|

市场调查报告书

商品编码

1801773

全球多波束迴声测深仪市场(按应用、深度、平台、最终用户和地区划分)- 预测至 2030 年Multi-Beam Echo Sounder Market by Platform (Crewed vs. Uncrewed Vessels, Surface vs. Underwater Vessels), Application (Seabed Mapping, Route Survey), End User (Hydrographic Agencies, CPIW, Maritime Construction), Depth - Global Forecast to 2030 |

||||||

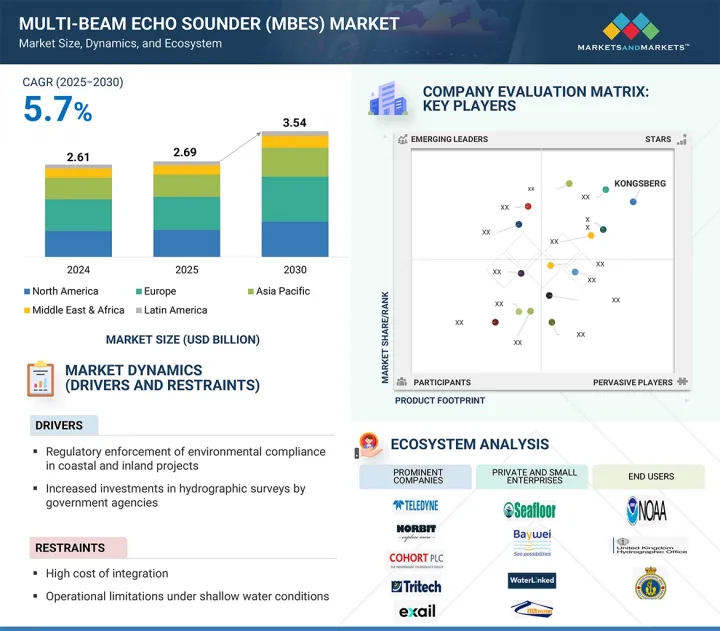

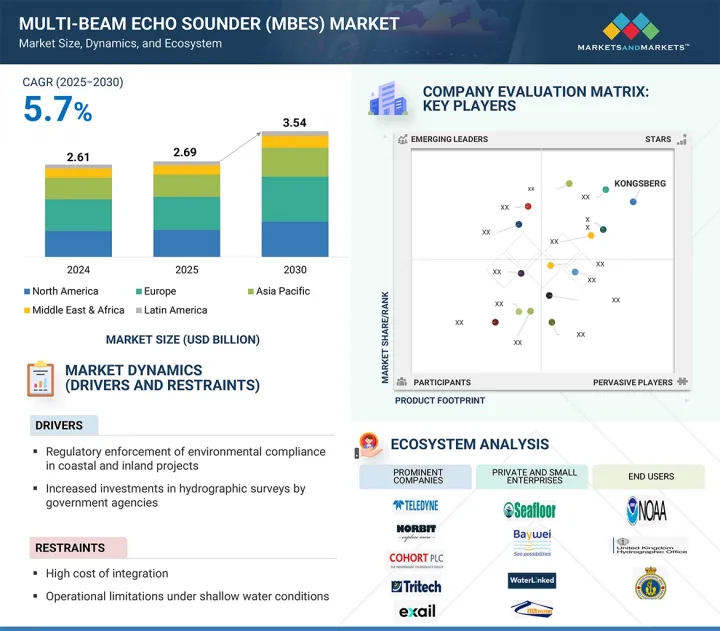

多波束迴声测深仪市场预计将从 2025 年的 26.9 亿美元成长到 2030 年的 35.4 亿美元,复合年增长率为 5.7%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(10美元) |

| 按细分市场 | 按应用程式、深度、平台、最终用户和地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

不断进步的技术以及不断变化的市场环境是市场驱动因素。

这一领域的快速成长很大程度上归功于近岸计划的增加,例如港口建设、海防设施和海上可再生设施,这些项目都需要在浅水区进行详细的水深测绘。与深水系统相比,浅水多波束迴声测深仪系统体积更小、电力消耗、价格更实惠,因而被商业营运商、港务局和环保组织广泛采用。此外,这些系统越来越多地与小型测量船、无人探勘航行器 (USV) 和自主水下航行器 (AUV) 配对使用,使其适用于常规和快速测绘作业。这一领域也受益于沿海水域更严格的安全和环境法规,这些法规要求定期监测海底,以防止航行危险并保护脆弱的海洋生态系统。即时数据收集和多感测器融合方面的进步使浅水多波束迴声测深仪解决方案能够达到与深水系统相当的分辨率,这使其成为繁忙航道中必不可少的工具。

