|

市场调查报告书

商品编码

1795414

压敏胶带市场(按类型、黏合剂类型、基材、技术、最终用途产业和地区划分)-预测至2030年Pressure-Sensitive Adhesive Tapes Market by Type (Single-Sided, Double-Sided), Adhesive Type (Acrylic, Rubber), Technology (Solvent, Hot-Melt, Water-Based), Backing (PP, Paper), End-use Industry (Medical & Hygiene), and Region - Global Forecast to 2030 |

||||||

预计2024年压敏胶带市场规模将达703亿美元。

预计 2025 年至 2030 年期间市场复合年增长率为 4.64%,2030 年达到 924.1 亿美元。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元)及数量(百万平方公尺) |

| 部分 | 按类型、黏合剂类型、背衬材料、技术、最终用途行业和地区 |

| 目标区域 | 大中华区、亚太区、北美、中东及非洲、南美 |

随着电子产品变得越来越小、越来越复杂,对能够将复杂精密零件黏合在一起的黏合剂的需求正在迅速增长。压敏胶带经常用于智慧型手机、平板电脑、电脑、穿戴式装置和其他消费性电子产品的组装。这些胶带在固定小部件、保护电路和温度控管方面发挥着至关重要的作用。专为必须严格控制污染的无尘室设计的胶带更有价值,因为它们可以切割成小部件而不会留下残留物。 5G、人工智慧和智慧连网型设备的快速成长正在加速对高效能压敏胶带的需求,以实现高效可靠的製造。这些胶带对当今的电子产品生产至关重要,可以加快生产速度、减少材料浪费并提高产品安全性和品质。随着创新不断定义消费性电子领域,压敏胶带在设计灵活性、卓越操作和持续性能方面将变得更加重要。

在预测期内,双面胶带将成为全球压敏胶带市场以金额为准第二大的类型。这种增长很大程度上是由标识和图形行业不断增长的需求推动的,该行业对清晰的沟通、稳定性和表面清洁至关重要。双面压敏胶带很有用,因为它们通常提供隐形黏合,并且易于用于安装显示器、张贴海报、层压横幅和组装促销品。它们厚度一致、黏合强度高、防潮性好,通常适用于零售店、交通系统和活动中使用的室内和室外标誌定位。这些胶带使用黏合剂而不是机械紧固件或可见黏合剂,这是一个显着的优势,因为它们不会影响计划的设计美感。

2024年,纸质背衬胶带占据压敏胶带市场第二大份额,这主要得益于其适用于客製化印刷和品牌推广应用。与塑胶或铝箔背衬相比,纸质背衬胶带具有更优异的表面质量,更利于油墨附着,从而能够将清晰的文字、品牌标籤和条码讯息直接印在胶带上。这项特性在电子商务、零售包装的各个环节、製造物流以及其他对识别、可追溯性和讯息至关重要的领域尤其重要。无论是防篡改封条、带有图案的品牌包装胶带,还是标籤保护,纸质背衬压敏胶带始终是传递讯息和提升品牌知名度的灵活且经济高效的选择。它还易于与可变资料列印技术集成,这对于序列化和批次追踪至关重要。随着产品识别与包装的连结日益紧密,包装也逐渐成为一种行销工具和传播媒介,与其他基材相比,印刷和客製化设计的纸质结构对製造商而言具有巨大的价值。这项特性增强了产品的功能性和视觉吸引力,使其更具商业性价值。

中东和非洲的成长得益于大规模基础建设和都市化,尤其是在阿联酋、沙乌地阿拉伯、埃及和奈及利亚。数百个政府支持的计划,如 NEOM、愿景 2030计划和智慧城市计划,正在创造对新型建筑材料的巨大需求。压敏胶带由于其清洁、防潮和快速应用,越来越多地被用于空调、密封和绝缘、接缝、嵌装玻璃和地板材料应用。压敏胶带在沿岸地区和撒哈拉以南非洲地区常见的炎热潮湿环境中具有出色的热稳定性和耐候性,使其比传统黏合剂系统更具吸引力且更易于使用。随着永续性需求的成熟,特别是在努力获得绿色认证的沿岸地区国家,对节能无毒压敏胶带的需求日益增加。预计建筑业将成为该地区压敏胶带市场的主要成长动力。

本报告研究了全球压敏胶带市场,按类型、黏合剂类型、背衬材料、技术、最终用途行业、区域趋势和参与市场的公司概况进行细分。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 宏观经济展望

第六章 产业趋势

- 供应链分析

- 原物料供应商

- 製造商

- 分销网络

- 最终用途产业

- 定价分析

- 影响客户业务的趋势/中断

- 生态系分析

- 案例研究分析

- 技术分析

- 贸易分析

- 监管状况

- 大型会议及活动

- 投资金筹措场景

- 专利分析

- 2025年美国关税的影响—概述

- 人工智慧/生成式人工智慧对胶带市场的影响

第七章 胶带市场(按类型)

