|

市场调查报告书

商品编码

1800734

全球半导体化学品市场(至 2030 年)按类型、应用、最终用户和地区划分Semiconductor Chemicals Market by Type, Application, End Use, & Region - Global Forecast to 2030 |

||||||

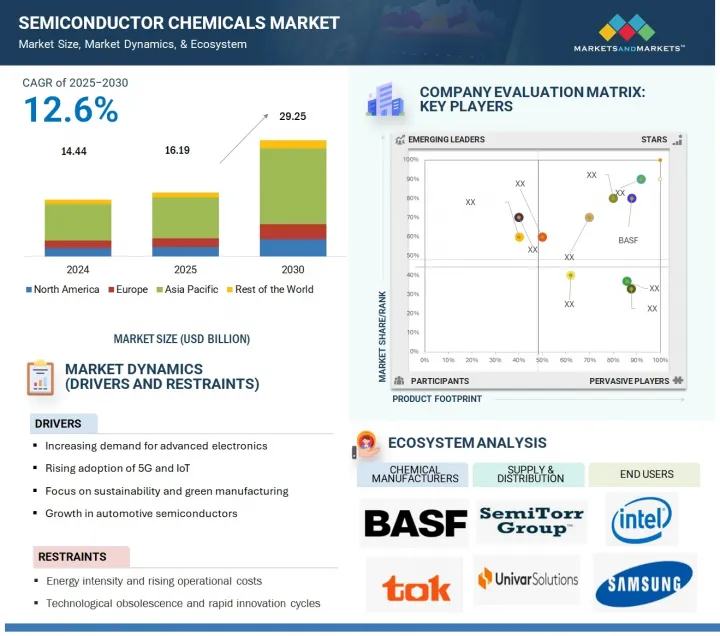

预计半导体化学品市场将从 2025 年的 161.9 亿美元成长到 2030 年的 292.5 亿美元,预测期内的复合年增长率为 12.6%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元)和数量(千吨) |

| 部分 | 类型、最终用户、用途和地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

全球半导体化学品市场正经历强劲成长,这得益于半导体装置日益复杂以及对高性能电子产品日益增长的需求。半导体化学品包括溶剂、酸、碱、光阻剂、掺杂剂和CMP浆料,在微影术、蚀刻、沉淀和清洗等诸多製造製程中发挥关键作用。 5G、人工智慧、物联网、电动车和高效能运算等新兴技术和半导体相关应用持续呈指数级增长。这些新技术需要具有更精细电路设计和复杂架构的先进晶片,从而对超纯、专用化学製剂产生了需求。

消费性电子产品的成长、全球数位转型的趋势以及对半导体製造业的大规模策略性投资是该产业的主要驱动力。台湾、韩国、中国大陆和美国正在透过巨额资本投资和大规模扩建晶圆厂来推动半导体技术的发展。此外,极紫外线 (EUV)微影术和 3D 封装技术的普及也推动了对全新、创新和先进化学解决方案及产品的需求。儘管面临营运成本上升和原材料供应受限等挑战,但全球半导体化学品市场前景仍乐观。

“按类型划分,溶剂部分预计在预测期内呈现最高增长。”

溶剂在整个半导体製造过程中发挥关键作用且应用范围广泛,因此占据了最大的市场占有率。溶剂广泛应用于各种半导体材料子类别中,而异丙醇 (IPA)、丙酮和N-甲基吡咯烷酮(NMP) 等超纯溶剂在微影术、晶圆清洗和表面处理等许多半导体应用中至关重要。这些溶剂对于去除光阻剂和其他有机残留物、颗粒和其他污染物至关重要,同时不会损坏复杂的晶片结构或引入其他化学物质引起的缺陷。随着半导体装置缩小到 5 奈米以下的尺寸,保持极其清洁的表面变得越来越具有挑战性,导致对錶面清洁度的需求不断增加,从而推动了溶剂使用量的增加。

在半导体製造中使用的材料中,溶剂的使用最为广泛,因为它们在前端和后端製程中均可回收。溶剂在品管中发挥关键作用,确保整体产品符合标准,同时提高製造流程的营运效率。溶剂与各种设备和材料的兼容性也使其广泛应用。随着电子、5G技术、人工智慧和电动车需求的不断增长,半导体产业持续扩张,溶剂的消耗量预计也将增加。因此,溶剂仍然是半导体化学品中最重要、最可靠的类别。

“按应用来看,光阻剂领域预计在预测期内实现最高增长。”

光阻剂是市场中成长最快的部分,因为它们在微影术中起着关键作用,而光刻对于将复杂的电路图案转移到半导体晶圆上至关重要。随着半导体产业扩展到更小的技术节点和更复杂的晶片结构,对下一代光阻剂的需求和要求正在增加。最近的技术进步,例如极紫外线 (EUV)微影术,大大增加了对下一代光阻剂材料的需求。这些材料对于实现亚奈米製造所需的精度至关重要。每个晶圆都要经过几个微影术循环,消耗大量的光阻剂在製造过程中经常使用。随着晶片製造商采用多重图形化和 3D 整合技术,每个晶圆的光阻剂使用量也以类似的速度成长。此外,人工智慧、5G、汽车电子产品和资料中心使用高性能晶片的需求不断增长,推动了对具有成本效益、扩充性且可靠的微影术材料的需求。对新的半导体製造设施的投资以及加强研发力度,特别是在亚太地区和美国,有利于推动光阻剂市场的快速成长。

“按地区划分,预计亚太地区将成为预测期内增长最快的地区。”

