|

市场调查报告书

商品编码

1802917

全球精准水产养殖市场(按产品、系统类型、应用、养殖场类型和地区划分)- 预测至 2030 年Precision Aquaculture Market By Offering (Sensors, Camera Systems, Control Systems, Software, Services), By System type, By Application, By Farm type and Region - Global Forecast to 2030 |

||||||

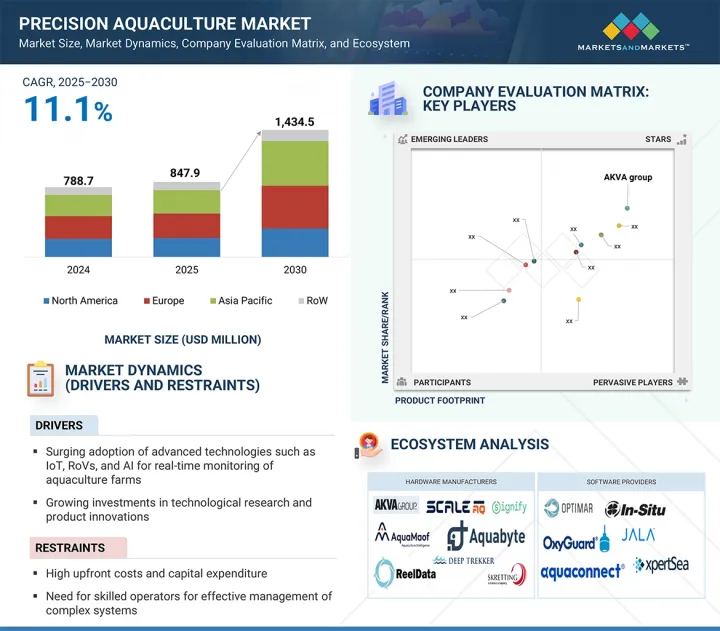

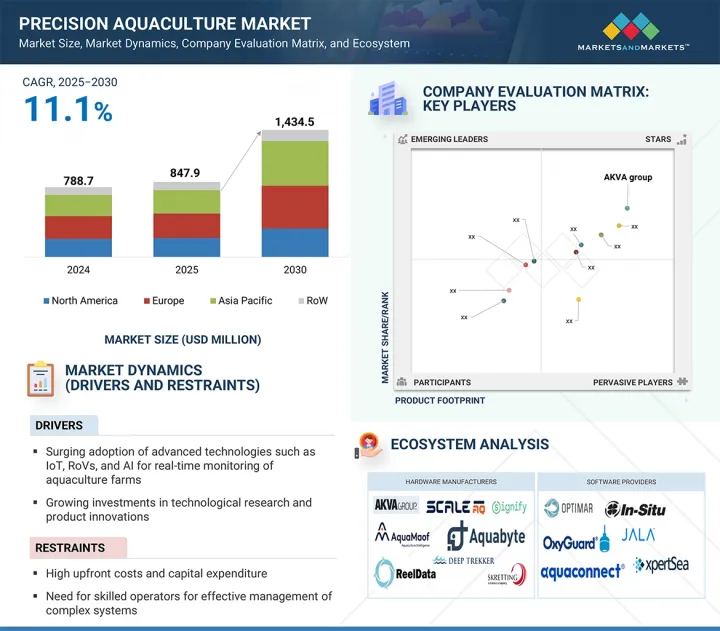

全球精准水产养殖市场预计将从 2025 年的 8.479 亿美元成长到 2030 年的 14.345 亿美元,预测期内的复合年增长率为 11.1%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 产品、系统类型、用途、农场类型、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

在现代水产养殖中,维持鱼类健康对于确保高产量和最大程度地减少经济损失至关重要。精准水产养殖工具,例如水下摄影机、环境感测器和人工智慧分析,使水产养殖户能够即时监测鱼类健康的行为和生理指标。这些技术有助于及早发现压力、疾病症状和海蝨等寄生虫威胁,从而在感染永续之前及时干预。这种预防方法减少了对抗生素和化学治疗的依赖,支持无抗生素生产,提高了存活率,并确保遵守日益严格的动物福利和食品安全法规。随着消费者对永续养殖水产品的需求不断增长,精准的健康监测正成为负责任且盈利的水产养殖营运的基石。

“监控和监视应用将在2024年占据最大的市场占有率。”

