|

市场调查报告书

商品编码

1802925

全球智慧城市平台市场(按产品、部署和应用)- 2030 年预测Smart City Platforms Market by Offering (Platforms, Services), Deployment (Cloud, On-premises, Hybrid), Application (Smart Transportation, Public Safety & Emergency Response, Smart Infrastructure, Smart Energy & Utilities) - Global Forecast to 2030 |

||||||

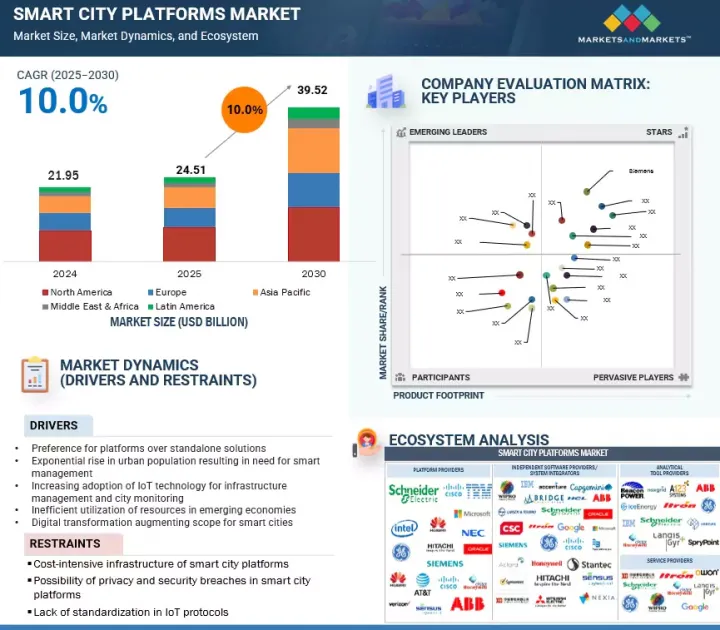

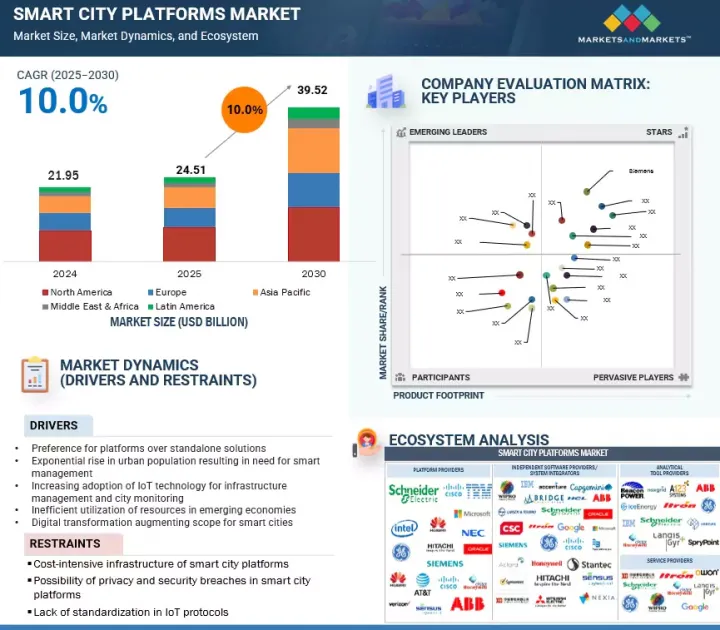

全球智慧城市平台市场预计将从 2025 年的 245.1 亿美元成长到 2030 年的 395.2 亿美元,预测期内的复合年增长率为 10.0%。

市场主要受快速都市化推动,这需要更智慧的基础设施来管理城市运营,如交通、能源、公共等。亚太、欧洲和中东等地区政府主导的智慧城市计画正在加速该平台的采用。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万/十亿美元 |

| 部分 | 供应、部署、使用、区域 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、拉丁美洲 |

物联网、5G 和边缘运算的技术进步,以及日益增长的环境永续性目标,进一步推动了对整合平台的需求。此外,人工智慧和高阶分析的应用正在提升即时决策能力和业务效率。然而,市场也面临着许多限制因素,例如高昂的初始投资和部署成本,以及对资料隐私和网路安全的持续担忧。与旧有系统的整合挑战和互通性问题构成了技术障碍,而技能人才的短缺和法规结构的不明确也进一步阻碍了大规模应用。

