|

市场调查报告书

商品编码

1782033

全球屏蔽泵市场按类型、最终用户、容量、安装类型、马达类型、泵浦设计和地区划分—预测至 2030 年Canned Motor Pumps Market by Type, By End User, Capacity, Installation Type, Motor Type, Pump Design and Region - Global Forecast to 2030 |

||||||

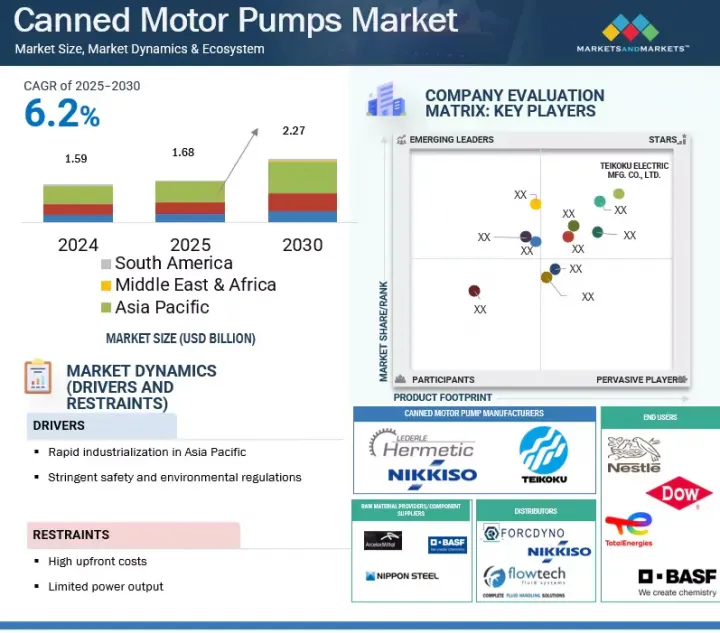

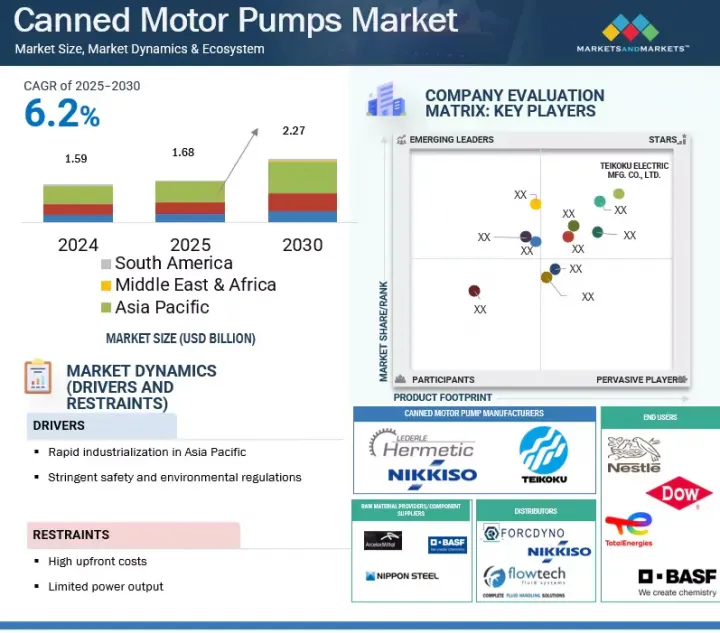

预计全球屏蔽泵市场规模将从 2025 年的 16.8 亿美元成长到 2030 年的 22.7 亿美元,预测期内的复合年增长率为 6.2%。

快速工业化是推动各行各业使用屏蔽泵的主要因素。随着各国製造能力和基础设施的提升,对可靠、高效、安全的流体处理解决方案的需求日益增长。屏蔽帮浦采用全密封设计,能够有效防止洩漏,是处理危险或腐蚀性流体的理想选择。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 类型、最终用户、容量、安装类型、马达类型、泵浦设计 |

| 目标区域 | 北美、欧洲、亚太地区、南美、中东和非洲 |

屏蔽泵的主要终端应用产业包括化学加工、石油天然气、发电和水处理。推动工业成长不仅增加了对这些泵浦的需求,也支持了全球能源效率和环境保护的趋势。更严格的法规和减少环境影响的需求,正在鼓励各行各业使用维护成本低、可靠性高的屏蔽泵。此外,自动化、数位技术和材料科学的发展使这些泵浦能够在更苛刻的条件下运行,从而支援持续的工业成长和现代化进程。

“预计在预测期内,中等容量部分将占据屏蔽泵市场的最大份额。”