- 介绍

- 单面胶带

- 双面胶带

- 其他的

第八章胶带市场(按黏合剂类型)

- 介绍

- 丙烯酸纤维

- 橡皮

- 硅酮

- 其他的

第九章 胶带市场(依基材)

- 介绍

- 聚丙烯

- 纸

- 聚氯乙烯

- 其他的

第十章压敏胶带市场(依技术)

- 介绍

- 溶剂型技术

- 水性技术

- 热熔技术

第 11 章胶带市场(依最终用途产业)

- 介绍

- 家电

- 电子产品

- 车

- 电气系统/线束

- 产业分布

- 柔版印刷和纸张

- 医疗卫生

- 包装

- 其他的

第十二章 胶带市场(按地区)

- 介绍

- 大中华区

- 中国

- 台湾

- 香港

- 亚太地区

- 日本

- 印度

- 韩国

- ASEAN

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 荷兰

- 波兰

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 南美洲

- 巴西

- 阿根廷

- 智利

第十三章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2024年市场占有率分析

- 2020年至2024年五大公司收益分析

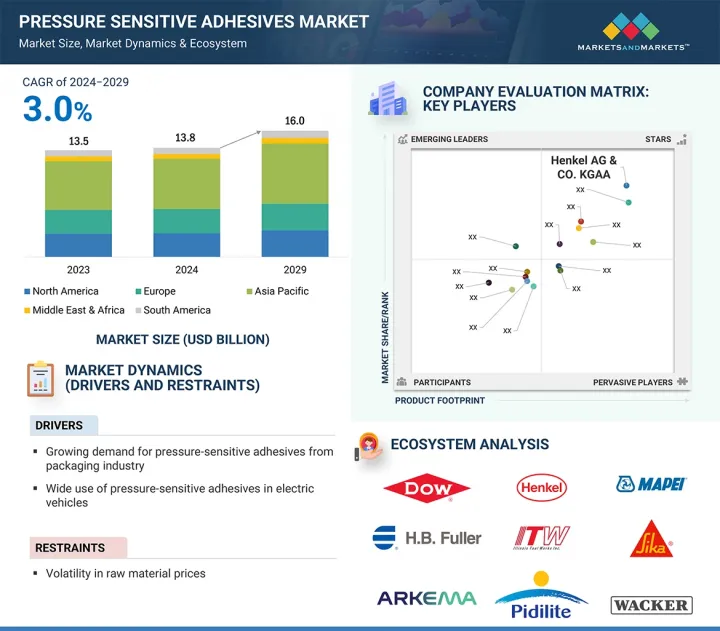

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 品牌/产品比较分析

- 估值和财务指标

- 竞争场景

第十四章:公司简介

- 主要参与企业

- 3M COMPANY

- TESA SE

- NITTO DENKO CORPORATION

- LINTEC CORPORATION

- INTERTAPE POLYMER GROUP INC.

- AVERY DENNISON CORPORATION

- LOHMANN GMBH & CO. KG

- BERRY GLOBAL GROUP, INC.

- SCAPA GROUP PLC(MATIV HOLDINGS)

- SAINT-GOBAIN SA

- Start-Ups/中小型企业

- NICHIBAN CO., LTD.

- SHURTAPE TECHNOLOGIES, LLC

- ROGERS CORPORATION

- GERGONNE INDUSTRIE

- ORAFOL EUROPE GMBH

- PPI ADHESIVE PRODUCTS(CE)SRO

- AMERICAN BILTRITE INC.

- TERAOKA SEISAKUSHO CO., LTD.

- ADVANCE TAPES INTERNATIONAL

- CCT TAPES

- BOLEX(SHENZHEN)ADHESIVE PRODUCTS CO., LTD.

- AJIT INDUSTRIES

- SUN CHEMICAL(DIC CORPORATION)

- PPM INDUSTRIES SPA

- LOUIS TAPE

第十五章:邻近市场与相关市场

第十六章 附录

The pressure-sensitive adhesive tapes market size was USD 70.30 billion in 2024 and is projected to reach USD 92.41 billion by 2030, at a CAGR of 4.64%, between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Million Square Meter) |

| Segments | Type, Adhesive Type, Backing, Technology, End-Use Industry, and Region |

| Regions covered | Greater China, Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Increasing Demand for High-Precision Adhesive Solutions to Drive Market in Electronics Sector."

As electronics get tinier and more advanced, the need for adhesives that can hold complicated and sensitive components is growing rapidly. Pressure-sensitive adhesive tapes are more frequently used in the assembly of smartphones, tablets, computers, wearables, and other consumer electronics. These tapes have essential roles in securing small components, circuit protection, and thermal management. Made for cleanrooms, where contamination must be carefully controlled, makes them even more valuable, as they do not leave residue and can be cut into mini parts. The fast growth of 5G, AI, and smart connected devices is accelerating the demand for high-performance pressure-sensitive adhesive tapes that enable efficient and reliable manufacturing. These tapes allow faster manufacturing, reducing material waste, and increasing product safety and quality; they are becoming essential in today's electronics production. As innovation continues to define the consumer electronics space, pressure-sensitive adhesive tapes will become more crucial in design flexibility, operational excellence, and sustained performance.

