|

市场调查报告书

商品编码

1787260

全球红外线成像市场(按类型、波长、组件、技术和应用)预测至 2030 年Infrared Imaging Market by Type, Wavelength, Component, Technology, Application - Global Forecast to 2030 |

||||||

由于对安全性、自动化和能源效率的需求不断增加,红外线 (IR)成像技术在汽车领域越来越受到关注。

热感像仪越来越多地被整合到高级驾驶辅助系统 (ADAS) 中,用于检测行人和动物,尤其是在夜间驾驶或雾天等能见度低的条件下。这些系统可以增强情境察觉,降低事故风险,并满足日益严格的安全法规和消费者期望。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 类型、组件、波长、应用、技术、产业、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

此外,热成像技术支援电动车 (EV) 的电池监控和温度控管,在性能和安全性方面发挥至关重要的作用。在製造业中,热像仪用于汽车组装上的品质保证、焊接完整性检查和零件校准。此外,随着自动驾驶汽车的兴起,热感感测器正与光达、雷达和可见光摄影机集成,以创建可在各种环境下运行的多模态感知系统。该技术也应用于车内乘员监控,以检测驾驶员疲劳并优化车内温度控制。随着汽车原始设备製造商 (OEM) 和一级供应商日益追求这些功能,红外线成像代表着行动生态系统中创新、伙伴关係和市场扩张的机会。

“预测期内,SWIR波长段市场将以最高的复合年增长率增长。”

短波红外线 (SWIR) 技术预计将在波长段内实现最高的复合年增长率,因为它在工业品质检测、半导体製造和军事成像应用中的应用日益广泛。与长波和中波红外线不同,SWIR 能够透过玻璃和硅材料进行高解析度成像,使其成为检测太阳能电池、电子晶圆和食品的理想选择。 SWIR 可有效侦测可见影像和热成像中不可见的水分、污染物和隐藏缺陷。此外,SWIR 摄影机可在烟雾、雾气和照度环境等恶劣环境条件下增强成像,使其在监视和航太应用中具有优势。 SWIR 支援雷射照明,在照度环境下不会暴露其位置,这使其可用于军事的秘密行动。此外,低成本铟镓砷 (InGaAs) 感测器的出现提高了 SWIR 的可用性,使其适用于广泛的领域。人们对精密製造、材料分类和高性能监控的日益关注加速了 SWIR 的采用,使其成为红外线成像市场中按波长增长最快的部分之一。

“根据应用,监控和检查部门将在预测期内见证红外线成像市场最高的复合年增长率。”

随着各行各业越来越依赖热成像技术进行预测性维护、流程优化和安全保障,监控和检查领域预计将在热成像市场中实现最高的复合年增长率。热像仪对于识别设备故障、检测电气系统中的热点以及即时监控热性能至关重要。製造业、石油和天然气、发电和公共产业等行业使用热成像技术来避免代价高昂的停机并延长资产寿命。随着工业4.0的兴起,红外线成像也被纳入自动化检查系统和支援物联网的设备中,从而实现持续的远距离诊断。这些系统可以识别组件劣化的早期征兆,减少非计划性停机,并提高营运效率。此外,热检查是非接触式和非破坏性的,可以对高压高温设备进行安全评估。随着越来越多的公司优先考虑运作可靠性、能源效率和遵守安全法规,对先进红外线监控解决方案的需求持续成长。这使得监控和检查应用成为热成像领域最具活力和发展最快的领域之一。

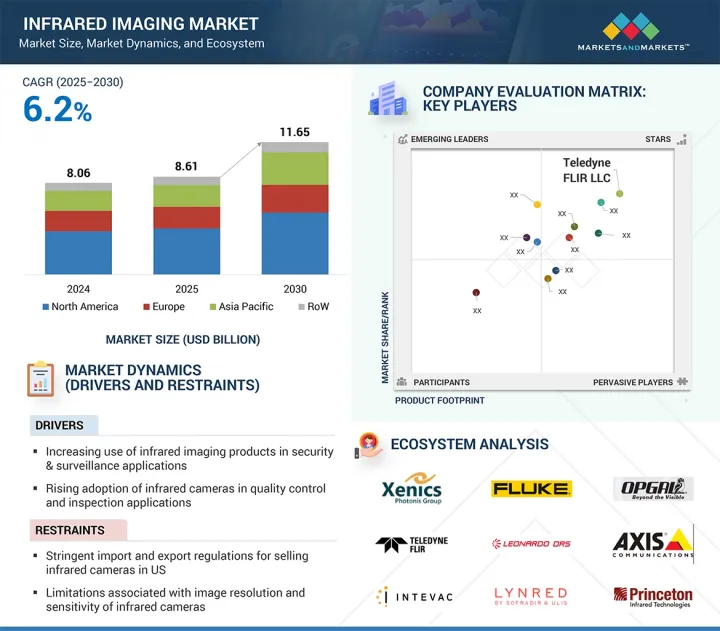

“预测期内,北美将占据最大的市场占有率。”

由于大量的国防投资、先进的工业基础设施以及强劲的技术创新,预计北美将在预测期内占据热成像市场的最大份额。尤其是美国,在军事监视、边防安全和执法领域广泛部署热成像技术,主导该地区的发展。 FLIR Systems、Teledyne 和 RTX 等主要企业在该地区拥有深厚的根基,这有助于其产品开发和快速商业化。