预计未来几年,中等容量屏蔽帮浦市场将占据屏蔽帮浦市场的最大份额。中等容量屏蔽泵设计用于处理中等流量和压力,通常是製程工业的基础。这些泵浦通常能够处理50-200立方公尺/小时范围内的平衡流量。它们因其可靠性、节能性和紧凑的设计而备受推崇。它们广泛应用于化学、石化和油气行业,在这些行业中,无洩漏地处理腐蚀性和易燃液体至关重要。选择中等容量屏蔽泵的主要原因是其无洩漏运作、极短的维护停机时间和操作灵活性。

“预计电力行业将成为预测期内增长最快的终端用户。”

电力产业是全球屏蔽泵市场成长最快的终端用户,预测期内复合年增长率为 6.9%。在电力产业,屏蔽泵对于安全、可靠和高效的流体传输至关重要。它们对于核能发电厂锅炉给水和冷凝水水管理等任务尤其重要。在核能发电厂中,屏蔽泵通常用于输送放射性和超纯流体的系统。这些系统包括一次冷却水迴路、硼酸盐系统、化学容积控制系统 (CVCS) 和核子反应炉给水操作。屏蔽泵坚固的结构使其能够在高压、高温和辐射下运作,确保关键核能过程的安全稳定运作。其紧凑的密封设计降低了噪音水平,并易于整合到工厂系统中,从而提高了运行效率和环境安全。电力产业使用屏蔽泵的主要原因是其可靠性、低维护要求以及在恶劣条件下安全运行的能力。

本报告分析了全球屏蔽帮浦市场,并提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 屏蔽泵市场为企业带来诱人机会

- 亚太地区屏蔽帮浦市场依最终用户和国家划分

- 屏蔽帮浦市场类型

- 屏蔽泵浦市场(按马达类型)

- 屏蔽泵市场(按安装类型)

- 屏蔽泵浦市场容量

- 屏蔽泵浦市场(按最终用户划分)

- 屏蔽泵浦市场(按泵浦设计)

- 屏蔽泵浦市场(按地区)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 供应链分析

- 生态系分析

- 案例研究分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 定价分析

- 各类型屏蔽泵参考价格(2024年)

- 各地区屏蔽帮浦平均销售价格趋势(2021-2024年)

- 贸易分析

- 出口情形(HS 编码 841370)

- 进口情形(HS 编码 841370)

- 专利分析

- 大型会议和活动(2025-2026年)

- 投资金筹措场景

- 监管格局

- 监管机构、政府机构和其他组织

- 屏蔽泵浦市场的监管

- 波特五力分析

- 主要相关利益者和采购标准

- 生成式人工智慧/人工智慧对屏蔽帮浦市场的影响

- 生成式人工智慧/人工智慧在屏蔽帮浦市场的应用

- 生成式人工智慧/人工智慧对最终用户屏蔽帮浦市场的影响

- 生成式人工智慧/人工智慧对各地区屏蔽帮浦市场的影响

- 全球宏观经济展望

- 介绍

- GDP趋势与预测

- 通货膨胀对屏蔽泵市场的影响。

- 2025年美国关税的影响—概述

- 介绍

- 主要关税税率

- 对该地区的影响

第六章 屏蔽泵浦市场(按类型)

- 介绍

- 标准基本泵

- 反循环泵

- 高温泵浦

- 自吸帮浦

- 其他的

7. 屏蔽泵浦市场(按泵浦设计)

- 介绍

- 单级

- 多阶段

第 8 章 屏蔽帮浦市场(依马达类型)

- 介绍

- 感应电动机

- 同步电动机

9. 屏蔽帮浦市场(按容量)

- 介绍

- 低的

- 中等的

- 高的

第 10 章 屏蔽帮浦市场(依安装类型)

- 介绍

- 水平的

- 垂直的

第 11 章 屏蔽帮浦市场(依最终用户划分)

- 介绍

- 化学

- 石油和天然气

- 电力

- 冷藏

- 其他最终用户

第 12 章屏蔽帮浦市场、区域分析

- 介绍

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

第十三章竞争格局

- 介绍

- 主要参与企业的策略/优势(2021-2025)

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 品牌/产品比较

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十四章:公司简介

- 主要企业

- TEIKOKU ELECTRIC MFG. CO., LTD.

- NIKKISO CO., LTD.

- KIRLOSKAR BROTHERS LIMITED

- HERMETIC-PUMPEN GMBH

- KSB SE & CO. KGAA

- CRISPUMPS

- OPTIMEX

- CHEMMP (KAIMIPU PUMP (SUZHOU) CO., LTD.)

- MONIBA ANAND ELECTRICALS PVT. LTD.

- ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD.

- HAYWARD TYLER LTD.

- HERMAG PUMPS

- DALIAN KEHUAN PUMP CO., LTD.

- DYNAMIC PUMPS & PROJECTS(I)PVT LTD.

- IWAKI CO., LTD.

- BUFFALO PUMPS

- 其他公司

- PRECISION SEALING SOLUTIONS

- FLOW OIL PUMPS PVT. LTD.

