|

市场调查报告书

商品编码

1782040

全球军用连接器市场(按形状、类型、平台、销售点和地区划分)- 预测至 2030 年Military Connectors Market by Shape {Circular [Mil-DTL-(38999,26482,5015)], Rectangular [MIL-DTL-(24308, 83513, 55302)]}, Type (Power, Signal, Data, RF & Microwave, Fiber Optic, Hybrid), Platform, Point of Sale and Region - Global Forecast to 2030 |

||||||

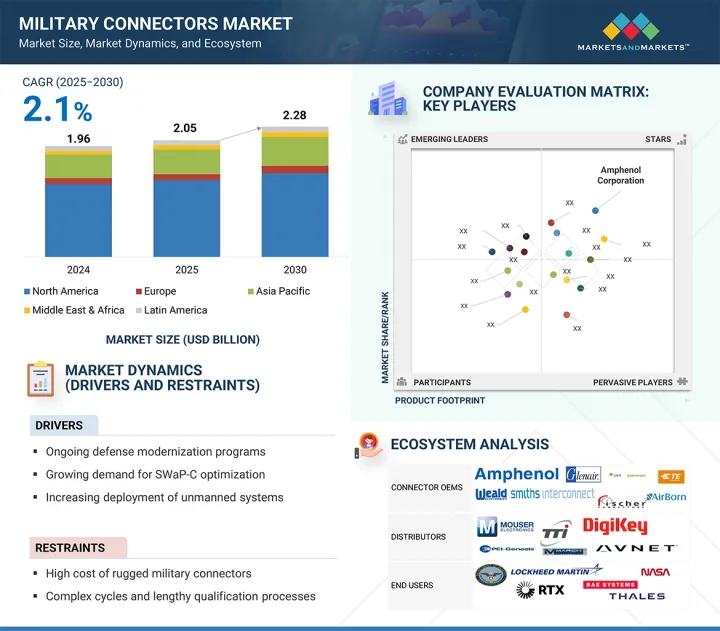

全球军用连接器市场预计将从 2025 年的 20.5 亿美元成长到 2030 年的 22.8 亿美元,复合年增长率为 2.1%。

市场由用于 C4ISR、电子战和无人机等尖端防御系统的强大而有弹性的互连解决方案驱动。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 形状、类型、平台、销售点、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

军事装备的日益现代化,加上在恶劣环境下对安全资料和电力传输的需求,也推动了市场的成长。国防费用的增加以及对自主平台的投资,正在推动对小型化、高效能连接器的需求。

“预计在预测期内,圆形连接器将占据军用连接器市场的最大份额。”

圆形连接器因其在陆、空、海防车辆的广泛应用,占据了军用连接器市场的最大份额。圆形连接器因其紧凑的尺寸、耐用性和易于配接的特点,在关键任务应用中备受青睐。圆形连接器为通讯、航空电子设备、雷达、士兵穿戴设备等传输电力、讯号和资料。它们能够承受包括衝击、振动和电磁干扰在内的恶劣环境,是国防应用的理想选择。

“预计在预测期内,太空领域将成为军用连接器市场成长最快的领域。”

由于卫星、太空监视系统和国防有效载荷对小型化、高性能连接器的需求日益增长,太空领域已成为成长最快的军用连接器市场。用于太空作业的军用连接器必须承受极端温度、真空条件和辐射,同时确保持续的讯号和电力传输。这些连接器对于军用通讯、预警系统和安全的天基资料链路至关重要。

“预计在预测期内,欧洲军用连接器市场的复合年增长率最高。”

由于国防开支、区域安全担忧以及强大的工业基础,欧洲是成长最快的军用连接器市场。各国正大力投资升级其陆、海、空系统,这需要坚固耐用的高性能连接器。目前和未来的国防计划都专注于数位化士兵系统、网路通讯和自主平台,对讯号和电源互连的需求保持稳定。

本报告研究了全球军用连接器市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 军用连接器市场为企业带来诱人机会

- 军用连接器市场(按平台)

- 海上平台军事连接器市场

- 军用连接器市场(按航空平台)

