rolls at Einsa Print International

- 7.1.5.2. Newspaper Printing in the Druckzentrum in Braunschweig

- 7.1.6. Electronics Industry

- 7.1.6.1. Just-in-Time Container Transport at Wöhner

- 7.1.7. Food and Beverage Industry

- 7.1.7.1. Intralogistics Initiatives in the Beverage Industry

- 7.1.7.2. Innovative Commissioning at Marktkauf Logistik GmbH

- 7.1.7.3. AGVs Monitors Cheese Aging Process at Campina

- 7.1.8. Steel-Making Industry

- 7.2. Logistics

- 7.2.1. Floor-Level Block Storage Warehouses

- 7.2.2. Multi-story Block Storage

- 7.2.3. Automated Case Handling Robot Shuttles

- 7.2.4. New Emerging AMR Offerings

- 7.3. Outdoor and Shipping

- 7.4. Healthcare

- 7.4.1. Clinic Logistics

- 7.4.1.1. AGVs in the State Hospital in Klagenfurt, Austria

- 7.4.1.2. Advanced Clinic Logistics with AGVs in Vorarlberg

- 7.4.1.3. AGVs in the University of Oslo, Norway

- 7.4.2. Pharmaceutical Industry

- 7.4.1. Clinic Logistics

- 7.5. Specialty

- 7.5.1. Disinfection

- 7.5.2. Cleaning

- 7.5.3. Tele-presence and Tele-operation

- 7.5.4. Security & Inspection

- 7.5.5. Agriculture

- 7.5.6. Retail & Inventory Management

- 7.5.7. Hospital Support

- 7.5.8. Indoor Delivery

- 7.5.9. Outdoor Delivery

- 7.5.10. Data Platforms and Remote Sensing

8. Market Size of AGV/AMR by Geography - Forecast to 2028 (Units and USD Million)

- 8.1. North America

- 8.1.1. U.S.

- 8.1.2. Canada

- 8.2. Europe

- 8.2.1. U.K.

- 8.2.2. Germany

- 8.2.3. France

- 8.2.4. Italy

- 8.2.5. Spain

- 8.2.6. Nordic Region

- 8.2.6.1. Key Developments

- 8.2.6.2. Past Developments

- 8.2.6.3. eGrocery Development

- 8.2.7. Rest of Europe

- 8.2.7.1. Poland is emerging as a distribution hub for Europe

- 8.2.7.2. Czech Republic - A new hub for warehouse automation

- 8.2.7.3. Romania has started adopting the mobile robotics in multiple applications

- 8.3. APAC

- 8.3.1. China

- 8.3.1.1. Automotive is a strong demand center in China

- 8.3.1.2. New Energy production also looks promising

- 8.3.1.3. Competition remains strong, Geek+ and HIK lead the market

- 8.3.1.4. Logistics and warehousing still has a lot of room to grow in China

- 8.3.1.5. Leading AGV-AMR players in China

- 8.3.2. Japan

- 8.3.3. South Korea

- 8.3.4. India

- 8.3.5. Australia

- 8.3.6. Taiwan

- 8.3.7. South-East Asia (ASEAN)

- 8.3.7.1. Indonesia

- 8.3.7.2. Thailand

- 8.3.7.3. Philippines

- 8.3.7.4. Vietnam

- 8.3.7.5. Malaysia

- 8.3.7.6. Singapore

- 8.3.1. China

- 8.4. Rest of World

- 8.4.1. Middle East & Africa

- 8.4.1.1. The Middle-East e-commerce market

- 8.4.1.2. Middle East: Key players and Developments

- 8.4.2. Latin America

- 8.4.2.1. Logistics Is Still the Main Bottleneck in Brazil

- 8.4.2.2. Omni-Channel rather than Pure-play online strategy is more common amongst eCommerce players

- 8.4.1. Middle East & Africa

9. AGV/AMR Business Model

- 9.1. System Integration Business Model

- 9.1.1. MRO services

- 9.1.1.1. Specialization

- 9.1.1.2. Return on Investment considerations (ROI)

- 9.1.1.3. Total Cost of Ownership (TCO)

- 9.1.1.4. Analysis of the Supplier Market

- 9.1.1.5. Invitation to Bid

- 9.1.1.6. Bid Assessment and Awarding Contract

- 9.1.1.7. Maintenance and Repair Services

- 9.1.1.8. Direct and Indirect cost for AGV deployment

- 9.1.1. MRO services

- 9.2. Direct sales / OEM

- 9.3. Robots as a Service (RaaS)

- 9.3.1. Warehouse Robots

- 9.3.2. Delivery Robots

- 9.3.3. Security Robots

- 9.3.4. Cleaning Robots

10. AGV/AMR Components & Functions

- 10.1. Navigation and Safety

- 10.1.1. Tape and Magnetic Sensors

- 10.1.2. 2D/3D Laser based

- 10.1.3. Vision sensors

- 10.1.4. LiDAR

- 10.1.4.1. Improvements in AGVs

- 10.1.4.2. Simultaneous localization and mapping

- 10.1.5. Sensor Fusion

- 10.2. Safety

- 10.2.1. Laws, Policies and Regulations

- 10.2.2. Need for new Safety Standards

- 10.2.2.1. E-stop Handling

- 10.2.2.2. Mobile Manipulation

- 10.2.2.3. Primary Controls

- 10.2.3. Upcoming standards

- 10.2.4. Responsibility for ensuring Workplace Safety

- 10.3. Motion Control

- 10.3.1.1. Wheels

- 10.3.1.2. Steering

- 10.3.1.3. Drives

- 10.4. AGV Energy Supply

- 10.4.1. Traction Batteries (EVBs - Electric Vehicle Batteries)

