|

市场调查报告书

商品编码

1808962

全球工业氮气产生器市场规模、设计、技术类型、最终用途产业和地区预测(2030 年)Industrial Nitrogen Generator Market by Size, Design, Technology Type, End-use Industry, and Region - Global Forecast to 2030 |

||||||

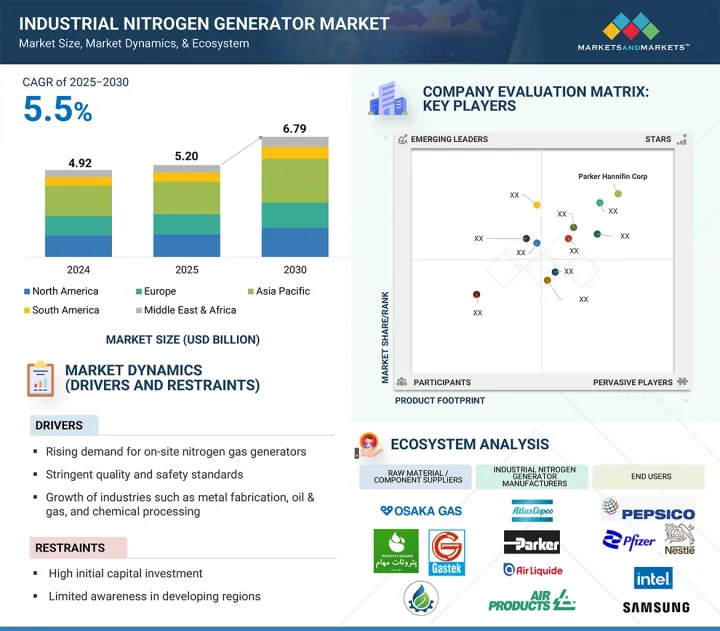

预计全球工业氮气产生器市场将从 2025 年的 52 亿美元成长到 2030 年的 67.9 亿美元,预测期内的复合年增长率为 5.5%。

市场驱动力主要源自于食品饮料、製药、化学、电子以及石油天然气产业对高纯度氮气日益增长的需求。对经济高效、持续的现场氮气供应的需求日益增长,推动人们从传统的气体供应方式转向氮气产生器。使用这些系统,产业可以摆脱对外部供应商的依赖,同时降低运输成本,提高安全性,并增强对营运的控制。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万美元,吨 |

| 部分 | 规模、设计、技术类型、最终用途产业、地区 |

| 目标区域 | 北美、欧洲、亚太地区、南美、中东和非洲 |

环境因素和严格的碳排放法规正在推动各行各业向节能永续的气体生产技术迈进。此外,技术创新和近期的系统自动化使氮气产生器更加紧凑、可靠,并且更易于整合到现有系统中。市场按应用细分为变压式吸附(PSA)、膜分离和深冷分离。 PSA 系统目前占据行业主导地位,因为它们能够提供高纯度氮气和操作灵活性的最佳组合。薄膜技术适用于较低纯度、较高流速的应用,而深冷系统则适用于更大规模、超高纯度的应用。总体而言,多种驱动因素正在推动市场在全球广泛采用工业氮气产生器产品。

“在预测期内,固定式工业氮气发生器是工业氮气发生器市场中增长速度第二快的类型。”

固定式工业氮气产生器凭藉其稳定的需求和支援大规模、持续工业运作的能力,成为市场中成长速度第二快的细分市场。这些系统能够生产大量高纯度氮气,是化学、製药和电子等需要持续气体供应的行业的理想选择。由于固定式产生器和生产基础设施专为工业用途而设计,因此其灵活性通常不如移动设备,但它们也具有显着的优势:长期拥有成本更低、对未签约的气体产品供应商的依赖更少、製程控制更佳。固定式氮气产生器的一个关键优势在于其能够无缝整合到集中式生产线中,从而持续供应氮气以满足稳定的需求。

“在预测期内,低温技术是工业氮气发生器市场中增长速度第二快的技术类型。”