- 军用连接器市场(按销售点)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势和中断

- 价值链分析

- 定价分析

- 主要企业军用连接器平均售价

- 各地区平均销售价格

- 营运数据

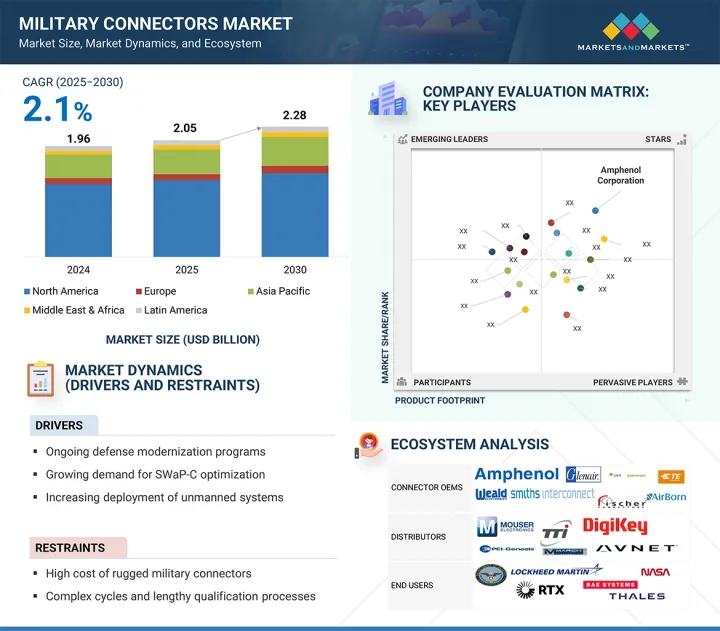

- 生态系分析

- 知名公司

- 私人企业和中小企业

- 最终用户

- 监管格局

- 监管机构、政府机构和其他组织

- 主要法规

- 贸易分析

- 进口情形(HS 编码 853690)

- 出口情形(HS 编码 853690)

- 大型会议和活动(2025-2026年)

- 主要相关利益者和采购标准

- 案例研究分析

- 经营模式

- OEM生产

- 客製化设计服务

- MRO服务

- 投资金筹措场景

- 技术分析

- 主要技术

- 互补技术

- 宏观经济展望

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 美国关税(2025年)

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

- 人工智慧/生成式人工智慧的影响

- 科技趋势

- 圆形混合连接器

- Nano/Pico 连接器

- 耐热材料

- EMP硬化连接器

- 大趋势的影响

- 数位双胞胎仿真

- 连接器健康监测

- 数位线程集成

- 主导战场的需求

- 技术蓝图

- 专利分析

第六章 军用连接器市场(依形状)

- 介绍

- 圆

- 长方形

7. 军用连接器市场(按类型)

- 介绍

- 电源连接器

- 讯号连接器

- 数据连接器

- 射频/微波连接器

- 光纤连接器

- 混合连接器

8. 军用连接器市场(按平台)

- 介绍

- 土地

- 航空

- 海

- 宇宙

9. 军用连接器市场(按销售点)

- 介绍

- OEM

- 售后市场

第 10 章军用连接器市场(按区域)

- 介绍

- 北美洲

- PESTLE分析

- 美国

- 加拿大

- 欧洲

- PESTLE分析

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- PESTLE分析

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- PESTLE分析

- GCC

- 以色列

- 土耳其

- 南非

- 拉丁美洲

- PESTLE分析

- 巴西

- 其他拉丁美洲

第十一章竞争格局

- 介绍

- 主要参与企业的策略/优势(2020-2024)

- 收益分析(2021-2024)

- 市场占有率分析(2024年)

- 品牌/产品比较

- 公司估值及财务指标

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十二章:公司简介

- 主要企业

- AMPHENOL CORPORATION

- TE CONNECTIVITY

- ITT INC.

- GLENAIR, INC.

- FISCHER CONNECTORS SA

- EATON

- SMITHS GROUP PLC

- NICOMATIC

- WINCHESTER INTERCONNECT

- MILNEC INTERCONNECT SYSTEMS

- WEALD ELECTRONICS LTD

- OMNETICS CONNECTOR CORP

- TURCK, INC

- CONESYS

- RAY SERVICE, AS

- ROJONE PTY LTD

- ALLIED ELECTRONICS CORPORATION

- 其他公司

- HIREL CONNECTORS INC.

- AIRBORN LLC

- SAMTEC

- SUNKYE INTERNATIONAL CO., LTD.

