|

市场调查报告书

商品编码

1795413

全球氢能市场(按产业、应用和地区划分)预测(至 2030 年)Hydrogen Market by Sector (Generation (Gray, Blue, Green), Storage (Physical, Material), Transportation (Long, Short)), Application (Energy (Power, CHP), Mobility, Chemical & Refinery (Petroleum, Ammonia, Methanol)), and Region - Global Forecast to 2030 |

||||||

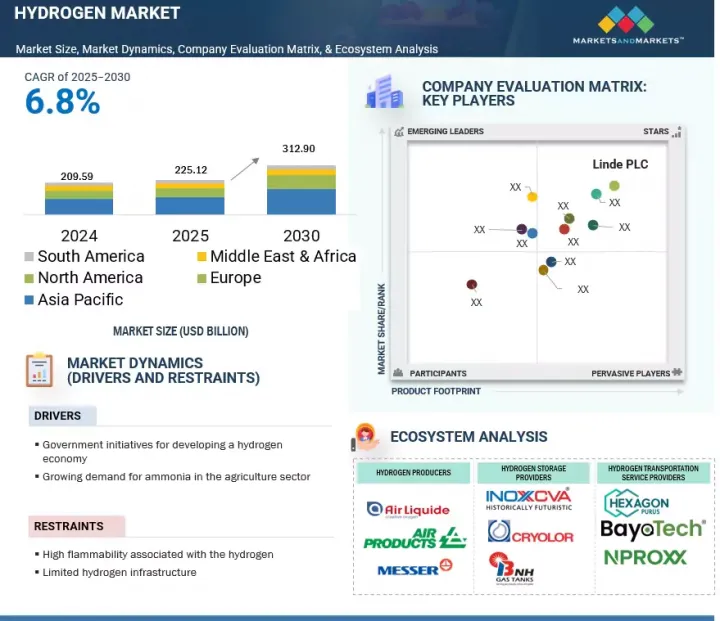

预计全球氢能市场规模将从 2025 年的 2,251.2 亿美元成长至 2030 年的 3,129 亿美元,复合年增长率为 6.8%。

氢能市场正处于成长轨道,这得益于交通运输、发电和工业应用领域对低排放、永续能源解决方案日益增长的需求。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 100万美元,1000吨 |

| 部分 | 部门、目的 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、南美 |

目前有利且广泛的政治环境、脱碳目标以及氢能基础设施建设,正在推动氢能的更高水准应用。电解、燃料电池和储能技术的进步正在稳步降低绿色氢能的生产成本,提高其商业性可行性,并推动更多可扩展计划的实施。政府、私人能源公司和产业界之间的伙伴关係正在建立具有规模和出口潜力的氢能供应链。

“按应用划分,化学和炼油领域将在 2024 年占据最大的市场占有率。”

化学和炼油领域在全球氢气市场中市场占有率最大份额,这主要得益于其在石油炼製和化学生产过程中的广泛应用。氢气是炼油厂加氢裂解和脱硫的关键原料,有助于满足严格的燃料品质标准。在化学领域,氢气被广泛用于生产氨、甲醇和其他工业化学品。对化学肥料、石化产品和清洁燃料的持续需求支撑了该领域的氢气消费,使其成为当前氢气市场的主要应用领域。随着全球努力推动难以脱碳的产业脱碳,预计该领域将逐步从「灰氢」向「蓝氢」和「绿氢」过渡。一些炼油厂和化学公司已开始投资低碳氢化合物解决方案,以达到排放目标。

“按运输类型划分,远距运输领域将成为2024年最大的市场。”

由于跨境氢能贸易的重视,尤其是在可再生资源丰富且需求旺盛的地区,远距运输占据了氢能市场的最大市场占有率。亚洲、欧洲和中东地区的国家正在积极投资氢能走廊、管线和液化氢运输基础设施,以实现大规模的国际氢能运输。政府支持的进出口协定、氨作为氢能载体的发展以及日本和韩国等氢能进口国日益增长的需求,进一步推动了这一领域的发展。这些趋势使远距运输成为全球氢能供应链中的关键参与者,巩固了其在市场上的主导地位。

“预计在预测期内,欧洲的氢能市场复合年增长率将位居第二。”

欧洲雄心勃勃的脱碳目标、能源转型策略以及减少对石化燃料依赖的倡议,正推动氢能市场强劲成长。欧盟已启动多项资助计划,包括《欧洲绿色协议》和《气候中和欧洲氢能战略》,旨在加速清洁氢能技术在交通运输、发电和重工业等行业的应用。一些国家(德国、法国、荷兰和西班牙)已推出国家氢能蓝图,支援电解槽的部署、基础建设和跨境氢能贸易。此外,对再生能源来源投资的增加正在推动绿色氢能生产,并巩固欧洲作为全球氢能经济重要枢纽的地位。

本报告研究了全球氢能市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 氢能市场对企业来说极具吸引力的机会

- 各地区氢气市场

- 氢能市场各领域

- 氢气市场(按应用)

- 亚太地区氢能市场(按应用和国家划分)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 各地区氢能发电平均售价趋势(2022-2024年)

- 各地区储氢参考价格分析(2024年)

- 氢气运输参考价格分析

- 供应链分析

- 生态系分析

- 贸易分析

- 汇出场景

- 导入场景

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 案例研究分析

- HYBRIT 计画协助瑞典利用非石化燃料绿色氢气改造钢铁生产

- 卡夫亨氏部署电解生产绿色氢气,实现其套件工厂脱碳

- NPROXX 支持英美资源集团开发零排放采矿车辆和经济高效的氢气储存

- 大型会议和活动(2025-2026年)

