|

市场调查报告书

商品编码

1793329

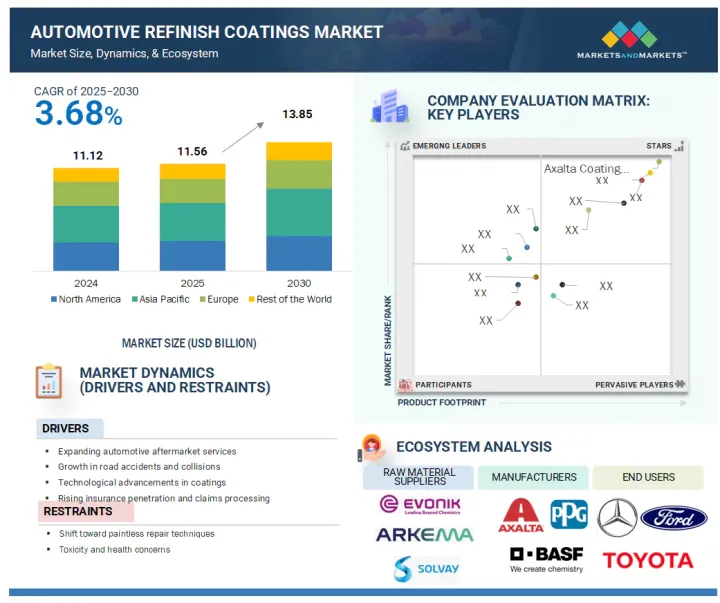

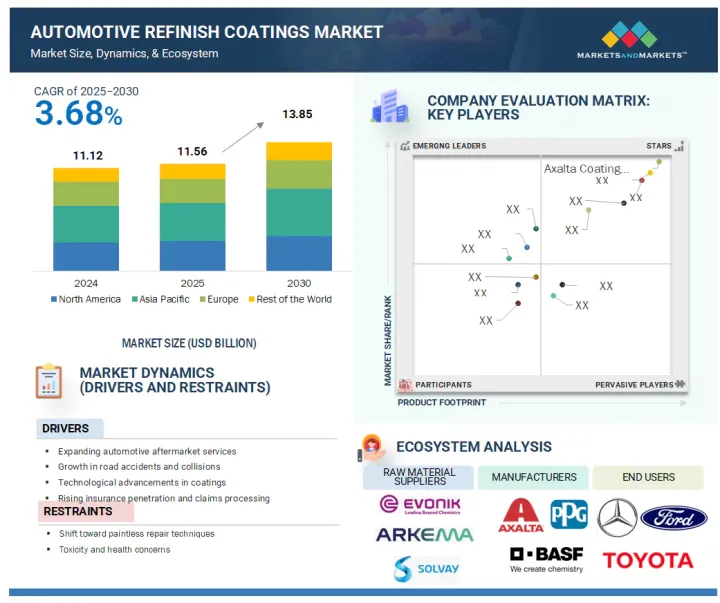

全球汽车修补漆市场(按层数、树脂类型、车辆类型和地区划分)- 预测至 2030 年Automotive Refinish Coatings Market by Layer (Clearcoat, Basecoat, Primer), Resin Type (Polyurethane, Epoxy, Acrylic, Alkyd), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region - Global Forecast to 2030 |

||||||

全球汽车售后市场基础设施的成熟和发展为汽车修补漆的扩张创造了有利条件。

从分级经销商服务中心和授权碰撞修理网路到独立修车厂和专利权修理连锁店,标准化、品管的修理厂的数量正在加速增长,而到达产品分销领域最偏远角落和实现更大品牌曝光的诱惑是不可抗拒的。

| 调查范围 | |

|---|---|

| 调查年份 | 2023-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(百万美元)、数量(千吨) |

| 部分 | 层类型、树脂类型、车辆类型、区域 |

| 目标区域 | 亚太地区、欧洲、北美和世界其他地区 |

具体来说,工厂利用先进的库存系统、数位采购平台和客户关係管理工具等方法来支援大量采购和稳定的涂料消耗。维修聚合器的兴起进一步定义了售后市场,例如将车主与优质研讨会连接起来的线上网站。因此,强大的售后市场生态系统可以充当需求稳定器,支援全部区域的销售和价值成长。

