|

市场调查报告书

商品编码

1787261

全球生物製药契约製造市场(按服务、类型、营运规模、原材料、分子类型、治疗领域和地区划分)- 预测至 2030 年Biopharmaceutical Contract Manufacturing Market by Service, Type, Scale, Source, Therapy Area, Molecule Type - Global Forecast to 2030 |

||||||

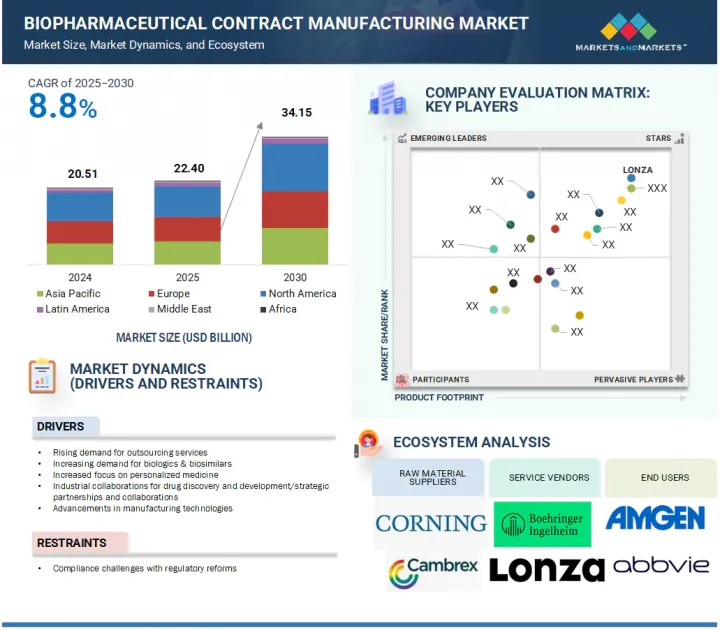

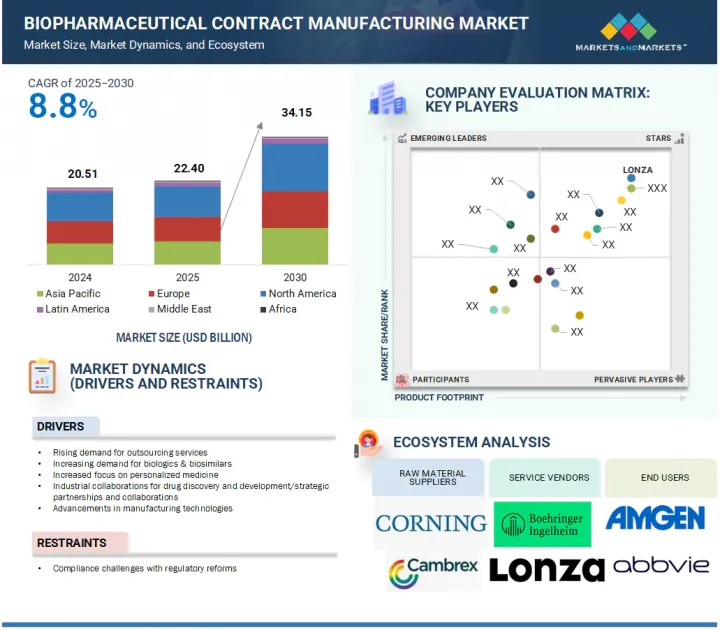

全球生物製药契约製造市场预计将从 2025 年的 224 亿美元成长到 2030 年的 341.5 亿美元,2025 年至 2030 年的复合年增长率为 8.8%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按服务、类型、业务规模、原材料、分子类型、治疗领域和地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

生物製药契约製造市场的成长主要受到製造技术的进步和对个人化医疗的日益关注的推动,然而,不断变化的法规可能会带来限制市场扩张的挑战。

2024年,单株抗体领域将占据生物製药契约製造市场的最大份额。

生物製药契约製造市场按分子类型细分为单株抗体 (mAb)、细胞和基因疗法、抗体药物复合体、疫苗、治疗性胜肽和蛋白质以及其他分子。由于癌症和自体免疫疾病等慢性疾病的发生率不断上升,推动了对标靶治疗的需求,mAb 细分市场在市场中处于领先地位。单株抗体因其能够精确靶向特定疾病途径而成为临床环境中的首选。政府对 mAb 研究的支持鼓励生物製药公司扩展其产品线,增加了临床试验中 mAb 候选药物的数量。因此,受託製造厂商对高效率且经济地生产这些先进生技药品的服务需求很高。

哺乳动物表现系统领域在全球生物製药契约製造市场占据主导地位,这主要归功于其在单株抗体等复杂生技药品製剂生产中发挥的关键作用。这种主导地位源自于哺乳动物细胞平台能够进行复杂的转译后修饰,进而增强疗效。对先进生技药品的需求不断增长以及对细胞培养技术的投资不断增加,进一步增强了这一领域。受託製造厂商正在扩展其哺乳动物细胞培养能力,并采用先进技术来提高产量和品质。随着生技药品产品线的不断扩展,哺乳动物表现系统领域预计将继续推动生物製药製造的成长和创新。

