|

市场调查报告书

商品编码

1807083

全球金属加工液市场(至 2030 年):按类型(直馏油、水溶性油、半合成油、合成油)、产品类型(除油、防銹油、成型油、加工油)、最终用户产业和地区划分Metalworking Fluids Market by Type (Straight Oils, Soluble Oils, Semi-synthetic Fluids, Synthetic Fluids), Product Type (Removal Fluid, Protecting Fluids, Forming Fluids, Treating Fluids), End-use Industry, and Region - Global Forecast to 2030 |

||||||

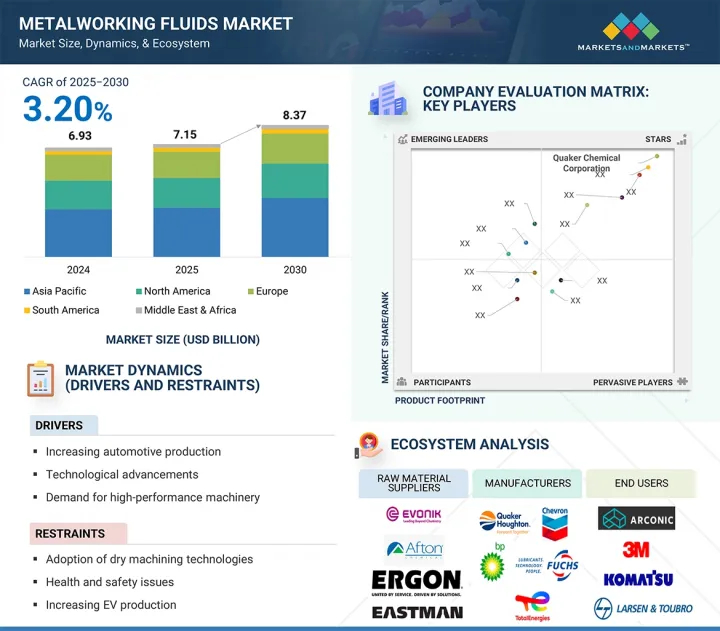

预计2025年至2030年全球金属加工液市场将以3.20%的复合年增长率成长,到2030年市场规模将达到83.7亿美元。

金属加工液在工业加工过程中至关重要,其关键特性包括冷却、润滑、防腐和切屑控制。这些液体在许多製造业的精密金属切割、研磨、冲压和成型中发挥着至关重要的作用。金属加工液产业主要由运输製造业推动,预计到2024年该产业将占据最大的市场占有率。快速的工业化、基础设施建设和技术创新正在推动汽车、航太、铁路和重型运输业的需求成长。这些产业利用先进的金属加工液来加工新型运输系统中使用的轻质、耐热和先进材料。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 部分 | 产品类型、最终用途产业、地区 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

此外,製造工厂引进高科技CNC设备和自动化技术,需要更高品质、更有效率的加工液,以确保最佳加工效果并延长刀具寿命。各种运输业对精密刀具的采用日益增多,凸显了金属加工液在现代製造环境中日益增长的重要性。

“按类型划分,水溶性油将在2024年占据最大的市场份额。”

这些液体含有可乳化成分,可与水混合后喷洒到机械上。由于其出色的冷却性能和适度的润滑性,它们能够提供卓越的性能。这种组合使其能够高效地应用于各种应用,包括金属切割、研磨和成型。其高效性和低成本使其广受欢迎,尤其是在那些注重营运效率且不牺牲性能的关键产业中。

“按产品类型划分,去除油占比最大,反映了机械加工和材料去除应用的需求。”

这些切削液主要用于车削、钻孔、铣削和研磨等製作流程,以物理方式切削加工材料或去除金属碎屑。由于零件製造高度依赖基于材料去除的加工技术,因此这类切削液的市场份额很高。切削液在散热、排放和润滑方面表现出色,而这些正是维持刀具寿命、尺寸精度和切屑表面光洁度的最重要因素。

2024 年亚太地区将占据最大份额

这得益于蓬勃发展的工业部门、快速的都市化以及汽车、机械製造和金属加工行业的持续发展。中国、印度、日本和韩国等国家正在投资基础建设和现代化製造设施,推动金属加工液在各种工业应用中的广泛应用。除了作为製造地之外,这些国家还受益于政府的优惠政策和奖励外商直接投资诱因。这些措施正在提升地区生产能力,并增加对高性能加工解决方案(尤其是先进金属加工液)的需求。