- LEMO

- HARWIN

- ODU GMBH & CO. KG

- MIL-CON, INC.

- CRISTEK INTERCONNECTS, LLC

- CONNECTIVE DESIGN, INC.

第十三章 附录

The military connectors market is expected to reach USD 2.28 billion by 2030, from USD 2.05 billion in 2025, at a CAGR of 2.1%. The market is led by strong and resilient interconnect solutions used in cutting-edge defense systems, including C4ISR, electronic warfare, and unmanned aerial vehicles.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Shape, Type, Platform, and Point of Sale and Region |

| Regions covered | North America, Europe, APAC, RoW |

Increasing military asset modernization and the need for secure data and power transmission in extreme environments are also propelling growth. Increasing defense spending and investment in autonomous platforms are compelling demand for miniature, high-performance connectors.

"The circular segment is expected to account for the largest share in the military connectors market during the forecast period."

The circular segment accounts for the largest share of the military connectors market because it is widely used on ground, air, and naval defense vehicles. Circular connectors are chosen for their small size, durability, and easy coupling in mission-critical applications. They transmit power, signals, and data for communications, avionics, radar, and soldier-wearable devices. Their durability against harsh environments like shock, vibration, and EMI makes them perfect for defense applications.

"The space segment is expected to exhibit the fastest growth in the military connectors market during the forecast period."

The space segment is rapidly growing in the military connectors market because the need for small, high-performance connectors in satellites, space-based surveillance systems, and defense payloads is rising. Military connectors for space missions must withstand extreme temperatures, vacuum conditions, and radiation, while ensuring continuous signal and power supply. These connectors have become essential to military communications satellites, early warning systems, and secure space-based data links.

"Europe is expected to record the highest CAGR in the military connectors market during the forecast period."

Europe is the fastest-growing market for military connectors due to defense spending, regional security concerns, and strong industrial bases. Countries are heavily investing in upgrading ground, water, and air systems, which require rugged, high-performance connectors. Both current and upcoming defense projects focus on digital soldier systems, networking communications, and autonomous platforms, which maintain steady demand for signal and power interconnects.

Breakdown of primaries

The study includes insights from various industry experts, from component suppliers to Tier-1 companies and OEMs. The breakdown of the primary sources is as follows:

- By Company Type: Tier 1-45%; Tier 2-35%; Tier 3-20%

- By Designation: C-level-50%; D-level-25%; Others-25%

- By Region: North America-40%; Europe-25%; Asia Pacific-15%; Middle East & Africa-10%; Latin America-10%

Amphenol Corporation (US), TE Connectivity (Ireland), ITT Inc. (US), Glenair, Inc (US), Fischer Connectors SA (Switzerland), Eaton (Ireland), and Smiths Group Plc (US) are some of the leading players in the military connectors market.

Research coverage

The study covers the military connectors market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on shape, type, platform, point of sale, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted them.

Key benefits of buying this report:

This report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall military connectors market and its subsegments. The report covers the entire ecosystem of the military connectors market. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers such as high demand for water quality monitoring and ocean data mapping, surging asymmetric threats, the need for maritime security, and increasing capital expenditure in offshore oil and gas industries in the military connectors market

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets - the report analyses the military connectors market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the military connectors market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Amphenol Corporation (US), ITT Inc. (US), Glenair, Inc (US), and Fischer Connectors SA (Switzerland), among others in the military connectors market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MILITARY CONNECTORS MARKET

- 4.2 MILITARY CONNECTORS MARKET, BY PLATFORM

- 4.3 MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM

- 4.4 MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM

- 4.5 MILITARY CONNECTORS MARKET, BY POINT OF SALE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Modernization of defense electronics

- 5.2.1.2 Elevated demand for SWaP-C optimization

- 5.2.1.3 Rapid deployment of unmanned systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of ruggedized military connectors

- 5.2.2.2 Complex and lengthy qualification process

- 5.2.2.3 Supply chain disruptions and material dependencies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Digitization of military platforms and shift toward network-centric warfare

- 5.2.3.2 Increased defense budgets in Asia Pacific and Middle East

- 5.2.3.3 Retrofit and upgrade programs for legacy platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Risk of counterfeit components

