|

市场调查报告书

商品编码

1808084

全球可携式超音波市场按产品类型、平台、最终用户、应用和地区划分—预测至 2030 年Portable Ultrasound Market by Product, Platform, Application, End User - Global Forecast to 2030 |

||||||

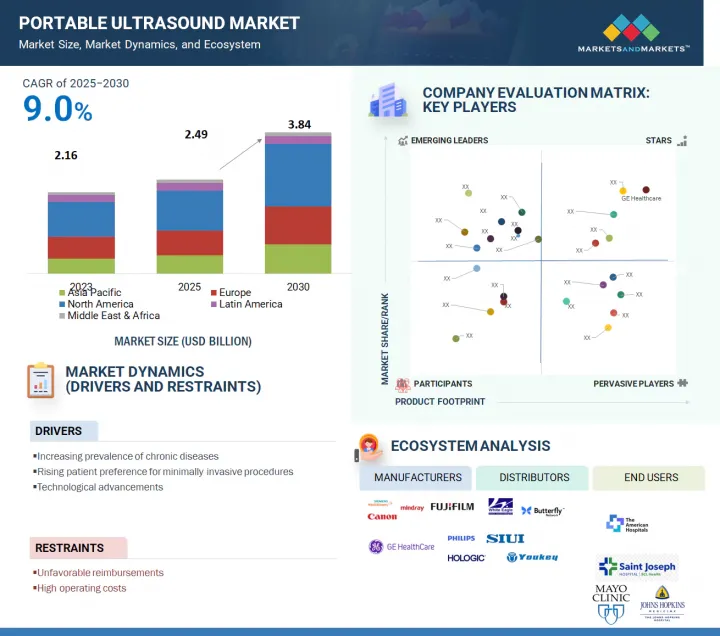

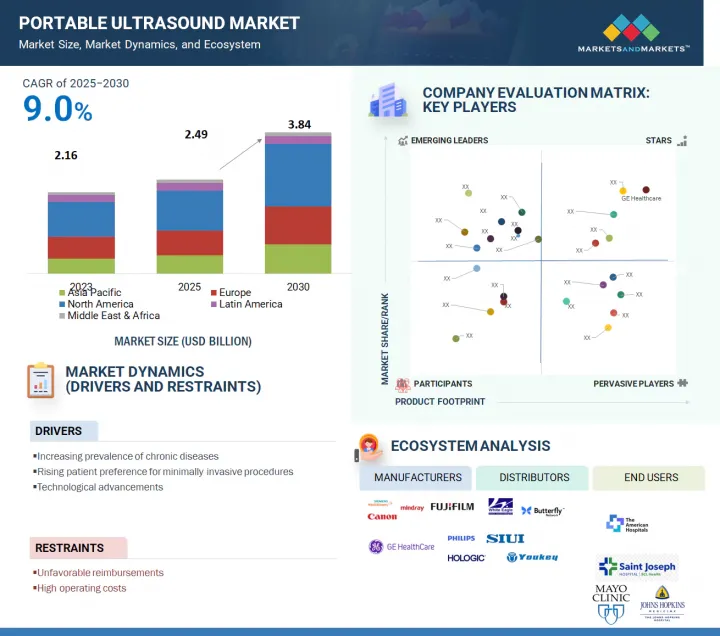

全球可携式超音波市场预计将从 2025 年的 24.9 亿美元成长到 2030 年的 38.4 亿美元,预测期内的复合年增长率为 9.0%。

照护现场诊断的需求日益增长,尤其是在各种环境下使用非侵入式成像技术的需求不断增长,这推动了对可携式超音波技术的需求。这种需求很大程度上源于慢性病和生活方式相关疾病的日益流行,凸显了临床环境中对快速影像解决方案的迫切需求。

| 调查范围 | |

|---|---|

| 调查年份 | 2023-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按产品类型、平台、最终用户、应用程式和地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

此外,技术进步正在提升影像质量,使其对医院、诊所和远距医疗服务提供者更具实用性和吸引力。这部分源于人们对孕产妇健康的日益重视,以及越来越多的证据支持在急诊和加护治疗环境中使用携带式超音波设备。随着对虚拟医疗解决方案的持续探索,我们预计人们对居家照护和远端医疗的兴趣将显着增长。

换能器/探头在可携式超音波市场中占据最大份额,因为它们在影像撷取中发挥着至关重要且专业的作用。每种换能器都针对特定的解剖结构和深度专门设计,因此其类型多种多样,包括用于浅表解剖的线性换能器、用于深层器官的曲线换能器,以及用于心臟应用的相位阵列换能器。这种多样性对于适应广泛的临床应用至关重要。

通常,需要多个专用探头才能充分利用单一可携式超音波系统的诊断功能。此外,换能器是高度工程化的设备,整合了先进的压电元件和先进材料,因此单价昂贵。由于经常使用和需要消毒,换能器容易磨损,因此需要频繁更换。