本报告调查了全球金属加工液市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

第六章 产业趋势

- 供应链分析

- 定价分析

- 影响客户业务的趋势/中断

- 生态系分析

- 技术分析

- 案例研究分析

- 贸易分析

- 监管状况

- 2025-2026年重要会议和活动

- 投资金筹措场景

- 专利分析

- 2025年美国关税对半导体液体市场的影响

- 人工智慧/生成式人工智慧对金属加工液市场的影响

第七章金属加工液市场(按类型)

- 直馏油

- 水溶性油

- 半合成油

- 合成油

第 8 章金属加工液市场(依产品类型)

- 除油

- 防銹油

- 成型油

- 成品油

第九章金属加工液市场(依最终用户)

- 交通运输设备製造业

- 金属加工

- 机器

- 其他的

第 10 章金属加工液市场(按地区)

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 中东和非洲

- 海湾合作委员会国家

- 埃及

- 南非

第十一章竞争格局

- 主要参与企业的策略/优势

- 市场占有率分析

- 收益分析

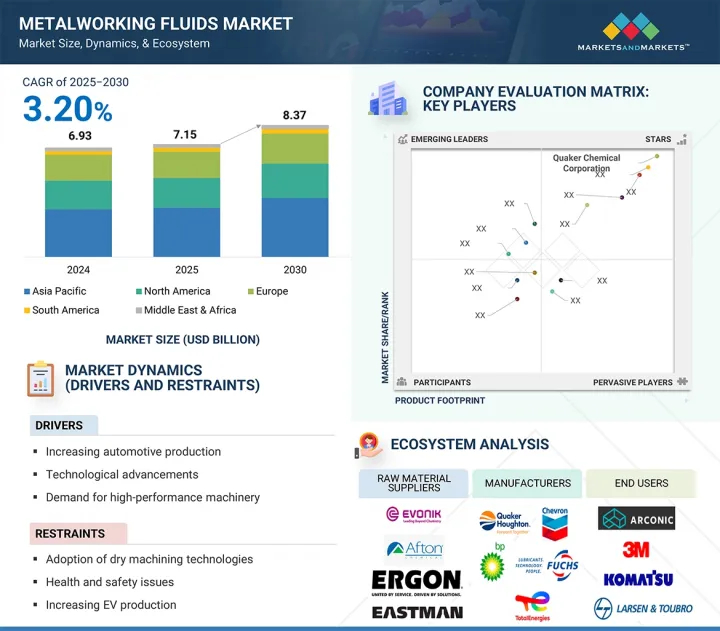

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 品牌/产品比较

- 估值和财务指标

- 竞争场景

第十二章:公司简介

- 主要企业

- QUAKER HOUGHTON

- TOTALENERGIES SE

- CHEVRON CORPORATION

- EXXON MOBIL CORPORATION

- PJSC LUKOIL

- FUCHS SE

- IDEMITSU KOSAN CO., LTD.

- BP PLC

- SAUDI ARAMCO

- CHINA PETROLEUM & CHEMICAL CORPORATION

- CHEM ARROW CORPORATION

- 其他公司

- PHILLIPS 66 COMPANY

- ENEOS HOLDINGS, INC.:

- GULF OIL INTERNATIONAL LTD

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- APAR INDUSTRIES LTD.

- PETROFER

- ENI SPA

- MOTUL SA

- KLUBER LUBRICATION MUNCHEN GMBH & CO. KG

- VERTEX LUBRICANTS

- METALFLOW SA

- DENNISON LUBRICANTS, INC.

- COSMO OIL LUBRICANTS CO., LTD.