2025年至2030年期间,欧洲将占据第二大市场占有率。

预计在预测期内,欧洲生物製药契约製造市场仍将保持第二大地位,这得益于对单株抗体、细胞和基因疗法等生技药品的投资不断增加,以及生物製造能力的不断提升。该地区是技术创新的中心,专注于提升品质和效率的先进技术。例如,龙沙于2023年3月推出了一个用于大规模药品生产的cGMP生产基地,这凸显了欧洲致力于满足全球对复杂生技药品的需求,并吸引寻求顶级契约製造服务的製药和生物技术公司。

本报告研究了全球生物製药契约製造市场,并提供了按服务、类型、业务规模、原材料、分子类型、治疗领域、区域趋势和公司概况分類的市场资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 技术分析

- 影响客户业务的趋势/中断

- 价格分析(定性)

- 价值链分析

- 生态系分析

- 专利分析

- 监管分析

- 2025-2026年主要会议和活动

- 波特五力分析

- 主要相关人员和采购标准

- 投资金筹措场景

- 人工智慧/生成人工智慧对生物製药契约製造市场的影响

- 2025年美国关税对生物製药契约製造市场的影响

第六章生物製药契约製造市场(按服务)

- 介绍

- 製造业

- 混合、填充和精加工

- 包装和标籤

- 其他的

第七章生物製药契约製造市场(按类型)

- 介绍

- 生物製药原料药的生产

- 生物製药製造

第八章生物製药契约製造市场(按业务规模)

- 介绍

- 商业业务

- 临床业务

第九章生物製药契约製造市场(依原料)

- 介绍

- 哺乳动物表现系统

- 非哺乳动物表现系统

第 10 章生物製药契约製造市场(按分子类型)

- 介绍

- 单株抗体

- 细胞和基因治疗

- 抗体药物复合体

- 疫苗

- 治疗性胜肽和蛋白质

- 其他的

第 11 章生物製药契约製造市场(按治疗领域)

- 介绍

- 肿瘤学

- 自体免疫疾病

- 心血管疾病

- 代谢疾病

- 感染疾病

- 神经病学

- 其他的

第十二章生物製药契约製造市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 瑞士

- 爱尔兰

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东

- 中东宏观经济展望

- 海湾合作委员会国家

- 其他的

- 非洲

- 提高本地药品生产水平,扩大市场

- 非洲宏观经济展望

第十三章竞争格局

- 概述

- 生物製药契约製造市场主要企业的策略概述(2022-2025 年)

- 2020-2024年收益分析

- 2024年市场占有率分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:小型企业/Start-Ups,2024 年

- 估值和财务指标

- 品牌/产品比较

- 竞争场景

第十四章:公司简介

- 主要参与企业

- LONZA

- WUXI BIOLOGICS

- SAMSUNG BIOLOGICS

- THERMO FISHER SCIENTIFIC INC.

- ABBVIE INC.

- CATALENT, INC.

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- FUJIFILM HOLDINGS CORPORATION

- EUROFINS SCIENTIFIC

- GENSCRIPT BIOTECH CORPORATION

- AGC INC.

- MERCK KGAA

- JSR CORPORATION

- IDT BIOLOGIKA

- AJINOMOTO BIO-PHARMA

- AGILENT TECHNOLOGIES INC.

- ASAHI KASEI CORPORATION

- 其他公司

- ONESOURCE PHARMA SOLUTIONS

- RECIPHARM AB

- EMERGENT BIOSOLUTIONS

- SHANGHAI FOSUN PHARMACEUTICAL CO., LTD.

- LOTTE BIOLOGICS

- CURIA GLOBAL, INC.

- POLYPLUS TRANSFECTION

- ALDEVRON LLC

- MINAPHARM PHARMACEUTICALS

- RENTSCHLER BIOPHARMA SE

- PORTON PHARMA SOLUTIONS

- CELLARES, INC.

- MABPLEX INTERNATIONAL CO., LTD.

- ASYMCHEM INC.

第十五章 附录

The global biopharmaceutical contract manufacturing market is expected to reach USD 34.15 billion by 2030 from an estimated USD 22.40 billion in 2025, at a CAGR of 8.8% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Service, Type, Source, Scale of Operation, Molecule Type, Therapeutic Area, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

This growth in the biopharmaceutical contract manufacturing market is primarily driven by advancements in manufacturing technologies and a growing emphasis on personalized medicine. However, evolving regulations may pose challenges that could limit market expansion.

The monoclonal antibodies segment accounted for the largest share of the biopharmaceutical contract manufacturing market in 2024.

The biopharmaceutical contract manufacturing market is segmented by molecule type into monoclonal antibodies (mAbs), cell & gene therapy, antibody-drug conjugates, vaccines, therapeutic peptides & proteins, and other molecules. The mAbs segment leads the market due to the rising prevalence of chronic disorders like cancer and autoimmune diseases, driving the demand for targeted therapies. Monoclonal antibodies are preferred in clinical practice for their precision in targeting specific disease pathways. Government support for mAb research has encouraged biopharmaceutical firms to expand their pipelines, increasing the number of mAb candidates in clinical trials. Consequently, contract manufacturing organizations are experiencing a growing demand for their services to produce these advanced biologics efficiently and cost-effectively.