由于监测和监视应用在确保营运效率、环境合规性和鱼类健康管理方面发挥重要作用,因此将在2024年占据最大的市场占有率。随着水产养殖作业日益采用资料驱动的方式,即时监测水质、溶氧、水温和鱼类行为等关键参数已成为预防疾病爆发、优化餵食和降低死亡率的关键。对可追溯和永续水产品生产日益增长的需求,加上主要水产养殖区严格的法规结构,进一步加速了综合监测系统的部署。这些解决方案不仅增强了决策能力和资源最佳化,还减少了对劳动力的依赖,使监测和监视成为现代水产养殖环境的核心应用。

“预计在预测期内,软体领域将实现最高的复合年增长率。”

在精准水产养殖市场中,软体领域预计将在预测期内实现最高的复合年增长率,这得益于水产养殖业对高级分析、自动化和即时决策支援工具日益增长的需求。随着养殖场规模扩大并采用更复杂的系统,软体平台能够无缝整合来自感测器、餵料器和摄影机等各种硬体组件的数据,从而实现精准控制、预测性维护和性能优化。为了提高饲料效率、鱼类健康和营运透明度,人们对云端基础的养殖场管理、远端监控和人工智慧驱动的洞察的需求日益增长,这进一步加速了软体的采用。此外,对永续性、法规遵循和可追溯性的日益关注,促使水产养殖户投资于强大的数位平台,这使得软体领域成为智慧化和可扩展水产养殖解决方案的关键成功因素。

“预计在预测期内,美国将引领北美精准水产养殖市场的成长。”

美国预计将在预测期内引领北美精准水产养殖市场的成长,这得益于其高度重视技术创新、加大对永续水产养殖方法的投资力度,以及拥有支持高科技水产养殖系统的先进基础设施。旨在扩大国内水产品产量并减少对进口依赖的联邦倡议,正在推动全国水产养殖业的现代化。此外,美国公司在开发精准工具(例如自动投餵系统、即时监控平台和基于人工智慧的分析)方面处于领先地位,这些工具正越来越多地被商业养鱼场采用。对可追溯优质鱼贝类日益增长的需求以及支持性法规结构,进一步巩固了美国在采用精准水产养殖解决方案方面的领先地位。

本报告研究了全球精准水产养殖市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 精准水产养殖市场为企业带来诱人机会

- 精准水产养殖市场(依应用)

- 精准水产养殖市场(依农场类型)

- 精准水产养殖市场(按地区)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 价值链分析

- 影响客户业务的趋势/中断

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 定价分析

- 主要企业感测器平均售价(按类型)(2024年)

- 各地区精准水产养殖感测器平均售价趋势(2021-2024)

- 案例研究分析

- INNOVASEA协助OPEN BLUE成为全球最大的开放海洋水产养殖场

- INNOVASEA 助力 EARTH OCEAN FARMS 扩大生产

- AKVA GROUP 的专业知识和快速反应服务帮助 ERKO SEAFOOD 扩大其鲑鱼养殖场

- 专利分析

- 贸易分析

- 进口情形(HS 编码 9026)

- 出口情形(HS 编码 9026)

- 波特五力分析

- 关税和监管格局

- 海关分析

- 监管机构、政府机构和其他组织

- 大型会议和活动(2025-2026年)

- 生成式人工智慧/人工智慧对精准水产养殖市场的影响

- 2025年美国关税的影响—概述

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对使用的影响

第六章 精准水产养殖市场(依产品)

- 介绍

- 硬体

- 感应器

- 网路摄影系统

- 控制系统

- 其他硬体类型

- 软体

- 云端基础

- 本地

- 服务

- 系统整合与部署

- 咨询

- 资料分析

- 支援和维护

7. 精准水产养殖市场(依系统类型)

- 介绍

- 智慧餵料系统

- 监控系统

- 水下ROV系统

- 其他系统类型

第八章精准水产养殖市场(依应用)

- 介绍

- 饲餵优化

- 监控

- 产量分析与测量

- 其他用途

9. 精准水产养殖市场(依养殖场型)

- 介绍

- 户外养鱼场

- 池塘基座

- 笼底

- RAS 农场

第十章 精准水产养殖市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 挪威

- 西班牙

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 东南亚

- 日本

- 韩国

- 印度

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济展望

- 南美洲

- 中东

- 非洲

第十一章竞争格局

- 概述

- 主要参与企业的策略/优势(2021-2025)

- 收益分析(2022-2024)

- 市场占有率分析(2024年)

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十二章:公司简介

- 介绍

- 主要企业

- AKVA GROUP

- SCALEAQ

- SKRETTING (ERUVAKA TECHNOLOGIES)

- INNOVASEA SYSTEMS INC.

- AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

- AQUABYTE

- SIGNIFY HOLDING

- REELDATA

- DEEP TREKKER INC.

- AQUACARE ENVIRONMENT, INC.

- 其他公司

- IMENCO AQUA AS

- OPTIMAR AS

- IN-SITU INC.

- OXYGUARD

- PT JALA AKUAKULTUR LESTARI ALAMKU

- AQUACONNECT

- SENSOREX

- PLANET LIGHTING

- MOLEAER INC.

- XPERTSEA

- FISHFARMFEEDER

- CAGEEYE

- AQUAMANAGER

- HUNAN RIKA ELECTRONIC TECH CO., LTD

- CHETU INC.

第十三章 附录

The global precision aquaculture market size is expected to grow from USD 847.9 million in 2025 to USD 1,434.5 million by 2030, at a CAGR of 11.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, system type, application, farm type, and region |

| Regions covered | North America, Europe, APAC, RoW |

In modern aquaculture, maintaining fish health is critical to ensure high productivity and minimize economic losses. Precision aquaculture tools such as underwater cameras, environmental sensors, and AI-driven analytics enable farmers to monitor behavioral and physiological indicators of fish health in real time. These technologies facilitate the early detection of stress, disease symptoms, and parasitic threats like sea lice, allowing for timely interventions before outbreaks escalate. This proactive approach reduces dependency on antibiotics and chemical treatments, thereby supporting antibiotic-free production, improving survival rates, and ensuring compliance with increasingly stringent animal welfare and food safety regulations. As consumer demand for sustainably raised seafood grows, precision health monitoring is becoming a cornerstone of responsible and profitable aquaculture operations.

"Monitoring and surveillance application accounted for the largest market share in 2024"

Due to its fundamental role in ensuring operational efficiency, environmental compliance, and fish health management, the monitoring and surveillance application holds the largest market share in 2024. As aquaculture operations increasingly adopt data-driven approaches, the need for real-time monitoring of key parameters such as water quality, dissolved oxygen, temperature, and fish behavior has become essential to prevent disease outbreaks, optimize feeding, and reduce mortality rates. The growing demand for traceable and sustainable seafood production, coupled with stringent regulatory frameworks in key aquaculture regions, has further accelerated the deployment of integrated surveillance systems. These solutions not only enhance decision-making and resource optimization but also reduce labor dependency, positioning monitoring and surveillance as a core application across modern aquafarming environments.

"The software segment is projected to register the highest CAGR during the forecast period"

The software segment is projected to register the highest CAGR during the forecast period in the precision aquaculture market, driven by the increasing demand for advanced analytics, automation, and real-time decision support tools across aquaculture operations. As farms scale and adopt more complex systems, software platforms enable seamless integration of data from various hardware components such as sensors, feeders, and cameras, allowing for precise control, predictive maintenance, and performance optimization. The rising need for cloud-based farm management, remote monitoring, and AI-driven insights to improve feed efficiency, fish health, and operational transparency further accelerates software adoption. Additionally, the growing emphasis on sustainability, regulatory compliance, and traceability is prompting aquafarmers to invest in robust digital platforms, positioning the software segment as a key enabler of intelligent and scalable aquaculture solutions.

"The US is estimated to lead growth in the North American precision aquaculture market during the forecast period"

The US is estimated to lead growth in the North American precision aquaculture market during the forecast period due to its strong focus on technological innovation, increasing investments in sustainable aquaculture practices, and the presence of advanced infrastructure supporting high-tech farming systems. Federal initiatives aimed at expanding domestic seafood production and reducing reliance on imports are driving the modernization of aquaculture operations across the country. Additionally, US-based companies are at the forefront of developing precision tools such as automated feeding systems, real-time monitoring platforms, and AI-based analytics, which are increasingly being adopted by commercial fish farms. The growing demand for traceable, high-quality seafood and supportive regulatory frameworks further reinforces the country's leadership in adopting precision aquaculture solutions.

