|

市场调查报告书

商品编码

1801774

全球自动固定无损检测系统市场:线上系统类型、超音波检测 (UT)、相位阵列超音波检测 (PAUT)、涡流检测 (ECT)、冶金、铁路、石油和天然气以及航太- 预测(至 2030 年)Automated Stationary NDT & Inspection Systems Market by in-line System Type, Ultrasonic Testing (UT), Phased Array Ultrasonic Testing (PAUT), Eddy Current Testing (ECT), Metals & Metallurgy, Rail, Oil & Gas, Aerospace - Global Forecast to 2030 |

||||||

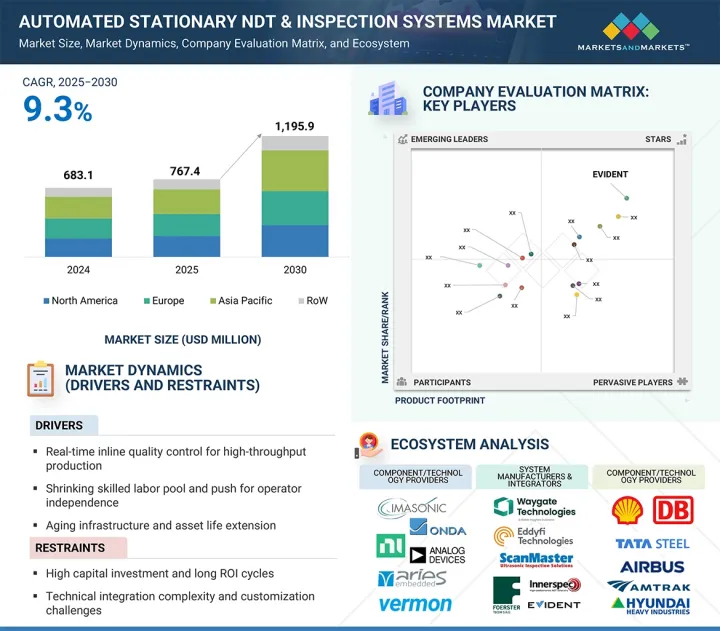

全球自动化固定无损检测系统市场预计将从 2025 年的 7.674 亿美元成长到 2030 年的 11.959 亿美元,复合年增长率为 9.3%。

这种成长主要得益于安全关键产业品管流程自动化程度的提高,其中,预测性维护、线上缺陷检测和数位检测平台的重视程度不断提高,加速了各行业的采用。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 100万美元 |

| 部分 | 系统类型、技术、产业 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

相控阵超音波检测 (PAUT)、多点雷射扫描 (MFLT) 和人工智慧 VT 系统等技术正在推动创新和性能提升,尤其是在石油天然气、铁路、航太和汽车等监管和营运要求严格的行业。向工业 4.0 的广泛转变以及数位双胞胎技术的使用也促进了市场发展。然而,高昂的前期投资要求、与旧有系统的复杂整合以及在成本敏感型和发展中地区的市场渗透率有限仍然是关键挑战。此外,监管机构对新型无损检测技术的适应缓慢,可能会减缓其在公共基础设施和能源计划中的推广应用。

“到2025年,石油和天然气行业将占据自动化固定无损检测系统市场的第二大份额。”

受防止洩漏、溢漏和意外停机需求的驱动,石油天然气产业持续成为自动化、固定式、无损检测系统的重要应用领域。北美和中东等地区法规结构趋于严格,迫使企业实施更一致的自动化检测程序。诸如相控阵超音波检测 (PAUT)、多点雷射扫描 (MFLT) 和电离辐射 (ECT) 等技术正在中下游业务中整合,以检测早期腐蚀、裂缝和焊接缺陷,从而确保提高可靠性并降低维护成本。

「在超音波检测 (UT) 技术中,相位阵列超音波检测 (PAUT) 将因缺陷检测的增强和在高精度行业的应用日益普及而实现快速增长。”