The double-sided tapes segment was the second-largest segment, in terms of value, of the global pressure-sensitive adhesive tapes market.

The double-sided tapes segment was the second-largest type in the global market for pressure-sensitive adhesive tapes, in terms of value, during the forecast period. This growth is largely supported by increased demand in the signage and graphics industry, where clarity of communication, stability, and cleanliness of the surface are paramount. Double-sided pressure-sensitive adhesive tapes are useful in that they typically provide a non-visible bond, and they can easily be used in display mounting, poster installation, banner lamination, and promotional product assembly. They are commonly constructed with consistent thickness, have aggressive tack, and are moisture resistant, making them able to offer both indoor and outdoor locating capabilities for signage used in retail stores, transportation, and events. Although these tapes use adhesives rather than mechanical fasteners or visible adhesives, one major advantage is that adhesives will not compromise the design aesthetic of a project, and in addition, double-sided tapes allow for fast and bubble-free application.

In 2024, the paper backing segment had the second-largest value share in the pressure-sensitive adhesive tapes market.

The paper backing category held the second-largest share of the pressure-sensitive adhesive tapes market in 2024, largely due to its highly compatible qualities with custom printing and branding applications. Paper offers better surface qualities for ink adhesion compared to plastic or foil backings, where clear text, brand labels, or barcode information can be printed directly onto the tape. This feature is especially important in e-commerce, various sectors of retail packaging, manufacturing logistics, and other areas where identification, traceability, or marketing messages matter. Whether it is tamper-evident seals, branded packaging tapes with graphics, or labeling protection, paper-backed pressure-sensitive adhesive tapes remain a flexible and cost-effective option for conveying information or enhancing brand visibility. They also facilitate integration with variable data printing technologies, which are essential for serialization or batch tracking. As product identity becomes more linked to packaging-transforming it into a marketing tool and communication medium-printed and custom-designed paper structures hold significantly more value for manufacturers compared to other substrates. This characteristic enhances both the functionality and visual appeal of products, making them more commercially relevant.

"The Middle East & Africa is estimated to be the third fastest-growing pressure-sensitive adhesive tapes market, in terms of value."

The growth of the Middle East & Africa is attributed to the large-scale development of new infrastructure and urbanization, especially in the UAE, Saudi Arabia, Egypt and Nigeria. Hundreds of government-backed megaprojects such as NEOM, Vision 2030 projects, and smart city initiatives create enormous demand for new building materials. Pressure-sensitive adhesive tapes are increasingly employed in HVAC applications, sealing and insulating, bonding joints, glazing and flooring applications since they're clean to deliver, moisture resistant and can be installed quickly. Pressure-sensitive adhesive tapes provide excellent thermal stability and weather-resistant value in hot and humid environments that are prevalent in Gulf and Sub-Saharan African regions, making them more attractive and useable than traditional adhesive systems. As sustainability mandates mature especially in Gulf region countries striving for green certifications, there are growing requirements for energy-efficient and non-toxic pressure-sensitive adhesive tapes. The construction sector will be an important growth pillar in the region's pressure sensitive adhesive tapes market.

- By Company Type: Tier 1 - 55%, Tier 2-25%, and Tier 3-20%

- By Designation: Directors- 50%, Managers-30%, and Others-20%

- By Region: North America- 40%, Europe-35%, Asia Pacific-20%, Rest of World - 5%

The key players profiled in the report include 3M Company (US), Tesa SE (Germany), Nitto Denko Corporation (Japan), LINTEC Corporation (Japan), Intertape Polymer Group, Inc. (Canada), Avery Dennison Corporation (US), Lohmann GmbH & Co. KG (Germany), Berry Global Group, Inc. (US), Scapa Group plc (Mativ Holdings) (US), and Saint-Gobain S.A. (France).

Research Coverage

This report segments the market for pressure sensitive adhesive tapes based on type, adhesive type, backing, technology, end-use industry and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for pressure sensitive adhesive tapes.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the pressure sensitive adhesive tapes market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on pressure-sensitive adhesive tapes offered by top players in the global market