根据部署情况,预计云端运算部分将在预测期内占据最大的市场占有率。

云端部署是智慧城市平台市场中最突出、成长最快的领域。云端基础因其扩充性、成本效益以及支援即时数据处理和分析的能力,正日益被城市所采用。这些平台有助于集中管理、快速部署服务以及不同城市系统之间的无缝整合。此外,云端部署支援远端访问,促进跨部门协作,并减少对繁重IT基础设施的需求,使其成为正在经历数位转型的城市的理想选择。

根据应用,公共和紧急应变部门预计在预测期内以最高的复合年增长率成长。

公共与紧急应变部门专注于透过预防性和紧急应变技术来保障公民安全。智慧城市平台整合来自监控系统、911客服中心、社交媒体、无人机和环境感测器的数据,以创建安全业务的集中视图。人工智慧视讯分析、脸部辨识和行为预测等先进工具有助于预防犯罪和快速发现事件。透过动态紧急车辆路线规划和情境察觉仪錶板,以及执法、消防和医疗服务之间的即时通讯,紧急应变能力得到增强。这些系统也有助于管理洪水、地震和流行病等大规模事件和灾害。

预计亚太地区在预测期内的复合年增长率最高。

受快速都市化、政府积极倡议以及物联网、人工智慧、云端运算和 5G 等先进技术的加速采用推动,亚太智慧城市平台市场呈现强劲成长。中国智慧城市发展规划和印度智慧城市计画等战略性国家计画正在推动大规模数位基础设施的部署。高成长领域包括智慧公用事业、行动性和管治,推动因素是向云端基础的部署的强劲转变,以实现更高的扩充性和成本效率。华为、阿里巴巴、微软、思科和 AWS 等领先的科技公司正在透过与政府和市政当局合作扩大在全部区域的业务。儘管面临资料隐私和基础设施发展缓慢等挑战,亚太地区仍然是智慧城市平台最具活力和机会最丰富的市场之一,为解决方案供应商和投资者提供了巨大的成长潜力。

本报告研究了全球智慧城市平台市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 对市场参与企业来说极具吸引力的机会

- 北美智慧城市平台市场(按产品和国家划分)

- 亚太智慧城市平台市场:提供量排名前三名的国家

- 智慧城市平台市场(按应用)

第五章市场概况及产业趋势

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 产业趋势

- 智慧城市平台市场的历史

- 影响客户业务的趋势/中断

- 供应链分析

- 生态系测绘

- 定价分析

- 技术分析

- 专利分析

- 波特五力分析

- 主要相关利益者和采购标准

- 案例研究分析

- 大型会议和活动(2025-2026年)

- 智慧城市平台市场的技术蓝图

- 智慧城市平台市场实施最佳实践

- 当前和新兴的经营模式经营模式

- 人工智慧和生成式人工智慧简介

- 投资金筹措场景

- 2025年美国关税的影响 - 智慧城市平台市场

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对最终用户的影响

第六章:依产品类型分類的智慧城市平台市场

- 介绍

- 平台

- 连结管理平台

- 整合平台

- 设备管理平台

- 资料管理平台

- 安全平台

- 其他平台

- 服务

- 专业服务

- 託管服务

第七章 智慧城市平台市场(按部署)

- 介绍

- 云

- 杂交种

- 本地

第 8 章:智慧城市平台市场(按应用)

- 介绍

- 智慧交通

- 公共和紧急应变

- 智慧型能源公用事业

- 智慧管治

- 智慧基础设施

- 其他用途

9. 智慧城市平台市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧的

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 东南亚

- 其他亚太地区

- 中东和非洲

- 中东和非洲的宏观经济展望

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第十章 竞争格局

- 介绍

- 主要参与企业的策略/优势(2021-2025)

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 品牌/产品比较

- 公司估值及财务指标

- 竞争场景

第十一章 公司简介

- 主要企业

- SIEMENS

- CISCO

- HUAWEI

- HITACHI

- MICROSOFT

- IBM

- AWS

- AT&T

- NOKIA

- ATOS

- 其他公司

- SAP

- NEC

- FUJITSU

- SCHNEIDER ELECTRIC

- ALIBABA CLOUD

- ERICSSON

- BOSCH.IO

- ITRON

- PWC

- SICE

- Start-Ups/中小型企业

- THETHINGS.IO

- KAAIOT TECHNOLOGIES

- QUANTELA

- UBICQUIA

- IGOR

- 75F

- TELENSA

- ENEVO

- KETOS

- CLEVERCITI

- GAIA SMART CITIES

- GLOBETOM

- TADOOM

- ATHENA SMART CITIES

第 12 章:邻近市场/附录

- 介绍

- 智慧城市市场 - 全球预测(至 2030 年)

- 智慧基础设施市场 - 全球预测(至 2029 年)