由于其在实现安全离岸风力发电、石油和天然气、海底通讯和大型港口升级计划,全球需求正在成长。海底测绘支援工程规划、精密疏浚、航线规划和基准环境调查,为营运和监管决策提供所需的高品质数据。各国政府也资助扩大海底测绘计划,以加强海上主权主张,并透过更好的沿海和水深数据提高灾害防备能力。多波束迴声测深仪的进步,包括更宽的测绘带、更先进的波束控制和自动噪音过滤,正在显着提高测绘解析度和效率。此外,自主和远端操作调查平台的出现降低了营运成本,并使得在偏远和具有挑战性的地方进行常规高解析度测绘成为可能。

欧洲凭藉其先进的海事基础设施、强大的法规环境和技术创新,预计将成为多波束迴声测深仪的最大市场。该地区拥有众多全球 MBES 製造商、研究机构和服务供应商,尤其是在挪威、英国、法国和德国。对海洋可再生能源、北极任务、海军升级和欧盟支持的多边水文调查的投资正在增加。欧洲海洋和渔业基金 (EMFF) 等政策以及《海洋战略框架指令》等环境法规正在推出大规模海底调查计画,以实现海洋资源的环境永续利用。欧洲各地的海上能源供应商和港口当局正在带头主导配备自主调查平台的多波束迴声测深仪系统,以提高效率和覆盖范围。

本报告研究了全球多波束迴声测深仪市场,并总结了应用、深度、平台、最终用户和地区的趋势,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 影响客户业务的趋势和中断

- 价值链分析

- 生态系分析

- 监管状况

- 贸易数据

- 主要相关人员和采购标准

- 用例

- 2025-2026年主要会议和活动

- 宏观经济展望

- 定价分析

- 营运数据

- 总拥有成本

- 投资金筹措场景

- 美国2025年关税

- 经营模式

- 技术蓝图

- 人工智慧/生成式人工智慧的影响

- 多波束迴声测深仪市场应用趋势

- 多波束迴声测深仪市场的成长机会

- 技术分析

- 大趋势的影响

- 供应链分析

- 专利分析

第六章 多波束迴声测深仪市场(依应用)

- 介绍

- 应用相关的见解

- 海底测绘

- 海运业航线勘测

- 海底基础设施现况测绘与检查

- 军事目的

- 其他的

第七章 多波束迴声测深仪市场(按深度)

- 介绍

- 很浅

- 浅的

- 中等的

- 深的

第八章 多波束迴声测深仪市场(依平台)

- 介绍

- 平台相关见解

- 载人船舶及无人船舶

- 遥控和自主船舶

- 水面和水下船

第九章 多波束迴声测深仪市场(依最终用户)

- 介绍

- 最终用户相关见解

- 水道测量局

- 海运业

- 海上建设

- CPIW

- 政府环境监测及监督机构

- 公立和私立教育/研究机构

第十章 多波束迴声测深仪市场(按地区)

- 介绍

- 北美洲

- PESTLE分析

- 宏观指标

- 各国沿海特征

- 美国

- 加拿大

- 欧洲

- PESTLE分析

- 宏观指标

- 各国沿海特征

- 英国

- 法国

- 德国

- 挪威

- 丹麦

- 其他的

- 亚太地区

- PESTLE分析

- 宏观指标

- 各国沿海特征

- 中国

- 印度

- 日本

- 韩国

- 其他的

- 中东和非洲

- PESTLE分析

- 宏观指标

- 各国沿海特征

- GCC

- 以色列

- 土耳其

- 非洲

- 拉丁美洲

- PESTLE分析

- 宏观指标

- 各国沿海特征

- 巴西

- 墨西哥

第十一章竞争格局

- 介绍

- 主要参与企业的策略/优势,2020-2025

- 2021-2024年收益分析

- 2024年市场占有率分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 品牌/产品比较

- 估值和财务指标

- 竞争场景

第十二章:公司简介

- 主要参与企业

- KONGSBERG

- TELEDYNE TECHNOLOGIES INCORPORATED

- NORBIT ASA

- TRITECH TECHNOLOGIES LIMITED

- R2SONIC LLC

- EXAIL

- WASSP LIMITED

- IMAGENEX TECHNOLOGY CORPORATION

- FURUNO ELECTRIC CO., LTD.

- COHORT PLC

- BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.

- SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.

- HI-TARGET NAVIGATION TECH CO., LTD.

- EDGETECH INC.

- PICOTECH LTD.

- 其他公司

- NANJING VASTSEA-TECH MARINE CO, LTD.

- SEAFLOOR SYSTEMS INC.

- GEOACOUSTICS LTD.

- R3VOX INC.

