|

市场调查报告书

商品编码

1796192

全球加油站市场:按收益模式、地区/国家、经营模式、相关人员分析、竞争基准化分析和地理区域划分 - 预测至 2035 年Forecourts Market by Revenue Model, Region/Country, Business Models, Stakeholder Mapping, Competitive Benchmarking - Global Forecast to 2035 |

|||||||

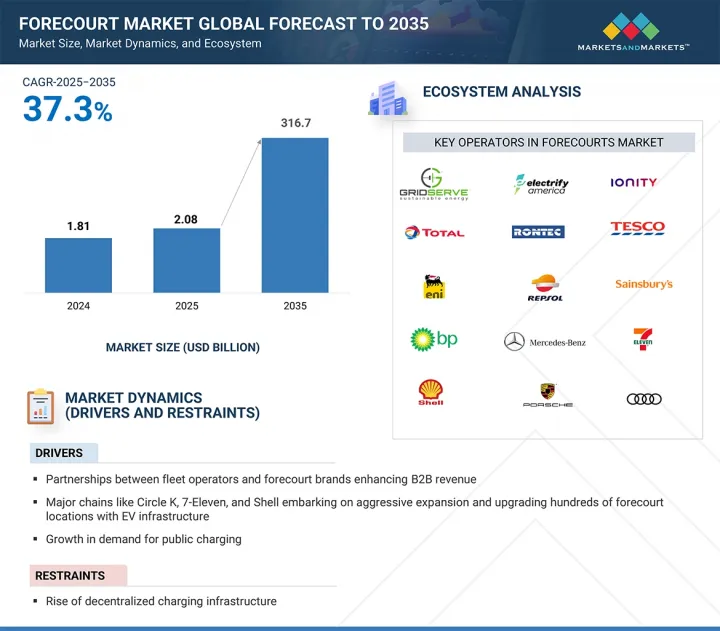

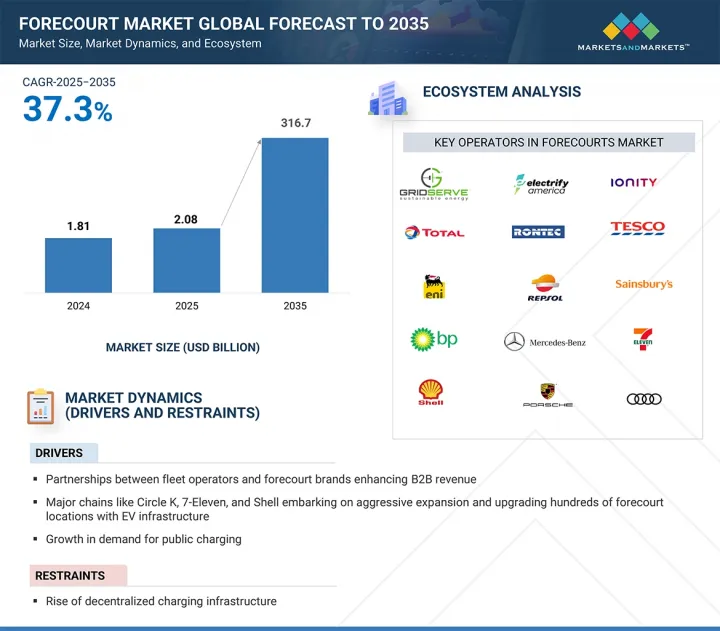

预计加油站市场规模将从 2024 年的 70 亿美元成长到 2035 年的 3,166 亿美元,复合年增长率为 37.3%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2035 |

| 基准年 | 2024 |

| 预测期 | 2025-2035 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按动力、车辆类型、载重指数、应用、轮圈尺寸、销售管道和地区 |

| 目标区域 | 北美、欧洲、亚太地区 |

全球各国政府正透过补贴电动车充电和建设加油站基础设施来推动清洁出行。这些政策措施既支持资本投资,也支持加油站部署和营运的长期成长。

在加油站市场,充电桩收益占最大份额,这主要得益于电动车(EV)的快速普及以及政府推出的鼓励电气化的支持性政策。随着电动车用户在充电站花费的时间越来越多,他们也越来越多地参与购物、餐饮和汽车保养等辅助活动。这种消费行为显着提高了附加价值服务的收益。此外,整合电池储能係统(BESS)使加油站能够在高峰需求时段出售储存的电力,并利用波动的能源市场。由于预计这些尖峰时段的能源价格将上涨,预计在预测期内,能源储存部门的收益潜力将大幅成长。