本报告对全球热成像市场进行了分析,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 红外线成像市场为企业带来诱人的成长机会

- 红外线成像市场类型

- 红外线成像市场(按组件)

- 红外线成像市场(按应用)

- 红外线成像市场(按波长)

- 北美红外线成像市场(按国家和应用)

- 各国红外线成像市场

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 供应链分析

- 红外线成像生态系统

- 影响客户业务的趋势/中断

- 定价分析

- 2024年各主要製造商红外线热像仪平均售价

- 各地区反射式红外线成像相机平均售价趋势(2021-2024)

- 各地区热红外线热像仪平均售价趋势(2021-2024)

- 科技趋势

- 利用红外线成像技术分析有机堆肥

- 振动光谱技术在茶叶品质与安全分析的应用

- 用于安全和检查的热感像仪

- 利用云端整合改变热成像技术

- 基于人工智慧的热成像技术的进展

- 人工智慧/生成式人工智慧对红外线成像市场的影响

- 波特五力分析

- 采购流程中的关键相关利益者和采购标准

- 案例研究分析

- ROCKWOOL GROUP 使用 TELEDYNE FLIR 热成像技术评估隔热效果并进行建筑分析

- VICENZA COURT 聘请 Multites SRL 的热成像专家解决建筑纠纷

- 高地直升机公司部署 INFRATEC热感仪扑灭野火

- 专利分析

- 大型会议和活动(2025-2026年)

- 贸易分析

- 进口情境(HS 902750)

- 出口情境(HS 902750)

- 海关分析

- 标准和监管环境

- 监管机构、政府机构和其他组织

- 政府法规

- 监管格局

- 政府标准

- 2025年美国关税对红外线成像市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家和地区产生重大影响

- 对产业的影响

第六章 红外线影像设备的类型

- 介绍

- 移动的

- 固定型

第七章 红外线成像市场(按类型)

- 介绍

- 反射

- 热

第八章 红外线成像市场(按组件)

- 介绍

- 相机

- 范围

- 模组

第九章 红外线影像市场(按技术)

- 介绍

- 冷却

- 未冷却

第十章 红外线影像市场(依波长)

- 介绍

- NIR

- SWIR

- MWIR

- LWIR

第11章 红外线成像市场(按应用)

- 介绍

- 安全与监控

- 监控和测试

- 侦测

第 12 章 红外线成像市场(按垂直产业划分)

- 介绍

- 工业

- 非工业

第十三章 红外线影像市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济展望

- 南美洲

- 中东

- 非洲

第十四章竞争格局

- 概述

- 主要参与企业的策略/优势(2020-2025)

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

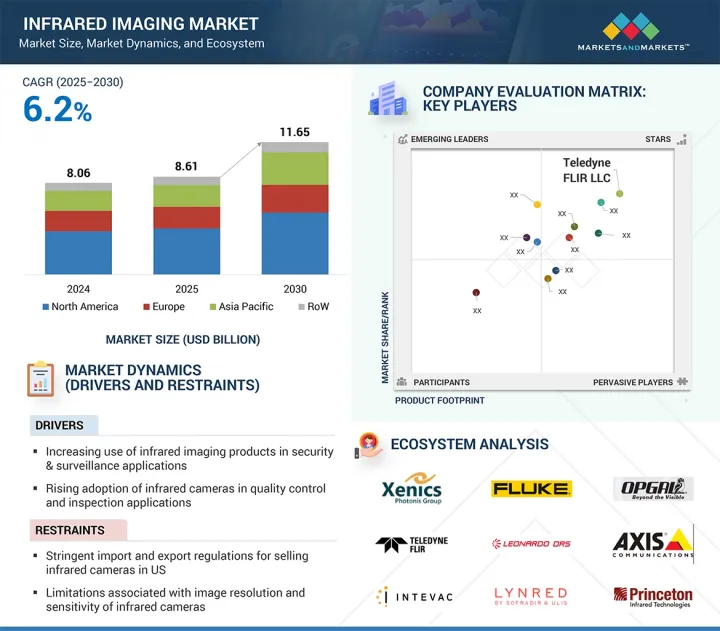

- 企业评估矩阵:主要企业(2024年)

- Start-Ups/中小型企业(2024)

- 竞争场景

第十五章:公司简介

- 主要企业

- TELEDYNE FLIR LLC

- FLUKE CORPORATION

- LEONARDO SPA

- AXIS COMMUNICATIONS AB

- RTX

- L3HARRIS TECHNOLOGIES, INC.

- EXOSENS

- OPGAL OPTRONIC INDUSTRIES LTD.

- LYNRED

- ALLIED VISION TECHNOLOGIES GMBH

- BAE SYSTEMS

- TESTO SE & CO. KGAA

- 其他主要企业

- INTEVAC, INC.

- ZHEJIANG DALI TECHNOLOGY CO., LTD.

- C-THERM TECHNOLOGIES LTD.

- IRCAMERAS LLC

- HGH

- RAPTOR PHOTONICS

- EPISENSORS

- INFRATEC GMBH

- PRINCETON INFRARED TECHNOLOGIES, INC.