The mammalian expression systems segment dominated the market in 2024.

The mammalian expression systems segment dominates the global biopharmaceutical contract manufacturing market, primarily due to its critical role in creating complex biologics like monoclonal antibodies. This dominance stems from the ability of mammalian cell platforms to perform intricate post-translational modifications, enhancing treatment effectiveness. The rising demand for advanced biologics and increased investments in cell culture technologies have further solidified this segment. Contract manufacturing organizations are expanding their mammalian cell culture capabilities and adopting advanced technologies to improve yield and quality. As the pipeline for biologics grows, the mammalian expression systems segment is expected to continue driving growth and innovation in biopharmaceutical manufacturing.

Europe accounted for the second-largest share of the market from 2025 to 2030.

The biopharmaceutical contract manufacturing market in Europe is the second largest during the forecast period, driven by rising investments in biologics such as monoclonal antibodies and cell & gene therapies, along with expansions in biomanufacturing capacity. The region is a hub for innovation, focusing on advanced technologies that enhance quality and efficiency. For example, in March 2023, Lonza launched a cGMP manufacturing site for large-scale drug production, underscoring Europe's commitment to meeting the global demand for complex biologics and attracting pharmaceutical and biotech firms seeking top-tier contract manufacturing services.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side (70%) and Demand Side (30%)

- By Designation: Managers (45%), CXOs and Directors (30%), and Executives (25%)

- By Region: North America (40%), Europe (25%), the Asia Pacific (25%), Latin America (5%), and the Middle East & Africa (5%)

List of Key Companies Profiled in the Report:

Key players in the biopharmaceutical contract manufacturing market include Lonza (Switzerland), Thermo Fisher Scientific Inc. (US), WuXi Biologics (China), Catalent, Inc. (US), Samsung Biologics (South Korea), Boehringer Ingelheim International GmbH (Germany), FUJIFILM Holdings Corporation (Japan), AbbVie, Inc. (US), Eurofins Scientific (Luxembourg), GenScript Biotech Corporation (US), AGC Inc. (Japan), Merck KGaA (Germany), JSR Corporation (Japan), IDT Biologika (Germany), Ajinomoto Bio-Pharma (Japan), Agilent Technologies, Inc. (US), and Asahi Kasei Corporation (Japan).

Research Coverage:

This research report categorizes the biopharmaceutical contract manufacturing market by service (manufacturing, formulation & fill-finish, packaging & labeling, and other services), type (biologic drug substance manufacturing and biologic drug product manufacturing), scale of operation (clinical and commercial operations), source (mammalian and non-mammalian expression systems), therapeutic area (oncology, autoimmune diseases, metabolic diseases, cardiovascular diseases, neurology, infectious diseases, and other therapeutic areas), molecule type (monoclonal antibodies, antibody-drug conjugates, cell & gene therapy, vaccines, therapeutic peptides & proteins, and other molecules), and region (North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa).

The report provides a comprehensive analysis of the key factors affecting the growth of the biopharmaceutical contract manufacturing market, including drivers, restraints, challenges, and opportunities. It includes an in-depth examination of major industry players, offering insights into their business overviews, products, solutions, and key strategies, as well as their collaborations, partnerships, and agreements. Additionally, the report highlights recent developments related to new approvals and launches, mergers and acquisitions, and other significant activities in the biopharmaceutical contract manufacturing market.

Key Benefits of Buying the Report:

The report will assist both market leaders and new entrants by providing accurate revenue estimates for the overall biopharmaceutical contract manufacturing market and its subsegments. It will also help stakeholders better understand the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, this report will offer insights into the market's dynamics, including key drivers, constraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for outsourcing services, increasing demand for biologics & biosimilars, increased focus on personalized medicine, industrial collaborations for drug discovery and development/strategic partnerships and collaborations, and advancements in manufacturing technologies), restraints (challenges complying with regulatory reforms), opportunities (rising demand for cell & gene therapy, emerging countries market, and strong emphasis on drug development), and challenges (challenges to meet reformed regulations) influencing the growth of the market.

- Service Development/Innovation: Detailed insights on the upcoming technologies and research & development activities in the biopharmaceutical contract manufacturing market.

- Market Development: The report provides comprehensive information about profitable markets by analyzing them across various regions.

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the biopharmaceutical contract manufacturing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, service launches/approvals, pipeline analysis, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the biopharmaceutical contract manufacturing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries (supply- and demand-side participants)

- 2.1.2.2 Key objective of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.1.1 Revenue share analysis of Thermo Fisher Scientific Inc.