亚太地区占据最大的区域份额,这得益于其在全球半导体製造业中的主导地位,以及完善的供应商、製造商和终端用户生态系统。台湾、韩国、中国大陆和日本等国家和地区拥有一些全球最大的半导体代工厂和整合设备製造商,包括台积电、三星电子、SK海力士和东芝。这导致对用于晶圆加工(包括微影术、蚀刻、掺杂和晶圆清洗)的高纯度化学品的需求巨大。

该地区的半导体供应链得益于完善的基础设施、高技能的劳动力、经济高效的製造设施以及政府对电子和半导体行业的大力支持。此外,5G、物联网、人工智慧和电动车等技术正在增加对半导体的需求,进而刺激相关化学品的消费。中国致力于实现半导体供应链的自给自足,并透过政策支持和对本地製造和材料供应链的大规模投资,进一步推动了市场成长。同时,日本和韩国在材料和化学行业继续保持优势,提供领先的创新技术和专业的半导体级化学品。

本报告调查了全球半导体化学品市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 产生人工智慧对半导体化学品市场的影响

第六章 产业趋势

- 影响客户业务的趋势/中断

- 2025年美国关税对半导体化学品市场的影响

- 供应链分析

- 投资金筹措场景

- 定价分析

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 2025-2026年重要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

- 案例研究分析

7. 半导体化学品市场(按类型)

- 高性能聚合物

- 聚酰亚胺

- 氟聚合物

- 聚醚醚酮

- 液晶聚合物

- 聚亚苯硫醚

- 其他的

- 酸碱化学品

- 氟化氢

- 氢氧化钾

- 氢氧化钠

- 四甲基氢氧化铵

- 胶水

- 环氧胶黏剂

- 硅胶黏合剂

- UV胶

- 聚酰亚胺胶黏剂

- 溶剂

- 丙二醇单甲醚乙酸酯(PGMEA)

- 环己酮

- 丙二醇单甲醚

- 三氯乙烯

- 异丙醇

- 硫酸

- 过氧化氢

- 氢氧化铵

- 盐酸

- 氢氟酸

- 硝酸

- 磷酸

- 其他的

- 其他的

- 气体

第八章半导体化学品市场(依应用)

- 光阻剂

- 蚀刻

- 沉积

- 打扫

- 兴奋剂

- 其他的

- 化学机械平坦化

- 包装

9. 半导体化学品市场(依最终用户)

- 积体电路(ICS)

- 离散半导体

- 感应器

- 光电子

第 10 章半导体化学品市场(按地区)

- 亚太地区

- 中国

- 日本

- 台湾

- 韩国

- 马来西亚

- 越南

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 荷兰

- 爱尔兰

- 英国

- 以色列

- 其他的

- 其他地区

- 巴西

- 南非

- 其他的

第十一章竞争格局

- 主要参与企业的策略/优势

- 市场占有率分析

- 收益分析

- 品牌/产品比较

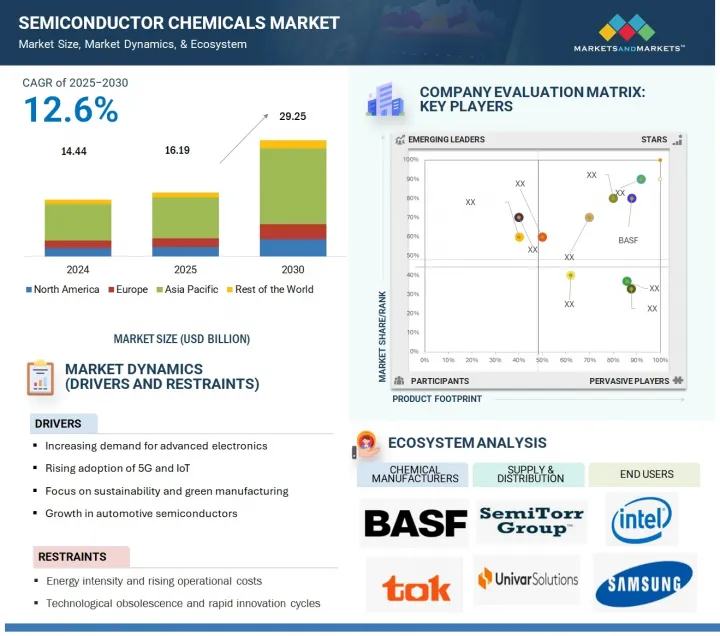

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 估值和财务指标

- 竞争场景

第十二章:公司简介

- 主要企业

- TOKYO OHKA KOGYO CO., LTD.

- JSR CORPORATION

- BASF

- SOLVAY

- DOW

- HONEYWELL INTERNATIONAL INC.

- FUJIFILM HOLDINGS CORPORATION

- EASTMAN CHEMICAL COMPANY

- MERCK KGAA (EMD ELECTRONICS)

- SUMITOMO CHEMICAL CO., LTD.

- SK INC.

- DUPONT

- 其他公司

- RESONAC HOLDINGS CORPORATION

- MITSUBISHI CHEMICAL CORPORATION

- PARKER HANNIFIN CORP

- AVANTOR, INC.

- AIR PRODUCTS AND CHEMICALS, INC.

- LINDE PLC

- CABOT CORPORATION

- KAO CORPORATION

- KANTO KAGAKU.

- NIPPON KAYAKU CO., LTD.

- FOOSUNG CO., LTD.

- OCI COMPANY LTD.

