|

市场调查报告书

商品编码

1800737

全球医疗设备维护市场(至 2030 年)按设备(MRI、X 光、CT、超音波、病患监测、牙科设备)、提供者(OEM、ISO)、服务(预防、纠正)、合约服务(客製化、附加元件)和最终用户(医院、ASC)划分Medical Equipment Maintenance Market by Device (MRI, X-ray, CT, Ultrasound, Patient Monitoring, Dental Equipment), Provider (OEM, ISO), Service (Preventive, Corrective), Contract Service (Customized, Add-on), End User (Hospital, ASCs) - Forecast to 2030 |

||||||

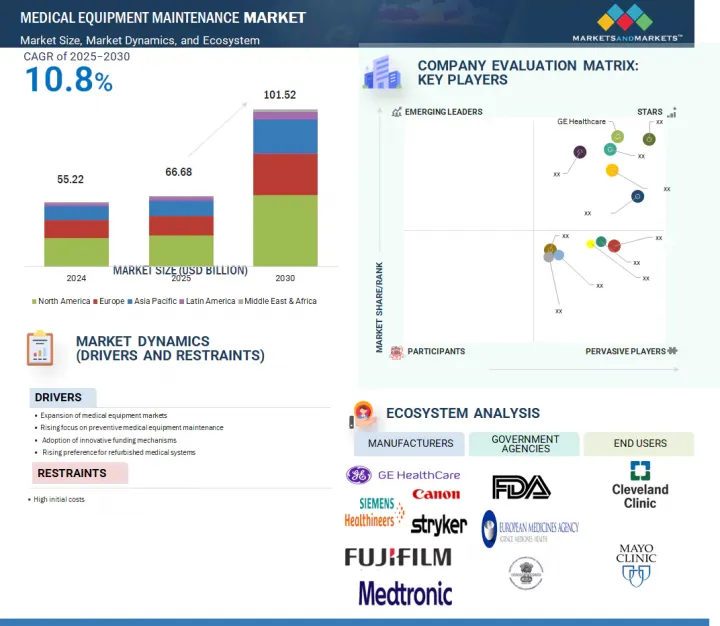

全球医疗设备维护市场预计将从 2025 年的 606.8 亿美元成长到 2030 年的 1,015.2 亿美元,预测期内的复合年增长率为 10.8%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 部分 | 设备类型、服务类型、服务供应商、合约类型、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

医疗保健成本不断上涨,尤其是在新兴国家,这促使人们引进先进的医疗设备,以加强医疗保健基础设施建设并提高患者照护水准。此类精密医疗设备的采购量不断增加,凸显了对可靠维护服务的迫切需求,以确保设备的持续性能和运作可靠性。

随着医疗保健提供者优先采用先进技术来满足其人口不断变化的医疗需求,他们也相应地重视确保强大的维护解决方案。因此,维护服务在保护先进医疗设备的功能和使用寿命方面发挥越来越重要的作用,有助于在不断增长的医疗预算内确保最佳的护理服务和患者治疗效果。

按设备类型划分,诊断成像设备将在 2024 年占据最大的市场占有率。

诊断影像设备对于确保准确的诊断和有效的治疗计划至关重要,因此精确度和可靠性至关重要。定期细緻的维护对于维持这些高标准至关重要。适当的维护可确保影像系统持续提供准确可靠的结果,从而最大限度地降低诊断错误的风险。这种可靠性可以增强临床信心,支持更好的决策,并改善患者的治疗效果。

按服务类型划分,预防性维护将在 2024 年占据最大份额。

虽然预防性维护可能需要初期投资,但从长远来看,其成本效益更高,因为它可以避免昂贵的维修、更换和运作。透过有系统地在潜在问题发生之前进行处理,预防性维护可以降低设备故障的风险,并最大限度地减少昂贵的紧急应变需求。这种积极主动的方法不仅可以维护医疗设备的健康和使用寿命,还可以确保医院运作不间断,并确保有效率地提供患者照护。

按地区划分,北美将在 2024 年占据最大的市场占有率。

2024年,北美引领全球医疗设备医疗设备维护市场,这得益于医疗设备采购、维护和升级方面庞大的医疗支出。该地区正积极投资,以确保医疗设备的可靠性、效率和安全性,以满足人口老化和高标准医疗保健的需求。这些投资包括引进尖端医疗设备和完善的维护计划,以优化设备性能和使用寿命。

本报告调查了全球医疗设备维护市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 产业趋势

- 技术分析

- 波特五力分析

- 监管状况

- 专利分析

- 监管分析

- 2025-2026年重要会议和活动

- 主要相关人员和采购标准

- 价值链分析

- 供应链分析

- 生态系分析

- 定价分析

- 投资金筹措场景

- 未满足的需求/最终用户期望

- 影响客户业务的趋势/中断

- 人工智慧/生成式人工智慧对医疗设备维护市场的影响

- 川普关税对医疗设备维修市场的影响

第六章医疗设备维修市场(依设备类型)