以以金额为准,底漆部分是全球汽车修补涂料市场第三大部分。

2024 年,底漆细分市场是全球汽车修补漆涂料市场的第三大细分市场。这一强劲地位归功于底漆作为重要防腐手段所扮演的角色。修补通常涉及修復刮痕、凹陷或生锈的面板,这些面板中的金属基材会暴露在环境因素中。如果没有适当的表面密封,这些表面就容易受到湿气、盐分和化学物质的侵蚀,导致腐蚀和结构劣化。底漆可充当屏障,防止氧化并提高车辆的整体耐用性。在高湿度、大雨和盐渍道路的地区,腐蚀威胁尤其高,因此使用防銹底漆尤为令人担忧。汽车修理厂非常重视防锈底漆,以保持车辆的完整性并符合 OEM 修理标准。

预计在预测期内,其他树脂类型部分将成为汽车修补涂料市场中成长速度第三快的部分。

其他类型的树脂(包括硝化纤维素和聚酯)的扩张,是由于低复杂度汽车维修作业对快干配方的需求不断增长。硝化纤维素树脂因其极快的干燥能力而特别受欢迎,这使得它们非常适合快速维修、小型维修或临时修补,在这些情况下,固化速度比长期性能更重要。在城市地区和人流量大的维修中心,车主往往要求快速完成小修、刮痕和局部维修。这些树脂很好地满足了这项需求,使技术人员能够在短时间内完成多项工作。此外,它们在缺乏先进固化设备但仍需要在短时间内获得一致结果的小型和移动维修单位中尤其受欢迎。

本报告分析了全球汽车修补涂料市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 汽车修补漆市场充满机会

- 亚太地区汽车修补漆市场(依国家)

- 汽车修补漆市场(按地区)

- 汽车修补漆市场的吸引力

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 波特五力分析

- 主要相关利益者和采购标准

- 总体经济指标

第六章 产业趋势

- 供应链分析

- 原物料供应商

- 製造商

- 分销网络

- 最终用途产业

- 定价分析

- 主要企业汽车修补漆树脂类型平均销售价格

- 各地区汽车修补漆平均售价趋势(2023-2030)

- 影响客户业务的趋势/中断

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 案例研究分析

- PPG工业公司欧洲水性涂料应用案例研究

- 艾仕得涂料系统有限公司北美商用车队快速固化涂料案例研究

- 贸易分析

- 进口情形(HS 编码 320820)

- 汽车修补漆出口情势

- 监管格局

- 监管机构、政府机构和其他组织

- 法规结构

- 大型会议和活动(2025-2026年)

- 投资金筹措场景

- 专利分析

- 方法

- 文件类型

- 主申请人

- 司法管辖权分析

- 2025年美国关税的影响—概述

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

- 人工智慧/产生人工智慧对汽车修补漆市场的影响

第七章 汽车修补漆市场区隔

- 介绍

- 底漆

- 底涂层

- 透明涂层

- 其他层类型

第八章 汽车修补漆市场(依树脂类型)

- 介绍

- 聚氨酯

- 丙烯酸纤维

- 环氧树脂

- 醇酸

- 其他树脂类型

9. 汽车修补漆市场(依技术)

- 介绍

- 水基技术

- 溶剂型技术

- 紫外线固化技术

第 10 章 汽车修补漆市场(依车型)

- 介绍

- 搭乘用车

- 商用车

第 11 章 汽车修补漆市场(按地区)

- 介绍

- 亚太地区

- 中国

- 印度

- 日本

- 印尼

- 欧洲

- 德国

- 义大利

- 西班牙

- 英国

- 法国

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他地区

第十二章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 市场占有率分析(2024年)

- 收益分析(2023-2025)

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 公司估值及财务指标

- 品牌/产品比较

- 竞争场景

第十三章:公司简介

- 主要企业

- AXALTA COATING SYSTEMS LLC

- PPG INDUSTRIES, INC.

- BASF SE

- THE SHERWIN-WILLIAMS COMPANY

- AKZO NOBEL NV

- KANSAI PAINT CO., LTD.

- KCC CORPORATION

- NIPPON PAINT HOLDINGS CO., LTD.

- KAPCI COATINGS

- TOA PERFORMANCE COATING CORPORATION CO., LTD.

- Start-Ups/中小型企业

- ROCK PAINT CO., LTD.