相位阵列超音波检测 (PAUT) 凭藉其在检测复杂缺陷方面的卓越精度以及生成精细影像的能力,已成为超音波检测技术领域中成长最快的领域。航太、石油天然气和汽车等行业正越来越多地采用 PAUT 来检测关键焊接并评估高精度零件。与自动化和数位平台的兼容性进一步提高了线上检测流程的效率。该技术对各种材料和几何形状的适应性进一步增强了其在工业领域的吸引力。

“由于强大的行业基础、监管力度和早期的技术采用,北美将在自动固定无损检测系统市场占有率。”

在成熟的製造业和能源产业的推动下,北美预计将占据自动化固定式无损检测系统市场的主要份额。该地区受益于严格的监管合规要求,这些要求要求石油天然气、航太和汽车等行业采用先进的无损检测实践。此外,主要技术提供者的存在以及自动化和基于人工智慧的检测工具的早期采用进一步巩固了该地区的地位。基础设施升级投资的不断增长也促进了持续的需求。

本报告分析了全球自动化固定无损检测系统市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 自动固定式无损检测系统市场为企业带来诱人机会

- 自动固定式无损检测系统超音波检测(UT)技术市场(按类型)

- 各地区超音波检测(UT)自动固定式无损检测系统市场

- 各国自动固定式无损检测系统市场

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 供应链分析

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 大型会议和活动(2025-2026年)

- 案例研究分析

- NDT GLOBAL 透过 UMP+ 支援管道营运商,提供深度识别精度

- INSPECTION INNERSPEC TECHNOLOGIES INC. 推出创新无损检测技术,用于检测和监控螺栓在运作中的负荷

- NDT GLOBAL 利用先进的超音波裂纹检测技术革新 NGL 管道检测

- 监管格局

- 波特五力分析

- 主要相关利益者和采购标准

- 人工智慧/产生人工智慧对自动固定无损检测系统市场的影响

- 介绍

- 在自动化固定式无损检测系统中利用生成式人工智慧

- 人工智慧/产生人工智慧对自动固定无损检测系统市场的影响

6. 自动固定无损检测系统市场(依系统类型)

- 介绍

- 排队

- 离线

7. 自动固定无损检测系统市场(按技术)

- 介绍

- 超音波检测(UT)

- 相位阵列超音波检测(UT)

- 其他超音波检测 (UT) 类型

- 涡流检测(ECT)

- 涡流阵列检测(ECAT)

- 脉衝涡流检测(PECT)

- 其他涡流检测(ECT)类型

- 漏磁检测(MFLT)

- 目视检查(VT)

- 其他技术

第 8 章:自动固定无损检测系统市场(依产业垂直划分)

- 介绍

- 石油和天然气

- 铁路

- 金属/冶金学

- 航太

- 其他行业

9. 自动固定无损检测系统市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济展望

- 南美洲

- 中东和非洲

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势(2022-2025)

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 品牌/产品比较

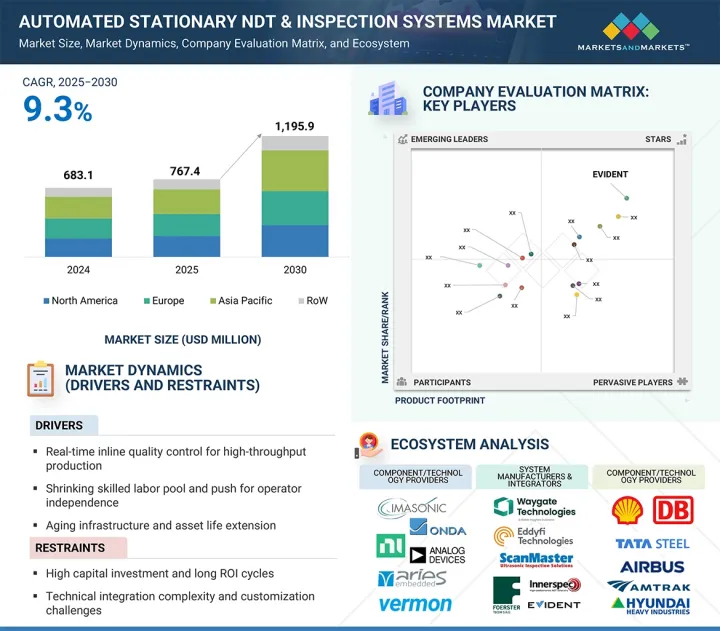

- 企业评估矩阵:主要企业(2024年)

- 竞争场景

第十一章 公司简介

- 主要企业

- EVIDENT

- BAKER HUGHES COMPANY

- EDDYFI

- FOERSTER HOLDING GMBH

- SCANMASTER

- MAGNETIC ANALYSIS CORPORATION

- INNERSPEC TECHNOLOGIES INC.