- 专利分析

- 监管格局

- 监管机构、政府机构和其他组织

- 法规结构

- 波特五力分析

- 主要相关利益者和采购标准

- 人工智慧/人工智慧世代对氢能市场的影响

- 对氢气生产的影响

- 对储氢的影响

- 对氢气运输的影响

- 影响:人工智慧/生成的人工智慧,按应用分类

- 人工智慧/生成式人工智慧在各地区的影响

- 氢市场的宏观经济前景

- 能源转型与政策转变

- 研发投入

- 基础设施成长

- 气候变迁

- 投资金筹措场景

- 2025年美国关税对氢能市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家和地区的影响

- 对使用的影响

第六章 氢能发电市场细分

- 介绍

- 生成类型

- 灰氢

- 蓝氢

- 绿色氢气

- 贮存

- 物理

- 材料基础

- 运输

- 远距

- 近距离

第七章 氢气市场(依应用)

- 介绍

- 活力

- 行动性

- 化学/精炼

- 其他的

第八章 氢能市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 其他欧洲国家

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

第九章 竞争态势

- 概述

- 主要参与企业的策略/优势(2020-2025)

- 市场占有率分析(2024年)

- 收益分析(2020-2024)

- 公司估值及财务指标

- 产品比较

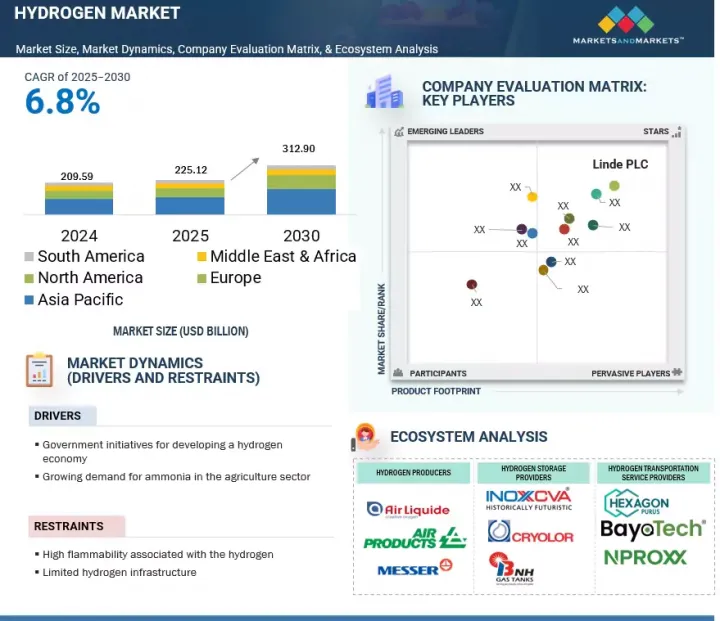

- 企业评估矩阵:主要氢气製造商(2024 年)

- 公司评估矩阵:领先的氢能储存供应商(2024年)

- 公司评估矩阵:领先的氢能运输供应商(2024 年)

- 公司评估矩阵:Start-Ups/中小企业(氢气製造商)(2024 年)

- 竞争场景

第十章:公司简介

- 主要氢气製造商

- LINDE PLC

- AIR LIQUIDE

- SAUDI ARABIAN OIL CO.

- AIR PRODUCTS AND CHEMICALS, INC.

- SHELL PLC

- CHEVRON CORPORATION

- UNIPER SE

- EXXON MOBIL CORPORATION

- BP PLC

- 氢气储存供应商

- INOX INDIA LIMITED

- CRYOLOR

- BNH GAS TANKS

- FABER ITALY

- 其他储氢供应商

- 氢气运输罐供应商

- BAYOTECH

- HEXAGON PURUS

- NPROXX

- CHART INDUSTRIES

- 其他氢气运输罐供应商

第十一章 附录

The global hydrogen market is projected to reach USD 312.90 billion by 2030 from USD 225.12 billion in 2025, registering a CAGR of 6.8%. The hydrogen market is on a growth trajectory driven by the increasing trend of switching to low-emission and sustainable energy solutions for transportation, power generation, and industrial uses.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million)/Volume (Thousand metric tons) |

| Segments | Sector (Generation, Storage, and Transportation), and Application |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

The current supportive broader political environment, decarbonization targets, and hydrogen infrastructure are enabling expansion in the level of adoption. Advances in electrolysis, fuel cells, and storage technology are steadily reducing production costs-especially for green hydrogen-improving its commercial viability and enabling more scalable projects. Partnerships between governments, private energy players, and industrial firms are creating hydrogen supply chains with growing scale and export potential.

"By application, the chemical & refinery segment accounted for the largest market share in 2024."

The chemical and refinery segment holds the largest market share in the global hydrogen market, primarily driven by its extensive use in petroleum refining and chemical production processes. Hydrogen is a critical feedstock in hydrocracking and desulfurization in refineries, helping meet stringent fuel quality standards. In the chemical sector, it is extensively used in the production of ammonia, methanol, and other industrial chemicals. The continued demand for fertilizers, petrochemicals, and cleaner fuels sustains hydrogen consumption across this segment, making it the most dominant application area in the current hydrogen market landscape. With global efforts to decarbonize hard-to-abate sectors, this segment is expected to gradually transition from gray hydrogen to blue and green alternatives. Several refinery and chemical companies are already investing in low-carbon hydrogen solutions to comply with emissions targets.

"By transportation, the long distance segment accounted for the largest market in 2024."

The long distance transportation segment has the largest market share in the hydrogen market due to the growing emphasis on cross-border hydrogen trade, particularly among regions with abundant renewable resources and high-demand centers. Countries in Asia, Europe, and the Middle East are actively investing in hydrogen corridors, pipelines, and liquefied hydrogen shipping infrastructure to enable large-scale, international hydrogen movement. This segment is further supported by government-backed export-import agreements, the development of ammonia as a hydrogen carrier, and rising demand from hydrogen-importing nations like Japan and South Korea. These trends collectively position long-distance transportation as a crucial enabler of global hydrogen supply chains, reinforcing its dominant share in the market.

