|

市场调查报告书

商品编码

1804848

全球真空蒸发器市场(按技术、应用、最终用途行业和地区划分)- 2030 年预测Vacuum Evaporators Market by Technology (Heat Pump, Mechanical Vapor Recompression, Thermal), Application (Wastewater Treatment, Product Processing), End-use Industry (Food & Beverage, Pharmaceutical) and Region - Global Forecast to 2030 |

||||||

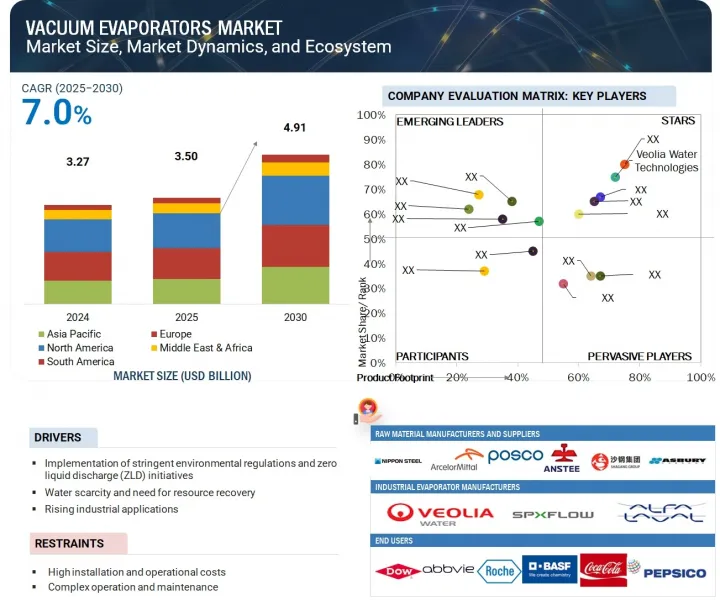

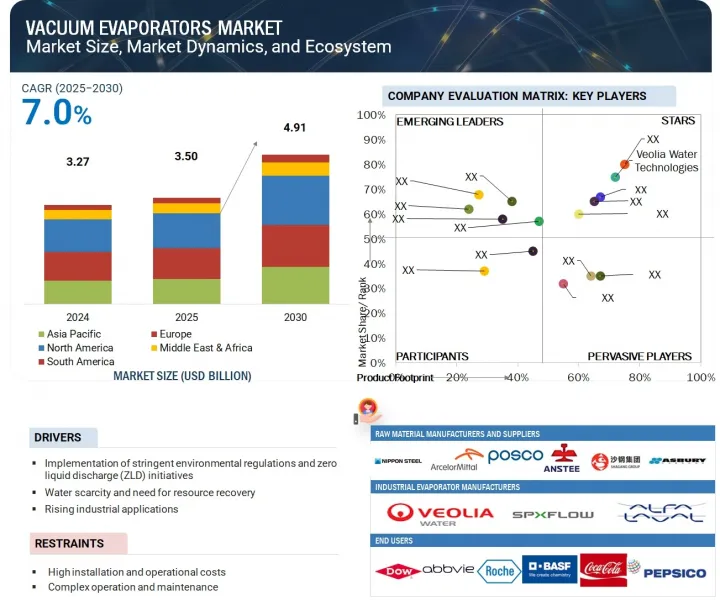

全球真空蒸发器市场规模预计将从 2025 年的 35 亿美元增至 2030 年的 49.1 亿美元,预测期内的复合年增长率为 7.0%。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万美元,吨 |

| 部分 | 技术、应用、最终用途产业、产能、安装类型、地区 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

食品饮料、製药、化学品、污水处理等产业对高效热分离过程的需求日益增加。工业化程度的提高以及对有效浓缩、净化和溶剂回收解决方案的需求正在推动先进蒸发器系统的采用。

“预测期内,产品加工应用领域将占据第二大市场占有率。”

产品加工领域预计将占据真空蒸发器市场的第二大份额,这得益于其在食品饮料、製药和化学品等行业中的关键作用,在这些行业中,浓缩、净化和溶剂回收是关键的生产步骤。真空蒸发器通常用于产品加工,在低温下去除敏感材料中的水分和溶剂,有助于保持产品品质、一致性以及化学或营养完整性。这对于热敏物质尤其重要,例如乳製品、浓缩果汁、活性药物成分 (API) 和特殊化学物质。此外,真空蒸发器在连续生产环境中具有重要价值,因为它们能够精确控制蒸发速率,提高加工效率并降低能耗。各行业对高纯度和高浓度产品的需求不断增长,再加上製程优化和永续性的进步,正在推动真空蒸发器在产品加工应用中的广泛应用。

“预测期内,热泵技术领域将占据第二大市场占有率。”