- TOKUYAMA CORPORATION

第十三章 附录

The semiconductor chemicals market is projected to grow from USD 16.19 billion in 2025 to USD 29.25 billion by 2030, registering a CAGR of 12.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Type, End Use, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, and the Rest of the World |

The global semiconductor chemicals market is experiencing strong growth, supported by the growing complexity of semiconductor devices and a rising demand for high-performance electronic products. Semiconductor chemicals include solvents, acids, bases, photoresists, dopants, and CMP slurries, which are important in many fabrication processes such as photolithography, etching, deposition, and cleaning. In many advanced technologies and semiconductor-related applications, such as 5G, artificial intelligence (AI), Internet of Things (IoT), electric vehicles (EVs), and high-performance computing continue to grow exponentially, and these new technologies will require advanced chips with smaller geometries and sophisticated architectures, creating a demand for ultra-high-purity and application-specific chemical formulations.

The growth of consumer electronics, the global shift toward digital transformation, and significant strategic investments in semiconductor manufacturing are the key driving forces in the industry. Major players in this field include Taiwan, South Korea, China, and the US, all of which are making advancements in semiconductor technologies through substantial capital investments and extensive factory expansions. The adoption of extreme ultraviolet (EUV) lithography and 3D packaging is also boosting the demand for new, innovative, and advanced chemical solutions and products. Despite facing challenges such as rising operational costs and constraints in raw material supply, the global outlook for the semiconductor chemicals market remains positive.

"Solvents segment to register the fastest growth in the semiconductor chemicals market in terms of value during the forecast period"

Solvents hold the largest market share within the semiconductor chemicals sector, primarily due to their crucial role and extensive application throughout the semiconductor fabrication process. They are prevalent across various subcategories of semiconductor materials. Ultra-high purity solvents, such as isopropyl alcohol (IPA), acetone, and N-methyl-2-pyrrolidone (NMP), are especially vital for the semiconductor industry and its many subsegments, including photolithography, wafer cleaning, and surface preparation. These solvents are essential for removing photoresists and other organic residues, as well as contaminants like particles, while preventing any damage to the intricate chip structures or defects from other chemicals. As semiconductor devices shrink to sizes of 5nm or smaller, achieving and maintaining ultra-clean surfaces has become increasingly challenging. High surface cleanliness is crucial, which drives up the volume of solvent usage. The quantity of solvents employed is significant compared to other types of materials used in semiconductor fabrication because these solvents are typically recycled throughout the fabrication process for both the front-end and back-end stages. They play a vital role in quality control, ensuring the overall product meets standards, and in enhancing the operational efficiency of the manufacturing process. Moreover, the wide range of equipment and materials compatible with solvents contributes to their widespread adoption. As the semiconductor industry continues to expand in response to the growing demand for electronics, 5G technology, artificial intelligence (AI), and electric vehicles (EVs), the consumption of solvents is expected to rise. Therefore, solvents remain the most significant and reliable category within semiconductor chemicals.

"Photoresist segment to register the fastest growth in the semiconductor chemicals market during the forecast period"

Photoresist is the fastest-growing segment in the semiconductor chemicals market because it plays a crucial role in photolithography, the essential process of transferring intricate circuit patterns onto semiconductor wafers. As the semiconductor industry expands into smaller technology nodes (i.e., 5nm, 3nm, and below) with more complex chip architectures, the demand and requirements for next-generation photoresists have increased; specifically, the demand for improved resolution, sensitivity, and etch resistance. Recent advancements in technology, such as extreme ultraviolet (EUV) lithography, have significantly increased the demand for next-generation photoresist materials. These materials are essential for achieving the precision required in sub-nanometer fabrication. Each wafer undergoes several cycles of photolithography, which consume substantial quantities of photoresist used frequently throughout the manufacturing process. As chipmakers adopt multi-patterning and 3D integration technologies, the amount of photoresist used per wafer is rising at a similar pace. Furthermore, the growing demand for high-performance chips used in AI, 5G, automotive electronics, and data centers is intensifying the requirements for photolithographic materials that are cost-effective, scalable, and reliable. Investments in new semiconductor fabrication facilities, coupled with increased research and development efforts-especially in the Asia Pacific region and the US-are well-positioned to drive the rapid growth of the photoresist market.

"Asia Pacific is projected to be the fastest-growing region in the semiconductor chemicals market in terms of value during the forecast period"

The Asia Pacific region holds the largest share of the semiconductor chemicals market, largely due to its dominance in global semiconductor manufacturing and the presence of a well-established ecosystem of suppliers, manufacturers, and end users. Countries such as Taiwan, South Korea, China, and Japan are home to some of the world's largest semiconductor foundries and integrated device manufacturers, including TSMC, Samsung Electronics, SK Hynix, and Toshiba. This results in a high demand for high-purity chemicals used in wafer processing, including lithography, etching, doping, and wafer cleaning. The semiconductor supply chains in this region benefit from a well-developed infrastructure, a skilled labor force, cost-effective fabrication facilities, and strong government support for the electronics and semiconductor industries. Additionally, the increasing demand for semiconductors driven by technologies such as 5G, IoT, AI, and electric vehicles is pressuring end users to consume more associated chemicals. China's push for self-sufficiency in its semiconductor supply chains, supported by policy direction and significant investments in local fabrication and material supply chains, has further fueled market growth. Meanwhile, Japan and South Korea continue to excel in the materials and chemicals industry, offering advanced innovations and specialized semiconductor-grade chemicals.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the semiconductor chemicals market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, Middle East & Africa - 5%, and South America - 5%

