|

市场调查报告书

商品编码

1777939

全球电解氧化市场(按电极材料、类型、最终用途产业、应用和地区划分)- 预测至 2030 年Electro-Oxidation Market by Type, Electrode Material (Boron-Doped Diamond, Lead Dioxide, Stannic Oxide, Titanium Suboxides, Graphite, and Platinum), Application, End-Use Industry & Region - Forecast to 2030 |

||||||

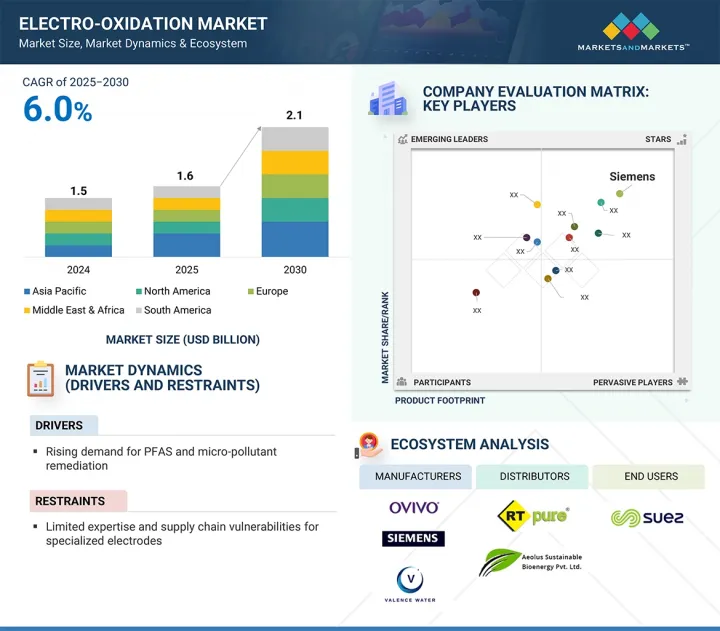

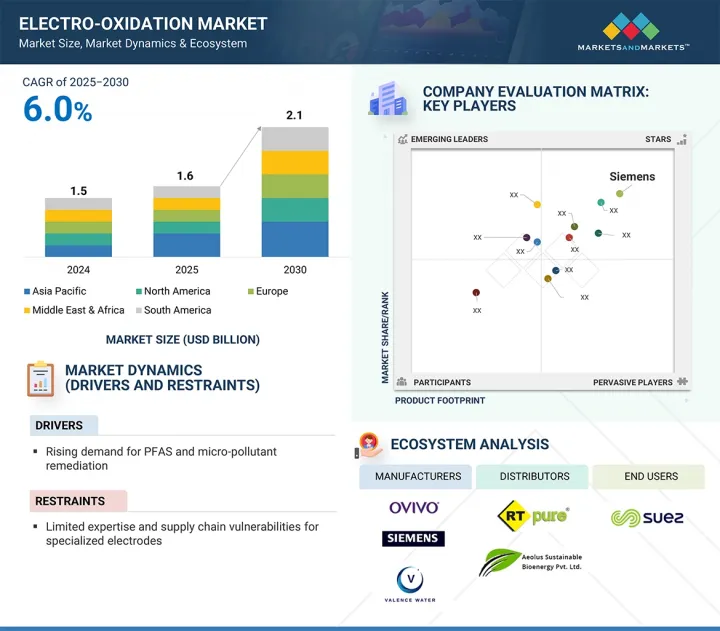

电解氧化市场预计将从 2025 年的 16 亿美元成长到 2030 年的 21 亿美元,预测期内的复合年增长率为 6.0%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元/十亿美元) |

| 部分 | 按电极材料、按类型、按电极材料、按最终用途行业、按应用、按地区 |

| 目标区域 | 北美、欧洲、中东/非洲、南美 |

随着人们对环保水处理解决方案的需求日益增长,电解氧化市场正在不断扩大,以解决持续存在的普遍性水污染和水资源短缺问题。日益严格的全球环境法规迫使各行各业采用新的处理技术以满足废水标准,而电解氧化作为一种能够转化极具挑战性的污染物同时最大限度减少外部输入的方法脱颖而出。在医疗机构和公共供水系统等水安全尤为重要的领域,公共卫生问题日益受到关注,引发了人们对水传播疾病和新兴污染物 (CEC) 的担忧。此外,随着工业脱碳和智慧水资源管理系统的发展,电解氧化作为一种植根于永续性的下一代水处理方法,具有巨大的发展潜力。

