|

市场调查报告书

商品编码

1782037

全球核子医学软体市场(按软体、应用、疾病、最终用户和地区划分)- 预测至 2030 年Nuclear Medicine Software Market by Software (Image Management, Workflow, PACS, Dosimetry, Treatment, AI/Analytics), Application (Diagnosis, Treatment, Theranostics, Research), Disease (Onco, Neuro, Cardio), End User & Region - Global Forecast to 2030 |

||||||

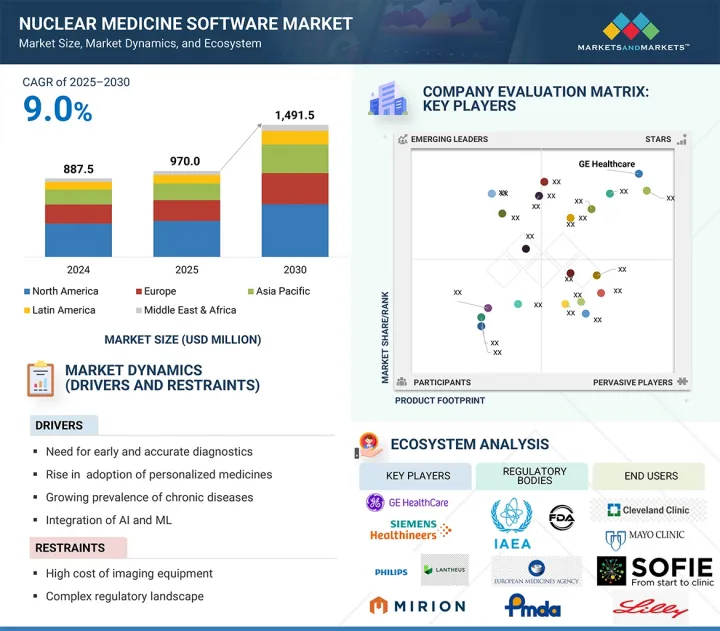

预计 2025 年全球核医软体市场规模为 9.7003 亿美元,到 2030 年将达到 14.916 亿美元,预测期内复合年增长率为 9.0%。

市场成长受到临床和技术进步的影响,以及已开发市场和新兴市场的有利监管和报销框架,这些因素极大地改变了核医学影像和放射性药物治疗的方式。

| 调查范围 | |

|---|---|

| 调查年份 | 2023-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 100万美元 |

| 部分 | 软体类型、工作流程、整合复杂性、软体授权模式、收益模式、应用、治疗领域、技术成熟度、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、拉丁美洲 |

主要成长动力包括对精确影像分析、PACS 整合、剂量测定、治疗计划、进阶分析和报告日益增长的需求。除了诊断影像领域不断增长的需求外,治疗诊断学在治疗性核子医学应用的应用也日益增加。市场主要企业正在将其解决方案与人工智慧驱动的肿瘤分割和自动报告工具结合,以提高诊断准确性和工作流程效率。製药和生命科学产业由于其放射性药物产品线不断扩大,正在推动对先进核医学软体解决方案的需求。此外,越来越多地转向云端原生 PACS 整合和远端存取解决方案也在推动先进软体解决方案的发展。然而,资料安全、基础设施不足和辐射暴露带来的挑战在一定程度上限制了该市场的成长。

“预计云端原生平台将在预测期内实现最快的成长。”

云端原生平台的良好成长是由整个医疗系统对远端存取、互通性和可扩展性日益增长的需求所推动的。核子医学随着多机构协作和人工智慧分析而迅速发展,推动了对云端原生解决方案的需求。这些平台支援即时资料共用、更快的软体更新和增强的网路安全安全功能。此外,医疗保健系统正在转向基于价值的护理方法,其中云端开发的基础设施支援综合决策,从而提高整体患者照护。此外,采用先进的核子医学工作流程需要能够同步影像处理和治疗计划的云端基础的软体平台。提供云端原生平台的公司包括 Sectra 的云端成像平台和 Intelerad 的 IntelePACS 云端。这些解决方案支援 PET/SPECT 检视和报告,并无缝整合 AI 模组以进行远端存取。

“基于订阅/软体即服务 (SaaS) 模式的部分占据了 2024 年核医学软体市场的最大份额。”

在核医软体市场中,基于订阅的软体即服务 (SaaS) 模式在 2024 年占据了软体授权领域的主导地位。这种主导地位归功于该模式提供的低前期成本、灵活性和云端基础的部署。医疗保健提供者、生命科学公司和研究机构正在越来越多地放弃传统的永久授权模式。 SaaS 模型透过提供可预测营运成本的定期软体更新以及与云端原生 PACS 和放射系统的无缝集成,帮助医院和影像中心实现其核子医学摄影工作流程的现代化。随着多中心影像网路的扩展,SaaS 平台支援集中资料存取、可互通的工作流程和远端存取诊断。透过基于订阅的 SaaS 模型提供解决方案的主要市场参与者包括 GE Healthcare 和 Siemens Healthineers。

本报告研究了全球核子医学软体市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 核子医学软体市场概览

- 亚太核医学软体市场(按国家和整合复杂性划分)

- 核子医学软体市场的地理简介

- 核子医学软体市场:区域细分

- 核子医学软体市场:已开发国家与新兴国家

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 产业趋势

- 用例概述

- 整合人工智慧和进阶分析

- 转向混合和多重模式成像解决方案

- 生态系分析

- 供应链分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 监管分析

- 监管机构、政府机构和其他组织

- 监管分析

- 定价分析

- 核医软体主要企业价格参考(2024年)

- 核子医学软体价格指引(按地区)(2024年)

- 定价模式(定性)

- 波特五力分析

- 专利分析

- 核子医学软体解决方案专利出版趋势

- 讨论:管辖权和主要申请人分析

- 主要相关利益者和采购标准

- 最终用户分析

- 未满足的需求

- 最终用户的期望

- 大型会议和活动(2025-2026年)

- 案例研究分析

- 投资金筹措场景

- 经营模式分析

- 基于许可证的经营模式

- 基于订阅的经营模式

- SAAS(软体即服务)经营模式

- 付费使用制经营模式

- 免费增值经营模式

- 整合服务/软体包经营模式

- 人工智慧/生成式人工智慧对核医学软体市场的影响

- 主要用例

- 人工智慧/生成式人工智慧实施案例研究

- 人工智慧/生成人工智慧对互联相邻生态系统的影响

- 使用者准备和影响评估

- 2025年美国关税对核医软体市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

6. 核子医学软体市场(依软体类型)

- 介绍

- 影像撷取与重建软体

- 影像分析和量化软体

- 工作流程管理与编配软体

- PACS 整合和资料管理软体

- 报告和文件软体

- 放射性药物管理软体

- 剂量测定和治疗计划软体

- 品管和品质保证软体

- 人工智慧和进阶分析软体

- 行动和远端存取软体

7. 核子医学软体市场(依工作流程)

- 介绍

- 影像撷取

- 资料处理

- 报告

- 资料管理

第八章核子医学软体市场:依综合复杂性

- 介绍

- 独立解决方案

- 整合解决方案

- 云端原生平台

9. 核子医学软体市场(依软体许可)