- 10.4.2. Non-contacting Energy Transfer

- 10.4.3. Hybrid System

- 10.5. Batteries and Chargers

- 10.5.1. Lithium-Ion Batteries

- 10.5.2. Capacitors

- 10.5.3. Fuel Cells

- 10.5.4. Charging Stations

- 10.5.4.1. Manual battery exchange station

- 10.5.4.2. Automatic battery exchange machine for AGVs

- 10.6. Wireless Communication

- 10.6.1. Limitations of existing 802.11 technologies

- 10.6.2. Addressing Challenges with 5G Cellular

- 10.7. Software and Control

- 10.7.1. Vehicle Guidance Control

- 10.7.1.1. Vehicle Guidance Control Interfaces

- 10.7.2. Function Blocks

- 10.7.3. AGV Working Environment

- 10.7.4. System-Specific Interfaces

- 10.7.1. Vehicle Guidance Control

11. Competitive landscape

- 11.1. Key Players

- 11.2. Innovative Start-Ups

- 11.3. Competitive Situation & Trends

- 11.3.1. Mergers & Acquisitions

- 11.3.2. New Product Developments

- 11.3.3. Partnerships, Collaborations, and Agreements

- 11.3.4. Major Players by HQ location

- AGV AMR MARKET - COMPANY PROFILES

1. System Integrators

- 1.1. Daifuku

- 1.1.1. Introduction

- 1.1.2. General Information

- 1.1.3. Financial Results by reportable segments for FY2022 (In Billion Yen)

- 1.1.4. Daifuku Sales by Industry (In Billion Yen)

- 1.1.5. Business Plan - Value Transformation 2023

- 1.1.6. The Innovation Center

- 1.1.7. Geographical Presence

- 1.1.8. Major Development & News

- 1.1.9. Product Portfolio By Industry

- 1.1.10. Product Portfolio By Function

- 1.1.11. Industries & Solutions Offered

- 1.1.12. Successful Case Studies (Customer List)

- 1.2. Dematic (KION Group)

- 1.2.1. Introduction

- 1.2.2. General Information

- 1.2.3. Major Developments & News

- 1.2.4. Micro-Fulfillment Center (MFC)

- 1.2.5. Latest Developments

- 1.2.6. Recent Win & Projects

- 1.2.7. Timeline for revenue recognition

- 1.2.8. Product Portfolio

- 1.2.9. Successful Case Studies (Customer List)

- 1.2.10. Industries & Solutions Offered

- 1.3. SSI-Schaefer

- 1.3.1. Introduction

- 1.3.2. General Information

- 1.3.3. System & Solutions

- 1.3.4. Major Development & News

- 1.3.5. Solutions By Industry

- 1.3.6. Product & Software Solutions

- 1.3.7. Successful Case Studies (Customer List)

- 1.4. Vanderlande (Toyota Advanced Logistics)

- 1.4.1. Introduction

- 1.4.2. General Information

- 1.4.3. History

- 1.4.4. Major Acquisitions by Vanderlande in the past

- 1.4.5. Key Investment - Smart Robotics

- 1.4.6. Major Development & News

- 1.4.7. Products & Segments

- 1.4.7.1. Airport

- 1.4.7.2. Warehousing

- 1.4.7.3. Parcel

- 1.4.7.4. Life Cycle Services

- 1.4.8. Successful Case Studies (Customer List)

- 1.5. Swisslog (KUKA)

- 1.5.1. Introduction

- 1.5.2. General Information

- 1.5.3. History

- 1.5.4. Major Development & News

- 1.5.5. Logistics Automation - Offering by Industries

- 1.5.6. Logistics Automation - Offering by Products & Systems

- 1.5.7. Successful Case Studies (Customer List)

- 1.6. Knapp AG

- 1.6.1. Introduction

- 1.6.2. General Information

- 1.6.3. Major Development & News

- 1.6.4. Technologies by Products

- 1.6.5. Successful Case Studies (Customer List)

- 1.6.6. History

- 1.7. Murata Machinery Ltd.

- 1.7.1. Introduction

- 1.7.2. General Information

- 1.7.3. Major Development & News

- 1.7.4. Logistics & Automation - Solutions by Technology

- 1.7.5. Markets & Industries Served

- 1.7.6. Successful Case Studies (Customer List)

- 1.7.7. History and Developments

- 1.8. Elettric 80

- 1.8.1. Introduction

- 1.8.2. General Information

- 1.8.3. Industries, Products & Successful Client Base

- 1.8.4. Major Development & News

- 1.9. Beumer Group

- 1.9.1. Introduction

- 1.9.2. General Information

- 1.9.3. Major Development & News

- 1.9.4. Focused Solutions

- 1.9.5. Products by Technology

- 1.9.6. Successful Case Studies (Customer List)

- 1.9.7. Solutions by Industry

- 1.10. Witron Logistik + Informatik

- 1.10.1. Introduction

- 1.10.2. General Information

- 1.10.3. Major Development & News

- 1.10.4. Storage System, Warehouse Technology & System Type

- 1.10.5. Solutions by Industry

- 1.10.6. Industries and Case studies (Successful Clients)

- 1.11. TGW Logistics

- 1.11.1. Introduction

- 1.11.2. General Information

- 1.11.3. Products Offering

- 1.11.4. Solutions & Services

- 1.11.5. Major Development & News

- 1.11.6. Successful Case Studies (Customer List)