- BAYWEI SONAR

- SATLAB GEOSOLUTIONS

- WATER LINKED

- BEIJING LCOCEAN

- CERULEAN SONAR

- ITER SYSTEMS

第十三章 附录

The multi-beam echo sounder market is expected to reach USD 3.54 billion by 2030, from USD 2.69 billion in 2025, with a CAGR of 5.7%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, Application, Acquirer, End User, Depth, and Power |

| Regions covered | North America, Europe, APAC, RoW |

Rising technological advancements and evolving market conditions are the key market drivers.

"By depth, shallow is expected to be the fastest-growing segment."

The rapid growth in this segment can largely be attributed to the increasing number of near-shore infrastructural projects, including harbor construction, coastal defense structures, and offshore renewable installations, such as detailed bathymetric mapping in shallow waters. Shallow multi-beam echo sounder systems are smaller, less power-intensive, and more affordable than deepwater systems, enabling broader adoption by commercial operators, port authorities, and environmental groups. Additionally, these systems are increasingly combined with smaller survey boats, unmanned surface vehicles (USVs), and autonomous underwater vehicles (AUVs), making them more suitable for routine and quick mapping tasks. The segment also benefits from stricter safety and environmental regulations in coastal waters that require regular seabed monitoring to prevent navigational hazards and protect delicate marine ecosystems. Advances in real-time data collection and multi-sensor fusion allow shallow-water multi-beam echo sounder solutions to achieve resolution comparable to deepwater systems, making them essential in busy shipping lanes.

"By application, seabed mapping is expected to be the fastest-growing segment."

This segment is expected to experience the fastest growth among multi-beam echo sounder applications because of its central role in enabling safe underwater navigation, marine spatial planning, and deployment of subsea assets. Global demand is increasing due to offshore wind power, oil & gas, subsea telecommunication, and major port upgrade projects. Seabed mapping supports engineering planning, precise dredging, route planning, and baseline environmental surveys, providing the high-quality data necessary for operational and regulatory decisions. Governments also fund growing seabed mapping initiatives to strengthen maritime sovereignty claims and improve disaster preparedness through better coastal and underwater topography data. Advances in multi-beam echo sounders, such as broader swaths, more advanced beam steering, and noise filtering automation, have considerably improved mapping resolution and efficiency. Additionally, the increased availability of autonomous and remotely operated survey platforms lowers operational costs, making routine and high-resolution mapping possible in remote or challenging locations.

"Europe is expected to be the leading regional market."

Europe is expected to be the largest market for multi-beam echo sounders due to its advanced maritime infrastructure, strong regulatory environment, and technological innovation. The region benefits from a robust presence of MBES manufacturers, research institutions, and service providers worldwide, especially in Norway, the UK, France, and Germany. Increasing investments are being allocated to offshore renewable energy, Arctic missions, naval upgrades, and multi-national hydrography supported by the EU. Policies like the European Maritime and Fisheries Fund (EMFF) and environmental regulations such as the Marine Strategy Framework Directive are launching large-scale seabed survey programs for environmentally sustainable ocean resource utilization. Offshore energy providers and port authorities across Europe are leading the adoption of multi-beam echo sounder systems with autonomous survey platforms, enhancing efficiency and coverage.

The break-up of the profile of primary participants in the multi-beam echo sounder market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation: C-level - 25%, D-level - 35%, Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Rest of World-20%

Kongsberg (Norway), Teledyne Technologies Incorporated (US), NORBIT ASA (Norway), R2Sonic LLC (US), and Tritech International Limited (UK) are the top five players in the multi-beam echo sounder market. These companies offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Research coverage:

The study explores the multi-beam echo sounder market across various segments and subsegments. It aims to estimate the size and growth potential of this market in different segments based on product, application, technology, and region. It also features an in-depth competitive analysis of the key players in the market, including their company profiles, essential insights related to their solutions and offerings, recent developments, and key market strategies. The report segments the multi-beam echo sounder market into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, along with their key countries. It provides detailed information on critical factors such as drivers, restraints, challenges, and opportunities influencing the market's growth. Additionally, a comprehensive analysis of leading industry players offers insights into their business profiles, solutions, and services. This analysis encompasses significant aspects like acquisitions, agreements, collaborations, expansions, partnerships, and product launches within the market.