- MAACO FRANCHISING, INC.

- XIANGJIANG PAINT TECHNOLOGY CO., LTD.

- BERGER PAINTS INDIA LTD.

- DONGLAI COATING TECHNOLOGY CO., LTD.

- NOROO PAINT & COATINGS CO., LTD.

- ALSA CORPORATION

- WEG SA

- BERNARDO ECENARRO SA

- ALPS COATING SDN. BHD.

- RUSSIAN COATINGS JSC

- NOVOL SP. Z OO

- MIPA SE

- HB BODY SA

- TERSUAVE

第14章:相邻市场与相关市场

- 介绍

- 限制

- 汽车涂料市场

- 市场定义

- 市场概览

- 隔热产品市场(按区域)

第十五章 附录

The increasing maturity and development of automotive aftermarket infrastructure worldwide have set favorable platforms for the expansion of automotive refinish coatings. With everything from tiered dealership service centers and authorized collision networks to independent garages and franchised repair chains, the appeal of an ever-accelerating number of standardized, quality-controlled repair outlets is irresistible when it comes to reaching the furthest corners of the product distribution landscape and achieving more brand exposure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Layer Type, Resin Type, Vehicle Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

More specifically, the facilities utilize methods such as sophisticated inventory systems, digital procurement platforms, and customer relationship management tools to support volume purchasing and consistent coating consumption. The aftermarket is further defined by the rise of repair aggregators, such as online sites that link vehicle owners with quality workshops, which may recommend refinish brands as part of their service package. Therefore, the robust aftermarket ecosystem acts as a demand stabilizer, supporting both volume and value growth across geographies.

The primer segment was the third-largest segment, in terms of value, of the global automotive refinish coatings market.

The primer segment was the third-largest segment in the global market for automotive refinish coatings in 2024. This robust positioning stems from the role played by the primer as an essential means of corrosion protection. Refinish processes often entail fixing scratched, dented, or rusted panels where the metal substrate is exposed to environmental factors. In the absence of proper sealing of the surface, these surfaces are at risk of moisture, salt, and chemical exposure and consequently suffer from corrosion and structural deterioration. Primers serve as a shield, protecting against oxidation and enhancing the overall durability of the vehicle's body. In areas with high humidity, intensive rain, or salty roadways, corrosion threats are very high, and the use of anti-corrosive primers is of particular concern. Car repair shops place emphasis on anti-corrosive primers to preserve vehicle integrity and adhere to OEM repair standards.

The other resin types segment is projected to be the third-fastest-growing segment in the automotive refinish coatings market during the forecast period.

The other resin types segment is projected to be the third-fastest-growing segment in the automotive refinish coatings market. Expansion in other types of resins, including nitrocellulose and polyester, is driven by increased demand for high-speed-drying types of formulations used in low-complexity repair jobs in automobiles. Nitrocellulose resins are particularly used because they have very fast drying capabilities and are suitable for quick refinishing processes, minor repairs, or transient touch-ups where curing speed takes precedence over long-term performance. In city areas and high-traffic service centers, owners of vehicles tend to request speedy turnaround for minor repairs, scratches, or localized repaint. Such resins fulfill this requirement well by allowing technicians to finish multiple tasks within short periods. Furthermore, they are particularly favored among small-scale units and mobile repair units with no sophisticated curing facilities but a need for consistent outcomes within short periods.

The passenger cars segment led the automotive refinish coatings market, in terms of value, in 2024.

The passenger cars segment led the automotive refinish coatings market, in terms of value, in 2024. The passenger cars segment ruled the automotive refinish coatings market in 2024, a trend brought by the continued urbanization and the resulting growth in vehicle ownership. Urbanization has brought about the swift expansion of cities, increasing vehicle presence in urban areas, where daily travel and urban road congestion place vehicles at higher risk of surface damage. Passenger vehicles are especially hit given their large-scale adoption and constant exposure to congested parking lots, rough road surfaces, and heavy pedestrian traffic. As a reaction to this city migration, automotive aftermarkets for ecosystems like refinish shops and repair shops are growing in quantity and service capacity. Increased availability of such infrastructure, particularly in emerging economies, is reducing the cost and speed of refinishing services for consumers. Concurrently, urban-focused product developments by coating manufacturers include low-VOC formulations, fast-drying coatings, and miniature application systems that fit in small working areas.