- 5.2.4.2 Stringent export control regulations

- 5.2.4.3 Adherence to harsh operating environment requirements

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF MILITARY CONNECTORS OFFERED BY KEY PLAYERS

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- 5.6 OPERATIONAL DATA

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 KEY REGULATIONS

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Middle East & Africa

- 5.8.2.5 Latin America

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 853690)

- 5.9.2 EXPORT SCENARIO (HS CODE 853690)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 AMPHENOL'S MIL-DTL-38999 SERIES III CIRCULAR CONNECTORS

- 5.12.2 TE'S MULTIGIG RT 2-R AND ARINC 836A CONNECTOR SOLUTIONS

- 5.12.3 HUBER+SUHNER'S QMA WATERPROOF RF CONNECTORS AND SENCITY SHIELDED CABLING SYSTEM

- 5.13 BUSINESS MODELS

- 5.13.1 OEM PRODUCTION

- 5.13.2 CUSTOM DESIGN SERVICES

- 5.13.3 MRO SERVICES

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Shielding

- 5.15.1.2 Ruggedized cable assemblies

- 5.15.1.3 Contact plating

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 High-speed data transmission

- 5.15.2.2 Miniaturization

- 5.15.2.3 Fiber optic connectors

- 5.15.1 KEY TECHNOLOGIES

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 NORTH AMERICA

- 5.16.2 EUROPE

- 5.16.3 ASIA PACIFIC

- 5.16.4 MIDDLE EAST & AFRICA

- 5.16.5 LATIN AMERICA

- 5.17 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 EU

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Army

- 5.17.5.2 Navy

- 5.17.5.3 Airforce

- 5.18 IMPACT OF AI/GEN AI

- 5.19 TECHNOLOGY TRENDS

- 5.19.1 CIRCULAR HYBRID CONNECTORS

- 5.19.2 NANO AND PICO CONNECTORS

- 5.19.3 HIGH-TEMPERATURE TOLERANT MATERIALS

- 5.19.4 EMP-HARDENED CONNECTORS

- 5.20 IMPACT OF MEGATRENDS

- 5.20.1 DIGITAL TWIN SIMULATION

- 5.20.2 CONNECTOR HEALTH MONITORING

- 5.20.3 DIGITAL THREAD INTEGRATION

- 5.20.4 AI-DRIVEN BATTLEFIELD DEMANDS

- 5.21 TECHNOLOGY ROADMAP

- 5.22 PATENT ANALYSIS

6 MILITARY CONNECTORS MARKET, BY SHAPE

- 6.1 INTRODUCTION

- 6.2 CIRCULAR

- 6.2.1 LARGE-SCALE ADOPTION BY GLOBAL DEFENSE SECTOR

- 6.2.2 MIL-DTL-38999

- 6.2.3 MIL-DTL-26482

- 6.2.4 MIL-DTL-5015

- 6.2.5 OTHERS

- 6.3 RECTANGULAR

- 6.3.1 SHIFT TOWARD DIGITAL AND ELECTRONIC WARFARE CAPABILITIES

- 6.3.2 MIL-DTL-24308

- 6.3.3 MIL-DTL-83513

- 6.3.4 MIL-DTL-55302

- 6.3.5 OTHERS

7 MILITARY CONNECTORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POWER CONNECTORS

- 7.2.1 ABILITY TO WITHSTAND HARSH MILITARY ENVIRONMENTS

- 7.3 SIGNAL CONNECTORS

- 7.3.1 EXTENSIVE USE IN AVIONICS AND VEHICLE CONTROL UNITS

- 7.4 DATA CONNECTORS

- 7.4.1 ONGOING DIGITALIZATION IN DEFENSE PLATFORMS

- 7.5 RF & MICROWAVE CONNECTORS

- 7.5.1 NEED FOR HIGH-FREQUENCY SIGNAL TRANSMISSION ACROSS MILITARY APPLICATIONS

- 7.6 FIBER OPTIC CONNECTORS

- 7.6.1 RAPID DEPLOYMENT IN NETWORK-CENTRIC WARFARE AND SENSOR SYSTEMS

- 7.7 HYBRID CONNECTORS

- 7.7.1 FOCUS ON ENHANCING MODULARITY IN MILITARY PLATFORMS

8 MILITARY CONNECTORS MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- 8.2 LAND

- 8.2.1 TREND OF MODULAR VEHICLE ARCHITECTURES AND DIGITAL BATTLEFIELD INTEGRATION

- 8.2.2 COMMAND CENTERS

- 8.2.3 SOLDIER SYSTEMS

- 8.2.4 ARMORED VEHICLES

- 8.2.4.1 Combat vehicles

- 8.2.4.2 Combat support vehicles

- 8.2.4.3 Unmanned ground vehicles

- 8.3 AIRBORNE

- 8.3.1 NEED FOR HIGH-SPEED DATA TRANSMISSION ACROSS MISSION-CRITICAL APPLICATIONS

- 8.3.2 MILITARY AIRCRAFT

- 8.3.3 HELICOPTERS

- 8.3.4 UNMANNED AERIAL VEHICLES

- 8.4 NAVAL

- 8.4.1 RAPID INTEGRATION OF MODULAR COMBAT SYSTEMS AND ADVANCED SENSORS

- 8.4.2 SHIPS

- 8.4.2.1 Aircraft carriers

- 8.4.2.2 Amphibious

- 8.4.2.3 Destroyers

- 8.4.2.4 Frigates

- 8.4.2.5 Corvettes

- 8.4.2.6 Patrol vehicles

- 8.4.3 SUBMARINES

- 8.4.4 UNMANNED MARINE VEHICLES

- 8.5 SPACE

- 8.5.1 SHIFT IN DEFENSE PRIORITIES FOR RESPONSIVE LAUNCH CAPABILITIES