Reasons to buy this report:

This report is a valuable resource for market leaders and newcomers in the multi-beam echo sounder market, providing data that closely estimates revenue figures for both the overall market and its subsegments. It gives stakeholders a thorough understanding of the competitive landscape, helping them make informed decisions to improve their market position and develop effective go-to-market strategies. The report offers key insights into market dynamics, including information on drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights into the following pointers:

- Analysis of key drivers, such as regulatory enforcement of environmental compliance in coastal and inland projects, increased investments in hydrographic surveys by government agencies, expansion of global maritime fleet, and rapid adoption in defense and maritime security

- Market Penetration: Comprehensive information on multi-beam echo sounder solutions offered by the top market players

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and new product & service launches in the multi-beam echo sounder market

- Market Development: Comprehensive information about lucrative markets - the report analyses the multi-beam echo sounder market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MULTI-BEAM ECHO SOUNDER MARKET

- 4.2 MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM

- 4.3 MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH

- 4.4 MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Regulatory enforcement of environmental compliance in coastal and inland projects

- 5.2.1.2 Increased investments in hydrographic surveys by government agencies

- 5.2.1.3 Expansion of global maritime fleet

- 5.2.1.4 Growing adoption in defense and maritime security

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of integration

- 5.2.2.2 Operational limitations under shallow water conditions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid integration of multi-beam echo sounders with autonomous underwater and surface vehicles

- 5.2.3.2 Innovations in multi-beam echo sounder technology

- 5.2.3.3 Increased deployment of submarine infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Substantial data volume and complex post-processing

- 5.2.4.2 Shortage of skilled workforce

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 OEMS

- 5.5.2 SYSTEM INTEGRATORS

- 5.5.3 SERVICE PROVIDERS

- 5.5.4 END USERS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.2 APPLICATION-WISE REGULATIONS FOR MULTI-BEAM ECHO SOUNDERS

- 5.6.3 REGULATORY FACTORS IMPACTING MULTI-BEAM ECHO SOUNDER MANUFACTURERS/END USERS

- 5.7 TRADE DATA

- 5.7.1 IMPORT SCENARIO (HS CODE 9015)

- 5.7.2 EXPORT SCENARIO (HS CODE 9015)

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 USE CASES

- 5.9.1 SEABAT T-SERIES MULTI-BEAM ECHO SOUNDER SYSTEM

- 5.9.2 SEABAT T20 MULTI-BEAM ECHO SOUNDER

- 5.9.3 SEABAT 7125 SV2 MULTI-BEAM ECHO SOUNDER

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 MACROECONOMIC OUTLOOK

- 5.11.1 NORTH AMERICA

- 5.11.2 EUROPE

- 5.11.3 ASIA PACIFIC

- 5.11.4 MIDDLE EAST

- 5.11.5 LATIN AMERICA

- 5.11.6 AFRICA

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE, BY VESSEL TYPE AND KEY PLAYER