Breakdown of Primaries

A variety of executives from key organizations operating in the precision aquaculture market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 15%, Tier 2 - 40%, and Tier 3 - 45%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 35%, Asia Pacific - 30%, Europe - 20%, and RoW - 15%

The precision aquaculture market is dominated by globally established players such as AKVA Group (Norway), ScaleAQ (Norway), Skretting (Norway), Innovasea Systems Inc. (US), AquaMaof Aquaculture Technologies Ltd. (Israel), Aquabyte (US), Signify Holding (Netherlands), ReelData (Canada), Deep Trekker Inc. (Canada), Aquacare Environment, Inc. (US), Imenco Aqua AS (Norway), Optimar AS (Norway), In-Situ, Inc. (US), OxyGuard (Denmark), PT JALA Akuakultur Lestari Alamku (Indonesia), AquaConnect (India), Sensorex (US), Planet Lighting (Australia), Moleaer Inc. (US), XpertSea (Canada), FishFarmFeeder (Spain), CageEye (Europe), AquaManager (Greece), Hunan Rika Electronic Tech Co., Ltd (China), and Chetu Inc. (US). The study includes an in-depth competitive analysis of these key players in the precision aquaculture market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the precision aquaculture market and forecasts its size by system type, offering, farm type, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. A value chain analysis has been included in the report, along with the key players and their competitive analysis of the precision aquaculture ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (surging adoption of advanced technologies such as IoT, ROVs, and AI for real-time monitoring of aquaculture farms), restraints (high upfront costs and capital expenditure), opportunities (unlocking inclusive growth through Farm-as-a-Service [FaaS] models), and challenge (lack of a common information management system platform in the aquaculture industry) influencing the growth of the precision aquaculture market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research, and development activities in the precision aquaculture market

- Market Development: Comprehensive information about lucrative markets-the report analyses the precision aquaculture market across varied regions

- Market Diversification: Exhaustive information about new hardware/systems/software/services, untapped geographies, recent developments, and investments in the precision aquaculture market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as AKVA Group (Norway), ScaleAQ (Norway), Skretting (Norway), Innovasea Systems Inc. (US), and Aquabyte (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (supply side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (demand side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION AQUACULTURE MARKET

- 4.2 PRECISION AQUACULTURE MARKET, BY APPLICATION

- 4.3 PRECISION AQUACULTURE MARKET, BY FARM TYPE

- 4.4 PRECISION AQUACULTURE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging adoption of advanced technologies to monitor aquaculture farms in real time

- 5.2.1.2 Growing investments in developing technologically advanced products

- 5.2.1.3 Elevating demand for protein-rich aqua food

- 5.2.1.4 Increasing government support for freshwater aquaculture production

- 5.2.1.5 Pressing need for proactive disease detection to reduce economic losses

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for high initial investment

- 5.2.2.2 Need for skilled operators for effective management of complex systems

- 5.2.2.3 Lack of technological awareness among aquaculture farmers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Escalating use of aquaculture monitoring and feed optimization devices in developing countries

- 5.2.3.2 Growing popularity of land-based recirculating aquaculture systems

- 5.2.3.3 Emergence of Farm-as-a-Service (FaaS) models

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns due to extensive aquaculture farming

- 5.2.4.2 Lack of common information management system platform in aquaculture industry

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Computer vision and imaging

- 5.6.1.2 AI and ML algorithms

- 5.6.1.3 IoT platforms

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Cloud computing and edge computing

- 5.6.2.2 Data dashboards and decision support system (DSS) platforms

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Robotics and drones

- 5.6.3.2 Digital twins

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF SENSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSORS, BY REGION, 2021-2024

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 INNOVASEA HELPS OPEN BLUE BECOME LARGEST OPEN OCEAN FISH FARM IN WORLD

- 5.8.2 INNOVASEA ENABLES EARTH OCEAN FARMS TO EXPAND PRODUCTION WITH RUGGED EVOLUTION PENS

- 5.8.3 AKVA GROUP'S EXPERTISE AND QUICK SERVICE HELP ERKO SEAFOOD TO EXPAND ITS SALMON FARM

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 9026)

- 5.10.2 EXPORT SCENARIO (HS CODE 9026)

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 IMPACT OF GEN AI/AI ON PRECISION AQUACULTURE MARKET

- 5.14.1 INTRODUCTION

- 5.15 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON APPLICATIONS

6 PRECISION AQUACULTURE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 SENSORS

- 6.2.1.1 Temperature & environmental monitoring sensors

- 6.2.1.1.1 Rising focus on improving yields and reducing feed costs to drive segmental growth

- 6.2.1.2 pH & dissolved oxygen sensors

- 6.2.1.2.1 Emphasis on optimizing fish health through oxygen and pH control to boost demand

- 6.2.1.3 EC sensors

- 6.2.1.3.1 Increasing use in recirculating aquaculture systems to foster segmental growth

- 6.2.1.4 Other sensor types

- 6.2.1.1 Temperature & environmental monitoring sensors

- 6.2.2 CAMERA SYSTEMS

- 6.2.2.1 Rising adoption of smart HD and 4K camera systems in aquaculture farms to fuel market growth