- 8.5.2 SATELLITE

9 MILITARY CONNECTORS MARKET, BY POINT OF SALE

- 9.1 INTRODUCTION

- 9.2 OEM

- 9.2.1 RISING CONNECTOR DEMAND AMID NEW SYSTEM PRODUCTION AND INTEGRATION

- 9.3 AFTERMARKET

- 9.3.1 STRATEGIC FOCUS ON EXTENDING LIFE OF LEGACY PLATFORMS

10 MILITARY CONNECTORS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Defense modernization programs to drive market

- 10.2.3 CANADA

- 10.2.3.1 Arctic defense expansion and NORAD modernization to drive market

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 UK

- 10.3.2.1 Tempest program advancements and NATO interoperability upgrades to drive market

- 10.3.3 GERMANY

- 10.3.3.1 Eurofighter upgrade programs and green defense push to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Rafale fleet expansion and strategic push for autonomy to drive market

- 10.3.5 ITALY

- 10.3.5.1 Naval feet modernization and Eurofighter upgrades to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 JAPAN

- 10.4.2.1 F-X fighter development and domestic industrial policy to drive market

- 10.4.3 INDIA

- 10.4.3.1 Indigenous fighter programs, border defense expansion, and Make-in-India push to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Indigenous defense system development and export-focused production strategy to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Defense force modernization and AUKUS technology alignment to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GCC

- 10.5.2.1 Saudi Arabia

- 10.5.2.1.1 Vision 2030 and defense self-reliance goals to drive market

- 10.5.2.2 UAE

- 10.5.2.2.1 Autonomous system adoption and naval ISR expansion to drive market

- 10.5.2.1 Saudi Arabia

- 10.5.3 ISRAEL

- 10.5.3.1 Emphasis on multi-domain network-centric warfare to drive market

- 10.5.4 TURKEY

- 10.5.4.1 Rise in drone swarm integration and air defense autonomy to drive market

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Focus on modernizing border security systems to drive market

- 10.6 LATIN AMERICA

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 BRAZIL

- 10.6.2.1 International defense industrial partnerships to drive market

- 10.6.3 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Platform footprint

- 11.7.5.4 Type footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AMPHENOL CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 TE CONNECTIVITY

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches/developments

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ITT INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 GLENAIR, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 FISCHER CONNECTORS SA

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches/developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 EATON

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Other developments

- 12.1.7 SMITHS GROUP PLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.8 NICOMATIC

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/developments

- 12.1.9 WINCHESTER INTERCONNECT

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches/developments

- 12.1.9.3.2 Deals

- 12.1.10 MILNEC INTERCONNECT SYSTEMS

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 WEALD ELECTRONICS LTD

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches/developments

- 12.1.12 OMNETICS CONNECTOR CORP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches/developments

- 12.1.13 TURCK, INC

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 CONESYS

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 RAY SERVICE, A.S.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Other developments

- 12.1.16 ROJONE PTY LTD

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.17 ALLIED ELECTRONICS CORPORATION

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.1 AMPHENOL CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 HIREL CONNECTORS INC.