据估计,热泵真空蒸发器因其能源效率、适用于中低容量应用以及在中小型企业中的广泛使用而占据第二大市场份额。这些系统利用热泵在蒸发循环中回收热能,与传统热感蒸发器相比,显着降低了能耗。这使得它们成为污水量适中的产业(如金属加工、电子、纺织和小规模食品加工)的经济高效且环保的选择。热泵真空蒸发器也因其紧凑的设计、低动作温度以及以极少的维护处理复杂污水流的能力而受到青睐。满足环境法规、降低处理成本和促进水重复利用的需求推动了热泵真空蒸发器的日益普及。

本报告探讨并分析了全球真空蒸发器市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 真空蒸发器市场充满诱人机会

- 真空蒸发器市场(按区域)

- 北美真空蒸发器市场(按最终用途行业和国家划分)

- 真空蒸发器市场:主要国家

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 波特五力分析

- 主要相关利益者和采购标准

- 价值链分析

- 真空蒸发器市场生态系统

- 专利分析

- 调查方法

- 专利公报趋势

- 考虑

- 司法管辖权分析

- 案例研究分析

- 适用于特用化学品公司的多效蒸发器

- 使用 ENCON热感蒸发器最大限度地减少掩埋渗滤液

- 贸易分析

- 导入场景

- 汇出场景

- 大型会议和活动(2025-2026年)

- 监管格局

- 技术分析

- 邻近技术

- 结晶器

- 干燥机(例如喷雾干燥机、滚筒干燥机)

- 互补技术

- 趋势/颠覆性变化的影响

- 全球宏观经济展望

- 2025年美国关税的影响-真空蒸发器市场

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对使用的影响

- 人工智慧对真空蒸发器市场的影响

6. 真空蒸发器市场(按技术)

- 介绍

- 热泵式真空蒸发器

- MVR真空蒸发器

- 热感真空蒸发器

第七章真空蒸发器市场(依应用)

- 介绍

- 污水处理

- 产品加工

- 其他用途

8. 真空蒸发器市场(按容量)

- 介绍

- 小规模(100公升/小时或以下)

- 中等规模(100-500公升/小时)

- 大规模(超过500公升/小时)

9. 真空蒸发器市场(依安装情形)

- 介绍

- 新安装

- 改装安装

第 10 章真空蒸发器市场(依最终用途产业)

- 介绍

- 化工/石化

- 电子和半导体

- 能源与电力

- 食品/饮料

- 製药

- 车

- 其他最终用途产业

第 11 章真空蒸发器市场(按地区)

- 介绍

- 亚太地区

- 中国

- 韩国

- 日本

- 印度

- 马来西亚

- 澳洲

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 俄罗斯

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 中东和非洲

- 海湾合作委员会国家

- 以色列

- 南非

- 其他中东和非洲地区

- 南美洲

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

第十二章竞争格局

- 介绍

- 主要参与企业的策略/优势(2020-2025)

- 收益分析

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- 品牌/产品比较

- VEOLIA WATER TECHNOLOGIES(VEOLIA GROUP)

- GEA GROUP AKTIENGESELLSCHAFT

- SPX FLOW INC

- ALFA LAVAL

- CONDORCHEM ENVIRO SOLUTIONS

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 公司估值及财务指标

- 竞争场景

第十三章:公司简介

- 主要企业

- VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP)

- ALFA LAVAL

- GEA GROUP AKTIENGESELLSCHAFT

- SPX FLOW, INC.

- CONDORCHEM ENVIRO SOLUTIONS

- ECO-TECHNO SRL

- H2O GMBH

- DE DIETRICH

- BUCHER UNIPEKTIN

- SASAKURA ENGINEERING CO, LTD.

- PRAJ INDUSTRIES

- SANSHIN MFG. CO., LTD.

- SALTWORKS TECHNOLOGIES INC.

- ZHEJIANG TAIKANG EVAPORATOR CO., LTD

- BELMAR TECHNOLOGIES

- HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.

- UNITOP AQUACARE LIMITED

- GMM PFAUDLER

- 其他公司

- 3V TECH SPA

- VILOKEN RECYCLING TECH

- SAMSCO

- 3R TECHNOLOGY

- KOVOFINIS

- ENCON EVAPORATORS

- SAITA SRL

- KMU LOFT CLEANWATER SE

- TETRA PAK INTERNATIONAL SA

- PROCECO LTD.

- CFT SPA

第14章:相邻市场与相关市场

- 介绍

- 限制

- 互联市场

- 零排水(ZLD)系统市场(按系统)

- 传统的

- 杂交种

第十五章 附录

The global vacuum evaporators market is projected to grow from USD 3.50 billion in 2025 to USD 4.91 billion by 2030, at a CAGR of 7.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | Technology, Application, End-use Industry, Capacity, Installation Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

There is a rising demand for efficient thermal separation processes across industries such as food and beverage, pharmaceuticals, chemicals, and wastewater treatment. Growing industrialization and the need for effective concentration, purification, and solvent recovery solutions are increasing the adoption of advanced evaporator systems.