- NORDINKRAFT AG

- KARL DEUTSCH

- CMS

- OKONDT GROUP

- ROHMANN GMBH

- STRUCTURAL DIAGNOSTICS INC.

- NDTT

- TECSCAN SYSTEMS

- 其他公司

- SONOTEC GMBH

- EKOSCAN

- SG NDT

- MISTRAS EUROSONIC

- ARCADIA AEROSPACE INDUSTRIES

第十二章 附录

The global automated stationary NDT & inspection systems market is estimated to grow from USD 767.4 million in 2025 to USD 1,195.9 million by 2030, reflecting a strong CAGR of 9.3%. This growth is primarily fueled by increasing automation in quality control processes across safety-critical industries. A growing emphasis on predictive maintenance, in-line defect detection, and digital inspection platforms is accelerating adoption across verticals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By system type, technology, and vertical |

| Regions covered | North America, Europe, APAC, RoW |

Technologies such as PAUT, MFLT, and AI-enabled VT systems are driving innovation and performance, particularly in sectors like oil & gas, rail, aerospace, and automotive, where regulatory and operational demands are high. The broader transition to Industry 4.0 and the use of digital twin technologies are also contributing to the market's momentum. However, high upfront capital requirements, integration complexity with legacy systems, and limited market penetration in cost-sensitive or developing regions pose key challenges. Additionally, slower regulatory adaptation to new NDT technologies may delay implementation in public infrastructure and energy projects.

"Oil & gas vertical to account for second-largest share in automated stationary NDT & inspection systems market by 2025"

The oil & gas sector remains a key adopter of automated stationary NDT systems as operators face growing pressure to prevent leaks, spills, and unplanned shutdowns. Stringent regulatory frameworks across regions such as North America and the Middle East push companies to implement more consistent and automated inspection routines. Technologies such as PAUT, MFLT, and ECT are being integrated across midstream and downstream operations to detect early-stage corrosion, cracks, and weld defects, ensuring improved reliability and reduced maintenance costs.

"Within the ultrasonic testing (UT) technology, phased array ultrasonic testing (PAUT) to witness fastest growth due to enhanced defect detection and rising adoption in high-precision industries"

Phased Array Ultrasonic Testing (PAUT) is emerging as the fastest-growing segment within the UT technology space, owing to its superior accuracy in detecting complex defects and its ability to generate detailed imaging. Industries such as aerospace, oil & gas, and automotive increasingly adopt PAUT for critical weld inspections and high-precision component evaluations. Its compatibility with automation and digital platforms further enhances efficiency in in-line inspection processes. The technology's adaptability to diverse materials and geometries strengthens its industrial appeal.

"North America to account for a significant market share in automated stationary NDT & inspection systems, driven by strong industrial base, regulatory enforcement, and early technology adoption"

North America is expected to maintain a significant share in the automated stationary NDT & inspection systems market, supported by its mature manufacturing and energy sectors. The region benefits from stringent regulatory compliance requirements in industries such as oil & gas, aerospace, and automotive, which mandate advanced NDT practices. Additionally, the presence of leading technology providers and early adoption of automation and AI-based inspection tools further strengthen its position. Growing investments in infrastructure renewal also contribute to sustained demand.