第十三章 附录

The global smart city platforms market will grow from USD 24.51 billion in 2025 to USD 39.52 billion by 2030 at a compounded annual growth rate (CAGR) of 10.0% during the forecast period. The smart city platforms market is primarily driven by rapid urbanization, which necessitates smarter infrastructure to manage city operations such as transportation, energy, and public safety. Government-led smart city initiatives across regions such as Asia Pacific, Europe, and the Middle East are accelerating platform adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Offering, Deployment, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Technological advancements in IoT, 5G, and edge computing, combined with growing environmental sustainability goals, are further fueling the need for integrated platforms. Additionally, the use of AI and advanced analytics is enhancing real-time decision-making and operational efficiency. However, the market faces restraints, including high initial investment and deployment costs, as well as persistent concerns over data privacy and cybersecurity. Integration challenges with legacy systems and interoperability issues pose technical barriers, while a lack of a skilled workforce and unclear regulatory frameworks further hinder large-scale adoption.

Based on deployment, the cloud segment is expected to hold the largest market share during the forecast period.

Cloud deployment is the most prominent and rapidly growing segment in the smart city platforms market. Cities are increasingly adopting cloud-based platforms due to their scalability, cost-effectiveness, and ability to support real-time data processing and analytics. These platforms facilitate centralized management, faster deployment of services, and seamless integration across various urban systems. Additionally, cloud deployment enables remote access, fosters cross-departmental collaboration, and reduces the need for heavy IT infrastructure, making it ideal for cities aiming for digital transformation.

Based on application, the public safety & emergency response segment is expected to grow at the highest CAGR during the forecast period.

Public safety & emergency response is focused on safeguarding citizens through proactive and reactive technologies. Smart city platforms unify data from surveillance systems, 911 call centers, social media, drones, and environmental sensors to create a centralized view of security operations. Advanced tools such as AI-powered video analytics, facial recognition, and behavior prediction help in crime prevention and rapid incident detection. Emergency response is enhanced through real-time communication between law enforcement, fire, and medical services, with dynamic routing for emergency vehicles and situational awareness dashboards. These systems are also instrumental in managing large-scale events and disasters, including floods, earthquakes, or pandemics.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The smart city platforms market in Asia Pacific is experiencing robust growth, fueled by rapid urbanization, proactive government initiatives, and accelerated adoption of advanced technologies such as IoT, AI, cloud, and 5G. Strategic national programs, such as China's Smart City Development Plan and India's Smart Cities Mission, are driving large-scale digital infrastructure rollouts. High-growth segments include smart utilities, mobility, and governance, supported by a strong shift toward cloud-based deployments for greater scalability and cost efficiency. Major technology players, including Huawei, Alibaba, Microsoft, Cisco, and AWS, are expanding their presence across the region through partnerships with governments and urban authorities. Despite challenges such as data privacy and uneven infrastructure readiness, Asia-Pacific remains the most dynamic and opportunity-rich market for smart city platforms, offering strong growth potential for solution providers and investors alike.

Breakdown of primaries

We interviewed Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant companies in the smart city platforms market.

- By Company: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 40%, Director Level: 25%, and Others: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, and Rest of the World: 10%

Some of the major smart city platform vendors are IBM (US), Siemens (Germany), Cisco (US), Hitachi (Japan), Microsoft (US), Huawei (China), AWS (US), AT&T (US), Nokia (Finland), and Atos (France).

Research coverage:

The market report covered the smart city platforms market across segments. We estimated the market size and growth potential for many segments based on offering, deployment, application, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole smart city platforms industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's increased understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights on the following pointers:

Analysis of key drivers (Preference for platforms over standalone solutions, exponential rise in urban population resulting in need for smart management, increasing adoption of IoT technology for infrastructure management and city monitoring, inefficient utilization of resources in emerging economies, digital transformation augmenting scope for smart cities), restraints (Cost-intensive infrastructure of smart city platforms, possibility of privacy and security breaches in smart city platforms, lack of standardization in IoT protocols), opportunities (Development of smart infrastructure, industrial and commercial deployment of smart city platforms, rising smart city initiatives worldwide), and challenges (Increasing concern over data privacy and security, growing cybersecurity attacks due to proliferation of IoT devices, disruption in logistics and supply chain of IoT devices).