- SIERRA-OLYMPIA TECH.

- COX CO., LTD.

- TONBO IMAGING

- OPTOTHERM, INC.

- SEEK THERMAL

- INFRARED CAMERAS, INC.

- LAND INSTRUMENTS INTERNATIONAL LTD

- DIAS INFRARED GMBH

- MOVITHERM

第十六章 附录

Infrared (IR) imaging technology is gaining significant traction in the automotive sector, driven by the growing demand for safety, automation, and energy efficiency. Thermal cameras are increasingly integrated into advanced driver-assistance systems (ADAS) for pedestrian and animal detection, especially in low-visibility conditions such as night-time driving or fog. These systems enhance situational awareness and reduce the risk of accidents, aligning with rising safety regulations and consumer expectations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By type, component, wavelength, application, technology, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, infrared imaging supports electric vehicle (EV) battery monitoring and thermal management, which are critical for performance and safety. In manufacturing, IR cameras are used in automotive assembly lines for quality assurance, checking weld integrity, and component alignment. Moreover, with the rise of autonomous vehicles, thermal sensors are being integrated alongside LiDAR, radar, and visible cameras to create a multi-modal perception system capable of operating in various environments. The technology also finds applications in in-cabin occupant monitoring for driver fatigue detection and climate control optimization. As automotive OEMs and Tier 1 suppliers increasingly explore these capabilities, IR imaging presents lucrative opportunities for innovation, partnerships, and market expansion within the mobility ecosystem.

"Market for SWIR in wavelength segment to grow at highest CAGR during forecast period."

Short-wave Infrared (SWIR) technology is expected to record the highest CAGR within the wavelength segment due to its increasing use in industrial quality inspection, semiconductor manufacturing, and military imaging applications. Unlike long-wave or mid-wave IR, SWIR enables high-resolution imaging through glass and silicon materials, making it ideal for inspecting solar cells, electronic wafers, and food products. It effectively detects invisible moisture, contaminants, and invisible defects under visible or thermal imaging. Additionally, SWIR cameras provide enhanced imaging under harsh environmental conditions, including smoke, fog, and low-light environments, which is advantageous in surveillance and aerospace applications. Military forces utilize SWIR for covert operations, as it supports laser illumination in low-light scenarios without revealing positions. Moreover, the emergence of lower-cost indium gallium arsenide (InGaAs) sensors is improving SWIR affordability and broadening its accessibility across sectors. The growing emphasis on precision manufacturing, material sorting, and high-performance surveillance is accelerating the adoption of SWIR, making it one of the fastest-growing segments within the infrared imaging market, by wavelength.

"Monitoring & inspection segment to exhibit highest CAGR in infrared imaging market, by application, during forecast period"

The monitoring & inspection segment is projected to witness the highest CAGR in the infrared imaging market, as industries increasingly rely on thermal imaging for predictive maintenance, process optimization, and safety assurance. Infrared cameras are essential for identifying equipment failures, detecting hotspots in electrical systems, and monitoring thermal performance in real time. Industries such as manufacturing, oil & gas, power generation, and utilities use IR imaging to prevent costly downtimes and enhance asset longevity. With the rise of Industry 4.0, IR imaging is also being integrated into automated inspection systems and IoT-enabled devices, offering continuous and remote diagnostics. These systems can identify early signs of component degradation, reduce unplanned shutdowns, and improve operational efficiency. Furthermore, thermal inspection is non-contact and non-destructive, allowing for safe evaluation of high-voltage or high-temperature equipment. Demand for advanced IR monitoring solutions continues to grow as more companies prioritize operational reliability, energy efficiency, and compliance with safety regulations. This makes the monitoring and inspection application one of the most dynamic and rapidly expanding areas in the infrared imaging landscape.

"North America to capture largest market share throughout forecast period"

North America is expected to maintain the largest share of the infrared imaging market throughout the forecast period, driven by substantial defense investments, advanced industrial infrastructure, and robust technology innovation. The US, in particular, leads the region with widespread deployment of IR imaging technologies in military surveillance, border security, and law enforcement. Major players such as FLIR Systems, Teledyne, and RTX have deep roots in the region, contributing to product development and rapid commercialization. In addition to defense, IR imaging is highly adopted in electrical inspection, smart manufacturing, building diagnostics, and healthcare applications. Government funding for R&D and a favorable regulatory framework supporting critical infrastructure protection and industrial safety accelerate market adoption. The region's leadership in AI, IoT, and automation technologies further strengthens its position, as infrared imaging increasingly integrates with intelligent systems for real-time data analysis and decision-making. With high purchasing power, early technology adoption, and an established ecosystem of end users and innovators, North America remains the most mature and dominant region in the global infrared imaging market.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the infrared imaging marketplace. The breakup of the profile of primary participants in the infrared imaging market is as follows:

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C-level Executives - 40%, Directors - 30%, and Others - 30%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 35%, and RoW - 10%

Teledyne FLIR LLC (US), Fluke Corporation (US), Leonardo S.p.A. (US), Axis Communications AB. (Sweden), L3Harris Technologies, Inc. (US), RTX (US), Exosens (France), Opgal, Optronic Industries Ltd. (Israel), Lynred (France), Allied Vision Technologies GmbH (Germany), BAE Systems (UK), and Testo SE & Co. KGaA (Germany) are some major players in the infrared imaging market.