"Product processing application segment to account for second-largest market share during forecast period"

The product processing segment is projected to hold the second-largest share in the vacuum evaporators market because of its vital role in industries like food & beverage, pharmaceuticals, and chemicals, where concentration, purification, and solvent recovery are key steps in production. Vacuum evaporators are commonly used in product processing to remove water or solvents from sensitive materials at low temperatures, helping to preserve product quality, consistency, and chemical or nutritional integrity. This is especially important for heat-sensitive substances such as dairy products, fruit concentrates, active pharmaceutical ingredients (APIs), and specialty chemicals. Moreover, vacuum evaporators allow for precise control over evaporation rates, improve process efficiency, and reduce energy consumption, making them valuable in continuous production settings. The rising demand for high-purity and concentrated products across different industries and advancements in process optimization and sustainability fuel the widespread adoption of vacuum evaporators in product processing applications.

"Heat pump technology segment to account for second-largest market share during forecast period"

Heat pump vacuum evaporators are estimated to hold the second-largest share in the market because of their energy efficiency, suitability for low- to medium-capacity applications, and widespread use in small and medium-sized industries. These systems utilize a heat pump to recycle thermal energy within the evaporation cycle, significantly lowering energy consumption compared to traditional thermal evaporators. This makes them a cost-effective and environmentally friendly choice for industries with moderate wastewater volumes, such as metal finishing, electronics, textiles, and small-scale food processing. Heat pump vacuum evaporators are also preferred for their compact design, low operating temperatures, and ability to treat complex wastewater streams with minimal maintenance. Their growing adoption is driven by the need to meet environmental regulations, reduce disposal costs, and promote water reuse, especially in regions with strict wastewater discharge limits and rising energy prices.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level- 30%, Director Level- 40%, and Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 35%, South America - 5%, and Middle East & Africa - 5%

Veolia Water Technologies (France), SPX Flow Inc. (US), Alfa Laval (Sweden), Condorchem Enviro Solutions (Spain), and GEA Group AG (Germany) are some of the major players in the vacuum evaporators market. These players have adopted acquisitions, expansions, partnerships, and agreements to increase their market share and business revenue.

Research Coverage

The report defines, segments, and projects the vacuum evaporators market based on technology, application, end-use industry, capacity, installation type, and region. It provides detailed information about the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles vacuum evaporator manufacturers, thoroughly analyzes their market shares and core competencies, and tracks and examines competitive developments they undertake in the market, such as expansions, partnerships, and product launches.

Reasons to Buy Report

The report is expected to assist both market leaders and new entrants by providing them with the closest estimates of revenue figures for the vacuum evaporators market and its segments. It also aims to help stakeholders better understand the market's competitive landscape, gather insights to enhance their business position, and develop effective go-to-market strategies. Additionally, it enables stakeholders to understand the market's pulse and provide them with information on key drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Implementation of stringent environmental regulations and zero liquid discharge (ZLD) initiatives, water scarcity and the need for resource recovery, expanding industrial applications), restraints (High installation and operational costs of vacuum evaporators, complex operation and maintenance), opportunities (Support for green chemistry initiatives, Technological advancements and energy-efficient designs, Increased investment in food safety and quality and increasing urbanization and municipal wastewater treatment), and challenges (Technical complexity and need for skilled labor, competitive from alternative technologies) influencing the growth of the vacuum evaporators market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the vacuum evaporators market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the vacuum evaporators market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the industrial market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Veolia Water Technologies (France), SPX Flow, Inc. (US), Condorchem Enviro Solutions (Spain), Eco-Techno Srl (Italy), GEA Group Aktiengesellschaft (Germany), H2O GmbH (Germany), De Dietrich (US), Bucher Unipektin (Switzerland), Alfa Laval (Sweden), Sasakura Engineering Co., Ltd. (Japan), Praj Industries (India), and Sanshin Mfg. Co., Ltd. (Japan), Saltworks Technologies Inc. (Canada), Zhejiang Taikang Evaporator Co., Ltd. (China), Belmar Technologies (England), Hebei Leheng Energy Saving Equipment Co., Ltd. (China), Unitop Aquacare Limited (India), and GMM Pfaudler (India) in the vacuum evaporators market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.3.5 INCLUSIONS & EXCLUSIONS

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 List of participating companies for primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN VACUUM EVAPORATORS MARKET

- 4.2 VACUUM EVAPORATORS MARKET, BY REGION

- 4.3 NORTH AMERICA VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.4 VACUUM EVAPORATORS MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Implementation of stringent environmental regulations and zero liquid discharge (ZLD) initiatives

- 5.2.1.2 Water scarcity and need for resource recovery

- 5.2.1.3 Expanding industrial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and operational costs of vacuum evaporators

- 5.2.2.2 Complex operation and maintenance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Support for green chemistry initiatives