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the smart city platforms market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global smart city platforms market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the smart city platforms market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, platforms, and service portfolios of the top competitors in the smart city platforms industry, such as IBM (US), Siemens (Germany), Cisco (US), Hitachi (Japan), Microsoft (US), Huawei (China), AWS (US), AT&T (US), Nokia (Finland), Atos (France), SAP (Germany), NEC (Japan), Fujitsu (Japan), Schneider Electric (France), Alibaba Cloud (China), Ericsson (Sweden), Bosch.io (Germany), Itron (US), PwC (UK), SICE (Spain), thethings.iO (Spain), KaaIoT Technologies (US), Quantela (US), Ubicquia (US), Igor (US), 75F (US), Telensa (UK), Enevo (US), KETOS (US), Cleverciti (Germany), Gaia Smart Cities (India), Globetom (South Africa), Tadoom (Oman), and Athena SmartCities (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING AND COUNTRY

- 4.3 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY OFFERING AND TOP 3 COUNTRIES

- 4.4 SMART CITY PLATFORMS MARKET, BY APPLICATION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Preference for platforms over standalone solutions

- 5.2.1.2 Exponential rise in urban population resulting in need for smart management

- 5.2.1.3 Increasing adoption of IoT technology for infrastructure management and city monitoring

- 5.2.1.4 Inefficient utilization of resources in emerging economies

- 5.2.1.5 Digital transformation augmenting scope for smart cities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cost-intensive infrastructure of smart city platforms

- 5.2.2.2 Possibility of privacy and security breaches in smart city platforms

- 5.2.2.3 Lack of standardization in IoT protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of smart infrastructure

- 5.2.3.2 Industrial and commercial deployment of smart city platforms

- 5.2.3.3 Rising smart city initiatives worldwide

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing concern over data privacy and security

- 5.2.4.2 Growing cybersecurity attacks due to proliferation of IoT devices

- 5.2.4.3 Disruption in logistics and supply chain of IoT devices

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 HISTORY OF SMART CITY PLATFORMS MARKET

- 5.3.1.1 1990-2000

- 5.3.1.2 2000-2010

- 5.3.1.3 2010-2020

- 5.3.1.4 2021-present

- 5.3.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.3 SUPPLY CHAIN ANALYSIS

- 5.3.4 ECOSYSTEM MAPPING

- 5.3.5 PRICING ANALYSIS

- 5.3.5.1 Average selling price of key players, by application

- 5.3.5.2 Indicative pricing trend of smart city platforms

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Key Technologies

- 5.3.6.1.1 AI and ML

- 5.3.6.1.2 IoT

- 5.3.6.1.3 Big data analytics

- 5.3.6.2 Adjacent Technologies

- 5.3.6.2.1 AR/VR

- 5.3.6.2.2 Edge computing

- 5.3.6.3 Complementary Technologies

- 5.3.6.3.1 Geospatial information system (GIS)

- 5.3.6.3.2 Smart grids

- 5.3.6.3.3 Cybersecurity solutions

- 5.3.6.1 Key Technologies

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 METHODOLOGY

- 5.3.8 PORTER'S FIVE FORCES ANALYSIS

- 5.3.9 THREAT OF NEW ENTRANTS

- 5.3.10 THREAT OF SUBSTITUTES

- 5.3.11 BARGAINING POWER OF BUYERS

- 5.3.12 BARGAINING POWER OF SUPPLIERS

- 5.3.13 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.14.1 Key stakeholders in buying process

- 5.3.14.2 Buying criteria

- 5.3.15 CASE STUDY ANALYSIS

- 5.3.15.1 Case study 1: Smart City Ahmedabad Development Limited (SCADL) partnered with NEC to upgrade manually operated bus transit infrastructure

- 5.3.15.2 Case study 2: Sierra Wireless helped Liveable Cities transform streetlights into sensor networks

- 5.3.15.3 Case study 3: Fastned relies on ABB to expand EV fast charge network across Europe

- 5.3.15.4 Case study 4: Honeywell enabled efficient flight routing for Newark Liberty International Airport

- 5.3.15.5 Case study 5: Bane NOR selected Thales to provide next-generation nationwide traffic management system

- 5.3.15.6 Case study 6: Curtin University adopted Hitachi IoT solution to create smart campus

- 5.3.16 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.3.17 TECHNOLOGY ROADMAP FOR SMART CITY PLATFORMS MARKET

- 5.3.17.1 Short-term Roadmap (2025-2026)

- 5.3.17.2 Mid-term Roadmap (2027-2028)

- 5.3.17.3 Long-term Roadmap (2029-2030)

- 5.3.18 BEST PRACTICES TO IMPLEMENT IN SMART CITY PLATFORMS MARKET

- 5.3.19 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.20 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.20.1 Impact of Generative AI on Smart City Platforms Market