"Europe accounted for the third-largest share in the automotive refinish coatings market in terms of value."

Europe accounted for the third-largest share in the automotive refinish coatings market, in terms of value, in 2024. The driving factor is the strict environmental regulations put in place by the European Union and governments of individual countries, specifically those addressing air quality, control of hazardous substances, and industrial emissions. Regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and directives against volatile organic compound (VOC) emissions are driving a region-wide transformation toward sustainable coating formulations. This involves the widespread use of waterborne coatings, high-solid content systems, and low-VOC clearcoats. Automotive refinish coating manufacturers across Europe are investing more in sustainable innovations to meet compliance requirements while holding performance levels. Body shops and collision centers, on their part, are also upgrading their operations to include clean technologies, typically subsidized and backed by training programs from local authorities.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Axalta Coating Systems LLC (US), PPG Industries, Inc. (US), BASF SE (Germany), Akzo Nobel N.V. (Netherlands), The Sherwin-Williams (US), Kansai Paint Co., Ltd. (Japan), Nippon Paint Holdings Co., Ltd. (Japan), KCC Corporation (China), and TOA Performance Coating Corporation Co., Ltd. (Thailand).

Research Coverage

This report segments the market for automotive refinish coatings based on layer type, resin type, vehicle type, and region, and provides estimations of value (USD million) for the overall market size across various regions. It has also conducted a detailed analysis of key industry players to provide insights into their business overviews, services, and key strategies associated with the market for automotive refinish coatings.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the automotive refinish coatings market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on automotive refinish coatings offered by top players in the global market

- Analysis of key drivers (expanding automotive aftermarket services, growth in road accidents and collisions, technological advancements in coatings, and rising insurance penetration and claims processing) restraints (shift toward paintless repair techniques and toxicity and health concerns) opportunities (adoption of eco-friendly coatings and expansion into emerging markets), and challenges (stringent environmental regulations) influencing the growth of the automotive refinish coatings market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive refinish coatings market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for automotive refinish coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global automotive refinish coatings market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the automotive refinish coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 AUTOMOTIVE REFINISH COATINGS MARKET SEGMENTATION AND REGIONAL SPREAD

- 1.3.2 AUTOMOTIVE REFINISH COATINGS MARKET: INCLUSIONS & EXCLUSIONS

- 1.3.3 AUTOMOTIVE REFINISH COATINGS MARKET: MARKET DEFINITIONS AND INCLUSIONS, BY LAYER TYPE

- 1.3.4 AUTOMOTIVE REFINISH COATINGS MARKET: MARKET DEFINITIONS AND INCLUSIONS, BY RESIN TYPE

- 1.3.5 AUTOMOTIVE REFINISH COATINGS MARKET: MARKET DEFINITIONS AND INCLUSIONS, BY VEHICLE TYPE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 DEMAND SIDE

- 2.5 ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE REFINISH COATINGS MARKET

- 4.2 ASIA PACIFIC AUTOMOTIVE REFINISH COATINGS MARKET, COUNTRY

- 4.3 AUTOMOTIVE REFINISH COATINGS MARKET, BY REGION

- 4.4 AUTOMOTIVE REFINISH COATINGS MARKET ATTRACTIVENESS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding automotive aftermarket services

- 5.2.1.2 Growth in road accidents and collisions

- 5.2.1.3 Technological advancements in coatings

- 5.2.1.4 Rising insurance penetration and claims processing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Disruption in supply chain due to geopolitical tensions

- 5.2.2.2 Toxicity and health concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of eco-friendly coatings

- 5.2.3.2 Expansion into emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIALS SUPPLIER

- 6.1.2 MANUFACTURER

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF AUTOMOTIVE REFINISH COATINGS OFFERED BY KEY PLAYERS, BY RESIN TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE REFINISH COATINGS, BY REGION, 2023-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Waterborne coatings technology

- 6.5.1.2 UV-curable coatings technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Low-VOC/high-solid coatings technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CASE STUDY ON PPG INDUSTRIES, INC.'S WATERBORNE COATING ADOPTION IN EUROPE

- 6.6.2 CASE STUDY ON AXALTA COATING SYSTEMS LLC'S FAST-CURE COATINGS FOR COMMERCIAL FLEET IN NORTH AMERICA

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 320820)