由于在紧急和时间敏感的情况下对快速即时诊断成像的迫切需求,创伤和急诊医学占据了可携式超音波市场的最大市场占有率。可携式超音波诊断设备能够在急诊室、救护车和灾难现场等医疗环境中即时评估内伤、出血和器官损伤,而无需将患者送往影像科室。其紧凑的尺寸、易用性和快速的启动时间使其成为在高压环境下快速决策的理想选择。此外,诸如FAST(创伤超音波重点评估)之类的通讯协定已成为创伤护理的标准做法,进一步推动了其应用。随着急救服务在全球范围内的扩张,尤其是在新兴市场和偏远地区,创伤和急救环境中对可携式超音波的需求持续增长,巩固了我们领先的市场份额。

医院和外科中心是可携式超音波市场的主要终端用户,因为它们的患者数量众多、诊断需求多样化,并且拥有支持各种成像模式的手术全期基础设施。这些机构经常使用可携式超音波诊断设备进行照护现场诊断、紧急情况、术前和术后评估以及床边影像,尤其是在加护病房(ICU) 和手术室。无需将严重患者从病床上移开即可进行快速、可靠、非侵入性的扫描,凸显了可携式超音波在这些环境中的价值。此外,在循环系统、产科和肌肉骨骼成像的常规工作流程中使用可携式系统将进一步推动此类机构对便携式超音波设备的采用。

预计亚太地区将在预测期内实现最高的复合年增长率,这主要得益于几个关键趋势。中国、印度和东南亚等国家医疗基础设施的不断扩张,推动先进医疗技术的普及。此外,慢性病发生率的上升和人口老化加剧,也推动了对便利且价格合理的诊断工具的需求。可携式超音波诊断设备比 CT、 核磁共振造影系统和传统超音波系统便宜得多,并且可用于各种环境。此外,人工智慧和无线技术的进步正在推动新设备的不断改进,增强了可携式超音波设备的功能和吸引力。

本报告研究了全球可携式超音波市场,并按产品类型、平台、最终用户、应用和地区对市场进行了细分,同时也提供了参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 价值链分析

- 供应链分析

- 波特五力分析

- 主要相关人员和采购标准

- 专利分析

- 贸易数据分析

- 2025-2026年主要会议和活动

- 未满足的需求和关键问题

- 生态系分析

- 2025年美国关税的影响

- 生成式人工智慧对可携式超音波市场的影响

- 影响客户业务的趋势/中断

- 技术分析

- 案例研究分析

- 监管状况

- 投资金筹措场景

- 定价分析

- 赎回情景

第六章可携式超音波市场(依产品类型)

- 介绍

- 感测器/探头

- 系统和主机

- 配件

- 软体和服务

第七章可携式超音波市场(依平台)

- 介绍

- 手推车/推车底座

- 手持式

- 基于笔记型电脑

- 平板电脑底座

第 8 章可携式超音波市场(按最终用户)

- 介绍

- 医院和外科中心

- 影像中心

- 门诊治疗中心

- 其他的

第九章可携式超音波市场(按应用)

- 介绍

- 妇产科

- 心臟病学

- 血管

- 小儿科

- 泌尿系统

第 10 章可携式超音波市场(按地区)

- 介绍

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 欧洲

- 宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 宏观经济展望

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他的

- 拉丁美洲

- 宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 宏观经济展望

- 海湾合作委员会国家

- 其他的

第十一章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2021-2024年收益分析

- 2024年市场占有率分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 品牌/产品比较

- 竞争场景

第十二章:公司简介

- 主要参与企业

- GE HEALTHCARE

- PHILIPS HEALTHCARE

- CANON MEDICAL SYSTEMS CORPORATION

- SIEMENS HEALTHINEERS AG

- FUJIFILM CORPORATION

- HOLOGIC, INC.

- SAMSUNG ELECTRONICS CO., LTD.

- MINDRAY MEDICAL INTERNATIONAL LIMITED

- ESAOTE SPA

- CHISON MEDICAL TECHNOLOGIES CO., LTD.

- NEUSOFT CORPORATION

- KONICA MINOLTA, INC.

- CLARIUS

- MEDGYN PRODUCTS, INC.

- PROMED TECHNOLOGY CO., LTD.

- 其他公司

- WHITE EAGLE SONIC TECHNOLOGIES, INC.

- PERLONG MEDICAL EQUIPMENT CO., LTD.

- YOUKEY MEDICAL

- SIUI

- TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING

- BUTTERFLY NETWORK, INC.

- ALPINION MEDICAL SYSTEMS

- EDAN INSTRUMENTS, INC.

- SHENZHEN LANDWIND INDUSTRY CO., LTD

- ECHONOUS INC.