- 5.2.3.2 Technological advancements and energy-efficient designs

- 5.2.3.3 Increased investment in food safety and quality and increasing urbanization and municipal wastewater treatment

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical complexity and need for skilled labor

- 5.2.4.2 Competition from alternative technologies

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 DEGREE OF COMPETITION

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM FOR VACUUM EVAPORATORS MARKET

- 5.7 PATENT ANALYSIS

- 5.7.1 METHODOLOGY

- 5.7.2 PATENT PUBLICATION TRENDS

- 5.7.3 INSIGHTS

- 5.7.4 JURISDICTION ANALYSIS

- 5.7.4.1 LIST OF MAJOR PATENTS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 MULTIPLE EFFECT EVAPORATOR FOR SPECIALTY CHEMICALS COMPANY

- 5.8.1.1 Objective

- 5.8.1.2 Challenge

- 5.8.1.3 Solution statement

- 5.8.1.4 Result

- 5.8.2 LANDFILL LEACHATE MINIMIZATION USING AN ENCON THERMAL EVAPORATOR

- 5.8.2.1 Objective

- 5.8.2.2 Challenge

- 5.8.2.3 Solution statement

- 5.8.2.4 Result

- 5.8.1 MULTIPLE EFFECT EVAPORATOR FOR SPECIALTY CHEMICALS COMPANY

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Vacuum evaporator technology

- 5.12.1 KEY TECHNOLOGIES

- 5.13 ADJACENT TECHNOLOGIES

- 5.13.1 CRYSTALLIZERS

- 5.13.2 DRYERS (E.G., SPRAY DRYERS, DRUM DRYERS)

- 5.14 COMPLEMENTARY TECHNOLOGIES

- 5.14.1 WASTE HEAT RECOVERY UNITS

- 5.15 TRENDS/DISRUPTION IMPACT

- 5.16 GLOBAL MACROECONOMIC OUTLOOK

- 5.16.1 GDP

- 5.17 IMPACT OF 2025 US TARIFF - VACUUM EVAPORATORS MARKET

- 5.17.1 KEY TARIFF RATES

- 5.17.2 PRICE IMPACT ANALYSIS

- 5.17.3 IMPACT ON COUNTRY/REGION

- 5.17.3.1 Us

- 5.17.3.2 Europe

- 5.17.3.3 Asia Pacific

- 5.17.4 IMPACT ON APPLICATIONS

- 5.17.4.1 Pharmaceutical

- 5.17.4.2 Chemical & petrochemical

- 5.17.4.3 Electronics & semiconductor

- 5.17.4.4 Energy & power

- 5.17.4.5 Food & beverage

- 5.17.4.6 Automotive

- 5.17.4.7 Other applications

- 5.18 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) ON VACUUM EVAPORATOR MARKET

6 VACUUM EVAPORATORS MARKET, BY TYPE OF TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 HEAT PUMP VACUUM EVAPORATORS

- 6.2.1 STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 6.3 MECHANICAL VAPOR RECOMPRESSION VACUUM EVAPORATORS

- 6.3.1 RISING FOCUS ON SUSTAINABLE AND CIRCULAR PROCESSES

- 6.4 THERMAL VACUUM EVAPORATORS

- 6.4.1 EFFECTIVE FOR HIGH-SALINITY AND HIGH-CONTAMINANT WASTEWATER

7 VACUUM EVAPORATORS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 WASTEWATER TREATMENT

- 7.2.1 RISING ADOPTION OF ZERO LIQUID DISCHARGE (ZLD) SYSTEMS

- 7.3 PRODUCT PROCESSING

- 7.3.1 GROWTH IN WATER-INTENSIVE INDUSTRIES

- 7.4 OTHER APPLICATIONS

8 VACUUM EVAPORATORS MARKET, BY CAPACITY

- 8.1 INTRODUCTION

- 8.2 SMALL SCALE (UP TO 100 LITERS/HOUR)

- 8.2.1 GROWING ADOPTION BY SMES AND LABORATORIES TO DRIVE MARKET

- 8.3 MEDIUM SCALE (100-500 LITERS/HOUR)

- 8.3.1 INCREASING DEMAND FROM MID-SIZED MANUFACTURING AND PROCESSING INDUSTRIES

- 8.4 LARGE SCALE (ABOVE 500 LITERS/HOUR)