- 6.7.2 EXPORT SCENARIO OF AUTOMOTIVE REFINISH COATINGS

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 International Organization for Standardization (ISO)

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES:

- 6.13 IMPACT OF AI/GEN AI ON AUTOMOTIVE REFINISH COATINGS MARKET

7 AUTOMOTIVE REFINISH COATINGS MARKET, BY LAYER TYPE

- 7.1 INTRODUCTION

- 7.2 PRIMER

- 7.2.1 PROTECTION AGAINST DEFORMATION AND CHIPPING TO BOOST MARKET

- 7.3 BASECOAT

- 7.3.1 REDUCED DOWNTIME AND MAINTENANCE OF VEHICLES TO DRIVE MARKET

- 7.4 CLEARCOAT

- 7.4.1 PROTECTION AGAINST SCRATCHES AND UV RAYS TO BOOST DEMAND

- 7.5 OTHER LAYER TYPES

8 AUTOMOTIVE REFINISH COATINGS MARKET, BY RESIN TYPE

- 8.1 INTRODUCTION

- 8.2 POLYURETHANE

- 8.2.1 GOOD ELASTICITY AT LOW TEMPERATURES TO BOOST MARKET

- 8.3 ACRYLIC

- 8.3.1 RESISTANCE TO ABRASION AND CHEMICAL ATTACK TO FUEL MARKET

- 8.4 EPOXY

- 8.4.1 HIGH ADHESION AND RUST RESISTANCE TO DRIVE MARKET

- 8.5 ALKYD

- 8.5.1 COST-EFFECTIVE SOLUTION TO SUPPORT MARKET GROWTH

- 8.6 OTHER RESIN TYPES

9 AUTOMOTIVE REFINISH COATINGS MARKET, BY TECHNOLOGY TYPE

- 9.1 INTRODUCTION

- 9.2 WATERBORNE TECHNOLOGY

- 9.3 SOLVENTBORNE TECHNOLOGY

- 9.4 UV-CURED TECHNOLOGY

10 AUTOMOTIVE REFINISH COATINGS MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 CONSUMER DEMAND FOR PERSONALIZED TRANSPORTATION FUEL TO DRIVE MARKET

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 RISING GLOBAL TRADE AND SURGE IN E-COMMERCE TO PROPEL DEMAND FOR COMMERCIAL VEHICLES

11 AUTOMOTIVE REFINISH COATINGS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Significant investments by global manufacturers to boost market

- 11.2.2 INDIA

- 11.2.2.1 Rapid economic growth and increasing disposable income to drive market

- 11.2.3 JAPAN

- 11.2.3.1 Well-established automotive industry and technological advancement to drive market

- 11.2.4 INDONESIA

- 11.2.4.1 Effective government policies and presence of global players to drive market

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Presence of major distribution channels to increase demand

- 11.3.2 ITALY

- 11.3.2.1 New investments and sustainable approaches to drive market

- 11.3.3 SPAIN

- 11.3.3.1 Sustainable strategies and capital inflows to propel market growth

- 11.3.4 UK

- 11.3.4.1 Sustainable investment in automotive R&D to drive market

- 11.3.5 FRANCE

- 11.3.5.1 Market expansion fueled by policy initiatives and tech progress to drive market

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Growing automotive industry to propel market

- 11.4.2 CANADA

- 11.4.2.1 Increased demand for water-borne coatings in automotive refinish to drive market

- 11.4.3 MEXICO

- 11.4.3.1 Leveraging trade pacts to boost market growth

- 11.4.1 US

- 11.5 REST OF THE WORLD

- 11.5.1 BRAZIL

- 11.5.1.1 Scaling production and distribution to drive market growth

- 11.5.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2023-2025

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Resin type footprint

- 12.5.5.4 Layer type footprint

- 12.5.5.5 Vehicle type footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 12.6.5.1 Detailed list of key start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 EXPANSIONS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 AXALTA COATING SYSTEMS LLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM View

- 13.1.1.4.1 Right to Win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 PPG INDUSTRIES, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM View

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 BASF SE

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM View

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 THE SHERWIN-WILLIAMS COMPANY

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM View

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 AKZO NOBEL N.V.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM View

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 KANSAI PAINT CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 KCC CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 NIPPON PAINT HOLDINGS CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 KAPCI COATINGS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 TOA PERFORMANCE COATING CORPORATION CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 AXALTA COATING SYSTEMS LLC

- 13.2 START-UP/SMES PLAYERS

- 13.2.1 ROCK PAINT CO., LTD.

