|

市场调查报告书

商品编码

1808969

全球微创手术市场(按产品、应用、最终用户和地区)预测至 2030 年Minimally Invasive Surgery Market by Type (Surgical Device, Imaging System, Electrosurgical Device, Endoscopy Device, Medical Robotics), Application (Urological, Vascular, Oncological), End User (Hospital, Clinic, ASC) Region-Global Forecast to 2030 |

||||||

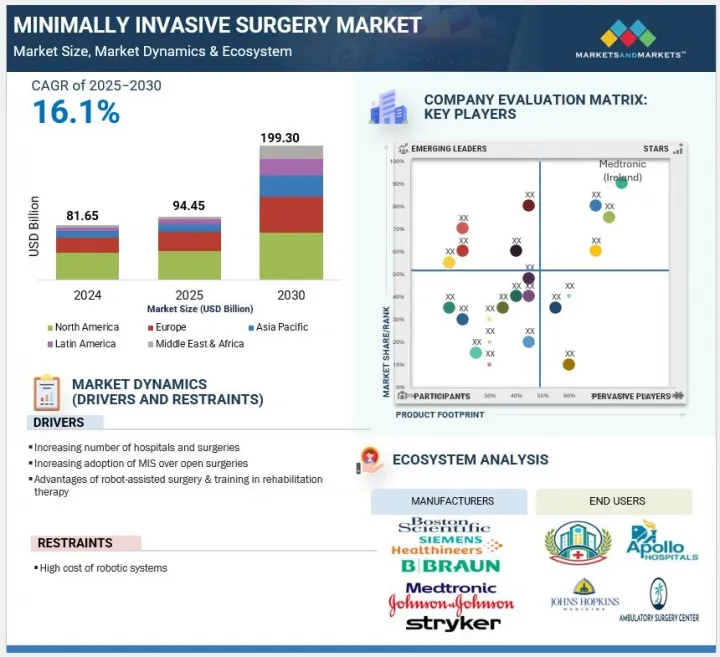

全球微创手术市场预计将从 2025 年的 9,445 万美元成长到 2030 年的 1.993 亿美元,预测期内的复合年增长率为 16.1%。

微创手术市场的成长动力源自于胃肠道疾病、癌症和心血管疾病等需要频繁手术介入的慢性疾病的日益增加。患者和医护人员越来越青睐微创手术,因为它相较于开放性手术有许多优势,包括恢復时间更快、併发症更少、住院时间更短。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按产品、按应用、按最终用户、按地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

此外,医院数量的扩张、医疗基础设施的改善以及住院患者数量的增加,也推动了对先进手术方案的需求。这些因素,加上持续的技术创新,正在加速全球各专科领域微创手术的普及。

依产品类型划分,全球微创手术市场分为手术设备、影像和视觉化系统、电外科设备、内视镜设备和医疗机器人。其中,手术器械部分预计将在 2024 年占据最大的市场占有率。此部分进一步分为手持器械、引导器械、充气系统和腹腔镜器械。手持器械部分由于其多功能性、可负担性和在各个手术领域的易用性而在 2024 年占据最大的市场份额。这些机械器械,包括抓紧器、牵开器、扩张器、镊子和缝线,对于腹腔镜、心胸外科、泌尿系统、神经外科和心血管外科至关重要。它们的多功能性和与标准 MIS 系统的兼容性使它们在先进的和资源有限的医疗环境中都必不可少。外科医生青睐这些手术器械,因为它们符合人体工学的设计、触觉回馈和精确的控制。此外,其可重复使用性和低维护成本提高了医院的采购效率。全球微创手术(MIS)的兴起,尤其是在普通外科和专科手术中的兴起,持续推动着需求,并保持了该领域的市场领导。

根据应用,微创手术市场分为心臟手术、血管手术、神经手术、耳鼻喉和胸腔外科、美容手术、胃肠和腹部手术、妇科手术、泌尿外科、泌尿系统手术、整形外科手术、牙科手术和其他应用。截至 2024 年,心胸外科领域将占据第二大市场占有率,这得益于全球心血管疾病的高负担。根据疾病预防控制中心的数据,心臟病仍然是美国最大的死亡原因,2023 年导致 919,032 人死亡,相当于每三分之一的死亡人数和每 34 秒就有一人死于心臟病。这种惊人的盛行率正在推动对有效、微创手术选择的需求。微创心胸手术具有显着的优势,包括减少创伤、缩短住院时间和加快恢復速度,因此受到患者和医疗保健提供者的欢迎。机器人辅助系统和微创瓣膜置换术等技术创新正在进一步推动其应用,加强该领域在整个 MIS 市场中的关键作用。