- 1.11.7. History & Developments

- 1.12. Grenzebach GmbH

- 1.12.1. Introduction

- 1.12.2. General Information

- 1.12.3. History

- 1.12.4. Major Development & News

- 1.12.5. Products & Markets

- 1.12.6. Transport and Handling Solutions

- 1.13. FIVES Group

- 1.13.1. Introduction

- 1.13.2. History

- 1.13.3. General Information

- 1.13.4. Major Development & News

- 1.13.5. Solutions By Industry

- 1.14. Honeywell Intelligrated

- 1.14.1. Introduction

- 1.14.2. General Information

- 1.14.3. History

- 1.14.4. Major Development & News

- 1.14.5. Solutions by Technology/Product

- 1.14.6. Industries & Solutions Offered

- 1.14.7. Successful Case Studies (Customer List)

- 1.15. Bastian Solutions (Toyota Advanced Logistics)

- 1.15.1. Introduction

- 1.15.2. General Information

- 1.15.3. Major Development & News

- 1.15.4. Solutions by Function

- 1.15.5. Solutions by Technology

- 1.15.6. Industries and Case studies (Successful Clients)

- 1.15.7. History

- 1.16. Wayzim Technology

- 1.16.1. Wayzim - Industrial Deployment

- 1.16.2. Innovative Technologies

- 1.16.3. Major Milestones & News

- 1.16.4. Product Portfolio By Industry

- 1.16.5. Product Portfolio by Function

- 1.16.6. Case Studies and Successful Clients

- 1.17. Material Handling System - MHS (FORTNA)

- 1.18. Jungheinrich AG

- 1.19. LODIGE Industries

- 1.20. ViaStore Systems (Toyota Advanced Logistics)

- 1.21. Interlake Macalux

- 1.22. Kardex

- 1.23. AutoStore

- 1.24. DMW&H

- 1.25. Westfalia

- 1.26. Dambach AG

- 1.27. PSB intralogistics GmbH

- 1.28. SIASUN Robot Automation Co., Ltd.

- 1.29. KPI Integrated Solutions

- 1.30. SAVOYE

- 1.31. OPEX Corporation

- 1.32. System Logistics (Krones Group)

- 1.33. Addverb Technologies

- 1.34. Lodamaster Group

- 1.35. GÜDEL

2. AGV & AMR - Key Players

- 2.1. Geek+

- 2.2. Quicktron (Flashhold)

- 2.3. ForwardX Robotics

- 2.4. Huaxiao Precision (Suzhou) Co., Ltd. - (CSG Huaxiao)

- 2.5. GreyOrange

- 2.6. HIKROBOT (HIKVISION)

- 2.7. Mobile Industrial Robots - MiR (Teradyne)

- 2.8. inVia Robotics

- 2.9. 6 River Systems (Ocado Group)

- 2.10. Fetch Robotics (Zebra Technologies)

- 2.11. John Bean Technologies (JBT Corporation)

- 2.12. JATEN

- 2.13. IAM Robotics

- 2.14. Locus Robotics

- 2.15. Vecna Robotics

- 2.16. BALYO

- 2.17. SEEGRID

- 2.18. Waypoint Robotics (Locus Robotics)

- 2.19. Tompkins Robotics

- 2.20. Scallog

- 2.21. OTTO Motors (Clearpath Robotics)

- 2.22. GIDEON Brothers

- 2.23. Magazino GmbH

- 2.24. NextShift Robotics (JASCI Robotics)

- 2.25. AutoGuide Mobile Robots (MiR, Teradyne)

- 2.26. EiraTech Robotics

- 2.27. Aethon (ST Engineering)

- 2.28. Prime Robotics (BLEUM)

- 2.29. HAI Robotics

- 2.30. Bionic HIVE

- 2.31. Oppent

- 2.32. PAL Robotics

- 2.33. Matthews Automation Solutions (Matthews International)

- 2.34. GUOZI Robotics

- 2.35. CAJA Robotics

- 2.36. Omron (Adept Technology)

- 2.37. Guidance Automation (Matthews International)

- 2.38. Syrius Robotics

- 2.39. MALU Innovation

- 2.40. Eurotec (Lowpad)

- 2.41. DS Automotion GmbH (SSI Schaefer)

- 2.42. Rocla (Mitsubishi Logisnext Europe Oy)

- 2.43. Neobotix

- 2.44. Transbotics (SCOTT Group)

- 2.45. ek-robotics (EK Automation)

- 2.46. OCEANEERING MOBILE ROBOTICS

- 2.47. Wellwit Robotics

- 2.48. Logistic-Jet

- 2.49. Mushiny

- 2.50. TÜNKERS Maschinenbau GmbH

- 2.51. CPM - Dürr Group

- 2.52. Shanghai Seer Intelligent Technology Corporation (SEER)

- 2.53. FlexQube

- 2.54. Continental Mobile Robots

- 2.55. IDEALworks GmbH

3. Autonomy Service Providers (ASP)

- 3.1. Brain Corporation

- 3.2. Bluebotics (Zapi Group)

- 3.3. Kollmorgen (Altra Industrial Motion Corp)

- 3.4. Autonomous Solutions, Inc. (ASI)

- 3.5. MOVEL AI

- 3.6. MOV AI

- 3.7. FREEDOM ROBOTICS

- 3.8. ROBOMINDS

- 3.9. PERCEPTIN

- 3.10. Hangzhou Coevolution Technology Co., Ltd.