低温技术是工业氮气产生器市场中成长速度第二快的技术类型。它能够生产大量超高纯度氮气,使其成为化学、石化和冶金等行业重型应用的理想选择。在低温氮气产生器中,空气经过低温分离和处理,可稳定地供应需要最高纯度製程所需的氮气。虽然与其他氮气生成技术相比,低温系统通常具有更高的资本和营业成本,但其能够输送大量氮气的能力,在大规模耗氮环境中可以证明这些成本的合理性。能源密集产业支撑的广泛工业基础设施高度依赖可靠的高容量氮气系统。因此,商用低温系统的采用和工业氮气基础设施的不断发展,可能会透过增强氮气系统的性能,为低温氮气生成系统带来巨大的需求。

预计在预测期内,中东和非洲市场将成为工业氮气发生器市场成长第二快的地区。

这一成长主要得益于化工、化肥和石化等能源密集产业的扩张,尤其是在埃及、沙乌地阿拉伯和奈及利亚。这些国家正在扩大出口并提高国内产量。中东和非洲也优先发展製造业和基础设施,包括化肥厂、石化设施和食品加工设施。这一重点推动了对现场氮气生产的需求,以支持这些业务。

本报告分析了全球工业氮气产生器市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 工业氮气发生器市场的企业机会

- 工业氮气产生器市场规模

- 工业氮气产生器市场设计

- 工业氮气产生器市场(依技术)

- 工业氮气发生器市场(按最终用途行业划分)

- 各国工业氮气发生器市场

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 波特五力分析

- 主要相关利益者和采购标准

- 总体经济指标

- 价值链分析

- 监管格局

- 北美洲

- 亚太地区

- 欧洲

- 中东和非洲

- 南美洲

- 监管机构、政府机构和其他组织

- 贸易分析

- 进口情形(HS 编码 840510)

- 出口情形(HS 编码 840510)

- 生态系分析

- 影响客户业务的趋势/中断

- 案例研究分析

- 派克汉尼汾为医疗和製药应用提供氮气产生器

- 阿特拉斯·科普柯为食品饮料产业提供PSA氮气产生器

- 林德为电子製造业提供先进的氮气产生器

- 技术分析

- 主要技术

- 互补技术

- 定价分析

- 各地区平均售价趋势(2022-2024)

- 各终端用途产业主要企业平均销售价格趋势(2024年)

- 大型会议和活动(2025-2026年)

- 专利分析

- 调查方法

- 文件类型

- 公告趋势

- 考虑

- 专利的法律地位

- 司法管辖权分析

- 主申请人

- 人工智慧/发电机人工智慧对工业氮气产生器市场的影响

- 投资金筹措场景

- 2025年美国关税对工业氮气发生器市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对主要国家的影响

- 对终端产业的影响

6. 工业氮气产生器市场(依设计)

- 介绍

- 即插即用

- 汽缸座

7. 工业氮气产生器市场规模

- 介绍

- 固定式工业氮气产生器

- 移动式工业氮气产生器

8. 工业氮气产生器市场(依技术)

- 介绍

- 变压式吸附(PSA)

- 基于膜

- 低温基地

9. 工业氮气产生器市场(依最终用途产业)

- 介绍

- 食品/饮料

- 医疗/製药

- 运输

- 电机与电子工程

- 化工/石化

- 製造业

- 包装

- 其他最终用途产业

第 10 章:工业氮气产生器市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会国家

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

第十一章竞争格局

- 概述

- 主要参与企业的策略(2023-2025)

- 收益分析(2022-2024)

- 市场占有率分析(2024年)

- 公司估值与财务指标(2024年)