能源储存(BESS) 和车辆到电网 (V2G) 等储能技术正在蓬勃发展。这些技术不再只是一种附加元件,而是正在成为核心收益来源。电动车的日益普及对电网基础设施带来越来越大的压力,需要更智慧、分散式的能源管理解决方案。电池储能係统 (BESS) 和车辆到电网 (V2G) 为加油站提供了一种盈利的收益模式,不仅能分配能源,还能储存、管理和交易能源。因此,预计在 2025 年至 2035 年期间,加油站能源储存服务的收益将呈指数级增长。

此外,作为电池储能係统 (BESS) 和车辆到电网 (V2G) 核心的锂离子电池组成本大幅下降,从而减少了加油站营运商的资本支出。随着电池技术的不断成熟和规模经济的实现,部署将变得更加经济实惠且更具可扩展性。因此,预计这一趋势将在加速能源储存服务的普及方面发挥关键作用。

在亚太地区,由于靠近高速公路和城市入口战略定位,加油站客流量依然居高不下,因此成为安装电动车充电桩的优先选择。这些地点交通便利,且能够容纳大量车辆,是快速充电基础设施的理想选择。此外,电动车充电的典型停留时间接近30分钟,这非常符合客户寻求快速便捷和短暂休息的使用模式。

欧洲日益严格的排放法规和欧盟绿色新政正在推动全部区域迈向清洁。加油站正在透过安装电动车充电基础设施来适应这一趋势,并将自己定位为转型的支柱。此外,道达尔能源、英国石油和意昂集团等大型能源公司正在投资升级欧洲各地的加油站,并支持推出数千个新的充电桩和智慧零售站。

公共交通和电动车生态系统的不断发展,以及能源巨头的大量投资,预计将推动欧洲和亚太地区的加油站市场的发展。

目录

第一章执行摘要

第二章 关键市场趋势与动向

- 透过多样化服务改善客户体验

- 客户体验(服务实施):云端基础和人工智慧的加油站

- 新用例:定位服务

- 定位服务:GRIDSEVE案例研究

- 新能源经营模式

- 定位服务:GridServe 透过能源创新实现 1.5 倍收益潜力的案例(第 1 部分,共 2 部分)

- 加油站积极发展太阳能发电业务而无需额外收入(2/2)

- 有利的法规环境

第三章案例研究

- GRIDSERVE

- ENI - ENILIVE

- CIRCLE K

- SHELL RECHARGE

- ELECTRIFY AMERICA

- PORSCHE CHARGING LOUNGE

- AUDI

第四章相关利益者分析与竞争基准测试

- 加油站营运商概述

- 竞争基准测试

- 电子加油站及独立加油站零售商

- C 商店

- 能源参与企业

- 电子加油站相关利益者地图:展望未来

第五章加油站基础设施与营运成本

- 加油站基础设施:GRIDSEVE

- 电动加油站:资本支出与营运支出

第六章 市场潜力与商业案例

- 电子加油站收益模式

- 预计 2025 年至 2035 年间,欧洲充电站收益的复合年增长率将达到 33% 左右

- 欧洲超过 6% 的加油站设有电动车充电桩

- 预计 2025 年至 2035 年期间北美充电站收益的复合年增长率约为 44%

- 在北美,大约 3% 的加油站设有电动车充电站。

- 在亚太地区,预计 2025 年至 2035 年期间,电动车充电站的收益将以约 33% 的复合年增长率成长

- 在亚太地区,约有 2% 的加油站设有电动车充电桩

- 电子停车领域 BESS 和 V2G 的全球年收益潜力

- 中国配备 BESS 和 V2G 的电动车加气站的预测收益和单位经济效益(2024-2035 年)

- 德国配备 BESS 和 V2G 的电动车加油站预计收益和单位经济效益(2024-2035 年)

- 美国使用 BESS 和 V2G 的电子加油站收益和单位经济效益(2024-2035 年)

- 对中国、德国和美国BESS 和 V2G 发展的关键见解

- 预计 2024 年至 2035 年间,电子停车普及率的复合年增长率约为 29%

- 预计 2024 年至 2035 年间充电桩渗透率将以约 28% 的复合年增长率成长

- 能源储存经营模式的渗透

- 策略结论

第七章 附录

- BESS 商业案例的关键假设和 E-Fuel Station S 的盈利

- 策略结论关键假设 V2G 商业案例和电子加油站盈利

- 策略结论

The forecourts market is projected to grow from USD 7.0 billion in 2024 to USD 316.6 billion by 2035 at a CAGR of 37.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Billion) |

| Segments | Propulsion, Vehicle Type, Load Index, Application, Rim Size, Sales Channel, and Region |

| Regions covered | North America, Europe, and Asia Pacific |

Globally, governments are promoting clean mobility through subsidies for EV charging and forecourt infrastructure development. These policy measures support both capital investment and long-term growth in forecourt deployment and operations.