- 诊断影像设备

- MRI系统

- CT扫描仪

- X射线系统

- 超音波系统

- 血管造影术系统

- 乳房X光摄影系统

- 核子造影系统

- 透视系统

- 病患监测和维生设备

- 人工呼吸器

- 麻醉监护设备

- 透析设备

- 点滴帮浦

- 其他的

- 内视镜设备

- 手术设备

- 眼科设备

- 医疗雷射器

- 电外科设备

- 放射治疗设备

- 牙科设备

- 牙科放射学设备

- 牙科雷射设备

- 其他的

- 拉比设备

- 耐用医疗设备

第七章医疗设备维修市场(依服务类型)

- 预防性维护

- 修正性维护

- 营运维护

第八章医疗设备维修市场(按服务供应商)

- 多供应商 OEM

- 单一供应商 OEM

- 独立服务组织

- 内部维护

第九章医疗设备维修市场(依合约类型)

- 高级合约

- 基本合约

- 客製化协议

- 附加元件协议

第 10 章医疗设备维修市场(依最终用户)

- 医院和诊所

- 门诊手术中心

- 牙医诊所

- 诊断影像中心

- 透析中心

- 其他的

第11章医疗设备维修市场(按区域)

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 中东和非洲宏观经济展望

- 海湾合作委员会国家

- 其他的

第十二章竞争格局

- 主要参与企业的策略/优势

- 收益占有率分析

- 市场占有率分析

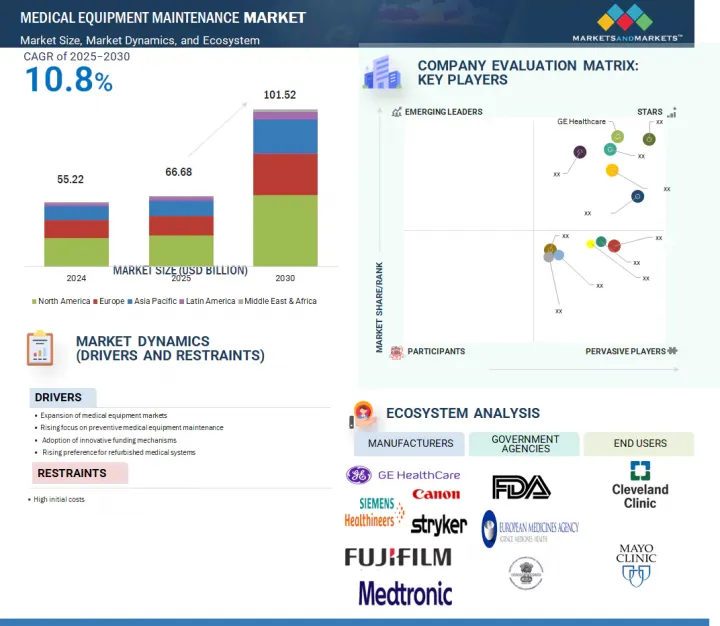

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 品牌/服务比较

- 估值和财务指标

- 竞争场景

第十三章:公司简介

- 主要企业

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- KONINKLIJKE PHILIPS NV

- MEDTRONIC

- FUJIFILM HOLDINGS CORPORATION

- OLYMPUS CORPORATION

- STRYKER

- CANON INC.

- DRAGERWERK AG & CO. KGAA

- HITACHI, LTD.

- B. BRAUN SE

- ELEKTA

- SHIMADZU CORPORATION

- AGFA-GEVAERT GROUP

- STERIS

- 其他公司

- ALTHEA GROUP

- BCAS BIO-MEDICAL SERVICES LTD.

- AGENOR

- GRUPO EMPRESARIAL ELECTROMEDICO

- CARESTREAM HEALTH

- KARL STORZ GMBH & CO. KG

- AVENSYS UK LTD.

- THE INTERMED GROUP

- CROTHALL HEALTHCARE

- TRIMEDX HOLDINGS LLC

第十四章 附录

The global medical equipment maintenance market is projected to reach USD 101.52 billion by 2030 from USD 60.68 billion in 2025, growing at a CAGR of 10.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Device Type, Service Type, Service Provider, Contract Type, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

Rising healthcare expenditures, particularly notable in emerging economies, are driving the acquisition of advanced medical equipment to bolster healthcare infrastructure and improve patient care standards. This uptick in procuring sophisticated medical devices highlights the critical need for reliable maintenance services to ensure sustained performance and operational integrity.

With healthcare providers prioritizing the adoption of advanced technologies to meet the evolving healthcare demands of their populations, there is a parallel emphasis on securing robust maintenance solutions. As a result, maintenance services play an increasingly vital role in safeguarding the functionality and longevity of advanced medical equipment, thereby facilitating optimal healthcare delivery and patient outcomes amidst expanding healthcare budgets.

By device type, the diagnostic imaging equipment segment accounted for the largest market share in 2024.

The market is categorized by device type into diagnostic imaging equipment, patient monitoring & life support devices, surgical equipment, radiotherapy devices, laboratory equipment, endoscopic devices, medical lasers, electrosurgical equipment, dental equipment, radiotherapy devices, ophthalmology equipment, and durable medical equipment. The diagnostic imaging equipment segment accounted for the largest market share in 2024. Diagnostic imaging equipment is critical in ensuring accurate diagnoses and effective treatment planning, making precision and reliability essential. Regular and meticulous maintenance is crucial to maintaining these high standards. Proper upkeep ensures that imaging systems consistently deliver accurate, dependable results, minimizing the risk of diagnostic errors. This reliability reinforces clinical confidence, supports better decision-making, and improves patient outcomes.