- 介绍

- 永久/传统许可证

- 订阅/SaaS 许可证

- 基于使用情况的许可

- 公司协议

第 10 章核医软体市场(按收益模式)

- 介绍

- 软体许可证

- 维护和支援

- 专业服务

- 云端服务

第 11 章核医软体市场(按应用)

- 介绍

- 诊断

- 治疗

- 紧急和统计工作流程

- 临床研究

第十二章 核子医学软体市场(依治疗领域)

- 介绍

- 瘤

- 神经

- 心

- 其他治疗领域

第 13 章核医软体市场(依技术成熟度划分)

- 介绍

- 未来科技

- 成熟的技术

第 14 章核医软体市场(按最终用户)

- 介绍

- 医疗保健提供者

- 製药和生物技术公司

- 医疗技术公司

- 其他最终用户

第 15 章。按地区分類的核子医学软体市场

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 日本

- 中国

- 印度

- 其他亚太地区

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 中东和非洲的宏观经济展望

- 海湾合作委员会国家

- 其他中东和非洲地区

第十六章竞争格局

- 概述

- 主要参与企业的策略/优势

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- PET(正子断层扫描)全球市场占有率分析

- 全球市场占有率分析

- 品牌/产品比较

- 公司估值及财务指标

- 财务指标

- 公司评估

- 市场排名分析

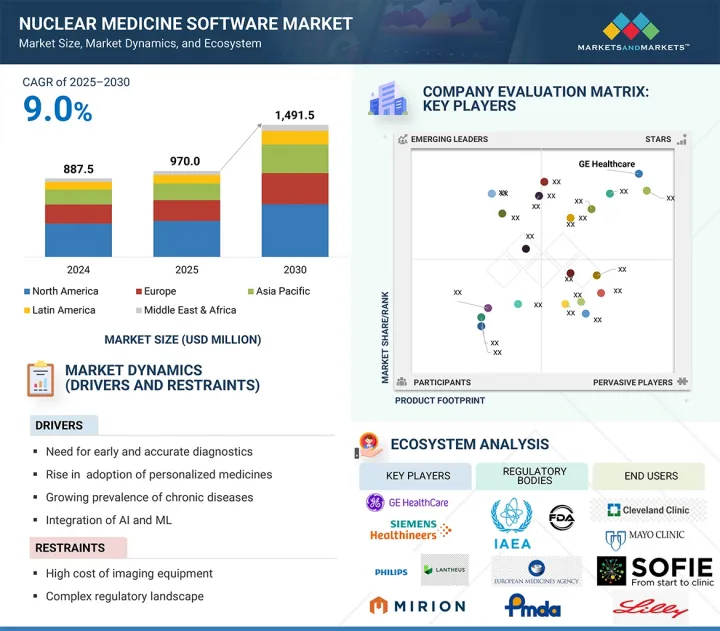

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十七章:公司简介

- 主要企业

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- KONINKLIJKE PHILIPS NV

- LANTHEUS

- CANON MEDICAL SYSTEMS CORPORATION

- MIRION TECHNOLOGIES, INC.

- BRAINLAB AG

- MIRADA MEDICAL LIMITED

- DOSISOFT SA

- BRACCO GROUP

- HERMES MEDICAL SOLUTIONS

- INVIA, LLC

- MEDISO LTD.

- LABLOGIC SYSTEMS LTD.

- COMECER SPA PRIVATE

- RAYSEARCH LABORATORIES

- ULTRASPECT INC.

- SECTRA AB

- AGFA-GEVAERT GROUP

- PERCEPTIVE

- 其他公司

- SYNTERMED INC.

- SEGAMI CORPORATION

- VERSANT MEDICAL PHYSICS & RADIATION SAFETY

- PIXMEO

- PAIRE

- SUBTLE MEDICAL, INC.

第十八章 附录

The nuclear medicine software market was valued at USD 970.03 million in 2025 and is estimated to reach USD 1,491.6 million by 2030, registering a CAGR of 9.0% during the forecast period. Growth in the nuclear medicine software market is being influenced by a convergence of clinical and technological advancements, along with favorable regulatory and reimbursement frameworks in developed and developing nations. These technological advancements are significantly transforming how nuclear medicine imaging and radiopharmaceutical therapies are delivered.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Software Type, Workflow, Integration Complexity, Software Licensing Model, Revenue Model, Application, Therapeutic Area, Technology Maturity, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Key factors driving growth include the increasing demand for accurate image analysis, PACS integration, dosimetry, treatment planning, advanced analytics, and reporting. In addition to the growing demand in the diagnostic imaging segment, nuclear medicine therapeutic applications are seeing an increase in the adoption rates of theranostics. Leading market players are increasingly integrating their solutions with AI-powered tools for tumor segmentation and automated reporting, thereby enhancing diagnostic accuracy and workflow efficiency. The pharmaceutical and life sciences sectors are fueling the demand for advanced nuclear medicine software solutions due to the expanding pipeline of radiopharmaceuticals. Furthermore, the growing transition towards cloud-native PACS integration and remotely accessible solutions is promoting the development of advanced software solutions. However, the growth of this market is moderately restrained due to challenges arising from data security, inadequate infrastructure, and radiation exposure.

"Cloud-native platforms are expected to register the fastest growth over the forecast period."

The lucrative growth of cloud-native platforms is attributed to the increasing demand for remote access, interoperability, and scalability across healthcare systems. Nuclear medicine is rapidly evolving through multi-center collaborations and AI-powered analytics, driving the need for cloud-native solutions. These platforms enable real-time data sharing, faster software updates, and enhanced cybersecurity features. Furthermore, healthcare systems are transitioning towards a value-based care approach, in which cloud-developed infrastructure supports integrated decision-making, thereby enhancing overall patient care. Moreover, the adoption of advanced nuclear medicine workflows requires cloud-based software platforms that can synchronize imaging and treatment planning. Some companies offering cloud-native platforms include Sectra's Cloud Imaging Platform and Intelerad's IntelePACS Cloud. These solutions support PET/SPECT viewing and reporting, seamlessly integrating with AI modules for remote accessibility.

"The subscription-based/Software-as-a-service (SaaS) models segment held the largest share of the nuclear medicine software market in 2024."

The subscription-based Software-as-a-Service (SaaS) model segment dominates the software licensing segment in the nuclear medicine software market in 2024. This dominance is due to the lower upfront costs, flexibility, and cloud-based deployments offered by this model. Healthcare providers, life sciences companies, and research institutes are increasingly shifting from traditional perpetual licensing models because of the high capital expenditures and limited scalability associated with them. SaaS models provide regular software updates with predictable operational costs and seamlessly integrate with cloud-native PACS and radiology systems, thereby supporting hospitals and imaging centers in modernizing their nuclear imaging workflows. With the expansion of multi-site imaging networks, SaaS platforms enable centralized data access, interoperable workflows, and remote access diagnostics. Some of the leading market players offering their solutions through subscription-based SaaS models are GE Healthcare and Siemens Healthineers.

"North America market accounts for the largest share in the nuclear medicine software market in 2024."