- 5.3.20.2 Use cases of generative AI in smart city platforms

- 5.3.21 INVESTMENT AND FUNDING SCENARIO

- 5.3.1 HISTORY OF SMART CITY PLATFORMS MARKET

- 5.4 IMPACT OF 2025 US TARIFF - SMART CITY PLATFORMS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 KEY TARIFF RATES

- 5.4.3 PRICE IMPACT ANALYSIS

- 5.4.3.1 Strategic shifts and emerging trends

- 5.4.4 IMPACT ON COUNTRY/REGION

- 5.4.4.1 US

- 5.4.4.2 China

- 5.4.4.3 Europe

- 5.4.4.4 Asia Pacific (excluding China)

- 5.4.5 IMPACT ON END USERS

- 5.4.5.1 City governments and municipal authorities

- 5.4.5.2 Citizens and residents

- 5.4.5.3 Utility companies and infrastructure providers

6 SMART CITY PLATFORMS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: MARKET DRIVERS

- 6.2 PLATFORMS

- 6.2.1 CONNECTIVITY MANAGEMENT PLATFORMS

- 6.2.1.1 Provide end-to-end connectivity solutions for seamless integration

- 6.2.2 INTEGRATION PLATFORMS

- 6.2.2.1 Need to merge data from different siloed systems to drive adoption

- 6.2.3 DEVICE MANAGEMENT PLATFORMS

- 6.2.3.1 Growing need to manage information across devices to boost adoption

- 6.2.4 DATA MANAGEMENT PLATFORMS

- 6.2.4.1 Ability to ease solution management of various applications to drive demand

- 6.2.5 SECURITY PLATFORMS

- 6.2.5.1 High demand due to rising risk of cyber threats

- 6.2.6 OTHER PLATFORMS

- 6.2.1 CONNECTIVITY MANAGEMENT PLATFORMS

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Consulting & architecture designing

- 6.3.1.1.1 Growing demand to ensure cost-optimization

- 6.3.1.2 Infrastructure monitoring & management

- 6.3.1.2.1 Provides high-precision information in real-time

- 6.3.1.3 Deployment & training

- 6.3.1.3.1 Rising demand for services to ensure optimized functioning of platforms

- 6.3.1.1 Consulting & architecture designing

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Facilitate efficient management of smart city operations

- 6.3.1 PROFESSIONAL SERVICES

7 SMART CITY PLATFORMS MARKET, BY DEPLOYMENT

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT: MARKET DRIVERS

- 7.2 CLOUD

- 7.2.1 GROWING PREFERENCE FOR COST-EFFECTIVE AND FLEXIBLE SOLUTIONS

- 7.3 HYBRID

- 7.3.1 HIGH DEMAND DUE TO NEED FOR SECURE AND SUSTAINABLE TOOLS TO BUILD SMART CITIES

- 7.4 ON-PREMISES

- 7.4.1 REQUIREMENT FOR TIMELY PROBLEM-SOLVING TO INCREASE DEMAND

8 SMART CITY PLATFORMS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: MARKET DRIVERS

- 8.2 SMART TRANSPORTATION

- 8.2.1 OPTIMIZE URBAN MOBILITY WITH REAL-TIME, DATA-DRIVEN TRANSIT SOLUTIONS

- 8.3 PUBLIC SAFETY & EMERGENCY RESPONSE

- 8.3.1 ENHANCE CITIZEN SAFETY THROUGH INTEGRATED, PREDICTIVE EMERGENCY MANAGEMENT

- 8.4 SMART ENERGY & UTILITIES

- 8.4.1 DRIVE EFFICIENCY AND SUSTAINABILITY WITH INTELLIGENT UTILITY INFRASTRUCTURE

- 8.5 SMART GOVERNANCE

- 8.5.1 TRANSFORM PUBLIC SERVICES WITH TRANSPARENT, CITIZEN-CENTRIC DIGITAL PLATFORMS

- 8.6 SMART INFRASTRUCTURE

- 8.6.1 NEED TO BUILD RESILIENT CITIES WITH CONNECTED, SELF-MONITORING URBAN ASSETS TO DRIVE MARKET

- 8.7 OTHER APPLICATIONS

9 SMART CITY PLATFORMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Technological advancements and digital readiness to boost market growth

- 9.2.3 CANADA

- 9.2.3.1 Rapid urbanization and use of IoT technology to drive growth of smart cities

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UNITED KINGDOM

- 9.3.2.1 Increased adoption of innovative digital technologies to boost market growth

- 9.3.3 GERMANY

- 9.3.3.1 Acceleration of urban digital transformation to drive smart city development