By service type, the preventive maintenance segment accounted for the largest share of the market in 2024.

The medical equipment maintenance market is segmented by service type into operational, corrective, and preventive maintenance. The preventive maintenance segment accounted for the largest share of the market in 2024. Although the initial investment in preventive maintenance may entail upfront costs, its long-term cost-effectiveness is highlighted by its ability to avert expensive repairs, replacements, and downtime commonly associated with reactive maintenance practices. Preventive maintenance mitigates the risk of equipment failures and malfunctions by systematically addressing potential issues before they escalate, thus minimizing the need for costly emergency interventions. This proactive approach not only preserves the integrity and longevity of medical equipment but also sustains uninterrupted workflow in healthcare settings, ensuring efficient delivery of patient care.

In 2024, by region, North America accounted for the largest market share of the medical equipment maintenance market.

The medical equipment maintenance market is segmented into North America, Europe, Latin America, the Asia Pacific, and the Middle East & Africa. North America leads the global medical equipment maintenance market, fueled by substantial healthcare expenditure directed towards procuring, maintaining, and enhancing medical devices. With a focus on meeting the evolving needs of an aging population and elevated healthcare standards, the region invests significantly in ensuring the reliability, efficiency, and safety of medical equipment. These investments encompass the acquisition of state-of-the-art devices and robust maintenance programs aimed at optimizing equipment performance and longevity.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

- By Designation: Director-level-14%, C-level-10%, and Others-76%

- By Region: North America-40%, Europe-32%, the Asia Pacific-20%, Latin America- 5%, and the Middle East & Africa- 3%

The prominent players in the medical equipment maintenance market are Siemens Healthineers AG (Germany), GE Healthcare (US), Medtronic (Ireland), Koninklijke Philips N.V. (Netherlands), FUJIFILM Holdings Corporation (Japan), Olympus Corporation (Japan), Stryker (US), Canon Inc. (Japan), Dragerwerk AG & Co. KGaA (Germany), Hitachi, Ltd (Japan), and B. Braun SE (Germany), among others.

Research Coverage

This report studies the medical equipment maintenance market based on device type, service type, service provider, contract type, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets concerning their growth trends. It forecasts the revenue of the market segments concerning five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established and entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growth in medical equipment markets, rising focus on preventive medical equipment maintenance, adoption of innovative funding mechanisms, increasing purchase of refurbished medical systems), restraints (high initial cost and significant maintenance expenditure), opportunities (innovation in service offerings and use of IoT, growing medical device sector in emerging economies across Central and Eastern Europe and Asia Pacific), and challenges (survival of small players in the highly fragmented and competitive market and regulatory pressure & compliance, dearth of skilled technicians and biomedical engineers) influencing the growth of medical equipment maintenance market

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the medical equipment maintenance market

- Service Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and service developments in the medical equipment maintenance market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new services, growing geographies, and recent developments in the medical equipment maintenance market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and services of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Indicative list of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION AND FORECAST

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 END-USER-BASED MARKET ESTIMATION

- 2.3 TOP-DOWN APPROACH

- 2.3.1 GROWTH RATE PROJECTION

- 2.3.2 PRIMARY RESEARCH VALIDATION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL EQUIPMENT MAINTENANCE MARKET OVERVIEW

- 4.2 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE AND COUNTRY

- 4.3 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER

- 4.4 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER

- 4.5 MEDICAL EQUIPMENT MAINTENANCE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in medical equipment market

- 5.2.1.2 Rising focus on preventive medical equipment maintenance

- 5.2.1.3 Adoption of innovative funding mechanisms

- 5.2.1.4 Increasing purchase of refurbished medical systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost and significant maintenance expenditure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in service offerings and use of IoT

- 5.2.3.2 Emergence of independent service organizations

- 5.2.3.3 Growth potential of medical devices sector in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Highly fragmented and competitive market

- 5.2.4.2 Issues regarding regulatory compliance

- 5.2.4.3 Shortage of skilled biomedical engineers and technicians

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 PREFERENCE FOR MULTI-VENDOR CONTRACTS

- 5.3.2 CONSOLIDATION OF DIALYSIS CENTERS AND HOSPITALS

- 5.3.3 EQUIPMENT SERVICE PROVIDERS AND GROUP PURCHASING

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Predictive and prescriptive maintenance

- 5.4.1.2 Intelligent maintenance systems

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Real-time Location Systems (RTLS)

- 5.4.2.2 IoT and sensor networks

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Digital twins

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY FRAMEWORK

- 5.6.1.1 North America

- 5.6.1.2 Europe

- 5.6.1.3 Asia Pacific

- 5.6.1.4 Latin America

- 5.6.1.5 Middle East & Africa

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATORY FRAMEWORK

- 5.7 PATENT ANALYSIS

- 5.7.1 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 REGULATORY ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 9018

- 5.8.2 EXPORT DATA FOR HS CODE 9018

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS, BY END USER

- 5.10.2 BUYING CRITERIA

- 5.11 VALUE CHAIN ANALYSIS

- 5.12 SUPPLY CHAIN ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.14.1.1 Average selling price of maintenance services for CT scanners, by key player

- 5.14.1.2 Average selling price of maintenance services for mammography machines, by key player