- 品牌/产品比较分析

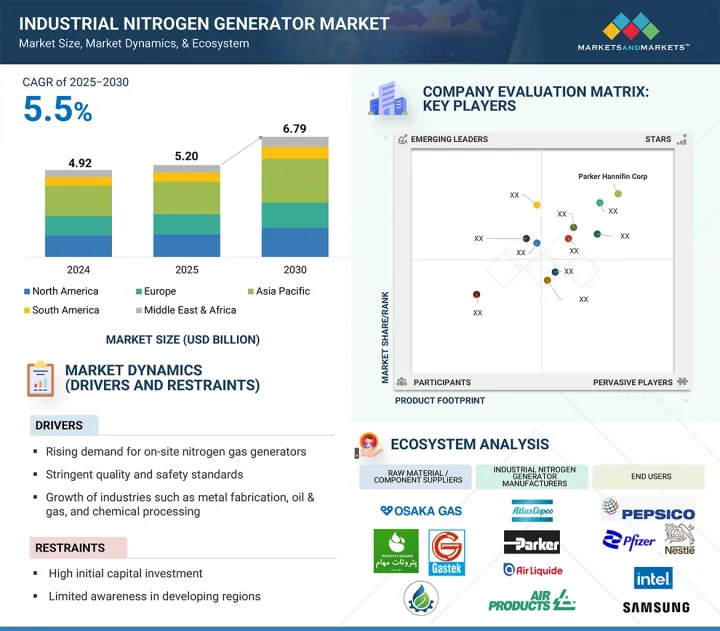

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十二章:公司简介

- 主要企业

- PARKER HANNIFIN CORP

- AIR PRODUCTS AND CHEMICALS, INC.

- ATLAS COPCO GROUP

- INGERSOLL RAND

- AIR LIQUIDE

- LINDE PLC

- HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

- INMATEC

- NOVAIR

- OXYMAT

- 其他公司

- AIRPACK

- CLAIND

- COMPRESSED GAS TECHNOLOGIES, INC.

- ERRE DUE SPA

- FOXOLUTION

- GENERON

- GAZTRON

- ISOLCELL SPA.

- NOBLEGEN

- OXYWISE SRO

- OMEGA AIR

- OXAIR

- ON SITE GAS

- PEAKGAS

- WERTHER INTERNATIONAL

第十三章 附录

The industrial nitrogen generator market is projected to reach USD 6.79 billion by 2030 from USD 5.20 billion in 2025, at a CAGR of 5.5% during the forecast period. The industrial nitrogen generator market is mainly driven by an increasing need for high-purity nitrogen in the food and beverage, pharmaceuticals, chemicals, electronics, and oil & gas industries. Growing demand for cost-efficient, continuous, on-site supply of nitrogen is encouraging industries to transition away from conventional methods of gas delivery to nitrogen generators. Using these systems allows industries to eliminate the dependency on external suppliers while providing lower transport costs, added safety, and much better control of the operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million)/ Volume (Tons) |

| Segments | Size, Design, Technology Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

Environmental factors and stringent regulations pertaining to carbon emissions are driving industries toward energy-efficient and sustainable gas generation technologies. Lastly, due to innovations and the recent automation of systems, nitrogen generators are much more compact, reliable, and easy to incorporate into any existing system. The market is segmented by application into pressure swing adsorption (PSA), membrane separation, and cryogenic separation. PSA systems currently dominate the industry as the most suitable system for both high-purity nitrogen and operational flexibility. Membrane technology is useful in applications with lower purity and higher flow, while cryogenic systems are suited for ultra-high purity applications on a larger scale. Overall, there are several drivers that are pushing the market toward more industrial nitrogen generator products geared toward global adoption.

"Stationary industrial nitrogen generator is the second-fastest-growing type in the industrial nitrogen generators market during the forecast period."

Stationary industrial nitrogen generators are the second-fastest-growing segment in the market due to their consistent demand and ability to support large-scale, continuous industrial operations. These systems produce high-capacity nitrogen with high-purity gas output, making them ideal for industries such as chemicals, pharmaceuticals, and electronics, where a continuous gas supply is essential. While stationary generators and production infrastructures are generally less flexible than portable units since they are specifically designed for industrial use, they offer significant advantages. These include lower long-term ownership costs, reduced reliance on uncontracted suppliers for gas products, and improved process control. A key benefit of stationary nitrogen generators is their seamless integration into centralized production lines, where they can supply nitrogen gas continuously to meet stable demand.

