|

市场调查报告书

商品编码

1786128

全球丁醛市场(按产品类型、最终用途产业、应用和地区划分)- 预测至2030年Butyraldehyde Market by Product Type, Application, End-use Industry, and Region - Global Forecast to 2030 |

||||||

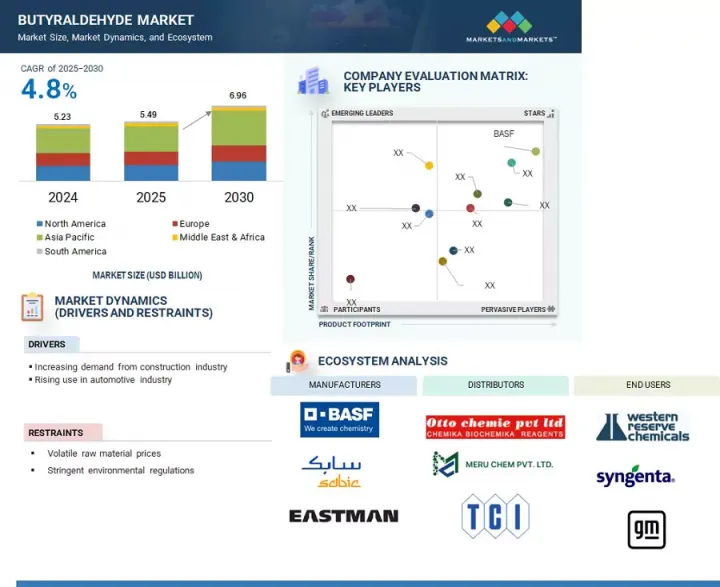

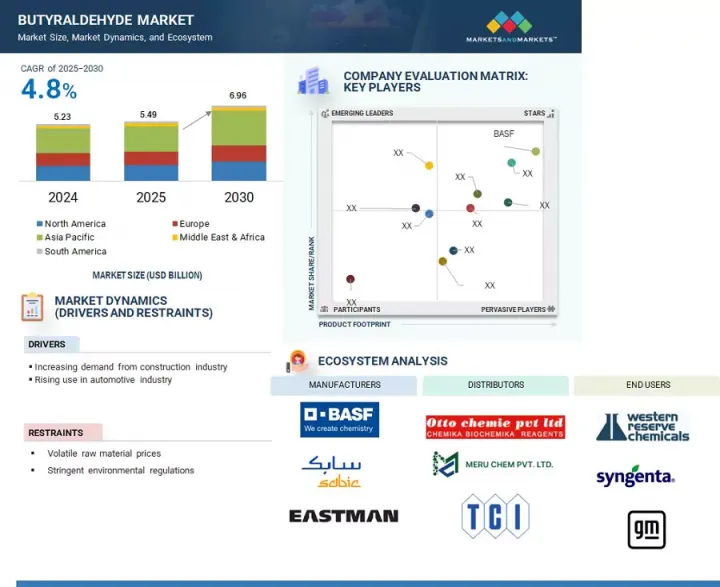

丁醛市场预计将从 2025 年的 54.9 亿美元成长到 2030 年的 69.6 亿美元,复合年增长率为 4.8%。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元)和数量(千吨) |

| 部分 | 按产品类型、最终用途产业、应用和地区 |

| 目标区域 | 欧洲、北美、亚太地区、中东和非洲、南美 |

市场驱动力源自于对关键下游衍生物(例如2-乙基己醇、正丁醇和丁酸)日益增长的需求。塑化剂、被覆剂、黏合剂和特殊化学品产量的不断增长,正在推动所有终端产业的消费,包括汽车、个人护理和建筑业。亚太地区製造业的蓬勃发展,以及欧洲以监管为重点、致力于低VOC和符合REACH法规的材料,也推动了市场需求。绿色化学领域的投资以及这些化学品在农业化学品和医药中间体中的日益增长的应用,预计将支撑市场成长。

正丁醛是丁醛市场中成长第二快的细分市场,其作为塑化剂、溶剂和树脂生产中间体的用途日益广泛。丁醛是生产2-乙基己醇 (2-EH) 和正丁醇等原料的关键中间体,这些原料用于建筑、汽车和涂料行业。由于其用途广泛且价格实惠,它常用于化学合成。不断增长的工业需求和对化学製造业的投资,尤其是在新兴市场,进一步推动了正丁醛市场的成长。