- 5.14.1.3 Average selling price of maintenance services for C-Arm/X-ray imaging systems, by key player

- 5.14.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14.2.1 Average selling price trend of maintenance services for CT scanners, by region

- 5.14.2.2 Average selling price trend of maintenance services for mammography machines, by region

- 5.14.2.3 Average selling price trend of maintenance services for C-Arm/X-ray imaging systems, by region

- 5.14.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 IMPACT OF AI/GEN AI ON MEDICAL EQUIPMENT MAINTENANCE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN MEDICAL EQUIPMENT MAINTENANCE

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.19 TRUMP TARIFF IMPACT ON MEDICAL EQUIPMENT MAINTENANCE MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.5 IMPACT ON END-USE SEGMENTS

6 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE

- 6.1 INTRODUCTION

- 6.2 DIAGNOSTIC IMAGING EQUIPMENT

- 6.2.1 MRI SYSTEMS

- 6.2.1.1 Increasing use of MRI in diagnostics and research to expedite growth

- 6.2.2 CT SCANNERS

- 6.2.2.1 Growing emphasis on maintaining state-of-the-art CT systems to drive market

- 6.2.3 X-RAY SYSTEMS

- 6.2.3.1 Growing demand for OEM-based X-ray maintenance services to boost market

- 6.2.4 ULTRASOUND SYSTEMS

- 6.2.4.1 Cost-effective and easy preventive maintenance measures to promote growth

- 6.2.5 ANGIOGRAPHY SYSTEMS

- 6.2.5.1 Increasing obsolescence of angiography systems to amplify growth

- 6.2.6 MAMMOGRAPHY SYSTEMS

- 6.2.6.1 Preference for mammography over general breast ultrasound to accelerate growth

- 6.2.7 NUCLEAR IMAGING SYSTEMS

- 6.2.7.1 Growing prevalence of cancer and increasing development of novel radiotracers to propel market

- 6.2.8 FLUOROSCOPY SYSTEMS

- 6.2.8.1 Increasing adoption of refurbished fluoroscopy equipment to spur growth

- 6.2.1 MRI SYSTEMS

- 6.3 PATIENT MONITORING & LIFE SUPPORT DEVICES

- 6.3.1 VENTILATORS

- 6.3.1.1 Rising prevalence of chronic respiratory diseases to encourage growth

- 6.3.2 ANESTHESIA MONITORING EQUIPMENT

- 6.3.2.1 Need for optimal performance and minimized risk to contribute to growth

- 6.3.3 DIALYSIS EQUIPMENT

- 6.3.3.1 Growing number of renal care centers to drive market

- 6.3.4 INFUSION PUMPS

- 6.3.4.1 Growing adoption of infusion pumps on rental basis to propel market

- 6.3.5 OTHER PATIENT MONITORING & LIFE SUPPORT DEVICES

- 6.3.1 VENTILATORS

- 6.4 ENDOSCOPIC DEVICES

- 6.4.1 INCREASING OFFERINGS FOR AFFORDABLE AND BUNDLED SERVICES TO ADVANCE GROWTH

- 6.5 SURGICAL EQUIPMENT

- 6.5.1 INCREASING NUMBER OF SURGERIES AND RISING GERIATRIC POPULATION TO BOOST MARKET

- 6.6 OPHTHALMOLOGY EQUIPMENT

- 6.6.1 RISING TECHNOLOGICAL ADVANCEMENTS IN OPHTHALMIC LASERS TO AUGMENT GROWTH

- 6.7 MEDICAL LASERS

- 6.7.1 GROWING ADOPTION OF MINIMALLY AND NON-INVASIVE AESTHETIC PROCEDURES TO DRIVE MARKET

- 6.8 ELECTROSURGICAL EQUIPMENT

- 6.8.1 RISING DEMAND FOR MAINTENANCE DUE TO SAFETY AND PERFORMANCE NEEDS TO AID GROWTH

- 6.9 RADIOTHERAPY DEVICES

- 6.9.1 STRINGENT REGULATORY GUIDELINES TO SUPPORT GROWTH

- 6.10 DENTAL EQUIPMENT

- 6.10.1 DENTAL RADIOLOGY EQUIPMENT

- 6.10.1.1 Reduced technological complexity and ease of utilization to bolster growth

- 6.10.2 DENTAL LASER DEVICES

- 6.10.2.1 Growing adoption of dental lasers due to shorter and painless operations to drive market