Breakdown of primaries

A variety of executives from key organizations operating in the automated stationary NDT & inspection systems market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 26%, Tier 2 - 32%, and Tier 3 - 42%

- By Designation: C-level Executives - 52%, Directors - 25%, and Others - 23%

- By Region: North America - 44%, Europe - 27%, Asia Pacific - 20%, and RoW - 9%

The automated stationary NDT & inspection systems market is dominated by globally established players such as Evident (Japan), Waygate Technologies (US), Zetec (US), Eddyfi (Canada), FOERSTER (Germany), OKOndt Group (Ukraine), MME Group (Netherlands), Magnetic Analysis Corporation (US), Phoenix Inspection Systems Ltd (Australia), Karl Deutsch (Germany), Nordinkraft AG (Germany), Innerspec Technologies (US), ScanMaster (Israel), CMS (Controle Mesure Systems) (France), and Rohmann GmbH (Germany). The study includes an in-depth competitive analysis of these key players in the automated stationary NDT & inspection systems market, along with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the automated stationary NDT & inspection systems market and forecasts its size by system type, technology, vertical, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. A supply chain analysis has been included in the report, along with the key players and their competitive analysis of the automated stationary NDT & inspection system ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (real-time in-line quality control for high-throughput production; compliance with evolving global safety and inspection standards; shrinking skilled labor pool and push for operator independence; aging infrastructure and asset life extension), restraints (high capital investment and long ROI cycles; technical integration complexity and customization challenges), opportunities (growth of modular, multi-technology inspection platforms; expanding adoption in emerging economies with new manufacturing hubs; integration of AI and machine learning for automated defect recognition), and challenge (lack of standardization across technologies and deployment environments; limited availability of field-proven use cases and skilled integration experts) influencing the growth of the automated stationary NDT & inspection systems market

- Product/Solution/Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product/solution/service launches in the automated stationary NDT & inspection systems market

- Market Development: Comprehensive information about lucrative markets; the report analyses the automated stationary NDT & inspection systems market across varied regions

- Market Diversification: Exhaustive information about new solutions/services, untapped geographies, recent developments, and investments in the automated stationary NDT & inspection systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as EVIDENT, Waygate Technologies, Zetec, Inc., Eddyfi, FOERSTER, OKOndt Group, MME Group, Magnetic Analysis Corporation, among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

- 4.2 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET FOR ULTRASONIC TESTING (UT) TECHNOLOGY, BY TYPE

- 4.3 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET FOR ULTRASONIC TESTING (UT), BY REGION

- 4.4 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of real-time, inline automated stationary NDT systems

- 5.2.1.2 Compliance with evolving global safety and inspection standards

- 5.2.1.3 Shrinking skilled labor pool

- 5.2.1.4 Deteriorating industrial and civil infrastructure

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments and long ROI cycles

- 5.2.2.2 Integration-related complexities associated with existing infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Evolution of modular and multi-technology inspection platforms

- 5.2.3.2 Rapid industrialization and infrastructure growth across emerging economies

- 5.2.3.3 Integration of AI and ML for automated defect recognition

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited availability of field-proven use cases and integration expertise

- 5.2.4.2 Absence of standardized protocols and interfaces

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Ultrasonic testing (UT)

- 5.6.1.2 Eddy current testing (ECT) and array technique

- 5.6.1.3 Automated visual testing (VT) using machine vision and AI

- 5.6.1.4 Magnetic flux leakage testing (MFLT)

- 5.6.1.5 Laser-based NDT

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Robotic automation and handling systems

- 5.6.2.2 AI and ML

- 5.6.2.3 Edge computing and IIoT

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Acoustic emission testing (AET)

- 5.6.3.2 Electromagnetic acoustic transducers (EMAT)

- 5.6.3.3 Automated resonance testing

- 5.6.1 KEY TECHNOLOGIES

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 NDT GLOBAL ASSISTS PIPELINE OPERATOR WITH UMP+ THAT OFFERS ACCURACY IN DEPTH IDENTIFICATION

- 5.8.2 INSPECTION INNERSPEC TECHNOLOGIES INC. INTRODUCES INNOVATIVE NDT TECHNOLOGIES FOR INSPECTION AND MONITORING OF BOLT LOAD IN SERVICE

- 5.8.3 NDT GLOBAL REVOLUTIONIZES NGL PIPELINE INSPECTION WITH ADVANCED ULTRASONIC CRACK DETECTION TECHNOLOGY

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 THREAT OF NEW ENTRANTS

- 5.10.3 THREAT OF SUBSTITUTES

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 BARGAINING POWER OF SUPPLIERS