"Cryogenic-based is the second-fastest growing technology type in the industrial nitrogen generator market during the forecast period."

Cryogenic technology is the second-fastest-growing type in the industrial nitrogen generator market. It can produce ultra-high-purity nitrogen at high volumes, making it highly relevant for heavy-duty applications in industries such as chemicals, petrochemicals, and metallurgy. In cryogenic nitrogen generators, air is separated at cryogenic temperatures and processed to provide a consistent supply of nitrogen required for processes demanding the highest levels of purity. Although cryogenic systems typically involve higher capital and operational costs compared to other nitrogen generation technologies, their ability to deliver high volumes justifies these costs in environments with large-scale nitrogen consumption. The extensive industrial infrastructure supported by energy-intensive sectors relies heavily on reliable, high-capacity nitrogen systems. Therefore, the introduction of commercial cryogenic systems, along with the growing trends in industrial nitrogen infrastructure, is likely to create significant demand for cryogenic nitrogen generation systems by enhancing nitrogen system capacity.

"The Middle East & African market is the second-fastest growing region in the industrial nitrogen generator market during the forecast period."

The Middle East and Africa (MEA) is the second fastest-growing region in the industrial nitrogen generator market. This growth is driven by the expansion of energy-intensive industries, such as chemicals, fertilizers, and petrochemicals, particularly in Egypt, Saudi Arabia, and Nigeria. These countries are boosting their exports and increasing domestic production. MEA has also prioritized the development of manufacturing and infrastructure, including fertilizer plants, petrochemical facilities, and food processing units. This focus enhances the demand for on-site production of nitrogen gas to support operations. Additionally, global instability and rising price volatility for ammonia and urea supplies have led to a greater reliance on on-site solutions to provide nitrogen, helping to mitigate the risks associated with supply chain disruptions. Governments in many larger MEA markets are reinvesting in modernizing their industries and providing incentives for the development of sustainable or decarbonized gas infrastructures. The combination of increased industrialization, diversification away from oil and gas-dependent economies, and a push for environmentally sustainable initiatives positions the Middle East and Africa as the second-fastest-growing region for industrial nitrogen generator assets.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C-level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, and the Middle East & Africa: 5%

Parker Hannifin Corp (US), Air Products and Chemicals, Inc. (US), Atlas Copco Group (Sweden), Ingersoll Rand (US), Air Liquide (France), Linde PLC (UK), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Inmatec (Germany), Novair SAS (France), and OXYMAT A/S (Germany) are some of the key players in the industrial nitrogen generator market.

The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the industrial nitrogen generator market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on design, size, technology type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the industrial nitrogen generator market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall industrial nitrogen generator market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for on-site nitrogen gas generators, stringent quality and safety standards, and growth of industries such as metal fabrication, oil & gas, and chemical processing), restraints (high initial capital investment and limited awareness in developing regions), opportunities (expansion of emerging markets and customization and scalability of industrial nitrogen generator), challenges (technological complexity and lack of a skilled workforce).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial nitrogen generator market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial nitrogen generator market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial nitrogen generator market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Parker Hannifin Corp (US), Air Products and Chemicals, Inc. (US), Atlas Copco Group (Sweden), Ingersoll Rand (US), Air Liquide (France), Linde PLC (UK), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Inmatec (Germany), Novair SAS (France), and OXYMAT A/S (Germany), among others, are the top manufacturers covered in the industrial nitrogen generators market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET

- 4.2 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

- 4.3 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

- 4.4 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

- 4.5 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 4.6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for on-site nitrogen gas generators

- 5.2.1.2 Stringent quality and safety standards

- 5.2.1.3 Growth of metal fabrication, oil & gas, and chemical processing industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital investments

- 5.2.2.2 Limited awareness in emerging regions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of emerging markets