- 6.2.3 CONTROL SYSTEMS

- 6.2.3.1 Pressing need to harness real-time data for smarter, sustainable fish farming to facilitate adoption

- 6.2.4 OTHER HARDWARE TYPES

- 6.2.1 SENSORS

- 6.3 SOFTWARE

- 6.3.1 CLOUD-BASED

- 6.3.1.1 Greater flexibility, scalability, and affordability to elevate demand

- 6.3.2 ON-PREMISES

- 6.3.2.1 Reduction in operational costs through server reuse and hardware sharing to support segmental growth

- 6.3.1 CLOUD-BASED

- 6.4 SERVICES

- 6.4.1 SYSTEM INTEGRATION & DEPLOYMENT

- 6.4.1.1 Rising installation of hardware equipment and software platforms in cage-based and RAS aquaculture farms to augment demand

- 6.4.2 CONSULTING

- 6.4.2.1 Execution of high-cost aquaculture projects to contribute to segmental growth

- 6.4.3 DATA ANALYTICS

- 6.4.3.1 Increasing deployment of IoT devices on aquaculture farms to spur demand

- 6.4.4 SUPPORT & MAINTENANCE

- 6.4.4.1 Pressing need to troubleshoot software-related issues and prevent hardware failures to propel market

- 6.4.1 SYSTEM INTEGRATION & DEPLOYMENT

7 PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE

- 7.1 INTRODUCTION

- 7.2 SMART FEEDING SYSTEMS

- 7.2.1 RISING INCLINATION TOWARD DATA-DRIVEN FISH FEEDING TO INCREASE ADOPTION

- 7.3 MONITORING & CONTROL SYSTEMS

- 7.3.1 GREATER EMPHASIS ON EFFECTIVE MANAGEMENT OF AQUACULTURE FARMS TO DRIVE DEPLOYMENT

- 7.4 UNDERWATER ROV SYSTEMS

- 7.4.1 RISING ADOPTION OF NEXT-GENERATION ROVS TO ENHANCE DEEPWATER FARM INTELLIGENCE TO FUEL SEGMENTAL GROWTH

- 7.5 OTHER SYSTEM TYPES

8 PRECISION AQUACULTURE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FEED OPTIMIZATION

- 8.2.1 TRANSITION TOWARD SUSTAINABLE AND PERFORMANCE-DRIVEN FARMING PRACTICES TO ACCELERATE MARKET GROWTH

- 8.3 MONITORING & SURVEILLANCE

- 8.3.1 ELEVATING ADOPTION OF IOT AND REAL-TIME ANALYTICS FOR FISH HEALTH MANAGEMENT TO FACILITATE SEGMENTAL GROWTH

- 8.4 YIELD ANALYSIS & MEASUREMENT

- 8.4.1 INTEGRATION OF SENSOR-BASED MONITORING TO ENHANCE FARM PRODUCTIVITY TO PROPEL SEGMENTAL GROWTH

- 8.5 OTHER APPLICATIONS

9 PRECISION AQUACULTURE MARKET, BY FARM TYPE

- 9.1 INTRODUCTION

- 9.2 OPEN AQUACULTURE FARMS

- 9.2.1 POND-BASED

- 9.2.1.1 Stringent biosecurity norms to support segmental growth

- 9.2.2 CAGE-BASED

- 9.2.2.1 Scalability and cost-efficiency features to foster segmental growth

- 9.2.1 POND-BASED

- 9.3 RAS FARMS

- 9.3.1 HIGH OPERATIONAL EFFICIENCY AND LOW WATER USAGE TO BOOST SEGMENTAL GROWTH

10 PRECISION AQUACULTURE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising demand for high-quality, locally sourced seafood to drive market

- 10.2.3 CANADA

- 10.2.3.1 Concentration of majority of aquaculture farms in east and west coasts of country to contribute to market growth

- 10.2.4 MEXICO

- 10.2.4.1 Gradual tech-driven shift toward shrimp and tilapia farming to support market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 NORWAY

- 10.3.2.1 Escalating demand for Norwegian salmon to foster market growth

- 10.3.3 SPAIN

- 10.3.3.1 Early integration of precision technologies in shellfish and mussel farming to support market growth

- 10.3.4 UK

- 10.3.4.1 Increasing focus on sustainable high-yield aquaculture operations to create growth opportunities

- 10.3.5 FRANCE

- 10.3.5.1 High fishing fleet density to boost demand

- 10.3.6 ITALY

- 10.3.6.1 Increasing funding to improve aquaculture infrastructure to stimulate market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Leading aquatic production to accelerate market expansion