- 12.2.2 AIRBORN LLC

- 12.2.3 SAMTEC

- 12.2.4 SUNKYE INTERNATIONAL CO., LTD.

- 12.2.5 LEMO

- 12.2.6 HARWIN

- 12.2.7 ODU GMBH & CO. KG

- 12.2.8 MIL-CON, INC.

- 12.2.9 CRISTEK INTERCONNECTS, LLC

- 12.2.10 CONNECTIVE DESIGN, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 AVERAGE SELLING PRICE OF MILITARY CONNECTORS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF MILITARY CONNECTORS, BY REGION, 2024 (USD)

- TABLE 4 NEW MILITARY CONNECTOR DELIVERIES, BY PLATFORM, 2021-2024 (UNITS)

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PLATFORM (%)

- TABLE 15 KEY BUYING CRITERIA, BY TYPE

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 KEY PRODUCT-RELATED TARIFF FOR MILITARY CONNECTORS

- TABLE 18 ANTICIPATED CHANGE IN PRICES AND POTENTIAL IMPACT ON MILITARY CONNECTORS MARKET

- TABLE 19 KEY ATTRIBUTES AND ADOPTION LANDSCAPE OF MILITARY CONNECTOR TECHNOLOGY TRENDS

- TABLE 20 EVOLUTION OF MILITARY CONNECTORS

- TABLE 21 PATENT ANALYSIS

- TABLE 22 MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 23 MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 24 MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 25 MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 27 MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 28 LAND: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 29 LAND: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 30 AIRBORNE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 31 AIRBORNE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 32 NAVAL: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 33 NAVAL: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 34 MILITARY CONNECTORS MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 35 MILITARY CONNECTORS MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 36 MILITARY CONNECTORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 MILITARY CONNECTORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 39 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2021-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2021-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2025-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 49 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: MILITARY CONNECTORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 US: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 53 US: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 54 US: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 US: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 US: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 57 US: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 58 CANADA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 59 CANADA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 60 CANADA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 CANADA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 CANADA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 63 CANADA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 65 EUROPE: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 EUROPE: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 69 EUROPE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 70 EUROPE: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2021-2024 (USD MILLION)

- TABLE 71 EUROPE: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2021-2024 (USD MILLION)

- TABLE 73 EUROPE: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: MILITARY CONNECTORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 EUROPE: MILITARY CONNECTORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 UK: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 79 UK: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 80 UK: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 UK: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 UK: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 83 UK: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 84 GERMANY: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 85 GERMANY: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 86 GERMANY: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 GERMANY: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 GERMANY: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 89 GERMANY: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 90 FRANCE: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 91 FRANCE: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 92 FRANCE: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 FRANCE: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 FRANCE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 95 FRANCE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 96 ITALY: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 97 ITALY: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 98 ITALY: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 ITALY: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 ITALY: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 101 ITALY: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 102 REST OF EUROPE: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 103 REST OF EUROPE: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 REST OF EUROPE: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 REST OF EUROPE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 107 REST OF EUROPE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 JAPAN: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 123 JAPAN: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 JAPAN: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 JAPAN: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 127 JAPAN: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 128 INDIA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 129 INDIA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 130 INDIA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 131 INDIA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 132 INDIA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 133 INDIA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 134 SOUTH KOREA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 135 SOUTH KOREA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH KOREA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 137 SOUTH KOREA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH KOREA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH KOREA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 140 AUSTRALIA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 141 AUSTRALIA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 142 AUSTRALIA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 143 AUSTRALIA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 AUSTRALIA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 145 AUSTRALIA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2021-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 SAUDI ARABIA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 167 SAUDI ARABIA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 168 SAUDI ARABIA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 169 SAUDI ARABIA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 170 SAUDI ARABIA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 171 SAUDI ARABIA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 172 UAE: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 173 UAE: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 174 UAE: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 175 UAE: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 176 UAE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 177 UAE: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 178 ISRAEL: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 179 ISRAEL: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 180 ISRAEL: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 181 ISRAEL: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 182 ISRAEL: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 183 ISRAEL: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 184 TURKEY: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 185 TURKEY: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 186 TURKEY: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 187 TURKEY: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 188 TURKEY: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 189 TURKEY: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AFRICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 191 SOUTH AFRICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AFRICA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH AFRICA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AFRICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 195 SOUTH AFRICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 197 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 199 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 200 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 201 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 202 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2021-2024 (USD MILLION)