"Europe is expected to register the second-highest CAGR for the hydrogen market over the forecast period."

Europe is experiencing strong growth in the hydrogen market, driven by its ambitious decarbonization goals, energy transition strategies, and focus on reducing dependency on fossil fuels. The European Union has launched multiple funding programs, including the European Green Deal and the Hydrogen Strategy for a Climate-Neutral Europe, which aim to accelerate the adoption of clean hydrogen across industries such as transport, power generation, and heavy manufacturing. Several countries-Germany, France, the Netherlands, and Spain-have rolled out national hydrogen roadmaps, supporting electrolyzer deployment, infrastructure development, and cross-border hydrogen trade. Additionally, increasing investments in renewable energy sources are facilitating green hydrogen production, reinforcing Europe's position as a key global hub in the hydrogen economy.

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 57%, Tier 2 - 29%, and Tier 3 - 14%

By Designation: C-Level Executives - 35%, Directors - 20%, and Others - 45%

By Region: North America - 20%, Europe - 15%, Asia Pacific - 30%, Middle East & Africa - 25%, and South America - 10%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million. Others include sales managers, engineers, and regional managers.

Linde plc (Ireland), Air Liquide (France), Air Products and Chemicals, Inc. (US), Saudi Arabian Oil Co. (Saudi Arabia), Shell plc (UK), Chevron Corporation (US), Exxon Mobil Corporation (US), BP p.l.c. (UK), Chart Industries (US), OPmobility (US), Luxfer Holdings PLC (US), Faber Italy (Italy), FIBA Technologies, Inc. (US), Bayotech (US), BNH Gas Tanks (India), Cryofab, Inc. (US), WELDSHIP (US), Cryolor (France), Hexagon Purus (Norway), INOX India Limited (India), NPROXX (Netherlands), CALVERA Hydrogen (Spain), Uniper SE (Germany), Composite Advanced Technologies, LLC. (US), and Quantum Fuel Systems (US) are some of the key players in the Hydrogen market. The study includes an in-depth competitive analysis of these key players in the Hydrogen market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report defines, describes, and forecasts the hydrogen market by Generation type (Blue Hydrogen, Gray Hydrogen, Green Hydrogen), Storage (Physical, Material-based), Transportation (Long distance, Short distance), Application (Energy, Chemical & Refinery, Mobility, and others), and region (North America, Europe, Asia Pacific, Middle East & Africa and South America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the hydrogen market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, expansion, Joint ventures, collaborations, and acquisitions; and recent developments associated with the hydrogen market. This report covers the competitive analysis of upcoming startups in the hydrogen market ecosystem.

Key Benefits of Buying the Report

- The report includes the analysis of key drivers (Government initiatives for developing hydrogen economy, Growing Demand of Ammonia in Agriculture Sector), restraints (High Flammability associated with the hydrogen, Limited Hydrogen Infrastructure), opportunities (Decarbonization targets and climate commitments, Growing demand for hydrogen vehicles) and challenges (High cost associated with renewable hydrogen production, High cost of composite-material based tanks).

- Product Development/Innovation: Hydrogen market players are rapidly advancing technologies across the value chain-generation, storage, and transportation-to improve efficiency, reduce costs, and enable large-scale deployment. In generation, innovations in electrolyzer design, such as high-efficiency solid oxide and anion exchange systems, are reducing energy consumption and boosting hydrogen yield. In storage and transport, companies are leveraging new materials for high-pressure tanks, cryogenic storage, and solid-state options, improving safety, density, and mobility across sectors. Digital technologies like AI-enabled system optimization, smart grid integration, and real-time monitoring platforms are being adopted to enhance performance and reliability.

- Market Development: In August 2024, Linde plc entered into a long-term agreement with Dow Inc. to supply clean hydrogen and other gases for Dow's new Path2Zero project in Fort Saskatchewan, Alberta, Canada. Under this deal, Linde will invest over USD 2 billion to build, own, and operate a large hydrogen production facility that uses advanced technology to produce low-carbon hydrogen and capture over 2 million tonnes of CO2 each year. The plant will also recycle hydrogen from Dow's operations and provide nitrogen and other industrial gases. This facility, expected to start in 2028, will support Dow's efforts to reduce emissions and will also supply other nearby industries looking to decarbonize. This report provides a detailed analysis of hydrogen solution provider strategies critical for project success, providing stakeholders with actionable insights into trends and opportunities for growth in the hydrogen market.

- Market Diversification: The report offers a comprehensive analysis of the strategies employed by hydrogen solutions provider players to facilitate market diversification. It outlines innovative products and operating models, as well as new partnership frameworks across various regions, which are underpinned by technology-driven business lines. The findings emphasize opportunities for expansion beyond traditional operations, identifying geographical areas and customer segments that are currently served but remain underserved and are suitable for strategic entry.

- Competitive Assessment: The report provides in-depth assessment of market shares, growth strategies, and service offerings of leading players such as Linde plc (Ireland), Air Liquide (France), Air Products and Chemicals, Inc. (US), Saudi Arabian Oil Co. (Saudi Arabia), Shell plc (UK), Uniper SE (Germany), Chevron Corporation (US), Exxon Mobil Corporation (US), BP p.l.c. (UK), Chart Industries (US), OPmobility (US), Luxfer Holdings PLC (US), Faber Italy (Italy), FIBA Technologies, Inc. (US), Bayotech (US), among others, in the hydrogen market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.3.1 Assumptions for demand-side analysis