The revenue from charging points segment holds the largest share in the forecourts market, primarily driven by the rapid rise in electric vehicle (EV) adoption and supportive government policies encouraging electrification. As EV users spend more time at charging stations, they are increasingly engaging in ancillary activities such as shopping, dining, or vehicle care. This consumer behavior is significantly boosting the revenue generated from value-added services. Furthermore, the integration of grid-connected battery energy storage systems (BESS) enables forecourts to capitalize on fluctuating energy markets by selling stored electricity during peak demand periods. With energy prices expected to rise during these peak intervals, the revenue potential from the energy storage segment is projected to grow substantially over the forecast period.

Revenue from Energy Storage Service (BESS and V2G) segment to register highest growth

There is a surge in energy storage technologies like BESS and Vehicle-to-Grid (V2G). These technologies are no longer complementary add-ons but are emerging as central revenue streams. With the expansion of EV adoption, the pressure on grid infrastructure is mounting, necessitating smarter, decentralized energy management solutions. BESS and V2G offer forecourts a profitable revenue model, where energy is not just dispensed but also stored, managed, and traded. Therefore, between 2025 and 2035, the revenue generated from energy storage services at forecourts is expected to grow exponentially.

Moreover, the cost of lithium-ion battery packs-central to both BESS and V2G-has declined significantly, reducing capital expenditure for forecourt operators. As battery technology continues to mature and economies of scale are achieved, implementation becomes more affordable and scalable. Therefore, this trend is expected to play a key role in accelerating the adoption of energy storage services.

Asia Pacific and Europe to hold significant shares in forecourts market

In Asia Pacific, footfall at forecourts remains high due to their strategic locations-near highways and urban entry points, they are being prioritized for EV charging point installation. These sites serve as ideal locations for fast-charging infrastructure due to their accessibility and ability to handle high volumes of vehicles. Additionally, the typical dwell time of nearly half an hour during EV charging aligns well with the usage patterns of customers seeking quick convenience or rest stops.

Europe's stringent emission norms and the EU green deal are pushing the entire region toward clean mobility. Forecourts are adapting by installing EV charging infrastructure, positioning themselves as pillars of the transition. Additionally, major energy players like TotalEnergies, BP, and E.ON are investing in forecourt upgrades across Europe, supporting the rollout of thousands of new charging points and smart retail stations.

The ongoing developments in public transit and EV ecosystem, coupled with the high investment from energy giants, are projected to drive the forecourts market in the European and Asia Pacific regions.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: Energy Players-45%, Convenience stores-25%, OEMs-5%, Charging Point Operators-10%, E-forecourt Retailers -15%

- By Designation: C Level- 40%, Directors- 40%, and Others- 20%

- By Region: North America- 20%, Europe- 30%, and Asia Pacific- 30%,

The forecourts market is led by established players such as GRIDSERVE (UK), Motor Fuel Group (MFG) (UK), Rontec (UK), Circle K (US), and SHELL RECHARGE (US).

Key Benefits of Buying the Report:

The forecourts market report will help market leaders and new entrants with information on the revenue segments of forecourts, including revenue from charging, value-added services, and energy storage systems. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, and opportunities.

The report provides insights into the following points:

Analysis of key drivers (charging points as revenue-generating hubs, rise in EV adoption), restraints (rise of decentralized charging infrastructure, cost and convenience of home charging), opportunities (monetization through BESS, V2G as a two-way revenue stream) influencing the forecourts market

Product Development/Innovation: Detailed insights into development activities, upcoming BESS and V2G project plans in the forecourts market

Market Development: Comprehensive information about the lucrative market (the report analyzes the forecourts market across varied regions)

Market Diversification: Exhaustive information about business opportunities, revenue potential, untapped geographies, and investments in the forecourts market

Competitive Assessment: In-depth assessment of growth strategies, and service offerings of leading players like GRIDSERVE (UK), Motor Fuel Group (MFG) (UK), Rontec (UK), Circle K (US), and SHELL RECHARGE (US) in the forecourts market