The semiconductor chemicals market comprises major players such as Tokyo Ohka Kogyo Co., Ltd. (Japan), JSR Corporation (Japan), BASF (Germany), Solvay (Belgium), Dow (US), Honeywell International Inc. (US), FUJIFILM Holdings Corporation (Japan), Eastman Chemical Company (US), Merck KGaA (Germany), Sumitomo Chemical Co., Ltd. (Japan), SK Inc. (South Korea), and DuPont (US). The study includes an in-depth competitive analysis of these key players in the semiconductor chemicals market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the semiconductor chemicals market by type, application, end-user, and region and estimates its overall value across various regions. It has also conducted a detailed analysis of key industry players to provide insights into their business overviews, products and services, key strategies, and expansions associated with the Semiconductor chemicals market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the semiconductor chemicals market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (increasing demand for advanced electronics, focus on sustainability and green manufacturing, and rising adoption of IoT and 5G), restraints (energy intensity and rising operational costs), opportunities (development of specialty chemicals for quantum computing), and challenges (complexity of scaling production for emerging materials).

- Market Penetration: Comprehensive information on the semiconductor chemicals offered by top players in the semiconductor chemicals market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product launches, expansions, investments, collaborations, partnerships, and announcements in the market.

- Market Development: The report provides comprehensive information about lucrative emerging markets and analyzes the semiconductor chemicals market across regions.

- Market Capacity: Wherever possible, the production capacities of companies producing semiconductor chemicals are provided, along with upcoming capacities for the semiconductor chemicals market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the semiconductor chemicals market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary data sources

- 2.1.2.3 Key primary participants

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SEMICONDUCTOR CHEMICALS MARKET

- 4.2 SEMICONDUCTOR CHEMICALS MARKET, BY TYPE

- 4.3 SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION

- 4.4 SEMICONDUCTOR CHEMICALS MARKET, BY END USE

- 4.5 SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased demand for advanced electronics

- 5.2.1.2 Rising adoption of 5G and IoT technologies

- 5.2.1.3 Increasing focus on sustainability and green manufacturing

- 5.2.1.4 Shift toward autonomous driving

- 5.2.2 RESTRAINTS

- 5.2.2.1 Energy-intensive chemical production & fab operations and rising operational costs

- 5.2.2.2 Technological obsolescence and rapid innovation cycles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of specialty chemicals for quantum computing

- 5.2.3.2 Increasing applications in medical and aerospace industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in scaling production of emerging materials

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON SEMICONDUCTOR CHEMICALS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 ACCELERATED R&D AND FORMULATION OF ADVANCED CHEMICALS

- 5.3.3 OPTIMIZATION OF PROCESS CHEMISTRY IN FABRICATION PLANTS

- 5.3.4 DIGITAL TWIN AND PREDICTIVE MAINTENANCE FOR CHEMICAL DELIVERY SYSTEMS

- 5.3.5 STREAMLINING SEMICONDUCTOR SUPPLY CHAIN AND INVENTORY MANAGEMENT

- 5.3.6 ENABLING SUSTAINABILITY AND GREEN CHEMISTRY IN SEMICONDUCTOR PROCESSING

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 IMPACT OF 2025 US TARIFFS ON SEMICONDUCTOR CHEMICALS MARKET

- 6.3.1 INTRODUCTION

- 6.3.2 KEY TARIFF RATES

- 6.3.3 PRICE IMPACT ANALYSIS

- 6.3.4 IMPACT ON KEY COUNTRIES/REGIONS

- 6.3.4.1 US

- 6.3.4.2 Europe

- 6.3.4.3 Asia Pacific

- 6.3.5 IMPACT ON END USE SEGMENTS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 INVESTMENT AND FUNDING SCENARIO

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.6.2 AVERAGE SELLING PRICE TREND, BY TYPE, 2021-2024

- 6.6.3 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2021-2024

- 6.6.4 AVERAGE SELLING PRICE TREND, BY END USE, 2021-2024

- 6.6.5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 GRANTED PATENTS, 2015-2024

- 6.9.2.1 Publication trends

- 6.9.3 INSIGHTS

- 6.9.4 LEGAL STATUS

- 6.9.5 JURISDICTION ANALYSIS

- 6.9.6 TOP APPLICANTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 381800)

- 6.10.2 EXPORT SCENARIO (HS CODE 381800)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF ANALYSIS RELATED TO SEMICONDUCTOR CHEMICALS

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS AND STANDARDS RELATED TO SEMICONDUCTOR CHEMICALS

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 BARGAINING POWER OF SUPPLIERS

- 6.13.2 THREAT OF NEW ENTRANTS

- 6.13.3 THREAT OF SUBSTITUTES

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC INDICATORS

- 6.15.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 TRANSFORMING SUPPLY CHAIN RESILIENCE AT INFINEON TECHNOLOGIES

- 6.16.2 INNOVATING CHEMICAL EFFICIENCY AT BREWER SCIENCE

- 6.16.3 SCALING SUSTAINABILITY AT SHIN-ETSU CHEMICAL CO., LTD.