- 2.2.3.2 Calculations for demand-side analysis

- 2.2.4 SUPPLY-SIDE ANALYSIS

- 2.2.4.1 Assumptions and calculations for supply-side analysis

- 2.3 GROWTH FORECAST

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN MARKET

- 4.2 HYDROGEN MARKET, BY REGION

- 4.3 HYDROGEN MARKET, BY SECTOR

- 4.4 HYDROGEN MARKET, BY APPLICATION

- 4.5 ASIA PACIFIC: HYDROGEN MARKET, BY APPLICATION & COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives for developing hydrogen economy

- 5.2.1.2 Growing demand for ammonia in agriculture sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 High flammability associated with hydrogen

- 5.2.2.2 Limited hydrogen infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Decarbonization targets and climate commitments

- 5.2.3.2 Growing demand for hydrogen vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs associated with renewable hydrogen production

- 5.2.4.2 High cost of composite material-based tanks and strict regulatory approvals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF HYDROGEN GENERATION, BY REGION, 2022-2024

- 5.4.2 INDICATIVE PRICING ANALYSIS OF HYDROGEN STORAGE, BY REGION, 2024

- 5.4.3 INDICATIVE PRICING ANALYSIS OF HYDROGEN TRANSPORTATION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO

- 5.7.2 IMPORT SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Steam methane reforming (SMR)

- 5.8.1.2 Partial oxidation

- 5.8.1.3 Coal gasification

- 5.8.1.4 Electrolysis

- 5.8.1.5 Hydrogen storage technologies

- 5.8.1.6 Hydrogen transport technologies

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Carbon capture, utilization, and storage (CCUS)

- 5.8.2.2 Renewable energy technologies

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Fuel cell technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 HYBRIT INITIATIVE HELPED IN TRANSFORMING STEEL PRODUCTION WITH FOSSIL-FREE GREEN HYDROGEN IN SWEDEN

- 5.9.2 KRAFT HEINZ DEPLOYS ELECTROLYZER TO PRODUCE GREEN HYDROGEN TO DECARBONIZE ITS KITT GREEN FACILITY

- 5.9.3 NPROXX HELPS ANGLO AMERICAN DEVELOP ZERO-EMISSION MINING VEHICLES AND STORE HYDROGEN COST-EFFECTIVELY

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 PATENT ANALYSIS

- 5.11.1 LIST OF MAJOR PATENTS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 Regulatory frameworks/policies in North America

- 5.12.2.2 Regulatory frameworks/policies in Asia Pacific

- 5.12.2.3 Regulatory frameworks/policies in Europe

- 5.12.2.4 Regulatory frameworks/policies in Middle East & Africa

- 5.12.2.5 Regulatory frameworks/policies in South America

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI/GENERATIVE AI ON HYDROGEN MARKET

- 5.15.1 IMPACT ON HYDROGEN GENERATION

- 5.15.2 IMPACT ON HYDROGEN STORAGE

- 5.15.3 IMPACT ON HYDROGEN TRANSPORTATION

- 5.15.4 IMPACT OF AI/GENERATIVE AI, BY APPLICATION

- 5.15.5 IMPACT OF AI/GENERATIVE AI, BY REGION

- 5.16 MACROECONOMIC OUTLOOK FOR HYDROGEN MARKET

- 5.16.1 ENERGY TRANSITION AND POLICY SHIFTS

- 5.16.2 R&D INVESTMENTS

- 5.16.3 INFRASTRUCTURE GROWTH

- 5.16.4 CLIMATE CHANGE

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON HYDROGEN MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON APPLICATIONS

6 HYDROGEN GENERATION MARKET, BY SECTOR

- 6.1 INTRODUCTION

- 6.2 GENERATION TYPE

- 6.2.1 GRAY HYDROGEN

- 6.2.1.1 Low cost of production to fuel demand for gray hydrogen

- 6.2.2 BLUE HYDROGEN

- 6.2.2.1 Rising demand for clean hydrogen to drive market growth

- 6.2.3 GREEN HYDROGEN

- 6.2.3.1 Increasing focus on achieving net-zero carbon emission targets to boost demand for green hydrogen

- 6.2.1 GRAY HYDROGEN

- 6.3 STORAGE

- 6.3.1 PHYSICAL

- 6.3.1.1 Increasing demand for stationary applications to drive market

- 6.3.2 MATERIAL-BASED

- 6.3.2.1 Greater reliability of material-based hydrogen storage technology to boost demand

- 6.3.1 PHYSICAL

- 6.4 TRANSPORTATION

- 6.4.1 LONG DISTANCE

- 6.4.1.1 Expanding hydrogen infrastructure to accelerate market development

- 6.4.2 SHORT DISTANCE

- 6.4.2.1 Rising demand for hydrogen for emergency responses to drive market

- 6.4.1 LONG DISTANCE

7 HYDROGEN MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ENERGY

- 7.2.1 EFFORTS TO DECARBONIZE GLOBAL ENERGY SYSTEMS TO DRIVE MARKET

- 7.2.2 POWER GENERATION

- 7.2.2.1 Growing application of hydrogen in portable devices, backup power, and grid stabilization to support market

- 7.2.3 COMBINED HEAT AND POWER (CHP)

- 7.2.3.1 Offers efficient and sustainable approach to energy generation

- 7.3 MOBILITY

- 7.3.1 RAPID RISE IN DEMAND FOR FUEL CELL ELECTRIC VEHICLES TO DRIVE MARKET

- 7.4 CHEMICAL & REFINERY

- 7.4.1 INCREASING USE OF HYDROGEN IN REFINERIES TO LOWER SULFUR CONTENT OF DIESEL TO BENEFIT MARKET

- 7.4.2 PETROLEUM REFINERY

- 7.4.2.1 Growing need to reduce sulfur content in diesel to boost market

- 7.4.3 AMMONIA PRODUCTION

- 7.4.3.1 Increasing focus on sustainable ammonia production to fuel demand

- 7.4.4 METHANOL PRODUCTION

- 7.4.4.1 Increasing application of methanol for transportation fuel and wastewater denitrification to strengthen market