- NXL FLOW INSTRUMENTS

- ASSOMA INC.

- GRUPPE RUTSCHI

- DARUIHONG PUMP (DALIAN) CO., LTD.

- FLOWDYNE PUMPS PVT. LTD.

- SINOFLO

第十五章 附录

The global canned motor pumps market is projected to reach USD 2.27 billion by 2030, up from USD 1.68 billion in 2025, registering a CAGR of 6.2% over the forecast period. Rapid industrialization is a major factor driving the use of canned motor pumps across different sectors. As countries develop their manufacturing capabilities and infrastructure, they need reliable, efficient, and safe fluid handling solutions. Canned motor pumps have a hermetically sealed design that provides excellent protection against leaks, making them perfect for applications that involve hazardous or corrosive fluids.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, End User, Capacity, Installation Type, Motor Type, and Pump Design |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

The key end-use industries of canned motor pumps include chemical processing, oil & gas, power generation, and water treatment. The push for industrial growth not only increases the demand for these pumps but also supports global trends aimed at energy efficiency and protecting the environment. Stricter regulations and the need to reduce environmental impact encourage industries to use canned motor pumps, which require low maintenance and offer high reliability. Furthermore, developments in automation, digital technology, and materials science allow these pumps to operate under tougher conditions, supporting ongoing industrial growth and modernization efforts.

"The medium capacity segment is estimated to account for the largest share of the canned motor pumps market during the forecast period."

The medium capacity segment is expected to account for the largest share in the canned motor pumps market in the coming years. Medium capacity canned motor pumps are designed to handle moderate flow rates and pressures. They often serve as a foundation for process industries. These pumps usually manage balanced flow rates between 50 and 200 m3/h. They are appreciated for their reliability, energy efficiency, and compact design. They are widely used in chemical, petrochemical, and oil & gas industries, where it is crucial to handle aggressive or flammable liquids without leaks. The main reason for choosing medium capacity canned motor pumps is their ability to operate without leaks, minimize maintenance downtime, and provide operational flexibility.

"The power segment is projected to be the fastest-growing end user during the forecast period."

The power segment is the fastest-growing end user in the global canned motor pumps market, registering a CAGR of 6.9% during the forecast period. In the power industry, canned motor pumps are essential for safe, reliable, and efficient movement of fluids. They are especially important for tasks like circulating cooling water in nuclear power plants and managing boiler feed water and condensate in thermal power plants. In nuclear power plants, canned motor pumps usually work in systems that move radioactive or ultra-pure fluids. This includes primary coolant circuits, borated water systems, chemical volume control systems (CVCS), and reactor feedwater operations. Their strong construction allows them to work well under high pressure, high temperature, and high radiation. This ensures the safe and steady operation of crucial nuclear processes. Their compact, sealed design leads to lower noise levels and makes it easier to fit them into plant systems. This improves both operational efficiency and environmental safety. The main reason for using canned motor pumps in the power sector is their proven reliability, low maintenance needs, and ability to operate safely in extreme conditions.

By region, Asia Pacific is expected to account for the largest share of the canned motor pumps market during the forecast period.

In 2024, Asia Pacific had the largest share of the global canned motor pumps market. The countries in this region include China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China is the biggest market in the region. Key factors driving the market in the region are the demand for reliable, maintenance-free pumping solutions that reduce environmental contamination and operational downtime. The addition of smart technologies and IoT-based monitoring is speeding up adoption, as these features improve efficiency and safety. Government support for green technology and ongoing investments in industrial modernization are likely to keep the market strong in the Asia Pacific region.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

By Designation: C-Level - 35%, Managers - 25%, and Others - 40%

By Region: North America - 27%, Europe - 20%, Asia Pacific - 33%, Middle East & Africa - 12%, and South America - 8%

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

HERMETIC-Pumpen GmbH (Germany), TEIKOKU ELECTRIC MFG. CO., LTD. (Japan), Nikkiso Co., Ltd. (Japan), Crispumps (Moldova), Kirloskar Brothers Limited (India), OPTIMEX (France), ChemmP ( Kaimipu Pump (Suzhou) Co., Ltd.) (China), MONIBA ANAND ELECTRICALS PVT. LTD. (India), ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD. (China), Hayward Tyler Ltd. (England), and HERMAG Pumps (Czech Republic) are some of the key players in the canned motor pumps market. The study includes an in-depth competitive analysis of these key players in the canned motor pumps market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the canned motor pumps market by type (Standard Basic Pumps, Reverse Circulation Pumps, High Temperature Pumps, Self-Priming Pumps, Others), by end user (Chemical, Oil & Gas, Power, Refrigeration, Others), by capacity (Low, Medium, High), by installation type (Vertical, Horizontal), by motor type (Synchronous Motors, Induction Motors), by pump design (Single-Stage, Multistage), and by region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the canned motor pumps market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, mergers & acquisitions; and recent developments associated with the canned motor pumps market.