农业是丁醛市场成长第二快的领域,这得益于对除草剂和杀虫剂等农业化学品需求的不断增长。全球粮食需求的不断增长和可耕地面积的有限使得人们更加重视提高作物产量,从而增加了对农业化学品的需求。丁醛及其衍生物是重要的农业化学品中间体,因为它们能够有效保护作物并提高土壤生产力。政府推行的永续农业和产量措施进一步推动了这一趋势。对粮食安全和生产力的重视持续推动农业对丁醛的需求,从而促进了该领域的成长率。

合成树脂领域是丁醛市场中成长第二快的终端用途领域,这得益于塑化剂和涂料需求的不断增长。丁醛是生产醇酸树脂和尿素树脂等合成树脂的关键中间体,广泛应用于汽车、建筑和工业领域。基础设施建设和汽车产量的不断增长推动了相关产业的发展,从而刺激了对高性能涂料和黏合剂的需求。此外,随着企业寻求降低成本和更耐用、更耐候的体系,对使用丁醛的合成树脂的需求也不断增长。

预计北美将成为全球丁醛增幅第二高的地区,这得益于化学和塑胶产业需求的健康成长以及特种化学品製造商投资的增加。受建设产业和汽车行业復苏的推动,美国用于塑化剂和被覆剂的丁醛衍生物消费量显着增长。政府对永续和先进化学製造流程的支持持续推动市场创新,而强大的研发能力和主要行业参与者的存在也正在推动北美的成长和产能的提升。

涉及的公司包括BASF(德国)、三菱化学集团公司(日本)、沙乌地阿拉伯基础工业公司(沙乌地阿拉伯)、伊士曼化学公司(美国)、KH Neochem(日本)、Perstorp(瑞典)、OXEA GmbH(德国)、Grupa Azoty(波兰)、Per Chem(韩国)和 Aurochemicals(美国)。

该研究包括丁醛市场主要企业的详细竞争分析、公司简介、最新发展和关键市场策略。

调查对象

本研究报告按产品类型(正丁醛、异丁醛)、终端用途产业(汽车、建筑、医疗保健、农业、食品和饮料、化妆品)、应用(化学中间体、橡胶促进剂、合成树脂、塑化剂)和地区(亚太地区、北美、欧洲、南美、中东和非洲)对丁醛市场进行细分。本报告的范围包括影响丁醛市场成长的驱动因素、阻碍因素、挑战和机会的详细资讯。它还对主要行业参与企业进行了透彻的分析,深入了解他们的业务概况、产品和关键策略,如与丁醛市场相关的合作伙伴关係、协议、产品发布、业务扩展和收购。此外,该报告还对丁醛市场生态系统中新兴企业进行了竞争分析。

购买报告的原因

本报告为市场领导和新进业者提供了丁醛市场及其细分市场的收益估算。它有助于相关人员了解竞争格局,获得洞察力,从而更好地定位业务,并制定有效的市场进入策略。该报告还提供了对市场现状的洞察,并提供了有关市场驱动因素、挑战和机会的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

- 人工智慧/生成式人工智慧对丁醛市场的影响

- 价值链分析

- 生态系分析

- 案例研究分析

- 监管状况

- 技术分析

- 影响客户业务的趋势/中断

- 贸易分析

- 2025-2026年主要会议和活动

- 定价分析

- 投资金筹措场景

- 专利分析

- 丁醛的潜在客户

第六章丁醛市场(依产品类型)

- 介绍

- 正丁醛

- 异丁醛

7. 丁醛市场(依最终用途产业)

- 介绍

- 车

- 建造

- 医疗保健

- 农业

- 食品/饮料

- 化妆品

- 其他的

第八章丁醛市场(按应用)

- 介绍

- 化学中间体

- 橡胶促进剂

- 合成树脂

- 塑化剂

- 其他的

第九章丁醛市场(按区域)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 收益分析

- 市场占有率分析

- 估值和财务指标

- 品牌/产品比较分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十一章:公司简介

- 主要参与企业

- BASF

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SABIC

- EASTMAN CHEMICAL COMPANY

- KH NEOCHEM CO., LTD.