- 5.2.3.2 Customization and scalability of industrial nitrogen generators

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological complexities

- 5.2.4.2 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 ASIA PACIFIC

- 5.7.3 EUROPE

- 5.7.4 MIDDLE EAST & AFRICA

- 5.7.5 SOUTH AMERICA

- 5.7.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 NORTH AMERICA

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 840510)

- 5.8.2 EXPORT SCENARIO (HS CODE 840510)

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PARKER HANNIFIN OFFERS NITROGEN GENERATORS FOR MEDICAL AND PHARMACEUTICAL APPLICATIONS

- 5.11.2 ATLAS COPCO PROVIDES PSA NITROGEN GENERATOR FOR FOOD & BEVERAGE INDUSTRY

- 5.11.3 LINDE OFFERS ADVANCED NITROGEN GENERATORS FOR ELECTRONIC MANUFACTURING

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Pressure Swing Adsorption (PSA)

- 5.12.1.2 Membrane Separation

- 5.12.1.3 Cryogenic Nitrogen Generation

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 IoT and Smart Monitoring Systems

- 5.12.2.2 Energy Recovery Systems

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.13.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PATENT ANALYSIS

- 5.15.1 METHODOLOGY

- 5.15.2 DOCUMENT TYPES

- 5.15.3 PUBLICATION TRENDS

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS OF PATENTS

- 5.15.6 JURISDICTION ANALYSIS

- 5.15.7 TOP APPLICANTS

- 5.16 IMPACT OF AI/GEN AI ON INDUSTRIAL NITROGEN GENERATOR MARKET

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON INDUSTRIAL NITROGEN GENERATOR MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

- 6.1 INTRODUCTION

- 6.2 PLUG & PLAY

- 6.2.1 COMPACT DESIGN, EASY ACCESSIBILITY, AND AUTONOMOUS FUNCTION TO BOOST GROWTH

- 6.3 CYLINDER-BASED

- 6.3.1 SPECIALIZED SYSTEM ARCHITECTURE PROVIDING SUPPLY CHAIN AUTONOMY TO DRIVE MARKET

7 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

- 7.1 INTRODUCTION

- 7.2 STATIONARY INDUSTRIAL NITROGEN GENERATOR

- 7.2.1 DEMAND FOR COST-EFFECTIVE SOLUTION FOR PRODUCTION OF LARGE NITROGEN VOLUMES TO BOOST GROWTH

- 7.3 PORTABLE INDUSTRIAL NITROGEN GENERATOR

- 7.3.1 NEED FOR NITROGEN IN TEMPORARY, REMOTE, OR EMERGENCY SITUATIONS TO DRIVE GROWTH

- 7.3.2 CONTAINERIZED SYSTEMS

- 7.3.3 TRAILER-MOUNTED SYSTEMS

- 7.3.4 MOBILE PUMPING SERVICES

8 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

- 8.1 INTRODUCTION

- 8.2 PRESSURE SWING ADSORPTION (PSA)

- 8.2.1 DEMAND FOR HIGH TO ULTRA HIGH PURITY TO DRIVE MARKET

- 8.3 MEMBRANE-BASED

- 8.3.1 SIMPLE DESIGN AND COST-EFFECTIVENESS TO FUEL MARKET

- 8.4 CRYOGENIC-BASED

- 8.4.1 RISING DEMAND FOR ADVANCED SEMICONDUCTOR MANUFACTURING PROCESSES TO BOOST MARKET

9 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGE

- 9.2.1 DEMAND FOR PRODUCTION, HANDLING, AND PACKING PRODUCTS TO DRIVE MARKET

- 9.3 MEDICAL & PHARMACEUTICAL

- 9.3.1 PROTECTION OF SENSITIVE, EXPENSIVE ACTIVE PHARMACEUTICAL INGREDIENTS, AND FINISHED DRUGS FROM DEGRADATION TO BOOST GROWTH