- 3.11. FORT Robotics

- 3.12. Romb Technologies

4. Machine Vision & Imaging

- 4.1. Basler AG

- 4.2. Keyence

- 4.3. Omron Microscan Systems

- 4.4. Cognex

5. Disinfection Robots

- 5.1. UVD Robotics (Blue Ocean Robotics)

- 5.2. Sarcos Robotics

- 5.3. Techmetics Robotics

- 5.4. Wellwit Disinfection Robotics

6. Retail Robots

- 6.1. Bossa Nova Robotics

- 6.2. Simbe Robotics

- 6.3. Badger Technologies

- 6.4. Lowe's - LoweBot (Powered by Fellow AI)

7. Indoor Delivery Robots

- 7.1. Bear Robotics

- 7.2. Keenon Robotics

- 7.3. Relay Robotics (Savioke Inc.)

- 7.4. Rice Robotics

8. Security and Inspection Robots

- 8.1. Cobalt Robotics

- 8.2. Knightscope Robotics

- 8.3. OTSAW Digital

- 8.4. SMP Robotics

9. Tele-operated / Telepresence Robots

- 9.1. Diligent Robotics

- 9.2. Ohmni Labs

- 9.3. AVA Robotics

- 9.4. GoBe Robotics (Blue Ocean Robotics)

10. Cleaning Robots

- 10.1. Softbank Robotics

- 10.2. Avidbots

- 10.3. Gaussian Robotics

- 10.4. LionsBot

11. Hospital Support Robots

- 11.1. Revotonix L.L.C

- 11.2. Jetbrain

12. Agriculture Robots

- 12.1. Bogaerts

- 12.2. Harvest Automation

13. Battery & Chargers

- 13.1. LG Chem (LG Energy Solutions)

- 13.2. Crown Equipment Corporation

- 13.3. East Penn Manufacturing

- 13.4. EnerSys

- 13.5. Conductix-Wampfler

14. Key Components

- 14.1. Advance Motion Control

- 14.2. Kollmorgen

- 14.3. Energid (Teradyne)

- 14.4. Harmonic Drive System

- 14.5. Murrelektronik

15. Piece Picking Robots

- 15.1. Berkshire Grey

- 15.2. Righthand Robotics

- 15.3. KINDRED (Ocado Group)

- 15.4. OSARO

- 15.5. Plus One Robotics

16. Warehouse Management System Providers

- 16.1. Blue Yonder (JDA)

- 16.1.1. Introduction

- 16.1.2. General Information

- 16.1.3. Company Acquisitions

- 16.1.4. Intelligent Fulfillment™ WMS

- 16.1.4.1. Highlights

- 16.2. Infor (Koch Industries)

- 16.2.1. Introduction

- 16.2.2. General Information:

- 16.2.3. History & Developments:

- 16.2.4. CloudSuite™ WMS

- 16.2.4.1. Highlights

- 16.2.4.2. Order Accuracy and Productivity

- 16.3. Oracle

- 16.3.1. Introduction

- 16.3.2. General Information

- 16.3.3. Products & Solutions

- 16.3.3.1. Cloud and On-Premise Software Business

- 16.3.3.2. Hardware Business

- 16.3.3.3. Services Business

- 16.3.4. Oracle Warehouse Management Cloud (WMS)

- 16.4. SAP

- 16.4.1. Introduction

- 16.4.2. General Information

- 16.4.3. Portfolio

- 16.4.4. SAP Extended Warehouse Management (SAP EWM)

- 16.5. Manhattan Associates

- 16.5.1. Introduction

- 16.5.2. General Information

- 16.5.3. Solutions

- 16.5.4. Manhattan SCALE™ WMS

- 16.6. HighJump (Körber AG)

- 16.6.1. Introduction

- 16.6.2. General Information

- 16.6.3. Körber Logistics System

- 16.6.4. HighJump WMS

17. Automatic Identification and Data Capture (AIDC)

- 17.1. Zebra Technologies

- 17.1.1. Introduction

- 17.1.2. General Information

- 17.1.3. Recent Acquisitions

- 17.1.4. Warehouse Solutions

- 17.1.5. Products & Industries

- 17.2. Honeywell AIDC

- 17.2.1. Introduction

- 17.2.2. General Information

- 17.2.3. Products & Solutions

- 17.2.4. Transportation & Logistics Solutions

- 17.3. Data Logic

- 17.3.1. Introduction

- 17.3.2. General Information

- 17.3.3. Industries Targeted

- 17.3.4. Products and Systems Offered

- 17.4. SATO

- 17.4.1. Introduction

- 17.4.2. General Information

- 17.4.3. History

- 17.4.4. Industries Targeted

- 17.4.5. Hand Labeling Systems

- 17.4.6. Software

- 17.5. SICK AG

- 17.5.1. Introduction

- 17.5.2. General Information

- 17.5.3. History

- 17.5.4. Product Portfolio

- 17.5.5. Industries Targeted

18. Warehouse Drones

- 18.1. Eyesee (HARDIS Group)

- 18.2. UVL ROBOTICS

- 18.3. AirMap (DroneUp)

19. Delivery Robots

- 19.1. Starship Technologies

- 19.2. NURO AI

- 19.3. Tele Retail

- 19.4. Kiwibot

- 19.5. Robby Technologies

LIST OF TABLES

- Table 1: AGV Market Revenue By Region and Geography (USD Million)

- Table 2: AGV Market Shipments By Region and Geography (units)

- Table 3: AGV Market Revenue By Industry (USD Million)

- Table 4: AGV Market Shipments By Industry (units)

- Table 5: AGV Market Revenue By Form Factor (USD Million)

- Table 6: AGV Market Shipments By Form Factor (units)

- Table 7: AGV Market Revenue By Navigation (USD Million)

- Table 8: AGV Market Shipments By Navigation (units)

- Table 9: AGV Market Revenue By Function (USD Million)

- Table 10: AGV Market Shipments By Function (units)