The North American market dominated the nuclear medicine software sector in 2024, due to its advanced healthcare infrastructure, increasing adoption of hybrid imaging systems, and strong regulatory support for radiopharmaceutical-based diagnostics and therapeutics. Additionally, the significant presence of market leaders such as GE Healthcare and Siemens Healthineers contributes to the growth of the North American market. In contrast, the Asia Pacific market is expected to register the fastest growth rate over the forecast period. This growth is attributed to rising public and private investments in precision medicine, an escalating disease burden from cancer and cardiovascular diseases, and advancements in infrastructure across China, India, Japan, Australia, and South Korea. Furthermore, the region is experiencing rapid adoption of personalized dosimetry and theranostics, alongside increasing partnerships between local hospitals and globally established companies. Growing patient awareness, rising healthcare IT expenditure, and the increasing adoption of AI-based imaging solutions are further boosting growth in the Asia Pacific market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the nuclear medicine software marketplace.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1 (31%), Tier 2 (31%), and Tier 3 (28%)

- By Designation - C-level Executives (44%), Director-level (31%), and Managers (25%)

- By Region - North America (45%), Europe (28%), Asia Pacific (20%), Latin America (4%), and Middle East & Africa (3%)

Key Players in the Nuclear Medicine Software Market

Prominent players in the nuclear medicine software market include include GE HealthCare (MIM Software Inc.)(US), Siemens Healthineers AG(Germay), Koninklijke Philips N.V. (Netherlands), Lantheus Holdings, Inc. (EXINI Diagnostics AB)(US), Brainlab AG(Germany), Mirada Medical(UK), DOSIsoft SA(France), Bracco Group (Italy), Hermes Medical Solutions (Sweden), INVIA, LLC (US), Mediso Ltd. (Hungary), Canon Medical Systems Corporation (Japan), LabLogic Systems Ltd. (UK), Mirion Technologies (ec2 Software Solutions)(US), COMECER S.p.A.(Italy), RaySearch Laboratories(Sweden), UltraSPECT Inc. (US), Sectra AB (Sweden), Agfa-Gevaert Group (Belgium), Perceptive(UK).

Players adopted both organic and inorganic growth strategies, including product launches and enhancements, as well as investments, partnerships, collaborations, joint ventures, funding, acquisitions, expansions, agreements, contracts, and alliances. These strategies aimed to increase their offerings, meet the unmet needs of customers, boost profitability, and expand their presence globally market.

The study includes an in-depth competitive analysis of these key players in the nuclear medicine software market, with their company profiles, recent developments, and key market strategies.

Research Coverage

- The report studies the nuclear medicine software market based on software type, workflow, integration complexity, software licensing model, revenue model, application, therapeutic area, technology maturity, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micromarkets with respect to their growth trends, prospects, and contributions to the total nuclear medicine software market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms, as well as new entrants/smaller firms, gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the five strategies mentioned below.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing demand for early and accurate diagnostics, growing focus on personalized medicine, integration of automated dosimetry tools, growing prevalence of chronic diseases and subsequent increase in clinical trials, effective monitoring of nuclear medicine software), restraints (high cost of imaging equipment, data privacy and security concerns, shortage of skilled professionals, interpolability issues), opportunities (infrastructure development, increased healthcare IT expenditure, data privacy and regulatory reforms), and challenges (compliance requirements, low penetration of advanced imaging devices, underdeveloped radiopharmcy ecosysytem, economic and financial barriers) influencing the industry macrodynamics of nuclear medicine software market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the nuclear medicine software market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of nuclear medicine software across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the nuclear medicine software market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the nuclear medicine software market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Insights from primary experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ESTIMATION

- 2.6 STUDY ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF NUCLEAR MEDICINE SOFTWARE MARKET

- 4.2 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY COUNTRY & INTEGRATION COMPLEXITY

- 4.3 GEOGRAPHIC SNAPSHOT OF NUCLEAR MEDICINE SOFTWARE MARKET

- 4.4 NUCLEAR MEDICINE SOFTWARE MARKET: REGIONAL MIX

- 4.5 NUCLEAR MEDICINE SOFTWARE MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global disease prevalence

- 5.2.1.2 Surge in AI-powered theranostics

- 5.2.1.3 Adoption of cloud-based platforms & mobile/remote diagnostics

- 5.2.1.4 Radiopharmaceutical supply chain visibility & radiopharmaceutical software

- 5.2.1.5 Expansion of personalized medicine in nuclear applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High acquisition & total cost of ownership

- 5.2.2.2 Regulatory & approval delays with AI integration

- 5.2.2.3 Integration & interoperability challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Precision & predictive dosimetry

- 5.2.3.2 Expansion of tele-nuclear medicine networks & mobile access

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of technical expertise

- 5.2.4.2 Regulatory uncertainties

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 OVERVIEW OF USE CASES

- 5.4.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND ADVANCED ANALYTICS

- 5.4.3 SHIFT TOWARD HYBRID AND MULTI-MODALITY IMAGING SOLUTIONS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 SPECT/PET image reconstruction algorithms

- 5.7.1.2 Quantitative molecular imaging tools

- 5.7.1.3 Radiopharmaceutical dosimetry software

- 5.7.1.4 Artificial intelligence and machine learning

- 5.7.1.5 Multi-modality fusion & co-registration engines

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 DICOM AND HL7 integration engines

- 5.7.2.2 Theranostics workflow orchestration tools

- 5.7.2.3 Cloud-based PACS/archiving solutions

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Molecular imaging-omics integration tools

- 5.7.3.2 Blockchain

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY ANALYSIS

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY ANALYSIS

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICE FOR NUCLEAR MEDICINE SOFTWARE, BY KEY PLAYER (2024)

- 5.9.2 INDICATIVE PRICE FOR NUCLEAR MEDICINE SOFTWARE, BY REGION (2024)

- 5.9.3 PRICING MODELS (QUALITATIVE)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR NUCLEAR MEDICINE SOFTWARE SOLUTIONS

- 5.11.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 END-USER ANALYSIS

- 5.13.1 UNMET NEEDS

- 5.13.2 END-USER EXPECTATIONS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14.1 NUCLEAR MEDICINE SOFTWARE MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 ENSURING PRECISION IN NUCLEAR MEDICINE WITH NATIONAL STANDARD TRACEABILITY

- 5.15.1.1 Case 1: Strengthening quality control and patient outcomes with ANSTO's coordinated CRM program

- 5.15.2 STREAMLINING MULTI-MODALITY IMAGE FUSION FOR BETTER DIAGNOSTICS

- 5.15.2.1 Case 2: GE HealthCare's Xeleris platform enhances multi-modality imaging at a leading academic medical center

- 5.15.3 SUPPORTING REMOTE CONSULTATIONS WITH CLOUD-BASED NUCLEAR MEDICINE ANALYSIS

- 5.15.3.1 Case 3: Sectra's cloud-based solution empowers remote nuclear medicine consultations for regional hospitals