- 8.4.1 EXPANSION OF INDUSTRIAL INFRASTRUCTURE AND MEGA PROJECTS IN EMERGING ECONOMIES

9 VACUUM EVAPORATORS MARKET, BY INSTALLATION

- 9.1 INTRODUCTION

- 9.2 NEW INSTALLATION

- 9.2.1 FOCUS ON WATER REUSE AND RECYCLING IN GREENFIELD PROJECTS TO DRIVE MARKET

- 9.3 RETROFIT INSTALLATION

- 9.3.1 NEED FOR UPGRADING AGING INFRASTRUCTURE

10 VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 CHEMICAL & PETROCHEMICAL

- 10.2.1 HIGH WATER CONSUMPTION AND COMPLEX WASTEWATER STREAMS TO DRIVE MARKET

- 10.3 ELECTRONICS & SEMICONDUCTOR

- 10.3.1 HIGH DEMAND FOR ULTRAPURE WATER (UPW) TO DRIVE GROWTH

- 10.4 ENERGY & POWER

- 10.4.1 NEED FOR EFFICIENT WASTEWATER TREATMENT

- 10.5 FOOD & BEVERAGE

- 10.5.1 GROWING DEMAND FOR PROCESSED AND SHELF-STABLE PRODUCTS

- 10.6 PHARMACEUTICAL

- 10.6.1 PRODUCT QUALITY AND STABILITY TO DRIVE MARKET

- 10.7 AUTOMOTIVE

- 10.7.1 GENERATION OF COMPLEX EFFLUENTS TO DRIVE MARKET

- 10.8 OTHER END-USE INDUSTRIES

11 VACUUM EVAPORATORS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Growing manufacturing hub to drive market

- 11.2.2 SOUTH KOREA

- 11.2.2.1 Growing electronics and automobile sectors to create opportunities

- 11.2.3 JAPAN

- 11.2.3.1 Rising demand driven by sustainability and technological innovation to drive market

- 11.2.4 INDIA

- 11.2.4.1 Initiative in food & beverage industries to generate demand

- 11.2.5 MALAYSIA

- 11.2.5.1 Expanding manufacturing sector to create opportunities

- 11.2.6 AUSTRALIA

- 11.2.6.1 High demand for vacuum evaporators in food & beverage sector to drive market

- 11.2.7 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Regulatory and industrial demand to drive market

- 11.3.2 CANADA

- 11.3.2.1 Industrial expansion to create demand for vacuum evaporators

- 11.3.3 MEXICO

- 11.3.3.1 Economic & policy support to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Pharmaceutical production and automotive industry to support market growth

- 11.4.2 UK

- 11.4.2.1 Rising demand for vacuum evaporators in electrical & electronics industry

- 11.4.3 RUSSIA

- 11.4.3.1 Growth in food & beverage industry to increase demand

- 11.4.4 FRANCE

- 11.4.4.1 Water treatment infrastructure to drive demand

- 11.4.5 ITALY

- 11.4.5.1 Growth in pharmaceutical and automotive industries to increase demand

- 11.4.6 SPAIN

- 11.4.6.1 Growth in food & beverage industry to support market

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Growth in chemical industry to create demand

- 11.5.1.2 UAE

- 11.5.1.2.1 Manufacturing sector to drive market

- 11.5.1.3 Qatar

- 11.5.1.3.1 Growing petrochemicals sector to drive market

- 11.5.1.4 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 ISRAEL

- 11.5.2.1 National water scarcity & circular economy initiatives to drive market

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Biggest industrial sectors to create demand for vacuum evaporators

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 ARGENTINA

- 11.6.1.1 Growing food & beverage and electronics industries to boost market growth

- 11.6.2 BRAZIL

- 11.6.2.1 Automotive industry to drive market

- 11.6.3 CHILE

- 11.6.3.1 Mining sector to create demand for vacuum evaporators

- 11.6.1 ARGENTINA

- 11.7 REST OF SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS

- 12.3.1 REVENUE ANALYSIS, 2020-2024

- 12.3.2 MARKET SHARE ANALYSIS, 2024

- 12.3.2.1 Veolia Water Technologies (France)

- 12.3.2.2 Alfa Laval (Sweden)

- 12.3.2.3 SPX Flow, Inc. (US)

- 12.3.2.4 Gea Group Aktiengesellschaft (Germany)

- 12.3.2.5 Condorchem Enviro Solutions (Spain)

- 12.4 BRAND/PRODUCT COMPARISON

- 12.4.1 VEOLIA WATER TECHNOLOGIES ( VEOLIA GROUP)

- 12.4.2 GEA GROUP AKTIENGESELLSCHAFT

- 12.4.3 SPX FLOW INC

- 12.4.4 ALFA LAVAL

- 12.4.5 CONDORCHEM ENVIRO SOLUTIONS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.6 REGION FOOTPRINT

- 12.5.7 TECHNOLOGY FOOTPRINT '

- 12.5.8 APPLICATION FOOTPRINT '

- 12.5.9 END USE FOOTPRINT

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP)

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ALFA LAVAL

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 GEA GROUP AKTIENGESELLSCHAFT

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SPX FLOW, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 CONDORCHEM ENVIRO SOLUTIONS

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 ECO-TECHNO SRL

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 H2O GMBH

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.8 DE DIETRICH

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.2.1 Product launches

- 13.1.9 BUCHER UNIPEKTIN

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 SASAKURA ENGINEERING CO, LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 PRAJ INDUSTRIES

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 SANSHIN MFG. CO., LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 SALTWORKS TECHNOLOGIES INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Expansions

- 13.1.14 ZHEJIANG TAIKANG EVAPORATOR CO., LTD

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.15 BELMAR TECHNOLOGIES

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.16 HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.17 UNITOP AQUACARE LIMITED

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Expansions

- 13.1.18 GMM PFAUDLER

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Deals

- 13.1.1 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP)

- 13.2 OTHER PLAYERS

- 13.2.1 3V TECH S.P.A.