- MOBISANTE

- SHENZHEN WISONIC MEDICAL TECHNOLOGY CO., LTD

- SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT CO., LTD

- SONOSCAPE MEDICAL CORP

- CURA HEALTHCARE

第十三章 附录

The global portable ultrasound market is projected to reach USD 3.84 billion by 2030 from USD 2.49 billion in 2025, growing at a CAGR of 9.0% during the forecast period. The increasing demand for point-of-care diagnostics has led to a rise in the need for portable ultrasound technology, particularly through the use of non-invasive imaging methods in various settings. This demand is largely driven by the growing prevalence of chronic and lifestyle-related diseases, highlighting the urgent need for prompt imaging solutions in clinical environments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Platform, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Additionally, advancements in technology have enhanced imaging quality, making it more beneficial and appealing to hospitals, clinics, and remote healthcare providers. A greater emphasis on maternal health and a growing body of evidence supporting the use of portable ultrasound in emergency and intensive care settings are also contributing factors. As we continue to explore virtual healthcare solutions, we can anticipate a significant increase in interest in home-based care and telemedicine.

"The transducers/probes segment is expected to register the highest growth rate in the market during the forecast period."

Transducers/probes comprise the largest portion of the portable ultrasound market due to their essential and specialized role in acquiring images. Each transducer is specifically designed for a particular anatomy and depth, resulting in a variety of types, such as linear transducers for superficial anatomy, curvilinear transducers for deeper organs, and phased array transducers for cardiac applications. This variety is necessary to address a wide range of clinical uses.

Typically, a single portable ultrasound system requires multiple unique probes to fully utilize its diagnostic capabilities. Additionally, transducers are highly engineered devices that incorporate sophisticated piezoelectric components and advanced materials, making them quite expensive on a per-unit basis. Their susceptibility to wear and tear from heavy use and the need for sterilization leads to frequent replacement, which further solidifies their dominant presence in the portable ultrasound industry.

"The trauma & emergency care segment commanded the largest market share in 2024."

Trauma & emergency care account for the largest market share in the portable ultrasound market due to the critical need for rapid, real-time diagnostic imaging in urgent and time-sensitive situations. Portable ultrasound devices enable immediate assessment of internal injuries, bleeding, or organ damage at the point of care-whether in emergency rooms, ambulances, or disaster sites-without requiring patient transport to imaging departments. Their compact size, ease of use, and quick boot-up times make them ideal for fast decision-making in high-pressure environments. Additionally, protocols like FAST (Focused Assessment with Sonography in Trauma) have become standard practice in trauma care, further driving adoption. As emergency services expand globally, especially in developing regions and remote areas, the demand for portable ultrasound in trauma and emergency settings continues to grow, reinforcing its leading market share.

"Hospitals & surgical centers held the largest share of the portable ultrasound market in 2024, by end user."

Hospitals & surgical centers are the primary end users in the portable ultrasound market due to their high patient volume, diverse diagnostic needs, and the perioperative infrastructure that supports various imaging procedures. These facilities frequently utilize portable ultrasound devices for point-of-care diagnostics, emergency situations, pre- and post-operative evaluations, and bedside imaging, particularly in intensive care units (ICUs) and operating rooms. The ability to perform rapid, reliable, and non-invasive scans without needing to move critically ill patients from their beds highlights the value of portable ultrasound in these settings. Additionally, the use of portable systems across routine workflows in cardiology, obstetrics, and musculoskeletal imaging further enhances their adoption in these types of facilities.

"Asia Pacific is expected to register the highest growth rate in the market during the forecast period."

The Asia Pacific region is anticipated to register the highest CAGR during the forecast period, driven by several key trends. The expanding healthcare infrastructure in countries like China, India, and those in Southeast Asia is facilitating the adoption of advanced medical technologies. Coupled with the rising prevalence of chronic diseases and an aging population, there is a growing demand for accessible and affordable diagnostic tools. Portable ultrasound devices are significantly less expensive than CT or MRI machines and traditional ultrasound systems, and they can be utilized in various settings. Additionally, newer devices are continually improving through advancements in artificial intelligence and wireless technology, enhancing both the functionality and appeal of portable ultrasound systems.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), Directors (27%), and Others (18%)

- By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (6%), and the Middle East & Africa (2%)

Prominent players in this market are Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), FUJIFILM Corporation (Japan), Hologic Inc.(US), Samsung Electronics Co., Ltd. (South Korea), Esaote SpA (Italy), Chison Medical Technologies Co., Ltd. (China), MobiSante Inc. (US), Clarius (Canada), MedGyn Products, Inc. (US), Promed Technology (China), and Neusoft Corporation (China), among others.

Research Coverage

The portable ultrasound market is segmented by product, platform, application, end user, and region. Key factors influencing market growth include driving forces, restraints, opportunities, and challenges for stakeholders. The report also reviews the leading companies competing in the portable ultrasound market. A micro-level analysis can be conducted to examine trends, growth opportunities, and contributions to the market. Additionally, it highlights potential revenue growth opportunities across various market segments in five major regions.