- PERSTORP

- OXEA GMBH

- GRUPA AZOTY

- LG CHEM

- AUROCHEMICALS

- 其他公司

- FORMOSA PLASTICS GROUP

- ALPHA CHEMIKA

- THE ANDHRA PETROCHEMICALS LIMITED

- SUMITOMO SEIKA CHEMICALS CO., LTD.

- HANGZHOU BETTER CHEMTECH LTD.

- JIANGSU HUACHANG CHEMICAL CO., LTD.

- CHEMICEA LIMITED

- OMAN CHEMICAL

- LOBACHEMIE PVT. LTD.

- NINGBO INNO PHARMCHEM CO., LTD.

- ADVENT

- VICKERS LABORATORIES LIMITED

- GLENTHAM LIFE SCIENCES LIMITED

- SHANDONG HUALU HENGSHENG GROUP CO., LTD

- MUBY CHEM PRIVATE LIMITED

第十二章 附录

The butyraldehyde market is projected to grow from USD 5.49 billion in 2025 to USD 6.96 billion in 2030, at a CAGR of 4.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Product Type, Application, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

The market is driven by increasing demand for major downstream derivatives such as 2-ethylhexanol, n-butanol, and butyric acid. The growing production of plasticizers, coatings, adhesives, and specialty chemicals is boosting consumption across all end-use industries, including automotive, personal care, and construction. The rise in manufacturing in Asia Pacific and a more regulatory-focused approach toward low-VOC and REACH-compliant materials in Europe are also fueling demand. Investments in green chemistry and the growing use of these chemicals in agrochemical and pharmaceutical intermediates are expected to support market growth.

"N-butyraldehyde to be second fastest-growing segment in butyraldehyde market"

N-butyraldehyde is the second fastest-growing segment in the butyraldehyde market, driven by its expanding use as an intermediate in producing plasticizers, solvents, and resins. It is a crucial intermediate in making raw materials like 2-ethylhexanol (2-EH) and n-butanol used in construction, automotive, and coatings industries. Its versatility and affordability have made it a popular choice in chemical synthesis. Industrial demand is increasing, and rising investments in chemical manufacturing, especially in emerging markets, further fuel the growth of the N-butyraldehyde market.

"Agriculture to be second fastest-growing segment in butyraldehyde market"

The agriculture segment is the second fastest-growing part of the butyraldehyde market due to rising demand for agrochemicals like herbicides and pesticides. With global food demand increasing and limited arable land, there will be a greater focus on increasing crop yields, which drives the need for agrochemicals. Butyraldehyde and its derivatives are key intermediates in agricultural chemicals because they are more effective at improving crop protection and soil productivity. This trend is further supported by government initiatives promoting sustainable farming and higher yields. The emphasis on food security and productivity continues to boost demand for butyraldehyde in agriculture, contributing to the segment's growth rate.

"Synthetic resins to be second fastest-growing segment in butyraldehyde market"

The synthetic resins segment is the second fastest-growing end-use segment in the butyraldehyde market, driven by increased demand for plasticizers and coatings. Butyraldehyde is a key intermediate in the production of synthetic resins like alkyd and urea resins, which are widely used in automotive, construction, and industrial applications. Growth is fueled by expanding infrastructure development and automotive production, which boost demand for high-performance coatings and adhesives. Additionally, as companies seek more durable and weather-resistant systems that reduce costs, the demand for synthetic resins made with butyraldehyde has increased.