- 5.12.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.13 OPERATIONAL DATA

- 5.14 TOTAL COST OF OWNERSHIP

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 US 2025 TARIFF

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.17 BUSINESS MODELS

- 5.18 TECHNOLOGY ROADMAP

- 5.19 IMPACT OF AI/GEN AI

- 5.20 APPLICATION TRENDS FOR MULTI-BEAM ECHO SOUNDER MARKET

- 5.20.1 HYDROGRAPHIC SURVEYING FOR NAUTICAL CHARTING

- 5.20.2 OFFSHORE WIND FARM DEVELOPMENT AND MONITORING

- 5.20.3 SUBSEA PIPELINE AND TELECOMMUNICATIONS CABLE INSPECTION

- 5.20.4 MINE COUNTERMEASURES AND SEABED INTELLIGENCE

- 5.20.5 ENVIRONMENTAL MONITORING AND SEABED HABITAT MAPPING

- 5.20.6 PORT CONSTRUCTION, MAINTENANCE, AND DREDGING OPERATIONS

- 5.20.7 INLAND WATERBODY MAPPING AND FLOODPLAIN MANAGEMENT

- 5.21 GROWTH OPPORTUNITIES FOR MULTI-BEAM ECHO SOUNDER MARKET

- 5.21.1 COMMERCIAL APPLICATIONS

- 5.21.2 DEFENSE APPLICATIONS

- 5.21.3 RESEARCH APPLICATIONS

- 5.22 TECHNOLOGY ANALYSIS

- 5.22.1 KEY TECHNOLOGIES

- 5.22.1.1 Real-time digital beamforming and signal processing

- 5.22.1.2 Backscatter processing and classification

- 5.22.1.3 Real-time data fusion and software integration

- 5.22.1.4 AI-powered seafloor classification

- 5.22.1.5 Dual-head and split-aperture configuration

- 5.22.2 ADJACENT TECHNOLOGIES

- 5.22.2.1 Side scan sonar systems

- 5.22.2.2 LiDAR bathymetry

- 5.22.2.3 Acoustic Doppler Current Profilers

- 5.22.1 KEY TECHNOLOGIES

- 5.23 IMPACT OF MEGATRENDS

- 5.23.1 RAPID ADOPTION OF UNCREWED AND AUTONOMOUS MARITIME SYSTEMS

- 5.23.2 RISE OF OCEAN MONITORING

- 5.23.3 OFFSHORE RENEWABLE ENERGY EXPANSION

- 5.23.4 DIGITALIZATION AND REAL-TIME DATA DELIVERY

- 5.23.5 STRATEGIC MARITIME SURVEILLANCE AND DEFENSE

- 5.24 SUPPLY CHAIN ANALYSIS

- 5.25 PATENT ANALYSIS

6 MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 APPLICATION-RELATED INSIGHTS

- 6.3 SEABED MAPPING

- 6.3.1 RISE OF NATIONAL OR REGIONAL MAPPING PROGRAMS

- 6.4 ROUTE SURVEY FOR MARITIME INDUSTRIES

- 6.4.1 ELEVATED DEMAND FOR ROUTE SAFE INSTALLATION AND LONG-TERM ASSET MONITORING

- 6.5 SUBSEA INFRASTRUCTURE AS-LAID MAPPING & INSPECTION

- 6.5.1 NEED FOR ASSET INTEGRITY MANAGEMENT IN OFFSHORE OIL & GAS AND SUBSEA RENEWABLES

- 6.6 MILITARY PURPOSES

- 6.6.1 EMPHASIS ON MARITIME SITUATIONAL AWARENESS AND ANTI-SUBMARINE WARFARE

- 6.7 OTHER APPLICATIONS

7 MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH

- 7.1 INTRODUCTION

- 7.2 VERY SHALLOW

- 7.2.1 COASTAL MAPPING AND PORT SURVEYS DRIVE HIGH-FREQUENCY MULTI-BEAM ECHO SOUNDER ADOPTION

- 7.3 SHALLOW

- 7.3.1 REGIONAL SURVEY PROGRAMS AND COASTAL INFRASTRUCTURE PROJECTS SUSTAIN DEMAND

- 7.4 MEDIUM

- 7.4.1 OFFSHORE SURVEY EXPANSION SUPPORT MULTI-BEAM ECHO SOUNDER DEPLOYMENT

- 7.5 DEEP

- 7.5.1 OCEAN MAPPING AND SUBSEA INFRASTRUCTURE DEMANDS PROPEL GROWTH

8 MULTI-BEAM ECHO SOUNDER MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- 8.2 PLATFORM-RELATED INSIGHTS

- 8.3 CREWED VS. UNCREWED VESSELS

- 8.4 REMOTE-CONTROLLED VS. AUTONOMOUS VESSELS

- 8.5 SURFACE VS. UNDERWATER VESSELS

9 MULTI-BEAM ECHO-SOUNDER MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 END-USER-RELATED INSIGHTS

- 9.3 HYDROGRAPHIC AGENCIES

- 9.3.1 NATIONAL CHARTING OBLIGATIONS PROMOTING LONG-TERM ADOPTION

- 9.4 MARITIME INDUSTRIES

- 9.4.1 OPERATIONAL EXPANSION OF OFFSHORE SECTORS

- 9.5 MARITIME CONSTRUCTION

- 9.5.1 RAPID DEPLOYMENT IN PRE- AND POST-LAY SURVEYS AND PROGRESS MONITORING

- 9.6 CPIW

- 9.6.1 TREND OF DIGITAL PORT INFRASTRUCTURE AND AUTOMATED CHANNEL MONITORING

- 9.7 GOVERNMENT ENVIRONMENTAL RESEARCH & MONITORING AGENCIES

- 9.7.1 ENVIRONMENTAL MANDATES SUPPORTING CONTINUOUS MONITORING

- 9.8 PUBLIC & PRIVATE EDUCATIONAL/RESEARCH ESTABLISHMENTS

- 9.8.1 ACADEMIC INSTITUTIONS BROADENING USE OF MULTI-BEAM ECHO SOUNDERS IN MARINE SCIENCE

10 MULTI-BEAM ECHO SOUNDER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 MACRO INDICATORS

- 10.2.3 COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

- 10.2.4 US

- 10.2.4.1 Government funding and naval modernization to drive market

- 10.2.5 CANADA

- 10.2.5.1 Government-led hydrographic initiatives and Arctic sovereignty programs to drive market

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 MACRO INDICATORS

- 10.3.3 COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

- 10.3.4 UK

- 10.3.4.1 Substantial investments in naval modernization and port infrastructure to drive market

- 10.3.5 FRANCE

- 10.3.5.1 Offshore energy developments to drive market

- 10.3.6 GERMANY

- 10.3.6.1 Focus on maritime infrastructure and scientific research to drive market