- RAYCO CHEMICAL

第十三章:相邻市场与相关市场

第十四章 附录

The global market for metalworking fluids is expected to grow steadily, at an estimated CAGR of 3.20% from 2025 to 2030, reaching a market size of USD 8.37 billion by 2030. Metalworking fluids form an inseparable part of industrial machining processes, the main characteristics of such fluids being cooling effects, lubrication, corrosion prevention, and swarf issues. These fluids play a major role in precision metal cutting, grinding, stamping, and forming in many manufacturing industries. The metalworking fluids industry is primarily driven by the transportation equipment manufacturing sector, which holds the largest market share in 2024. Factors such as rapid industrialization, infrastructure development, and technological innovations have contributed to the increased demand in the automotive, aerospace, railway, and heavy transport equipment industries. These sectors utilize advanced metalworking fluids to facilitate the machining of modern lightweight and heat-resistant materials used in new transportation systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Type, Product Type, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Furthermore, the implementation of high-tech CNC equipment and automation in manufacturing plants requires even higher quality and more efficient fluids. This ensures optimal processing and extends the lifespan of the tools. The rising adoption of precision tooling across various transportation industries highlights the growing emphasis on metalworking fluids in contemporary manufacturing environments.

"Soluble oils accounted for the largest share of the metalworking fluids market in 2024."

Soluble oils held the largest market share in 2024. These oils contain emulsifiable components that are mixed with water and then sprayed onto machinery. They perform exceptionally well, providing a high cooling rate alongside a moderate lubricating rate. This combination allows them to work efficiently in various metal cutting, grinding, and forming applications. They are widely utilized because of their high efficiency and affordability, particularly in major industries that prioritize operational effectiveness without sacrificing performance. The semi-synthetic fluids segment accounted for the second-largest share. They consist of synthetic and mineral oil emulsions that balance between the performance offered by fully synthetic fluids and the lubrication ability of straight oils. Pure oils are the basic oils and are very good lubricants in heavy-duty machining, but they lack in the cooling aspect, so they can only be used in certain areas of high-torque machines. Niche, high-precision operations utilize synthetic fluids where resistance to thermal breakdown and cleanliness are amongst the objectives. Rising environmental standards and the increasing trend to bio-based fluids are further shaping other formulation trends, where soluble oils and semi-synthetic oils are preferred due to their recyclable and reduced-risk characteristics.

"Removal fluids accounted for the largest share of the market, reflecting demand in machining and material removal applications."

As per product type, the removal fluids segment accounted for the largest share of the metalworking fluids market in 2024. In machining operations like turning, drilling, milling, and grinding, these fluids are mostly applied in physical cutting or removing pieces of metal from a workpiece. The share is high due to dominance in manufacturing techniques, which are based on material removal in fabrication parts. The removal fluids come in a design that promises a good dissipation of heat, chip escape, and lubrication, the most important factors that would sustain the tool life, dimensional accuracy, and the surface finish of the chip.

Forming fluids are mainly used in non-cutting processes such as stamping, forging, rolling, and extrusion. The fluids aid extreme-pressure jobs, reducing friction and wear where the metals are worked on, not machined away. Protective fluids are used to prevent corrosion during storage and transportation, ensuring that they do not corrode before removal. Finally, heating functions and surface conditioning are accomplished using fluids that are treated. As more pressure is established on operational efficiency, fluid recycling, and environmental compliance, developing multifunctional and durable fluids in general, and removal fluids in particular, is emerging as a game-changer in the metalworking fluids market.

"Asia Pacific dominates the global metalworking fluids market, with the largest regional share in 2024."

The Asia Pacific region dominated the metalworking fluids market in 2024. This is due to its vibrant industrial sector, rapid urbanization, and ongoing development in the automobile, machine building, and metalworking industries. Countries such as China, India, Japan, and South Korea are investing in infrastructure development and modern manufacturing equipment, which ensures that metalworking fluids are widely used across various industrial applications. In addition to being manufacturing hubs, these countries benefit from favorable government policies and local incentives for foreign direct investment. These initiatives are enhancing regional production capabilities and increasing the demand for high-performance machining solutions, including advanced metalworking fluids.

Other regions, such as North America and Europe, will also maintain a strong presence in the market due to their superior manufacturing systems and innovations in synthetic and sustainable metalworking solutions. However, the Asia Pacific will continue to be a key area for market growth through 2030, driven by rising competition, increasing energy efficiency regulations, and growing domestic consumption.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Quaker Houghton (US), TotalEnergies SE (France), Chevron Corporation (US), Exxon Mobil Corporation (US), PJSC LUKOIL (Russia), FUCHS SE (Germany), Idemitsu Kosan Co., Ltd. (Japan), BP p.l.c. (UK), Saudi Aramco (Saudi Arabia), and China Petroleum & Chemical Corporation (SINOPEC) (China).