- 7.5 OTHERS

8 HYDROGEN MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 US

- 8.2.1.1 Rising demand for hydrogen in petroleum refineries and availability of advanced storage solutions to drive demand

- 8.2.2 CANADA

- 8.2.2.1 Growing low-carbon initiatives and government-backed storage & transportation initiatives to fuel demand

- 8.2.3 MEXICO

- 8.2.3.1 Growing production of ammonia to drive market

- 8.2.1 US

- 8.3 ASIA PACIFIC

- 8.3.1 CHINA

- 8.3.1.1 Growing ammonia production and FCEV adoption to boost market

- 8.3.2 INDIA

- 8.3.2.1 Growing refining capacity to support market growth

- 8.3.3 JAPAN

- 8.3.3.1 Government plans and policies to boost market

- 8.3.4 AUSTRALIA

- 8.3.4.1 Strong natural gas reserves, infrastructure, and export-oriented storage and transport solutions to drive market

- 8.3.5 SOUTH KOREA

- 8.3.5.1 Expanding hydrogen infrastructure to drive market growth

- 8.3.6 REST OF ASIA PACIFIC

- 8.3.1 CHINA

- 8.4 EUROPE

- 8.4.1 GERMANY

- 8.4.1.1 Growing adoption of fuel cell electric vehicles to augment market growth

- 8.4.2 FRANCE

- 8.4.2.1 Rising investments in renewable energy generation to support market growth

- 8.4.3 UK

- 8.4.3.1 Increasing focus on reducing natural gas imports to drive market

- 8.4.4 RUSSIA

- 8.4.4.1 Stringent government regulations to increase use of cleaner fuels to boost demand

- 8.4.5 REST OF EUROPE

- 8.4.1 GERMANY

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 GCC

- 8.5.1.1 Saudi Arabia

- 8.5.1.1.1 Rising demand for low-sulfur fuel in transportation to drive market

- 8.5.1.2 UAE

- 8.5.1.2.1 Increasing use of hydrogen fuel for electricity generation to support market growth

- 8.5.1.1 Saudi Arabia

- 8.5.2 SOUTH AFRICA

- 8.5.2.1 Growing use of hydrogen in mining industry to boost demand

- 8.5.3 REST OF MIDDLE EAST & AFRICA

- 8.5.1 GCC

- 8.6 SOUTH AMERICA

- 8.6.1 BRAZIL

- 8.6.1.1 Rising demand for clean hydrogen in transportation sector to drive market

- 8.6.2 ARGENTINA

- 8.6.2.1 Increasing oil refining activities to drive market

- 8.6.3 REST OF SOUTH AMERICA

- 8.6.1 BRAZIL

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 9.3 MARKET SHARE ANALYSIS, 2024

- 9.4 REVENUE ANALYSIS, 2020-2024

- 9.5 COMPANY VALUATION AND FINANCIAL METRICS

- 9.6 PRODUCT COMPARISON

- 9.7 COMPANY EVALUATION MATRIX: KEY HYDROGEN PRODUCERS, 2024

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- 9.7.4.1 Generation type footprint

- 9.8 COMPANY EVALUATION MATRIX: KEY HYDROGEN STORAGE PROVIDERS, 2024

- 9.8.1 STARS

- 9.8.2 EMERGING LEADERS

- 9.8.3 PERVASIVE PLAYERS

- 9.8.4 PARTICIPANTS

- 9.8.4.1 Storage footprint

- 9.9 COMPANY EVALUATION MATRIX: KEY HYDROGEN TRANSPORTATION PROVIDERS, 2024

- 9.9.1 STARS

- 9.9.2 EMERGING LEADERS

- 9.9.3 PERVASIVE PLAYERS

- 9.9.4 PARTICIPANTS

- 9.9.4.1 Transportation footprint

- 9.9.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.9.5.1 Company footprint

- 9.9.5.2 Region footprint

- 9.9.5.3 Application footprint

- 9.10 COMPANY EVALUATION MATRIX: STARTUPS/SMES (HYDROGEN PRODUCERS), 2024

- 9.10.1 PROGRESSIVE COMPANIES

- 9.10.2 RESPONSIVE COMPANIES

- 9.10.3 DYNAMIC COMPANIES

- 9.10.4 STARTING BLOCKS

- 9.10.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.10.5.1 Detailed list of key startups/SMEs

- 9.10.5.2 Competitive benchmarking of key startups/SMEs

- 9.11 COMPETITIVE SCENARIO

- 9.11.1 PRODUCT LAUNCHES

- 9.11.2 DEALS

- 9.11.3 EXPANSIONS

- 9.11.4 OTHER DEVELOPMENTS

10 COMPANY PROFILE

- 10.1 KEY HYDROGEN PRODUCERS

- 10.1.1 LINDE PLC

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Deals

- 10.1.1.3.2 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 AIR LIQUIDE

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Deals

- 10.1.2.3.2 Expansions

- 10.1.2.3.3 Other developments

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses and competitive threats

- 10.1.3 SAUDI ARABIAN OIL CO.

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.3.2 Expansions

- 10.1.4 AIR PRODUCTS AND CHEMICALS, INC.

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Deals

- 10.1.4.3.2 Expansions

- 10.1.4.3.3 Other developments

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strategies

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses and competitive threats

- 10.1.5 SHELL PLC

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Deals

- 10.1.5.3.2 Expansions

- 10.1.5.3.3 Other developments

- 10.1.5.4 MnM View

- 10.1.5.4.1 Key strengths

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses and competitive threats

- 10.1.6 CHEVRON CORPORATION

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Deals

- 10.1.7 UNIPER SE

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Deals

- 10.1.7.3.2 Other developments

- 10.1.8 EXXON MOBIL CORPORATION

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Solutions/Services offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.9 BP P.L.C.