- 10.3.7 NORWAY

- 10.3.7.1 Growing offshore oil & gas and wind sectors to drive market

- 10.3.8 DENMARK

- 10.3.8.1 Environmental monitoring efforts under EU directives to drive market

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 MACRO INDICATORS

- 10.4.3 COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

- 10.4.4 CHINA

- 10.4.4.1 Sovereignty mapping and naval expansion to drive market

- 10.4.5 INDIA

- 10.4.5.1 Growing maritime footprint to drive market

- 10.4.6 JAPAN

- 10.4.6.1 Strong maritime research institutions and active port operations to drive market

- 10.4.7 SOUTH KOREA

- 10.4.7.1 High investments in naval modernization and marine research to drive market

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 MACRO INDICATORS

- 10.5.3 COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

- 10.5.4 GCC

- 10.5.4.1 UAE

- 10.5.4.1.1 Strategic focus on maritime trade and port automation to drive market

- 10.5.4.2 Saudi Arabia

- 10.5.4.2.1 National development goals under Vision 2030 to drive market

- 10.5.4.1 UAE

- 10.5.5 ISRAEL

- 10.5.5.1 National hydrography and coastal management initiatives to drive market

- 10.5.6 TURKEY

- 10.5.6.1 Expansion and modernization of maritime infrastructure to drive market

- 10.5.7 AFRICA

- 10.5.7.1 Institutional investment in maritime safety to drive market

- 10.6 LATIN AMERICA

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 MACRO INDICATORS

- 10.6.3 COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

- 10.6.4 BRAZIL

- 10.6.4.1 Maritime defense priorities and national hydrographic efforts to drive market

- 10.6.5 MEXICO

- 10.6.5.1 Expansion of coastal engineering and marine monitoring programs to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Depth footprint

- 11.5.5.4 End user Footprint

- 11.5.5.5 Platform Footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 List of start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of start-ups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 KONGSBERG

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 TELEDYNE TECHNOLOGIES INCORPORATED

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 NORBIT ASA

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 TRITECH TECHNOLOGIES LIMITED

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 R2SONIC LLC

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 EXAIL

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Other developments

- 12.1.7 WASSP LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 IMAGENEX TECHNOLOGY CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 FURUNO ELECTRIC CO., LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 COHORT PLC

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent Developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Other developments

- 12.1.11 BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 HI-TARGET NAVIGATION TECH CO., LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 EDGETECH INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Other developments

- 12.1.15 PICOTECH LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches

- 12.1.15.3.2 Deals

- 12.1.1 KONGSBERG

- 12.2 OTHER PLAYERS

- 12.2.1 NANJING VASTSEA-TECH MARINE CO, LTD.

- 12.2.2 SEAFLOOR SYSTEMS INC.

- 12.2.3 GEOACOUSTICS LTD.

- 12.2.4 R3VOX INC.

- 12.2.5 BAYWEI SONAR

- 12.2.6 SATLAB GEOSOLUTIONS

- 12.2.7 WATER LINKED

- 12.2.8 BEIJING LCOCEAN

- 12.2.9 CERULEAN SONAR

- 12.2.10 ITER SYSTEMS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 ECOSYSTEM ANALYSIS FOOTPRINT

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 IMPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 13 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 KONGSBERG: AVERAGE SELLING PRICE OF MULTI-BEAM ECHO SOUNDERS, BY VESSEL TYPE, 2024 USD MILLION

- TABLE 15 TELEDYNE TECHNOLOGIES INCORPORATED: AVERAGE SELLING PRICE OF MULTI-BEAM ECHO SOUNDERS, BY VESSEL TYPE, 2024 USD MILLION

- TABLE 16 NORBIT ASA: AVERAGE SELLING PRICE OF MULTI-BEAM ECHO SOUNDERS, BY VESSEL TYPE, 2024 USD MILLION

- TABLE 17 AVERAGE SELLING PRICE TREND OF MULTI-BEAM ECHO SOUNDERS, BY REGION, 2024 (USD MILLION)

- TABLE 18 MULTI-BEAM ECHO SOUNDER DELIVERIES, BY VESSEL TYPE, 2021-2030

- TABLE 19 BUSINESS MODELS IN MULTI-BEAM ECHO SOUNDER MARKET

- TABLE 20 COMPARISON BETWEEN BUSINESS MODELS OF KEY PLAYERS

- TABLE 21 TECHNOLOGY USAGE BY KEY PLAYERS

- TABLE 22 PATENT ANALYSIS

- TABLE 23 MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 24 MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 DEPTH-RELATED INSIGHTS

- TABLE 26 MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021-2024 (USD MILLION)

- TABLE 27 MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025-2030 (USD MILLION)

- TABLE 28 MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 29 MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 30 MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 31 MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 32 MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 33 MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 34 MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 35 MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 36 MULTI-BEAM ECHO SOUNDER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 MULTI-BEAM ECHO SOUNDER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 49 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025-2030 (USD MILLION)