直接电解因其操作简单、处理效率高、对额外试剂和催化剂的需求低等特点,预计将成为电解市场中成长最快的细分领域。污染物直接在阳极表面氧化,无需中间阶段或二次氧化剂。这种简单的直接电解机制简化了系统设计、维护和监控,特别适用于寻求高效、稳定、可靠的污水处理解决方案的工业和公共产业客户。直接电解的快速成长主要源自于其能有效分解有机污染物并矿化持久性、非生物分解物质的能力。直接电解在电极表面创造强氧化条件,使极性和非极性污染物完全矿化成无害的最终产物。这对于排放高浓度废水的化学、製药、染料和石化等行业客户尤其具有吸引力,尤其是在生物处理已达到极限或氯和臭氧等化学处理无法有效去除或转化污染物的情况下。

二氧化铅 (PbO2) 正迅速成为电解市场上最受欢迎的电极材料。这一趋势源于其在碱性高级氧化製程中无与伦比的高性能、化学稳定性和成本效益。二氧化铅迅速普及的主要原因是它能够氧化降解多种有机污染物,包括标准治疗方法无法去除的微量和非生物分解的污染物。此外,二氧化铅电极具有较高的析氧过电位,允许羟基自由基等强氧化物质形成,而不会被副反应快速消耗,从而提高处理效率。除了氧化能力外,PbO2 在电化学条件下也表现出优异的稳定性。这使其成为处理含有大量有机物的高污染工业污水的理想电极材料,而其他电极可能会随着时间的推移而劣化或失效。二氧化铅电极的耐用性意味着它们即使在恶劣的腐蚀性环境中也能长时间运作而不会失去氧化能力,从而提高了性能和可靠性。这项特性使得二氧化铅电极在市政和工业应用中常用的连续流处理系统中具有优势。

由于需要处理重金属、硝酸盐和其他无机污染物,无机污染物是电解市场中成长最快的应用领域。电解透过直接电子转移或活性物质生成进行氧化或还原去除无机物,使其成为传统方法无法满足去除需求时非常有效的无机处理技术。由于工业实践的改变和法规的不断完善,电解已成为一种首选的处理技术,主要在亚太地区。在该地区,采矿、化学和电子产业必须符合严格的污染物排放标准。在北美,有关硝酸盐污染的农业法规已修订,涵盖农业径流和地下水,这增加了使用二氧化铅和钛电极进行高效硝酸盐处理的电解试工厂的使用。在欧洲, 《都市废水处理指令》及其关于防止工业废水中污染(包括无机污染物)的要求,引起了人们对化工厂电解的兴趣。在世界银行的支持下,非洲、南美和拉丁美洲国家的采矿活动不断增长,也推动了对能够处理含有重金属的酸性矿井废水的电解製程的需求。

工业製造业正成为电解氧化 (EO) 市场成长最快的终端应用领域,这得益于对先进污水处理技术异常强劲的需求,以满足环境排放标准并支持永续性目标。製造业(包括化学物质和製药业)产生的废水成分复杂,含有顽固有机污染物、重金属以及全氟烷基和多氟烷基物质 (PFAS) 等微量污染物,传统的水处理方法难以永续处理这些废水。电解氧化可以透过直接或间接氧化降解污染物,同时维持硼掺杂钻石和二氧化铅等强电极的性能。当排放标准较低时,电化学污水处理的上限会达到,这主要透过回收污水进行回注来实现。製造业的零液体排放(ZLD) 目标鼓励采用电解氧化技术,并要求减少废弃物,从而实现循环经济并消除所有废弃物。在电解氧化技术产生先进污水处理流程的例子中,对于一些工业企业而言,电解氧化不太可能成为满足现有复杂污水排放标准的客製化处理解决方案。由于电解氧化技术能够处理多种有机和无机污染物,因此可以产生先进的污水,并且能够很好地处理製药厂和化学品製造商为满足复杂的工业废水标准而产生的高 COD、高毒性污水。

本报告研究了全球电解氧化市场,并按电极材料、类型、最终用途行业、应用、区域趋势和公司概况对市场进行了概述。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 生成式人工智慧对电解氧化市场的影响

第六章 产业趋势

- 介绍

- 影响客户业务的趋势/中断

- 价值链分析

- 2025年美国关税的影响-电解氧化市场

- 指示性价格分析

- 投资金筹措场景

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 2025-2026年主要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 宏观经济展望

- 案例研究分析

第七章电解氧化市场(按电极材料)

- 介绍

- 掺硼金刚石

- 二氧化铅

- 氧化锡

- 亚砜钛

- 石墨

- 铂

第 8 章电解氧化市场(按类型)

- 介绍

- 直接电解氧化

- 间接电解氧化

第九章电解氧化市场(依最终用途产业)