- 9.4 TRANSPORTATION

- 9.4.1 IMPROVED SAFETY, FUEL EFFICIENCY, AND TIRE LIFE TO FUEL MARKET

- 9.5 ELECTRICAL & ELECTRONICS

- 9.5.1 RISING DEMAND FOR CLEAN, STRONG, AND RELIABLE SOLDER JOINTS TO PROPEL GROWTH

- 9.6 CHEMICAL & PETROCHEMICAL

- 9.6.1 CREATION OF INERT ATMOSPHERES IN STORAGE TANKS, REACTORS, AND PIPELINES TO SUPPORT GROWTH

- 9.7 MANUFACTURING

- 9.7.1 DEMAND FOR PURGING, CARBONIZING, SHIELDING, AND COOLING APPLICATIONS TO BOOST MARKET

- 9.8 PACKAGING

- 9.8.1 RISING DEMAND FOR BOTTLING & CANNING, INERTING, AND BLANKETING APPLICATIONS TO FUEL GROWTH

- 9.9 OTHER END-USE INDUSTRIES

10 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Changing lifestyles, growing demand for convenience foods, and recovering industrial activities to boost market

- 10.2.2 CANADA

- 10.2.2.1 Massive investments in battery manufacturing and clean hydrogen production to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Surge in foreign direct investments and industrial real estate to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Robust industrial base and leadership in high-precision manufacturing to fuel market

- 10.3.2 FRANCE

- 10.3.2.1 Growing food & beverage, electric vehicle, and pharmaceutical industries to propel market

- 10.3.3 UK

- 10.3.3.1 Industrial strategy focused on life sciences sector to drive market

- 10.3.4 ITALY

- 10.3.4.1 Pharmaceutical industry to drive demand

- 10.3.5 SPAIN

- 10.3.5.1 Electrification and renewable energy sector to boost market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Government policies and development of EV industry to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Revitalization of semiconductor industry to boost market

- 10.4.3 INDIA

- 10.4.3.1 Growing food & beverage, pharmaceutical, and electronics industries to propel market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Massive investments in semiconductor industry to fuel market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Vision 2030 and NEOM megaproject to support market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Government initiatives to drive market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Policy supporting healthcare segment to propel market

- 10.6.2 ARGENTINA

- 10.6.2.1 Demand for downstream shale production to fuel market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES, 2023-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Size footprint

- 11.7.5.4 Design footprint

- 11.7.5.5 Technology type footprint

- 11.7.5.6 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 PARKER HANNIFIN CORP

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ATLAS COPCO GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 INGERSOLL RAND

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 AIR LIQUIDE

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 LINDE PLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.7 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.8 INMATEC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 NOVAIR

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 OXYMAT

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 PARKER HANNIFIN CORP

- 12.2 OTHER PLAYERS

- 12.2.1 AIRPACK

- 12.2.2 CLAIND

- 12.2.3 COMPRESSED GAS TECHNOLOGIES, INC.

- 12.2.4 ERRE DUE S.P.A.

- 12.2.5 FOXOLUTION

- 12.2.6 GENERON

- 12.2.7 GAZTRON

- 12.2.8 ISOLCELL SPA.

- 12.2.9 NOBLEGEN

- 12.2.10 OXYWISE S.R.O.

- 12.2.11 OMEGA AIR

- 12.2.12 OXAIR

- 12.2.13 ON SITE GAS

- 12.2.14 PEAKGAS

- 12.2.15 WERTHER INTERNATIONAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 INDUSTRIAL NITROGEN GENERATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 IMPORT SCENARIO FOR HS CODE 840510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 840510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 ROLE OF COMPANIES IN INDUSTRIAL NITROGEN GENERATOR ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE OF INDUSTRIAL NITROGEN GENERATOR, BY REGION, 2022-2024 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE OF INDUSTRIAL NITROGEN GENERATOR, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- TABLE 14 INDUSTRIAL NITROGEN GENERATOR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 TOP 10 PATENT OWNERS, 2015-2024

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 18 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 19 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNIT)

- TABLE 20 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNIT)