Key Benefits of Buying the Report

- Analysis of key drivers (Rapid industrialization in Asia Pacific, Stringent safety and environmental regulation), restraints (High upfront cost, Limited power output), opportunities (Rising demand for safe handling of hazardous and toxic Fluids, Growth in oil & gas and chemical industries), and challenges (Competition from alternate technologies, Skilled workforce requirement) influencing the growth of the canned motor pumps market.

- Product Development/Innovation: The canned motor pump industry is undergoing rapid transformation, propelled by technological innovation and evolving industrial demands. Recent advancements focus on enhancing energy efficiency, operational reliability, and environmental sustainability. Key innovations include the integration of smart technologies such as IoT and AI, enabling real-time monitoring, predictive maintenance, and remote diagnostics for optimized performance and reduced downtime.

- Market Development: In January 2025, Torishima Pump Mfg Co. Ltd. of Osaka, Japan, and HERMETIC-Pumpen GmbH of Germany formed a business alliance focused on the ammonia fuel sector. The aim of this collaboration is to jointly develop and supply advanced pumping systems capable of safely handling and transferring large volumes of liquefied ammonia, which is gaining attention as a next-generation, carbon-neutral energy source.

- Market Diversification: In January 2023, Nikkiso Co., Ltd. completed the acquisition of Cryotec Anlagenbau GmbH through its Nikkiso Clean Energy & Industrial Gases Group. Cryotec is a German plant engineering and construction company specializing in air separation, liquefaction plants, and CO2 technologies. This strategic move aims to expand Nikkiso's footprint in Europe, enhance its expertise in carbon capture, biogas, and cryogenic solutions, and support the group's sustainability and climate-neutral goals.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like HERMETIC-Pumpen GmbH (Germany), TEIKOKU ELECTRIC MFG. CO., LTD. (Japan), Nikkiso Co., Ltd. (Japan), Crispumps (Moldova), Kirloskar Brothers Limited (India), OPTIMEX (France), ChemmP ( Kaimipu Pump (Suzhou) Co., Ltd.) (China), MONIBA ANAND ELECTRICALS PVT. LTD. (India), ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD. (China), Hayward Tyler Ltd. ( England), and HERMAG Pumps (Czech Republic), among others, in the canned motor pumps market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Demand-side assumptions

- 2.3.3.2 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CANNED MOTOR PUMPS MARKET

- 4.2 ASIA PACIFIC CANNED MOTOR PUMPS MARKET, BY END USER AND COUNTRY

- 4.3 CANNED MOTOR PUMPS MARKET, BY TYPE

- 4.4 CANNED MOTOR PUMPS MARKET, BY MOTOR TYPE

- 4.5 CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE

- 4.6 CANNED MOTOR PUMPS MARKET, BY CAPACITY

- 4.7 CANNED MOTOR PUMPS MARKET, BY END USER

- 4.8 CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN

- 4.9 CANNED MOTOR PUMPS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid industrialization in Asia Pacific

- 5.2.1.2 Stringent safety and environmental regulations

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront costs

- 5.2.2.2 Limited power output

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for safe handling of hazardous and toxic fluids

- 5.2.3.2 Growth of oil & gas and chemical industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of alternative pump technologies

- 5.2.4.2 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 HAYWARD TYLER'S NUCLEAR-GRADE LIQUID RING VACUUM PUMP UPGRADE

- 5.6.2 UPGRADING PUMP BEARINGS FOR GREATER RELIABILITY AND LOWER MAINTENANCE

- 5.6.3 PETROCHEMICAL PLANT MODERNIZATION IN SOUTH-EAST NORWAY

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Hermetically sealed construction

- 5.7.1.2 Canned motor technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Secondary containment & leak monitoring sensors

- 5.7.2.2 IoT-driven canned motor pumps

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 AI and ML for canned motor pumps

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING OF CANNED MOTOR PUMPS, BY TYPE, 2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF CANNED MOTOR PUMPS, BY REGION, 2021-2024

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 841370)

- 5.9.2 IMPORT SCENARIO (HS CODE 841370)

- 5.10 PATENT ANALYSIS

- 5.10.1 LIST OF PATENTS, 2021-2024

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATIONS RELATED TO CANNED MOTOR PUMPS MARKET

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON CANNED MOTOR PUMPS MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN CANNED MOTOR PUMPS MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON CANNED MOTOR PUMPS MARKET, BY END USER