Key Benefits of Buying the Report

The report is valuable for new entrants in the portable ultrasound market as it provides comprehensive information about the market. This information is essential for understanding various investment opportunities. The report offers insights into both key and smaller players in the market, which can help in creating a solid basis for risk analysis when making investment decisions. It accurately segments the market by end users and regions, providing focused insights into specific market segments. Additionally, the report highlights key trends, challenges, growth drivers, and opportunities to support strategic decision-making through a thorough analysis.

The report provides insights into the following pointers:

- Key drivers (increasing prevalence of chronic diseases, growing demand for point-of-care diagnostics, technological advancements, and growing public and private investments, funding, and grants), restraints (unfavorable reimbursements and high operating costs), opportunities (integration of AI in portable ultrasound, high growth of emerging markets, and development of wearable and wireless ultrasound devices), and challenges (limited battery life and device durability and shortage of sonographers).

- Product Development/Innovation: Emerging technologies in the space, R&D, recent product & service launches in the portable ultrasound market.

- Market Growth: In-depth insights into the portable ultrasound market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the portable ultrasound market.

- Competitive Assessment: Detailed assessment of market shares, product offerings, and leading strategies of key players, such as Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), and FUJIFILM Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 PORTABLE ULTRASOUND MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Customer-based market estimation

- 2.3 MARKET FORECASTING APPROACH

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THE PORTABLE ULTRASOUND MARKET

- 4.2 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY COUNTRY AND END USER, 2024

- 4.3 GEOGRAPHIC SNAPSHOT OF PORTABLE ULTRASOUND MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases

- 5.2.1.2 Growing demand for point-of-care diagnostics

- 5.2.1.3 Rising technological advancements in portable ultrasound devices

- 5.2.1.4 Growing public and private investments, funding, and grants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI in portable ultrasound

- 5.2.3.2 High growth potential in emerging economies

- 5.2.3.3 Development of wearable and wireless ultrasound devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited battery life and device durability

- 5.2.4.2 Shortage of skilled sonographers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.4.3 MARKETING & SALES, DISTRIBUTION, AND POST-SALES SERVICES

- 5.4.4 END USERS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 PATENT ANALYSIS

- 5.8 TRADE DATA ANALYSIS

- 5.8.1 IMPORT DATA

- 5.8.2 EXPORT DATA

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 UNMET NEEDS AND KEY PAIN POINTS

- 5.11 ECOSYSTEM ANALYSIS

- 5.12 IMPACT OF 2025 US TARIFFS

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.4.4 Impact on end-user facilities

- 5.13 IMPACT OF GEN AI ON PORTABLE ULTRASOUND MARKET

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Probes

- 5.15.1.2 Contrast-enhanced portable ultrasound

- 5.15.1.3 Portable and handheld ultrasound devices

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Elastography

- 5.15.2.2 Transrectal Ultrasound

- 5.15.2.3 Transvaginal Ultrasound

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 Positron emission tomography and computed tomography

- 5.15.1 KEY TECHNOLOGIES

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 EFFICIENT POWER FOR HANDHELD ULTRASOUND UNITS

- 5.16.2 ADVANCEMENTS IN USING PORTABLE ULTRASOUND WITH ARTIFICIAL INTELLIGENCE IN PRE-HOSPITAL EMERGENCIES AND DISASTER RESPONSE SETTINGS

- 5.16.3 EFFECTIVENESS OF HANDHELD PORTABLE ULTRASOUND IN RURAL HOSPITAL IN GUATEMALA

- 5.17 REGULATORY LANDSCAPE

- 5.17.1 NORTH AMERICA

- 5.17.1.1 US

- 5.17.1.2 Canada

- 5.17.2 EUROPE

- 5.17.3 ASIA PACIFIC

- 5.17.3.1 Japan

- 5.17.3.2 China

- 5.17.3.3 India

- 5.17.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17.1 NORTH AMERICA

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 PRICING ANALYSIS

- 5.19.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.19.2 AVERAGE SELLING PRICE OF HANDHELD ULTRASOUND BY KEY PLAYERS (USD), 2024

- 5.20 REIMBURSEMENT SCENARIO

6 PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 TRANSDUCERS/PROBES

- 6.2.1 CURVILINEAR/CONVEX ARRAY

- 6.2.1.1 Allows for wide-field imaging and better visualization of structures at depth

- 6.2.2 LINEAR ARRAY

- 6.2.2.1 Versatile tool in ultrasound imaging

- 6.2.3 PHASED ARRAY

- 6.2.3.1 Ability to steer and focus the portable ultrasound beam electronically to drive growth

- 6.2.4 OTHER ARRAY TYPES

- 6.2.1 CURVILINEAR/CONVEX ARRAY

- 6.3 SYSTEMS & CONSOLES

- 6.3.1 ADVANCED IMAGING CAPABILITIES AND ROBUST PERFORMANCE TO DRIVE GROWTH

- 6.4 ACCESSORIES

- 6.4.1 CRITICAL TO ENSURING IMAGE QUALITY, USER CONVENIENCE, AND INFECTION CONTROL ACROSS CLINICAL ENVIRONMENTS

- 6.5 SOFTWARE & SERVICES

- 6.5.1 ADVANCED FEATURES LIKE REAL-TIME IMAGE GUIDANCE, CLOUD-BASED IMAGE STORAGE AND SHARING, AND AUTOMATED DIAGNOSTICS TO DRIVE GROWTH