- 9.3.4 FRANCE

- 9.3.4.1 High usage of smart devices to drive market

- 9.3.5 ITALY

- 9.3.5.1 Growing adoption of latest technologies to boost market

- 9.3.6 SPAIN

- 9.3.6.1 Government initiatives to improve quality of life to drive market

- 9.3.7 NORDICS

- 9.3.7.1 Focus on sustainable development to boost demand for smart cities

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Government initiatives to promote growth of smart cities

- 9.4.3 JAPAN

- 9.4.3.1 Highly developed telecom sector to boost development of smart cities

- 9.4.4 INDIA

- 9.4.4.1 Growing urban population to drive need for smart cities

- 9.4.5 SOUTH KOREA

- 9.4.6 AUSTRALIA AND NEW ZEALAND

- 9.4.6.1 Knowledge-based Australian economy to offer opportunities for market growth

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Rapid urbanization to drive market

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 UAE

- 9.5.2.1 Government focus on sustainable development to drive demand for smart city platforms

- 9.5.3 KSA

- 9.5.3.1 Increasing development of smart cities to boost market

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Rising urbanization to increase development of smart cities

- 9.5.5 EGYPT

- 9.5.5.1 Introduction of people-centered digital policies to create demand for smart cities

- 9.5.6 NIGERIA

- 9.5.6.1 Rising urbanization to increase demand for smart cities

- 9.5.7 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Early adoption of smart city technologies to boost market

- 9.6.3 MEXICO

- 9.6.3.1 Need to create digitally smart urban areas to drive market growth

- 9.6.4 ARGENTINA

- 9.6.4.1 Rising need for smart city management tools to drive market

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 Offering footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SIEMENS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CISCO

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 HUAWEI

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 HITACHI

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 MICROSOFT

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 IBM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.7 AWS

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.8 AT&T

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 NOKIA

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 ATOS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 SIEMENS

- 11.2 OTHER PLAYERS

- 11.2.1 SAP

- 11.2.2 NEC

- 11.2.3 FUJITSU

- 11.2.4 SCHNEIDER ELECTRIC

- 11.2.5 ALIBABA CLOUD

- 11.2.6 ERICSSON

- 11.2.7 BOSCH.IO

- 11.2.8 ITRON

- 11.2.9 PWC

- 11.2.10 SICE

- 11.3 STARTUPS/SMES

- 11.3.1 THETHINGS.IO

- 11.3.2 KAAIOT TECHNOLOGIES

- 11.3.3 QUANTELA

- 11.3.4 UBICQUIA

- 11.3.5 IGOR

- 11.3.6 75F

- 11.3.7 TELENSA

- 11.3.8 ENEVO

- 11.3.9 KETOS

- 11.3.10 CLEVERCITI

- 11.3.11 GAIA SMART CITIES

- 11.3.12 GLOBETOM

- 11.3.13 TADOOM

- 11.3.14 ATHENA SMART CITIES

12 ADJACENT MARKETS & APPENDIX

- 12.1 INTRODUCTION

- 12.2 SMART CITIES MARKET - GLOBAL FORECAST TO 2030

- 12.2.1 MARKET DEFINITION

- 12.3 SMART INFRASTRUCTURE MARKET - GLOBAL FORECAST TO 2029

- 12.3.1 MARKET DEFINITION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 SMART CITY PLATFORMS MARKET: ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION, 2024

- TABLE 5 INDICATIVE PRICING ANALYSIS FOR SMART CITY PLATFORMS, 2024

- TABLE 6 LIST OF MAJOR PATENTS, 2021-2025

- TABLE 7 SMART CITY PLATFORMS MARKET: PORTER'S FIVE FORCES MODEL

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 10 SMART CITY PLATFORMS MARKET: CONFERENCES AND EVENTS IN 2025-2026

- TABLE 11 US: ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR SMART CITY PLATFORMS

- TABLE 13 SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 14 SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 15 SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 16 SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 17 PLATFORM TYPE: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 18 PLATFORM TYPE: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19 CONNECTIVITY MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 20 CONNECTIVITY MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 INTEGRATION PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 INTEGRATION PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 DEVICE MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 DEVICE MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 DATA MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 DATA MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 SECURITY PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 SECURITY PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 OTHER PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 OTHER PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 32 SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 33 SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 36 SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 CONSULTING & ARCHITECTURE DESIGNING: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 CONSULTING & ARCHITECTURE DESIGNING: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 INFRASTRUCTURE MONITORING & MANAGEMENT: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 INFRASTRUCTURE MONITORING & MANAGEMENT: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 DEPLOYMENT & TRAINING: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 DEPLOYMENT & TRAINING: SMART CITY PLATFORMS MARKET, 2025-2030 (USD MILLION)