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Solutions/Services offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Deals

- 10.1.9.3.2 Other developments

- 10.1.1 LINDE PLC

- 10.2 HYDROGEN STORAGE PROVIDERS

- 10.2.1 INOX INDIA LIMITED

- 10.2.1.1 Business overview

- 10.2.1.2 Products/Solutions/Services offered

- 10.2.1.3 Recent developments

- 10.2.1.3.1 Deals

- 10.2.1.4 MnM view

- 10.2.1.4.1 Key strengths

- 10.2.1.4.2 Strategic choices

- 10.2.1.4.3 Weaknesses and competitive threats

- 10.2.2 CRYOLOR

- 10.2.2.1 Business overview

- 10.2.2.2 Products/Solutions/Services offered

- 10.2.2.3 MnM view

- 10.2.2.3.1 Key strengths

- 10.2.2.3.2 Strategic choices

- 10.2.2.3.3 Weaknesses and competitive threats

- 10.2.3 BNH GAS TANKS

- 10.2.3.1 Business overview

- 10.2.3.2 Products/Solutions/Services offered

- 10.2.4 FABER ITALY

- 10.2.4.1 Business overview

- 10.2.4.2 Products/Solutions/Services offered

- 10.2.5 OTHER HYDROGEN STORAGE PROVIDERS

- 10.2.5.1 Luxfer Holdings PLC

- 10.2.5.2 FIBA Technologies, Inc.

- 10.2.5.3 Cryofab, Inc.

- 10.2.5.4 Opmobility

- 10.2.1 INOX INDIA LIMITED

- 10.3 HYDROGEN TRANSPORTATION TANK PROVIDERS

- 10.3.1 BAYOTECH

- 10.3.1.1 Business overview

- 10.3.1.2 Products/Solutions/Services offered

- 10.3.1.3 Recent developments

- 10.3.1.3.1 Deals

- 10.3.2 HEXAGON PURUS

- 10.3.2.1 Business overview

- 10.3.2.2 Products/Solutions/Services offered

- 10.3.2.3 Recent developments

- 10.3.2.3.1 Expansions

- 10.3.2.3.2 Other developments

- 10.3.2.4 MnM view

- 10.3.2.4.1 Key strategies

- 10.3.2.4.2 Strategic choices

- 10.3.2.4.3 Weaknesses and competitive threats

- 10.3.3 NPROXX

- 10.3.3.1 Business overview

- 10.3.3.2 Products/Solutions/Services offered

- 10.3.3.3 Recent developments

- 10.3.3.3.1 Product launches

- 10.3.3.3.2 Deals

- 10.3.4 CHART INDUSTRIES

- 10.3.4.1 Business overview

- 10.3.4.2 Products/Solutions/Services offered

- 10.3.4.3 Recent developments

- 10.3.4.3.1 Deals

- 10.3.4.3.2 Other developments

- 10.3.4.4 MnM view

- 10.3.4.4.1 Key strategies

- 10.3.4.4.2 Strategic choices

- 10.3.4.4.3 Weaknesses and competitive threats

- 10.3.5 OTHER HYDROGEN TRANSPORTATION TANK PROVIDERS

- 10.3.5.1 Quantum Fuel Systems

- 10.3.5.2 Composite Advanced Technologies, LLC

- 10.3.5.3 Weldship

- 10.3.5.4 CALVERA Hydrogen

- 10.3.1 BAYOTECH

11 APPENDIX

- 11.1 INSIGHTS OF INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 2 HYDROGEN MARKET SNAPSHOT

- TABLE 3 AVERAGE SELLING PRICE TREND OF HYDROGEN GENERATION, BY REGION, 2022-2024 (USD/KG)

- TABLE 4 INDICATIVE PRICING ANALYSIS OF HYDROGEN STORAGE, BY REGION, 2024

- TABLE 5 HYDROGEN MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 7 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 8 HYDROGEN MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 HYDROGEN MARKET: MAJOR PATENTS RELATED TO HYDROGEN GENERATION, STORAGE, AND TRANSPORTATION

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 HYDROGEN MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP THREE APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF

- TABLE 19 HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 20 HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 21 GENERATION TYPE: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 22 GENERATION TYPE: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 23 GENERATION TYPE: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 GENERATION TYPE: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 GENERATION TYPE: HYDROGEN MARKET, BY TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 26 GENERATION TYPE: HYDROGEN MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 27 GENERATION TYPE: HYDROGEN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 GENERATION TYPE: HYDROGEN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 GRAY HYDROGEN: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 30 GRAY HYDROGEN: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 31 GRAY HYDROGEN: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 GRAY HYDROGEN: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 BLUE HYDROGEN: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 34 BLUE HYDROGEN: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 35 BLUE HYDROGEN: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 BLUE HYDROGEN: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 GREEN HYDROGEN: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 38 GREEN HYDROGEN: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 39 GREEN HYDROGEN: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 GREEN HYDROGEN: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 STORAGE: HYDROGEN MARKET, 2021-2024 (USD MILLION)

- TABLE 42 STORAGE: HYDROGEN MARKET, 2025-2030 (USD MILLION)

- TABLE 43 PHYSICAL: HYDROGEN MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 44 PHYSICAL: HYDROGEN MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 45 PHYSICAL: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 PHYSICAL: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 TRANSPORTATION: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 48 TRANSPORTATION: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 49 TRANSPORTATION: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 TRANSPORTATION: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 TRANSPORTATION: HYDROGEN MARKET, BY TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 52 TRANSPORTATION: HYDROGEN MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 53 TRANSPORTATION: HYDROGEN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 54 TRANSPORTATION: HYDROGEN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 55 LONG DISTANCE: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 56 LONG DISTANCE: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 57 LONG DISTANCE: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 LONG DISTANCE: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 LONG DISTANCE: HYDROGEN MARKET, BY TYPE, 2021-2030 (THOUSAND METRIC TONS)