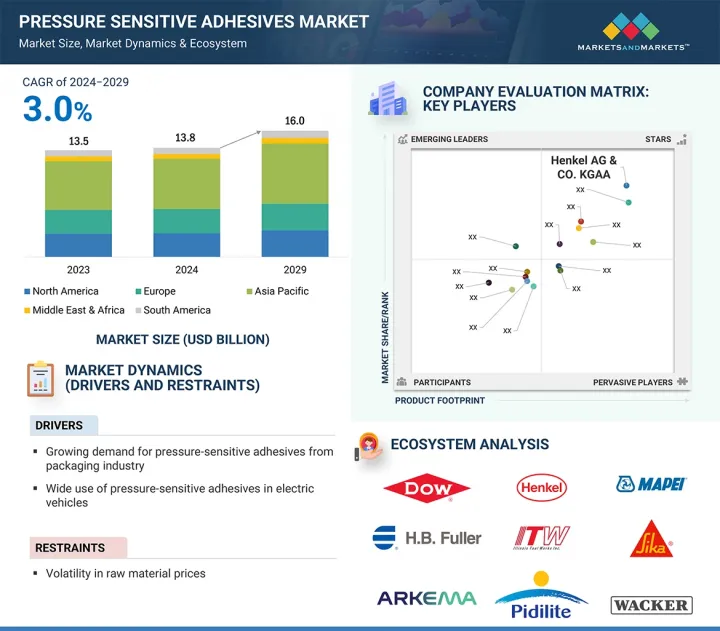

- Analysis of key drivers (Growing demand for pressure-sensitive adhesive tapes from packaging industry, increasing emphasis on environmental sustainability across various industries, and wide use of tapes in electric vehicles), restraints (volatility in raw material prices), opportunities (Potential substitutes to traditional fastening systems and advancement in pressure-sensitive adhesive tape technology), and challenges (Implementation of stringent regulatory policies) influencing the growth of pressure sensitive adhesive tapes market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the pressure-sensitive adhesive tapes market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for pressure-sensitive adhesive tapes across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global pressure-sensitive adhesive tapes market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the pressure-sensitive adhesive tapes market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRESSURE-SENSITIVE ADHESIVE TAPES MARKET

- 4.2 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION

- 4.3 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.4 REGIONAL ANALYSIS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE

- 4.5 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for PSA tapes from packaging industry

- 5.2.1.2 Increasing emphasis on environmental sustainability across various industries

- 5.2.1.3 Wide use of PSA tapes in electric vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential substitutes to traditional fastening systems

- 5.2.3.2 Advancements in PSA tape technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Implementation of stringent regulatory policies

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF PRESSURE-SENSITIVE ADHESIVE TAPES OFFERED BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF PRESSURE-SENSITIVE ADHESIVE TAPES, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 STREAMLINING PACKAGING AT MAJOR CHEMICAL MANUFACTURER WITH SPECTAPE

- 6.5.2 REDUCING VOCS IN AUTOMOTIVE LABELING THROUGH CIRCULAR PSA INNOVATION

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Adhesive formulation technology

- 6.6.1.2 Coating and lamination technology

- 6.6.2 COMPLIMENTARY TECHNOLOGIES

- 6.6.2.1 Application and dispensing equipment

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 3919)

- 6.7.2 EXPORT SCENARIO (HS CODE 3919)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 ISO 13485 - Quality Management Systems for Medical Devices

- 6.8.2.2 RoHS Directive (2011/65/EU) - Restriction of Hazardous Substances

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES:

- 6.13 IMPACT OF AI/GEN AI ON PRESSURE-SENSITIVE ADHESIVE TAPES MARKET

7 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SINGLE-SIDED TAPES

- 7.2.1 EXPANDING USAGE IN LABELING AND PACKAGING TO DRIVE MARKET

- 7.3 DOUBLE-SIDED TAPES

- 7.3.1 DEMAND FOR AESTHETIC AND SEAMLESS BONDING TO BOOST MARKET

- 7.4 OTHER TYPES

8 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE

- 8.1 INTRODUCTION

- 8.2 ACRYLIC

- 8.2.1 RISING DEMAND FOR HIGH-PERFORMANCE BONDING SOLUTIONS TO DRIVE DEMAND

- 8.3 RUBBER

- 8.3.1 COST-EFFECTIVENESS OF RUBBER TO BOOST DEMAND

- 8.4 SILICONE

- 8.4.1 ADVANCED INDUSTRIAL APPLICATIONS TO ACCELERATE SILICONE TAPE ADOPTION

- 8.5 OTHER ADHESIVE TYPES

9 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL

- 9.1 INTRODUCTIONS

- 9.2 POLYPROPYLENE

- 9.2.1 STRENGTH AND VERSATILITY ACROSS INDUSTRIES TO FUEL MARKET GROWTH

- 9.3 PAPER

- 9.3.1 ECO-FRIENDLY PACKAGING AND PROCESS EFFICIENCY TO DRIVE MARKET

- 9.4 POLYVINYL CHLORIDE

- 9.4.1 DURABILITY AND ELECTRICAL INSULATION PROPERTIES TO DRIVE DEMAND

- 9.5 OTHER BACKING MATERIALS

10 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 SOLVENT-BASED TECHNOLOGY