- 13.2.2 MAACO FRANCHISING, INC.

- 13.2.3 XIANGJIANG PAINT TECHNOLOGY CO., LTD.

- 13.2.4 BERGER PAINTS INDIA LTD.

- 13.2.5 DONGLAI COATING TECHNOLOGY CO., LTD.

- 13.2.6 NOROO PAINT & COATINGS CO., LTD.

- 13.2.7 ALSA CORPORATION

- 13.2.8 WEG S.A.

- 13.2.9 BERNARDO ECENARRO S.A.

- 13.2.10 ALPS COATING SDN. BHD.

- 13.2.11 RUSSIAN COATINGS JSC

- 13.2.12 NOVOL SP. Z O.O.

- 13.2.13 MIPA SE

- 13.2.14 HB BODY S.A.

- 13.2.15 TERSUAVE

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 AUTOMOTIVE COATINGS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 INSULATION PRODUCTS MARKET, BY REGION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AUTOMOTIVE REFINISH COATINGS MARKET: RISK ASSESSMENT

- TABLE 2 AUTOMOTIVE REFINISH COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE RESIN TYPES

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE RESIN TYPES

- TABLE 5 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 6 AVERAGE SELLING PRICE OF AUTOMOTIVE REFINISH COATINGS OFFERED BY KEY PLAYERS, BY RESIN TYPE, 2024 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE REFINISH COATINGS, BY REGION, 2022-2030 (USD/KG)

- TABLE 8 AUTOMOTIVE REFINISH COATINGS MARKET: ECOSYSTEM

- TABLE 9 IMPORT OF AUTOMOTIVE REFINISH COATINGS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 10 EXPORT OF AUTOMOTIVE REFINISH COATINGS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 11 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 AUTOMOTIVE REFINISH COATINGS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 AUTOMOTIVE REFINISH COATINGS MARKET: FUNDING/INVESTMENT SCENARIO, 2024-2025

- TABLE 19 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 20 LIST OF MAJOR PATENTS RELATED TO AUTOMOTIVE REFINISH COATINGS, 2014-2024

- TABLE 21 PATENTS BY BASF SE

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 AUTOMOTIVE REFINISH COATINGS MARKET, BY LAYER TYPE, 2023-2030 (KILOTON)

- TABLE 24 AUTOMOTIVE REFINISH COATINGS MARKET, BY LAYER TYPE, 2023-2030 (USD MILLION)

- TABLE 25 AUTOMOTIVE REFINISH COATINGS MARKET, BY RESIN TYPE, 2023-2030 (KILOTON)

- TABLE 26 AUTOMOTIVE REFINISH COATINGS MARKET, BY RESIN TYPE, 2023-2030 (USD MILLION)

- TABLE 27 AUTOMOTIVE REFINISH COATINGS MARKET, BY VEHICLE TYPE, 2023-2030 (KILOTON)

- TABLE 28 AUTOMOTIVE REFINISH COATINGS MARKET, BY VEHICLE TYPE, 2023-2030 (USD MILLION)

- TABLE 29 AUTOMOTIVE REFINISH COATINGS MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 30 AUTOMOTIVE REFINISH COATINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 32 ASIA PACIFIC: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 EUROPE: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 34 EUROPE: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 36 NORTH AMERICA: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 REST OF THE WORLD: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 38 REST OF THE WORLD: AUTOMOTIVE REFINISH COATINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 OVERVIEW OF STRATEGIES ADOPTED BY KEY LUBRICANT MANUFACTURERS

- TABLE 40 AUTOMOTIVE REFINISH COATINGS MARKET: DEGREE OF COMPETITION

- TABLE 41 AUTOMOTIVE REFINISH COATINGS MARKET: REGION FOOTPRINT

- TABLE 42 AUTOMOTIVE REFINISH COATINGS MARKET: RESIN TYPE FOOTPRINT

- TABLE 43 AUTOMOTIVE REFINISH COATINGS MARKET: LAYER TYPE FOOTPRINT

- TABLE 44 AUTOMOTIVE REFINISH COATINGS MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 45 AUTOMOTIVE REFINISH COATINGS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 46 AUTOMOTIVE REFINISH COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 47 AUTOMOTIVE REFINISH COATINGS MARKET: DEALS, JANUARY 2019-FEBRUARY 2024