- 13.2.2 VILOKEN RECYCLING TECH

- 13.2.3 SAMSCO

- 13.2.4 3R TECHNOLOGY

- 13.2.5 KOVOFINIS

- 13.2.6 ENCON EVAPORATORS

- 13.2.7 S.A.I.T.A SRL

- 13.2.8 KMU LOFT CLEANWATER SE

- 13.2.9 TETRA PAK INTERNATIONAL S.A.

- 13.2.10 PROCECO LTD.

- 13.2.11 CFT S.P.A.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKETS

- 14.3.1 ZERO LIQUID DISCHARGE (ZLD) SYSTEMS MARKET

- 14.3.1.1 Market definition

- 14.3.1.2 Market overview

- 14.3.1 ZERO LIQUID DISCHARGE (ZLD) SYSTEMS MARKET

- 14.4 ZERO LIQUID DISCHARGE (ZLD) SYSTEMS MARKET, BY SYSTEM

- 14.4.1 CONVENTIONAL

- 14.4.1.1 Requirement in small and medium capacity plants to drive market

- 14.4.2 HYBRID

- 14.4.2.1 High water recovery rate to promote use

- 14.4.1 CONVENTIONAL

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 VACUUM EVAPORATORS MARKET, SEGMENT: INCLUSIONS & EXCLUSIONS

- TABLE 2 VACUUM EVAPORATORS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 VACUUM EVAPORATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA, BY TOP THREE END-USE INDUSTRIES

- TABLE 6 VACUUM EVAPORATORS MARKET: ECOSYSTEM

- TABLE 7 VACUUM EVAPORATORS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 8 STANDARDS FOR VACUUM EVAPORATORS

- TABLE 9 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 10 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024

- TABLE 11 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024

- TABLE 12 FOREIGN DIRECT INVESTMENT, 2022 VS. 2023

- TABLE 13 VACUUM EVAPORATORS MARKET, BY TYPE OF TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 14 VACUUM EVAPORATORS MARKET, BY TYPE OF TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 15 HEAT PUMP VACUUM EVAPORATORS: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 16 HEAT PUMP VACUUM EVAPORATORS: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17 MECHANICAL VAPOR RECOMPRESSION VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 18 MECHANICAL VAPOR RECOMPRESSION VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19 THERMAL VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 20 THERMAL VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 22 VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 WASTEWATER TREATMENT: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 WASTEWATER TREATMENT: VACUUM EVAPORATORS MARKET, BY REGION, 2025 -2030 (USD MILLION)

- TABLE 25 PRODUCT PROCESSING: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 PRODUCT PROCESSING: VACUUM EVAPORATORS MARKET, BY REGION, 2025 -2030 (USD MILLION)