- 5.16.3 IMPACT OF GEN AI/AI ON CANNED MOTOR PUMPS MARKET, BY REGION

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 IMPACT OF INFLATION ON CANNED MOTOR PUMPS MARKET

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON REGION

- 5.18.3.1 North America

- 5.18.3.2 Europe

- 5.18.3.3 Asia pacific

- 5.18.3.4 RoW

6 CANNED MOTOR PUMPS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 STANDARD BASIC PUMPS

- 6.2.1 PRIORITIZATION OF SAFETY, ENERGY EFFICIENCY, AND REGULATORY COMPLIANCE TO DRIVE GROWTH

- 6.3 REVERSE CIRCULATION PUMPS

- 6.3.1 DEMAND IN APPLICATIONS REQUIRING ENHANCED COOLING AND LUBRICATION TO DRIVE SEGMENTAL GROWTH

- 6.4 HIGH TEMPERATURE PUMPS

- 6.4.1 HIGH DEMAND IN PETROCHEMICAL AND SPECIALTY CHEMICAL PROCESSES TO DRIVE MARKET GROWTH

- 6.5 SELF-PRIMING PUMPS

- 6.5.1 ADOPTION IN CHALLENGING FLUID TRANSFER APPLICATIONS TO DRIVE MARKET

- 6.6 OTHERS

7 CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN

- 7.1 INTRODUCTION

- 7.2 SINGLE-STAGE

- 7.2.1 SIMPLICITY, EFFICIENCY, AND RELIABILITY FOR MODERATE HEAD AND FLOW TO DRIVE GROWTH

- 7.3 MULTISTAGE

- 7.3.1 DEMAND FOR HIGH PRESSURE TOLERANCE CANNED MOTOR PUMPS TO DRIVE SEGMENTAL GROWTH

8 CANNED MOTOR PUMPS MARKET, BY MOTOR TYPE

- 8.1 INTRODUCTION

- 8.2 INDUCTION MOTORS

- 8.2.1 SIMPLICITY, EFFICIENCY, AND RELIABILITY FOR MODERATE HEAD AND FLOW TO DRIVE DEMAND

- 8.3 SYNCHRONOUS MOTORS

- 8.3.1 GROWING DEMAND FOR PERMANENT MAGNET MOTORS TO DRIVE GROWTH

9 CANNED MOTOR PUMPS MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 LOW

- 9.2.1 DEMAND FOR RELIABLE, MAINTENANCE-FREE OPERATION FOR PRECISE FLUID HANDLING TO DRIVE GROWTH

- 9.3 MEDIUM

- 9.3.1 LEAK-FREE PERFORMANCE AND OPERATIONAL FLEXIBILITY TO DRIVE GROWTH

- 9.4 HIGH

- 9.4.1 ROBUST SAFETY AND RELIABILITY IN HIGH-RISK ENVIRONMENTS TO DRIVE DEMAND FOR HIGH-CAPACITY CANNED MOTOR PUMPS

10 CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE

- 10.1 INTRODUCTION

- 10.2 HORIZONTAL

- 10.2.1 EASE OF INSTALLATION IN STANDARD INDUSTRIAL SETUPS TO DRIVE GROWTH

- 10.3 VERTICAL

- 10.3.1 INCREASING DEMAND IN SPACE-CONSTRAINED ENVIRONMENTS TO DRIVE GROWTH

11 CANNED MOTOR PUMPS MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 CHEMICAL

- 11.2.1 NEED FOR COMPLIANCE WITH STRINGENT REGULATIONS IN CHEMICAL INDUSTRY TO DRIVE DEMAND

- 11.3 OIL & GAS

- 11.3.1 SUPERIOR SAFETY, REDUCED DOWNTIME, AND HIGH HYDRAULIC PERFORMANCE DRIVING ADOPTION

- 11.4 POWER

- 11.4.1 CRITICAL FLUID HANDLING ABILITY AT EXTREME CONDITIONS TO DRIVE MARKET GROWTH

- 11.5 REFRIGERATION

- 11.5.1 SHIFT TOWARD GREENER AND MORE SUSTAINABLE COOLING SOLUTIONS TO DRIVE MARKET

- 11.6 OTHER END USERS

12 CANNED MOTOR PUMPS MARKET, REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Large-scale investment in chemical and petrochemical capacity to propel market growth

- 12.2.2 INDIA

- 12.2.2.1 PCPIR policy-led investment and industry clustering to propel market growth

- 12.2.3 JAPAN

- 12.2.3.1 Need for decarbonization and process safety in heavy industries to drive growth

- 12.2.4 AUSTRALIA

- 12.2.4.1 Growing demand from mining and resource sectors to drive growth

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Significant investments and expansion projects to boost market growth

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Environmental sustainability and clean energy transition goals to stimulate demand

- 12.3.2 UK

- 12.3.2.1 Increasing investment in water conservation technology to support market growth

- 12.3.3 FRANCE

- 12.3.3.1 Stringent environmental regulations and ambitious renewable energy goals to contribute to market growth

- 12.3.4 ITALY

- 12.3.4.1 Increasing efforts toward reducing water wastage and addressing water scarcity issues to fuel demand