- Table 11: North America AGV Market Revenue By Industry (USD Million)

- Table 12: North America AGV Market Shipments By Industry (units)

- Table 13: North America AGV Market Revenue By Form Factor (USD Million)

- Table 14: North America AGV Market Shipments By Form Factor (units)

- Table 15: North America AGV Market Revenue By Navigation (USD Million)

- Table 16: North America AGV Market Shipments By Navigation (units)

- Table 17: North America AGV Market Revenue By Function (USD Million)

- Table 18: North America AGV Market Shipments By Function (units)

- Table 19: Europe AGV Market Revenue By Industry (USD Million)

- Table 20: Europe AGV Market Shipments By Industry (units)

- Table 21: Europe AGV Market Revenue By Form Factor (USD Million)

- Table 22: Europe AGV Market Shipments By Form Factor (units)

- Table 23: Europe AGV Market Revenue By Navigation (USD Million)

- Table 24: Europe AGV Market Shipments By Navigation (units)

- Table 25: Europe AGV Market Revenue By Function (USD Million)

- Table 26: Europe AGV Market Shipments By Function (units)

- Table 27: APAC AGV Market Revenue By Industry (USD Million)

- Table 28: APAC AGV Market Shipments By Industry (units)

- Table 29: APAC AGV Market Revenue By Form Factor (USD Million)

- Table 30: APAC AGV Market Shipments By Form Factor (units)

- Table 31: APAC AGV Market Revenue By Navigation (USD Million)

- Table 32: APAC AGV Market Shipments By Navigation (units)

- Table 33: APAC AGV Market Revenue By Function (USD Million)

- Table 34: APAC AGV Market Shipments By Function (units)

- Table 35: ROW AGV Market Revenue By Industry (USD Million)

- Table 36: ROW AGV Market Shipments By Industry (units)

- Table 37: ROW AGV Market Revenue By Form Factor (USD Million)

- Table 38: ROW AGV Market Shipments By Form Factor (units)

- Table 39: ROW AGV Market Revenue By Navigation (USD Million)

- Table 40: ROW AGV Market Shipments By Navigation (units)

- Table 41: ROW AGV Market Revenue By Function (USD Million)

- Table 42: ROW AGV Market Shipments By Function (units)

- Table 43: AMR Market Revenue By Region and Geography (USD Million)

- Table 44: AMR Market Shipments By Region and Geography (units)

- Table 45: AMR Market Revenue By Industry (USD Million)

- Table 46: AMR Market Shipments By Industry (units)

- Table 47: AMR Market Revenue By Navigation (USD Million)

- Table 48: AMR Market Shipments By Navigation (units)

- Table 49: AMR Market Revenue By Function (USD Million)

- Table 50: AMR Market Shipments By Function (units)

- Table 51: AMR Market Revenue By Industry (USD Million)

- Table 52: North America AMR Market Shipments By Industry (units)

- Table 53: North America AMR Market Revenue By Navigation (USD Million)

- Table 54: North America AMR Market Shipments By Navigation (units)

- Table 55: North America AMR Market Revenue By Function (USD Million)

- Table 56: North America AMR Market Shipments By Function (units)

- Table 57: AMR Market Revenue By Industry (USD Million)

- Table 58: Europe AMR Market Shipments By Industry (units)

- Table 59: Europe AMR Market Revenue By Navigation (USD Million)

- Table 60: Europe AMR Market Shipments By Navigation (units)

- Table 61: Europe AMR Market Revenue By Function (USD Million)

- Table 62: Europe AMR Market Shipments By Function (units)

- Table 63: AMR Market Revenue By Industry (USD Million)

- Table 64: APAC AMR Market Shipments By Industry (units)

- Table 65: APAC AMR Market Revenue By Navigation (USD Million)

- Table 66: APAC AMR Market Shipments By Navigation (units)

- Table 67: APAC AMR Market Revenue By Function (USD Million)

- Table 68: APAC AMR Market Shipments By Function (units)

- Table 69: AMR Market Revenue By Industry (USD Million)

- Table 70: ROW AMR Market Shipments By Industry (units)

- Table 71: ROW AMR Market Revenue By Navigation (USD Million)

- Table 72: ROW AMR Market Shipments By Navigation (units)

- Table 73: ROW AMR Market Revenue By Function (USD Million)

- Table 74: ROW AMR Market Shipments By Function (units)

- Table 75: United States AGV/AMR Market Shipments (units)

- Table 76: United States AGV/AMR Market Revenue (USD million)

- Table 77: Canada AGV/AMR Market Shipments (units)

- Table 78: Canada AGV/AMR Market Revenue (USD million)

- Table 79: Germany AGV/AMR Market Shipments (units)

- Table 80: Germany AGV/AMR Market Revenue (USD million)

- Table 81: UK AGV/AMR Market Shipments (units)

- Table 82: UK AGV/AMR Market Revenue (USD million)

- Table 83: France AGV/AMR Market Shipments (units)

- Table 84: France AGV/AMR Market Revenue (USD million)

- Table 85: Italy AGV/AMR Market Shipments (units)

- Table 86: Italy AGV/AMR Market Revenue (USD million)

- Table 87: Spain AGV/AMR Market Shipments (units)

- Table 88: Spain AGV/AMR Market Revenue (USD million)

- Table 89: Nordics AGV/AMR Market Shipments (units)

- Table 90: Nordics AGV/AMR Market Revenue (USD million)

- Table 91: China AGV/AMR Market Shipments (units)

- Table 92: China AGV/AMR Market Revenue (USD million)

- Table 93: Japan AGV/AMR Market Shipments (units)