- 6.10.3 OTHER DENTAL EQUIPMENT

- 6.10.1 DENTAL RADIOLOGY EQUIPMENT

- 6.11 LABORATORY EQUIPMENT

- 6.11.1 INCREASING ADOPTION OF AUTOMATED SYSTEMS TO FAVOR GROWTH

- 6.12 DURABLE MEDICAL EQUIPMENT

- 6.12.1 GROWING AWARENESS ABOUT IN-HOUSE MAINTENANCE SERVICES TO BOOST MARKET

7 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE

- 7.1 INTRODUCTION

- 7.2 PREVENTIVE MAINTENANCE

- 7.2.1 NEED FOR IMPROVED SAFETY FOR PATIENTS AND OPERATORS TO AID GROWTH

- 7.3 CORRECTIVE MAINTENANCE

- 7.3.1 INCREASED ADOPTION OF REFURBISHED EQUIPMENT TO FOSTER GROWTH

- 7.4 OPERATIONAL MAINTENANCE

- 7.4.1 REDUCED EQUIPMENT DOWNTIME AND DECREASED MAINTENANCE COSTS TO SPUR GROWTH

8 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER

- 8.1 INTRODUCTION

- 8.2 MULTI-VENDOR OEMS

- 8.2.1 AVAILABILITY OF 24/7 TECHNICAL ASSISTANCE AND STRONG TECHNICAL KNOWLEDGE TO STIMULATE GROWTH

- 8.3 SINGLE-VENDOR OEMS

- 8.3.1 PREFERENCE OF HEALTHCARE PROVIDERS FOR CONSISTENT STYLE, USABILITY, AND FUNCTIONS TO DRIVE MARKET

- 8.4 INDEPENDENT SERVICE ORGANIZATIONS

- 8.4.1 REDUCED OPERATING EXPENSES AND EXPERTISE IN HANDLING DIFFERENT BRANDS TO PROMOTE GROWTH

- 8.5 IN-HOUSE MAINTENANCE

- 8.5.1 GROWING NEED TO CURTAIL HEALTHCARE COSTS TO FUEL MARKET

9 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE

- 9.1 INTRODUCTION

- 9.2 PREMIUM CONTRACTS

- 9.2.1 BETTER RETURNS ON INVESTMENT AND REDUCED COMPLEXITY TO BOLSTER GROWTH

- 9.3 BASIC CONTRACTS

- 9.3.1 AFFORDABLE PRICING OF BASIC MEDICAL DEVICE MAINTENANCE CONTRACTS TO FAVOR GROWTH

- 9.4 CUSTOMIZED CONTRACTS

- 9.4.1 INCREASED POPULARITY OF TAILOR-MADE MAINTENANCE SERVICES FOR MEDICAL DEVICES TO FACILITATE GROWTH

- 9.5 ADD-ON CONTRACTS

- 9.5.1 EASY INTRODUCTION OF NEW SERVICES FOR CLIENTS TO PROPEL MARKET

10 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS & CLINICS

- 10.2.1 INCREASING NUMBER OF SURGERIES AND DIAGNOSTIC IMAGING PROCEDURES TO FACILITATE GROWTH

- 10.3 AMBULATORY SURGICAL CENTERS

- 10.3.1 LESS TIME-CONSUMING TREATMENTS AND COST-EFFECTIVE DIAGNOSIS TO CONTRIBUTE TO GROWTH

- 10.4 DENTAL CLINICS

- 10.4.1 LOWER COST REQUIREMENTS AND HIGHER PATIENT PREFERENCE FOR OUTPATIENT CARE TO AID GROWTH

- 10.5 DIAGNOSTIC IMAGING CENTERS

- 10.5.1 RISING SHIFT TOWARD OUTSOURCING TO SPECIALIZED IMAGING FACILITIES TO FAVOR GROWTH

- 10.6 DIALYSIS CENTERS

- 10.6.1 INCREASING NUMBER OF PRIVATE AND PUBLIC DIALYSIS CENTERS IN EMERGING ECONOMIES TO BOOST MARKET

- 10.7 OTHER END USERS

11 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing incidence of lifestyle diseases and adoption of advanced imaging equipment to aid growth

- 11.2.3 CANADA

- 11.2.3.1 Growing shift toward value-based healthcare to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Robust infrastructure for manufacturing medical imaging technologies and high-quality medical equipment to aid growth

- 11.3.3 UK

- 11.3.3.1 Rising emphasis on public-private partnerships and strong government healthcare initiatives to promote growth

- 11.3.4 FRANCE

- 11.3.4.1 Growing adoption of cost-effective in-house maintenance strategies to boost market

- 11.3.5 ITALY

- 11.3.5.1 Increasing demand for preventive care and remote monitoring to augment growth

- 11.3.6 SPAIN

- 11.3.6.1 Growing investments in advanced technologies to propel market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Aging population and favorable government policies to promote growth

- 11.4.3 CHINA

- 11.4.3.1 Growing demand for advanced and premium-priced medical equipment to fuel market

- 11.4.4 INDIA

- 11.4.4.1 Increasing healthcare expenditure and public healthcare investment to expedite growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing reliance on complex medical technologies to boost market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing focus on improved healthcare structure to spur growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Rising awareness about advanced diagnostic and treatment procedures to bolster growth

- 11.5.3 MEXICO

- 11.5.3.1 Growing focus on improved diagnostic access to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.2.1.1 Rising access to advanced medical technologies to stimulate growth

- 11.6.2.2 United Arab Emirates (UAE)

- 11.6.2.2.1 Increasing prevalence of non-communicable diseases to facilitate growth

- 11.6.2.3 Rest of GCC Countries

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET

- 12.3 REVENUE SHARE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Device type footprint

- 12.5.5.4 Service type footprint

- 12.5.5.5 Contract type footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/SERVICE COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8.1 FINANCIAL METRICS

- 12.8.2 COMPANY VALUATION

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 SERVICE LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 GE HEALTHCARE

- 13.1.1.1 Business overview

- 13.1.1.2 Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SIEMENS HEALTHINEERS AG

- 13.1.2.1 Business overview

- 13.1.2.2 Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KONINKLIJKE PHILIPS N.V.