- TABLE 203 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY LAND PLATFORM, 2025-2030 (USD MILLION)

- TABLE 204 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2021-2024 (USD MILLION)

- TABLE 205 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM, 2025-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 207 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 208 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 209 LATIN AMERICA: MILITARY CONNECTORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 210 BRAZIL: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 211 BRAZIL: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 212 BRAZIL: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 213 BRAZIL: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 BRAZIL: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 215 BRAZIL: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 216 REST OF LATIN AMERICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 217 REST OF LATIN AMERICA: MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 218 REST OF LATIN AMERICA: MILITARY CONNECTORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 219 REST OF LATIN AMERICA: MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 220 REST OF LATIN AMERICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 221 REST OF LATIN AMERICA: MILITARY CONNECTORS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 222 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 223 MILITARY CONNECTORS MARKET: DEGREE OF COMPETITION

- TABLE 224 REGION FOOTPRINT

- TABLE 225 PLATFORM FOOTPRINT

- TABLE 226 TYPE FOOTPRINT

- TABLE 227 LIST OF START-UPS/SMES

- TABLE 228 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 229 MILITARY CONNECTORS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 230 MILITARY CONNECTORS MARKET: DEALS, 2021-2024

- TABLE 231 MILITARY CONNECTORS MARKET: OTHER DEVELOPMENTS, 2021-2025

- TABLE 232 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 233 AMPHENOL CORPORATION: PRODUCTS OFFERED

- TABLE 234 AMPHENOL CORPORATION: DEALS

- TABLE 235 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 236 TE CONNECTIVITY: PRODUCTS OFFERED

- TABLE 237 TE CONNECTIVITY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 238 TE CONNECTIVITY: OTHER DEVELOPMENTS

- TABLE 239 ITT INC.: COMPANY OVERVIEW

- TABLE 240 ITT INC.: PRODUCTS OFFERED

- TABLE 241 GLENAIR, INC.: COMPANY OVERVIEW

- TABLE 242 GLENAIR, INC.: PRODUCTS OFFERED

- TABLE 243 FISCHER CONNECTORS SA: COMPANY OVERVIEW

- TABLE 244 FISCHER CONNECTORS SA: PRODUCTS OFFERED

- TABLE 245 FISCHER CONNECTORS SA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 246 EATON: COMPANY OVERVIEW

- TABLE 247 EATON: PRODUCTS OFFERED

- TABLE 248 EATON: OTHER DEVELOPMENTS

- TABLE 249 SMITHS GROUP PLC: COMPANY OVERVIEW

- TABLE 250 SMITHS GROUP PLC: PRODUCTS OFFERED

- TABLE 251 SMITHS GROUP PLC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 252 NICOMATIC: COMPANY OVERVIEW

- TABLE 253 NICOMATIC: PRODUCTS OFFERED

- TABLE 254 NICOMATIC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 255 WINCHESTER INTERCONNECT: COMPANY OVERVIEW

- TABLE 256 WINCHESTER INTERCONNECT: PRODUCTS OFFERED

- TABLE 257 WINCHESTER INTERCONNECT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 258 WINCHESTER INTERCONNECT: DEALS

- TABLE 259 MILNEC INTERCONNECT SYSTEMS: COMPANY OVERVIEW

- TABLE 260 MILNEC INTERCONNECT SYSTEMS: PRODUCTS OFFERED

- TABLE 261 WEALD ELECTRONICS LTD: COMPANY OVERVIEW

- TABLE 262 WEALD ELECTRONICS LTD: PRODUCTS OFFERED

- TABLE 263 WEALD ELECTRONICS LTD: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 OMNETICS CONNECTOR CORP: COMPANY OVERVIEW