7 SEMICONDUCTOR CHEMICALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 HIGH-PERFORMANCE POLYMERS

- 7.2.1 POLYIMIDES

- 7.2.1.1 Exceptional dielectric properties and low thermal coefficient to drive market

- 7.2.2 FLUOROPOLYMERS

- 7.2.2.1 Efficient electric insulation to drive market

- 7.2.3 POLYETHER ETHER KETONES

- 7.2.3.1 Enhanced mechanical strength and stiffness to propel demand

- 7.2.4 LIQUID CRYSTAL POLYMERS

- 7.2.4.1 Resistance to temperature and chemicals to boost demand

- 7.2.5 POLYPHENYLENE SULFIDE

- 7.2.5.1 Excellent chemical resistance and thermal stability to drive market

- 7.2.6 OTHER HIGH-PERFORMANCE POLYMER TYPES

- 7.2.6.1 Polyetherimide

- 7.2.6.2 Polyethylene naphthalate

- 7.2.1 POLYIMIDES

- 7.3 ACID & BASE CHEMICALS

- 7.3.1 HYDROGEN FLUORIDE

- 7.3.1.1 High use in etching and cleaning applications to fuel market growth

- 7.3.2 POTASSIUM HYDROXIDE

- 7.3.2.1 Rising use in fabrication of precise patterns and wafer cleaning to drive market

- 7.3.3 SODIUM HYDROXIDE

- 7.3.3.1 Growing adoption in wafer cleaning to boost market

- 7.3.4 TETRAMETHYLAMMONIUM HYDROXIDE

- 7.3.4.1 Use as developer for positive photoresists to drive market

- 7.3.1 HYDROGEN FLUORIDE

- 7.4 ADHESIVES

- 7.4.1 EPOXY ADHESIVES

- 7.4.1.1 Mechanical resilience and adhesive properties to drive market

- 7.4.2 SILICONE ADHESIVES

- 7.4.2.1 Increasing use in sealing and bonding applications to fuel market growth

- 7.4.3 UV ADHESIVES

- 7.4.3.1 Fast curing properties to boost market growth

- 7.4.4 POLYIMIDE ADHESIVES

- 7.4.4.1 High-temperature resistance to boost market growth

- 7.4.1 EPOXY ADHESIVES

- 7.5 SOLVENTS

- 7.5.1 PROPYLENE GLYCOL MONOMETHYL ETHER ACETATE (PGMEA)

- 7.5.1.1 Wide use in manufacturing of cleaning agents to drive market

- 7.5.2 CYCLOHEXANONE

- 7.5.2.1 Fast evaporation rate and aromatic odor to fuel demand

- 7.5.3 PROPYLENE GLYCOL MONOMETHYL ETHER

- 7.5.3.1 Excellent solvency properties and rising application in formulation of photoresists to drive market

- 7.5.4 TRICHLOROETHYLENE

- 7.5.4.1 Light sensitivity and effective dissolving properties to drive market

- 7.5.5 ISOPROPYL ALCOHOL

- 7.5.5.1 Effective disinfectant properties to boost market

- 7.5.6 SULFURIC ACID

- 7.5.6.1 High applications in lead-acid batteries to drive market

- 7.5.7 HYDROGEN PEROXIDE

- 7.5.7.1 Excellent oxidative properties to drive market

- 7.5.8 AMMONIUM HYDROXIDE

- 7.5.8.1 Increased use in laboratories and chemical industries to drive market

- 7.5.9 HYDROCHLORIC ACID

- 7.5.9.1 Rising applications in photolithography to propel market

- 7.5.10 HYDROFLUORIC ACID

- 7.5.10.1 High corrosiveness and etching properties to drive demand

- 7.5.11 NITRIC ACID

- 7.5.11.1 Passivation of silicon wafers and chemical polishing to drive market

- 7.5.12 PHOSPHORIC ACID

- 7.5.12.1 Deoxidizing and etching properties to fuel market growth

- 7.5.13 OTHER SOLVENT TYPES

- 7.5.13.1 Acetone

- 7.5.13.2 Methanol

- 7.5.1 PROPYLENE GLYCOL MONOMETHYL ETHER ACETATE (PGMEA)

- 7.6 OTHER TYPES

- 7.6.1 GASES

- 7.6.1.1 Nitrogen

- 7.6.1.2 Oxygen

- 7.6.1.3 Argon

- 7.6.1.4 Hydrogen

- 7.6.1 GASES

8 SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 PHOTORESIST

- 8.2.1 RISING DEMAND FOR INTRICATE DESIGNS AND PATTERNS TO DRIVE MARKET

- 8.3 ETCHING

- 8.3.1 INCREASING DEMAND FOR PRECISE AND COMPLEX SEMICONDUCTOR DEVICE FABRICATION TO FUEL MARKET GROWTH

- 8.4 DEPOSITION

- 8.4.1 GROWING ADOPTION OF ADVANCED DEPOSITION CHEMICALS FOR THIN FILM FORMATION AND CIRCUIT LAYER DEVELOPMENT TO DRIVE MARKET

- 8.5 CLEANING

- 8.5.1 RISING COMPLEXITY OF SEMICONDUCTOR ARCHITECTURES AND DEMAND FOR ULTRA-PURE CLEANING CHEMICALS TO ENSURE DEFECT-FREE WAFER SURFACES DURING FABRICATION TO DRIVE MARKET

- 8.6 DOPING

- 8.6.1 GROWING NEED FOR ENHANCED ELECTRICAL PERFORMANCE IN SEMICONDUCTOR COMPONENTS TO ACCELERATE DEMAND

- 8.7 OTHER APPLICATIONS

- 8.7.1 CHEMICAL MECHANICAL PLANARIZATION

- 8.7.2 PACKAGING

9 SEMICONDUCTOR CHEMICALS MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 INTEGRATED CIRCUITS (ICS)

- 9.2.1 RISING ADOPTION OF ADVANCED INTEGRATED CIRCUITS (ICS) IN CONSUMER ELECTRONICS, AUTOMOTIVE, AND COMMUNICATION DEVICE INDUSTRIES TO DRIVE DEMAND