- 5.15.1 ENSURING PRECISION IN NUCLEAR MEDICINE WITH NATIONAL STANDARD TRACEABILITY

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 BUSINESS MODEL ANALYSIS

- 5.17.1 LICENSE-BASED BUSINESS MODELS

- 5.17.2 SUBSCRIPTION-BASED BUSINESS MODELS

- 5.17.3 SOFTWARE-AS-A-SERVICE (SAAS) BUSINESS MODELS

- 5.17.4 PAY-PER-USE BUSINESS MODELS

- 5.17.5 FREEMIUM BUSINESS MODELS

- 5.17.6 INTEGRATED SERVICE AND SOFTWARE BUNDLE BUSINESS MODELS

- 5.18 IMPACT OF AI/GEN AI ON NUCLEAR MEDICINE SOFTWARE MARKET

- 5.18.1 KEY USE CASES

- 5.18.2 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

- 5.18.2.1 Case study 1: AI-based low-dose PET image reconstruction

- 5.18.2.2 Case study 2: Dose-aware diffusion models for 3D low-dose PET

- 5.18.3 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.3.1 Medical image analysis software

- 5.18.3.2 Radiology information systems

- 5.18.3.3 Clinical decision support systems

- 5.18.4 USER READINESS & IMPACT ASSESSMENT

- 5.18.4.1 User readiness

- 5.18.4.1.1 User A: Healthcare providers

- 5.18.4.1.2 User B: Pharmaceutical & biotechnology companies

- 5.18.4.2 Impact assessment

- 5.18.4.2.1 User A: Healthcare providers

- 5.18.4.2.1.1 Implementation

- 5.18.4.2.1.2 Impact

- 5.18.4.2.2 User B: Pharmaceutical & biotechnology companies

- 5.18.4.2.2.1 Implementation

- 5.18.4.2.2.2 Impact

- 5.18.4.2.1 User A: Healthcare providers

- 5.18.4.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFFS ON NUCLEAR MEDICINE SOFTWARE MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE

- 6.1 INTRODUCTION

- 6.2 IMAGE ACQUISITION & RECONSTRUCTION SOFTWARE

- 6.2.1 ABILITY TO OPTIMIZE NUCLEAR IMAGING THROUGH AI-POWERED ACQUISITION AND RECONSTRUCTION SOFTWARE TO DRIVE MARKET

- 6.3 IMAGE ANALYSIS & QUANTIFICATION SOFTWARE

- 6.3.1 AI INNOVATION, WORKFLOW OPTIMIZATION, AND PERSONALIZED CARE TRENDS TO SUPPORT GROWTH

- 6.4 WORKFLOW MANAGEMENT & ORCHESTRATION SOFTWARE

- 6.4.1 NEED FOR ADVANCING NUCLEAR MEDICINE THROUGH INTEGRATED WORKFLOW MANAGEMENT SOLUTIONS TO BOOST GROWTH

- 6.5 PACS INTEGRATION & DATA MANAGEMENT SOFTWARE

- 6.5.1 GROWING NEED FOR RADIOTRACER-AWARE ANALYTICS, COMPLIANCE, AND INTEROPERABILITY TO BOOST ADOPTION

- 6.6 REPORTING & DOCUMENTATION SOFTWARE

- 6.6.1 EXPANDING HEALTHCARE INVESTMENTS IN APAC AND MIDDLE EAST TO ACCELERATE ADOPTION OF REPORTING & DOCUMENTATION SOFTWARE