- 2.2.1.2 MnM repository analysis

- 2.2.1.3 Primary interviews

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.2 INSIGHTS OF PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET OVERVIEW

- 4.2 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION AND COUNTRY (2025)

- 4.3 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE, BY THERAPEUTIC AREA, 2025 VS. 2030

- 4.4 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2025 VS. 2030 (USD MILLION)

- 4.5 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing outsourcing of biologics manufacturing among biopharmaceutical companies

- 5.2.1.2 Rising demand for biologics and biosimilars

- 5.2.1.3 Growing focus on personalized medicine

- 5.2.1.4 Increasing collaborations between pharmaceutical companies and biologics CMOs

- 5.2.1.5 Advancements in manufacturing technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Intellectual property rights issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for cell & gene therapy

- 5.2.3.2 Significant growth opportunities offered by emerging countries

- 5.2.3.3 Expansion of biologics manufacturing capacities by CMOs

- 5.2.4 CHALLENGES

- 5.2.4.1 Strict regulations

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Single-use technologies

- 5.3.1.2 Continuous bioprocessing

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Robotics and automation in fill-finish

- 5.3.2.2 CRISPR & gene editing tools

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 3D bioprinting & microfluidics

- 5.3.3.2 Biosensors & real-time analytics

- 5.3.1 KEY TECHNOLOGIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS (QUALITATIVE)

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 PATENT ANALYSIS

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATORY LANDSCAPE

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 INVESTMENT & FUNDING SCENARIO

- 5.14 IMPACT OF AI/GEN AI ON BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- 5.15 IMPACT OF 2025 US TARIFFS ON BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRY/REGION

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 APAC

- 5.15.5 IMPACT ON UPSTREAM INDUSTRIES

6 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE

- 6.1 INTRODUCTION

- 6.2 MANUFACTURING

- 6.2.1 SHIFT TOWARD CONTINUOUSLY IMPROVING SINGLE-USE TECHNOLOGIES TO DRIVE MARKET

- 6.3 FORMULATION & FILL-FINISH

- 6.3.1 CRITICAL ROLE OF FORMULATION & FILL-FINISH IN BIOLOGICS MANUFACTURING TO DRIVE MARKET GROWTH

- 6.4 PACKAGING & LABELING

- 6.4.1 IMPORTANCE OF PACKAGING & LABELING IN ENSURING SAFETY AND EFFECTIVENESS TO SUPPORT MARKET GROWTH

- 6.5 OTHER SERVICES

7 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 BIOLOGIC DRUG SUBSTANCE MANUFACTURING

- 7.2.1 INCREASING DEMAND FOR BIOTECHNOLOGY PRODUCTS TO DRIVE MARKET

- 7.3 BIOLOGIC DRUG PRODUCT MANUFACTURING

- 7.3.1 INCREASING R&D COST AND PROCESS COMPLEXITY TO DRIVE DEMAND FOR CONTRACT MANUFACTURING FOR BIOLOGIC DRUG PRODUCTS

8 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION

- 8.1 INTRODUCTION

- 8.2 COMMERCIAL OPERATIONS

- 8.2.1 INCREASING APPROVALS OF BIOLOGICS TO SUPPORT MARKET GROWTH

- 8.3 CLINICAL OPERATIONS

- 8.3.1 INCREASING NUMBER OF CLINICAL TRIALS FOR TARGETED THERAPIES TO DRIVE MARKET

9 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 MAMMALIAN EXPRESSION SYSTEMS

- 9.2.1 VERSATILE THERAPEUTIC DIVERSITY OF MAMMALIAN EXPRESSION SYSTEMS TO DRIVE MARKET

- 9.3 NON-MAMMALIAN EXPRESSION SYSTEMS

- 9.3.1 INCREASING DEMAND FOR BIOLOGICS VACCINES TO SUPPORT MARKET GROWTH

10 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE

- 10.1 INTRODUCTION

- 10.2 MONOCLONAL ANTIBODIES

- 10.2.1 GROWING APPROVALS FOR MABS TO PROPEL MARKET

- 10.3 CELL & GENE THERAPY

- 10.3.1 INCREASING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET

- 10.4 ANTIBODY-DRUG CONJUGATES

- 10.4.1 INCREASING INVESTMENTS IN BIOLOGICS TO SUPPORT MARKET GROWTH

- 10.5 VACCINES

- 10.5.1 INCREASING DEMAND FOR VACCINES TO DRIVE MARKET

- 10.6 THERAPEUTIC PEPTIDES & PROTEINS

- 10.6.1 INCREASING NUMBER OF RESEARCH PROJECTS IN GENOMICS TO SUPPORT MARKET GROWTH

- 10.7 OTHER MOLECULES

11 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA

- 11.1 INTRODUCTION

- 11.2 ONCOLOGY

- 11.2.1 INCREASED APPROVALS AND LAUNCH OF BIOLOGICS FOR ONCOLOGY TO DRIVE MARKET

- 11.3 AUTOIMMUNE DISEASES

- 11.3.1 RISING PREVALENCE OF AUTOIMMUNE DISEASES TO DRIVE MARKET

- 11.4 CARDIOVASCULAR DISEASES

- 11.4.1 DEVELOPMENT OF NEW TREATMENT OPTIONS TO SUPPORT MARKET GROWTH

- 11.5 METABOLIC DISEASES

- 11.5.1 INCREASING PREVALENCE OF METABOLIC DISEASES TO DRIVE ADOPTION OF BIOLOGICS

- 11.6 INFECTIOUS DISEASES

- 11.6.1 RISING EPIDEMIC OUTBREAKS TO SUPPORT MARKET GROWTH

- 11.7 NEUROLOGY

- 11.7.1 HIGH BURDEN OF NEUROLOGICAL DISORDERS TO PROPEL MARKET

- 11.8 OTHER THERAPEUTIC AREAS

12 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Presence of large number of FDA-approved manufacturing facilities to favor market growth