- TABLE 48 AUTOMOTIVE REFINISH COATINGS MARKET: EXPANSIONS, JANUARY 2023-FEBRUARY 2024

- TABLE 49 AUTOMOTIVE REFINISH COATINGS MARKET: OTHER DEVELOPMENTS, JANUARY 2019-FEBRUARY 2024

- TABLE 50 AXALTA COATING SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 51 AXALTA COATING SYSTEMS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 52 AXALTA COATING SYSTEMS LLC: DEALS JANUARY 2019-JUNE 2025

- TABLE 53 AXALTA COATING SYSTEMS LLC: EXPANSIONS JANUARY 2019-JUNE 2025

- TABLE 54 AXALTA COATING SYSTEMS LLC: OTHER DEVELOPMENTS JANUARY 2019-JUNE 2025

- TABLE 55 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 56 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 57 PPG INDUSTRIES, INC.: DEALS JANUARY 2019-JUNE 2025

- TABLE 58 PPG INDUSTRIES, INC.: EXPANSIONS JANUARY 2019-JUNE 2025

- TABLE 59 BASF SE: COMPANY OVERVIEW

- TABLE 60 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 61 BASF SE: DEALS, JANUARY 2019-JUNE 2025

- TABLE 62 BASF SE: EXPANSIONS, JANUARY 2019-JUNE 2025

- TABLE 63 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 64 THE SHERWIN-WILLIAMS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 65 THE SHERWIN-WILLIAMS COMPANY: DEALS, JANUARY 2019-JUNE 2025

- TABLE 66 AKZO NOBEL N.V.: COMPANY OVERVIEW

- TABLE 67 AKZO NOBEL N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 68 AKZO NOBEL N.V.: DEALS, JANUARY 2019-JUNE 2025

- TABLE 69 AKZO NOBEL N.V.: EXPANSIONS, JANUARY 2019-JUNE 2025

- TABLE 70 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 71 KANSAI PAINT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 72 KANSAI PAINT CO., LTD.: DEALS, JANUARY 2019-JUNE 2025

- TABLE 73 KCC CORPORATION: COMPANY OVERVIEW

- TABLE 74 KCC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 75 KCC CORPORATION: DEALS, JANUARY 2019-JUNE 2025

- TABLE 76 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 77 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 78 NIPPON PAINT HOLDINGS CO., LTD.: DEALS, JANUARY 2019-JUNE 2025

- TABLE 79 KAPCI COATINGS: COMPANY OVERVIEW

- TABLE 80 KAPCI COATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 KAPCI COATINGS: DEALS, JANUARY 2019-JUNE 2025

- TABLE 82 TOA PERFORMANCE COATING CORPORATION CO., LTD.: COMPANY OVERVIEW

- TABLE 83 TOA PERFORMANCE COATING CORPORATION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 84 TOA PERFORMANCE COATING CORPORATION CO., LTD.: DEALS, JANUARY 2019-JUNE 2025

- TABLE 85 ROCK PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 86 MAACO FRANCHISING, INC.: COMPANY OVERVIEW

- TABLE 87 XIANGJIANG PAINT TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 88 BERGER PAINTS INDIA LTD.: COMPANY OVERVIEW

- TABLE 89 DONGLAI COATING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 90 NOROO PAINT & COATINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 91 ALSA CORPORATION: COMPANY OVERVIEW

- TABLE 92 WEG S.A.: COMPANY OVERVIEW

- TABLE 93 BERNARDO ECENARRO S.A.: COMPANY OVERVIEW

- TABLE 94 ALPS COATING SDN. BHD.: COMPANY OVERVIEW

- TABLE 95 RUSSIAN COATINGS JSC: COMPANY OVERVIEW

- TABLE 96 NOVOL SP. Z O.O.: COMPANY OVERVIEW

- TABLE 97 MIPA SE: COMPANY OVERVIEW

- TABLE 98 HB BODY S.A.: COMPANY OVERVIEW

- TABLE 99 TERSUAVE: COMPANY OVERVIEW

- TABLE 100 AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 101 AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 102 AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 103 AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 104 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 107 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 108 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 109 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 111 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 112 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 115 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 116 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 117 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 118 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 119 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 120 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 123 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