Research Coverage

This report segments the metalworking fluids market based on type, product type, end-use industry, and region, and provides estimations of value (USD million) for the overall market size across various regions. The report also provides a detailed analysis of key industry players to provide insights into their business overviews, services, and key strategies associated with the metalworking fluids market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the metalworking fluids market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on metalworking fluids offered by top players in the global market.

- Analysis of key drivers (increasing automotive production, technological advancements, and demand for high-performance machinery), restraints (adoption of dry machining technologies, health and safety issues, and increasing EV production), opportunities (product innovation and differentiation and data-driven fluid management systems), and challenges (fluctuating raw material prices and stringent environmental regulations) influencing the growth of the metalworking fluids market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the metalworking fluids market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for metalworking fluids across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global metalworking fluids market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the metalworking fluids market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METALWORKING FLUIDS MARKET

- 4.2 METALWORKING FLUIDS MARKET, BY REGION

- 4.3 ASIA PACIFIC METALWORKING FLUIDS MARKET, BY TYPE AND COUNTRY

- 4.4 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE AND REGION

- 4.5 METALWORKING FLUIDS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing automobile production

- 5.2.1.2 Technological advancements in metalworking techniques

- 5.2.1.3 Rising demand for high-performance machinery

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adoption of dry machining technologies

- 5.2.2.2 Health and safety issues associated with metalworking fluids

- 5.2.2.3 Increasing electric vehicle (EV) production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Product innovation and differentiation

- 5.2.3.2 Implementation of data-driven fluid management systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices

- 5.2.4.2 Stringent environmental regulations related to metalworking fluids

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END USE, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Emulsification technology

- 6.5.1.2 Nanofluid technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Advanced filtration systems

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 STEEL HOT-MILL ROLLING: 65% FEWER KICK-OUT DELAYS

- 6.6.2 METAL FORMING: BETTER FLUID MAINTENANCE AND ODOR ELIMINATION

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 340319)

- 6.7.2 EXPORT SCENARIO (HS CODE 340319)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF ON SEMICONDUCTOR FLUIDS MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRIES/REGIONS

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END USES

- 6.13 IMPACT OF AI/GEN AI ON METALWORKING FLUIDS MARKET

7 METALWORKING FLUIDS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 STRAIGHT OILS

- 7.2.1 EFFECTIVENESS IN MACHINING AND FORMING APPLICATIONS TO DRIVE MARKET

- 7.3 SOLUBLE OILS

- 7.3.1 GROWTH OF METAL FABRICATION PROCESS TO DRIVE MARKET

- 7.4 SEMI-SYNTHETIC FLUIDS

- 7.4.1 ENHANCED PERFORMANCE AND AFFORDABILITY OF SEMI-SYNTHETIC FLUIDS TO DRIVE MARKET

- 7.5 SYNTHETIC FLUIDS

- 7.5.1 SUPERIOR COOLING CAPABILITIES OF SYNTHETIC FLUIDS TO FUEL DEMAND

8 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 REMOVAL FLUIDS

- 8.2.1 STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 8.3 PROTECTING FLUIDS

- 8.3.1 ANTI-CORROSION PROPERTY OF PROTECTING FLUIDS TO DRIVE MARKET

- 8.4 FORMING FLUIDS

- 8.4.1 ENHANCED PROCESS EFFICIENCY OF FORMING FLUIDS TO DRIVE MARKET

- 8.5 TREATING FLUIDS

- 8.5.1 ENHANCEMENT OF MECHANICAL PROPERTIES OF TREATING FLUIDS TO FUEL DEMAND

9 METALWORKING FLUIDS MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 TRANSPORT EQUIPMENT MANUFACTURING

- 9.2.1 GROWING AUTOMOBILE PRODUCTION TO DRIVE MARKET

- 9.3 METAL FABRICATION

- 9.3.1 GROWING MANUFACTURING SECTOR IN EMERGING ECONOMIES TO DRIVE MARKET

- 9.4 MACHINERY

- 9.4.1 DEMAND FOR HIGH-PERFORMANCE MACHINERY TO DRIVE MARKET

- 9.5 OTHER END USES

10 METALWORKING FLUIDS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Growing manufacturing sector to drive market

- 10.2.2 JAPAN

- 10.2.2.1 High automobile production to drive demand

- 10.2.3 INDIA

- 10.2.3.1 Expanding infrastructure and construction sectors to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Rapid industrialization to drive market