- TABLE 27 OTHER APPLICATIONS: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 OTHER APPLICATIONS: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 30 VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 CHEMICAL & PETROCHEMICAL: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 CHEMICAL & PETROCHEMICAL: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ELECTRONICS & SEMICONDUCTOR: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 ELECTRONICS & SEMICONDUCTOR: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 ENERGY & POWER: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 ENERGY & POWER: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 FOOD & BEVERAGE: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 FOOD & BEVERAGE: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 PHARMACEUTICAL: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 PHARMACEUTICAL: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 AUTOMOTIVE: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 AUTOMOTIVE: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OTHER END-USE INDUSTRIES: VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 OTHER END-USE INDUSTRIES: VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 VACUUM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 VACUUM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 52 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 54 ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 CHINA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 56 CHINA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 CHINA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 58 CHINA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 59 CHINA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 60 CHINA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 SOUTH KOREA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 62 SOUTH KOREA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 SOUTH KOREA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 64 SOUTH KOREA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 65 SOUTH KOREA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 66 SOUTH KOREA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 JAPAN: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 68 JAPAN: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 JAPAN: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 70 JAPAN: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 71 JAPAN: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 72 JAPAN: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 INDIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 74 INDIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 INDIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 76 INDIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 77 INDIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 78 INDIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 MALAYSIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 80 MALAYSIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 MALAYSIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 82 MALAYSIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 83 MALAYSIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 84 MALAYSIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 AUSTRALIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 86 AUSTRALIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 AUSTRALIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 88 AUSTRALIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 89 AUSTRALIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 90 AUSTRALIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 US: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 106 US: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 US: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 108 US: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 109 US: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 110 US: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 112 CANADA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 114 CANADA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 115 CANADA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 116 CANADA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 MEXICO: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 118 MEXICO: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 MEXICO: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 120 MEXICO: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 121 MEXICO: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 122 MEXICO: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 124 EUROPE: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 126 EUROPE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 128 EUROPE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 130 EUROPE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 132 GERMANY: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 GERMANY: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 134 GERMANY: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 135 GERMANY: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 136 GERMANY: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 UK: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 138 UK: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 UK: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 140 UK: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 141 UK: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 142 UK: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 RUSSIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 144 RUSSIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 RUSSIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 146 RUSSIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 147 RUSSIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 148 RUSSIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 FRANCE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 150 FRANCE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 FRANCE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 152 FRANCE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 153 FRANCE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 154 FRANCE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 ITALY: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 156 ITALY: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 ITALY: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 158 ITALY: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 159 ITALY: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 160 ITALY: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 SPAIN: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 162 SPAIN: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 SPAIN: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 164 SPAIN: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 165 SPAIN: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 166 SPAIN: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 REST OF EUROPE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 170 REST OF EUROPE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 172 REST OF EUROPE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 SAUDI ARABIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 182 SAUDI ARABIA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 183 SAUDI ARABIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 184 SAUDI ARABIA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 185 SAUDI ARABIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 186 SAUDI ARABIA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 UAE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 188 UAE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 UAE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 190 UAE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 191 UAE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 192 UAE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 QATAR: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 194 QATAR: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 QATAR: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 196 QATAR: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 197 QATAR: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 198 QATAR: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199 REST OF GCC COUNTRIES: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 200 REST OF GCC COUNTRIES: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 201 REST OF GCC COUNTRIES: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 202 REST OF GCC COUNTRIES: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 203 REST OF GCC COUNTRIES: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 204 REST OF GCC COUNTRIES: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 ISRAEL: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 206 ISRAEL: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 207 ISRAEL: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 208 ISRAEL: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 209 ISRAEL: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 210 ISRAEL: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 SOUTH AFRICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 212 SOUTH AFRICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AFRICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 214 SOUTH AFRICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 215 SOUTH AFRICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 216 SOUTH AFRICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 217 REST MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 218 REST MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 219 REST MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 220 REST MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 221 REST MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 222 REST MIDDLE EAST & AFRICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 223 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 224 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 226 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 227 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 228 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 229 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 230 SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 231 ARGENTINA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 232 ARGENTINA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 ARGENTINA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 234 ARGENTINA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 235 ARGENTINA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 236 ARGENTINA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 237 BRAZIL: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 238 BRAZIL: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 239 BRAZIL: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 240 BRAZIL: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 241 BRAZIL: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 242 BRAZIL: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 243 CHILE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 244 CHILE: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 245 CHILE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 246 CHILE: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 247 CHILE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 248 CHILE: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 253 REST OF SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 254 REST OF SOUTH AMERICA: VACUUM EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 255 VACUUM EVAPORATORS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 256 VACUUM EVAPORATORS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 257 VACUUM EVAPORATORS MARKET: REGION FOOTPRINT

- TABLE 258 VACUUM EVAPORATORS MARKET: TYPE OF TECHNOLOGY FOOTPRINT

- TABLE 259 VACUUM EVAPORATORS MARKET: APPLICATION FOOTPRINT

- TABLE 260 VACUUM EVAPORATORS MARKET: END USE FOOTPRINT

- TABLE 261 VACUUM EVAPORATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 262 VACUUM EVAPORATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 263 VACUUM EVAPORATORS MARKET: PRODUCT LAUNCHES, JANUARY 2020- APRIL 2025

- TABLE 264 VACUUM EVAPORATORS MARKET: DEALS, JANUARY 2020- APRIL 2025

- TABLE 265 VACUUM EVAPORATORS MARKET: EXPANSIONS, JANUARY 2020 - APRIL 2025

- TABLE 266 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): COMPANY OVERVIEW

- TABLE 267 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): DEALS, JANUARY 2020-JUNE 2025

- TABLE 269 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): EXPANSION, JANUARY 2020-JUNE 2025

- TABLE 270 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 271 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 273 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 275 GEA GROUP AKTIENGESELLSCHAFT: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 276 SPX FLOW, INC.: COMPANY OVERVIEW

- TABLE 277 SPX FLOW, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 CONDORCHEM ENVIRO SOLUTIONS: COMPANY OVERVIEW

- TABLE 279 CONDORCHEM ENVIRO SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 ECO-TECHNO SRL: COMPANY OVERVIEW

- TABLE 281 ECO-TECHNO SRL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 H2O GMBH: COMPANY OVERVIEW

- TABLE 283 H2O GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 H2O GMBH: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 285 DE DIETRICH: COMPANY OVERVIEW