The study includes an in-depth competitive analysis of these key players in the infrared imaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the infrared imaging market, by type (reflective, thermal), component (cameras, scopes, modules), technology (cooled, uncooled), wavelength (NIR, SWIR, MWIR, LWIR), application (security & surveillance, monitoring & inspection, detection), vertical (industrial, non-industrial), and region (North America, Europe, Asia Pacific, RoW). It analyzes major factors influencing market growth, including drivers, restraints, challenges, and opportunities. The report also provides insights into key industry players, their strategies, contract activities, and recent developments, along with a competitive analysis of emerging startups in the market.

Reasons to Buy This Report:

The report will help market leaders and new entrants with information on the closest approximations of the infrared imaging market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report:

- Analysis of key drivers increasing use of infrared imaging products in security & surveillance applications, rising adoption of infrared cameras in quality control and inspection applications, growing popularity of uncooled infrared cameras, boosting demand for SWIR cameras in machine vision applications), restraints (stringent import and export regulations for selling infrared cameras in US, limitations associated with image resolution and sensitivity of infrared cameras), opportunities (emerging applications of IR imaging technology in automotive sector, newer application areas of SWIR cameras, integration of infrared imaging technology into consumer electronics), and challenges (high cost associated with infrared cameras, designing highly accurate IR imaging products, integration and compatibility challenges pertaining to infrared imaging technology) influencing the growth of the infrared imaging market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product and service launches in the infrared imaging market

- Market Development: Comprehensive information about lucrative markets by analyzing the infrared imaging market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the infrared imaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading companies, such as Teledyne FLIR LLC (US), Fluke Corporation (US), Leonardo S.p.A. (US), and Axis Communications AB. (Sweden), L3Harris Technologies, Inc. (US), RTX (US), Exosens (France), Opgal, Optronic Industries Ltd. (Israel), Lynred (France), Allied Vision Technologies GmbH (Germany), BAE Systems. (UK), and Testo SE & Co. KGaA (Germany) in the infrared imaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Estimating market size using bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Estimating market size using top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INFRARED IMAGING MARKET

- 4.2 INFRARED IMAGING MARKET, BY TYPE

- 4.3 INFRARED IMAGING MARKET, BY COMPONENT

- 4.4 INFRARED IMAGING MARKET, BY APPLICATION

- 4.5 INFRARED IMAGING MARKET, BY WAVELENGTH

- 4.6 INFRARED IMAGING MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

- 4.7 INFRARED IMAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of infrared imaging products in security & surveillance applications

- 5.2.1.2 Rising adoption of infrared cameras in quality control and inspection applications

- 5.2.1.3 Growing popularity of uncooled infrared cameras

- 5.2.1.4 Boosting demand for SWIR cameras in machine vision applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent import and export regulations for selling infrared cameras in US

- 5.2.2.2 Limitations associated with image resolution and sensitivity of infrared cameras

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging applications of IR imaging technology in automotive sector

- 5.2.3.2 Newer application areas of SWIR cameras

- 5.2.3.3 Integration of infrared imaging technology into consumer electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost associated with infrared cameras

- 5.2.4.2 Designing highly accurate IR imaging products

- 5.2.4.3 Integration and compatibility challenges pertaining to infrared imaging technology

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 INFRARED IMAGING ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF INFRARED IMAGING CAMERA TYPES, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF REFLECTIVE INFRARED IMAGING CAMERAS, BY REGION, 2021-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF THERMAL INFRARED IMAGING CAMERAS, BY REGION, 2021-2024

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 USE OF IR IMAGING TECHNOLOGY TO ANALYZE ORGANIC COMPOST

- 5.7.2 IMPLEMENTATION OF VIBRATIONAL SPECTROSCOPIC TECHNIQUES TO ANALYZE TEA QUALITY AND SAFETY

- 5.7.3 ADOPTION OF THERMAL CAMERAS IN SECURITY AND INSPECTION APPLICATIONS

- 5.7.4 TRANSFORMATION IN INFRARED IMAGING TECHNOLOGY WITH CLOUD INTEGRATION

- 5.7.5 ADVANCEMENTS IN AI-BASED INFRARED IMAGING

- 5.8 IMPACT OF AI/GEN AI ON INFRARED IMAGING MARKET

- 5.8.1 TOP USE CASES AND MARKET POTENTIAL

- 5.8.1.1 Anomaly detection

- 5.8.1.2 Medical diagnostics fever screening

- 5.8.1.3 Surveillance & border security

- 5.8.1.4 Smart city infrastructure monitoring

- 5.8.1.5 Automotive driver-assistance and EV battery monitoring

- 5.8.1 TOP USE CASES AND MARKET POTENTIAL

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS IN BUYING PROCESS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ROCKWOOL GROUP USED TELEDYNE FLIR'S THERMAL IMAGING TECHNOLOGY TO ASSESS INSULATION EFFECTIVENESS AND CONDUCT BUILDING ANALYSIS