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Increase in automobile production to fuel demand

- 10.3.2 UK

- 10.3.2.1 Increasing investments in infrastructure development to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Metal fabrication industry to dominate market

- 10.3.4 SPAIN

- 10.3.4.1 Growth of automotive industry to drive market

- 10.3.5 ITALY

- 10.3.5.1 Expanding manufacturing sector to drive market

- 10.3.6 RUSSIA

- 10.3.6.1 Booming automotive industry to propel market

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Technological innovations to create lucrative opportunities for market growth

- 10.4.2 CANADA

- 10.4.2.1 Expanding manufacturing sector to propel market

- 10.4.3 MEXICO

- 10.4.3.1 Increasing demand from automotive sector to drive market

- 10.4.1 US

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Significant investments in automotive industry to accelerate market growth

- 10.5.2 ARGENTINA

- 10.5.2.1 Developing automotive industry to drive demand

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Strategic initiatives aimed at diversifying economy to drive market

- 10.6.1.1 Saudi Arabia

- 10.6.2 EGYPT

- 10.6.2.1 High availability and low cost of raw materials to drive market

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Advancements in machining technologies to drive demand

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Product type footprint

- 11.5.5.5 End use footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 QUAKER HOUGHTON

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 TOTALENERGIES SE

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 CHEVRON CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 EXXON MOBIL CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 PJSC LUKOIL

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.5.4 MnM View

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 FUCHS SE

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 IDEMITSU KOSAN CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.8 BP P.L.C.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 SAUDI ARAMCO

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 CHINA PETROLEUM & CHEMICAL CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Others

- 12.1.11 CHEM ARROW CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.1 QUAKER HOUGHTON

- 12.2 OTHER PLAYERS

- 12.2.1 PHILLIPS 66 COMPANY

- 12.2.2 ENEOS HOLDINGS, INC.:

- 12.2.3 GULF OIL INTERNATIONAL LTD

- 12.2.4 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 12.2.5 APAR INDUSTRIES LTD.

- 12.2.6 PETROFER

- 12.2.7 ENI S.P.A.

- 12.2.8 MOTUL S.A.

- 12.2.9 KLUBER LUBRICATION MUNCHEN GMBH & CO. KG

- 12.2.10 VERTEX LUBRICANTS

- 12.2.11 METALFLOW S.A.

- 12.2.12 DENNISON LUBRICANTS, INC.

- 12.2.13 COSMO OIL LUBRICANTS CO., LTD.

- 12.2.14 RAYCO CHEMICAL

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 FIRE-RESISTANT LUBRICANTS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 FIRE-RESISTANT LUBRICANTS MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 METALWORKING FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 METALWORKING FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY PRODUCT TYPE

- TABLE 3 METALWORKING FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY END USE

- TABLE 4 METALWORKING FLUIDS MARKET: GLOBAL REGULATORY BODIES

- TABLE 5 METALWORKING FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USE SEGMENTS (%)

- TABLE 7 KEY BUYING CRITERIA, BY END USE

- TABLE 8 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 9 AVERAGE SELLING PRICE TREND OF METALWORKING FLUIDS OFFERED BY KEY PLAYERS, BY END USE, 2024 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE TREND OF METALWORKING FLUIDS, BY REGION, 2022-2030 (USD/KG)

- TABLE 11 ROLES OF COMPANIES IN METALWORKING FLUIDS ECOSYSTEM

- TABLE 12 IMPORT DATA RELATED TO HS CODE 340319-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA RELATED TO HS CODE 340319-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 METALWORKING FLUIDS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 METALWORKING FLUIDS MARKET: FUNDING/INVESTMENT SCENARIO, 2020-2024

- TABLE 20 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 21 METALWORKING FLUIDS MARKET: LIST OF MAJOR PATENTS, 2023-2024