- 13.1.3.1 Business overview

- 13.1.3.2 Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 MEDTRONIC

- 13.1.4.1 Business overview

- 13.1.4.2 Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FUJIFILM HOLDINGS CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 OLYMPUS CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.7 STRYKER

- 13.1.7.1 Business overview

- 13.1.7.2 Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 CANON INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Service launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.9 DRAGERWERK AG & CO. KGAA

- 13.1.9.1 Business overview

- 13.1.9.2 Services offered

- 13.1.10 HITACHI, LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Services offered

- 13.1.11 B. BRAUN SE

- 13.1.11.1 Business overview

- 13.1.11.2 Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 ELEKTA

- 13.1.12.1 Business overview

- 13.1.12.2 Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Service launches

- 13.1.12.3.2 Deals

- 13.1.13 SHIMADZU CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Service launches

- 13.1.13.3.2 Deals

- 13.1.14 AGFA-GEVAERT GROUP

- 13.1.14.1 Business overview

- 13.1.14.2 Services offered

- 13.1.15 STERIS

- 13.1.15.1 Business overview

- 13.1.15.2 Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Expansions

- 13.1.1 GE HEALTHCARE

- 13.2 OTHER PLAYERS

- 13.2.1 ALTHEA GROUP

- 13.2.2 BCAS BIO-MEDICAL SERVICES LTD.

- 13.2.3 AGENOR

- 13.2.4 GRUPO EMPRESARIAL ELECTROMEDICO

- 13.2.5 CARESTREAM HEALTH

- 13.2.6 KARL STORZ GMBH & CO. KG

- 13.2.7 AVENSYS UK LTD.

- 13.2.8 THE INTERMED GROUP

- 13.2.9 CROTHALL HEALTHCARE

- 13.2.10 TRIMEDX HOLDINGS LLC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 SUPPLY-SIDE DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MEDICAL EQUIPMENT MAINTENANCE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2022-2024

- TABLE 3 MEDICAL EQUIPMENT MAINTENANCE MARKET: RISK ASSESSMENT

- TABLE 4 PROMINENT ACQUISITIONS IN DIALYSIS SERVICES INDUSTRY, 2022-2024

- TABLE 5 MEDICAL EQUIPMENT MAINTENANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MEDICAL EQUIPMENT MAINTENANCE MARKET: KEY PATENTS, 2023-2025

- TABLE 12 IMPORT DATA FOR INSTRUMENTS & APPLIANCES USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY SCIENCES (HS CODE 9018), BY COUNTRY, 2020-2024 (USD THOUSANDS)

- TABLE 13 EXPORT DATA FOR INSTRUMENTS & APPLIANCES USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY SCIENCES (HS CODE 9018), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 MEDICAL EQUIPMENT MAINTENANCE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 16 KEY BUYING CRITERIA, BY END USER

- TABLE 17 MEDICAL EQUIPMENT MAINTENANCE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 18 AVERAGE SELLING PRICE OF MAINTENANCE SERVICES FOR CT SCANNERS, BY KEY PLAYER, 2024 (USD)

- TABLE 19 AVERAGE SELLING PRICE OF MAINTENANCE SERVICES FOR MAMMOGRAPHY MACHINES, BY KEY PLAYER, 2024 (USD)

- TABLE 20 AVERAGE SELLING PRICE OF MAINTENANCE SERVICES FOR C-ARM/X-RAY IMAGING SYSTEMS, BY KEY PLAYER, 2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND OF MAINTENANCE SERVICES FOR CT SCANNERS, BY REGION, 2022-2024 (USD)

- TABLE 22 AVERAGE SELLING PRICE TREND OF MAINTENANCE SERVICES FOR MAMMOGRAPHY MACHINES, BY REGION, 2022-2024 (USD)

- TABLE 23 AVERAGE SELLING PRICE TREND OF MAINTENANCE SERVICES FOR C-ARM /X-RAY IMAGING SYSTEMS, BY REGION, 2022-2024 (USD)

- TABLE 24 MEDICAL EQUIPMENT MAINTENANCE MARKET: UNMET NEEDS/ END USER EXPECTATIONS

- TABLE 25 KEY COMPANIES IMPLEMENTING AI IN MEDICAL EQUIPMENT MAINTENANCE MARKET

- TABLE 26 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 27 KEY PRODUCT-RELATED TARIFF EFFECTIVE MEDICAL EQUIPMENT MAINTENANCE

- TABLE 28 NORTH AMERICA: IMPACT OF US TARIFF ON CANADA

- TABLE 29 ASIA PACIFIC: IMPACT OF US TARIFF ON CHINA, JAPAN, AND INDIA

- TABLE 30 EUROPE: IMPACT OF US TARIFF ON GERMANY AND UK

- TABLE 31 LATIN AMERICA: IMPACT OF US TARIFF ON MEXICO

- TABLE 32 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 33 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR DIAGNOSTIC IMAGING EQUIPMENT

- TABLE 34 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR MRI SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR CT SCANNERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR X-RAY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ULTRASOUND SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ANGIOGRAPHY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR MAMMOGRAPHY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR NUCLEAR IMAGING SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR FLUOROSCOPY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR PATIENT MONITORING & LIFE SUPPORT DEVICES