- TABLE 52 US: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 53 US: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 54 US: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 55 US: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 56 US: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 57 US: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 58 US: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 59 US: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 60 US: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 61 US: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 62 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 63 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 64 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 65 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 66 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 67 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 68 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 69 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 70 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 71 CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 77 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025-2030 (USD MILLION)

- TABLE 86 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 89 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 90 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 91 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 92 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 93 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 94 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 95 UK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 96 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 99 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 100 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 101 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 102 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 103 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 104 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 105 FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 106 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 109 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 110 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 111 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 112 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 113 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 114 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 115 GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 116 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 119 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 121 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 122 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 123 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 124 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 125 NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 126 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 129 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 130 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 131 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 132 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 133 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 134 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 135 DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 136 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 139 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 140 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 141 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 142 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 143 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 145 REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025-2030 (USD MILLION)

- TABLE 160 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 163 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 164 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 165 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 166 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 167 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 168 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 169 CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 170 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 171 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 173 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 174 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 175 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 176 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 177 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 178 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 179 INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 180 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 181 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 183 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 184 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 185 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 186 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 187 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 188 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 189 JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 191 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 195 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021-2024 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025-2030 (USD MILLION)

- TABLE 224 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 225 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 226 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 227 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 228 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 229 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 230 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 231 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 232 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 233 UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 234 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 235 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 236 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 237 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 238 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 239 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 240 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 241 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 242 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 243 SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 244 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 245 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 246 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 247 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 248 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 249 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 250 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 251 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 252 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 253 ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 254 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 255 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 256 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 257 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 258 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 259 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 260 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 261 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 262 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 263 TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 264 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 265 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 266 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 267 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 268 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 269 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 270 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 271 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 272 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 273 AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 274 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 275 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 277 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 278 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 279 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 280 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 281 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 282 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 283 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 284 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 285 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 286 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021-2024 (USD MILLION)

- TABLE 287 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025-2030 (USD MILLION)

- TABLE 288 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 289 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 290 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 291 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 292 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 293 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 294 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 295 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 296 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 297 BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 298 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 299 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 300 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 301 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 302 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 303 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 304 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 305 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 306 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 307 MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 308 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 309 MULTI-BEAM ECHO SOUNDER MARKET: DEGREE OF COMPETITION

- TABLE 310 REGION FOOTPRINT

- TABLE 311 DEPTH FOOTPRINT

- TABLE 312 END USER FOOTPRINT

- TABLE 313 PLATFORM FOOTPRINT

- TABLE 314 LIST OF START-UPS/SMES

- TABLE 315 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 316 MULTI-BEAM ECHO SOUNDER MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 317 MULTI-BEAM ECHO SOUNDER MARKET: DEALS, 2021-2025

- TABLE 318 MULTI-BEAM ECHO SOUNDER MARKET: OTHER DEVELOPMENTS, 2021-2025

- TABLE 319 KONGSBERG: COMPANY OVERVIEW

- TABLE 320 KONGSBERG: PRODUCTS OFFERED

- TABLE 321 KONGSBERG: PRODUCT LAUNCHES

- TABLE 322 KONGSBERG: OTHER DEVELOPMENTS

- TABLE 323 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 324 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 325 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 326 TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

- TABLE 327 NORBIT ASA: COMPANY OVERVIEW

- TABLE 328 NORBIT ASA: PRODUCTS OFFERED

- TABLE 329 NORBIT ASA: PRODUCT LAUNCHES

- TABLE 330 NORBIT ASA: DEALS

- TABLE 331 NORBIT ASA: OTHER DEVELOPMENTS

- TABLE 332 TRITECH TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 333 TRITECH TECHNOLOGIES LIMITED: PRODUCTS OFFERED

- TABLE 334 TRITECH TECHNOLOGIES LIMITED: PRODUCT LAUNCHES

- TABLE 335 TRITECH TECHNOLOGIES LIMITED: DEALS

- TABLE 336 TRITECH TECHNOLOGIES LIMITED: OTHER DEVELOPMENTS

- TABLE 337 R2SONIC LLC: COMPANY OVERVIEW

- TABLE 338 R2SONIC LLC: PRODUCTS OFFERED

- TABLE 339 R2SONIC LLC: OTHER DEVELOPMENTS

- TABLE 340 EXAIL: COMPANY OVERVIEW

- TABLE 341 EXAIL: PRODUCTS OFFERED

- TABLE 342 EXAIL: DEALS

- TABLE 343 EXAIL: OTHER DEVELOPMENTS

- TABLE 344 WASSP LIMITED: COMPANY OVERVIEW

- TABLE 345 WASSP LIMITED: PRODUCTS OFFERED

- TABLE 346 WASSP LIMITED: PRODUCT LAUNCHES

- TABLE 347 WASSP LIMITED: DEALS

- TABLE 348 IMAGENEX TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 349 IMAGENEX TECHNOLOGY CORPORATION: PRODUCTS OFFERED