- 介绍

- 城市供水和污水处理

- 工业製造

- 纤维

- 食品/饮料

- 矿业

- 其他的

第 10 章电解氧化市场(按应用)

- 介绍

- 有机和微加工部门

- 无机处理

- 消毒和特殊处理

第 11 章电解氧化市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 西班牙

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 阿根廷

- 巴西

- 其他的

第十二章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2024年市场占有率分析

- 收益分析

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 2024 年估值与财务指标

- 竞争场景

第十三章:公司简介

- 主要参与企业

- LUMMUS TECHNOLOGY

- OVIVO USA LLC

- VALENCE WATER INC

- HYDROLEAP

- JIANGSU JINGYUAN ENVIRONMENTAL PROTECTION CO., LTD

- GROUND EFFECTS ENVIRONMENTAL SERVICES INC

- E-FLOC WASTEWATER SOLUTIONS

- YASA ET(SHANGHAI)CO., LTD.

- AQUA PULSAR

- AXINE WATER TECHNOLOGIES

- 其他公司

- AEOLUS SUSTAINABLE BIOENERGY PVT. LTD

- MAGNELI MATERIALS

- HUNAN BOROMOND EPT CO. LTD.

- VENTILAQUA

- RT SAFEBALLAST PVT LTD.

- MAGNETO SPECIAL ANODES(SUZHOU)CO., LTD.

- AQUACARE SOLUTION ENVIRO ENGINEERS

- GREEN ECOWATER SYSTEMS

- BLUE EDEN CLEAN TECHNOLOGY

- PPU UMWELTTECHNIK

第十四章 附录

The electro-oxidation market size is projected to grow from USD 1.6 billion in 2025 to USD 2.1 billion by 2030, registering a CAGR of 6.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Electrode Material, Application, End-Use Industry, and Region |

| Regions covered | North America, Europe, Middle East & Africa, South America |

The market for electro-oxidation is expanding as it meets the rising demand for green water treatment solutions in response to ongoing and widespread issues of water pollution and scarcity. Stricter environmental regulations worldwide are encouraging industries to adopt new treatment technologies to meet effluent standards, and electro-oxidation stands out as a method capable of transforming pollutants that are particularly challenging with minimal external inputs. In sectors where water safety is especially critical, such as healthcare facilities and public water systems, there is increased focus on public health and concerns over waterborne diseases and emerging contaminants (CECs). Additionally, with the growth of industrial decarbonization and smart water management systems, electro-oxidation has significant potential for expansion as a next-generation water treatment approach rooted in sustainability.

" Direct electro-oxidation is the fastest-growing type segment of the electro-oxidation market in terms of value."

Direct electro-oxidation is expected to be the fastest-growing type segment in the electro-oxidation market because it is simple to operate, efficient to treat, and has lower demands for additional reagents or catalysts. Pollutants are oxidized directly at the surface of the anode, with no intermediate steps and no secondary oxidants produced. This straightforward mechanism of direct electro-oxidation simplifies system design, maintenance, and monitoring for industrial or utility clients seeking an efficient, consistent, and reliable wastewater treatment solution. The primary reason for the rapid growth of direct electro-oxidation is its ability to effectively break down organic pollutants and help mineralize persistent, non-biodegradable substances. Direct electro-oxidation creates strong oxidizing conditions at the electrode surface, enabling the complete mineralization of polar and non-polar contaminants into harmless end products. This is particularly appealing to clients discharging high-strength effluents from industries such as chemicals, pharmaceuticals, dyes, and petrochemicals, especially when biological treatment limits are met or chemical treatments such as chlorine and ozone are ineffective in removing or transforming contaminants effectively.

"Lead oxidation is the fastest-growing electrode material segment of the electro-oxidation market in terms of value."

Lead dioxide (PbO2) is rapidly becoming the most popular electrode material in the electro-oxidation market. This trend is driven by its unmatched combination of high performance, chemical stability, and cost-effectiveness in alkaline advanced oxidation processes. A key reason for its quick adoption is its ability to oxidatively break down a wide range of organic pollutants, including micropollutants and non-biodegradable pollutants that standard treatment methods cannot remove. Additionally, lead dioxide electrodes feature a high oxygen evolution overpotential, which enables the formation of strong oxidizing species like hydroxyl radicals without being quickly consumed by side reactions, thus improving treatment efficiency. Besides its oxidizing power, PbO2 shows excellent stability under electrochemical conditions. This makes it a suitable electrode material for treating heavily contaminated industrial wastewater containing high levels of organics, where other electrode options may degrade or lose effectiveness over time. The durability of lead dioxide electrodes means they can operate for a long period in harsh, corrosive environments without losing their oxidizing capability, thereby enhancing performance and reliability. This characteristic gives PbO2 electrodes an advantage in continuous-flow treatment systems, often used in municipal or industrial applications.