- Table 94: Japan AGV/AMR Market Revenue (USD million)

- Table 95: South Korea AGV/AMR Market Shipments (units)

- Table 96: South Korea AGV/AMR Market Revenue (USD million)

- Table 97: Australia AGV/AMR Market Shipments (units)

- Table 98: Australia AGV/AMR Market Revenue (USD million)

- Table 99: India AGV/AMR Market Shipments (units)

- Table 100: India AGV/AMR Market Revenue (USD million)

- Table 101: Taiwan AGV/AMR Market Shipments (units)

- Table 102: Taiwan AGV/AMR Market Revenue (USD million)

- Table 103: Thailand AGV/AMR Market Shipments (units)

- Table 104: Thailand AGV/AMR Market Revenue (USD million)

- Table 105: Malaysia AGV/AMR Market Shipments (units)

- Table 106: Malaysia AGV/AMR Market Revenue (USD million)

- Table 107: Singapore AGV/AMR Market Shipments (units)

- Table 108: Singapore AGV/AMR Market Revenue (USD million)

- Table 109: Middle East & Africa AGV/AMR Market Shipments (units)

- Table 110: Middle East & Africa AGV/AMR Market Revenue (USD million)

- Table 111: Latin America AGV/AMR Market Shipments (units)

- Table 112: Latin America AGV/AMR Market Revenue (USD million)

- Table 113: China AGV Market Revenue By Navigation (USD million)

- Table 114: China AMR Market Revenue By Navigation (USD million)

- Table 115: China AGV Market Revenue By Industry (USD million)

- Table 116: China AMR Market Revenue By Industry (USD million)

- Table 117: Japan AGV Market Revenue By Navigation (USD million)

- Table 118: Japan AMR Market Revenue By Navigation (USD million)

- Table 119: Japan AGV Market Revenue By Industry (USD million)

- Table 120: Japan AMR Market Revenue By Industry (USD million)

- Table 121: South Korea AGV Market Revenue By Navigation (USD million)

- Table 122: South Korea AMR Market Revenue By Navigation (USD million)

- Table 123: South Korea AGV Market Revenue By Industry (USD million)

- Table 124: South Korea AMR Market Revenue By Industry (USD million)

- Table 125: Australia AGV Market Revenue By Navigation (USD million)

- Table 126: Australia AMR Market Revenue By Navigation (USD million)

- Table 127: Australia AGV Market Revenue By Industry (USD million)

- Table 128: Australia AMR Market Revenue By Industry (USD million)

- Table 129: India AGV Market Revenue By Navigation (USD million)

- Table 130: India AMR Market Revenue By Navigation (USD million)

- Table 131: India AGV Market Revenue By Industry (USD million)

- Table 132: India AMR Market Revenue By Industry (USD million)

- Table 133: Taiwan AGV Market Revenue By Navigation (USD million)

- Table 134: Taiwan AMR Market Revenue By Navigation (USD million)

- Table 135: Taiwan AGV Market Revenue By Industry (USD million)

- Table 136: Taiwan AMR Market Revenue By Industry (USD million)

- Table 137: Thailand AGV Market Revenue By Navigation (USD million)

- Table 138: Thailand AMR Market Revenue By Navigation (USD million)

- Table 139: Thailand AGV Market Revenue By Industry (USD million)

- Table 140: Thailand AMR Market Revenue By Industry (USD million)

- Table 141: Malaysia AGV Market Revenue By Navigation (USD million)

- Table 142: Malaysia AMR Market Revenue By Navigation (USD million)

- Table 143: Malaysia AGV Market Revenue By Industry (USD million)

- Table 144: Malaysia AMR Market Revenue By Industry (USD million)

- Table 145: Singapore AGV Market Revenue By Navigation (USD million)

- Table 146: Singapore AMR Market Revenue By Navigation (USD million)

- Table 147: Singapore AGV Market Revenue By Industry (USD million)

- Table 148: Singapore AMR Market Revenue By Industry (USD million)

- Table 149: Indonesia AGV Market Revenue By Navigation (USD million)

- Table 150: Indonesia AMR Market Revenue By Navigation (USD million)

- Table 151: Indonesia AGV Market Revenue By Industry (USD million)

- Table 152: Indonesia AMR Market Revenue By Industry (USD million)

- Table 153: Philippines AGV Market Revenue By Navigation (USD million)

- Table 154: Philippines AMR Market Revenue By Navigation (USD million)

- Table 155: Philippines AGV Market Revenue By Industry (USD million)

- Table 156: Philippines AMR Market Revenue By Industry (USD million)

LIST OF EXHIBITS

- EXHIBIT 1: Timeline of AGV development

- EXHIBIT 2: AGV development through the decades

- EXHIBIT 3: Timeline of AMR development

- EXHIBIT 4: AMR development through the decades

- EXHIBIT 5: Examples of AMRs

- EXHIBIT 6: Retail sales are declining in 2020, but eCommerce adoption has accelerated