- 12.2.3 CANADA

- 12.2.3.1 Rising government funding for drug development to support market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Rapidly growing pharmaceutical market to drive market

- 12.3.3 UK

- 12.3.3.1 Rising investments in drug development to favor market growth

- 12.3.4 FRANCE

- 12.3.4.1 Availability of funds from government and private organizations for domestic drug development to support market growth

- 12.3.5 ITALY

- 12.3.5.1 Rising commercial drug development pipeline to drive market

- 12.3.6 SPAIN

- 12.3.6.1 Rising R&D expenditure to propel market

- 12.3.7 SWITZERLAND

- 12.3.7.1 Strong R&D investments and infrastructure expansion to bolster biotech manufacturing

- 12.3.8 IRELAND

- 12.3.8.1 Robust R&D growth and CDMO capacity expansion to fuel pharma manufacturing

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Low manufacturing cost and high demand for medicines to favor market growth

- 12.4.3 JAPAN

- 12.4.3.1 Growing demand for biosimilars to drive growth

- 12.4.4 INDIA

- 12.4.4.1 Increasing pharma R&D activities and government funding for biotechnology industry to support market growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Increasing R&D activities for drug development to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Growing pharmaceutical industry to drive market

- 12.5.3 MEXICO

- 12.5.3.1 Regulatory Improvements to support market growth

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST

- 12.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Substantial opportunities fueled by strong government support to boost growth

- 12.6.3 REST OF MIDDLE EAST

- 12.7 AFRICA

- 12.7.1 EFFORTS TO IMPROVE LOCAL PHARMACEUTICAL PRODUCTION TO BOOST MARKET

- 12.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2022-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Service type footprint

- 13.5.5.4 Molecule type footprint

- 13.5.5.5 Therapeutic area footprint

- 13.6 COMPANY EVALUATION MATRIX: SMES/STARTUPS, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: SMES/STARTUPS, 2024

- 13.6.5.1 Detailed list of key SMEs/startups

- 13.6.5.2 Competitive benchmarking of key emerging players/startups

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 SERVICE LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 LONZA

- 14.1.1.1 Business overview

- 14.1.1.2 Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 WUXI BIOLOGICS

- 14.1.2.1 Business overview

- 14.1.2.2 Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 SAMSUNG BIOLOGICS

- 14.1.3.1 Business overview

- 14.1.3.2 Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Service launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 THERMO FISHER SCIENTIFIC INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 ABBVIE INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Services offered

- 14.1.6 CATALENT, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses & competitive threats

- 14.1.7 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 14.1.7.1 Business overview

- 14.1.7.2 Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Other developments

- 14.1.8 FUJIFILM HOLDINGS CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Expansions

- 14.1.9 EUROFINS SCIENTIFIC

- 14.1.9.1 Business overview

- 14.1.9.2 Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Expansions

- 14.1.10 GENSCRIPT BIOTECH CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Service launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.11 AGC INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.12 MERCK KGAA

- 14.1.12.1 Business overview

- 14.1.12.2 Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Expansions

- 14.1.13 JSR CORPORATION

- 14.1.13.1 Business overview

- 14.1.13.2 Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Expansions

- 14.1.14 IDT BIOLOGIKA

- 14.1.14.1 Business overview

- 14.1.14.2 Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Other developments

- 14.1.15 AJINOMOTO BIO-PHARMA

- 14.1.15.1 Business overview

- 14.1.15.2 Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.16 AGILENT TECHNOLOGIES INC.

- 14.1.16.1 Business overview

- 14.1.16.2 Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.17 ASAHI KASEI CORPORATION

- 14.1.17.1 Business overview

- 14.1.17.2 Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.1 LONZA

- 14.2 OTHER PLAYERS

- 14.2.1 ONESOURCE PHARMA SOLUTIONS

- 14.2.2 RECIPHARM AB

- 14.2.3 EMERGENT BIOSOLUTIONS

- 14.2.4 SHANGHAI FOSUN PHARMACEUTICAL CO., LTD.

- 14.2.5 LOTTE BIOLOGICS

- 14.2.6 CURIA GLOBAL, INC.

- 14.2.7 POLYPLUS TRANSFECTION

- 14.2.8 ALDEVRON LLC

- 14.2.9 MINAPHARM PHARMACEUTICALS

- 14.2.10 RENTSCHLER BIOPHARMA SE

- 14.2.11 PORTON PHARMA SOLUTIONS

- 14.2.12 CELLARES, INC.