- 6.7 RADIOPHARMACEUTICAL MANAGEMENT SOFTWARE

- 6.7.1 OPERATIONAL, CLINICAL, AND REGULATORY CATALYSTS TO DRIVE MARKET GROWTH

- 6.8 DOSIMETRY & TREATMENT PLANNING SOFTWARE

- 6.8.1 PRECISION IMAGING AND AI-DRIVEN WORKFLOWS TO ADVANCE DOSIMETRY & TREATMENT PLANNING

- 6.9 QUALITY CONTROL & ASSURANCE SOFTWARE

- 6.9.1 HYBRID-IMAGING QA NEEDS, DIGITAL AUDIT READINESS, AND EDGE-BASED AI FOR OFFLINE ENVIRONMENTS TO FUEL GROWTH

- 6.10 AI & ADVANCED ANALYTICS SOFTWARE

- 6.10.1 ABILITY OF INTEGRATED AI ECOSYSTEMS TO REDEFINE NUCLEAR IMAGING EFFICIENCY TO SUPPORT MARKET

- 6.11 MOBILE & REMOTE ACCESS SOFTWARE

- 6.11.1 GROWING POPULARITY OF PORTABLE AND POINT-OF-CARE SCANNERS TO DRIVE MARKET DEMAND

7 NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW

- 7.1 INTRODUCTION

- 7.2 IMAGE ACQUISITION

- 7.2.1 ADVANCED INNOVATIONS TRANSFORMING IMAGE ACQUISITION INTO DYNAMIC, MULTI-FUNCTIONAL COMPONENTS TO DRIVE MARKET

- 7.3 DATA PROCESSING

- 7.3.1 OPTIMIZING CLINICAL INSIGHTS WITH INTELLIGENT DATA PROCESSING IN NUCLEAR MEDICINE WORKFLOWS TO SUPPORT GROWTH

- 7.4 REPORTING

- 7.4.1 PRECISION AND EFFICIENCY ASSOCIATED WITH AI-INTEGRATED REPORTING SOLUTIONS TO TRANSFORM MARKET

- 7.5 DATA MANAGEMENT

- 7.5.1 GROWING NEED FOR ADVANCED DATA MANAGEMENT SOLUTIONS TO STREAMLINE IMAGING WORKFLOWS TO DRIVE GROWTH

8 NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY

- 8.1 INTRODUCTION

- 8.2 STANDALONE SOLUTIONS

- 8.2.1 AVAILABILITY OF ROBUST STANDALONE SOLUTIONS TAILORED TO SPECIFIC IMAGING AND ANALYSIS NEEDS TO BOOST MARKET

- 8.3 INTEGRATED SOLUTIONS

- 8.3.1 ADVANTAGES SUCH AS REDUCED MANUAL STEPS AND IMPROVED DIAGNOSTIC ACCURACY TO DRIVE DEMAND

- 8.4 CLOUD-NATIVE PLATFORMS

- 8.4.1 ABILITY OF CLOUD-NATIVE PLATFORMS TO DRIVE SCALABLE AND CONNECTED IMAGING IN NUCLEAR MEDICINE TO DRIVE MARKET

9 NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING

- 9.1 INTRODUCTION

- 9.2 PERPETUAL/TRADITIONAL LICENSES

- 9.2.1 GROWING DEMAND FOR PREDICTABLE LONG-TERM COSTS TO DRIVE ADOPTION

- 9.3 SUBSCRIPTION/SAAS LICENSES

- 9.3.1 ABILITY OF CLOUD-BASED SAAS SOLUTIONS TO ENHANCE IMAGING SCALABILITY AND EXPAND ACCESS TO FUEL GROWTH

- 9.4 USAGE-BASED LICENSES

- 9.4.1 ADVANTAGES SUCH AS SCALABLE ACCESS, REGULATORY COMPLIANCE, AND OPTIMIZED COSTS TO DRIVE DEMAND

- 9.5 ENTERPRISE AGREEMENTS

- 9.5.1 SEAMLESS DIGITAL TRANSFORMATION IN NUCLEAR MEDICINE THROUGH ENTERPRISE AGREEMENTS TO SUPPORT MARKET GROWTH

10 NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL

- 10.1 INTRODUCTION

- 10.2 SOFTWARE LICENSES

- 10.2.1 ADVANTAGES SUCH AS SCALABLE, AI-POWERED, AND COMPLIANT IMAGING SOLUTIONS TO DRIVE DEMAND

- 10.3 MAINTENANCE & SUPPORT

- 10.3.1 RELIABLE DIAGNOSTICS AND MINIMIZED DOWNTIME ASSOCIATED WITH MAINTENANCE & SUPPORT SERVICES TO BOOST MARKET

- 10.4 PROFESSIONAL SERVICES

- 10.4.1 OPTIMIZING PHARMACY OPERATIONS THROUGH COMPREHENSIVE AUTOMATION SERVICES TO DRIVE GROWTH

- 10.5 CLOUD SERVICES

- 10.5.1 ACCELERATING NUCLEAR MEDICINE TRANSFORMATION THROUGH CLOUD-DRIVEN IMAGING AND AI INTEGRATION TO BOOST MARKET

11 NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 DIAGNOSTICS

- 11.2.1 AUTOMATED IMAGE INTERPRETATION

- 11.2.1.1 Ability of AI-powered automated interpretation tools to streamline imaging workflows and reduce variability to boost adoption

- 11.2.2 TUMOR SEGMENTATION & QUANTIFICATION

- 11.2.2.1 Advancing precision oncology through AI-powered tumor segmentation solutions to support market growth

- 11.2.1 AUTOMATED IMAGE INTERPRETATION

- 11.3 THERAPEUTICS

- 11.3.1 PREDICTIVE ANALYTICS

- 11.3.1.1 Advantages such as enhanced dosimetry accuracy and improved clinical outcomes to drive growth

- 11.3.2 WORKFLOW OPTIMIZATION & QUALITY CONTROL

- 11.3.2.1 Ability of workflow optimization and quality control solutions to enhance operational efficiency to boost market

- 11.3.3 PERSONALIZED DOSIMETRY CALCULATIONS

- 11.3.3.1 Optimized radiation delivery and standardized nuclear medicine workflows to drive demand

- 11.3.4 THERANOSTICS

- 11.3.4.1 Advantages such as real-time treatment optimization in nuclear medicine to drive popularity of theranostics

- 11.3.1 PREDICTIVE ANALYTICS

- 11.4 EMERGENCY & STAT WORKFLOWS

- 11.4.1 NEED TO ACCELERATE CRITICAL CARE DELIVERY WITH AI-DRIVEN NUCLEAR MEDICINE SOFTWARE SOLUTIONS TO PROPEL MARKET

- 11.5 CLINICAL RESEARCH

- 11.5.1 GROWING DEMAND FOR SCALABLE SERVICE SOLUTIONS THAT STREAMLINE IT DEPLOYMENT TO FURTHER MARKET GROWTH

12 NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA

- 12.1 INTRODUCTION

- 12.2 ONCOLOGY

- 12.2.1 GROWING NEED FOR CANCER DETECTION AND THERAPY PLANNING THROUGH MOLECULAR IMAGING MODALITIES TO DRIVE GROWTH

- 12.3 NEUROLOGY

- 12.3.1 ADVANTAGES SUCH AS EARLY DETECTION, FUNCTIONAL BRAIN MAPPING, AND AUTOMATED DISEASE TRACKING TO DRIVE DEMAND

- 12.4 CARDIOLOGY

- 12.4.1 NEED TO TRANSFORM CARDIAC NUCLEAR IMAGING WITH SMART TECHNOLOGIES TO BOOST GROWTH

- 12.5 OTHER THERAPEUTIC AREAS

13 NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY

- 13.1 INTRODUCTION

- 13.2 UPCOMING TECHNOLOGIES

- 13.2.1 AI & ADVANCED ANALYTICS

- 13.2.1.1 High burden of neurodegenerative diseases and oncology imaging complexity to boost market

- 13.2.2 DOSIMETRY & TREATMENT PLANNING

- 13.2.2.1 Rise of radioligand therapies like lutetium-177 to increase dosimetry software adoption

- 13.2.3 CLOUD-NATIVE PLATFORMS

- 13.2.3.1 Scalable AI-integrated nuclear medicine solutions with remote accessibility to drive nuclear medicine software growth

- 13.2.4 MOBILE & REMOTE ACCESS

- 13.2.4.1 Growing use of portable imaging devices, hybrid care demands, and supportive reimbursement trends to support market growth

- 13.2.1 AI & ADVANCED ANALYTICS

- 13.3 MATURE TECHNOLOGIES

- 13.3.1 IMAGE ACQUISITION & RECONSTRUCTION

- 13.3.1.1 Ability of image reconstruction to drive precision and low-dose imaging in nuclear medicine to boost market

- 13.3.2 PACS INTEGRATION

- 13.3.2.1 Rise of hybrid imaging, need for SUV harmonization, and increasing regulatory focus on dosimetry to propel market

- 13.3.3 QUALITY CONTROL

- 13.3.3.1 Advancing quality control through standardized reconstruction in nuclear medicine to aid growth

- 13.3.1 IMAGE ACQUISITION & RECONSTRUCTION

14 NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 HEALTHCARE PROVIDERS

- 14.2.1 HOSPITALS

- 14.2.1.1 Ability of hospitals to drive diagnostic precision and workflow efficiency in nuclear medicine to boost market

- 14.2.2 OUTPATIENT SETTINGS

- 14.2.2.1 Need for accessibility, efficiency, and growth in nuclear medicine software to boost adoption

- 14.2.3 DIAGNOSTIC & IMAGING CENTERS

- 14.2.3.1 Expanding access and precision in nuclear diagnostics to support market growth

- 14.2.4 RADIOPHARMACIES

- 14.2.4.1 Accelerating radiopharmaceutical precision and safety through radiopharmacy software innovations to fuel growth

- 14.2.5 OTHER HEALTHCARE PROVIDERS

- 14.2.1 HOSPITALS

- 14.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 14.3.1 EXPANDING INFLUENCE OF NUCLEAR MEDICINE SOFTWARE IN RADIOPHARMACEUTICAL R&D AND CLINICAL TRIALS TO BOOST MARKET

- 14.4 MEDTECH COMPANIES

- 14.4.1 NEED TO ADVANCE NUCLEAR IMAGING TRIALS WITH PRECISION SOFTWARE INTEGRATION TO PROPEL MARKET

- 14.5 OTHER END USERS

15 NUCLEAR MEDICINE SOFTWARE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.2.2 US

- 15.2.2.1 Emergence of hybrid imaging systems with enhanced diagnostic accuracy to drive market growth

- 15.2.3 CANADA

- 15.2.3.1 Government initiatives and funding to support market growth

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.3.2 GERMANY

- 15.3.2.1 Rising theranostic procedures to drive demand for advanced dosimetry and imaging software

- 15.3.3 UK

- 15.3.3.1 Infrastructure expansion and digital health initiatives to advance market growth