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 24 METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 26 METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 27 STRAIGHT OILS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 STRAIGHT OILS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 STRAIGHT OILS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 30 STRAIGHT OILS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 31 SOLUBLE OILS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 SOLUBLE OILS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 SOLUBLE OILS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 34 SOLUBLE OILS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 35 SEMI-SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 SEMI-SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 SEMI-SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 38 SEMI-SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 39 SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 42 SYNTHETIC FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 43 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 44 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 45 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (KILOTON)

- TABLE 46 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 47 REMOVAL FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 REMOVAL FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 EMOVAL FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 50 REMOVAL FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 51 PROTECTING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 PROTECTING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 PROTECTING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 54 PROTECTING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 FORMING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 FORMING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 FORMING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 58 FORMING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 59 TREATING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 TREATING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 TREATING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 62 TREATING FLUIDS: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 63 METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 64 METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 65 METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 66 METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 67 TRANSPORT EQUIPMENT MANUFACTURING: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 TRANSPORT EQUIPMENT MANUFACTURING: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 TRANSPORT EQUIPMENT MANUFACTURING: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 70 TRANSPORT EQUIPMENT MANUFACTURING: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 71 METAL FABRICATION: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 METAL FABRICATION: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 METAL FABRICATION: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 74 METAL FABRICATION: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 75 MACHINERY: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 MACHINERY: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 MACHINERY: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 78 MACHINERY: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 79 OTHER END USES: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 OTHER END USES: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 OTHER END USES: METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 82 OTHER END USES: METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 83 METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 METALWORKING FLUIDS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 86 METALWORKING FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 87 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 88 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 90 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 91 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (KILOTON)

- TABLE 94 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 95 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 98 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 99 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 102 ASIA PACIFIC: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 103 CHINA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 104 CHINA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 105 CHINA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 106 CHINA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 107 JAPAN: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 108 JAPAN: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 109 JAPAN: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 110 JAPAN: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 111 INDIA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 112 INDIA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 113 INDIA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 114 INDIA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 115 SOUTH KOREA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 116 SOUTH KOREA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 117 SOUTH KOREA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 118 SOUTH KOREA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 119 EUROPE: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 122 EUROPE: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 123 EUROPE: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 124 EUROPE: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (KILOTON)

- TABLE 126 EUROPE: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 127 EUROPE: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 128 EUROPE: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 130 EUROPE: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 131 EUROPE: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 132 EUROPE: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 134 EUROPE: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 135 GERMANY: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 136 GERMANY: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 137 GERMANY: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 138 GERMANY: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 139 UK: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 140 UK: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 141 UK: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 142 UK: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 143 FRANCE: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 144 FRANCE: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 145 FRANCE: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 146 FRANCE: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 147 SPAIN: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 148 SPAIN: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 149 SPAIN: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 150 SPAIN: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 151 ITALY: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 152 ITALY: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 153 ITALY: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 154 ITALY: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 155 RUSSIA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 156 RUSSIA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 157 RUSSIA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 158 RUSSIA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 159 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 162 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 163 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 164 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 165 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (KILOTON)

- TABLE 166 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 167 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 168 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 169 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 170 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 171 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 172 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 174 NORTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 175 US: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 176 US: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 177 US: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 178 US: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 179 CANADA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 180 CANADA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 181 CANADA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 182 CANADA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 183 MEXICO: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 184 MEXICO: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 185 MEXICO: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 186 MEXICO: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 187 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 190 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 191 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 192 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (KILOTON)

- TABLE 194 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 195 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 196 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 198 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 199 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 200 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 202 SOUTH AMERICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 203 BRAZIL: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 204 BRAZIL: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 205 BRAZIL: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 206 BRAZIL: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 207 ARGENTINA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 208 ARGENTINA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 209 ARGENTINA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 210 ARGENTINA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 214 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2020-2024 (KILOTON)

- TABLE 218 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 223 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 226 MIDDLE EAST & AFRICA: METALWORKING FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 227 SAUDI ARABIA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 228 SAUDI ARABIA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 229 SAUDI ARABIA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 230 SAUDI ARABIA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 231 EGYPT: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 232 EGYPT: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 233 EGYPT: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 234 EGYPT: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 235 SOUTH AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 236 SOUTH AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 237 SOUTH AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2020-2024 (KILOTON)