"North America to be second fastest-growing regional market for butyraldehyde market"

North America is expected to experience the second-highest growth among regions worldwide in butyraldehyde, driven by healthy demand growth in the chemicals and plastics industries and increased investments in specialty chemical manufacturers. The US has notably reported a rise in the consumption of butyraldehyde derivatives used in plasticizers and coatings, aided by recoveries in both the construction and automotive industries. Government support for sustainable and advanced chemical manufacturing processes continues to foster market innovation, while strong R&D capabilities and the presence of major industry players are boosting growth and increasing production capacity in North America.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: BASF (Germany), Mitsubishi Chemical Group Corporation (Japan), SABIC (Saudi Arabia), Eastman Chemical Company (US), KH Neochem Co., Ltd. (Japan), Perstorp (Sweden), OXEA GmbH (Germany), Grupa Azoty (Poland), LG Chem (South Korea), and Aurochemicals (US) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the butyraldehyde market and their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the butyraldehyde market by product type (n-butyraldehyde and isobutyraldehyde), end-use industry (automotive, construction, medical, agriculture, food & beverage, and cosmetics), application (chemical intermediate, rubber accelerator, synthetic resins, and plasticizers), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope includes detailed information on the drivers, restraints, challenges, and opportunities impacting the growth of the butyraldehyde market. It also thoroughly analyzes key industry players, offering insights into their business overview, products, and key strategies such as partnerships, agreements, product launches, expansions, and acquisitions related to the butyraldehyde market. Additionally, this report covers a competitive analysis of upcoming startups within the butyraldehyde market ecosystem.

Reasons to Buy Report

The report will provide market leaders and new entrants with estimates of the revenue figures for the overall butyraldehyde market and its segments. It will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses better, and develop effective go-to-market strategies. Additionally, the report will help stakeholders grasp the market's current conditions and offer information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Increasing demand from the construction industry and Rising automotive industry demand), restraints (Volatile raw material prices and Stringent environment regulations), opportunities (Expansion in emerging economies and Shift toward sustainable production methods), and challenges (Supply chain disruptions and Competition from alternative chemicals).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the butyraldehyde market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the peristaltic pumps market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the peristaltic pumps market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as BASF (Germany), Mitsubishi Chemical Group Corporation (Japan), SABIC (Saudi Arabia), Eastman Chemical Company (US), KH Neochem Co., Ltd. (Japan), Perstorp (Sweden), OXEA GmbH (Germany), Grupa Azoty (Polland), LG Chem (South Korea), and Aurochemicals (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BUTYRALDEHYDE MARKET

- 4.2 BUTYRALDEHYDE MARKET, BY PRODUCT TYPE

- 4.3 BUTYRALDEHYDE MARKET, BY APPLICATION

- 4.4 BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY

- 4.5 BUTYRALDEHYDE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand from construction industry

- 5.2.1.2 Rising use in automotive industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Stringent environmental regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of emerging economies

- 5.2.3.2 Shift toward sustainable production methods

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 Competition from alternative chemicals

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 IMPACT OF AI/GEN AI ON BUTYRALDEHYDE MARKET

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CHRONIC INHALATION TOXICITY AND CARCINOGENICITY ASSESSMENT OF BUTYRALDEHYDE IN F344 RATS

- 5.9.2 OPTIMIZATION OF ZINC OXIDE CATALYST FOR BUTYRALDEHYDE SYNTHESIS VIA BUTANOL DEHYDROGENATION

- 5.9.3 ACETALIZATION REACTION OF ETHANOL WITH BUTYRALDEHYDE COUPLED WITH PERVAPORATION

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 Europe

- 5.10.1.2 Asia Pacific

- 5.10.1.3 North America

- 5.10.2 STANDARDS

- 5.10.2.1 REACH (Regulation (EC) No. 1907/2006)

- 5.10.2.2 CLP Regulation (EC) No. 1272/2008

- 5.10.2.3 Inventory of Existing Chemical Substances in China (IECSC)

- 5.10.2.4 OSHA Hazard Communication Standard (29 CFR 1910.1200)

- 5.10.3 REGULATORY BODIES, GOVERNMENT ORGANIZATIONS, AND OTHER AGENCIES

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Hydroformylation

- 5.11.1.2 Continuous flow chemistry

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Reverse-phase high-performance liquid chromatography (RP-HPLC)

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Bio-based production

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO (HS CODE 291219)

- 5.13.2 IMPORT SCENARIO (HS CODE 291219)

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.15.2 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2022-2030