- 15.3.4 FRANCE

- 15.3.4.1 Accelerated digital transformation and expansion of targeted radiotherapy to drive growth

- 15.3.5 ITALY

- 15.3.5.1 Growing need for tailored diagnostics to drive nuclear medicine software market growth

- 15.3.6 SPAIN

- 15.3.6.1 Targeted public investments to drive advancements in nuclear medicine software

- 15.3.7 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 JAPAN

- 15.4.2.1 Deeply ingrained culture of technological advancements in healthcare and medical imaging to support market

- 15.4.3 CHINA

- 15.4.3.1 China's strategy for healthcare modernization and technological independence to boost growth

- 15.4.4 INDIA

- 15.4.4.1 Steady growth in number of nuclear medicine facilities and SPECT/PET equipment to fuel growth

- 15.4.5 REST OF ASIA PACIFIC

- 15.5 LATIN AMERICA

- 15.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 15.5.2 BRAZIL

- 15.5.2.1 Improving healthcare infrastructure to boost procedural volume

- 15.5.3 MEXICO

- 15.5.3.1 Increasing focus on digital transformation within healthcare system to support market growth

- 15.5.4 REST OF LATIN AMERICA

- 15.6 MIDDLE EAST & AFRICA

- 15.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 15.6.2 GCC COUNTRIES

- 15.6.2.1 Substantial investments and national visions to transform market

- 15.6.3 REST OF MIDDLE EAST & AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NUCLEAR MEDICINE SOFTWARE MARKET

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.4.1 GLOBAL MARKET SHARE ANALYSIS FOR PET (POSITRON EMISSION TOMOGRAPHY)

- 16.4.2 GLOBAL MARKET SHARE ANALYSIS FOR SPECT (SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY)

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY VALUATION & FINANCIAL METRICS

- 16.6.1 FINANCIAL METRICS

- 16.6.2 COMPANY VALUATION

- 16.7 MARKET RANKING ANALYSIS

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Region footprint

- 16.8.5.3 Software type footprint

- 16.8.5.4 Workflow footprint

- 16.8.5.5 Integration complexity footprint

- 16.8.5.6 Application footprint

- 16.8.5.7 Therapeutic area footprint

- 16.8.5.8 End-user footprint

- 16.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.9.1 PROGRESSIVE COMPANIES

- 16.9.2 RESPONSIVE COMPANIES

- 16.9.3 DYNAMIC COMPANIES

- 16.9.4 STARTING BLOCKS

- 16.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.9.5.1 Detailed list of key startups/SMEs

- 16.9.5.2 Competitive benchmarking of startups/SMEs

- 16.10 COMPETITIVE SCENARIO

- 16.10.1 PRODUCT LAUNCHES & APPROVALS

- 16.10.2 DEALS

- 16.10.3 EXPANSIONS

- 16.10.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 GE HEALTHCARE

- 17.1.1.1 Business overview

- 17.1.1.2 Products & services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches & approvals

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 SIEMENS HEALTHINEERS AG

- 17.1.2.1 Business overview

- 17.1.2.2 Products & services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 KONINKLIJKE PHILIPS N.V.

- 17.1.3.1 Business overview

- 17.1.3.2 Products & services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 LANTHEUS

- 17.1.4.1 Business overview

- 17.1.4.2 Products & services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Deals

- 17.1.4.3.2 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 CANON MEDICAL SYSTEMS CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products & services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.6 MIRION TECHNOLOGIES, INC.

- 17.1.6.1 Business overview

- 17.1.6.2 Products & services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.6.4 MnM view

- 17.1.6.4.1 Right to win

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses & competitive threats

- 17.1.7 BRAINLAB AG

- 17.1.7.1 Business overview

- 17.1.7.2 Products & services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product approvals

- 17.1.8 MIRADA MEDICAL LIMITED

- 17.1.8.1 Business overview

- 17.1.8.2 Products & services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product approvals

- 17.1.8.3.2 Deals

- 17.1.9 DOSISOFT SA

- 17.1.9.1 Business overview

- 17.1.9.2 Products & services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product approvals

- 17.1.9.3.2 Deals

- 17.1.10 BRACCO GROUP

- 17.1.10.1 Business overview

- 17.1.10.2 Products & services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches & approvals

- 17.1.11 HERMES MEDICAL SOLUTIONS

- 17.1.11.1 Business overview

- 17.1.11.2 Products & services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches & approvals

- 17.1.11.3.2 Deals

- 17.1.12 INVIA, LLC

- 17.1.12.1 Business overview

- 17.1.12.2 Products & services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches

- 17.1.12.3.2 Deals

- 17.1.13 MEDISO LTD.

- 17.1.13.1 Business overview

- 17.1.13.2 Products & services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches & approvals

- 17.1.14 LABLOGIC SYSTEMS LTD.

- 17.1.14.1 Business overview

- 17.1.14.2 Products & services offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product approvals

- 17.1.15 COMECER S.P.A. PRIVATE

- 17.1.15.1 Business overview

- 17.1.15.2 Products & services offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product updates

- 17.1.15.3.2 Deals

- 17.1.16 RAYSEARCH LABORATORIES

- 17.1.16.1 Business overview

- 17.1.16.2 Products & services offered

- 17.1.16.3 Recent developments

- 17.1.16.3.1 Product launches

- 17.1.17 ULTRASPECT INC.

- 17.1.17.1 Business overview

- 17.1.17.2 Products & services offered

- 17.1.18 SECTRA AB

- 17.1.18.1 Business overview

- 17.1.18.2 Products & services offered

- 17.1.18.3 Recent developments

- 17.1.18.3.1 Product launches

- 17.1.18.3.2 Deals

- 17.1.19 AGFA-GEVAERT GROUP

- 17.1.19.1 Business overview

- 17.1.19.2 Products & services offered

- 17.1.20 PERCEPTIVE

- 17.1.20.1 Business overview

- 17.1.20.2 Products & services offered

- 17.1.20.3 Recent developments

- 17.1.20.3.1 Product launches

- 17.1.20.3.2 Deals

- 17.1.1 GE HEALTHCARE

- 17.2 OTHER PLAYERS

- 17.2.1 SYNTERMED INC.

- 17.2.2 SEGAMI CORPORATION

- 17.2.3 VERSANT MEDICAL PHYSICS & RADIATION SAFETY

- 17.2.4 PIXMEO

- 17.2.5 PAIRE

- 17.2.6 SUBTLE MEDICAL, INC.