- 9.2.1.1 Analog

- 9.2.1.2 Micro

- 9.2.1.3 Logic

- 9.2.1.4 Memory

- 9.2.1 RISING ADOPTION OF ADVANCED INTEGRATED CIRCUITS (ICS) IN CONSUMER ELECTRONICS, AUTOMOTIVE, AND COMMUNICATION DEVICE INDUSTRIES TO DRIVE DEMAND

- 9.3 DISCRETE SEMICONDUCTORS

- 9.3.1 GROWING DEMAND FOR SPECIALIZED ELECTRONIC COMPONENTS LIKE DIODES, TRANSISTORS, AND RECTIFIERS FOR PRECISE, SINGLE-FUNCTION APPLICATIONS IN ELECTRONIC SYSTEMS TO FUEL DEMAND

- 9.4 SENSORS

- 9.4.1 HIGH USE IN AUTOMOBILES AND MEDICAL DEVICES TO DRIVE MARKET

- 9.5 OPTOELECTRONICS

- 9.5.1 INCREASING DEMAND FOR OPTOELECTRONIC DEVICES TO DRIVE MARKET

10 SEMICONDUCTOR CHEMICALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 High government-led investments and "Made in China 2025" initiatives to drive production

- 10.2.2 JAPAN

- 10.2.2.1 Strategic government subsidies and focus on high-end materials like photoresists to fuel market growth

- 10.2.3 TAIWAN

- 10.2.3.1 Growth of Taiwan Semiconductor Manufacturing Company (TSMC) and government-led R&D investments to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 "K-Semiconductor Strategy" and surging demand for memory chips to propel market

- 10.2.5 MALAYSIA

- 10.2.5.1 Tax incentives and strategic location as Assembly, Testing, and Packaging (ATP) hub to boost market

- 10.2.6 VIETNAM

- 10.2.6.1 Rising foreign direct investments to drive market

- 10.2.7 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 High investment by CHIPS and Science Act and focus on domestic manufacturing to drive market

- 10.3.2 CANADA

- 10.3.2.1 Strategic partnerships and large presence of skilled workforce to propel market

- 10.3.3 MEXICO

- 10.3.3.1 Expanding automotive sector to fuel market growth

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Government-led subsidies and Intel's massive fab investment to drive market

- 10.4.2 NETHERLANDS

- 10.4.2.1 ASML's R&D leadership and EU Chips Act to propel market

- 10.4.3 IRELAND

- 10.4.3.1 Multinational tech investments to drive market

- 10.4.4 UK

- 10.4.4.1 Government-led semiconductor strategy and focus on quantum computing to boost market

- 10.4.5 ISRAEL

- 10.4.5.1 Innovation-driven startups to accelerate demand

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 ROW

- 10.5.1 BRAZIL

- 10.5.1.1 Government-led investments and reopening of Ceitec to drive market

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Abundant mineral resources and surge in 5G adoption to drive market

- 10.5.3 OTHERS IN ROW

- 10.5.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Type footprint

- 11.6.5.4 End use footprint

- 11.6.5.5 Application footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

- 11.9.3 OTHERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TOKYO OHKA KOGYO CO., LTD.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 JSR CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.3.3 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 BASF

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 SOLVAY

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 DOW

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 HONEYWELL INTERNATIONAL INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths/Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses/Competitive threats

- 12.1.7 FUJIFILM HOLDINGS CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths/Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses/Competitive threats

- 12.1.8 EASTMAN CHEMICAL COMPANY

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Key strengths/Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses/Competitive threats

- 12.1.9 MERCK KGAA (EMD ELECTRONICS)

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Expansions

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strengths/Right to win

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses/Competitive threats

- 12.1.10 SUMITOMO CHEMICAL CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Expansions

- 12.1.10.4 MnM view

- 12.1.10.4.1 Key strengths/Right to win

- 12.1.10.4.2 Strategic choices

- 12.1.10.4.3 Weaknesses/Competitive threats

- 12.1.11 SK INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Others

- 12.1.11.4 MnM view

- 12.1.11.4.1 Key strengths/Right to win

- 12.1.11.4.2 Strategic choices

- 12.1.11.4.3 Weaknesses/Competitive threats

- 12.1.12 DUPONT

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.4 MnM view

- 12.1.12.4.1 Key strengths/Right to win

- 12.1.12.4.2 Strategic choices

- 12.1.12.4.3 Weaknesses/Competitive threats

- 12.1.1 TOKYO OHKA KOGYO CO., LTD.

- 12.2 OTHER PLAYERS

- 12.2.1 RESONAC HOLDINGS CORPORATION

- 12.2.2 MITSUBISHI CHEMICAL CORPORATION

- 12.2.3 PARKER HANNIFIN CORP

- 12.2.4 AVANTOR, INC.

- 12.2.5 AIR PRODUCTS AND CHEMICALS, INC.

- 12.2.6 LINDE PLC

- 12.2.7 CABOT CORPORATION

- 12.2.8 KAO CORPORATION

- 12.2.9 KANTO KAGAKU.

- 12.2.10 NIPPON KAYAKU CO., LTD.

- 12.2.11 FOOSUNG CO., LTD.

- 12.2.12 OCI COMPANY LTD.