- 5.15.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.15.4 FACTORS IMPACTING PRICES OF BUTYRALDEHYDE

- 5.15.4.1 Feedstock costs - propylene price volatility

- 5.15.4.2 Downstream demand from plasticizers and coatings industries

- 5.15.4.3 Global supply and capacity utilization

- 5.15.4.4 Trade flows and tariff barriers

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 APPROACH

- 5.17.2 DOCUMENT TYPES

- 5.17.3 PATENT PUBLICATION TRENDS

- 5.17.4 INSIGHTS

- 5.17.5 LEGAL STATUS OF PATENTS

- 5.17.6 JURISDICTION ANALYSIS

- 5.17.7 TOP COMPANIES/APPLICANTS

- 5.17.8 US: TOP 10 PATENT OWNERS IN LAST 11 YEARS

- 5.18 BUTYRALDEHYDE POTENTIAL CUSTOMERS

- 5.18.1 LIST OF POTENTIAL CUSTOMERS

6 BUTYRALDEHYDE MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 N-BUTYRALDEHYDE

- 6.2.1 HIGH CHEMICAL REACTIVITY, WIDE COMPATIBILITY, AND SCALABILITY FOR INDUSTRIAL USE TO DRIVE DEMAND

- 6.3 ISOBUTYRALDEHYDE

- 6.3.1 USE IN VARIOUS INDUSTRIES, COST-EFFECTIVE PRODUCTION, AND HIGH REACTIVITY TO FUEL MARKET GROWTH

7 BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- 7.2 AUTOMOTIVE

- 7.2.1 RISING DEMAND FOR FUEL-EFFICIENT AND LIGHTWEIGHT VEHICLES TO DRIVE MARKET

- 7.3 CONSTRUCTION

- 7.3.1 ABILITY TO ENHANCE BUILDING VISUAL APPEARANCE AND PROVIDE PROTECTION AGAINST MOISTURE, UV RADIATION, AND CORROSION TO FUEL DEMAND

- 7.4 MEDICAL

- 7.4.1 EXCELLENT REACTIVITY AND ABILITY TO FORM VARIOUS CHEMICAL BONDS TO PROPEL DEMAND

- 7.5 AGRICULTURE

- 7.5.1 ENHANCEMENT OF YIELD AND SOIL HEALTH THROUGH ADVANCED AGROCHEMICAL INTERMEDIATES TO DRIVE DEMAND

- 7.6 FOOD & BEVERAGE

- 7.6.1 USE TO ENHANCE TASTE AND SHELF LIFE IN PROCESSED FOODS TO FUEL MARKET GROWTH

- 7.7 COSMETICS

- 7.7.1 CAPABILITY TO BOOST INGREDIENT EFFICIENCY IN SKINCARE AND MAKEUP PRODUCTS TO FUEL MARKET GROWTH

- 7.8 OTHER END-USE INDUSTRIES

8 BUTYRALDEHYDE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CHEMICAL INTERMEDIATES

- 8.2.1 USE IN PRODUCTION OF FLEXIBLE PVC FOR CONSTRUCTION AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

- 8.3 RUBBER ACCELERATORS

- 8.3.1 KEY ROLE IN MANUFACTURING OF TIRES, HOSES, AND BELTS TO PROPEL MARKET

- 8.4 SYNTHETIC RESINS

- 8.4.1 USE IN MANUFACTURING ALKYD RESINS TO FUEL MARKET GROWTH

- 8.5 PLASTICIZERS

- 8.5.1 COMPLIANCE WITH STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE DEMAND

- 8.6 OTHER APPLICATIONS

9 BUTYRALDEHYDE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Robust downstream demand in coatings, plasticizers, and agriculture industries to fuel market growth

- 9.2.2 CANADA

- 9.2.2.1 Expansion of coatings and adhesives industries to propel market

- 9.2.3 MEXICO

- 9.2.3.1 Growing industrial base and infrastructure development to boost demand

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Demand for sustainable solutions in sanitation, cleaning products, and chemical innovation to drive market

- 9.3.2 UK

- 9.3.2.1 Booming chemical and pharmaceutical industries to drive demand

- 9.3.3 FRANCE

- 9.3.3.1 Rising use in pharmaceutical, coating, resin, and plasticizer production to drive growth

- 9.3.4 ITALY

- 9.3.4.1 Focus on sustainable development and clean water to accelerate demand

- 9.3.5 SPAIN

- 9.3.5.1 Focus on sustainable chemical innovation and industrial growth to fuel demand