- TABLE 60 LONG DISTANCE: HYDROGEN MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 61 LONG DISTANCE: HYDROGEN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 62 LONG DISTANCE: HYDROGEN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 63 SHORT DISTANCE: HYDROGEN MARKET, BY REGION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 64 SHORT DISTANCE: HYDROGEN MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 65 SHORT DISTANCE: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 SHORT DISTANCE: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 ENERGY: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 ENERGY: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 ENERGY: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 ENERGY: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 MOBILITY: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 MOBILITY: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 CHEMICAL & REFINERY: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 CHEMICAL & REFINERY: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 CHEMICAL & REFINERY: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 CHEMICAL & REFINERY: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 OTHERS: HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 OTHERS: HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 HYDROGEN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 HYDROGEN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: HYDROGEN MARKET, BY SECTOR, 2025-2030(USD MILLION)

- TABLE 85 NORTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 86 NORTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 87 NORTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (THOUSANDS METRIC TONS)

- TABLE 90 NORTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 91 NORTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: HYDROGEN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: HYDROGEN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 US: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 98 US: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 100 CANADA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 101 MEXICO: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 102 MEXICO: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 106 ASIA PACIFIC: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 107 ASIA PACIFIC: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 110 ASIA PACIFIC: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 111 ASIA PACIFIC: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: HYDROGEN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: HYDROGEN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 CHINA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 118 CHINA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 119 INDIA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 120 INDIA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 121 JAPAN: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 122 JAPAN: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 123 AUSTRALIA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 124 AUSTRALIA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 125 SOUTH KOREA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 126 SOUTH KOREA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 132 EUROPE: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 133 EUROPE: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 136 EUROPE: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 137 EUROPE: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: HYDROGEN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 EUROPE: HYDROGEN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 GERMANY: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 144 GERMANY: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 145 FRANCE: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 146 FRANCE: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 147 UK: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 148 UK: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 149 RUSSIA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 150 RUSSIA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 151 REST OF EUROPE: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 152 REST OF EUROPE: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 156 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 157 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 160 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 161 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 SAUDI ARABIA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 168 SAUDI ARABIA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 169 UAE: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 170 UAE: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH AFRICA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 172 SOUTH AFRICA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH AMERICA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 176 SOUTH AMERICA: HYDROGEN MARKET, BY SECTOR, 2025-2030(USD MILLION)

- TABLE 177 SOUTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 178 SOUTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 179 SOUTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2021-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: HYDROGEN MARKET, BY GENERATION TYPE, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (THOUSAND METRIC TONS)

- TABLE 182 SOUTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 183 SOUTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2021-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: HYDROGEN MARKET, BY TRANSPORTATION, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: HYDROGEN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: HYDROGEN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: HYDROGEN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: HYDROGEN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 BRAZIL: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 190 BRAZIL: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 191 ARGENTINA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 192 ARGENTINA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: HYDROGEN MARKET, BY SECTOR, 2021-2024 (USD MILLION)

- TABLE 194 REST OF SOUTH AMERICA: HYDROGEN MARKET, BY SECTOR, 2025-2030 (USD MILLION)

- TABLE 197 HYDROGEN MARKET: GENERATION TYPE FOOTPRINT

- TABLE 198 HYDROGEN MARKET: STORAGE FOOTPRINT

- TABLE 199 HYDROGEN MARKET: TRANSPORTATION FOOTPRINT

- TABLE 200 HYDROGEN MARKET: REGION FOOTPRINT

- TABLE 201 HYDROGEN MARKET: APPLICATION FOOTPRINT

- TABLE 202 HYDROGEN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 203 HYDROGEN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 204 HYDROGEN MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 205 HYDROGEN MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 206 HYDROGEN MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 207 HYDROGEN MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JUNE 2025

- TABLE 208 LINDE PLC: COMPANY OVERVIEW

- TABLE 209 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 LINDE PLC: DEALS

- TABLE 211 LINDE PLC: EXPANSIONS

- TABLE 212 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 213 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 AIR LIQUIDE: DEALS

- TABLE 215 AIR LIQUIDE: EXPANSIONS

- TABLE 216 AIR LIQUIDE: OTHER DEVELOPMENTS

- TABLE 217 SAUDI ARABIAN OIL CO.: COMPANY OVERVIEW

- TABLE 218 SAUDI ARABIAN OIL CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 SAUDI ARABIAN OIL CO.: DEALS

- TABLE 220 SAUDI ARABIAN OIL CO.: EXPANSIONS

- TABLE 221 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 222 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 223 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 224 AIR PRODUCTS AND CHEMICALS, INC.: EXPANSIONS

- TABLE 225 AIR PRODUCTS AND CHEMICALS, INC.: OTHER DEVELOPMENTS

- TABLE 226 SHELL PLC: COMPANY OVERVIEW

- TABLE 227 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SHELL PLC: DEALS

- TABLE 229 SHELL PLC: EXPANSIONS

- TABLE 230 SHELL PLC: OTHER DEVELOPMENTS

- TABLE 231 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 232 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 CHEVRON CORPORATION: DEALS

- TABLE 234 UNIPER SE: COMPANY OVERVIEW

- TABLE 235 UNIPER SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 UNIPER SE: DEALS

- TABLE 237 UNIPER SE: OTHER DEVELOPMENTS

- TABLE 238 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 239 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 EXXON MOBIL CORPORATION: DEALS

- TABLE 241 BP P.L.C.: COMPANY OVERVIEW

- TABLE 242 BP P.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 BP P.L.C.: DEALS