"Inorganic pollutant treatment for the fastest-growing electrode material segment of the electro-oxidation market in terms of value."

Inorganic pollutants are the fastest-growing application segment in the electro-oxidation market due to the need to treat heavy metals, nitrates, and other inorganic contaminants. Electro-oxidation removes inorganics through oxidation or reduction by direct electron transfer or reactive species generation, and treatment of inorganics can be very effective when traditional methods cannot meet removal needs. Due to changes in industrial practices and stricter regulations, electro-oxidation is mainly emerging as a preferred treatment technology in the Asia-Pacific region, where industries in mining, chemicals, and electronics must meet stringent discharge standards for pollutants, especially heavy metals-as seen in pilots in China's industrial wastewater and mining industries and in India, where mining operations have a zero-liquid discharge component in wastewater standards. Changes in North America's agricultural regulations for nitrate contamination, which now target agricultural runoff and groundwater, have increased the use of electro-oxidation pilots using lead dioxide or titanium electrodes for effective and efficient nitrate treatment. In Europe, the Urban Waste Water Treatment Directive and its requirements for pollution prevention-including inorganic contaminants-in industrial discharges have generated interest in electro-oxidation applications in chemical plants. The growth of mining activities in countries across Africa, South America, and Latin America has also driven demand for electro-oxidation treatment, as it can treat acidic mine drainage with heavy metals, with support from the World Bank.

"Industrial manufacturing is expected to be the fastest-growing segment of the electro-oxidation market in terms of value."

Industrial manufacturing is becoming the fastest-growing end-use segment of the Electro-Oxidation (EO) market due to its highly intense demand for advanced wastewater treatment to comply with water discharge environmental standards and support sustainability goals. The manufacturing sectors (including chemicals and pharmaceuticals) produce complex effluents with recalcitrant organic contaminants along with heavy metals and micropollutants like per- and polyfluoroalkyl substances (completed grouped as PFAS) that conventional water treatments struggle to sustainably treat. Electro-oxidation is able to degrade contaminants through either direct or indirect oxidation which can preserve strong electrodes such as boron-doped diamond or lead dioxide. The upper limits of electrochemical wastewater treatment occur when poor discharge standards are being achieved with the primary goal of reclaiming wastewater for the purpose of reinjection. The zero-liquid discharge (ZLD) goals in manufacturing industries encourage the adoption of electro-oxidation, forcing the reduction of wastes with the intention of implementing circular economy practices and the elimination of any waste. In the instance of electro-oxidation producing advanced wastewater treatment processes, it is highly unlikely electro-oxidation will become a discrete treatment solution catered to some industrial companies' efforts to meet complex existing discharge standards in their rejected water. Electro-oxidation has the potential to generate advanced wastewater as it has the ability to treat a wide range of organic and inorganic contaminants, and works well with high-COD, highly toxic effluents from a pharmaceutical manufacturer or a chemical manufacturer trying to comply with their complex industry water discharge standards.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Electro-Oxidation market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East & Africa - 10%, South America - 5%.

Aqua Pulsar (US), Hydroleap (Singapore), Yasa ET (Shanghai) Co., Ltd. (China), OVIVO USA LLC (US), E-FLOC (US), Siemens (Germany), Valence Water Inc. (Colombia), PPU Umwelttechnik (Germany), Inc. (Canada), and Jiangsu Jingyuan Environmental Protection Co., Ltd (China) are the major companies in this market. The study includes an in-depth competitive analysis of these key players in the electro-oxidation market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the electro-oxidation market based on type, electrode material, application, end-use industry, and region and provides estimates for the overall market value across different regions. It has also conducted a detailed analysis of key industry players to offer insights into their business overviews, products and services, key strategies, and expansions related to the electro-oxidation market.

Key benefits of buying this report

This research report focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the electro-oxidation market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers (Rising Demand for PFAS and Micro-Pollutant Remediation), restraints (Limited Expertise and Supply Chain Vulnerabilities for Specialized Electrodes), opportunities (Integration of Renewable Energy Sources to Reduce Operational Costs), and challenges (Partial Oxidation of Ammonia and Ions Requiring Additional Processes).

- Market Penetration: Comprehensive information on the Electro-Oxidation market offered by top players in the electro-oxidation market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, partnership, agreement, joint venture, collaboration, announcement, awards, and expansion in the market.

- Market Development: The report provides comprehensive information about lucrative emerging markets and analyzes the electro-oxidation market across regions.