- TABLE 21 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 22 INDUSTRIAL NITROGEN GENERATORS MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 23 INDUSTRIAL NITROGEN GENERATORS MARKET, BY SIZE, 2022-2024 (UNIT)

- TABLE 24 INDUSTRIAL NITROGEN GENERATORS MARKET, BY SIZE, 2025-2030 (UNIT)

- TABLE 25 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2022-2024 (USD MILLION)

- TABLE 26 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2022-2024 (UNIT)

- TABLE 28 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2025-2030 (UNIT)

- TABLE 29 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 30 INDUSTRIAL NITROGEN GENERATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 INDUSTRIAL NITROGEN GENERATORS MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 32 INDUSTRIAL NITROGEN GENERATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 33 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2022-2024 (UNIT)

- TABLE 34 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2025-2030 (UNIT)

- TABLE 35 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 36 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 38 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 39 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 42 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 43 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 46 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 47 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 48 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 50 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 51 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 52 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 54 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 55 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 58 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 59 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 60 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 62 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 63 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 64 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 66 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 67 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 68 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 70 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 71 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 72 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 74 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 75 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 76 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 78 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 79 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 80 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 82 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 83 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 84 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 86 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 87 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 88 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 90 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 91 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 94 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 95 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 98 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 99 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 100 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 102 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 103 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 104 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 106 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 107 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 108 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 110 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 111 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 112 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 114 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 115 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 118 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 119 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 122 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 123 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 126 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 127 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 128 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 130 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 131 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 132 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 134 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 135 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 136 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 142 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 143 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 144 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 146 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 147 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 150 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 151 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 152 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 154 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 155 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 156 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 158 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 159 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET BETWEEN 2023 AND 2025

- TABLE 162 INDUSTRIAL NITROGEN GENERATOR MARKET: DEGREE OF COMPETITION

- TABLE 163 INDUSTRIAL NITROGEN GENERATOR MARKET: REGION FOOTPRINT

- TABLE 164 INDUSTRIAL NITROGEN GENERATOR MARKET: SIZE FOOTPRINT

- TABLE 165 INDUSTRIAL NITROGEN GENERATOR MARKET: DESIGN FOOTPRINT

- TABLE 166 INDUSTRIAL NITROGEN GENERATOR MARKET: TECHNOLOGY TYPE FOOTPRINT

- TABLE 167 INDUSTRIAL NITROGEN GENERATOR MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 168 INDUSTRIAL NITROGEN GENERATOR MARKET: KEY STARTUPS/SMES

- TABLE 169 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/2)

- TABLE 170 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 171 INDUSTRIAL NITROGEN GENERATOR MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 172 INDUSTRIAL NITROGEN GENERATOR MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 173 INDUSTRIAL NITROGEN GENERATOR MARKET: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 174 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 175 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 177 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 178 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 179 AIR PRODUCTS AND CHEMICALS, INC.: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 180 ATLAS COPCO GROUP: COMPANY OVERVIEW

- TABLE 181 ATLAS COPCO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ATLAS COPCO GROUP: DEALS, JANUARY 2023-JULY 2025

- TABLE 183 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 184 INGERSOLL RAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 INGERSOLL RAND: DEALS, JANUARY 2023-JULY 2025

- TABLE 186 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 187 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 AIR LIQUIDE: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 189 LINDE PLC: COMPANY OVERVIEW

- TABLE 190 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 LINDE PLC: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 192 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 193 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 INMATEC: COMPANY OVERVIEW

- TABLE 195 INMATEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 NOVAIR: COMPANY OVERVIEW

- TABLE 197 NOVAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 OXYMAT: COMPANY OVERVIEW

- TABLE 199 OXYMAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 AIRPACK: COMPANY OVERVIEW