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Increased manufacturing of consumer products and electronics to drive market

- 9.4.2 JAPAN

- 9.4.2.1 Rising demand for specialty chemicals, coatings, and sustainable manufacturing to drive market

- 9.4.3 INDIA

- 9.4.3.1 Expanding infrastructure, coatings, and pharmaceutical sectors to drive market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Transition toward sustainability and rising production of specialty chemicals and cosmetics to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Rising demand for butyraldehyde derivatives in construction and automotive industries to drive market

- 9.5.1.2 Rest of GCC countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Infrastructure investment plans to boost demand

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Rising demand in automotive and construction industries to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Construction and mobility projects to boost demand

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Product type footprint

- 10.7.5.3 Application footprint

- 10.7.5.4 End-use industry footprint

- 10.7.5.5 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BASF

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths/Right to win

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses/Competitive threats

- 11.1.2 MITSUBISHI CHEMICAL GROUP CORPORATION

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths/Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses/Competitive threats

- 11.1.3 SABIC

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths/Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses/Competitive threats

- 11.1.4 EASTMAN CHEMICAL COMPANY

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 KH NEOCHEM CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 PERSTORP

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Expansions

- 11.1.6.4 MnM view

- 11.1.7 OXEA GMBH

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.8 GRUPA AZOTY

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 LG CHEM

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 AUROCHEMICALS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.1 BASF

- 11.2 OTHER PLAYERS

- 11.2.1 FORMOSA PLASTICS GROUP

- 11.2.2 ALPHA CHEMIKA

- 11.2.3 THE ANDHRA PETROCHEMICALS LIMITED

- 11.2.4 SUMITOMO SEIKA CHEMICALS CO., LTD.

- 11.2.5 HANGZHOU BETTER CHEMTECH LTD.

- 11.2.6 JIANGSU HUACHANG CHEMICAL CO., LTD.

- 11.2.7 CHEMICEA LIMITED

- 11.2.8 OMAN CHEMICAL

- 11.2.9 LOBACHEMIE PVT. LTD.

- 11.2.10 NINGBO INNO PHARMCHEM CO., LTD.

- 11.2.11 ADVENT

- 11.2.12 VICKERS LABORATORIES LIMITED

- 11.2.13 GLENTHAM LIFE SCIENCES LIMITED

- 11.2.14 SHANDONG HUALU HENGSHENG GROUP CO., LTD

- 11.2.15 MUBY CHEM PRIVATE LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AUTOMOBILE PRODUCTION, BY KEY COUNTRY, 2022-2024 (UNITS)

- TABLE 2 BUTYRALDEHYDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030 (%)

- TABLE 6 ROLES OF COMPANIES IN BUTYRALDEHYDE ECOSYSTEM

- TABLE 7 BUTYRALDEHYDE MARKET: MANUFACTURERS/SUPPLIERS, BY REGION

- TABLE 8 BUTYRALDEHYDE MARKET: MANUFACTURERS/SUPPLIERS EXPORTING TO US/EUROPE

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 BUTYRALDEHYDEMARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 AVERAGE SELLING PRICE TREND OF BUTYRALDEHYDE, BY REGION, 2022-2030 (USD/KG)

- TABLE 13 INDICATIVE PRICING ANALYSIS OF BUTYRALDEHYDE, BY END-USE INDUSTRY, 2022-2030 (USD/KG)

- TABLE 14 INDICATIVE PRICING ANALYSIS OF BUTYRALDEHYDE OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 15 INDICATIVE COST STRUCTURE OF BUTYRALDEHYDE