- Market Capacity: Production capacities of companies producing electro-oxidation are provided wherever available, with upcoming capacities for the electro-oxidation market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the electro-oxidation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRO-OXIDATION MARKET

- 4.2 ELECTRO-OXIDATION MARKET, BY TYPE

- 4.3 ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL

- 4.4 ELECTRO-OXIDATION MARKET, BY APPLICATION

- 4.5 ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY

- 4.6 ELECTRO-OXIDATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for PFAS and micro-pollutant remediation

- 5.2.1.2 Adoption in decentralized and modular wastewater treatment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited expertise and supply chain vulnerabilities for specialized electrodes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of renewable energy sources to reduce operational costs

- 5.2.3.2 Treatment of non-biodegradable organic compounds and nitrogen organisms

- 5.2.4 CHALLENGES

- 5.2.4.1 Partial oxidation of ammonia and ions requiring additional processes

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON ELECTRO-OXIDATION MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT ON ELECTRO-OXIDATION MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL PROCUREMENT

- 6.3.2 TECHNOLOGY DEVELOPMENT & R&D

- 6.3.3 COMPONENT MANUFACTURING & ASSEMBLY

- 6.3.4 SYSTEM INTEGRATION & END-USE CUSTOMIZATION

- 6.3.5 DISTRIBUTION, INSTALLATION & AFTER-SALES SERVICE

- 6.4 IMPACT OF 2025 US TARIFFS-ELECTRO-OXIDATION MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 KEY IMPACT ON VARIOUS REGIONS

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 END-USE INDUSTRY IMPACT

- 6.5 INDICATIVE PRICING ANALYSIS

- 6.5.1 INTRODUCTION

- 6.5.2 INDICATIVE PRICING OF ELECTRO-OXIDATION AMONG KEY PLAYERS, BY TYPE, 2021-2024

- 6.5.3 INDICATIVE PRICE, BY TYPE, 2021-2024

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED, 2015-2024

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 EXPORT SCENARIO (HS CODE 842121)

- 6.10.2 IMPORT SCENARIO (HS CODE 842121)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF, 2024

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS RELATED TO ELECTRO-OXIDATION MARKET

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 APPLICATION OF ELECTRO-OXIDATION TECHNOLOGY FOR EFFECTIVE TREATMENT OF MUNICIPAL LANDFILL LEACHATE

- 6.16.2 OX TREATMENT OF MUNICIPAL WASTEWATER FOR DISCHARGE TO WATERSHED

7 ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL

- 7.1 INTRODUCTION

- 7.2 BORON-DOPED DIAMOND

- 7.2.1 ENABLING HIGH-EFFICIENCY POLLUTANT MINERALIZATION

- 7.3 LEAD DIOXIDE

- 7.3.1 PROVIDING COST-EFFECTIVE OXIDATION OF CONTAMINANTS

- 7.4 STANNIC OXIDE

- 7.4.1 FACILITATING EFFICIENT DEGRADATION WITH STABLE PERFORMANCE

- 7.5 TITANIUM SUBOXIDE

- 7.5.1 DELIVERING CORROSION-RESISTANT OXIDATION SOLUTIONS

- 7.6 GRAPHITE

- 7.6.1 SUPPORTING ECONOMIC ELECTROCHEMICAL TREATMENT

- 7.7 PLATINUM

- 7.7.1 ENHANCING CATALYTIC OXIDATION WITH NOBLE METAL PRECISION

8 ELECTRO-OXIDATION MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 DIRECT ELECTRO-OXIDATION

- 8.2.1 OXIDIZING POLLUTANTS DIRECTLY AT ANODE

- 8.3 INDIRECT ELECTRO-OXIDATION

- 8.3.1 GENERATING INTERMEDIATE OXIDANTS FOR POLLUTANT DEGRADATION

9 ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 MUNICIPAL WATER & WASTEWATER