- EXHIBIT 6: Warehouse occupancy rates remain high, despite an economic slowdown

- EXHIBIT 7: Online Aggregation Model

- EXHIBIT 8: Illustration of Product Range by Retailer: U.K. Clothing

- EXHIBIT 9: Robots deployed in Amazon's warehouses have seen immense growth

- Exhibit 40: Fetch Robotics' Fetch And Freight

- Exhibit 41: Adept's Lynx

- EXHIBIT 42: Geekplus's Mobile Robot

- EXHIBIT 43: Mobile Industrial Robots (MIR)'S MIR200

- EXHIBIT 44: Hikrobotics' Qianmo Smart Warehouse Robot

- EXHIBIT 45: Quicktron Robot

- EXHIBIT 36: Ultrafast Delivery Services - Race to begin

- EXHIBIT 37: Ultrafast Delivery Services in USA

- EXHIBIT 10: Online grocery penetration is increasing in major global economies

- EXHIBIT 50: Palletizing Robot

- EXHIBIT 51: Picking Robot

- EXHIBIT 52: AGV

- EXHIBIT 53: Some of the Warehouse Automation Robot Players Outside Palletizing

- EXHIBIT 11: Categories of Automated Guided Vehicles

- EXHIBIT 12: Forklift AGV

- EXHIBIT 13: Forklift AGV, standardised equipment

- EXHIBIT 14: Pallet AGV

- EXHIBIT 15: Tugger/Towing AGV

- EXHIBIT 16: The underride AGV

- EXHIBIT 17: AGVs for assembly and supply at Daimler

- EXHIBIT 18: Heavy Load AGV

- EXHIBIT 19: The mini-AGV

- EXHIBIT 20: AGVs used for container handling at ports

- EXHIBIT 21: AGV Market Revenue by Form Factor (USD Million)

- EXHIBIT 22: AGV Market shipments by Form Factor (units)

- EXHIBIT 23: AGV Market Revenue by Navigation (USD Million)

- EXHIBIT 24: AGV Shipments by Navigation (units)

- EXHIBIT 25: AMR Market Revenue by Navigation (USD Million)

- EXHIBIT 26: AMR Shipments by Navigation (units)

- EXHIBIT 27: AGV Market Revenue by Function (USD Million)

- EXHIBIT 28: AGV Shipments by Function (Units)

- EXHIBIT 29: AMR Market Revenue by Function (USD Million)

- EXHIBIT 30: AMR Shipments by Function (Units)

- EXHIBIT 31: AGV Market Revenue by Industry (USD Million)

- EXHIBIT 32: AGV Shipments by Industry (USD Million)

- EXHIBIT 33: AMR Market Revenue by Industry (USD Million)

- EXHIBIT 34: AMR Shipments by Industry (Units)

- EXHIBIT 35: Suitability table for conveyor systems in mass assembly tasks

- EXHIBIT 36: Handling of Paper Rolls

- EXHIBIT 37: AGVs handling cheese in the aging warehouse

- EXHIBIT 38: Coil transporter carries 30-ton rolls

- EXHIBIT 39: Example of a floor-level block storage warehouse

- EXHIBIT 40: Characteristics of AGVs with pallet recognition in block storage a warehouse

- EXHIBIT 41: Automated Case Handling Robot Shuttles

- EXHIBIT 42: G2P Mobile Robots (1/2)

- EXHIBIT 43: G2P Mobile Robots (2/2)

- EXHIBIT 44: AGV carries a roller container (L); Underride AGV with pickup for towing roller containers (R)

- EXHIBIT 45: AGV used in hospitals to transport food trays

- EXHIBIT 46: Vehicle empty, loaded and with payload at transfer station

- EXHIBIT 47: Disinfection Robots

- EXHIBIT 48: Cleaning Robots

- EXHIBIT 49: Telepresence Robots

- EXHIBIT 50: Security and Inspection Robots

- EXHIBIT 51: Agriculture Mobile Robots

- EXHIBIT 52: Retail and Inventory Management Robots

- EXHIBIT 53: Hospital Assistance Robots

- EXHIBIT 54: Indoor Delivery Robots (Hotels, Restaurants, Offices, Airports etc.)

- EXHIBIT 55: Outdoor Delivery Robots

- EXHIBIT 56: Data Platforms and Remote Sensing Robots

- EXHIBIT 57: AGV Market Revenue by Region and Geography (in USD Million)

- EXHIBIT 58: AGV Market Shipments by Region and Geography (units)

- EXHIBIT 59: AMR Market Revenue by Region and Geography (USD Million)

- EXHIBIT 60: AMR Market Shipments by Region and Geography (units)

- EXHIBIT 61: CEOs are looking to cut investments across the board; however, automation is still the last priority

- EXHIBIT 62: United States - Shipments and Revenues of AGV/AMR

- EXHIBIT 62: Walmart Fulfillment center in Salem, Massachusetts

- EXHIBIT 63: Investment Deals in USA for 2021

- EXHIBIT 64: Canada AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 65: Investment Deals in Canada for 2021

- EXHIBIT 66: UK AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 67: Investment Deals in Canada for 2021

- EXHIBIT 68: Germany AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 69: Investment Deals in Germany for 2021

- EXHIBIT 70: Investment Deals in France for 2020-21

- EXHIBIT 71: Online grocery in France will be a $48bn market by 2027

- EXHIBIT 140: Casino has partnered with Ocado to develop automated CFC

- EXHIBIT 72: France AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 73: Italy AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 74: Spain AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 151: Parcel lockers in the Nordics

- EXHIBIT 75: Nordics AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 76: Online Penetration of Goods Retail Sales Will Remain Flat in 2023

- EXHIBIT 77: Automated warehouses cost more than 15x traditional warehouse

- EXHIBIT 78: Investment Deals in China for 2021

- EXHIBIT 79: China AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 80: China AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 167: Investment Deals in China for 2021

- EXHIBIT 81: Japan AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 81: MiR250 AMRs boosts productivity and increased associate accountability

- EXHIBIT 82: Japan AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 83: Autonomous vehicles transport products at a Coupang fulfillment center

- EXHIBIT 83: South Korea AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 84: South Korea AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 85: Demand for warehouse space is being driven by eCommerce