- 10.2.1 HIGH BOND STRENGTH AND MATERIAL COMPATIBILITY TO DRIVE MARKET

- 10.3 WATER-BASED TECHNOLOGY

- 10.3.1 ECO-FRIENDLY FORMULATIONS AND SAFER PRODUCTION TO BOOST MARKET DEMAND

- 10.4 HOT MELT-BASED TECHNOLOGY

- 10.4.1 RAPID PROCESSING AND HIGH TACK EFFICIENCY TO FUEL MARKET GROWTH

11 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 CONSUMER

- 11.2.1 RISING DEMAND FOR FUNCTIONAL AND DECORATIVE ADHESIVE SOLUTIONS TO DRIVE MARKET

- 11.3 ELECTRONICS

- 11.3.1 ELECTRONICS MINIATURIZATION AND ASSEMBLY EFFICIENCY TO FUEL DEMAND

- 11.4 AUTOMOTIVE

- 11.4.1 LIGHTWEIGHT AND DURABLE BONDING SOLUTIONS TO DRIVE MARKET

- 11.5 ELECTRICAL SYSTEM/WIRE HARNESSING

- 11.5.1 SAFE AND DURABLE WIRE MANAGEMENT TO BOOST MARKET DEMAND

- 11.6 INDUSTRIAL DISTRIBUTION

- 11.6.1 RELIABLE SUPPLY CHAIN OPERATIONS TO FUEL GROWTH

- 11.7 FLEXO PRINTING & PAPER

- 11.7.1 PRINTING PRECISION AND OPERATIONAL UPTIME TO FUEL MARKET DEMAND

- 11.8 MEDICAL & HYGIENE

- 11.8.1 ADVANCED HEALTHCARE AND HYGIENE NEEDS TO FUEL ADOPTION

- 11.9 PACKAGING

- 11.9.1 SUSTAINABLE AND TAMPER-PROOF SOLUTIONS TO DRIVE DEMAND

- 11.10 OTHER END-USE INDUSTRIES

12 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 GREATER CHINA

- 12.2.1 CHINA

- 12.2.1.1 Rapidly expanding economy to boost market

- 12.2.2 TAIWAN

- 12.2.2.1 Strong semiconductor and electronics base to drive demand

- 12.2.3 HONG KONG

- 12.2.3.1 Active re-export trade to boost demand

- 12.2.1 CHINA

- 12.3 ASIA PACIFIC

- 12.3.1 JAPAN

- 12.3.1.1 Strong presence of automobile manufacturers to drive market

- 12.3.2 INDIA

- 12.3.2.1 Growing healthcare industry to drive demand

- 12.3.3 SOUTH KOREA

- 12.3.3.1 Government initiatives in industrial sector to drive market

- 12.3.4 ASEAN

- 12.3.4.1 Growing electronics manufacturing ecosystem to fuel growth

- 12.3.1 JAPAN

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Strong industrial infrastructure to fuel growth

- 12.4.2 CANADA

- 12.4.2.1 Focus on advanced research and development to drive demand

- 12.4.3 MEXICO

- 12.4.3.1 Expanding manufacturing sector to support market growth

- 12.4.1 US

- 12.5 EUROPE

- 12.5.1 GERMANY

- 12.5.1.1 Automotive industry leadership to boost market

- 12.5.2 FRANCE

- 12.5.2.1 Emphasis on sustainable packaging to fuel demand

- 12.5.3 UK

- 12.5.3.1 Stringent regulatory framework to propel market

- 12.5.4 SPAIN

- 12.5.4.1 Growing aerospace industry to drive market

- 12.5.5 NETHERLANDS

- 12.5.5.1 Advanced logistics and export activities to drive demand

- 12.5.6 POLAND

- 12.5.6.1 Robust industrial base to drive demand

- 12.5.1 GERMANY

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 SAUDI ARABIA

- 12.6.1.1 Growth in local manufacturing to fuel demand

- 12.6.2 UAE

- 12.6.2.1 Foreign investments and rapid urbanization to drive market

- 12.6.3 TURKEY

- 12.6.3.1 Rising automotive parts manufacturing to boost demand

- 12.6.4 SOUTH AFRICA

- 12.6.4.1 Cheap labor and raw material cost to drive market

- 12.6.1 SAUDI ARABIA

- 12.7 SOUTH AMERICA

- 12.7.1 BRAZIL

- 12.7.1.1 Rising infrastructure investments to drive demand

- 12.7.2 ARGENTINA

- 12.7.2.1 Expansion of public healthcare services to drive demand

- 12.7.3 CHILE

- 12.7.3.1 Packaging and food exports growth to fuel demand

- 12.7.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Adhesive type footprint

- 13.5.5.5 Backing material footprint

- 13.5.5.6 Technology footprint

- 13.5.5.7 End-use industry footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMES

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 3M COMPANY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 TESA SE

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 NITTO DENKO CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 LINTEC CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 INTERTAPE POLYMER GROUP INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 AVERY DENNISON CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 LOHMANN GMBH & CO. KG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BERRY GLOBAL GROUP, INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 SCAPA GROUP PLC (MATIV HOLDINGS)

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 SAINT-GOBAIN S.A.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 3M COMPANY

- 14.2 STARTUP/SMES

- 14.2.1 NICHIBAN CO., LTD.