- 9.2.1 ENSURING PUBLIC WATER SAFETY AND COMPLIANCE

- 9.3 INDUSTRIAL MANUFACTURING

- 9.3.1 TREATING ORGANIC POLLUTANTS IN INDUSTRIAL WASTEWATER

- 9.4 TEXTILES

- 9.4.1 REMOVING DYES FROM WASTEWATER FOR COMPLIANCE

- 9.5 FOOD & BEVERAGE

- 9.5.1 BALANCING ORGANIC WASTE TREATMENT AND HYGIENE STANDARDS

- 9.6 MINING

- 9.6.1 MITIGATING ENVIRONMENTAL IMPACT OF INORGANIC POLLUTANTS

- 9.7 OTHERS

- 9.7.1 ELECTRONIC & SEMICONDUCTOR

- 9.7.2 AQUACULTURE

10 ELECTRO-OXIDATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 ORGANIC & MICROPOLLUTANT TREATMENT SEGMENT

- 10.2.1 DEGRADING ORGANIC POLLUTANTS AND EMERGING CONTAMINANTS

- 10.3 INORGANIC TREATMENT

- 10.3.1 REMOVING HEAVY METALS AND INORGANIC CONTAMINANTS

- 10.4 DISINFECTION & SPECIALIZED TREATMENT

- 10.4.1 ENSURING MICROBIAL SAFETY AND ENHANCING WATER QUALITY

11 ELECTRO-OXIDATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Stricter industrial effluent control driving electro-oxidation adoption in textile and chemical sectors

- 11.2.2 JAPAN

- 11.2.2.1 Focus on emerging contaminants in electronics and pharmaceutical industries

- 11.2.3 INDIA

- 11.2.3.1 Urban wastewater management driving electro-oxidation adoption in municipal and agricultural sectors

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Water reuse mandates boosting electro-oxidation in semiconductor and municipal sectors

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 PFAS remediation to drive electro-oxidation adoption in municipal and chemical sectors

- 11.3.2 CANADA

- 11.3.2.1 Mining effluent management boosting electro-oxidation in mining and forestry sectors

- 11.3.3 MEXICO

- 11.3.3.1 Industrial water reuse to drive electro-oxidation in manufacturing and textile sectors

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Industrial Compliance Driving Electro-Oxidation adoption in Chemical Sector

- 11.4.2 ITALY

- 11.4.2.1 Water Scarcity Mitigation Driving Electro-oxidation in Agricultural and Aquaculture Sectors

- 11.4.3 FRANCE

- 11.4.3.1 Pharmaceutical Residue Control Boosting Electro-oxidation in Healthcare and Biotech Sectors

- 11.4.4 UK

- 11.4.4.1 Decentralized Demand and Regulatory Shift Fueling Electro-oxidation Uptake

- 11.4.5 SPAIN

- 11.4.5.1 Drought and Industrial Agriculture Demanding Advanced Wastewater Solutions

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Industrial diversification and water sustainability mandates fueling market expansion

- 11.5.1.2 UAE

- 11.5.1.2.1 Water stress and smart infrastructure agenda driving electro-oxidation deployment

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Industrial contamination and urban infrastructure gaps propelling electro-oxidation adoption

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 ARGENTINA

- 11.6.1.1 Aging infrastructure and food processing demand prompt electro-oxidation integration

- 11.6.2 BRAZIL

- 11.6.2.1 Industrial hubs and water scarcity driving electro-oxidation expansion in urban and semi-urban zones

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 ARGENTINA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Product type footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 End-use industry footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LUMMUS TECHNOLOGY

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 OVIVO USA LLC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 VALENCE WATER INC

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HYDROLEAP

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 JIANGSU JINGYUAN ENVIRONMENTAL PROTECTION CO., LTD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 GROUND EFFECTS ENVIRONMENTAL SERVICES INC

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 E-FLOC WASTEWATER SOLUTIONS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 YASA ET (SHANGHAI) CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 AQUA PULSAR

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 AXINE WATER TECHNOLOGIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Other developments

- 13.1.1 LUMMUS TECHNOLOGY

- 13.2 OTHER PLAYERS

- 13.2.1 AEOLUS SUSTAINABLE BIOENERGY PVT. LTD

- 13.2.2 MAGNELI MATERIALS

- 13.2.3 HUNAN BOROMOND EPT CO. LTD.

- 13.2.4 VENTILAQUA

- 13.2.5 RT SAFEBALLAST PVT LTD.

- 13.2.6 MAGNETO SPECIAL ANODES (SUZHOU) CO., LTD.

- 13.2.7 AQUACARE SOLUTION ENVIRO ENGINEERS

- 13.2.8 GREEN ECOWATER SYSTEMS

- 13.2.9 BLUE EDEN CLEAN TECHNOLOGY

- 13.2.10 PPU UMWELTTECHNIK

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INDICATIVE PRICING OF ELECTRO-OXIDATION, BY TYPE, BY KEY PLAYER, 2021-2024 (USD/M3)

- TABLE 2 INDICATIVE PRICING, BY TYPE, 2021-2024 (USD/M3)

- TABLE 3 ELECTRO-OXIDATION MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 4 KEY TECHNOLOGIES IN ELECTRO-OXIDATION