- TABLE 265 OMNETICS CONNECTOR CORP: PRODUCTS OFFERED

- TABLE 266 OMNETICS CONNECTOR CORP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 267 TURCK, INC: COMPANY OVERVIEW

- TABLE 268 TURCK, INC: PRODUCTS OFFERED

- TABLE 269 CONESYS: COMPANY OVERVIEW

- TABLE 270 CONESYS: PRODUCTS OFFERED

- TABLE 271 CONESYS: DEALS

- TABLE 272 RAY SERVICE, A.S.: COMPANY OVERVIEW

- TABLE 273 RAY SERVICE, A.S.: PRODUCTS OFFERED

- TABLE 274 RAY SERVICE, A.S.: DEALS

- TABLE 275 RAY SERVICE, A.S.: OTHER DEVELOPMENTS

- TABLE 276 ROJONE PTY LTD: COMPANY OVERVIEW

- TABLE 277 ROJONE PTY LTD: PRODUCTS OFFERED

- TABLE 278 ALLIED ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 279 ALLIED ELECTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 280 HIREL CONNECTORS INC.: COMPANY OVERVIEW

- TABLE 281 AIRBORN LLC: COMPANY OVERVIEW

- TABLE 282 SAMTEC: COMPANY OVERVIEW

- TABLE 283 SUNKYE INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 284 LEMO: COMPANY OVERVIEW

- TABLE 285 HARWIN: COMPANY OVERVIEW

- TABLE 286 ODU GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 287 MIL-CON, INC.: COMPANY OVERVIEW

- TABLE 288 CRISTEK INTERCONNECTS, LLC: COMPANY OVERVIEW

- TABLE 289 CONNECTIVE DESIGN, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MILITARY CONNECTORS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 LAND SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 8 SIGNAL CONNECTORS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 9 CIRCULAR SEGMENT TO HOLD HIGHER SHARE THAN RECTANGULAR SEGMENT IN 2030

- FIGURE 10 OEM TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 EUROPE TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 GROWING NEED FOR SECURE, HIGH-SPEED CONNECTIVITY TO DRIVE MARKET

- FIGURE 13 LAND SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 14 SHIPS TO SURPASS OTHER NAVAL PLATFORMS DURING FORECAST PERIOD

- FIGURE 15 MILITARY AIRCRAFT TO ACQUIRE HIGHEST SHARE IN 2025

- FIGURE 16 AFTERMARKET TO BE LARGER THAN OEM IN 2025

- FIGURE 17 MILITARY CONNECTORS MARKET DYNAMICS

- FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 ECOSYSTEM ANALYSIS

- FIGURE 21 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PLATFORM

- FIGURE 24 KEY BUYING CRITERIA, BY TYPE

- FIGURE 25 BUSINESS MODELS IN MILITARY CONNECTORS MARKET

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 27 IMPACT OF AI/GEN AI

- FIGURE 28 TECHNOLOGY TRENDS

- FIGURE 29 TECHNOLOGY ROADMAP FOR MILITARY CONNECTORS

- FIGURE 30 PATENT ANALYSIS

- FIGURE 31 MILITARY CONNECTORS MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- FIGURE 32 MILITARY CONNECTORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- FIGURE 34 MILITARY CONNECTORS MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- FIGURE 35 MILITARY CONNECTORS MARKET, BY REGION, 2025-2030

- FIGURE 36 NORTH AMERICA: MILITARY CONNECTORS MARKET SNAPSHOT

- FIGURE 37 EUROPE: MILITARY CONNECTORS MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MILITARY CONNECTORS MARKET SNAPSHOT

- FIGURE 39 MIDDLE EAST & AFRICA: MILITARY CONNECTORS MARKET SNAPSHOT

- FIGURE 40 LATIN AMERICA: MILITARY CONNECTORS MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2024

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2024

- FIGURE 43 BRAND/PRODUCT COMPARISON

- FIGURE 44 COMPANY VALUATION (USD BILLION)

- FIGURE 45 FINANCIAL METRICS (EV/EBIDTA)

- FIGURE 46 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 COMPANY FOOTPRINT

- FIGURE 48 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 49 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 51 ITT INC.: COMPANY SNAPSHOT

- FIGURE 52 EATON: COMPANY SNAPSHOT

- FIGURE 53 SMITHS GROUP PLC: COMPANY SNAPSHOT