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 IMPACT OF AI/GEN AI ON AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 USE OF GEN AI IN AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS

- 5.12.3 IMPACT OF AI/GEN AI ON AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

6 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY SYSTEM TYPE

- 6.1 INTRODUCTION

- 6.2 INLINE

- 6.2.1 INCREASING DEMAND FOR REAL-TIME DEFECT DETECTION TO SUPPORT MARKET GROWTH

- 6.3 OFFLINE

- 6.3.1 RISING DEMAND FOR HIGH-RESOLUTION AND COMPREHENSIVE INSPECTION TO DRIVE MARKET

7 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 ULTRASONIC TESTING (UT)

- 7.2.1 PHASED ARRAY ULTRASONIC TESTING (PAUT)

- 7.2.1.1 Adoption of AI-driven signal interpretation and cloud-connected analytics to offer lucrative growth opportunities

- 7.2.2 OTHER ULTRASONIC TESTING (UT) TYPES

- 7.2.1 PHASED ARRAY ULTRASONIC TESTING (PAUT)

- 7.3 EDDY CURRENT TESTING (ECT)

- 7.3.1 EDDY CURRENT ARRAY TESTING (ECAT)

- 7.3.1.1 Ability to combine high inspection speed with digital accuracy to boost demand

- 7.3.2 PULSED EDDY CURRENT TESTING (PECT)

- 7.3.2.1 Growing application to detect corrosion and wall loss in conductive materials to fuel market growth

- 7.3.3 OTHER EDDY CURRENT TESTING (ECT) TYPES

- 7.3.1 EDDY CURRENT ARRAY TESTING (ECAT)

- 7.4 MAGNETIC FLUX LEAKAGE TESTING (MFLT)

- 7.4.1 INTEGRATION OF CLOUD PLATFORMS AND DIGITAL TWINS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.5 VISUAL TESTING (VT)

- 7.5.1 RISING APPLICATION FOR WELD SEAM INSPECTION FOR AUTOMOTIVE AND AEROSPACE STRUCTURES TO BOOST DEMAND

- 7.6 OTHER TECHNOLOGIES

8 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.2 OIL & GAS

- 8.2.1 DEPLOYMENT OF ADVANCED TECHNOLOGIES TO ASSESS CUI TO FOSTER MARKET GROWTH

- 8.3 RAILWAY

- 8.3.1 SHIFT FROM REACTIVE MAINTENANCE TO DATA-DRIVEN ASSET MANAGEMENT TO DRIVE MARKET

- 8.4 METALS & METALLURGY

- 8.4.1 GROWING APPLICATION OF DIGITALIZATION IN METALS PRODUCTION TO SUPPORT MARKET GROWTH

- 8.5 AEROSPACE

- 8.5.1 RISING APPLICATIONS FOR DETECTING DELAMINATIONS, POROSITY, AND DISBONDS TO FUEL MARKET GROWTH

- 8.6 OTHER VERTICALS

9 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Pressing need for high-resolution, repeatable, and non-contact inspection of mission-critical components to boost demand

- 9.2.3 CANADA

- 9.2.3.1 Favorable regulatory landscape to foster market growth

- 9.2.4 MEXICO

- 9.2.4.1 Growing adoption of Industry 4.0 principles to fuel market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising production complexities and tightening regulatory requirements to boost demand

- 9.3.3 UK

- 9.3.3.1 Increasing pressure for enhanced monitoring of aging infrastructure to foster market growth

- 9.3.4 FRANCE

- 9.3.4.1 Environmental pressures to maintain energy security to support market growth

- 9.3.5 ITALY

- 9.3.5.1 Growing emphasis on modernizing national infrastructure to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Ongoing industrialization and infrastructure development to fuel market growth

- 9.4.3 JAPAN

- 9.4.3.1 Rising emphasis on technological modernization in public and industrial asset management to offer lucrative growth opportunities

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Thriving automotive, semiconductor, and electronics manufacturing sectors to foster market growth

- 9.4.5 INDIA

- 9.4.5.1 Increasing emphasis on smart manufacturing and Industry 4.0 integration to boost demand