- TABLE 5 COMPLEMENTARY TECHNOLOGIES IN ELECTRO-OXIDATION

- TABLE 6 ELECTRO-OXIDATION MARKET: TOTAL NUMBER OF PATENTS

- TABLE 7 ELECTRO-OXIDATION: LIST OF MAJOR PATENT OWNERS, 2015-2024

- TABLE 8 ELECTRO-OXIDATION: LIST OF MAJOR PATENTS, 2015-2024

- TABLE 9 EXPORT DATA OF HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 IMPORT DATA OF HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 11 ELECTRO-OXIDATION MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 TARIFFS RELATED TO ELECTRO-OXIDATION MARKET, 2024

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REGULATIONS FOR PLAYERS IN ELECTRO-OXIDATION

- TABLE 19 ELECTRO-OXIDATION MARKET: IMPACT OF FIVE PORTER FORCES

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 22 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 24 ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 25 ELECTRO-OXIDATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 ELECTRO-OXIDATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 28 ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 29 ELECTRO-OXIDATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 ELECTRO-OXIDATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 ELECTRO-OXIDATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, ELECTRODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 38 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 39 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 43 CHINA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 CHINA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 JAPAN: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 46 JAPAN: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 47 INDIA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 48 INDIA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 SOUTH KOREA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 50 SOUTH KOREA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 REST OF ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 REST OF ASIA PACIFIC: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: ELECTRO-OXIDATION MARKET, ELECTRODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 US: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 64 US: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 CANADA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 66 CANADA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 MEXICO: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 68 MEXICO: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 EUROPE: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: ELECTRO-OXIDATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 EUROPE: ELECTRO-OXIDATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: ELECTRO-OXIDATION MARKET, ELECTRODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 GERMANY: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 80 GERMANY: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 ITALY: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 82 ITALY: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 83 FRANCE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 84 FRANCE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 UK: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 86 UK: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 SPAIN: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 88 SPAIN: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 REST OF EUROPE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 90 REST OF EUROPE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, ELECTRODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 SAUDI ARABIA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 SAUDI ARABIA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 UAE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 104 UAE: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 REST OF GCC COUNTRIES: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 REST OF GCC COUNTRIES: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 SOUTH AFRICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 SOUTH AFRICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 REST OF MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 REST OF MIDDLE EAST & AFRICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY COUNTRY, 2025-2030(USD MILLION)

- TABLE 113 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 114 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 115 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, ELECTRODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 116 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY ELECTRODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 117 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 ARGENTINA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 ARGENTINA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 BRAZIL: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 BRAZIL: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 REST OF SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 REST OF SOUTH AMERICA: ELECTRO-OXIDATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 ELECTRO-OXIDATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 128 ELECTRO-OXIDATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 129 ELECTRO-OXIDATION MARKET: REGION FOOTPRINT

- TABLE 130 ELECTRO-OXIDATION MARKET: TYPE FOOTPRINT

- TABLE 131 ELECTRO-OXIDATION MARKET: APPLICATION FOOTPRINT

- TABLE 132 ELECTRO-OXIDATION MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 133 ELECTRO-OXIDATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 134 ELECTRO-OXIDATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 135 ELECTRO-OXIDATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 136 ELECTRO-OXIDATION MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 137 ELECTRO-OXIDATION MARKET: OTHERS, JANUARY 2021-MAY 2025

- TABLE 138 LUMMUS TECHNOLOGY : COMPANY OVERVIEW

- TABLE 139 LUMMUS TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 LUMMUS TECHNOLOGY: DEALS, JANUARY 2020-MARCH 2025

- TABLE 141 OVIVO USA LLC: COMPANY OVERVIEW

- TABLE 142 OVIVO USA LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 OVIVO USA LLC: DEALS, JANUARY 2020-MARCH 2025

- TABLE 144 OVIVO USA LLC: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 145 VALENCE WATER INC: COMPANY OVERVIEW

- TABLE 146 VALENCE WATER INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 VALENCE WATER INC: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 148 HYDROLEAP: COMPANY OVERVIEW

- TABLE 149 HYDROLEAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 HYDROLEAP: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 151 JIANGSU JINGYUAN ENVIRONMENTAL PROTECTION CO., LTD: COMPANY OVERVIEW

- TABLE 152 JIANGSU JINGYUAN ENVIRONMENTAL PROTECTION CO., LTD: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 153 GROUND EFFECTS ENVIRONMENTAL SERVICES INC: COMPANY OVERVIEW

- TABLE 154 GROUND EFFECTS ENVIRONMENTAL SERVICES INC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 155 E-FLOC WASTEWATER SOLUTIONS: COMPANY OVERVIEW

- TABLE 156 E-FLOC WASTEWATER SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 YASA ET (SHANGHAI) CO., LTD: COMPANY OVERVIEW