- 14.2.2 SHURTAPE TECHNOLOGIES, LLC

- 14.2.3 ROGERS CORPORATION

- 14.2.4 GERGONNE INDUSTRIE

- 14.2.5 ORAFOL EUROPE GMBH

- 14.2.6 PPI ADHESIVE PRODUCTS (C.E.) S.R.O.

- 14.2.7 AMERICAN BILTRITE INC.

- 14.2.8 TERAOKA SEISAKUSHO CO., LTD.

- 14.2.9 ADVANCE TAPES INTERNATIONAL

- 14.2.10 CCT TAPES

- 14.2.11 BOLEX (SHENZHEN) ADHESIVE PRODUCTS CO., LTD.

- 14.2.12 AJIT INDUSTRIES

- 14.2.13 SUN CHEMICAL (DIC CORPORATION)

- 14.2.14 PPM INDUSTRIES SPA

- 14.2.15 LOUIS TAPE

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 ADHESIVE TAPES MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 ADHESIVE TAPES MARKET, BY REGION

- 15.4.1 EUROPE

- 15.4.2 NORTH AMERICA

- 15.4.3 ASIA PACIFIC

- 15.4.4 MIDDLE EAST & AFRICA

- 15.4.5 SOUTH AMERICA

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY ADHESIVE TYPE

- TABLE 3 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY BACKING MATERIAL

- TABLE 4 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- TABLE 5 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 6 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 IMPACT OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END-USE INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 9 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 10 AVERAGE SELLING PRICE OF PRESSURE-SENSITIVE ADHESIVE TAPES OFFERED BY KEY PLAYERS, BY ADHESIVE TYPE, 2024 (USD/SQUARE METER)

- TABLE 11 AVERAGE SELLING PRICE TREND OF PRESSURE-SENSITIVE ADHESIVE TAPES, BY REGION, 2022-2030 (USD/SQUARE METER)

- TABLE 12 ROLE OF COMPANIES IN PRESSURE-SENSITIVE ADHESIVE TAPES ECOSYSTEM

- TABLE 13 IMPORT DATA RELATED TO PRESSURE-SENSITIVE ADHESIVE TAPES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 14 EXPORT DATA RELATED TO PRESSURE-SENSITIVE ADHESIVE TAPES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 15 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: FUNDING/INVESTMENT SCENARIO

- TABLE 23 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 24 LIST OF MAJOR PATENTS RELATED TO PRESSURE-SENSITIVE ADHESIVE TAPES, 2014-2024