- 5.11.2 VICENZA COURT RESOLVED CONSTRUCTION DISPUTE BY HIRING SERVICES OF THERMAL IMAGING EXPERTS FROM MULTITES SRL

- 5.11.3 HIGHLAND HELICOPTERS DEPLOYED THERMAL CAMERAS FROM INFRATEC TO COMBAT WILDFIRES

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT SCENARIO (HS 902750)

- 5.14.2 EXPORT SCENARIO (HS 902750)

- 5.15 TARIFF ANALYSIS

- 5.16 STANDARDS AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 GOVERNMENT REGULATIONS

- 5.16.3 REGULATORY LANDSCAPE

- 5.16.4 GOVERNMENT STANDARDS

- 5.17 2025 US TARIFF IMPACT ON INFRARED IMAGING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON VARIOUS COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICALS

6 INFRARED IMAGING DEVICE TYPES

- 6.1 INTRODUCTION

- 6.2 PORTABLE 95 6.2.1 USE OF PORTABLE CAMERAS FOR CONVENIENCE AND EFFORTLESS IMAGING

- 6.2.2 AERIAL

- 6.2.2.1 Deployment of aerial cameras for thermographic view and improved visibility of objects to be monitored or inspected

- 6.2.3 HANDHELD

- 6.2.3.1 Implementation of handheld cameras in buildings to inspect heat loss and detect insulation issues

- 6.2.2 AERIAL

- 6.3 FIXED

- 6.3.1 ADOPTION OF FIXED CAMERAS TO ENSURE CONSISTENT AND RELIABLE IMAGING OUTPUT

7 INFRARED IMAGING MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 REFLECTIVE

- 7.2.1 RISING USE IN SEMICONDUCTOR INSPECTION AND SECURITY APPLICATIONS TO SUPPORT MARKET GROWTH

- 7.3 THERMAL

- 7.3.1 PRESSING NEED FOR ENHANCED SAFETY AND OPERATIONAL EFFICIENCY ACROSS INDUSTRIES TO BOOST DEMAND

8 INFRARED IMAGING MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 CAMERAS

- 8.2.1 SIGNIFICANT USE IN PUBLIC SAFETY, MEDICAL, AND INDUSTRIAL APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 8.3 SCOPES

- 8.3.1 DEFENSE, OUTDOOR SPORTS, AND TACTICAL SURVEILLANCE APPLICATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.4 MODULES

- 8.4.1 SURGING USE OF MODULAR INFRARED IMAGING SYSTEMS IN DRONES, ROBOTICS, AND SMART DEVICES TO FOSTER SEGMENTAL GROWTH

9 INFRARED IMAGING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 COOLED

- 9.2.1 NEED TO REDUCE SENSOR NOISE AND IMPROVE SENSITIVITY TO ENCOURAGE ADOPTION

- 9.3 UNCOOLED

- 9.3.1 INCREASING ADOPTION IN HIGH-VOLUME APPLICATIONS OWING TO LOW COST AND EASY INSTALLATION TO FOSTER SEGMENTAL GROWTH

10 INFRARED IMAGING MARKET, BY WAVELENGTH

- 10.1 INTRODUCTION

- 10.2 NIR

- 10.2.1 HIGH ADOPTION OF NIR CCTV CAMERAS FOR SECURITY & SURVEILLANCE TO DRIVE MARKET

- 10.3 SWIR

- 10.3.1 INCREASED USE OF SWIR IMAGING TECHNOLOGY IN NON-DESTRUCTIVE TESTING TO PROPEL MARKET

- 10.4 MWIR

- 10.4.1 RAPID TECHNOLOGICAL ADVANCEMENTS IN MWIR TO BOOST SEGMENTAL GROWTH

- 10.5 LWIR

- 10.5.1 SIGNIFICANT USE IN WEARABLES, DRONES, AND HANDHELD DEVICES TO FUEL SEGMENTAL GROWTH

11 INFRARED IMAGING MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 SECURITY & SURVEILLANCE

- 11.2.1 SURGING DEPLOYMENT OF INFRARED CAMERAS DUE TO INCREASED TERRORISM TO DRIVE MARKET

- 11.3 MONITORING & INSPECTION

- 11.3.1 RISING USE OF INFRARED CAMERAS IN ENERGY AUDITS, BUILDING DIAGNOSTICS, AND INDUSTRIAL FAULT DETECTION TO PROPEL MARKET

- 11.3.2 CONDITION MONITORING

- 11.3.3 STRUCTURAL HEALTH MONITORING

- 11.3.4 QUALITY CONTROL

- 11.4 DETECTION

- 11.4.1 INCREASING IMPORTANCE OF SITUATIONAL AWARENESS TO SPIKE DEMAND

- 11.4.2 GAS DETECTION

- 11.4.3 FIRE/FLARE DETECTION

- 11.4.4 BODY TEMPERATURE MEASUREMENT

12 INFRARED IMAGING MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 INDUSTRIAL

- 12.2.1 ELEVATING USE OF SWIR CAMERAS TO ENSURE PRECISION IN GLASS, SEMICONDUCTOR, AND METAL PROCESSING TO FAVOR MARKET GROWTH