- TABLE 158 YASA ET (SHANGHAI) CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 AQUA PULSAR: COMPANY OVERVIEW

- TABLE 160 AQUA PULSAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 AXINE WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 162 AXINE WATER TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 AXINE WATER TECHNOLOGIES: DEALS, JANUARY 2020-MARCH 2025

- TABLE 164 AXINE WATER TECHNOLOGIES: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 165 AEOLUS SUSTAINABLE BIOENERGY PVT. LTD: COMPANY OVERVIEW

- TABLE 166 MAGNELI MATERIALS: COMPANY OVERVIEW

- TABLE 167 HUNAN BOROMOND EPT CO. LTD.: COMPANY OVERVIEW

- TABLE 168 VENTILAQUA: COMPANY OVERVIEW

- TABLE 169 RT SAFEBALLAST PVT LTD.: COMPANY OVERVIEW

- TABLE 170 MAGNETO SPECIAL ANODES (SUZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 171 AQUACARE SOLUTION ENVIRO ENGINEERS: COMPANY OVERVIEW

- TABLE 172 GREEN ECOWATER SYSTEMS: COMPANY OVERVIEW

- TABLE 173 BLUE EDEN CLEAN TECHNOLOGY: COMPANY OVERVIEW

- TABLE 174 PPU UMWELTTECHNIK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRO-OXIDATION MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 ELECTRO-OXIDATION MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 ELECTRO-OXIDATION MARKET: DATA TRIANGULATION

- FIGURE 9 INDIRECT ELECTRO-OXIDATION SEGMENT TO LEAD MARKET IN 2025

- FIGURE 10 BORON-DOPED DIAMOND BASED SEGMENT TO REGISTER HIGHEST CAGR FORECAST PERIOD

- FIGURE 11 ORGANIC & MICROPOLLUTANT TREATMENT SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 12 MUNICIPAL WATER & WASTEWATER SEGMENT TO REMAIN LARGEST SEGMENT THROUGH 2030

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 GROWING USE OF ELECTRO-OXIDATION IN SEMICONDUCTOR & ELECTRONICS INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES

- FIGURE 15 DIRECT ELECTRO-OXIDATION SEGMENT TO REGISTER FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 16 STANNIC OXIDE BASED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INORGANIC TREATMENT SEGMENT TO REGISTER FASTEST GROWTH DURING 2025-2030

- FIGURE 18 INDUSTRIAL MANUFACTURING SEGMENT TO REGISTER HIGHEST CAGR DURING 2025-2030

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 ELECTRO-OXIDATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 USE OF GENERATIVE AI IN ELECTRO-OXIDATION MARKET

- FIGURE 22 ELECTRO-OXIDATION MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 ELECTRO-OXIDATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 ELECTRO-OXIDATION: INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 ELECTRO-OXIDATION: ECOSYSTEM ANALYSIS

- FIGURE 26 NUMBER OF PATENTS GRANTED (2015-2024)

- FIGURE 27 ELECTRO-OXIDATION: LEGAL STATUS OF PATENTS

- FIGURE 28 PATENT ANALYSIS FOR ELECTRO-OXIDATION, BY JURISDICTION, 2015-2024

- FIGURE 29 TOP 7 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 30 EXPORT DATA OF HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 IMPORT DATA OF HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 32 ELECTRO-OXIDATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 BORON-DOPED DIAMOND SEGMENT TO LEAD ELECTRO-OXIDATION MARKET IN 2025

- FIGURE 36 INDIRECT ELECTRO-OXIDATION TO BE LARGEST SEGMENT OF ELECTRO-OXIDATION MARKET IN 2025

- FIGURE 37 MUNICIPAL WATER & WASTEWATER SEGMENT TO LEAD ELECTRO-OXIDATION MARKET IN 2025

- FIGURE 38 ORGANIC & MICROPOLLUTANT TREATMENT TO LEAD ELECTRO-OXIDATION MARKET IN 2025

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: ELECTRO-OXIDATION MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: ELECTRO-OXIDATION MARKET SNAPSHOT

- FIGURE 42 EUROPE: ELECTRO-OXIDATION MARKET SNAPSHOT

- FIGURE 43 ELECTRO-OXIDATION MARKET SHARE ANALYSIS, 2024

- FIGURE 44 ELECTRO-OXIDATION MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 45 ELECTRO-OXIDATION MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 ELECTRO-OXIDATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 ELECTRO-OXIDATION MARKET: COMPANY FOOTPRINT

- FIGURE 48 ELECTRO-OXIDATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 ELECTRO-OXIDATION MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 50 ELECTRO-OXIDATION MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2020-2024