- TABLE 201 CLAIND: COMPANY OVERVIEW

- TABLE 202 COMPRESSED GAS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 203 ERRE DUE S.P.A.: COMPANY OVERVIEW

- TABLE 204 FOXOLUTION: COMPANY OVERVIEW

- TABLE 205 GENERON: COMPANY OVERVIEW

- TABLE 206 GAZTRON: COMPANY OVERVIEW

- TABLE 207 ISOLCELL S.P.A.: COMPANY OVERVIEW

- TABLE 208 NOBLEGEN: COMPANY OVERVIEW

- TABLE 209 OXYWISE S.R.O.: COMPANY OVERVIEW

- TABLE 210 OMEGA AIR: COMPANY OVERVIEW

- TABLE 211 OXAIR: COMPANY OVERVIEW

- TABLE 212 ON SITE GAS: COMPANY OVERVIEW

- TABLE 213 PEAKGAS: COMPANY OVERVIEW

- TABLE 214 WERTHER INTERNATIONAL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INDUSTRIAL NITROGEN GENERATOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL NITROGEN GENERATOR MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL NITROGEN GENERATOR MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INDUSTRIAL NITROGEN GENERATOR MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: INDUSTRIAL NITROGEN GENERATOR MARKET TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 INDUSTRIAL NITROGEN GENERATOR MARKET: DATA TRIANGULATION

- FIGURE 8 PLUG & PLAY TO BE LARGER DESIGN TYPE BETWEEN 2025 AND 2030

- FIGURE 9 STATIONARY INDUSTRIAL NITROGEN GENERATOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 PSA INDUSTRIAL NITROGEN GENERATOR SEGMENT TO LEAD INDUSTRIAL NITROGEN GENERATOR MARKET DURING FORECAST PERIOD

- FIGURE 11 FOOD & BEVERAGE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET BETWEEN 2025 AND 2030

- FIGURE 13 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

- FIGURE 14 STATIONARY INDUSTRIAL NITROGEN GENERATOR SEGMENT TO CAPTURE LARGER MARKET SHARE BY 2030

- FIGURE 15 PLUG & PLAY DESIGN TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 PSA TECHNOLOGY TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 FOOD & BEVERAGE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 MARKET IN INDIA TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 19 INDUSTRIAL NITROGEN GENERATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 INDUSTRIAL NITROGEN GENERATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 23 INDUSTRIAL NITROGEN GENERATOR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 IMPORT DATA FOR HS CODE 840510-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 25 EXPORT DATA FOR HS CODE 840510-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 26 INDUSTRIAL NITROGEN GENERATOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF INDUSTRIAL NITROGEN GENERATOR, BY REGION, 2022-2024 (USD/UNIT)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF INDUSTRIAL NITROGEN GENERATOR, BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- FIGURE 30 INDUSTRIAL NITROGEN GENERATOR MARKET: GRANTED PATENTS, 2015-2024

- FIGURE 31 NUMBER OF PATENTS PER YEAR, 2015-2024

- FIGURE 32 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 33 TOP JURISDICTION, BY DOCUMENT, 2015-2024

- FIGURE 34 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 36 PLUG & PLAY INDUSTRIAL NITROGEN GENERATORS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 STATIONARY INDUSTRIAL NITROGEN GENERATOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 38 PRESSURE SWING ADSORPTION (PSA) INDUSTRIAL NITROGEN GENERATOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 FOOD & BEVERAGE INDUSTRIAL NITROGEN GENERATOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 INDIA TO BE FASTEST-GROWING INDUSTRIAL NITROGEN GENERATOR MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

- FIGURE 42 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2022-2024

- FIGURE 45 SHARE OF TOP FIVE COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2024

- FIGURE 46 VALUATION OF KEY COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2024

- FIGURE 47 FINANCIAL METRICS OF KEY COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2024

- FIGURE 48 INDUSTRIAL NITROGEN GENERATOR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 50 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPANY FOOTPRINT

- FIGURE 51 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 52 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 53 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 54 ATLAS COPCO GROUP: COMPANY SNAPSHOT

- FIGURE 55 INGERSOLL RAND: COMPANY SNAPSHOT

- FIGURE 56 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 57 LINDE PLC: COMPANY SNAPSHOT