- TABLE 25 PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

- TABLE 26 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 27 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 28 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 30 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 31 SINGLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 SINGLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 SINGLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 34 SINGLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 35 DOUBLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 DOUBLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 DOUBLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 38 DOUBLE-SIDED TAPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 39 OTHER TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 OTHER TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 42 OTHER TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 43 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 44 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 45 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 46 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 47 ACRYLIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 ACRYLIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 ACRYLIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 50 ACRYLIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 51 RUBBER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 RUBBER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 RUBBER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 54 RUBBER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 55 SILICONE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 SILICONE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 SILICONE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 58 SILICONE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 59 OTHER ADHESIVE TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 OTHER ADHESIVE TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 OTHER ADHESIVE TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 62 OTHER ADHESIVE TYPES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 63 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 64 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 65 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 66 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 67 POLYPROPYLENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 POLYPROPYLENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 POLYPROPYLENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 70 POLYPROPYLENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 71 PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 74 PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 75 POLYVINYL CHLORIDE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 POLYVINYL CHLORIDE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 POLYVINYL CHLORIDE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 78 POLYVINYL CHLORIDE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 79 OTHER BACKING MATERIALS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 OTHER BACKING MATERIALS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 OTHER BACKING MATERIALS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 82 OTHER BACKING MATERIALS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 83 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 84 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 85 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 86 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 87 SOLVENT-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 SOLVENT-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 SOLVENT-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 90 SOLVENT-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 91 WATER-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 WATER-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 WATER-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 94 WATER-BASED: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 95 HOT MELT: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 HOT MELT: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 HOT MELT: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 98 HOT MELT: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 99 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 100 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 102 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 103 CONSUMER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 CONSUMER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 CONSUMER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 106 CONSUMER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 107 ELECTRONICS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 ELECTRONICS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 ELECTRONICS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 110 ELECTRONICS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 111 AUTOMOTIVE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 AUTOMOTIVE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 AUTOMOTIVE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 114 AUTOMOTIVE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 115 ELECTRICAL SYSTEM/WIRE HARNESSING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 116 ELECTRICAL SYSTEM/WIRE HARNESSING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 ELECTRICAL SYSTEM/WIRE HARNESSING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 118 ELECTRICAL SYSTEM/WIRE HARNESSING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 119 INDUSTRIAL DISTRIBUTION: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 120 INDUSTRIAL DISTRIBUTION: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 INDUSTRIAL DISTRIBUTION: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 122 INDUSTRIAL DISTRIBUTION: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 123 FLEXO PRINTING & PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 124 FLEXO PRINTING & PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 FLEXO PRINTING & PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 126 FLEXO PRINTING & PAPER: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 127 MEDICAL & HYGIENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 128 MEDICAL & HYGIENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 MEDICAL & HYGIENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 130 MEDICAL & HYGIENE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 131 PACKAGING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 132 PACKAGING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 PACKAGING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 134 PACKAGING: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 135 OTHER END-USE INDUSTRIES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 136 OTHER END-USE INDUSTRIES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 OTHER END-USE INDUSTRIES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 138 OTHER END-USE INDUSTRIES: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 139 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 140 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 141 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 142 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 143 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 144 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 146 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 147 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 148 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 149 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 150 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 151 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 152 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 153 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 154 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 155 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 156 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 157 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 158 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 159 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 160 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 162 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 163 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 164 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 GRAETER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 166 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 167 CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 168 CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 169 CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 170 CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 171 TAIWAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 172 TAIWAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 173 TAIWAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 174 TAIWAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 175 HONG KONG: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 176 HONG KONG: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 177 HONG KONG: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 178 HONG KONG: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 179 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 182 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 183 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 186 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 187 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 190 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 191 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 194 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 195 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 196 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 198 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 199 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 200 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 202 ASIA PACIFIC: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 203 JAPAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 204 JAPAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 205 JAPAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 206 JAPAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 207 INDIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 208 INDIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 209 INDIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 210 INDIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 211 SOUTH KOREA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 212 SOUTH KOREA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH KOREA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 214 SOUTH KOREA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 215 ASEAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 216 ASEAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 217 ASEAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 218 ASEAN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 219 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 220 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 222 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 223 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 224 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 225 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 226 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 227 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 228 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 229 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 230 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 231 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 232 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 233 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 234 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 235 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 236 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 237 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 238 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 239 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 240 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 241 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 242 NORTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 243 US: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 244 US: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 245 US: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 246 US: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 247 CANADA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 248 CANADA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 249 CANADA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 250 CANADA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 251 MEXICO: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 252 MEXICO: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 253 MEXICO: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 254 MEXICO: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 255 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 256 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 257 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 258 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 259 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 260 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 261 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 262 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 263 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 264 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 265 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 266 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 267 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 268 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 269 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 270 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 271 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 272 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 273 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 274 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 275 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 276 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 277 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 278 EUROPE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 279 GERMANY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 280 GERMANY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 281 GERMANY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 282 GERMANY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 283 FRANCE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 284 FRANCE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 285 FRANCE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 286 FRANCE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 287 UK: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 288 UK: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 289 UK: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 290 UK: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 291 SPAIN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 292 SPAIN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 293 SPAIN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 294 SPAIN: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 295 NETHERLANDS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 296 NETHERLANDS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 297 NETHERLANDS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 298 NETHERLANDS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 299 POLAND: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 300 POLAND: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 301 POLAND: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 302 POLAND: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 303 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 306 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 307 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 310 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 311 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 314 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 315 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 318 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 319 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 322 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 323 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 325 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 326 MIDDLE EAST & AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 327 SAUDI ARABIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 328 SAUDI ARABIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 329 SAUDI ARABIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 330 SAUDI ARABIA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 331 UAE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 332 UAE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 333 UAE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 334 UAE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 335 TURKEY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 336 TURKEY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 337 TURKEY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 338 TURKEY: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 339 SOUTH AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 340 SOUTH AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 341 SOUTH AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 342 SOUTH AFRICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 343 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 344 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 345 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 346 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 347 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 348 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 349 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 350 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 351 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 352 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 353 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 354 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 355 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 356 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 357 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 358 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 359 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 360 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 361 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 362 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 363 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 364 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 365 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 366 SOUTH AMERICA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 367 BRAZIL: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 368 BRAZIL: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 369 BRAZIL: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 370 BRAZIL: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 371 ARGENTINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 372 ARGENTINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 373 ARGENTINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 374 ARGENTINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 375 CHILE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (USD MILLION)

- TABLE 376 CHILE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 377 CHILE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 378 CHILE: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 379 STRATEGIES ADOPTED BY KEY PRESSURE-SENSITIVE ADHESIVE TAPE MANUFACTURERS, JANUARY 2020-JUNE 2025

- TABLE 380 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEGREE OF COMPETITION

- TABLE 381 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: REGION FOOTPRINT

- TABLE 382 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: TYPE FOOTPRINT

- TABLE 383 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: ADHESIVE TYPE FOOTPRINT

- TABLE 384 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: BACKING MATERIAL FOOTPRINT

- TABLE 385 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 386 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 387 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: KEY STARTUPS/SMES