- TABLE 45 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR VENTILATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ANESTHESIA MONITORING EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIALYSIS EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR INFUSION PUMPS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR LIFE SUPPORT DEVICES

- TABLE 52 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR OTHER PATIENT MONITORING & LIFE SUPPORT DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR ENDOSCOPIC DEVICES

- TABLE 54 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ENDOSCOPIC DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR SURGICAL EQUIPMENT

- TABLE 56 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR SURGICAL EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR OPHTHALMOLOGY EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR MEDICAL LASERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ELECTROSURGICAL EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR RADIOTHERAPY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL RADIOLOGY EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL LASER DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR OTHER DENTAL EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR LABORATORY EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DURABLE MEDICAL EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 69 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PREVENTIVE MAINTENANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR CORRECTIVE MAINTENANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR OPERATIONAL MAINTENANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 COST OF CONTRACTS FROM DIFFERENT TYPES OF SERVICE PROVIDERS

- TABLE 73 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2023-2030 (USD MILLION)

- TABLE 74 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR MULTI-VENDOR OEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR SINGLE-VENDOR OEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR INDEPENDENT SERVICE ORGANIZATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR IN-HOUSE MAINTENANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2023-2030 (USD MILLION)

- TABLE 79 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PREMIUM CONTRACTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR BASIC CONTRACTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR CUSTOMIZED CONTRACTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ADD-ON CONTRACTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 84 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR HOSPITALS & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 85 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIALYSIS CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 MEDICAL EQUIPMENT MAINTENANCE MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 US: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 101 US: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 US: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 US: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 CANADA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 110 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 118 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 122 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 126 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 130 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 134 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2023-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2023-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 JAPAN: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 151 JAPAN: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 JAPAN: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 JAPAN: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 CHINA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 155 CHINA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 CHINA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 CHINA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 INDIA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 159 INDIA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 INDIA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 INDIA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 AUSTRALIA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 163 AUSTRALIA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 AUSTRALIA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 AUSTRALIA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 SOUTH KOREA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 SOUTH KOREA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2023-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 184 BRAZIL: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 185 BRAZIL: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 BRAZIL: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 BRAZIL: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 MEXICO: MACROECONOMIC INDICATORS

- TABLE 189 MEXICO: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 190 MEXICO: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 MEXICO: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MEXICO: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 194 REST OF LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2023-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2023-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 206 GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 207 GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 208 GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 KINGDOM OF SAUDI ARABIA (KSA): MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 212 KINGDOM OF SAUDI ARABIA (KSA): MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 KINGDOM OF SAUDI ARABIA (KSA): MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 KINGDOM OF SAUDI ARABIA (KSA): MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 UAE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 216 UAE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 UAE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 UAE: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 REST OF GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 220 REST OF GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 REST OF GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 REST OF GCC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR PATIENT MONITORING & LIFE SUPPORT DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET

- TABLE 228 MEDICAL EQUIPMENT MAINTENANCE MARKET: DEGREE OF COMPETITION

- TABLE 229 MEDICAL EQUIPMENT MAINTENANCE MARKET: REGION FOOTPRINT

- TABLE 230 MEDICAL EQUIPMENT MAINTENANCE MARKET: DEVICE TYPE FOOTPRINT

- TABLE 231 MEDICAL EQUIPMENT MAINTENANCE MARKET: SERVICE TYPE FOOTPRINT

- TABLE 232 MEDICAL EQUIPMENT MAINTENANCE MARKET: CONTRACT TYPE FOOTPRINT

- TABLE 233 MEDICAL EQUIPMENT MAINTENANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 234 MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 235 MEDICAL EQUIPMENT MAINTENANCE MARKET: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 236 MEDICAL EQUIPMENT MAINTENANCE MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 237 MEDICAL EQUIPMENT MAINTENANCE MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 238 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 239 GE HEALTHCARE: SERVICES OFFERED

- TABLE 240 GE HEALTHCARE: DEALS, JANUARY 2022-JUNE 2025

- TABLE 241 GE HEALTHCARE: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 242 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 243 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 244 SIEMENS HEALTHINEERS AG: SERVICES OFFERED

- TABLE 245 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-JUNE 2025

- TABLE 246 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 247 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 248 KONINKLIJKE PHILIPS N.V.: SERVICES OFFERED

- TABLE 249 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 250 KONINKLIJKE PHILIPS N.V.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 251 MEDTRONIC: COMPANY OVERVIEW

- TABLE 252 MEDTRONIC: SERVICES OFFERED

- TABLE 253 MEDTRONIC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 254 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 255 FUJIFILM HOLDINGS CORPORATION: SERVICES OFFERED

- TABLE 256 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 257 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 258 OLYMPUS CORPORATION: SERVICES OFFERED

- TABLE 259 OLYMPUS CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 260 OLYMPUS CORPORATION: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 261 STRYKER: COMPANY OVERVIEW

- TABLE 262 STRYKER: SERVICES OFFERED

- TABLE 263 STRYKER: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 264 CANON INC.: COMPANY OVERVIEW

- TABLE 265 CANON INC.: SERVICES OFFERED

- TABLE 266 CANON INC.: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 267 CANON INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 268 CANON INC.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 269 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 270 DRAGERWERK AG & CO. KGAA: SERVICES OFFERED