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 3 RISK ASSESSMENT: NUCLEAR MEDICINE SOFTWARE MARKET

- TABLE 4 NUCLEAR MEDICINE SOFTWARE MARKET: IMPACT ANALYSIS

- TABLE 5 NUCLEAR MEDICINE SOFTWARE MARKET: ROLE IN ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REGULATORY STANDARDS IN NUCLEAR MEDICINE

- TABLE 10 REGULATORY REQUIREMENTS IN NORTH AMERICA

- TABLE 11 REGULATORY REQUIREMENTS IN EUROPE

- TABLE 12 REGULATORY REQUIREMENTS IN ASIA PACIFIC

- TABLE 13 REGULATORY REQUIREMENTS IN LATIN AMERICA

- TABLE 14 REGULATORY REQUIREMENTS IN MIDDLE EAST & AFRICA

- TABLE 15 INDICATIVE PRICE FOR NUCLEAR MEDICINE SOFTWARE, BY KEY PLAYER (2024)

- TABLE 16 AVERAGE SELLING PRICE OF NUCLEAR CARDIOLOGY REPORTING SOFTWARE (2024)

- TABLE 17 INDICATIVE PRICE FOR NUCLEAR MEDICINE SOFTWARE, BY REGION (2024)

- TABLE 18 NUCLEAR MEDICINE SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR NUCLEAR MEDICINE SOFTWARE SOLUTIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 21 KEY BUYING CRITERIA FOR END USERS

- TABLE 22 UNMET NEEDS IN NUCLEAR MEDICINE SOFTWARE MARKET

- TABLE 23 END-USER EXPECTATIONS IN NUCLEAR MEDICINE SOFTWARE MARKET

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 26 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ACQUISITION & RECONSTRUCTION SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 27 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ACQUISITION & RECONSTRUCTION SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ANALYSIS & QUANTIFICATION SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 29 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ANALYSIS & QUANTIFICATION SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 NUCLEAR MEDICINE SOFTWARE MARKET FOR WORKFLOW MANAGEMENT & ORCHESTRATION SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 31 NUCLEAR MEDICINE SOFTWARE MARKET FOR WORKFLOW MANAGEMENT & ORCHESTRATION SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 NUCLEAR MEDICINE SOFTWARE MARKET FOR PACS INTEGRATION & DATA MANAGEMENT SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 33 NUCLEAR MEDICINE SOFTWARE MARKET FOR PACS INTEGRATION & DATA MANAGEMENT SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 NUCLEAR MEDICINE SOFTWARE MARKET FOR REPORTING & DOCUMENTATION SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 35 NUCLEAR MEDICINE SOFTWARE MARKET FOR REPORTING & DOCUMENTATION SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 NUCLEAR MEDICINE SOFTWARE MARKET FOR RADIOPHARMACEUTICAL MANAGEMENT SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 37 NUCLEAR MEDICINE SOFTWARE MARKET FOR RADIOPHARMACEUTICAL MANAGEMENT SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 NUCLEAR MEDICINE SOFTWARE MARKET FOR DOSIMETRY & TREATMENT PLANNING SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 39 NUCLEAR MEDICINE SOFTWARE MARKET FOR DOSIMETRY & TREATMENT PLANNING SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NUCLEAR MEDICINE SOFTWARE MARKET FOR QUALITY CONTROL & ASSURANCE SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 41 NUCLEAR MEDICINE SOFTWARE MARKET FOR QUALITY CONTROL & ASSURANCE SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 NUCLEAR MEDICINE SOFTWARE MARKET FOR AI & ADVANCED ANALYTICS SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 43 NUCLEAR MEDICINE SOFTWARE MARKET FOR AI & ADVANCED ANALYTICS SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 NUCLEAR MEDICINE SOFTWARE MARKET FOR MOBILE & REMOTE ACCESS SOFTWARE: MAJOR PLAYERS AND OFFERINGS

- TABLE 45 NUCLEAR MEDICINE SOFTWARE MARKET FOR MOBILE & REMOTE ACCESS SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 47 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ACQUISITION WORKFLOWS: MAJOR PLAYERS AND OFFERINGS

- TABLE 48 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ACQUISITION WORKFLOWS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 NUCLEAR MEDICINE SOFTWARE MARKET FOR DATA PROCESSING WORKFLOWS: MAJOR PLAYERS AND OFFERINGS

- TABLE 50 NUCLEAR MEDICINE SOFTWARE MARKET FOR DATA PROCESSING WORKFLOWS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 NUCLEAR MEDICINE SOFTWARE MARKET FOR REPORTING WORKFLOWS: MAJOR PLAYERS AND OFFERINGS

- TABLE 52 NUCLEAR MEDICINE SOFTWARE MARKET FOR REPORTING WORKFLOWS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 NUCLEAR MEDICINE SOFTWARE MARKET FOR DATA MANAGEMENT WORKFLOWS: MAJOR PLAYERS AND OFFERINGS

- TABLE 54 NUCLEAR MEDICINE SOFTWARE MARKET FOR DATA MANAGEMENT WORKFLOWS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 56 NUCLEAR MEDICINE SOFTWARE MARKET FOR STANDALONE SOLUTIONS: MAJOR PLAYERS AND OFFERINGS

- TABLE 57 NUCLEAR MEDICINE SOFTWARE MARKET FOR STANDALONE SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 NUCLEAR MEDICINE SOFTWARE MARKET FOR INTEGRATED SOLUTIONS: MAJOR PLAYERS AND OFFERINGS

- TABLE 59 NUCLEAR MEDICINE SOFTWARE MARKET FOR INTEGRATED SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLOUD-NATIVE PLATFORMS: MAJOR PLAYERS AND OFFERINGS

- TABLE 61 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLOUD-NATIVE PLATFORMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 63 NUCLEAR MEDICINE SOFTWARE MARKET FOR PERPETUAL/TRADITIONAL LICENSES: MAJOR PLAYERS AND OFFERINGS

- TABLE 64 NUCLEAR MEDICINE SOFTWARE MARKET FOR PERPETUAL/TRADITIONAL LICENSES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 NUCLEAR MEDICINE SOFTWARE MARKET FOR SUBSCRIPTION/SAAS LICENSES: MAJOR PLAYERS AND OFFERINGS

- TABLE 66 NUCLEAR MEDICINE SOFTWARE MARKET FOR SUBSCRIPTION/SAAS LICENSES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 NUCLEAR MEDICINE SOFTWARE MARKET FOR USAGE-BASED LICENSES: MAJOR PLAYERS AND OFFERINGS

- TABLE 68 NUCLEAR MEDICINE SOFTWARE MARKET FOR USAGE-BASED LICENSES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 NUCLEAR MEDICINE SOFTWARE MARKET FOR ENTERPRISE AGREEMENTS: MAJOR PLAYERS AND OFFERINGS

- TABLE 70 NUCLEAR MEDICINE SOFTWARE MARKET FOR ENTERPRISE AGREEMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 72 NUCLEAR MEDICINE SOFTWARE MARKET FOR SOFTWARE LICENSES: MAJOR PLAYERS AND OFFERINGS

- TABLE 73 NUCLEAR MEDICINE SOFTWARE MARKET FOR SOFTWARE LICENSES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NUCLEAR MEDICINE SOFTWARE MARKET FOR MAINTENANCE & SUPPORT SERVICES: MAJOR PLAYERS AND OFFERINGS

- TABLE 75 NUCLEAR MEDICINE SOFTWARE MARKET FOR MAINTENANCE & SUPPORT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 NUCLEAR MEDICINE SOFTWARE MARKET FOR PROFESSIONAL SERVICES: MAJOR PLAYERS AND OFFERINGS