List of Figures

- FIGURE 1 AUTOMOTIVE REFINISH COATINGS MARKET SEGMENTATION AND REGIONAL SPREAD

- FIGURE 2 AUTOMOTIVE REFINISH COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS (BOTTOM-UP)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE): PRODUCTS SOLD (BOTTOM UP)

- FIGURE 6 AUTOMOTIVE REFINISH COATINGS MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET GROWTH PROJECTION FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 8 CLEARCOAT AUTOMOTIVE REFINISH COATINGS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 9 POLYURETHANE RESIN TYPE DOMINATED OVERALL AUTOMOTIVE REFINISH COATINGS MARKET IN 2024

- FIGURE 10 PASSENGER CARS TO BE DOMINANT CONSUMER OF AUTOMOTIVE REFINISH COATINGS DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 AUTOMOTIVE REFINISH COATINGS MARKET TO WITNESS STEADY GROWTH DURING FORECAST PERIOD

- FIGURE 13 CHINA LED ASIA PACIFIC AUTOMOTIVE REFINISH COATINGS MARKET IN 2024

- FIGURE 14 ASIA PACIFIC TO BE LARGEST MARKET FOR AUTOMOTIVE REFINISH COATINGS DURING FORECAST PERIOD

- FIGURE 15 INDIA PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 AUTOMOTIVE REFINISH COATINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 AUTOMOTIVE REFINISH COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE RESIN TYPES

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE RESIN TYPES

- FIGURE 20 AUTOMOTIVE REFINISH COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE OF AUTOMOTIVE REFINISH COATINGS OFFERED BY KEY PLAYERS, BY RESIN TYPE, 2024 (USD/KG)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE REFINISH COATINGS, BY REGION, 2023-2030

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AUTOMOTIVE REFINISH COATINGS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 IMPORT OF AUTOMOTIVE REFINISH COATINGS, BY KEY COUNTRIES (2019-2024)

- FIGURE 26 EXPORT OF AUTOMOTIVE REFINISH COATINGS, BY KEY COUNTRIES (2019-2024)

- FIGURE 27 PATENTS REGISTERED FOR AUTOMOTIVE REFINISH COATINGS, 2014-2024

- FIGURE 28 MAJOR PATENTS RELATED TO AUTOMOTIVE REFINISH COATINGS, 2014-2024

- FIGURE 29 LEGAL STATUS OF PATENTS FILED RELATED TO AUTOMOTIVE REFINISH COATINGS MARKET, 2014-2024

- FIGURE 30 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA, 2014-2024

- FIGURE 31 IMPACT OF AI/GEN AI ON AUTOMOTIVE REFINISH COATINGS MARKET

- FIGURE 32 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR AUTOMOTIVE REFINISH COATINGS DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC: AUTOMOTIVE REFINISH COATINGS MARKET SNAPSHOT

- FIGURE 34 EUROPE: AUTOMOTIVE REFINISH COATINGS MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: AUTOMOTIVE REFINISH COATINGS MARKET SNAPSHOT

- FIGURE 36 AXALTA COATINGS SYSTEMS LLC LED AUTOMOTIVE REFINISH COATINGS MARKET IN 2024

- FIGURE 37 AUTOMOTIVE REFINISH COATINGS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2023-2025 (USD MILLION)

- FIGURE 38 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 39 AUTOMOTIVE REFINISH COATINGS MARKET: COMPANY FOOTPRINT

- FIGURE 40 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- FIGURE 41 AUTOMOTIVE REFINISH COATINGS MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS

- FIGURE 42 AUTOMOTIVE REFINISH COATINGS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 43 BRAND/PRODUCT COMPARISON

- FIGURE 44 AXALTA COATING SYSTEMS LLC: COMPANY SNAPSHOT

- FIGURE 45 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 46 BASF SE: COMPANY SNAPSHOT

- FIGURE 47 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 48 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 49 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 TOA PERFORMANCE COATING CORPORATION CO., LTD.: COMPANY SNAPSHOT