- 10.4.3 SOUTHEAST ASIA

- 10.4.3.1 Rising investment in aquatic startups to create lucrative growth opportunities

- 10.4.4 JAPAN

- 10.4.4.1 Greater emphasis on next-generation shrimp farming to push demand

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Government investments in smart and sustainable aquaculture to spike demand

- 10.4.6 INDIA

- 10.4.6.1 Government focus on boosting aquaculture infrastructure to spur demand

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Brazil

- 10.5.2.1.1 Growing trend of data-driven decision-making in aquaculture industry to boost demand

- 10.5.2.2 Chile

- 10.5.2.2.1 Government-backed initiatives promoting sustainability and environmental stewardship to drive market

- 10.5.2.3 Ecuador

- 10.5.2.3.1 Rising demand for traceable, sustainably farmed shrimp from US, Europe, and Asia to fuel market growth

- 10.5.2.4 Rest of South America

- 10.5.2.1 Brazil

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Substantial increase in seafood consumption to drive market

- 10.5.4 AFRICA

- 10.5.4.1 Elevating use of IoT-based farm monitoring and management solutions to support market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Offering footprint

- 11.5.5.4 System type footprint

- 11.5.5.5 Application footprint

- 11.5.5.6 Farm type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- 11.7.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 AKVA GROUP

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses/Competitive threats

- 12.2.2 SCALEAQ

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths/Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses/Competitive threats

- 12.2.3 SKRETTING (ERUVAKA TECHNOLOGIES)

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses/Competitive threats

- 12.2.4 INNOVASEA SYSTEMS INC.

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths/Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses/Competitive threats

- 12.2.5 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 MnM view

- 12.2.5.3.1 Key strengths/Right to win

- 12.2.5.3.2 Strategic choices

- 12.2.5.3.3 Weaknesses/Competitive threats

- 12.2.6 AQUABYTE

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.7 SIGNIFY HOLDING

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.8 REELDATA

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Deals

- 12.2.9 DEEP TREKKER INC.

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.10 AQUACARE ENVIRONMENT, INC.

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.1 AKVA GROUP

- 12.3 OTHER PLAYERS

- 12.3.1 IMENCO AQUA AS

- 12.3.2 OPTIMAR AS

- 12.3.3 IN-SITU INC.

- 12.3.4 OXYGUARD

- 12.3.5 PT JALA AKUAKULTUR LESTARI ALAMKU

- 12.3.6 AQUACONNECT

- 12.3.7 SENSOREX

- 12.3.8 PLANET LIGHTING

- 12.3.9 MOLEAER INC.

- 12.3.10 XPERTSEA

- 12.3.11 FISHFARMFEEDER

- 12.3.12 CAGEEYE

- 12.3.13 AQUAMANAGER

- 12.3.14 HUNAN RIKA ELECTRONIC TECH CO., LTD

- 12.3.15 CHETU INC.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 PRECISION AQUACULTURE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 CHANGES IMPLEMENTED IN UPDATED VERSION

- TABLE 3 PRECISION AQUACULTURE MARKET: RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN PRECISION AQUACULTURE ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSOR TYPES OFFERED BY PLAYERS, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 7 LIST OF MAJOR PATENTS, 2025

- TABLE 8 IMPORT DATA FOR HS CODE 9026-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 9026-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 PRECISION AQUACULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 MFN TARIFF FOR HS CODE 9026-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 19 PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 20 PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 21 PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 22 HARDWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 23 HARDWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 24 HARDWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 HARDWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 27 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 28 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 29 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 30 PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 31 PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 32 SOFTWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 33 SOFTWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 34 SOFTWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 SOFTWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 37 PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 38 SERVICES: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 39 SERVICES: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 40 SERVICES: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 SERVICES: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 43 PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 44 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 45 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 46 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 47 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 48 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 49 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 50 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 51 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 52 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 53 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 54 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 59 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 60 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 61 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 62 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 63 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 64 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 65 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 66 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 67 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 68 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 69 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 70 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 75 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 76 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 77 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 78 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 79 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 80 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 81 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 82 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 83 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 84 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 85 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 86 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 89 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 90 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 91 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 92 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 93 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 94 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 95 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 96 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 97 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 98 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 99 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 100 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 105 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 106 PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 FEED OPTIMIZATION: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 109 FEED OPTIMIZATION: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 110 MONITORING & SURVEILLANCE: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 111 MONITORING & SURVEILLANCE: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 112 YIELD ANALYSIS & MEASUREMENT: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 113 YIELD ANALYSIS & MEASUREMENT: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 114 OTHER APPLICATIONS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 115 OTHER APPLICATIONS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 116 PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 117 PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 118 PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 119 PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 120 OPEN AQUACULTURE FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 121 OPEN AQUACULTURE FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 122 RAS FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 123 RAS FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 124 PRECISION AQUACULTURE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 PRECISION AQUACULTURE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: PRECISION AQUACULTURE MARKET, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: PRECISION AQUACULTURE MARKET, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 144 ROW: PRECISION AQUACULTURE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 ROW: PRECISION AQUACULTURE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 ROW: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 147 ROW: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ROW: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 149 ROW: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 150 SOUTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 SOUTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 PRECISION AQUACULTURE MARKET: KEY PLAYER STRATEGIES/ RIGHT TO WIN, APRIL 2021-JULY 2025