- TABLE 45 MANAGED SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 MANAGED SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 48 SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 49 CLOUD: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 CLOUD: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 HYBRID: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 HYBRID: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 ON-PREMISES: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 ON-PREMISES: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 56 SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 SMART TRANSPORTATION: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 SMART TRANSPORTATION: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 PUBLIC SAFETY & EMERGENCY RESPONSE: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 PUBLIC SAFETY & EMERGENCY RESPONSE: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 SMART ENERGY & UTILITIES: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 SMART ENERGY & UTILITIES: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 SMART GOVERNANCE: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 SMART GOVERNANCE: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 SMART INFRASTRUCTURE: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 SMART INFRASTRUCTURE: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 SMART CITY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 SMART CITY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 US: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 86 US: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 87 US: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 88 US: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 89 US: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 90 US: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 91 US: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 92 US: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 93 US: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 94 US: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 95 US: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 96 US: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 CANADA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 98 CANADA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 100 CANADA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 101 CANADA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 102 CANADA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 103 CANADA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 104 CANADA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 105 CANADA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 106 CANADA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 108 CANADA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 112 EUROPE: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 114 EUROPE: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 122 EUROPE: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 UK: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 124 UK: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 125 UK: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 126 UK: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 127 UK: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 128 UK: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 129 UK: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 130 UK: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 131 UK: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 132 UK: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 133 UK: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 134 UK: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 CHINA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 150 CHINA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 151 CHINA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 152 CHINA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 154 CHINA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 155 CHINA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 156 CHINA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 157 CHINA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 158 CHINA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 159 CHINA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 160 CHINA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY REGION/COUNTRY, 2020-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY REGION/COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 KSA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 176 KSA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 177 KSA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 178 KSA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 179 KSA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 180 KSA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 181 KSA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 182 KSA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 183 KSA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 184 KSA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 185 KSA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 186 KSA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 188 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 190 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 192 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 194 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 196 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 198 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 200 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 BRAZIL: SMART CITY PLATFORMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 202 BRAZIL: SMART CITY PLATFORMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 203 BRAZIL: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 204 BRAZIL: SMART CITY PLATFORMS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 205 BRAZIL: SMART CITY PLATFORMS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 206 BRAZIL: SMART CITY PLATFORMS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 207 BRAZIL: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 208 BRAZIL: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 209 BRAZIL: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2020-2024 (USD MILLION)

- TABLE 210 BRAZIL: SMART CITY PLATFORMS MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 211 BRAZIL: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 212 BRAZIL: SMART CITY PLATFORMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SMART CITY PLATFORM PLAYERS

- TABLE 214 SMART CITY PLATFORMS MARKET: DEGREE OF COMPETITION

- TABLE 215 SMART CITY PLATFORMS MARKET: REGION FOOTPRINT

- TABLE 216 SMART CITY PLATFORMS MARKET: APPLICATION FOOTPRINT

- TABLE 217 SMART CITY PLATFORMS MARKET: OFFERING FOOTPRINT

- TABLE 218 SMART CITY PLATFORMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 219 SMART CITY PLATFORMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 220 SMART CITY PLATFORMS MARKET: PRODUCT LAUNCHES, 2021-JUNE 2025

- TABLE 221 SMART CITY PLATFORMS MARKET: DEALS, 2021-JUNE 2025

- TABLE 222 SIEMENS: COMPANY OVERVIEW

- TABLE 223 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 SIEMENS: PRODUCT LAUNCHES

- TABLE 225 SIEMENS: DEALS

- TABLE 226 CISCO: COMPANY OVERVIEW

- TABLE 227 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 CISCO: PRODUCT LAUNCHES

- TABLE 229 CISCO: DEALS

- TABLE 230 HUAWEI: COMPANY OVERVIEW

- TABLE 231 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HUAWEI: PRODUCT LAUNCHES

- TABLE 233 HUAWEI: DEALS

- TABLE 234 HITACHI: COMPANY OVERVIEW

- TABLE 235 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 HITACHI: PRODUCT LAUNCHES

- TABLE 237 HITACHI: DEALS

- TABLE 238 MICROSOFT: COMPANY OVERVIEW

- TABLE 239 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 MICROSOFT: PRODUCT LAUNCHES

- TABLE 241 MICROSOFT: DEALS

- TABLE 242 IBM: COMPANY OVERVIEW

- TABLE 243 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 IBM: PRODUCT LAUNCHES