- 12.2.2 AUTOMOTIVE

- 12.2.3 AEROSPACE

- 12.2.4 ELECTRONICS & SEMICONDUCTOR

- 12.2.5 OIL & GAS

- 12.2.6 FOOD & BEVERAGES

- 12.2.7 GLASS

- 12.2.8 OTHER INDUSTRIAL VERTICALS

- 12.3 NON-INDUSTRIAL

- 12.3.1 RISING ADOPTION IN PUBLIC SAFETY, RESEARCH, AND HEALTHCARE TO PROPEL MARKET

- 12.3.2 MILITARY & DEFENSE

- 12.3.3 CIVIL INFRASTRUCTURE

- 12.3.4 MEDICAL

- 12.3.5 SCIENTIFIC RESEARCH

13 INFRARED IMAGING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Government focus on safety and security of country to fuel market growth

- 13.2.3 CANADA

- 13.2.3.1 Growing focus on safeguarding assets and ensuring public safety to boost demand

- 13.2.4 MEXICO

- 13.2.4.1 Increasing challenges related to border security, drug trafficking, and organized crime to spike demand

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Booming automotive sector to accelerate demand

- 13.3.3 UK

- 13.3.3.1 Medical and pharmaceutical companies to contribute most to market growth

- 13.3.4 FRANCE

- 13.3.4.1 Technology advancements in automotive sector to propel market growth

- 13.3.5 ITALY

- 13.3.5.1 Government focus on strengthening military surveillance capabilities to propel market

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Border control, critical infrastructure protection, and public safety applications to create opportunities

- 13.4.3 JAPAN

- 13.4.3.1 Consumer electronics, automotive, and healthcare sectors to strengthen market momentum

- 13.4.4 INDIA

- 13.4.4.1 Increasing use in predictive maintenance and quality control applications by industry players to support market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Greater emphasis on addressing urban crime and supporting border security operations to stimulate demand

- 13.5.3 MIDDLE EAST

- 13.5.3.1 Bahrain

- 13.5.3.1.1 Government initiatives to modernize surveillance and border control to drive market

- 13.5.3.2 Kuwait

- 13.5.3.2.1 Strong focus on modernizing oil, defense, and health infrastructure to accelerate demand

- 13.5.3.3 Oman

- 13.5.3.3.1 Rising emphasis on advanced safety protocols and sustainable operations to create opportunities

- 13.5.3.4 Qatar

- 13.5.3.4.1 Smart city development initiatives to fuel market growth

- 13.5.3.5 Saudi Arabia

- 13.5.3.5.1 Pressing need to monitor high-temperature processes in oil and petrochemical plants to boost demand

- 13.5.3.6 UAE

- 13.5.3.6.1 Vision of becoming global innovation hub to support market growth

- 13.5.3.7 Rest of Middle East

- 13.5.3.1 Bahrain

- 13.5.4 AFRICA

- 13.5.4.1 Urban infrastructure development to create opportunities

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Type footprint

- 14.5.5.4 Vertical footprint

- 14.6 STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 COMPETITIVE SCENARIOS

- 14.7.1 PRODUCT LAUNCHES

- 14.7.2 DEALS

- 14.7.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 TELEDYNE FLIR LLC

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 FLUKE CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 LEONARDO S.P.A.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 AXIS COMMUNICATIONS AB

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 RTX

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 L3HARRIS TECHNOLOGIES, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 EXOSENS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.8 OPGAL OPTRONIC INDUSTRIES LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.9 LYNRED

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.10 ALLIED VISION TECHNOLOGIES GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.11 BAE SYSTEMS

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.3.2 Deals

- 15.1.12 TESTO SE & CO. KGAA

- 15.1.12.1 Products offered

- 15.1.12.2 Recent developments

- 15.1.12.2.1 Product launches

- 15.1.1 TELEDYNE FLIR LLC

- 15.2 OTHER KEY PLAYERS

- 15.2.1 INTEVAC, INC.

- 15.2.2 ZHEJIANG DALI TECHNOLOGY CO., LTD.

- 15.2.3 C-THERM TECHNOLOGIES LTD.,

- 15.2.4 IRCAMERAS LLC

- 15.2.5 HGH

- 15.2.6 RAPTOR PHOTONICS

- 15.2.7 EPISENSORS

- 15.2.8 INFRATEC GMBH

- 15.2.9 PRINCETON INFRARED TECHNOLOGIES, INC.

- 15.2.10 SIERRA-OLYMPIA TECH.

- 15.2.11 COX CO., LTD.

- 15.2.12 TONBO IMAGING

- 15.2.13 OPTOTHERM, INC.

- 15.2.14 SEEK THERMAL

- 15.2.15 INFRARED CAMERAS, INC.