- TABLE 153 PRECISION AQUACULTURE MARKET: DEGREE OF COMPETITION

- TABLE 154 PRECISION AQUACULTURE MARKET: REGION FOOTPRINT

- TABLE 155 PRECISION AQUACULTURE MARKET: OFFERING FOOTPRINT

- TABLE 156 PRECISION AQUACULTURE MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 157 PRECISION AQUACULTURE MARKET: APPLICATION FOOTPRINT

- TABLE 158 PRECISION AQUACULTURE MARKET: FARM TYPE FOOTPRINT

- TABLE 159 PRECISION AQUACULTURE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 160 PRECISION AQUACULTURE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 161 PRECISION AQUACULTURE MARKET: PRODUCT LAUNCHES, APRIL 2021-JULY 2025

- TABLE 162 PRECISION AQUACULTURE MARKET: DEALS, APRIL 2021-JULY 2025

- TABLE 163 AKVA GROUP: COMPANY OVERVIEW

- TABLE 164 AKVA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 AKVA GROUP: PRODUCT LAUNCHES

- TABLE 166 AKVA GROUP: DEALS

- TABLE 167 SCALEAQ: COMPANY OVERVIEW

- TABLE 168 SCALEAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 SCALEAQ: PRODUCT LAUNCHES

- TABLE 170 SCALEAQ: DEALS

- TABLE 171 SKRETTING (ERUVAKA TECHNOLOGIES): COMPANY OVERVIEW

- TABLE 172 SKRETTING (ERUVAKA TECHNOLOGIES): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 SKRETTING (ERUVAKA TECHNOLOGIES): PRODUCT LAUNCHES

- TABLE 174 INNOVASEA SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 175 INNOVASEA SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 INNOVASEA SYSTEMS INC.: PRODUCT LAUNCHES

- TABLE 177 INNOVASEA SYSTEMS INC.: DEALS

- TABLE 178 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 179 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 AQUABYTE: COMPANY OVERVIEW

- TABLE 181 AQUABYTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SIGNIFY HOLDING: COMPANY OVERVIEW

- TABLE 183 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 REELDATA: COMPANY OVERVIEW

- TABLE 185 REELDATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 REELDATA: DEALS

- TABLE 187 DEEP TREKKER INC.: COMPANY OVERVIEW

- TABLE 188 DEEP TREKKER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 AQUACARE ENVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 190 AQUACARE ENVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 IMENCO AQUA AS: COMPANY OVERVIEW

- TABLE 192 OPTIMAR AS: COMPANY OVERVIEW

- TABLE 193 IN-SITU INC.: COMPANY OVERVIEW

- TABLE 194 OXYGUARD: COMPANY OVERVIEW

- TABLE 195 PT JALA AKUAKULTUR LESTARI ALAMKU: COMPANY OVERVIEW

- TABLE 196 AQUACONNECT: COMPANY OVERVIEW

- TABLE 197 SENSOREX: COMPANY OVERVIEW

- TABLE 198 PLANET LIGHTING: COMPANY OVERVIEW

- TABLE 199 MOLEAER INC.: COMPANY OVERVIEW

- TABLE 200 XPERTSEA: COMPANY OVERVIEW

- TABLE 201 FISHFARMFEEDER: COMPANY OVERVIEW

- TABLE 202 CAGEEYE: COMPANY OVERVIEW

- TABLE 203 AQUAMANAGER: COMPANY OVERVIEW

- TABLE 204 HUNAN RIKA ELECTRONIC TECH CO., LTD: COMPANY OVERVIEW

- TABLE 205 CHETU INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PRECISION AQUACULTURE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION COVERED