- 12.2.13 TOKUYAMA CORPORATION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS, BY REGION, 2021-2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS, BY TYPE, 2021-2024 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS, BY APPLICATION, 2021-2024 (USD/KG)

- TABLE 4 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS, BY END USE, 2021-2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- TABLE 6 ROLES OF COMPANIES IN SEMICONDUCTOR CHEMICALS ECOSYSTEM

- TABLE 7 SEMICONDUCTOR CHEMICALS MARKET: KEY TECHNOLOGIES

- TABLE 8 SEMICONDUCTOR CHEMICALS MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 9 SEMICONDUCTOR CHEMICALS MARKET: ADJACENT TECHNOLOGIES

- TABLE 10 TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 11 MAJOR PATENT OWNERS FOR SEMICONDUCTOR CHEMICALS, 2015-2024

- TABLE 12 SEMICONDUCTOR CHEMICALS MARKET: LIST OF MAJOR PATENTS, 2015-2024

- TABLE 13 SEMICONDUCTOR CHEMICALS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 TARIFFS RELATED TO SEMICONDUCTOR CHEMICALS, 2024

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SEMICONDUCTOR CHEMICALS MARKET: REGULATIONS/STANDARDS

- TABLE 21 SEMICONDUCTOR CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 23 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- TABLE 24 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 25 SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 28 SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 29 SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 32 SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 33 SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 34 SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 35 SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (KILOTON)

- TABLE 36 SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 37 SEMICONDUCTOR CHEMICALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 SEMICONDUCTOR CHEMICALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 SEMICONDUCTOR CHEMICALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 40 SEMICONDUCTOR CHEMICALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 41 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 44 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 45 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 48 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 49 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 52 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 53 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (KILOTON)

- TABLE 56 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 57 CHINA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 58 CHINA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 CHINA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 60 CHINA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 61 JAPAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 JAPAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 JAPAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 64 JAPAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 65 TAIWAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 66 TAIWAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 TAIWAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 68 TAIWAN: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 69 SOUTH KOREA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 SOUTH KOREA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 SOUTH KOREA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 72 SOUTH KOREA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 73 MALAYSIA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 MALAYSIA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 MALAYSIA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 76 MALAYSIA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 77 VIETNAM: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 VIETNAM: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 VIETNAM: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 80 VIETNAM: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 84 REST OF ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 85 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 88 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 89 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 92 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 93 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 96 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 97 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (KILOTON)

- TABLE 100 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 101 US: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 US: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 US: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 104 US: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 105 CANADA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 CANADA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 108 CANADA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 109 MEXICO: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 MEXICO: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 MEXICO: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 112 MEXICO: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 113 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 116 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 117 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 120 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 121 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 124 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 125 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (KILOTON)

- TABLE 128 EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 129 GERMANY: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 132 GERMANY: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 133 NETHERLANDS: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 NETHERLANDS: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 NETHERLANDS: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 136 NETHERLANDS: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 137 IRELAND: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 IRELAND: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 IRELAND: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 140 IRELAND: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 141 UK: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 UK: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 UK: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 144 UK: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 145 ISRAEL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 ISRAEL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 ISRAEL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 148 ISRAEL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 149 REST OF EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 REST OF EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 REST OF EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 152 REST OF EUROPE: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 153 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 156 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 157 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 160 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 161 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 162 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 164 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 165 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 166 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 167 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2021-2024 (KILOTON)

- TABLE 168 ROW: SEMICONDUCTOR CHEMICALS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 169 BRAZIL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 BRAZIL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 BRAZIL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 172 BRAZIL: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 173 SOUTH AFRICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 SOUTH AFRICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH AFRICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 176 SOUTH AFRICA: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 177 OTHERS IN ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 178 OTHERS IN ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 OTHERS IN ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 180 OTHERS IN ROW: SEMICONDUCTOR CHEMICALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 181 SEMICONDUCTOR CHEMICALS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JUNE 2025

- TABLE 182 SEMICONDUCTOR CHEMICALS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 183 SEMICONDUCTOR CHEMICALS MARKET: REGION FOOTPRINT

- TABLE 184 SEMICONDUCTOR CHEMICALS MARKET: TYPE FOOTPRINT

- TABLE 185 SEMICONDUCTOR CHEMICALS MARKET: END USE FOOTPRINT

- TABLE 186 SEMICONDUCTOR CHEMICALS MARKET: APPLICATION FOOTPRINT

- TABLE 187 SEMICONDUCTOR CHEMICALS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 188 SEMICONDUCTOR CHEMICALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 SEMICONDUCTOR CHEMICALS MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 190 SEMICONDUCTOR CHEMICALS MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 191 SEMICONDUCTOR CHEMICALS MARKET: OTHERS, JANUARY 2021-JUNE 2025

- TABLE 192 TOKYO OHKA KOGYO CO., LTD.: COMPANY OVERVIEW

- TABLE 193 TOKYO OHKA KOGYO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 TOKYO OHKA KOGYO CO., LTD.: DEALS

- TABLE 195 TOKYO OHKA KOGYO CO., LTD.: EXPANSIONS

- TABLE 196 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 197 JSR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 JSR CORPORATION: DEALS

- TABLE 199 JSR CORPORATION: EXPANSIONS

- TABLE 200 JSR CORPORATION: OTHERS

- TABLE 201 BASF: COMPANY OVERVIEW

- TABLE 202 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 BASF: DEALS

- TABLE 204 BASF: EXPANSIONS

- TABLE 205 SOLVAY: COMPANY OVERVIEW

- TABLE 206 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 SOLVAY: PRODUCT LAUNCHES