- TABLE 238 SOUTH AFRICA: METALWORKING FLUIDS MARKET, BY END USE, 2025-2030 (KILOTON)

- TABLE 239 METALWORKING FLUIDS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 240 METALWORKING FLUIDS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 241 METALWORKING FLUIDS MARKET: REGION FOOTPRINT

- TABLE 242 METALWORKING FLUIDS MARKET: TYPE FOOTPRINT

- TABLE 243 METALWORKING FLUIDS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 244 METALWORKING FLUIDS MARKET: END USE FOOTPRINT

- TABLE 245 METALWORKING FLUIDS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 246 METALWORKING FLUID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 247 METALWORKING FLUIDS MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 248 METALWORKING FLUIDS MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 249 METALWORKING FLUIDS MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 250 QUAKER HOUGHTON: COMPANY OVERVIEW

- TABLE 251 QUAKER HOUGHTON: PRODUCTS OFFERED

- TABLE 252 QUAKER HOUGHTON: DEALS

- TABLE 253 TOTALENERGIES SE: COMPANY OVERVIEW

- TABLE 254 TOTALENERGIES SE: PRODUCTS OFFERED

- TABLE 255 TOTALENERGIES SE: DEALS

- TABLE 256 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 257 CHEVRON CORPORATION: PRODUCTS OFFERED

- TABLE 258 CHEVRON CORPORATION: DEALS

- TABLE 259 CHEVRON CORPORATION: EXPANSIONS

- TABLE 260 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 261 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 EXXON MOBIL CORPORATION: DEALS

- TABLE 263 EXXON MOBIL CORPORATION: EXPANSIONS

- TABLE 264 PJSC LUKOIL: COMPANY OVERVIEW

- TABLE 265 PJSC LUKOIL: PRODUCTS OFFERED

- TABLE 266 PJSC LUKOIL: DEALS

- TABLE 267 PJSC LUKOIL: EXPANSIONS

- TABLE 268 FUCHS SE: COMPANY OVERVIEW

- TABLE 269 FUCHS SE: PRODUCTS OFFERED

- TABLE 270 FUCHS SE: PRODUCT LAUNCHES

- TABLE 271 FUCHS SE: DEALS

- TABLE 272 FUCHS SE: EXPANSIONS

- TABLE 273 IDEMITSU KOSAN CO., LTD.: COMPANY OVERVIEW

- TABLE 274 IDEMITSU KOSAN CO., LTD.: PRODUCTS OFFERED

- TABLE 275 IDEMITSU KOSAN CO., LTD.: EXPANSIONS

- TABLE 276 BP P.L.C.: COMPANY OVERVIEW

- TABLE 277 BP P.L.C.: PRODUCTS OFFERED

- TABLE 278 BP P.L.C.: DEALS

- TABLE 279 BP P.L.C.: EXPANSIONS

- TABLE 280 SAUDI ARAMCO: COMPANY OVERVIEW

- TABLE 281 SAUDI ARAMCO: PRODUCTS OFFERED

- TABLE 282 SAUDI ARAMCO: DEALS

- TABLE 283 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 284 CHINA PETROLEUM & CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 285 CHINA PETROLEUM & CHEMICAL CORPORATION: OTHERS

- TABLE 286 CHEM ARROW CORPORATION: COMPANY OVERVIEW

- TABLE 287 CHEM ARROW CORPORATION: PRODUCTS OFFERED

- TABLE 288 PHILLIPS 66: COMPANY OVERVIEW

- TABLE 289 ENEOS HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 290 GULF OIL INTERNATIONAL LTD: COMPANY OVERVIEW

- TABLE 291 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 292 APAR INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 293 PETROFER: COMPANY OVERVIEW

- TABLE 294 ENI S.P.A.: COMPANY OVERVIEW

- TABLE 295 MOTUL S.A.: COMPANY OVERVIEW

- TABLE 296 KLUBER LUBRICATION MUNCHEN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 297 VERTEX LUBRICANTS: COMPANY OVERVIEW