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Ongoing expansion of large-scale mining operations to boost demand

- 9.5.3 MIDDLE EAST & AFRICA

- 9.5.3.1 Growing deployment of advanced techniques to support market growth

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES /RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 System type footprint

- 10.7.5.4 Technology footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPETITIVE SCENARIOS

- 10.8.1 PRODUCT LAUNCHES

- 10.8.2 DEALS

- 10.8.3 EXPANSIONS

- 10.8.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 EVIDENT

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 BAKER HUGHES COMPANY

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 EDDYFI

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 FOERSTER HOLDING GMBH

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 SCANMASTER

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 MAGNETIC ANALYSIS CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.7 INNERSPEC TECHNOLOGIES INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 NORDINKRAFT AG

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 KARL DEUTSCH

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.9.3.2 Other developments

- 11.1.10 CMS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.11 OKONDT GROUP

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 ROHMANN GMBH

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.13 STRUCTURAL DIAGNOSTICS INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.14 NDTT

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.15 TECSCAN SYSTEMS

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.1 EVIDENT

- 11.2 OTHER PLAYERS

- 11.2.1 SONOTEC GMBH

- 11.2.2 EKOSCAN

- 11.2.3 SG NDT

- 11.2.4 MISTRAS EUROSONIC

- 11.2.5 ARCADIA AEROSPACE INDUSTRIES

12 APPENDIX

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 RISK FACTOR ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN AUTOMATED STATIONARY NDT & INSPECTION SYSTEM ECOSYSTEM

- TABLE 4 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 5 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: REGULATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL (%)

- TABLE 12 KEY BUYING CRITERIA, BY VERTICAL

- TABLE 13 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 14 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 15 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 16 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 17 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (UNIT)

- TABLE 18 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (UNIT)

- TABLE 19 ULTRASONIC TESTING (UT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 20 ULTRASONIC TESTING (UT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 21 ULTRASONIC TESTING (UT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 22 ULTRASONIC TESTING (UT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 ULTRASONIC TESTING (UT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 ULTRASONIC TESTING (UT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 EDDY CURRENT TESTING (ECT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 26 EDDY CURRENT TESTING (ECT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 27 EDDY CURRENT TESTING (ECT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 EDDY CURRENT TESTING (ECT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 EDDY CURRENT TESTING (ECT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 EDDY CURRENT TESTING (ECT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 MAGNETIC FLUX LEAKAGE TESTING (MFLT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 32 MAGNETIC FLUX LEAKAGE TESTING (MFLT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 33 MAGNETIC FLUX LEAKAGE TESTING (MFLT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 MAGNETIC FLUX LEAKAGE TESTING (MFLT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 35 VISUAL TESTING (VT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 36 VISUAL TESTING (VT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 37 VISUAL TESTING (VT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 VISUAL TESTING (VT): AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 OTHER TECHNOLOGIES: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 40 OTHER TECHNOLOGIES: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 41 OTHER TECHNOLOGIES: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 OTHER TECHNOLOGIES: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 44 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 45 OIL & GAS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 OIL & GAS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 OIL & GAS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 OIL & GAS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 RAILWAY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 50 RAILWAY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 51 RAILWAY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 RAILWAY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 METALS & METALLURGY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 54 METALS & METALLURGY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 55 METALS & METALLURGY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 METALS & METALLURGY: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 AEROSPACE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 58 AEROSPACE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 59 AEROSPACE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 AEROSPACE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 OTHER VERTICALS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 62 OTHER VERTICALS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 63 OTHER VERTICALS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 OTHER VERTICALS: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 ROW: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 86 ROW: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 87 ROW: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 88 ROW: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 89 ROW: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 ROW: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2022-JULY 2025

- TABLE 92 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 93 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 94 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 95 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 96 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: VERTICAL FOOTPRINT

- TABLE 97 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 98 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 99 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 100 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 101 EVIDENT: COMPANY OVERVIEW

- TABLE 102 EVIDENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 103 EVIDENT: DEALS