- 12.3.5 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Demand for energy-saving and low-maintenance equipment fueling market growth

- 12.4.2 CANADA

- 12.4.2.1 Supporting government initiatives to drive market growth

- 12.4.3 MEXICO

- 12.4.3.1 Industrial upgrades and government initiatives boosting demand

- 12.4.1 US

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC

- 12.5.1.1 Industrial expansion and infrastructure modernization to support demand

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Saudi Arabia's Vision 2030-driven industrial diversification to support market growth

- 12.5.1.3 UAE

- 12.5.1.3.1 Major petrochemical and industrial project investments to drive market growth

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Infrastructure investments and transition to green industrial processes to drive market

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Import LNG terminal expansion to propel market growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Supportive policies and industrial development plans to boost market growth

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 By pump design

- 13.7.5.4 Type footprint

- 13.7.5.5 End user footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 EXPANSIONS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 TEIKOKU ELECTRIC MFG. CO., LTD.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 NIKKISO CO., LTD.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 KIRLOSKAR BROTHERS LIMITED

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 HERMETIC-PUMPEN GMBH

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 KSB SE & CO. KGAA

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 CRISPUMPS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 OPTIMEX

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 CHEMMP (KAIMIPU PUMP (SUZHOU) CO., LTD.)

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 MONIBA ANAND ELECTRICALS PVT. LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.11 HAYWARD TYLER LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Other development

- 14.1.12 HERMAG PUMPS

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 DALIAN KEHUAN PUMP CO., LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 DYNAMIC PUMPS & PROJECTS (I) PVT LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.15 IWAKI CO., LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.16 BUFFALO PUMPS

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.3.2 Expansions

- 14.1.1 TEIKOKU ELECTRIC MFG. CO., LTD.

- 14.2 OTHER PLAYERS

- 14.2.1 PRECISION SEALING SOLUTIONS

- 14.2.2 FLOW OIL PUMPS PVT. LTD.

- 14.2.3 NXL FLOW INSTRUMENTS

- 14.2.4 ASSOMA INC.

- 14.2.5 GRUPPE RUTSCHI

- 14.2.6 DARUIHONG PUMP (DALIAN) CO., LTD.

- 14.2.7 FLOWDYNE PUMPS PVT. LTD.

- 14.2.8 SINOFLO

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 CANNED MOTOR PUMPS MARKET: RISK ANALYSIS

- TABLE 5 SNAPSHOT OF CANNED MOTOR PUMPS MARKET

- TABLE 6 CANNED MOTOR PUMPS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 INDICATIVE PRICING OF CANNED MOTOR PUMPS, BY TYPE, 2024 (USD/UNIT)

- TABLE 8 AVERAGE SELLING PRICE TREND OF CANNED MOTOR PUMPS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 9 EXPORT DATA FOR HS CODE 841370-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 10 IMPORT DATA FOR HS CODE 841370-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 11 CANNED MOTOR PUMPS MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 CANNED MOTOR PUMPS MARKET: REGULATIONS

- TABLE 17 CANNED MOTOR PUMPS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 19 KEY BUYING CRITERIA, BY END USER

- TABLE 20 WORLD GDP GROWTH, 2021-2028 (USD TRILLION)

- TABLE 21 INFLATION RATE (ANNUAL PERCENT CHANGE), 2024

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES (USD BILLION)

- TABLE 23 CANNED MOTOR PUMPS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 CANNED MOTOR PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 STANDARD BASIC PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 STANDARD BASIC PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 REVERSE CIRCULATION PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 REVERSE CIRCULATION PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 HIGH TEMPERATURE PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 HIGH TEMPERATURE PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 SELF-PRIMING PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 SELF-PRIMING PUMPS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 OTHERS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 OTHERS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2021-2024 (USD MILLION)

- TABLE 36 CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2025-2030 (USD MILLION)

- TABLE 37 SINGLE-STAGE: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 SINGLE-STAGE: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 MULTISTAGE: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 MULTISTAGE: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 CANNED MOTOR PUMPS MARKET, BY MOTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 42 CANNED MOTOR PUMPS MARKET, BY MOTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 43 CANNED MOTOR PUMPS MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 44 CANNED MOTOR PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 45 CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD MILLION)

- TABLE 46 CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD MILLION)

- TABLE 47 HORIZONTAL: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 HORIZONTAL: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 VERTICAL: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 VERTICAL: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 52 CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 53 CHEMICAL: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 CHEMICAL: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OIL & GAS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 OIL & GAS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 POWER: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 POWER: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 REFRIGERATION: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 REFRIGERATION: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 OTHER END USERS: CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 OTHER END USERS: CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 CANNED MOTOR PUMPS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 66 CANNED MOTOR PUMPS MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 67 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 70 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD MILLION)

- TABLE 72 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2021-2024 (USD MILLION)