- TABLE 271 HITACHI LTD.: COMPANY OVERVIEW

- TABLE 272 HITACHI LTD.: SERVICES OFFERED

- TABLE 273 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 274 B. BRAUN SE: SERVICES OFFERED

- TABLE 275 B. BRAUN SE: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 276 ELEKTA: COMPANY OVERVIEW

- TABLE 277 ELEKTA: SERVICES OFFERED

- TABLE 278 ELEKTA: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 279 ELEKTA: DEALS, JANUARY 2022-JUNE 2025

- TABLE 280 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 281 SHIMADZU CORPORATION: SERVICES OFFERED

- TABLE 282 SHIMADZU CORPORATION: SERVICE LAUNCHES

- TABLE 283 SHIMADZU CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 284 AGFA-GEVAERT GROUP: COMPANY OVERVIEW

- TABLE 285 AGFA-GEVAERT GROUP: SERVICES OFFERED

- TABLE 286 STERIS: COMPANY OVERVIEW

- TABLE 287 STERIS: SERVICES OFFERED

- TABLE 288 STERIS: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 289 ALTHEA GROUP: COMPANY OVERVIEW

- TABLE 290 BCAS BIO-MEDICAL SERVICES LTD.: COMPANY OVERVIEW

- TABLE 291 AGENOR: COMPANY OVERVIEW

- TABLE 292 GRUPO EMPRESARIAL ELECTROMEDICO: COMPANY OVERVIEW

- TABLE 293 CARESTREAM HEALTH: COMPANY OVERVIEW

- TABLE 294 KARL STORZ GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 295 AVENSYS UK LTD.: COMPANY OVERVIEW

- TABLE 296 THE INTERMED GROUP: COMPANY OVERVIEW

- TABLE 297 CROTHALL HEALTHCARE: COMPANY OVERVIEW

- TABLE 298 TRIMEDX HOLDINGS LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL EQUIPMENT MAINTENANCE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MEDICAL EQUIPMENT MAINTENANCE MARKET: YEARS CONSIDERED

- FIGURE 3 MEDICAL EQUIPMENT MAINTENANCE MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 PRIMARY RESPONDENTS

- FIGURE 6 MEDICAL EQUIPMENT MAINTENANCE MARKET: INSIGHTS FROM PRIMARIES

- FIGURE 7 MEDICAL EQUIPMENT MAINTENANCE MARKET: BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS)

- FIGURE 8 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 9 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2024

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 11 MEDICAL EQUIPMENT MAINTENANCE MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS, 2024

- FIGURE 12 MEDICAL EQUIPMENT MAINTENANCE MARKET: TOP-DOWN APPROACH

- FIGURE 13 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF MEDICAL EQUIPMENT MAINTENANCE MARKET

- FIGURE 21 GROWING TREND OF PREVENTIVE MAINTENANCE TO DRIVE MARKET

- FIGURE 22 PREVENTIVE MAINTENANCE SEGMENT AND GERMANY LED EUROPEAN MARKET IN 2024

- FIGURE 23 MULTI-VENDOR OEMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 HOSPITALS & CLINICS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 25 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 MEDICAL EQUIPMENT MAINTENANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 EU: DISTRIBUTION OF POPULATION, BY AGE, 2010 VS. 2020 VS. 2030

- FIGURE 28 MEDICAL EQUIPMENT MAINTENANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 MEDICAL EQUIPMENT MAINTENANCE MARKET: PATENT ANALYSIS, JANUARY 2014-JUNE 2025

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 31 KEY BUYING CRITERIA, BY END USER

- FIGURE 32 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDITION DURING MANUFACTURING PHASE

- FIGURE 33 MEDICAL EQUIPMENT MAINTENANCE WORKFLOW: VALUE CHAIN ANALYSIS

- FIGURE 34 MEDICAL EQUIPMENT MAINTENANCE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 35 MEDICAL EQUIPMENT MAINTENANCE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 36 MEDICAL EQUIPMENT MAINTENANCE MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 37 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET

- FIGURE 38 MEDICAL EQUIPMENT MAINTENANCE MARKET: AI USE CASES

- FIGURE 39 NORTH AMERICA: MEDICAL EQUIPMENT MAINTENANCE MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MEDICAL EQUIPMENT MAINTENANCE MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, 2022-2024

- FIGURE 42 MEDICAL EQUIPMENT MAINTENANCE MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 43 RANKING OF KEY PLAYERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, 2024

- FIGURE 44 MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPANY FOOTPRINT

- FIGURE 46 MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 MEDICAL EQUIPMENT MAINTENANCE MARKET: BRAND/SERVICE COMPARATIVE ANALYSIS

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 51 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 52 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 53 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 54 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 56 STRYKER: COMPANY SNAPSHOT (2024)

- FIGURE 57 CANON INC.: COMPANY SNAPSHOT (2024)

- FIGURE 58 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 59 HITACHI, LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 60 B. BRAUN SE: COMPANY SNAPSHOT (2024)

- FIGURE 61 ELEKTA: COMPANY SNAPSHOT (2024)

- FIGURE 62 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 63 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 64 STERIS: COMPANY SNAPSHOT (2024)