- TABLE 245 IBM: DEALS

- TABLE 246 AWS: COMPANY OVERVIEW

- TABLE 247 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 AWS: PRODUCT LAUNCHES

- TABLE 249 AT&T: COMPANY OVERVIEW

- TABLE 250 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 NOKIA: COMPANY OVERVIEW

- TABLE 252 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ATOS: COMPANY OVERVIEW

- TABLE 254 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 SMART CITIES MARKET, BY FOCUS AREA, 2019-2024 (USD MILLION)

- TABLE 256 SMART CITIES MARKET, BY FOCUS AREA, 2025-2030 (USD MILLION)

- TABLE 257 SMART CITIZEN SERVICES MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 258 SMART CITIZEN SERVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 259 SMART CITIES MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 260 SMART CITIES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 261 SMART INFRASTRUCTURE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 262 SMART INFRASTRUCTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 263 SMART INFRASTRUCTURE MARKET, BY FOCUS AREA, 2019-2023 (USD MILLION)

- TABLE 264 SMART INFRASTRUCTURE MARKET, BY FOCUS AREA, 2024-2029 (USD MILLION)

- TABLE 265 SMART INFRASTRUCTURE MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 266 SMART INFRASTRUCTURE MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 267 SMART INFRASTRUCTURE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 268 SMART INFRASTRUCTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 SMART CITY PLATFORMS MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 SMART CITY PLATFORMS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORMS AND SERVICES IN SMART CITY PLATFORMS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (BOTTOM-UP) (SUPPLY-SIDE): COLLECTIVE REVENUE OF PLATFORMS AND SERVICES IN SMART CITY PLATFORMS MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE ANALYSIS): COLLECTIVE REVENUE FROM ALL PLATFORMS AND SERVICES IN SMART CITY PLATFORMS MARKET

- FIGURE 8 SMART CITY PLATFORMS MARKET, 2023-2030 (USD MILLION)

- FIGURE 9 SMART CITY PLATFORMS MARKET: REGIONAL SHARE, 2025

- FIGURE 10 INCREASING SMART CITY INITIATIVES WORLDWIDE TO DRIVE SMART CITY PLATFORMS MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 11 PLATFORMS SEGMENT AND US TO DOMINATE MARKET IN NORTH AMERICA

- FIGURE 12 PLATFORMS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF ASIA PACIFIC MARKET

- FIGURE 13 SMART TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART CITY PLATFORMS MARKET

- FIGURE 15 HISTORY OF SMART CITY PLATFORMS MARKET

- FIGURE 16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 17 SMART CITY PLATFORMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 18 SMART CITY PLATFORMS MARKET: ECOSYSTEM

- FIGURE 19 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION, 2024

- FIGURE 20 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- FIGURE 24 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN SMART CITY PLATFORMS

- FIGURE 25 USE CASES OF GENERATIVE AI IN SMART CITY PLATFORMS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020 TO 2024

- FIGURE 27 SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 CONNECTIVITY MANAGEMENT PLATFORMS SEGMENT TO HOLD LARGEST MARKET SIZE

- FIGURE 29 MANAGED SERVICES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 INFRASTRUCTURE MONITORING & MANAGEMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 CLOUD DEPLOYMENT TO RECORD HIGHEST CAGR

- FIGURE 32 SMART TRANSPORTATION TO HOLD LARGEST MARKET SIZE

- FIGURE 33 ASIA PACIFIC TO LEAD SMART CITY PLATFORMS MARKET

- FIGURE 34 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 38 SHARE OF LEADING COMPANIES IN SMART CITY PLATFORMS MARKET, 2024

- FIGURE 39 SMART CITY PLATFORMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 SMART CITY PLATFORMS MARKET: COMPANY FOOTPRINT

- FIGURE 41 SMART CITY PLATFORMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPANY VALUATION

- FIGURE 44 VALUATION AND FINANCIAL METRICS OF KEY SMART CITY PLATFORM PLAYERS

- FIGURE 45 SIEMENS: COMPANY SNAPSHOT

- FIGURE 46 CISCO: COMPANY SNAPSHOT

- FIGURE 47 HUAWEI: COMPANY SNAPSHOT

- FIGURE 48 HITACHI: COMPANY SNAPSHOT

- FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 50 IBM: COMPANY SNAPSHOT

- FIGURE 51 AWS: COMPANY SNAPSHOT

- FIGURE 52 AT&T: COMPANY SNAPSHOT

- FIGURE 53 NOKIA: COMPANY SNAPSHOT

- FIGURE 54 ATOS: COMPANY SNAPSHOT