- TABLE 16 TOTAL PATENT COUNT, 2014-2024

- TABLE 17 US: TOP 10 PATENT OWNERS, 2014-2024

- TABLE 18 LIST OF POTENTIAL CUSTOMERS

- TABLE 19 BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 20 BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 21 BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 22 BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 23 BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 24 BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 25 BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 26 BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 27 BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 28 BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 30 BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 31 BUTYRALDEHYDE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 32 BUTYRALDEHYDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 BUTYRALDEHYDE MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 34 BUTYRALDEHYDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 35 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 38 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 39 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 42 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 43 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 46 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 47 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 48 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 50 NORTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 51 US: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 52 US: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 US: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 54 US: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 55 CANADA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 56 CANADA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 CANADA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 58 CANADA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 59 MEXICO: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 60 MEXICO: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 MEXICO: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 62 MEXICO: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 63 EUROPE: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 64 EUROPE: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 EUROPE: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 66 EUROPE: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 67 EUROPE: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 68 EUROPE: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 70 EUROPE: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 71 EUROPE: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 72 EUROPE: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 74 EUROPE: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 75 EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 76 EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 78 EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 79 GERMANY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 80 GERMANY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 GERMANY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 82 GERMANY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 83 UK: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 UK: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 UK: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 86 UK: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 87 FRANCE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 88 FRANCE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 FRANCE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 90 FRANCE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 91 ITALY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 92 ITALY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 ITALY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 94 ITALY: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 95 SPAIN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 96 SPAIN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 SPAIN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 98 SPAIN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 99 REST OF EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 100 REST OF EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 102 REST OF EUROPE: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 103 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 106 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 107 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 110 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 111 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 114 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 115 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 118 ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 119 CHINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 120 CHINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 CHINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 122 CHINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 123 JAPAN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 124 JAPAN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 JAPAN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 126 JAPAN: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 127 INDIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 128 INDIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 INDIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 130 INDIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 131 SOUTH KOREA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 132 SOUTH KOREA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 SOUTH KOREA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 134 SOUTH KOREA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 135 REST OF ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 138 REST OF ASIA PACIFIC: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 155 SAUDI ARABIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 156 SAUDI ARABIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 SAUDI ARABIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 158 SAUDI ARABIA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 159 REST OF GCC COUNTRIES: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 160 REST OF GCC COUNTRIES: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 REST OF GCC COUNTRIES: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 162 REST OF GCC COUNTRIES: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 163 SOUTH AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 164 SOUTH AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 166 SOUTH AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 171 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 172 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 174 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 175 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 176 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 177 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 178 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 179 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 182 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 183 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 186 SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 187 BRAZIL: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 188 BRAZIL: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 BRAZIL: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 190 BRAZIL: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 191 ARGENTINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 192 ARGENTINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 ARGENTINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 194 ARGENTINA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 195 REST OF SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 196 REST OF SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 REST OF SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 198 REST OF SOUTH AMERICA: BUTYRALDEHYDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 199 BUTYRALDEHYDE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-APRIL 2025

- TABLE 200 BUTYRALDEHYDE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 201 BUTYRALDEHYDE MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 202 BUTYRALDEHYDE MARKET: APPLICATION FOOTPRINT

- TABLE 203 BUTYRALDEHYDE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 204 BUTYRALDEHYDE MARKET: REGION FOOTPRINT

- TABLE 205 BUTYRALDEHYDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 206 BUTYRALDEHYDE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/2)

- TABLE 207 BUTYRALDEHYDE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 208 BUTYRALDEHYDE MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 209 BASF: COMPANY OVERVIEW

- TABLE 210 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 212 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 213 SABIC: COMPANY OVERVIEW

- TABLE 214 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 216 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 KH NEOCHEM CO., LTD.: COMPANY OVERVIEW

- TABLE 218 KH NEOCHEM CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 PERSTORP: COMPANY OVERVIEW

- TABLE 220 PERSTORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 PERSTORP: EXPANSIONS

- TABLE 222 OXEA GMBH: COMPANY OVERVIEW

- TABLE 223 OXEA GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 GRUPA AZOTY: COMPANY OVERVIEW

- TABLE 225 GRUPA AZOTY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 LG CHEM: COMPANY OVERVIEW

- TABLE 227 LG CHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 AUROCHEMICALS: COMPANY OVERVIEW

- TABLE 229 AUROCHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 FORMOSA PLASTICS GROUP: COMPANY OVERVIEW

- TABLE 231 ALPHA CHEMIKA: COMPANY OVERVIEW

- TABLE 232 THE ANDHRA PETROCHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 233 SUMITOMO SEIKA CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 234 HANGZHOU BETTER CHEMTECH LTD.: COMPANY OVERVIEW