7 PORTABLE ULTRASOUND MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- 7.2 TROLLEY/CART BASED

- 7.2.1 INCREASED USE IN ACUTE CARE SETTINGS AND EMERGENCY CARE IN HOSPITALS TO DRIVE GROWTH

- 7.3 HANDHELD

- 7.3.1 INCREASING NUMBER OF TRAUMA/EMERGENCY CASES TO DRIVE DEMAND

- 7.4 LAPTOP BASED

- 7.4.1 ABILITY TO DELIVER NEAR-CART-LEVEL PERFORMANCE IN A COMPACT FORM TO DRIVE GROWTH

- 7.5 TABLET BASED

- 7.5.1 LIGHTWEIGHT AND USER-FRIENDLY DESIGN TO DRIVE DEMAND

8 PORTABLE ULTRASOUND MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS & SURGICAL CENTERS

- 8.2.1 INCREASING NUMBER OF CANCER CASES TO DRIVE DEMAND

- 8.3 IMAGING CENTERS

- 8.3.1 NEED FOR STREAMLINED WORKFLOWS AND POINT-OF-CARE DIAGNOSTICS TO DRIVE GROWTH

- 8.4 AMBULATORY CARE CENTERS

- 8.4.1 INCREASING DEMAND FOR COMPACT PORTABLE ULTRASOUND DEVICES TO DRIVE GROWTH

- 8.5 OTHER END USERS

9 PORTABLE ULTRASOUND MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 OBSTETRICS/GYNECOLOGY

- 9.2.1 ADOPTION OF AI IN PORTABLE ULTRASOUND TO DRIVE SEGMENTAL GROWTH

- 9.3 OTHER APPLICATIONS

- 9.4 CARDIOLOGY

- 9.4.1 RISING PREVALENCE OF CARDIAC DISEASES TO DRIVE DEMAND

- 9.4.2 ORTHOPEDIC AND MUSCULOSKELETAL

- 9.4.2.1 Rising prevalence of osteoarthritis to drive growth

- 9.5 VASCULAR

- 9.5.1 NEED FOR EARLY DETECTION OF VASCULAR DISEASES TO DRIVE GROWTH

- 9.6 PEDIATRIC

- 9.6.1 LEVERAGING PEDIATRIC PORTABLE ULTRASOUND TO COMBAT NEONATAL MORTALITY

- 9.7 UROLOGY

- 9.7.1 PORTABLE ULTRASOUND WIDELY USED IN DIAGNOSIS AND TREATMENT OF VARIOUS UROLOGICAL DISORDERS

- 9.7.2 PAIN MANAGEMENT

- 9.7.2.1 Increasing adoption of portable ultrasound in outpatient settings to drive growth

10 PORTABLE ULTRASOUND MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Presence of advanced healthcare infrastructure to drive market

- 10.2.3 CANADA

- 10.2.3.1 New product launch & conference events to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 GERMANY

- 10.3.2.1 Rapid expansion in applications of portable ultrasound technologies to drive market

- 10.3.3 UK

- 10.3.3.1 Increase in awareness about different diagnostic imaging procedures to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Increasing demand for portable ultrasound devices for routine health check-ups, prenatal care, and diagnostic procedures to drive market

- 10.3.5 ITALY

- 10.3.5.1 Increased availability of reimbursement coverage for diagnostic procedures to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing adoption of point-of-care portable ultrasound to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Emphasis on modernization and expansion of rural healthcare infrastructure to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Established healthcare infrastructure and research facilities to drive market

- 10.4.4 INDIA

- 10.4.4.1 Rising adoption of advanced diagnostic imaging technologies to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing investments in healthcare infrastructure to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising investments in disease diagnostic system development to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Growing adoption of healthcare insurance to drive market

- 10.5.3 MEXICO

- 10.5.3.1 Investment in portable ultrasound devices to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Government initiatives aimed at digital health and telemedicine to drive market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PORTABLE ULTRASOUND MARKET

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 RANKING OF KEY MARKET PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: PORTABLE ULTRASOUND MARKET, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Product type footprint

- 11.5.5.3 Platform footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End user footprint

- 11.5.5.6 Region footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES (2024)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & APPROVALS

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GE HEALTHCARE

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 PHILIPS HEALTHCARE

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 CANON MEDICAL SYSTEMS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 SIEMENS HEALTHINEERS AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 FUJIFILM CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 HOLOGIC, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 SAMSUNG ELECTRONICS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Other developments

- 12.1.8 MINDRAY MEDICAL INTERNATIONAL LIMITED

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 ESAOTE SPA

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Other developments

- 12.1.10 CHISON MEDICAL TECHNOLOGIES CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 NEUSOFT CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 KONICA MINOLTA, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.13 CLARIUS

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches and approvals

- 12.1.13.3.2 Deals

- 12.1.14 MEDGYN PRODUCTS, INC.