全球微创手术市场主要分为五个地区:北美、欧洲、亚太、拉丁美洲以及中东和非洲。预计到2024年,北美将在微创手术市场占据最大份额,这得益于慢性病的高发病率、日益增长的整容手术需求以及大型医疗设备製造商的布局。根据美国疾病管制与预防中心 (CDC) 的数据,到2024年,将有1.29亿美国至少患有一种慢性病,其中每10人中就有6人至少患有一种慢性病,每10人中就有4人患有两种或两种以上慢性病。日益加重的疾病负担将推动创伤更小、更有效的手术方案的需求。此外,用于美容的微创手术正在经历强劲增长,预计到2024年,将进行超过980万例神经调节剂注射(增长4%)和超过370万例皮肤重修置换术(增长6%),这表明患者对微创手术的偏好日益增加。该地区还受益于先进的医疗基础设施、优惠的报销政策以及创新技术的广泛应用。此外,强生、史赛克、波士顿科学、雅培和直觉外科等行业领导者的存在确保了产品的持续创新和供应,巩固了北美在全球 MIS 市场的领导地位。

本报告研究了全球微创手术市场,提供了按产品、应用、最终用户和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 技术分析

- 产业趋势

- 价值链分析

- 生态系分析

- 供应链分析

- 贸易分析

- 波特五力分析

- 主要相关人员和采购标准

- 监管分析

- 专利分析

- 定价分析

- 2025-2026年主要会议和活动

- 邻近市场分析

- 未满足的需求/最终用户期望

- 影响客户业务的趋势/中断

- 投资金筹措场景

- 人工智慧/生成人工智慧对微创手术市场的影响

- 2025年美国关税对微创手术市场的影响

第六章微创手术市场(按产品)

- 介绍

- 手术设备

- 成像和视觉化系统

- 电外科设备

- 内视镜设备

- 医疗机器人

第七章 微创手术市场(依应用)

- 介绍

- 胃肠/腹部手术

- 心胸外科

- 整形外科

- 血管外科

- 妇科手术

- 外科肿瘤学

- 神经外科

- 泌尿系统

- 耳鼻喉科及胸腔外科

- 整容手术

- 牙科手术

- 其他的

第八章微创手术市场(按最终用户)

- 介绍

- 医院

- 门诊手术中心

- 诊所

- 急救和创伤中心

- 其他的

第九章微创手术市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 中东和非洲宏观经济展望

- 海湾合作委员会国家

- 其他的

第十章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2020-2024年收益分析

- 2024年市场占有率分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 品牌/产品比较

- 竞争场景

第十一章 公司简介

- 主要参与企业

- MEDTRONIC

- JOHNSON & JOHNSON

- STRYKER

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT

- ZIMMER BIOMET

- B. BRAUN SE

- GLOBUS MEDICAL

- INTEGRA LIFESCIENCES CORPORATION

- SIEMENS HEALTHINEERS AG

- FUJIFILM CORPORATION

- KONINKLIJKE PHILIPS NV

- INTUITIVE SURGICAL OPERATIONS, INC.

- KARL STORZ SE & CO. KG

- GE HEALTHCARE

- 其他公司

- NIPRO

- SMITH+NEPHEW

- GETINGE

- CONMED CORPORATION

- TELEFLEX INCORPORATED

- OLYMPUS CORPORATION

- COOPERSURGICAL, INC.

- APPLIED MEDICAL RESOURCES CORPORATION

- OTU MEDICAL

- ATMOS MEDIZINTECHNIK GMBH & CO. KG

第十二章 附录

The global minimally invasive surgery market is projected to reach USD 199.30 million by 2030 from USD 94.45 million in 2025, at a CAGR of 16.1% during the forecast period. The growth of the minimally invasive surgery market is fueled by the increasing prevalence of chronic diseases such as gastrointestinal disorders, cancer, and cardiovascular conditions, which often require frequent surgical intervention. Patients and providers are more and more favoring MIS because of its advantages over open surgery, including shorter recovery times, fewer complications, and reduced hospital stays.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa |

Furthermore, the expanding number of hospitals, better healthcare infrastructure, and rising hospital admissions are boosting the demand for advanced surgical options. These factors, along with continuous technological innovation, are speeding up the global adoption of MIS procedures across various specialties.

The handheld instruments segment of the minimally invasive surgery market, by type of surgical device, had the highest market share in 2024.

By product, the global minimally invasive surgery market is segmented into surgical devices, imaging & visualization systems, electrosurgical devices, endoscopy devices, and medical robotics. Among these, in 2024, the surgical devices segment held the largest market share. This segment is further broken down into handheld instruments, guiding devices, inflation systems, and laparoscopy devices. In 2024, the handheld instruments segment had the highest share, due to their wide application, affordability, and ease of use across various surgical fields. These mechanical tools-such as graspers, retractors, dilators, forceps, and suturing devices-are vital in laparoscopic, cardiothoracic, urological, neurological, and cardiovascular surgeries. Their versatility and compatibility with standard MIS systems make them essential in both advanced and resource-limited healthcare environments. Surgeons favor these instruments for their ergonomic design, tactile feedback, and precise control. Moreover, their reusability and lower maintenance costs improve hospital procurement efficiency. The global rise in MIS procedures, especially in general and specialized surgeries, continues to boost demand, maintaining this segment's market leadership.