- TABLE 235 JIANGSU HUACHANG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 236 CHEMICEA LIMITED: COMPANY OVERVIEW

- TABLE 237 OMAN CHEMICAL: COMPANY OVERVIEW

- TABLE 238 LOBACHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 239 NINGBO INNO PHARMCHEM CO., LTD.: COMPANY OVERVIEW

- TABLE 240 ADVENT: COMPANY OVERVIEW

- TABLE 241 VICKERS LABORATORIES LIMITED: COMPANY OVERVIEW

- TABLE 242 GLENTHAM LIFE SCIENCES LIMITED: COMPANY OVERVIEW

- TABLE 243 SHANDONG HUALU HENGSHENG GROUP CO., LTD: COMPANY OVERVIEW

- TABLE 244 MUBY CHEM PRIVATE LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BUTYRALDEHYDE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 BUTYRALDEHYDE MARKET: RESEARCH DESIGN

- FIGURE 3 BUTYRALDEHYDE MARKET: BOTTOM-UP APPROACH

- FIGURE 4 BUTYRALDEHYDE MARKET: TOP-DOWN APPROACH

- FIGURE 5 BUTYRALDEHYDE MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 BUTYRALDEHYDE MARKET: DATA TRIANGULATION

- FIGURE 8 N-BUTYRALDEHYDE SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 9 CHEMICAL INTERMEDIATES SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 10 CONSTRUCTION SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FOR BUTYRALDEHYDE IN EMERGING ECONOMIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 ISOBUTYRALDEHYDE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 CHEMICAL INTERMEDIATES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 MEDICAL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 BUTYRALDEHYDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 BUTYRALDEHYDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- FIGURE 20 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 21 AUTOMOBILE PRODUCTION, BY KEY COUNTRY, 2023 (THOUSAND UNITS)

- FIGURE 22 BUTYRALDEHYDE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 BUTYRALDEHYDE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 EXPORT DATA FOR HS CODE 291219-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 26 IMPORT DATA FOR HS CODE 291219-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF BUTYRALDEHYDE, BY REGION, 2022-2030 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF BUTYRALDEHYDE, BY END-USE INDUSTRY, 2022-2030 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF BUTYRALDEHYDE OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 30 BUTYRALDEHYDE MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 31 TOTAL NUMBER OF PATENTS, 2014-2024

- FIGURE 32 NUMBER OF PATENTS YEAR-WISE, 2014-2024

- FIGURE 33 PATENT ANALYSIS, BY LEGAL STATUS, 2014-2024

- FIGURE 34 TOP JURISDICTION, BY DOCUMENT, 2014-2024

- FIGURE 35 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2014-2024

- FIGURE 36 N-BUTYRALDEHYDE SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 37 CONSTRUCTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 38 CHEMICAL INTERMEDIATES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 39 INDIA TO BE FASTEST-GROWING MARKET FOR BUTYRALDEHYDE DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO DOMINATE BUTYRALDEHYDE MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: BUTYRALDEHYDE MARKET SNAPSHOT

- FIGURE 42 EUROPE: BUTYRALDEHYDE MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: BUTYRALDEHYDE MARKET SNAPSHOT

- FIGURE 44 BUTYRALDEHYDE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 45 BUTYRALDEHYDE MARKET SHARE ANALYSIS, 2024

- FIGURE 46 BUTYRALDEHYDE MARKET: COMPANY VALUATION OF KEY COMPANIES, 2024 (USD BILLION)

- FIGURE 47 BUTYRALDEHYDE MARKET: FINANCIAL METRICS OF KEY COMPANIES, 2024

- FIGURE 48 BUTYRALDEHYDE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 BUTYRALDEHYDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 BUTYRALDEHYDE MARKET: COMPANY FOOTPRINT

- FIGURE 51 BUTYRALDEHYDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 BASF: COMPANY SNAPSHOT

- FIGURE 53 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 SABIC: COMPANY SNAPSHOT

- FIGURE 55 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 56 KH NEOCHEM CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 GRUPA AZTOY: COMPANY SNAPSHOT

- FIGURE 58 LG CHEM: COMPANY SNAPSHOT