- TABLE 77 NUCLEAR MEDICINE SOFTWARE MARKET FOR PROFESSIONAL SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLOUD SERVICES: MAJOR PLAYERS AND OFFERINGS

- TABLE 79 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLOUD SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS: MAJOR PLAYERS AND OFFERINGS

- TABLE 82 NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 NUCLEAR MEDICINE SOFTWARE MARKET FOR AUTOMATED IMAGE INTERPRETATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 85 NUCLEAR MEDICINE SOFTWARE MARKET FOR TUMOR SEGMENTATION & QUANTIFICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS: MAJOR PLAYERS AND OFFERINGS

- TABLE 87 NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 NUCLEAR MEDICINE SOFTWARE MARKET FOR PREDICTIVE ANALYTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 NUCLEAR MEDICINE SOFTWARE MARKET FOR WORKFLOW OPTIMIZATION & QUALITY CONTROL, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 NUCLEAR MEDICINE SOFTWARE MARKET FOR PERSONALIZED DOSIMETRY CALCULATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 92 NUCLEAR MEDICINE SOFTWARE MARKET FOR THERANOSTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 NUCLEAR MEDICINE SOFTWARE MARKET FOR EMERGENCY STAT WORKFLOWS: MAJOR PLAYERS AND OFFERINGS

- TABLE 94 NUCLEAR MEDICINE SOFTWARE MARKET FOR EMERGENCY STAT WORKFLOWS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 95 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLINICAL RESEARCH APPLICATIONS: MAJOR PLAYERS AND OFFERINGS

- TABLE 96 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLINICAL RESEARCH APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 98 NUCLEAR MEDICINE SOFTWARE MARKET FOR ONCOLOGY: MAJOR PLAYERS AND OFFERINGS

- TABLE 99 NUCLEAR MEDICINE SOFTWARE MARKET FOR ONCOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NUCLEAR MEDICINE SOFTWARE MARKET FOR NEUROLOGY: MAJOR PLAYERS AND OFFERINGS

- TABLE 101 NUCLEAR MEDICINE SOFTWARE MARKET FOR NEUROLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 102 NUCLEAR MEDICINE SOFTWARE MARKET FOR CARDIOLOGY: MAJOR PLAYERS AND OFFERINGS

- TABLE 103 NUCLEAR MEDICINE SOFTWARE MARKET FOR CARDIOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 104 NUCLEAR MEDICINE SOFTWARE MARKET FOR OTHER THERAPEUTIC AREAS: MAJOR PLAYERS AND OFFERINGS

- TABLE 105 NUCLEAR MEDICINE SOFTWARE MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 107 NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES: MAJOR PLAYERS AND OFFERINGS

- TABLE 108 NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 110 NUCLEAR MEDICINE SOFTWARE MARKET FOR AI & ADVANCED ANALYTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 111 NUCLEAR MEDICINE SOFTWARE MARKET FOR DOSIMETRY & TREATMENT PLANNING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 112 NUCLEAR MEDICINE SOFTWARE MARKET FOR CLOUD-NATIVE PLATFORMS TECHNOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 113 NUCLEAR MEDICINE SOFTWARE MARKET FOR MOBILE & REMOTE ACCESS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 114 NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 116 NUCLEAR MEDICINE SOFTWARE MARKET FOR IMAGE ACQUISITION & RECONSTRUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 NUCLEAR MEDICINE SOFTWARE MARKET FOR PACS INTEGRATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 118 NUCLEAR MEDICINE SOFTWARE MARKET FOR QUALITY CONTROL, BY REGION, 2023-2030 (USD MILLION)

- TABLE 119 NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 120 NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS: MAJOR PLAYERS AND OFFERINGS

- TABLE 121 NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 123 NUCLEAR MEDICINE SOFTWARE MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 124 NUCLEAR MDICINE SOFTWARE MARKET FOR OUTPATIENT SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 125 NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 126 NUCLEAR MDICINE SOFTWARE MARKET FOR RADIOPHARMACIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 127 NUCLEAR MEDICINE SOFTWARE MARKET FOR OTHER HEALTHCARE ROVIDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 128 NUCLEAR MEDICINE SOFTWARE MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES: MAJOR PLAYERS AND OFFERINGS

- TABLE 129 NUCLEAR MEDICINE SOFTWARE MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 130 NUCLEAR MEDICINE SOFTWARE MARKET FOR MEDTECH COMPANIES: MAJOR PLAYERS AND OFFERINGS

- TABLE 131 NUCLEAR MEDICINE SOFTWARE MARKET FOR MEDTECH COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 132 NUCLEAR MEDICINE SOFTWARE MARKET FOR OTHER END USERS: MAJOR PLAYERS AND OFFERINGS

- TABLE 133 NUCLEAR MEDICINE SOFTWARE MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 134 NUCLEAR MEDICINE SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 136 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 NORTH AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 152 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 153 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 154 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 155 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 156 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 157 US: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 US: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 160 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 161 US: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 US: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 US: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 US: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 166 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 167 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 168 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 169 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 170 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 171 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 174 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 175 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 CANADA: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 180 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 182 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 183 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 184 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 185 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 186 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 187 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 190 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 191 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 196 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 197 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 198 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 199 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 200 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 201 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 204 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 205 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 208 GERMANY: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 210 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 211 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 212 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 213 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 214 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 215 UK: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 UK: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 218 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 219 UK: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 UK: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 UK: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 UK: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 224 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 225 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 226 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 227 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 228 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 229 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 232 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 233 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 236 FRANCE: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 238 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 239 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 240 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 241 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 242 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 243 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 246 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 247 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 250 ITALY: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 252 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 253 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 254 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 255 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 256 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 257 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 260 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 261 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 264 SPAIN: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 266 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 267 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 268 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 269 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 270 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 271 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 274 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 275 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 278 REST OF EUROPE: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 280 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 281 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 282 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 283 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 284 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 285 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 286 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 287 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 290 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 291 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 294 ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 296 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 297 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 298 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 299 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 300 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 301 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 304 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 305 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 308 JAPAN: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 310 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 311 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 312 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 313 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 314 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 315 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 318 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 319 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 322 CHINA: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 324 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 325 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 326 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 327 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 328 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 329 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 332 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 333 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 336 INDIA: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 337 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 338 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 339 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 340 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 341 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 342 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 343 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 346 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 347 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR MATURE TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 350 REST OF ASIA PACIFIC: NUCLEAR MEDICINE SOFTWARE MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 351 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 352 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 353 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 354 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY WORKFLOW, 2023-2030 (USD MILLION)

- TABLE 355 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY INTEGRATION COMPLEXITY, 2023-2030 (USD MILLION)

- TABLE 356 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY SOFTWARE LICENSING, 2023-2030 (USD MILLION)

- TABLE 357 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY REVENUE MODEL, 2023-2030 (USD MILLION)

- TABLE 358 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 359 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 360 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 361 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 362 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET, BY TECHNOLOGY MATURITY, 2023-2030 (USD MILLION)

- TABLE 363 LATIN AMERICA: NUCLEAR MEDICINE SOFTWARE MARKET FOR UPCOMING TECHNOLOGIES, BY TYPE, 2023-2030 (USD MILLION)