- TABLE 74 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2025-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 CHINA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 78 CHINA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 79 INDIA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 80 INDIA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 JAPAN: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 82 JAPAN: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 AUSTRALIA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 84 AUSTRALIA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 SOUTH KOREA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 86 SOUTH KOREA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 87 REST OF ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: CANNED MOTOR PUMPS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: CANNED MOTOR PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 GERMANY: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 100 GERMANY: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 UK: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 102 UK: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 103 FRANCE: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 104 FRANCE: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 105 ITALY: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 106 ITALY: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 108 REST OF EUROPE: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 US: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 120 US: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 CANADA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 122 CANADA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 MEXICO: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 124 MEXICO: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2021-2024 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2025-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 SAUDI ARABIA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 136 SAUDI ARABIA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 137 UAE: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 138 UAE: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 SOUTH AFRICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 140 SOUTH AFRICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH AMERICA CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY PUMP DESIGN, 2025-2030 (USD MILLION)

- TABLE 151 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 BRAZIL: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 154 BRAZIL: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 155 ARGENTINA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 156 ARGENTINA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 REST OF SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 158 REST OF SOUTH AMERICA: CANNED MOTOR PUMPS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 159 CANNED MOTOR PUMPS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 160 CANNED MOTOR PUMPS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 161 CANNED MOTOR PUMPS MARKET: REGION FOOTPRINT

- TABLE 162 CANNED MOTOR PUMPS MARKET: PUMP DESIGN FOOTPRINT

- TABLE 163 CANNED MOTOR PUMPS MARKET: TYPE FOOTPRINT

- TABLE 164 CANNED MOTOR PUMPS MARKET: END USER FOOTPRINT

- TABLE 165 CANNED MOTOR PUMPS MARKET: KEY STARTUPS/SMES

- TABLE 166 CANNED MOTOR PUMPS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 167 CANNED MOTOR PUMPS MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 168 CANNED MOTOR PUMPS MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 169 CANNED MOTOR PUMPS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 170 TEIKOKU ELECTRIC MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 171 TEIKOKU ELECTRIC MFG. CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 NIKKISO CO., LTD.: COMPANY OVERVIEW

- TABLE 173 NIKKISO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 NIKKISO CO., LTD.: DEALS

- TABLE 175 KIRLOSKAR BROTHERS LIMITED: COMPANY OVERVIEW

- TABLE 176 KIRLOSKAR BROTHERS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 HERMETIC-PUMPEN GMBH: COMPANY OVERVIEW

- TABLE 178 HERMETIC-PUMPEN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 HERMETIC-PUMPEN GMBH: DEALS

- TABLE 180 KSB SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 181 KSB SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 KSB SE & CO. KGAA: DEALS

- TABLE 183 CRISPUMPS: COMPANY OVERVIEW

- TABLE 184 CRISPUMPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 OPTIMEX: COMPANY OVERVIEW

- TABLE 186 OPTIMEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 CHEMMP (KAIMIPU PUMP (SUZHOU) CO., LTD.): COMPANY OVERVIEW

- TABLE 188 CHEMMP (KAIMIPU PUMP (SUZHOU) CO., LTD.): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 189 MONIBA ANAND ELECTRICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 190 MONIBA ANAND ELECTRICALS PVT. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 191 ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD.: COMPANY OVERVIEW

- TABLE 192 ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 ANHUI SHINHOO CANNED MOTOR PUMP CO., LTD.: DEALS

- TABLE 194 HAYWARD TYLER LTD.: COMPANY OVERVIEW

- TABLE 195 HAYWARD TYLER LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 HAYWARD TYLER LTD.: DEALS

- TABLE 197 HAYWARD TYLER LTD.: OTHER DEVELOPMENTS

- TABLE 198 HERMAG PUMPS: COMPANY OVERVIEW

- TABLE 199 HERMAG PUMPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 DALIAN KEHUAN PUMP CO., LTD.: COMPANY OVERVIEW

- TABLE 201 DALIAN KEHUAN PUMP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 DYNAMIC PUMPS & PROJECTS (I) PVT LTD.: COMPANY OVERVIEW

- TABLE 203 DYNAMIC PUMPS & PROJECTS (I) PVT LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 204 IWAKI CO., LTD.: COMPANY OVERVIEW

- TABLE 205 IWAKI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 BUFFALO PUMPS: COMPANY OVERVIEW

- TABLE 207 BUFFALO PUMPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 BUFFALO PUMPS: DEALS

- TABLE 209 BUFFALO PUMPS: EXPANSIONS

- TABLE 210 PRECISION SEALING SOLUTIONS

- TABLE 211 FLOW OIL PUMPS PVT. LTD.

- TABLE 212 NXL FLOW INSTRUMENTS

- TABLE 213 ASSOMA INC.

- TABLE 214 GRUPPE RUTSCHI

- TABLE 215 DARUIHONG PUMP (DALIAN) CO., LTD.