- TABLE 298 METAL FLOW, S.A.: COMPANY OVERVIEW

- TABLE 299 DENNISON LUBRICANTS, INC.: COMPANY OVERVIEW

- TABLE 300 COSMO OIL LUBRICANTS CO., LTD.: COMPANY OVERVIEW

- TABLE 301 RAYCO CHEMICAL: COMPANY OVERVIEW

- TABLE 302 FIRE-RESISTANT LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 303 FIRE-RESISTANT LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 304 NORTH AMERICA: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 305 NORTH AMERICA: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 306 EUROPE: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 307 EUROPE: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 308 ASIA PACIFIC: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 309 ASIA PACIFIC: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 312 SOUTH AMERICA: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 313 SOUTH AMERICA: FIRE-RESISTANT LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

List of Figures

- FIGURE 1 METALWORKING FLUIDS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 METALWORKING FLUIDS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - COLLECTIVE SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) - COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- FIGURE 7 METALWORKING FLUIDS MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 10 SOLUBLE OILS SEGMENT TO LEAD METALWORKING FLUIDS MARKET DURING FORECAST PERIOD

- FIGURE 11 TRANSPORT EQUIPMENT MANUFACTURING SEGMENT TO LEAD METALWORKING FLUIDS MARKET DURING FORECAST PERIOD

- FIGURE 12 REMOVAL FLUIDS SEGMENT TO LEAD METALWORKING FLUIDS MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 INCREASING AUTOMOBILE PRODUCTION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 SOLUBLE OILS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC METALWORKING FLUIDS MARKET IN 2024

- FIGURE 17 REMOVAL FLUIDS SEGMENT AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES OF MOST REGIONAL MARKETS IN 2024

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 METALWORKING FLUIDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL AUTOMOBILE PRODUCTION, 2020-2024 (MILLION UNITS)

- FIGURE 21 METALWORKING FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USE SEGMENTS

- FIGURE 23 KEY BUYING CRITERIA, BY END USE

- FIGURE 24 METALWORKING FLUIDS: SUPPLY CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF METALWORKING FLUIDS OFFERED BY KEY PLAYERS, BY END USE, 2024 (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF METALWORKING FLUIDS, BY REGION, 2022-2030 (USD/KG)

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 METALWORKING FLUIDS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 IMPORT DATA FOR HS CODE 340319-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 340319-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 PATENTS REGISTERED FOR METALWORKING FLUIDS, 2014-2024

- FIGURE 32 LIST OF MAJOR PATENTS RELATED TO METALWORKING FLUIDS, 2014-2024

- FIGURE 33 LEGAL STATUS OF PATENTS FILED FOR METALWORKING FLUIDS, 2014-2024

- FIGURE 34 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA, 2014-2024

- FIGURE 35 IMPACT OF AI/GEN AI ON METALWORKING FLUIDS MARKET

- FIGURE 36 SOLUBLE OILS SEGMENT TO HOLD LARGEST SHARE OF METALWORKING FLUIDS MARKET IN 2025

- FIGURE 37 REMOVAL FLUIDS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF METALWORKING FLUIDS MARKET IN 2025

- FIGURE 38 TRANSPORT EQUIPMENT MANUFACTURING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING METALWORKING FLUIDS MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: METALWORKING FLUIDS MARKET SNAPSHOT

- FIGURE 41 EUROPE: METALWORKING FLUIDS MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: METALWORKING FLUIDS MARKET SNAPSHOT

- FIGURE 43 METALWORKING FLUIDS MARKET SHARE ANALYSIS, 2024

- FIGURE 44 METALWORKING FLUID MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD MILLION)

- FIGURE 45 METALWORKING FLUIDS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 METALWORKING FLUIDS MARKET: COMPANY FOOTPRINT

- FIGURE 47 METALWORKING FLUIDS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 METALWORKING FLUIDS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 METALWORKING FLUIDS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 50 METALWORKING FLUIDS MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS (USD BILLION)

- FIGURE 51 QUAKER HOUGHTON: COMPANY SNAPSHOT

- FIGURE 52 TOTALENERGIES SE: COMPANY SNAPSHOT

- FIGURE 53 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 FUCHS SE: COMPANY SNAPSHOT

- FIGURE 56 IDEMITSU KOSAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 58 SAUDI ARAMCO: COMPANY SNAPSHOT

- FIGURE 59 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY SNAPSHOT