- TABLE 104 EVIDENT: OTHER DEVELOPMENTS

- TABLE 105 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 106 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 107 BAKER HUGHES COMPANY: PRODUCT LAUNCHES

- TABLE 108 BAKER HUGHES COMPANY: DEALS

- TABLE 109 BAKER HUGHES COMPANY: OTHER DEVELOPMENTS

- TABLE 110 EDDYFI: COMPANY OVERVIEW

- TABLE 111 EDDYFI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 EDDYFI: PRODUCT LAUNCHES

- TABLE 113 EDDYFI: DEALS

- TABLE 114 FOERSTER HOLDING GMBH: COMPANY OVERVIEW

- TABLE 115 FOERSTER HOLDING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 SCANMASTER: COMPANY OVERVIEW

- TABLE 117 SCANMASTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 SCANMASTER: DEALS

- TABLE 119 MAGNETIC ANALYSIS CORPORATION: COMPANY OVERVIEW

- TABLE 120 MAGNETIC ANALYSIS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 INNERSPEC TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 122 INNERSPEC TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 INNERSPEC TECHNOLOGIES INC.: DEALS

- TABLE 124 NORDINKRAFT AG: COMPANY OVERVIEW

- TABLE 125 NORDINKRAFT AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 KARL DEUTSCH: COMPANY OVERVIEW

- TABLE 127 KARL DEUTSCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 KARL DEUTSCH: EXPANSIONS

- TABLE 129 KARL DEUTSCH: OTHER DEVELOPMENTS

- TABLE 130 CMS: COMPANY OVERVIEW

- TABLE 131 CMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 OKONDT GROUP: COMPANY OVERVIEW

- TABLE 133 OKONDT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 ROHMANN GMBH: COMPANY OVERVIEW

- TABLE 135 ROHMANN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 STRUCTURAL DIAGNOSTICS INC.: COMPANY OVERVIEW

- TABLE 137 STRUCTURAL DIAGNOSTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 NDTT: COMPANY OVERVIEW

- TABLE 139 NDTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 TECSCAN SYSTEMS: COMPANY OVERVIEW

- TABLE 141 TECSCAN SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY SYSTEM PROVIDERS IN AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS ECOSYSTEM

- FIGURE 4 APPROACH 2 (DEMAND SIDE): MARKET ESTIMATION BASED ON REGION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, 2021-2030 (USD MILLION)

- FIGURE 9 INLINE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 EDDY CURRENT TESTING (ECT) SEGMENT TO EXPAND AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 METALS & METALLURGY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 ASIA PACIFIC TO DOMINATE MARKET IN 2025

- FIGURE 13 RISING DEMAND FOR PREDICTIVE MAINTENANCE AND ASSET LIFECYCLE MANAGEMENT TO BOOST DEMAND

- FIGURE 14 PHASED ARRAY ULTRASONIC TESTING (PAUT) TO RECORD HIGHEST CAGR FORECAST PERIOD

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 CHINA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 17 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS OF DRIVERS ON AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

- FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS ON AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

- FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES ON AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

- FIGURE 21 IMPACT OF CHALLENGES ON AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS ECOSYSTEM ANALYSIS

- FIGURE 25 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- FIGURE 27 KEY BUYING CRITERIA, BY VERTICAL

- FIGURE 28 ADOPTION OF GEN AI IN AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS

- FIGURE 29 INLINE SYSTEM SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 ULTRASONIC TESTING (UT) SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 32 EUROPE TO DOMINATE MARKET IN 2025

- FIGURE 33 AEROSPACE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA TO DOMINATE MARKET IN 2025

- FIGURE 35 ASIA PACIFIC TO SECURE LARGEST MARKET SHARE IN 2025

- FIGURE 36 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 38 NORTH AMERICA: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 39 EUROPE: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, 2020-2024

- FIGURE 42 MARKET SHARE ANALYSIS OF AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET, 2024

- FIGURE 43 COMPANY VALUATION, 2025

- FIGURE 44 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 45 BRAND/PRODUCT COMPARISON

- FIGURE 46 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 AUTOMATED STATIONARY NDT & INSPECTION SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 48 BAKER HUGHES COMPANY: COMPANY SNAPSHOT