- 15.2.16 LAND INSTRUMENTS INTERNATIONAL LTD

- 15.2.17 DIAS INFRARED GMBH

- 15.2.18 MOVITHERM

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 RESEARCH LIMITATIONS

- TABLE 2 PRICING RANGE OF INFRARED IMAGING CAMERAS OFFERED BY MAJOR PLAYERS, BY TYPE, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF REFLECTIVE INFRARED IMAGING CAMERAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 4 AVERAGE SELLING PRICE OF THERMAL INFRARED IMAGING CAMERAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 5 IMPACT OF FORCES ON INFRARED IMAGING MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 8 INFRARED IMAGING MARKET: KEY PATENTS

- TABLE 9 INFRARED IMAGING MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 IMPORT DATA FOR HS 902750-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS 902750-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 13 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 14 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 ANTICIPATED CHANGE IN PRICES AND IMPACT ON VERTICALS DUE TO TARIFF

- TABLE 21 INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 22 INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 23 REFLECTIVE: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 24 REFLECTIVE: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 25 REFLECTIVE: INFRARED IMAGING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 26 REFLECTIVE: INFRARED IMAGING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 27 REFLECTIVE: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 28 REFLECTIVE: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 THERMAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 30 THERMAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 31 THERMAL: INFRARED IMAGING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 32 THERMAL: INFRARED IMAGING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 33 THERMAL: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 34 THERMAL: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 35 INFRARED IMAGING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 36 INFRARED IMAGING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 37 CAMERAS: INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 38 CAMERAS: INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 39 CAMERAS: INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 CAMERAS: INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 SCOPES: INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 SCOPES: INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 MODULES: INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 MODULES: INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 INFRARED IMAGING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 INFRARED IMAGING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 COOLED: INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 COOLED: INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 COOLED: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 COOLED: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 UNCOOLED: INFRARED IMAGING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 UNCOOLED: INFRARED IMAGING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 UNCOOLED: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 54 UNCOOLED: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 56 INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 57 NIR: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 58 NIR: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 NIR: INFRARED IMAGING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 60 NIR: INFRARED IMAGING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 61 SWIR: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 SWIR: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 SWIR: INFRARED IMAGING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 64 SWIR: INFRARED IMAGING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 65 MWIR: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 66 MWIR: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 MWIR: INFRARED IMAGING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 68 MWIR: INFRARED IMAGING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 69 LWIR: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 LWIR: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 LWIR: INFRARED IMAGING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 72 LWIR: INFRARED IMAGING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 73 INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 76 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 77 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 78 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 79 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 82 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 83 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 84 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 85 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 DETECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 88 DETECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 89 DETECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 90 DETECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 91 DETECTION: INFRARED IMAGING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 DETECTION: INFRARED IMAGING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 INFRARED IMAGING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 94 INFRARED IMAGING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 95 INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 96 INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 97 NON-INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 98 NON-INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2025-2030 (USD MILLION)

- TABLE 99 INFRARED IMAGING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 INFRARED IMAGING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: INFRARED IMAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: INFRARED IMAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 US: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 112 US: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 CANADA: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 MEXICO: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 116 MEXICO: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: INFRARED IMAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: INFRARED IMAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 GERMANY: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 UK: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 UK: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 FRANCE: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 FRANCE: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 ITALY: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 REST OF EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: INFRARED IMAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: INFRARED IMAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 CHINA: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 CHINA: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 JAPAN: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 JAPAN: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 ROW: INFRARED IMAGING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 156 ROW: INFRARED IMAGING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 157 ROW: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 ROW: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 ROW: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 ROW: INFRARED IMAGING MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 161 ROW: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ROW: INFRARED IMAGING MARKET FOR MONITORING & INSPECTION APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 ROW: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 ROW: INFRARED IMAGING MARKET FOR DETECTION APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: INFRARED IMAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: INFRARED IMAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: INFRARED IMAGING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 AFRICA: INFRARED IMAGING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 OVERVIEW OF STRATEGIES FOLLOWED BY TOP 5 PLAYERS IN INFRARED IMAGING MARKET, JULY 2020-JUNE 2025

- TABLE 174 INFRARED IMAGING MARKET: DEGREE OF COMPETITION

- TABLE 175 INFRARED IMAGING MARKET: REGION FOOTPRINT

- TABLE 176 INFRARED IMAGING MARKET: TYPE FOOTPRINT

- TABLE 177 INFRARED IMAGING MARKET: VERTICAL FOOTPRINT

- TABLE 178 INFRARED IMAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 INFRARED IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 INFRARED IMAGING MARKET: PRODUCT LAUNCHES, JULY 2020-JUNE 2025

- TABLE 181 INFRARED IMAGING MARKET: DEALS, JULY 2020-JUNE 2025

- TABLE 182 INFRARED IMAGING MARKET: OTHER DEVELOPMENTS, JULY 2020-JUNE 2025

- TABLE 183 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 184 TELEDYNE FLIR LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 186 TELEDYNE FLIR LLC: DEALS

- TABLE 187 TELEDYNE FLIR LLC: OTHER DEVELOPMENTS

- TABLE 188 FLUKE CORPORATION: COMPANY OVERVIEW

- TABLE 189 FLUKE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 FLUKE CORPORATION: PRODUCT LAUNCHES

- TABLE 191 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 192 LEONARDO S.P.A.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 194 LEONARDO S.P.A.: DEALS

- TABLE 195 LEONARDO S.P.A.: OTHER DEVELOPMENTS

- TABLE 196 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 197 AXIS COMMUNICATIONS AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 199 AXIS COMMUNICATIONS AB: DEALS

- TABLE 200 RTX: COMPANY OVERVIEW

- TABLE 201 RTX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 202 RTX: PRODUCT LAUNCHES

- TABLE 203 RTX: DEALS

- TABLE 204 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 205 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 207 EXOSENS: COMPANY OVERVIEW