- 14.2.13 MABPLEX INTERNATIONAL CO., LTD.

- 14.2.14 ASYMCHEM INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

- TABLE 3 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: RISK ANALYSIS

- TABLE 4 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 LIST OF KEY BIOSIMILARS APPROVED, 2023-2025

- TABLE 6 LIST OF EXPANSIONS BY TOP COMPANIES

- TABLE 7 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ROLE IN ECOSYSTEM

- TABLE 8 NUMBER OF PATENTS FILED IN BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2014-2024

- TABLE 9 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: INDICATIVE LIST OF PATENTS, 2022

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 COUNTRY-WISE REGULATORY SCENARIO FOR CONTRACT MANUFACTURING

- TABLE 15 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2025-2026)

- TABLE 16 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF BIOPHARMACEUTICAL CONTRACT MANUFACTURING SERVICES (%)

- TABLE 18 KEY BUYING CRITERIA FOR BIOPHARMACEUTICAL CONTRACT MANUFACTURING SERVICES, BY END USER

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 21 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FORMULATION & FILL-FINISH SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FORMULATION & FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FORMULATION & FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FORMULATION & FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FORMULATION & FILL-FINISH SERVICES BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FORMULATION & FILL-FINISH SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 BIOLOGIC DRUG SUBSTANCE MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: BIOLOGIC DRUG SUBSTANCE MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 EUROPE: BIOLOGIC DRUG SUBSTANCE MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: BIOLOGIC DRUG SUBSTANCE MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 LATIN AMERICA: BIOLOGIC DRUG SUBSTANCE MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 MIDDLE EAST: BIOLOGIC DRUG SUBSTANCE MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 BIOLOGIC DRUG PRODUCT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: BIOLOGIC DRUG PRODUCT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 EUROPE: BIOLOGIC DRUG PRODUCT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: BIOLOGIC DRUG PRODUCT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 LATIN AMERICA: BIOLOGIC DRUG PRODUCT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 MIDDLE EAST: BIOLOGIC DRUG PRODUCT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 59 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR COMMERCIAL OPERATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR COMMERCIAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR COMMERCIAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR COMMERCIAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR COMMERCIAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR COMMERCIAL OPERATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CLINICAL OPERATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CLINICAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CLINICAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CLINICAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CLINICAL OPERATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CLINICAL OPERATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 72 TYPES OF MAMMALIAN EXPRESSION SYSTEMS

- TABLE 73 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MAMMALIAN EXPRESSION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MAMMALIAN EXPRESSION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 TYPES OF MICROBIAL EXPRESSION SYSTEMS AND THEIR APPLICATIONS

- TABLE 80 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NON-MAMMALIAN EXPRESSION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NON-MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NON-MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NON-MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NON-MAMMALIAN EXPRESSION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NON-MAMMALIAN EXPRESSION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 87 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 FDA-APPROVED CAR T-CELL THERAPIES

- TABLE 94 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY-DRUG CONJUGATES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY-DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY-DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY-DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY-DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY-DRUG CONJUGATES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NIH FUNDING FOR VACCINE RESEARCH, 2018-2024 (USD MILLION)

- TABLE 107 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 113 EXAMPLES OF PEPTIDE THERAPEUTICS

- TABLE 114 COMMERCIALIZED RECOMBINANT PROTEINS USED IN MEDICINE

- TABLE 115 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 121 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER MOLECULES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER MOLECULES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER MOLECULES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER MOLECULES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER MOLECULES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER MOLECULES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 127 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 128 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ONCOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ONCOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 134 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR AUTOIMMUNE DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR AUTOIMMUNE DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 140 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 146 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR METABOLIC DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR METABOLIC DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR METABOLIC DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR METABOLIC DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR METABOLIC DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR METABOLIC DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 152 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 158 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NEUROLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR NEUROLOGY, BY REGION 2023-2030 (USD MILLION)

- TABLE 164 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 165 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 170 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 171 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 172 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 179 US: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 180 US: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 US: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 182 US: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 183 US: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 184 US: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 185 CANADA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 186 CANADA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 CANADA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 188 CANADA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 189 CANADA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 190 CANADA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 191 EUROPE: KEY MACROINDICATORS