- EXHIBIT 86: India AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 87: India AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 88: Tompkins tSort shuttles carry individual items and deposit items into outgoing crates

- EXHIBIT 88: Australia AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 89: Australia AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 90: Taiwan AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 91: Taiwan AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 92: The South-east Asian eCommerce market is booming

- EXHIBIT 93: Indonesia AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 94: Thailand AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 95: Thailand AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 96: Phillippines AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 97: Malaysia AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 98: Malaysia AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 99: Singapore AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 100: Singapore AGV/AMR Market Revenue by Navigation, and by Industry (USD Million)

- EXHIBIT 101: Middle-east & Africa AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 101: Geek+ and Starlinks' hybrid warehouse solution

- EXHIBIT 102: eCommerce, Fashion & Beauty and Grocery will be the biggest end-consumers

- EXHIBIT 103: Middle East e-commerce is worth $10.3 billion and will grow by 13% through 2025

- EXHIBIT 104: E-commerce penetration as a percentage of total retail (2017)

- EXHIBIT 105: Latin America AGV/AMR Market, Shipments (units) and Revenue (USD Million)

- EXHIBIT 106: System Integration Work Flow

- EXHIBIT 107: Benefits of in-sourcing vs outsourcing of MRO services

- EXHIBIT 108: Positions in a bid assessment

- EXHIBIT 109: Direct costs in AGV calculation

- EXHIBIT 110: Indirect costs in AGV calculation

- EXHIBIT 111: Bluebotics Navigation Software ANT® comparison chart

- EXHIBIT 112: Robots as a Service - Different Segments

- EXHIBIT 113: Warehouse Robots - Examples

- EXHIBIT 114: Warehouse Robots - RaaS Players

- EXHIBIT 115: Delivery Robots - Examples

- EXHIBIT 116: Delivery Robots - RaaS Players

- EXHIBIT 117: Security Robots - Examples

- EXHIBIT 118: Security Robots - RaaS Players

- EXHIBIT 119: Cleaning Robots - Examples

- EXHIBIT 120: Cleaning Robots - RaaS Players

- EXHIBIT 121: Types of Navigation Systems

- EXHIBIT 122: Relevant criteria for choosing the right navigation system

- EXHIBIT 123: The common navigation procedures

- EXHIBIT 124: Basic sketch of inductive and optical track guidance

- EXHIBIT 125: Basic sketch of track guidance with a double conducting track for non-contacting energy transfer

- EXHIBIT 126: Basic sketch for dead-reckoning navigation (left) and for magnetic or transponder navigation (right)

- EXHIBIT 127: Magnetic measurement sensors

- EXHIBIT 128: Reading units for transponders

- EXHIBIT 129: Laser Scanner Navigation Method

- EXHIBIT 130: AGV systems with 3D vision

- EXHIBIT 131: Landmark recognition

- EXHIBIT 132: Positioning based on reflector locations

- EXHIBIT 133: Moveable laser scanner (red), with natural markers on the ceiling: fixed personnel protection scanner. (ceiling navigation ((yellow):

- EXHIBIT 134: Mobile robot platform coupled with a dual-arm articulated robot works autonomously processing parts for lights-out manufacturing

- EXHIBIT 135: Autonomous mobile robot outfitted with shelves

- EXHIBIT 136: AMR Collision Avoidance Operation

- EXHIBIT 137: Roles and responsibilities of manufacturers, integrators and end-users to ensure safety in an AMR system workplace

- EXHIBIT 138: Laws, Policies and Binding Regulations on Safety and Compatibility of AGV and AMR systems

- EXHIBIT 139: Diagrams of typical AGV chassis

- EXHIBIT 140: Left Diagram of the Mecanum wheel, right installed on a piggyback AGV

- EXHIBIT 141: A typical wheel hub drive for an AGV: The RNA 27 with integrated steering unit, 270 mm wheel diameter, 1,300 kg wheel load, available in 24 or 48 V, in DC or AC version

- EXHIBIT 142: Comparison of current energy supply technologies

- EXHIBIT 143: AGV with non-contacting energy transfer

- EXHIBIT 144: System components for non-contacting energy transfer

- EXHIBIT 145: Assessment of battery technologies for use in AGV/AMR

- EXHIBIT 146: Comparison of power and energy densities of various energy storage sources

- EXHIBIT 147: Fuel cell stacks with 24 cells and 500 W each

- EXHIBIT 148: Battery exchange trolley and battery charging station

- EXHIBIT 149: Battery station with manual battery exchange

- EXHIBIT 150: Communication challenges in AGV/AMR

- EXHIBIT 151: AGV/AMR communication challenges and 5G benefits

- EXHIBIT 152: AGV operating panel: 2 stop switches, WLAN antenna, junction box, entry terminal, sensors & lights

- EXHIBIT 153: Function blocks for an AGV guidance control

- EXHIBIT 154: Stationary protection measures according to VDI 2510-1 purpose of use

- EXHIBIT 155: Innovative Start-Ups - Disinfection, Cleaning, Security and Hospital Automation

- EXHIBIT 156: Innovative Start-Ups - Meal and Food Delivery, Floor Cleaning and Tele-operations

- EXHIBIT 157: Since 2012, there has been more than $10B in M&A

- EXHIBIT 158: Centre-Controlled Rider Automated Forklift and Core Tow Tractor Automated Forklift

- EXHIBIT 159: Nord Modules - Quick Mover 180

- EXHIBIT 160: Parcel sortation robots from Geek+

- EXHIBIT 161: ASTI Mobile Robotics - UV-C light disinfection robot

- EXHIBIT 162: Keenon Robotics - Delivery Robots or Robotic Waiter