- TABLE 244 BP P.L.C.: OTHER DEVELOPMENTS

- TABLE 245 INOX INDIA LIMITED: COMPANY OVERVIEW

- TABLE 246 INOX INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 INOX INDIA LIMITED: DEALS

- TABLE 248 CRYOLOR: COMPANY OVERVIEW

- TABLE 249 CRYOLOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 BNH GAS TANKS: COMPANY OVERVIEW

- TABLE 251 BNH GAS TANKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 FABER ITALY: COMPANY OVERVIEW

- TABLE 253 FABER ITALY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 LUXFER HOLDINGS PLC: COMPANY OVERVIEW

- TABLE 255 FIBA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 256 CRYOFAB, INC.: COMPANY OVERVIEW

- TABLE 257 OPMOBILITY: COMPANY OVERVIEW

- TABLE 258 BAYOTECH: COMPANY OVERVIEW

- TABLE 259 BAYOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 BAYOTECH: DEALS

- TABLE 261 HEXAGON PURUS: COMPANY OVERVIEW

- TABLE 262 HEXAGON PURUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 HEXAGON PURUS: DEALS

- TABLE 264 HEXAGON PURUS: EXPANSIONS

- TABLE 265 HEXAGON PURUS: OTHER DEVELOPMENTS

- TABLE 266 NPROXX: COMPANY OVERVIEW

- TABLE 267 NPROXX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 NPROXX: PRODUCT LAUNCHES

- TABLE 269 NPROXX: DEALS

- TABLE 270 CHART INDUSTRIES: COMPANY OVERVIEW

- TABLE 271 CHART INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 CHART INDUSTRIES: DEALS

- TABLE 273 CHART INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 274 QUANTUM FUEL SYSTEMS: COMPANY OVERVIEW

- TABLE 275 COMPOSITE ADVANCED TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 276 WELDSHIP: COMPANY OVERVIEW

- TABLE 277 CALVERA HYDROGEN: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HYDROGEN MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HYDROGEN MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 HYDROGEN MARKET: BOTTOM-UP APPROACH

- FIGURE 8 HYDROGEN MARKET: TOP-DOWN APPROACH

- FIGURE 9 METRICS CONSIDERED TO ANALYZE DEMAND FOR HYDROGEN

- FIGURE 10 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF HYDROGEN

- FIGURE 11 HYDROGEN MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 12 HYDROGEN MARKET SHARE ANALYSIS, 2024

- FIGURE 13 HYDROGEN MARKET: DATA TRIANGULATION

- FIGURE 14 HYDROGEN MARKET: RESEARCH LIMITATIONS

- FIGURE 15 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF HYDROGEN MARKET IN 2024

- FIGURE 16 CHEMICAL & REFINERY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 GENERATION TYPE TO DOMINATE HYDROGEN MARKET DURING FORECAST PERIOD

- FIGURE 18 GROWING NEED TO REDUCE GREENHOUSE GAS EMISSIONS TO FUEL MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 GENERATION TYPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 21 CHEMICAL & REFINERY SEGMENT TO BE DOMINANT APPLICATION DURING FORECAST PERIOD

- FIGURE 22 CHINA DOMINATED ASIA PACIFIC HYDROGEN MARKET IN 2024

- FIGURE 23 HYDROGEN MARKET: MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 DEMAND FOR AMMONIA, BY END USE, 2024

- FIGURE 25 GREENHOUSE GAS EMISSIONS, BY SECTOR, 2023

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF HYDROGEN GENERATION, BY REGION, 2022-2024

- FIGURE 28 INDICATIVE PRICING OF HYDROGEN TRANSPORTATION, BY TRANSPORTATION MODE, USD MILLION

- FIGURE 29 HYDROGEN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 HYDROGEN MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 EXPORT SCENARIO FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 32 IMPORT SCENARIO FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 33 NUMBER OF PATENTS GRANTED IN HYDROGEN MARKET, 2014-2024

- FIGURE 34 HYDROGEN MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP THREE APPLICATIONS

- FIGURE 36 BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 37 IMPACT OF AI/GENERATIVE AI, BY APPLICATION

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO

- FIGURE 39 HYDROGEN MARKET, BY SECTOR, 2024

- FIGURE 40 HYDROGEN MARKET, BY APPLICATION, 2024

- FIGURE 41 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 HYDROGEN MARKET SHARE, BY REGION, 2024

- FIGURE 44 EUROPE: HYDROGEN MARKET SNAPSHOT

- FIGURE 45 MARKET SHARE ANALYSIS OF COMPANIES OFFERING HYDROGEN SOLUTIONS, 2024

- FIGURE 46 HYDROGEN MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 47 COMPANY VALUATION

- FIGURE 48 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 49 PRODUCT COMPARISON

- FIGURE 50 HYDROGEN MARKET: COMPANY EVALUATION MATRIX (KEY HYDROGEN PRODUCERS), 2024

- FIGURE 51 HYDROGEN MARKET: COMPANY EVALUATION MATRIX (KEY HYDROGEN STORAGE PROVIDERS), 2024

- FIGURE 52 HYDROGEN MARKET: COMPANY EVALUATION MATRIX (KEY HYDROGEN TRANSPORTATION PROVIDERS), 2024

- FIGURE 53 HYDROGEN MARKET: COMPANY FOOTPRINT

- FIGURE 54 HYDROGEN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 LINDE PLC: COMPANY SNAPSHOT

- FIGURE 56 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 57 SAUDI ARABIAN OIL CO.: COMPANY SNAPSHOT

- FIGURE 58 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 59 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 60 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 UNIPER SE: COMPANY SNAPSHOT

- FIGURE 62 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 64 INOX INDIA LIMITED: COMPANY SNAPSHOT

- FIGURE 65 HEXAGON PURUS: COMPANY SNAPSHOT

- FIGURE 66 CHART INDUSTRIES: COMPANY SNAPSHOT