- 12.1.14.1 Business overview

- 12.1.14.1.1 Products offered

- 12.1.14.1 Business overview

- 12.1.15 PROMED TECHNOLOGY CO., LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 GE HEALTHCARE

- 12.2 OTHER COMPANIES

- 12.2.1 WHITE EAGLE SONIC TECHNOLOGIES, INC.

- 12.2.2 PERLONG MEDICAL EQUIPMENT CO., LTD.

- 12.2.3 YOUKEY MEDICAL

- 12.2.4 SIUI

- 12.2.5 TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING

- 12.2.6 BUTTERFLY NETWORK, INC.

- 12.2.7 ALPINION MEDICAL SYSTEMS

- 12.2.8 EDAN INSTRUMENTS, INC.

- 12.2.9 SHENZHEN LANDWIND INDUSTRY CO., LTD

- 12.2.10 ECHONOUS INC.

- 12.2.11 MOBISANTE

- 12.2.12 SHENZHEN WISONIC MEDICAL TECHNOLOGY CO., LTD

- 12.2.13 SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT CO., LTD

- 12.2.14 SONOSCAPE MEDICAL CORP

- 12.2.15 CURA HEALTHCARE

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PORTABLE ULTRASOUND MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 RECENT PRODUCT LAUNCHES IN PORTABLE ULTRASOUND MARKET

- TABLE 3 PORTABLE ULTRASOUND MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%) FOR TOP 4 END USERS

- TABLE 5 KEY BUYING CRITERIA, BY TOP 4 END USERS

- TABLE 6 LIST OF MAJOR PATENT INNOVATIONS AND PATENT REGISTRATIONS, SEPTEMBER 2024-FEBRUARY 2025

- TABLE 7 IMPORT DATA FOR HS CODE 9018, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 9018, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 PORTABLE ULTRASOUND MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 PORTABLE ULTRASOUND MARKET: CURRENT UNMET NEEDS

- TABLE 11 PORTABLE ULTRASOUND MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 14 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 15 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 16 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 17 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 AVERAGE SELLING PRICE OF PORTABLE ULTRASOUND, BY REGION, 2022-2024 (USD)

- TABLE 24 AVERAGE SELLING PRICE OF HANDHELD ULTRASOUND BY KEY PLAYERS (USD), 2024

- TABLE 25 US: MAJOR CPT CODES FOR ULTRASOUND, 2025

- TABLE 26 PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 27 PORTABLE ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 PORTABLE ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 PORTABLE ULTRASOUND MARKET FOR CURVILINEAR/CONVEX ARRAY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 PORTABLE ULTRASOUND MARKET FOR LINEAR ARRAY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 PORTABLE ULTRASOUND MARKET FOR PHASED ARRAY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 PORTABLE ULTRASOUND MARKET FOR OTHER ARRAY TYPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 PORTABLE ULTRASOUND MARKET FOR SYSTEMS & CONSOLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 PORTABLE ULTRASOUND MARKET FOR ACCESSORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 PORTABLE ULTRASOUND MARKET FOR SOFTWARE & SERVICES, 2023-2030 (USD MILLION)

- TABLE 36 PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 37 PORTABLE ULTRASOUND MARKET FOR TROLLEY/CART-BASED ULTRASOUND, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 PORTABLE ULTRASOUND MARKET FOR HANDHELD ULTRASOUND, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 PORTABLE ULTRASOUND MARKET FOR LAPTOP-BASED ULTRASOUND, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 TABLET-BASED ULTRASOUND MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 42 PORTABLE ULTRASOUND MARKET FOR END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 PORTABLE ULTRASOUND MARKET FOR HOSPITALS & SURGICAL CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 PORTABLE ULTRASOUND MARKET FOR IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 PORTABLE ULTRASOUND MARKET FOR AMBULATORY CARE CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 PORTABLE ULTRASOUND MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 48 PORTABLE ULTRASOUND MARKET FOR OBSTETRICS/GYNECOLOGY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 PORTABLE ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 PORTABLE ULTRASOUND MARKET FOR CARDIOLOGY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 PORTABLE ULTRASOUND MARKET FOR ORTHOPEDIC AND MUSCULOSKELETAL APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 PORTABLE ULTRASOUND MARKET FOR VASCULAR APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 PORTABLE ULTRASOUND MARKET FOR PEDIATRIC APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 PORTABLE ULTRASOUND MARKET FOR UROLOGY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 PORTABLE ULTRASOUND MARKET FOR ORTHOPEDIC AND PAIN MANAGEMENT APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 PORTABLE ULTRASOUND MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NUMBER OF PORTABLE ULTRASOUND UNITS SOLD BY BUTTERFLY NETWORK