- TABLE 208 SOLVAY: DEALS

- TABLE 209 SOLVAY: EXPANSIONS

- TABLE 210 DOW: COMPANY OVERVIEW

- TABLE 211 DOW: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 212 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 213 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 215 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 216 FUJIFILM HOLDINGS CORPORATION:: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 FUJIFILM HOLDINGS CORPORATION: DEALS

- TABLE 218 FUJIFILM HOLDINGS CORPORATION: EXPANSIONS

- TABLE 219 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 220 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 MERCK KGAA: COMPANY OVERVIEW

- TABLE 222 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 MERCK KGAA: PRODUCT LAUNCHES

- TABLE 224 MERCK KGAA: DEALS

- TABLE 225 MERCK KGAA: EXPANSIONS

- TABLE 226 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 227 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SUMITOMO CHEMICAL CO., LTD.: DEALS

- TABLE 229 SUMITOMO CHEMICAL CO., LTD.: EXPANSIONS

- TABLE 230 SK INC.: COMPANY OVERVIEW

- TABLE 231 SK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SK INC.: DEALS

- TABLE 233 SK INC.: OTHERS

- TABLE 234 DUPONT: COMPANY OVERVIEW

- TABLE 235 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 DUPONT: DEALS

- TABLE 237 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 238 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 239 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 240 AVANTOR, INC.: COMPANY OVERVIEW

- TABLE 241 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 242 LINDE PLC: COMPANY OVERVIEW

- TABLE 243 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 244 KAO CORPORATION: COMPANY OVERVIEW

- TABLE 245 KANTO KAGAKU: COMPANY OVERVIEW

- TABLE 246 NIPPON KAYAKU CO., LTD.: COMPANY OVERVIEW

- TABLE 247 FOOSUNG CO., LTD.: COMPANY OVERVIEW

- TABLE 248 OCI COMPANY LTD.: COMPANY OVERVIEW

- TABLE 249 TOKUYAMA CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SEMICONDUCTOR CHEMICALS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SEMICONDUCTOR CHEMICALS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 SEMICONDUCTOR CHEMICALS MARKET: DATA TRIANGULATION

- FIGURE 8 SOLVENTS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 9 PHOTORESIST SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 10 INTEGRATED CIRCUITS (ICS) SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 11 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 RISING DEMAND FROM ELECTRONICS AND AUTOMOTIVE INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 SOLVENTS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 ETCHING AND PHOTORESIST TO BE FASTEST-GROWING SEGMENTS DURING FORECAST PERIOD

- FIGURE 15 INTEGRATED CIRCUITS AND OPTOELECTRONICS TO BE FASTEST-GROWING SEGMENTS DURING FORECAST PERIOD

- FIGURE 16 TAIWAN TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 17 SEMICONDUCTOR CHEMICALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 USE OF GENERATIVE AI IN SEMICONDUCTOR CHEMICALS MARKET

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 SEMICONDUCTOR CHEMICALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 SEMICONDUCTOR CHEMICALS MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF SEMICONDUCTOR CHEMICALS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- FIGURE 24 SEMICONDUCTOR CHEMICALS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 PATENTS GRANTED FROM 2015 TO 2024

- FIGURE 26 PATENT ANALYSIS, BY LEGAL STATUS, 2015-2024

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED RELATED TO SEMICONDUCTOR CHEMICALS, 2015-2024

- FIGURE 28 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 29 IMPORT DATA RELATED TO HS CODE 381800-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA RELATED TO HS CODE 381800-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 SEMICONDUCTOR CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- FIGURE 34 SOLVENTS SEGMENT TO HOLD LARGEST SHARE OF SEMICONDUCTOR CHEMICALS MARKET IN 2025

- FIGURE 35 PHOTORESIST SEGMENT TO HOLD LARGEST SHARE OF SEMICONDUCTOR CHEMICALS MARKET IN 2025

- FIGURE 36 INTEGRATED CIRCUITS (ICS) SEGMENT TO HOLD LARGEST SHARE OF SEMICONDUCTOR CHEMICALS MARKET IN 2025

- FIGURE 37 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR SEMICONDUCTOR CHEMICALS DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: SEMICONDUCTOR CHEMICALS MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: SEMICONDUCTOR CHEMICALS MARKET SNAPSHOT

- FIGURE 40 EUROPE: SEMICONDUCTOR CHEMICALS MARKET SNAPSHOT

- FIGURE 41 SEMICONDUCTOR CHEMICALS MARKET SHARE ANALYSIS, 2024

- FIGURE 42 SEMICONDUCTOR CHEMICALS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 43 SEMICONDUCTOR CHEMICALS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 44 SEMICONDUCTOR CHEMICALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 SEMICONDUCTOR CHEMICALS MARKET: COMPANY FOOTPRINT

- FIGURE 46 SEMICONDUCTOR CHEMICALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 SEMICONDUCTOR CHEMICALS MARKET: EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 48 SEMICONDUCTOR CHEMICALS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2025

- FIGURE 49 TOKYO OHKA KOGYO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 JSR CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 BASF: COMPANY SNAPSHOT

- FIGURE 52 SOLVAY: COMPANY SNAPSHOT

- FIGURE 53 DOW: COMPANY SNAPSHOT

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 55 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 57 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 58 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 SK INC.: COMPANY SNAPSHOT

- FIGURE 60 DUPONT: COMPANY SNAPSHOT