- TABLE 216 FLOWDYNE PUMPS PVT. LTD.

- TABLE 217 SINOFLO

List of Figures

- FIGURE 1 CANNED MOTOR PUMPS MARKET SEGMENTAL AND REGIONAL SCOPE

- FIGURE 2 CANNED MOTOR PUMPS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 CANNED MOTOR PUMPS MARKET: DATA TRIANGULATION

- FIGURE 7 CANNED MOTOR PUMPS MARKET: BOTTOM-UP APPROACH

- FIGURE 8 CANNED MOTOR PUMPS MARKET: TOP-DOWN APPROACH

- FIGURE 9 CANNED MOTOR PUMPS MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 10 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF CANNED MOTOR PUMPS

- FIGURE 11 CANNED MOTOR PUMPS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 12 STANDARD BASIC PUMPS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 SINGLE-STAGE SEGMENT TO ACCOUNT FOR LARGER SHARE OF CANNED MOTOR PUMPS MARKET DURING FORECAST PERIOD

- FIGURE 14 CHEMICAL TO BE LARGEST END USER IN CANNED MOTOR PUMPS MARKET DURING FORECAST PERIOD

- FIGURE 15 MEDIUM SEGMENT TO LEAD CANNED MOTOR PUMPS MARKET DURING FORECAST PERIOD

- FIGURE 16 HORIZONTAL SEGMENT TO ACCOUNT FOR DOMINANT MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 INDUCTION MOTORS SEGMENT TO LEAD CANNED MOTOR PUMPS MARKET DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF CANNED MOTOR PUMPS MARKET IN 2024

- FIGURE 19 HIGH ADOPTION OF CANNED MOTOR PUMPS IN CHEMICAL INDUSTRY TO FUEL MARKET GROWTH

- FIGURE 20 CHINA ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC CANNED MOTOR PUMPS MARKET IN 2024

- FIGURE 21 STANDARD BASIC PUMPS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 22 INDUCTION MOTORS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 23 HORIZONTAL SEGMENT TO LEAD CANNED MOTOR PUMPS MARKET IN 2030

- FIGURE 24 MEDIUM SEGMENT TO LEAD CANNED MOTOR PUMPS MARKET IN 2030

- FIGURE 25 CHEMICAL SEGMENT TO LEAD CANNED MOTOR PUMPS MARKET IN 2030

- FIGURE 26 SINGLE-STAGE SEGMENT TO LEAD CANNED MOTOR PUMPS MARKET IN 2030

- FIGURE 27 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 CANNED MOTOR PUMPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 GLOBAL INDUSTRIAL OUTPUT, 2024 (MVA)

- FIGURE 30 GLOBAL MANUFACTURING OUTPUT IN 2023

- FIGURE 31 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 32 SUPPLY CHAIN ANALYSIS: CANNED MOTOR PUMPS MARKET

- FIGURE 33 CANNED MOTOR PUMPS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF CANNED MOTOR PUMPS, BY REGION, 2021-2024

- FIGURE 35 EXPORT SCENARIO FOR HS CODE 841370-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 36 IMPORT SCENARIO FOR HS CODE 841370-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 39 PORTER'S FIVE FORCES ANALYSIS: CANNED MOTOR PUMPS MARKET

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 41 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 42 IMPACT OF GEN AI/AI ON CANNED MOTOR PUMPS MARKET, BY END USER

- FIGURE 43 STANDARD BASIC PUMPS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 44 SINGLE-STAGE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 45 INDUCTION MOTORS SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 46 MEDIUM CAPACITY SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 47 HORIZONTAL SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 48 CHEMICAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 49 REGIONAL SNAPSHOT: ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 CANNED MOTOR PUMPS MARKET SHARE, BY REGION, 2024

- FIGURE 51 ASIA PACIFIC: CANNED MOTOR PUMPS MARKET SNAPSHOT

- FIGURE 52 EUROPE: CANNED MOTOR PUMPS MARKET SNAPSHOT

- FIGURE 53 CANNED MOTOR PUMPS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 54 CANNED MOTOR PUMPS MARKET SHARE ANALYSIS, 2024

- FIGURE 55 COMPANY VALUATION

- FIGURE 56 FINANCIAL METRICS

- FIGURE 57 BRAND/PRODUCT COMPARISON

- FIGURE 58 CANNED MOTOR PUMPS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 59 CANNED MOTOR PUMPS MARKET: COMPANY FOOTPRINT

- FIGURE 60 CANNED MOTOR PUMPS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 61 TEIKOKU ELECTRIC MFG. CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 NIKKISO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 KIRLOSKAR BROTHERS LIMITED: COMPANY SNAPSHOT

- FIGURE 64 KSB SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 65 IWAKI CO., LTD.: COMPANY SNAPSHOT