- TABLE 58 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 59 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 US: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 66 US: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 67 US: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 68 US: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 US: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 CANADA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 71 CANADA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 72 CANADA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 73 CANADA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 76 EUROPE: PORTABLE ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 GERMANY: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 83 GERMANY: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 84 GERMANY: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 85 GERMANY: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 GERMANY: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 UK: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 88 UK: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 89 UK: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 90 UK: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 UK: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 FRANCE: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 93 FRANCE: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 94 FRANCE: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 95 FRANCE: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 96 FRANCE: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 ITALY: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 98 ITALY: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 99 ITALY: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 100 ITALY: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 101 ITALY: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 SPAIN: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 103 SPAIN: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 104 SPAIN: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 105 SPAIN: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 106 SPAIN: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 113 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 119 CHINA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 120 CHINA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 121 CHINA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 122 CHINA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 123 CHINA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 JAPAN: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 125 JAPAN: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 126 JAPAN: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 127 JAPAN: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 128 JAPAN: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 129 INDIA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 130 INDIA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 131 INDIA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 132 INDIA: PORTABLE ULTRASOUND MARKET, BY APPLICATION,

023-2030 (USD MILLION)

- TABLE 133 INDIA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 134 AUSTRALIA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 135 AUSTRALIA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 136 AUSTRALIA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 137 AUSTRALIA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 138 AUSTRALIA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 SOUTH KOREA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 140 SOUTH KOREA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 141 SOUTH KOREA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 142 SOUTH KOREA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 SOUTH KOREA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 150 LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 152 LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 153 LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 155 LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 156 BRAZIL: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 157 BRAZIL: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 158 BRAZIL: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 159 BRAZIL: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 160 BRAZIL: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 MEXICO: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 162 MEXICO: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 163 MEXICO: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 164 MEXICO: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 165 MEXICO: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 166 REST OF LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 172 MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 GCC COUNTRIES: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 179 GCC COUNTRIES: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 180 GCC COUNTRIES: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 181 GCC COUNTRIES: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 182 GCC COUNTRIES: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY TRANSDUCER/PROBE TYPE, 2023-2030 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: PORTABLE ULTRASOUND MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 188 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN PORTABLE ULTRASOUND MARKET

- TABLE 189 PORTABLE ULTRASOUND MARKET: DEGREE OF COMPETITION

- TABLE 190 PORTABLE ULTRASOUND MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 191 PORTABLE ULTRASOUND MARKET: PLATFORM FOOTPRINT

- TABLE 192 PORTABLE ULTRASOUND MARKET: APPLICATION FOOTPRINT

- TABLE 193 PORTABLE ULTRASOUND MARKET: END USER FOOTPRINT

- TABLE 194 ULTRASOUND MARKET: REGION FOOTPRINT

- TABLE 195 PORTABLE ULTRASOUND EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 196 PORTABLE ULTRASOUND MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 197 PORTABLE ULTRASOUND MARKET: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 198 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 199 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 200 GE HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 201 GE HEALTHCARE: DEALS, JANUARY 2021-JUNE 2025

- TABLE 202 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 203 PHILIPS HEALTHCARE: COMPANY OVERVIEW

- TABLE 204 PHILIPS HEALTHCARE: PRODUCTS OFFERED

- TABLE 205 PHILIPS HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 206 PHILIPS HEALTHCARE: DEALS, JANUARY 2021-JUNE 2025

- TABLE 207 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 208 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 209 CANON MEDICAL SYSTEMS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 210 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 211 CANON MEDICAL SYSTEMS CORPORATION: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 212 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 213 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 214 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 215 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2021-JUNE 2025

- TABLE 216 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 217 FUJIFILM CORPORATION: COMPANY OVERVIEW

- TABLE 218 FUJIFILM CORPORATION: PRODUCTS OFFERED

- TABLE 219 FUJIFILM CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 220 FUJIFILM CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 221 FUJIFILM CORPORATION: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 222 HOLOGIC, INC.: COMPANY OVERVIEW

- TABLE 223 HOLOGIC, INC.: PRODUCTS OFFERED

- TABLE 224 HOLOGIC, INC.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 225 HOLOGIC, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 226 HOLOGIC, INC.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 227 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 228 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 229 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 230 SAMSUNG ELECTRONICS CO., LTD.: DEALS, JANUARY 2021- JUNE 2025

- TABLE 231 SAMSUNG ELECTRONICS CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 232 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 233 MINDRAY MEDICAL INTERNATIONAL LIMITED: PRODUCTS OFFERED

- TABLE 234 MINDRAY MEDICAL INTERNATIONAL LIMITED: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 235 MINDRAY MEDICAL INTERNATIONAL LIMITED: DEALS, JANUARY 2021- JUNE 2025

- TABLE 236 ESAOTE SPA: COMPANY OVERVIEW

- TABLE 237 ESAOTE SPA: PRODUCTS OFFERED

- TABLE 238 ESAOTE SPA: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 239 ESAOTE SPA: OTHER DEVELOPMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 240 CHISON MEDICAL TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 241 CHISON MEDICAL TECHNOLOGIES CO., LTD.: PRODUCTS OFFERED