- TABLE 192 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 193 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 196 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 197 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 198 EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 199 GERMANY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 200 GERMANY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 GERMANY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 202 GERMANY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 203 GERMANY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 204 GERMANY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 205 UK: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 206 UK: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 UK: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 208 UK: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 209 UK: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 210 UK: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 211 FRANCE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 212 FRANCE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 FRANCE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 214 FRANCE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 215 FRANCE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 216 FRANCE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 217 ITALY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 218 ITALY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 ITALY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 220 ITALY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 221 ITALY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 222 ITALY: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 223 SPAIN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 224 SPAIN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 SPAIN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 226 SPAIN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 227 SPAIN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 228 SPAIN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 229 SWITZERLAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 230 SWITZERLAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 SWITZERLAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 232 SWITZERLAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 233 SWITZERLAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 234 SWITZERLAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 235 IRELAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 236 IRELAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 IRELAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 238 IRELAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 239 IRELAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 240 IRELAND: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 241 REST OF EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 242 REST OF EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 REST OF EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 244 REST OF EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 245 REST OF EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 246 REST OF EUROPE: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 247 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 248 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 249 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 250 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 252 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 253 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 254 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 255 CHINA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 256 CHINA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 CHINA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 258 CHINA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 259 CHINA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 260 CHINA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 261 JAPAN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 262 JAPAN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 JAPAN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 264 JAPAN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 265 JAPAN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 266 JAPAN: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 267 INDIA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 268 INDIA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 INDIA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 270 INDIA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 271 INDIA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 272 INDIA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 273 SOUTH KOREA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 274 SOUTH KOREA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 SOUTH KOREA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 276 SOUTH KOREA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 277 SOUTH KOREA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 278 SOUTH KOREA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 286 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 287 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 288 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 290 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 292 LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 293 BRAZIL: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 294 BRAZIL: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 BRAZIL: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 296 BRAZIL: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 297 BRAZIL: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 298 BRAZIL: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 299 MEXICO: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 300 MEXICO: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 MEXICO: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 302 MEXICO: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 303 MEXICO: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 304 MEXICO: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 306 REST OF LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 REST OF LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 308 REST OF LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 309 REST OF LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 310 REST OF LATIN AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST: KEY MACROINDICATORS

- TABLE 312 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 313 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 314 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 316 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 319 GCC COUNTRIES: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 320 GCC COUNTRIES: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 GCC COUNTRIES: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 322 GCC COUNTRIES: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 323 GCC COUNTRIES: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 324 GCC COUNTRIES: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 325 REST OF MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 326 REST OF MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 REST OF MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 328 REST OF MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 329 REST OF MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 330 REST OF MIDDLE EAST: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 331 AFRICA: KEY MACROINDICATORS

- TABLE 332 AFRICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 333 AFRICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 AFRICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 335 AFRICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 336 AFRICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE TYPE, 2023-2030 (USD MILLION)

- TABLE 337 AFRICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 338 STRATEGIES DEPLOYED BY KEY PLAYERS

- TABLE 339 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DEGREE OF COMPETITION

- TABLE 340 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: REGION FOOTPRINT

- TABLE 341 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: SERVICE TYPE FOOTPRINT

- TABLE 342 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: MOLECULE TYPE FOOTPRINT

- TABLE 343 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: THERAPEUTIC AREA FOOTPRINT

- TABLE 344 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 345 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS, 2024

- TABLE 346 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 347 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 348 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: EXPANSIONS, JANUARY 2022- JUNE 2025

- TABLE 349 LONZA: COMPANY OVERVIEW

- TABLE 350 LONZA: SERVICES OFFERED

- TABLE 351 LONZA: DEALS, JANUARY 2022-JUNE 2025

- TABLE 352 LONZA: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 353 WUXI BIOLOGICS: COMPANY OVERVIEW

- TABLE 354 WUXI BIOLOGICS: SERVICES OFFERED

- TABLE 355 WUXI BIOLOGICS: DEALS, JANUARY 2022-JUNE 2025

- TABLE 356 WUXI BIOLOGICS: EXPANSIONS, JANUARY 2022- JUNE 2025

- TABLE 357 SAMSUNG BIOLOGICS: COMPANY OVERVIEW

- TABLE 358 SAMSUNG BIOLOGICS: SERVICES OFFERED

- TABLE 359 SAMSUNG BIOLOGICS: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 360 SAMSUNG BIOLOGICS: DEALS, JANUARY 2022-JUNE 2025

- TABLE 361 SAMSUNG BIOLOGICS: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 362 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 363 THERMO FISHER SCIENTIFIC INC.: SERVICES OFFERED

- TABLE 364 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 365 ABBVIE INC.: COMPANY OVERVIEW

- TABLE 366 ABBVIE INC.: SERVICES OFFERED

- TABLE 367 CATALENT, INC.: COMPANY OVERVIEW

- TABLE 368 CATALENT, INC.: SERVICES OFFERED

- TABLE 369 CATALENT, INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 370 CATALENT, INC.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 371 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 372 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: SERVICES OFFERED

- TABLE 373 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 374 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 375 FUJIFILM HOLDINGS CORPORATION: SERVICES OFFERED

- TABLE 376 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 377 FUJIFILM HOLDINGS CORPORATION: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 378 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 379 EUROFINS SCIENTIFIC: SERVICES OFFERED

- TABLE 380 EUROFINS SCIENTIFIC: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 381 GENSCRIPT BIOTECH CORPORATION: COMPANY OVERVIEW

- TABLE 382 GENSCRIPT BIOTECH CORPORATION: SERVICES OFFERED

- TABLE 383 GENSCRIPT BIOTECH CORPORATION: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 384 GENSCRIPT BIOTECH CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 385 GENSCRIPT BIOTECH CORPORATION: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 386 ACG INC.: COMPANY OVERVIEW