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

2. KEY MARKET TRENDS AND DEVELOPMENTS

- 2.1 ENHANCING CUSTOMER EXPERIENCE THROUGH SERVICE DIVERSIFICATION

- 2.1.1 CUSTOMER EXPERIENCE (SERVICE IMPLEMENTATION): CLOUD-BASED AND AI-LED FORECOURTS

- 2.2 EMERGING USE CASES: LOCATION-BASED SERVICES

- 2.2.1 LOCATION-BASED SERVICES: GRIDSERVE CASE STUDY

- 2.3 NEW ENERGY BUSINESS MODELS

- 2.3.1 LOCATION-BASED SERVICES: GRIDSERVE CASE 1.5X REVENUE POTENTIAL THROUGH ENERGY INNOVATION (1/2)

- 2.3.2 FUEL FORECOURTS ARE ACTIVELY 'SOLARIZING' OPERATIONS WITHOUT EARNING ADDITIONAL REVENUES (2/2)

- 2.4 FAVORABLE REGULATORY ENVIRONMENT

3. CASE STUDIES

- 3.1 GRIDSERVE

- 3.2 ENI - ENILIVE

- 3.3 CIRCLE K

- 3.4 SHELL RECHARGE

- 3.5 ELECTRIFY AMERICA

- 3.6 PORSCHE CHARGING LOUNGE

- 3.7 AUDI

4. STAKEHOLDER MAPPING & COMPETITOR BENCHMARKING

- 4.1 OVERVIEW OF FORECOURT OPERATORS

- 4.2 COMPETITOR BENCHMARKING

- 4.2.1 E-FORECOURT & INDEPENDENT FORECOURT RETAILER

- 4.2.2 C-STORES

- 4.2.3 ENERGY PLAYERS

- 4.3 E-FORECOURT STAKEHOLDER MAPPING: FUTURE OUTLOOK

5. FORECOURT INFRASTRUCTURE AND COST TO OPERATOR

- 5.1 FORECOURT INFRASTRUCTURE: GRIDSERVE

- 5.2 E-FORECOURTS: CAPEX AND OPEX

6. MARKET POTENTIAL AND BUSINESS CASE

- 6.1 E-FORECOURTS REVENUE MODELS

- 6.1.1 REVENUE FROM CHARGING POINTS IN EUROPE TO GROW AT A CAGR OF ~33% BETWEEN 2025 AND 2035

- 6.1.2 IN EUROPE, MORE THAN 6% OF FORECOURTS HAVE EV CHARGING POINTS

- 6.1.3 REVENUE FROM CHARGING POINTS IN NORTH AMERICA TO GROW AT CAGR OF ~44% FROM 2025 TO 2035

- 6.1.4 IN NORTH AMERICA, NEARLY 3% OF FORECOURTS HAVE EV CHARGING POINTS.

- 6.1.5 REVENUE FROM EV CHARGING FROM FORECOURT IS EXPECTED TO GROW AT A CAGR OF ~33% FROM 2025 TO 2035 IN ASIA PACIFIC.

- 6.1.6 IN ASIA PACIFIC, NEARLY 2% OF FORECOURTS HAVE EV CHARGING POINTS

- 6.2 GLOBAL ANNUAL REVENUE POTENTIAL OF BESS AND V2G IN E-FORECOURTS

- 6.2.1 PROJECTED REVENUE AND UNIT ECONOMICS OF E-FORECOURTS WITH BESS AND V2G IN CHINA (2024-2035)

- 6.2.2 PROJECTED REVENUE & UNIT ECONOMICS OF E-FORECOURTS WITH BESS AND V2G IN GERMANY (2024-2035)

- 6.2.3 PROJECTED REVENUE & UNIT ECONOMICS OF E-FORECOURTS WITH BESS AND V2G IN US (2024-2035)

- 6.3 KEY INSIGHTS ON BESS AND V2G DEVELOPMENTS IN CHINA, GERMANY, AND US

- 6.4 PENETRATION OF E-FORECOURTS TO GROW AT A CAGR OF ~29% FROM 2024 TO 2035

- 6.5 PENETRATION OF CHARGING POINTS TO GROW AT A CAGR OF ~28% FROM 2024 TO 2035

- 6.6 PENETRATION OF ENERGY STORAGE BUSINESS MODELS

- 6.7 STRATEGIC CONCLUSIONS

7. APPENDIX

- 7.1 KEY ASSUMPTIONS FOR BESS BUSINESS CASE AND REVENUE POTENTIAL OF E-FORECOURTS

- 7.2 STRATEGIC CONCLUSIONS KEY ASSUMPTIONS V2G BUSINESS CASE AND REVENUE POTENTIAL OF E-FORECOURTS

- 7.3 STRATEGIC CONCLUSIONS