- TABLE 242 CHISON MEDICAL TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 243 CHISON MEDICAL TECHNOLOGIES CO., LTD: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 244 NEUSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 245 NEUSOFT CORPORATION: PRODUCTS OFFERED

- TABLE 246 NEUSOFT CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 247 KONICA MINOLTA, INC.: COMPANY OVERVIEW

- TABLE 248 KONICA MINOLTA, INC.: PRODUCTS OFFERED

- TABLE 249 KONICA MINOLTA, INC.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 250 KONICA MINOLTA, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 251 CLARIUS: COMPANY OVERVIEW

- TABLE 252 CLARIUS: PRODUCTS OFFERED

- TABLE 253 CLARIUS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-JULY 2025

- TABLE 254 CLARIUS: DEALS, JANUARY 2021-JULY 2025

- TABLE 255 MEDGYN PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 256 MEDGYN PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 257 PROMED TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 258 PROMED TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 259 WHITE EAGLE SONIC TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 260 PERLONG MEDICAL EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 261 YOUKEY MEDICAL: COMPANY OVERVIEW

- TABLE 262 SIUI: COMPANY OVERVIEW

- TABLE 263 TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING: COMPANY OVERVIEW

- TABLE 264 BUTTERFLY NETWORK, INC.: COMPANY OVERVIEW

- TABLE 265 ALPINION MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 266 EDAN INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 267 SHENZHEN LANDWIND INDUSTRY CO., LTD: COMPANY OVERVIEW

- TABLE 268 ECHONOUS INC.: COMPANY OVERVIEW

- TABLE 269 MOBISANTE: COMPANY OVERVIEW

- TABLE 270 SHENZHEN WISONIC MEDICAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 271 SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT CO., LTD: COMPANY OVERVIEW

- TABLE 272 SONOSCAPE MEDICAL CORP: COMPANY OVERVIEW

- TABLE 273 CURA HEALTHCARE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PORTABLE ULTRASOUND MARKET: RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 KEY SECONDARY SOURCES

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 8 PORTABLE ULTRASOUND MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 9 PORTABLE ULTRASOUND MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 GLOBAL MARKET GROWTH PROJECTIONS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 PORTABLE ULTRASOUND MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 PORTABLE ULTRASOUND MARKET, BY PLATFORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 PORTABLE ULTRASOUND MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 PORTABLE ULTRASOUND MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 RISING DEMAND FOR POINT-OF-CARE IMAGING TO DRIVE MARKET

- FIGURE 18 US AND HOSPITALS & SURGICAL CENTERS SEGMENTS ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 19 JAPAN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 PORTABLE ULTRASOUND MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 PORTABLE ULTRASOUND MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 PORTABLE ULTRASOUND MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 PORTABLE ULTRASOUND MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 4 END USERS

- FIGURE 25 KEY BUYING CRITERIA, BY TOP 4 END USERS

- FIGURE 26 PATENT ANALYSIS FOR PORTABLE ULTRASOUND MARKET (JANUARY 2013-DECEMBER 2024)

- FIGURE 27 PORTABLE ULTRASOUND MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 ARTIFICIAL INTELLIGENCE IN PORTABLE ULTRASOUND MARKET

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 31 NUMBER OF INVESTOR DEALS, BY KEY PLAYERS, 2019-2023

- FIGURE 32 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 33 AVERAGE SELLING PRICE OF PORTABLE ULTRASOUND SYSTEMS, BY REGION, 2024 (USD)

- FIGURE 34 AVERAGE SELLING PRICE OF TRANSDUCERS/PROBES & ACCESSORIES, BY REGION, 2024 (USD)

- FIGURE 35 AVERAGE SELLING PRICE OF TROLLEY BASED SYSTEMS, BY REGION, 2024 (USD)

- FIGURE 36 NORTH AMERICA: PORTABLE ULTRASOUND MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: PORTABLE ULTRASOUND MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF TOP LISTED PLAYERS IN PORTABLE ULTRASOUND MARKET, 2021-2024 (USD BILLION)

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PORTABLE ULTRASOUND MARKET (2024)

- FIGURE 40 RANKING OF KEY PLAYERS IN PORTABLE ULTRASOUND MARKET, 2024

- FIGURE 41 PORTABLE ULTRASOUND MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 PORTABLE ULTRASOUND MARKET: COMPANY FOOTPRINT

- FIGURE 43 PORTABLE ULTRASOUND MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK BETA OF KEY VENDORS, 2024

- FIGURE 46 PORTABLE ULTRASOUND MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 47 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 48 PHILIPS HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 49 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 51 FUJIFILM CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 52 HOLOGIC, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 54 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY SNAPSHOT (2023)

- FIGURE 55 NEUSOFT CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 56 KONICA MINOLTA, INC.: COMPANY SNAPSHOT (2024)