- TABLE 387 AGC INC.: SERVICES OFFERED

- TABLE 388 AGC INC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 389 AGC INC.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 390 MERCK KGAA: COMPANY OVERVIEW

- TABLE 391 MERCK KGAA: SERVICES OFFERED

- TABLE 392 MERCK KGAA: DEALS, JANUARY 2022-JUNE 2025

- TABLE 393 MERCK KGAA: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 394 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 395 JSR CORPORATION: SERVICES OFFERED

- TABLE 396 JSR CORPORATION: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 397 IDT BIOLOGIKA: COMPANY OVERVIEW

- TABLE 398 IDT BIOLOGIKA: SERVICES OFFERED

- TABLE 399 IDT BIOLOGIKA: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 400 AJINOMOTO BIO-PHARMA: COMPANY OVERVIEW

- TABLE 401 AJINOMOTO BIO-PHARMA: SERVICES OFFERED

- TABLE 402 AJINOMOTO BIO-PHARMA: DEALS, JANUARY 2022-JUNE 2025

- TABLE 403 AGILENT TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 404 AGILENT TECHNOLOGIES INC.: SERVICES OFFERED

- TABLE 405 AGILENT TECHNOLOGIES INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 406 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 407 ASAHI KASEI CORPORATION: SERVICES OFFERED

- TABLE 408 ASAHI KASEI CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 409 ONESOURCE PHARMA SOLUTIONS: COMPANY OVERVIEW

- TABLE 410 RECIPHARM AB: COMPANY OVERVIEW

- TABLE 411 EMERGENT: COMPANY OVERVIEW

- TABLE 412 SHANGHAI FOSUN PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 413 LOTTE BIOLOGICS: COMPANY OVERVIEW

- TABLE 414 CURIA GLOBAL, INC.: COMPANY OVERVIEW

- TABLE 415 POLYPLUS TRANSFECTION: COMPANY OVERVIEW

- TABLE 416 ALDEVRON LLC: COMPANY OVERVIEW

- TABLE 417 MINAPHARM PHARMACEUTICALS: COMPANY OVERVIEW

- TABLE 418 RENTSCHLER BIOPHARMA SE: COMPANY OVERVIEW

- TABLE 419 PORTON PHARMA SOLUTIONS: COMPANY OVERVIEW

- TABLE 420 CELLARES, INC.: COMPANY OVERVIEW

- TABLE 421 MABPLEX INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 422 ASYMCHEM INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: YEARS CONSIDERED

- FIGURE 3 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: RESEARCH DESIGN

- FIGURE 4 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2024

- FIGURE 7 COMPANY REVENUE ANALYSIS-BASED ESTIMATION: BOTTOM-UP APPROACH (2024)

- FIGURE 8 REVENUE SHARE ANALYSIS OF THERMO FISHER SCIENTIFIC INC. (2024)

- FIGURE 9 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 10 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: TOP-DOWN APPROACH

- FIGURE 11 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: CAGR PROJECTIONS

- FIGURE 12 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

- FIGURE 13 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- FIGURE 17 INCREASING APPROVALS OF BIOLOGICS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 18 COMMERCIAL OPERATIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2025

- FIGURE 19 ONCOLOGY SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2030

- FIGURE 20 MONOCLONAL ANTIBODIES TO CONTINUE TO DOMINATE MARKET IN 2030

- FIGURE 21 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET DURING FORECAST PERIOD

- FIGURE 22 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 PERSONALIZED MEDICINES (% OF ALL FDA-APPROVED DRUGS), 2015-2024

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ECOSYSTEM MAP

- FIGURE 27 PATENT ANALYSIS OF BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, JANUARY 2014-DECEMBER 2024

- FIGURE 28 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF BIOPHARMACEUTICAL CONTRACT MANUFACTURING SERVICES

- FIGURE 30 KEY BUYING CRITERIA FOR BIOPHARMACEUTICAL CONTRACT MANUFACTURING SERVICES, BY END USER

- FIGURE 31 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: INVESTMENT & FUNDING SCENARIO

- FIGURE 32 NORTH AMERICA: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2024 (USD MILLION)

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET (2024)

- FIGURE 36 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPANY FOOTPRINT

- FIGURE 38 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (SMES/STARTUPS), 2024

- FIGURE 39 EV/EBITDA OF KEY VENDORS

- FIGURE 40 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 41 BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 42 LONZA: COMPANY SNAPSHOT (2024)

- FIGURE 43 WUXI BIOLOGICS: COMPANY SNAPSHOT (2024)

- FIGURE 44 SAMSUNG BIOLOGICS: COMPANY SNAPSHOT (2024)

- FIGURE 45 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 46 ABBVIE INC.: COMPANY SNAPSHOT (2024)

- FIGURE 47 CATALENT, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 48 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT (2024)

- FIGURE 49 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2024)

- FIGURE 51 SGENSCRIPT BIOTECH CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 52 AGC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 MERCK KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 54 JSR CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 AJINOMOTO BIO-PHARMA: COMPANY SNAPSHOT (2024)

- FIGURE 56 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2024)

- FIGURE 57 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2024)