- TABLE 350 FURUNO ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 351 FURUNO ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 352 COHORT PLC: COMPANY OVERVIEW

- TABLE 353 COHORT PLC: PRODUCTS OFFERED

- TABLE 354 COHORT PLC: DEALS

- TABLE 355 COHORT PLC: OTHER DEVELOPMENTS

- TABLE 356 BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 357 BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 358 BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 359 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 360 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: PRODUCTS OFFERED

- TABLE 361 HI-TARGET NAVIGATION TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 362 HI-TARGET NAVIGATION TECH CO., LTD.: PRODUCTS OFFERED

- TABLE 363 EDGETECH INC.: COMPANY OVERVIEW

- TABLE 364 EDGETECH INC.: PRODUCTS OFFERED

- TABLE 365 EDGETECH INC.: PRODUCT LAUNCHES

- TABLE 366 EDGETECH INC.: OTHER DEVELOPMENTS

- TABLE 367 PICOTECH LTD.: COMPANY OVERVIEW

- TABLE 368 PICOTECH LTD.: PRODUCTS OFFERED

- TABLE 369 PICOTECH LTD.: PRODUCT LAUNCHES

- TABLE 370 PICOTECH LTD.: DEALS

- TABLE 371 NANJING VASTSEA-TECH MARINE CO, LTD: COMPANY OVERVIEW

- TABLE 372 SEAFLOOR SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 373 GEOACOUSTIC LTD.: COMPANY OVERVIEW

- TABLE 374 R3VOX INC.: COMPANY OVERVIEW

- TABLE 375 BAYWEI SONAR: COMPANY OVERVIEW

- TABLE 376 SATLAB GEOSOLUTIONS: COMPANY OVERVIEW

- TABLE 377 WATER LINKED: COMPANY OVERVIEW

- TABLE 378 BEIJING LCOCEAN: COMPANY OVERVIEW

- TABLE 379 CERULEAN SONAR: COMPANY OVERVIEW

- TABLE 380 ITER SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MULTI-BEAM ECHO SOUNDER MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 HYDROGRAPHIC AGENCIES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 8 SEABED MAPPING TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 9 SHALLOW TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 EUROPE TO ACCOUNT FOR HIGHEST SHARE IN 2025

- FIGURE 11 REGULATORY EMPHASIS ON DETAILED HYDROGRAPHIC DATA TO DRIVE MARKET

- FIGURE 12 SURFACE VESSELS TO BE LARGER THAN UNDERWATER VESSELS DURING FORECAST PERIOD

- FIGURE 13 SHALLOW SEGMENT TO BE LARGER DURING FORECAST PERIOD

- FIGURE 14 NORWAY TO EXHIBIT FASTEST GROWTH IN 2025

- FIGURE 15 MULTI-BEAM ECHO SOUNDER MARKET DYNAMICS

- FIGURE 16 GLOBAL FLEET SIZE, BY VESSEL TYPE, 2023 VS. 2024

- FIGURE 17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 IMPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 24 TOTAL COST OF OWNERSHIP FOR MULTI-BEAM ECHO SOUNDERS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 26 BUSINESS MODELS IN MULTI-BEAM ECHO SOUNDER MARKET

- FIGURE 27 EVOLUTION OF MULTI-BEAM ECHO SOUNDER TECHNOLOGY

- FIGURE 28 TECHNOLOGY ROADMAP

- FIGURE 29 IMPACT OF AI/GEN AI ON MULTI-BEAM ECHO SOUNDER MARKET

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- FIGURE 31 PATENT ANALYSIS

- FIGURE 32 MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 33 MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025 VS. 2030 (USD MILLION)

- FIGURE 34 MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 36 MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 37 MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 MULTI-BEAM ECHO SOUNDER MARKET, BY REGION

- FIGURE 39 NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

- FIGURE 40 EUROPE: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

- FIGURE 43 LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 46 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 COMPANY FOOTPRINT

- FIGURE 48 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 FINANCIAL METRICS (EV/EBIDTA)

- FIGURE 51 COMPANY VALUATION (USD BILLION)

- FIGURE 52 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 53 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 54 NORBIT ASA: COMPANY SNAPSHOT

- FIGURE 55 EXAIL: COMPANY SNAPSHOT

- FIGURE 56 FURUNO ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 COHORT PLC: COMPANY SNAPSHOT

- FIGURE 58 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY SNAPSHOT

- FIGURE 59 HI-TARGET NAVIGATION TECH CO., LTD.: COMPANY SNAPSHOT