- TABLE 388 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 389 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 390 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 391 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 392 3M COMPANY: COMPANY OVERVIEW

- TABLE 393 3M COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 394 3M COMPANY: PRODUCT LAUNCHES

- TABLE 395 3M COMPANY: DEALS

- TABLE 396 TESA SE: COMPANY OVERVIEW

- TABLE 397 TESA SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 TESA SE: PRODUCT LAUNCHES

- TABLE 399 TESA SE: EXPANSIONS

- TABLE 400 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- TABLE 401 NITTO DENKO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 402 NITTO DENKO CORPORATION: DEALS

- TABLE 403 NITTO DENKO CORPORATION: EXPANSIONS

- TABLE 404 LINTEC CORPORATION: COMPANY OVERVIEW

- TABLE 405 LINTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 406 INTERTAPE POLYMER GROUP INC.: COMPANY OVERVIEW

- TABLE 407 INTERTAPE POLYMER GROUP INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 INTERTAPE POLYMER GROUP INC.: PRODUCT LAUNCHES

- TABLE 409 INTERTAPE POLYMER GROUP INC.: EXPANSIONS

- TABLE 410 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 411 AVERY DENNISON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 AVERY DENNISON CORPORATION: DEALS

- TABLE 413 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 414 LOHMANN GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 415 BERRY GLOBAL GROUP, INC.: COMPANY OVERVIEW

- TABLE 416 BERRY GLOBAL GROUP, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 417 SCAPA GROUP PLC: COMPANY OVERVIEW

- TABLE 418 SCAPA GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 419 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- TABLE 420 SAINT-GOBAIN S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 421 NICHIBAN CO., LTD.: COMPANY OVERVIEW

- TABLE 422 SHURTAPE TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 423 ROGERS CORPORATION: COMPANY OVERVIEW

- TABLE 424 GERGONNE INDUSTRIE: COMPANY OVERVIEW

- TABLE 425 ORAFOL EUROPE GMBH: COMPANY OVERVIEW

- TABLE 426 PPI ADHESIVE PRODUCTS (C.E.) S.R.O.: COMPANY OVERVIEW

- TABLE 427 AMERICAN BILTRITE INC.: COMPANY OVERVIEW

- TABLE 428 TERAOKA SEISAKUSHO CO., LTD.: COMPANY OVERVIEW

- TABLE 429 ADVANCE TAPES INTERNATIONAL: COMPANY OVERVIEW

- TABLE 430 CCT TAPES: COMPANY OVERVIEW

- TABLE 431 BOLEX (SHENZHEN) ADHESIVE PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 432 AJIT INDUSTRIES: COMPANY OVERVIEW

- TABLE 433 SUN CHEMICAL (DIC CORPORATION): COMPANY OVERVIEW

- TABLE 434 PPM INDUSTRIES SPA: COMPANY OVERVIEW

- TABLE 435 LOUIS TAPE: COMPANY OVERVIEW

- TABLE 436 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 437 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 438 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 439 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 440 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 441 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 442 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 443 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 444 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 445 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 446 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 447 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 448 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 449 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 450 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 451 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 452 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 453 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 454 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 455 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

List of Figures

- FIGURE 1 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- FIGURE 7 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 SINGLE-SIDED TAPES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 ACRYLIC SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 12 SOLVENT-BASED TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 PAPER BACKING MATERIAL SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 14 MEDICAL & HYGIENE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 GREATER CHINA ACCOUNTED FOR LARGEST SHARE OF PRESSURE-SENSITIVE ADHESIVE TAPES MARKET IN 2024

- FIGURE 16 RAPID URBANIZATION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 17 GREATER CHINA TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 PACKAGING SEGMENT ACCOUNTED FOR LARGEST SHARE OF GREATER CHINA PRESSURE-SENSITIVE ADHESIVE TAPES MARKET IN 2024

- FIGURE 19 SINGLE-SIDED TAPES SEGMENT DOMINATED MARKET ACROSS ALL REGIONS IN 2024

- FIGURE 20 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 25 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE OF PRESSURE-SENSITIVE ADHESIVE TAPES OFFERED BY KEY PLAYERS FOR TOP THREE ADHESIVE TYPES, 2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF PRESSURE-SENSITIVE ADHESIVE TAPES, BY REGION, 2022-2030

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 IMPORT DATA FOR PRESSURE-SENSITIVE ADHESIVE TAPES, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR PRESSURE-SENSITIVE ADHESIVE TAPES, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 32 PATENTS REGISTERED FOR PRESSURE-SENSITIVE ADHESIVE TAPES, 2014-2024

- FIGURE 33 MAJOR PATENTS RELATED TO PRESSURE-SENSITIVE ADHESIVE TAPES, 2014-2024

- FIGURE 34 LEGAL STATUS OF PATENTS FILED RELATED TO PRESSURE-SENSITIVE ADHESIVE TAPES, 2014-2024