- TABLE 286 DE DIETRICH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 DE DIETRICH: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 288 BUCHER UNIPEKTIN: COMPANY OVERVIEW

- TABLE 289 BUCHER UNIPEKTIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 SASAKURA ENGINEERING CO, LTD.: COMPANY OVERVIEW

- TABLE 291 SASAKURA ENGINEERING CO, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 PRAJ INDUSTRIES: COMPANY OVERVIEW

- TABLE 293 PRAJ INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 SANSHIN MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 295 SANSHIN MFG. CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 SALTWORKS TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 297 SALTWORKS TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 SALTWORKS TECHNOLOGIES INC: EXPANSION, JANUARY 2020-JUNE 2025

- TABLE 299 ZHEJIANG TAIKANG EVAPORATOR CO., LTD: COMPANY OVERVIEW

- TABLE 300 ZHEJIANG TAIKANG EVAPORATOR CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 BELMAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 302 BELMAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.: COMPANY OVERVIEW

- TABLE 304 HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 UNITOP AQUACARE LIMITED: COMPANY OVERVIEW

- TABLE 306 UNITOP AQUACARE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 UNITOP AQUACARE LIMITED: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 308 GMM PFAUDLER: COMPANY OVERVIEW

- TABLE 309 GMM PFAUDLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 GMM PFAUDLER: DEALS, JANUARY 2020-JUNE 2025

- TABLE 311 3V TECH S.P.A.: COMPANY OVERVIEW

- TABLE 312 VILOKEN RECYCLING TECH: COMPANY OVERVIEW

- TABLE 313 SAMSCO: COMPANY OVERVIEW

- TABLE 314 3R TECHNOLOGY: COMPANY OVERVIEW

- TABLE 315 KOVOFINIS: COMPANY OVERVIEW

- TABLE 316 ENCON EVAPORATORS: COMPANY OVERVIEW

- TABLE 317 S.A.I.T.A SRL: COMPANY OVERVIEW

- TABLE 318 KMU LOFT CLEANWATER SE: COMPANY OVERVIEW

- TABLE 319 TETRA PAK INTERNATIONAL S.A.: COMPANY OVERVIEW

- TABLE 320 PROCECO LTD.: COMPANY OVERVIEW

- TABLE 321 CFT S.P.A..: COMPANY OVERVIEW

- TABLE 322 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 323 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 324 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 325 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

List of Figures

- FIGURE 1 VACUUM EVAPORATORS MARKET SEGMENTATION

- FIGURE 2 VACUUM EVAPORATORS MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

- FIGURE 6 VACUUM EVAPORATORS MARKET: DATA TRIANGULATION

- FIGURE 7 FACTOR ANALYSIS

- FIGURE 8 THERMAL VACUUM EVAPORATORS ACCOUNTED FOR LARGER SHARE OF VACUUM EVAPORATORS MARKET IN 2024

- FIGURE 9 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET SHARE IN 2024

- FIGURE 10 FOOD & BEVERAGE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING VACUUM EVAPORATORS MARKET THROUGH 2030

- FIGURE 12 IMPLEMENTATION OF STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE VACUUM EVAPORATORS MARKET

- FIGURE 13 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 14 AUTOMOTIVE INDUSTRY AND US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN VACUUM EVAPORATORS MARKET IN 2024

- FIGURE 15 VACUUM EVAPORATORS MARKET IN CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 28 THERMAL VACUUM EVAPORATORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 WASTEWATER TREATMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 AUTOMOTIVE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 VACUUM EVAPORATORS MARKET, BY REGION (USD MILLION)

- FIGURE 32 ASIA PACIFIC: VACUUM EVAPORATORS MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: VACUUM EVAPORATORS MARKET SNAPSHOT

- FIGURE 34 EUROPE: VACUUM EVAPORATORS MARKET SNAPSHOT

- FIGURE 35 VACUUM EVAPORATORS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 36 VACUUM EVAPORATORS MARKET SHARE ANALYSIS, 2024

- FIGURE 37 VACUUM EVAPORATORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 38 VACUUM EVAPORATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 VACUUM EVAPORATORS MARKET: COMPANY FOOTPRINT

- FIGURE 40 VACUUM EVAPORATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 VACUUM EVAPORATORS MARKET: EV/EBITDA

- FIGURE 42 VACUUM EVAPORATORS MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 43 VACUUM EVAPORATORS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 44 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): COMPANY SNAPSHOT

- FIGURE 45 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 46 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 47 BUCHER UNIPEKTIN: COMPANY SNAPSHOT

- FIGURE 48 SASAKURA ENGINEERING CO, LTD.: COMPANY SNAPSHOT

- FIGURE 49 PRAJ INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 50 GMM PFAUDLER: COMPANY SNAPSHOT