- TABLE 208 EXOSENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 209 EXOSENS: PRODUCT LAUNCHES

- TABLE 210 EXOSENS: DEALS

- TABLE 211 OPGAL OPTRONIC INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 212 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 214 LYNRED: COMPANY OVERVIEW

- TABLE 215 LYNRED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 LYNRED: PRODUCT LAUNCHES

- TABLE 217 LYNRED: DEALS

- TABLE 218 ALLIED VISION TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 219 ALLIED VISION TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 220 ALLIED VISION TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 221 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 222 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 223 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 224 BAE SYSTEMS: DEALS

- TABLE 225 TESTO SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 226 TESTO SE & CO. KGAA: PRODUCTS OFFERED

- TABLE 227 TESTO SE & CO. KGAA: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 INFRARED IMAGING MARKET SEGMENTATION

- FIGURE 2 INFRARED IMAGING MARKET: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 INFRARED IMAGING MARKET: BOTTOM-UP APPROACH

- FIGURE 5 INFRARED IMAGING MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE)- REVENUE GENERATED FROM SALES OF INFRARED IMAGING PRODUCTS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 THERMAL SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2030

- FIGURE 9 CAMERAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 10 NIR SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 11 SECURITY & SURVEILLANCE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 12 UNCOOLED SEGMENT TO COMMAND INFRARED IMAGING MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 13 NON-INDUSTRIAL SEGMENT TO HOLD LARGER SHARE OF INFRARED IMAGING MARKET IN 2030

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR INFRARED IMAGING DURING FORECAST PERIOD

- FIGURE 15 INCREASING ADOPTION OF INFRARED IMAGING TECHNOLOGY IN ASIA PACIFIC TO DRIVE MARKET

- FIGURE 16 THERMAL TYPE TO HOLD LARGER SHARE OF INFRARED IMAGING MARKET IN 2025

- FIGURE 17 CAMERAS TO CAPTURE LARGEST SHARE OF INFRARED IMAGING MARKET IN 2025

- FIGURE 18 SECURITY & SURVEILLANCE APPLICATIONS TO HOLD LARGEST SHARE OF INFRARED IMAGING MARKET IN 2025

- FIGURE 19 NIR WAVELENGTH TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 20 US AND SECURITY & SURVEILLANCE APPLICATIONS TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2030

- FIGURE 21 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL INFRARED IMAGING MARKET DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INFRARED IMAGING MARKET

- FIGURE 23 ANALYSIS OF IMPACT OF DRIVERS ON INFRARED IMAGING MARKET

- FIGURE 24 ANALYSIS OF IMPACT OF RESTRAINTS ON INFRARED IMAGING MARKET

- FIGURE 25 ANALYSIS OF IMPACT OF OPPORTUNITIES ON INFRARED IMAGING MARKET

- FIGURE 26 ANALYSIS OF IMPACT OF CHALLENGES ON INFRARED IMAGING MARKET

- FIGURE 27 VALUE CHAIN ANALYSIS: INFRARED IMAGING MARKET

- FIGURE 28 INFRARED IMAGING ECOSYSTEM

- FIGURE 29 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE OF INFRARED IMAGING CAMERAS OFFERED BY MAJOR PLAYERS, BY TYPE, 2024

- FIGURE 31 AVERAGE SELLING PRICE TREND OF REFLECTIVE INFRARED IMAGING CAMERAS, BY REGION, 2021-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF THERMAL INFRARED IMAGING CAMERAS, BY REGION, 2021-2024

- FIGURE 33 IMPACT OF AI/GEN AI ON INFRARED IMAGING MARKET

- FIGURE 34 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 36 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 37 PATENTS GRANTED AND APPLIED FOR INFRARED IMAGING PRODUCTS, 2016-2025

- FIGURE 38 IMPORT SCENARIO FOR HS CODE 902750-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 39 EXPORT SCENARIO FOR HS CODE 902750-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 40 THERMAL SEGMENT TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2030

- FIGURE 41 CAMERAS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 42 UNCOOLED SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 43 SWIR SEGMENT TO WITNESS HIGHEST CAGR IN INFRARED IMAGING MARKET DURING FORECAST PERIOD

- FIGURE 44 MONITORING & INSPECTION SEGMENT TO WITNESS HIGHEST CAGR IN INFRARED IMAGING MARKET DURING FORECAST PERIOD

- FIGURE 45 NON-INDUSTRIAL SEGMENT TO COMMAND INFRARED IMAGING MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INFRARED IMAGING MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: INFRARED IMAGING MARKET SNAPSHOT

- FIGURE 48 EUROPE: INFRARED IMAGING MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: INFRARED IMAGING MARKET SNAPSHOT

- FIGURE 50 ROW: INFRARED IMAGING MARKET SNAPSHOT

- FIGURE 51 INFRARED IMAGING MARKET: REVENUE ANALYSIS, 2020-2024

- FIGURE 52 INFRARED IMAGING MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 53 INFRARED IMAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 INFRARED IMAGING MARKET: COMPANY FOOTPRINT

- FIGURE 55 INFRARED IMAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 57 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 58 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

- FIGURE 59 RTX: COMPANY SNAPSHOT

- FIGURE 60 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 61 BAE SYSTEMS: COMPANY SNAPSHOT