- FIGURE 3 PRECISION AQUACULTURE MARKET: RESEARCH DESIGN

- FIGURE 4 PRECISION AQUACULTURE MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 (SUPPLY SIDE)

- FIGURE 5 PRECISION AQUACULTURE MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (SUPPLY SIDE)

- FIGURE 6 PRECISION AQUACULTURE MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 3 (DEMAND SIDE)

- FIGURE 7 PRECISION AQUACULTURE MARKET: BOTTOM-UP APPROACH

- FIGURE 8 PRECISION AQUACULTURE MARKET: TOP-DOWN APPROACH

- FIGURE 9 PRECISION AQUACULTURE MARKET: DATA TRIANGULATION

- FIGURE 10 PRECISION AQUACULTURE MARKET: RESEARCH ASSUMPTIONS

- FIGURE 11 PRECISION AQUACULTURE MARKET: RESEARCH LIMITATIONS

- FIGURE 12 PRECISION AQUACULTURE MARKET SIZE, 2021-2030 (USD MILLION)

- FIGURE 13 MONITORING & CONTROL SYSTEMS TO DOMINATE MARKET BETWEEN 2025 AND 2030

- FIGURE 14 HARDWARE SEGMENT TO CAPTURE LARGEST SHARE OF PRECISION AQUACULTURE MARKET, BY OFFERING, IN 2025

- FIGURE 15 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PRECISION AQUACULTURE MARKET FROM 2025 TO 2030

- FIGURE 16 EUROPE LED MARKET WITH STRONG REGULATORY SUPPORT FOR SUSTAINABLE AQUACULTURE PRACTICES IN 2024

- FIGURE 17 FEED OPTIMIZATION SEGMENT TO CAPTURE SECOND-LARGEST SHARE OF PRECISION AQUACULTURE MARKET IN 2030

- FIGURE 18 OPEN AQUACULTURE FARMS TO DOMINATE PRECISION AQUACULTURE MARKET IN 2030

- FIGURE 19 EUROPE HELD PROMINENT SHARE OF PRECISION AQUACULTURE MARKET IN 2024

- FIGURE 20 PRECISION AQUACULTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT ANALYSIS: DRIVERS

- FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

- FIGURE 25 PRECISION AQUACULTURE VALUE CHAIN ANALYSIS

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 PRECISION AQUACULTURE ECOSYSTEM

- FIGURE 28 AVERAGE SELLING PRICE OF PRECISION AQUACULTURE SENSORS PROVIDED BY KEY PLAYERS, BY TYPE, 2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSORS, BY REGION, 2021-2024

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 31 IMPORT SCENARIO FOR HS CODE 9026-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 32 EXPORT SCENARIO FOR HS CODE 9026-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 33 PRECISION AQUACULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 IMPACT OF GEN AI/AI ON PRECISION AQUACULTURE MARKET

- FIGURE 35 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR IN PRECISION AQUACULTURE MARKET DURING FORECAST PERIOD

- FIGURE 36 MONITORING & CONTROL SYSTEMS TO EXHIBIT HIGHEST CAGR IN PRECISION AQUACULTURE MARKET FROM 2025 TO 2030

- FIGURE 37 MONITORING & SURVEILLANCE SEGMENT TO LEAD PRECISION AQUACULTURE MARKET, BY APPLICATION, IN 2030

- FIGURE 38 RAS FARMS TO EXHIBIT HIGHER CAGR IN PRECISION AQUACULTURE MARKET FROM 2025 TO 2030

- FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR IN PRECISION AQUACULTURE MARKET BETWEEN 2025 AND 2030

- FIGURE 40 NORTH AMERICA: PRECISION AQUACULTURE MARKET SNAPSHOT

- FIGURE 41 EUROPE: PRECISION AQUACULTURE MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: PRECISION AQUACULTURE MARKET SNAPSHOT

- FIGURE 43 SOUTH AMERICA TO LEAD PRECISION AQUACULTURE MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 44 PRECISION AQUACULTURE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 45 MARKET SHARE ANALYSIS OF TOP COMPANIES OFFERING PRECISION AQUACULTURE SOLUTIONS/SERVICES, 2024

- FIGURE 46 PRECISION AQUACULTURE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 PRECISION AQUACULTURE MARKET: COMPANY FOOTPRINT

- FIGURE 48 PRECISION AQUACULTURE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 AKVA GROUP: COMPANY SNAPSHOT

- FIGURE 50 SCALEAQ: COMPANY SNAPSHOT

- FIGURE 51 SIGNIFY HOLDING: COMPANY SNAPSHOT