The cardiothoracic surgery segment of the minimally invasive surgery market had the second-highest market share in 2024, based on application.

Based on application, the minimally invasive surgery market is segmented into cardiothoracic surgery, vascular surgery, neurological surgery, ENT & respiratory surgery, cosmetic surgery, gastrointestinal & abdominal surgery, gynecological surgery, urological surgery, orthopedic surgery, oncology surgery, dental surgery, and other applications. In 2024, the cardiothoracic surgery segment held the second-highest market share, driven by the global high burden of cardiovascular diseases. According to the CDC, heart disease remains the leading cause of death in the U.S., with 919,032 deaths in 2023, equal to one in every three deaths and one death every 34 seconds. This alarming rate of prevalence increases the demand for effective, less invasive surgical options. Minimally invasive cardiothoracic procedures provide notable advantages, such as less trauma, shorter hospital stays, and quicker recovery, making them more favored by both patients and healthcare providers. Innovations like robotic-assisted systems and minimally invasive valve replacements further boost adoption, strengthening this segment's prominent role in the overall MIS market.

In 2024, North America accounted for the largest share of the minimally invasive surgery market.

The global minimally invasive surgery market is segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Among these in 2024, the North American region held the largest share in the minimally invasive surgery market, driven by the high prevalence of chronic diseases, increasing demand for cosmetic procedures, and the presence of leading medical device manufacturers. According to the CDC, as of 2024, 129 million Americans have at least one chronic disease, with 6 in 10 Americans having at least one, and 4 in 10 having two or more chronic diseases. This growing disease burden drives demand for less invasive, more effective surgical options. Additionally, cosmetic minimally invasive procedures are experiencing strong growth, with over 9.8 million neuromodulator injections (up 4%) and 3.7 million skin resurfacing procedures (up 6%) performed in 2024, indicating rising patient preference. The region also benefits from advanced healthcare infrastructure, favorable reimbursement policies, and widespread adoption of innovative technologies. Furthermore, the presence of major industry players like Johnson & Johnson, Stryker, Boston Scientific, Abbott, and Intuitive Surgical ensures ongoing product innovation and availability, solidifying North America's leadership in the global MIS market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 40%, Tier 2- 30%, and Tier 3- 30%

- By Designation: C-level- 50%, Director level- 30%, and Others- 20%

- By Region: North America- 30%, Europe- 25%, Asia Pacific- 20%, Latin America- 15%, and Middle East & Africa- 10%.

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

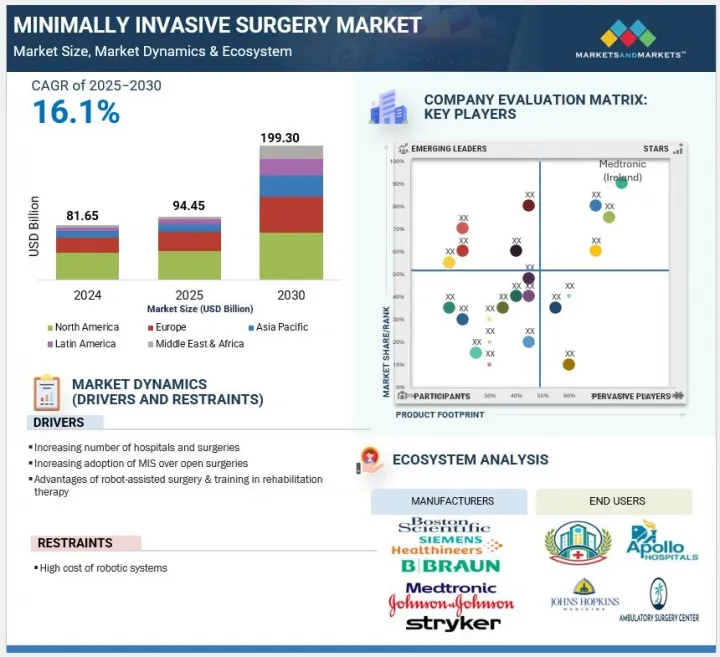

The players operating in the minimally invasive surgery market include Medtronic (Ireland), Johnson & Johnson (US), Stryker (US), Boston Scientific Corporation (US), Siemens Healthineers AG (Germany), Abbott (US), GE HealthCare (US), Koninklijke Philips N.V. (Netherland), Intuitive Surgical Operations, Inc. (US), FUJIFILM Corporation (Japan), B Braun SE (Germany), Globus Medical, Inc. (US), Integra LifeSciences Corporation (US), KARL STORZ SE & Co. KG (Germany), Nipro (Japan), Smith+Nephew (UK), Getinge AB (Sweden), CONMED Corporation (US), Teleflex Incorporated (US), Olympus Corporation (Japan), CooperSurgical, Inc. (US), Applied Medical Resources Corporation (US), OTU Medical Inc. (US), and ATMOS MedizinTechnik GmbH & Co. KG (Germany).

Research Coverage

This report examines the minimally invasive surgery market based on component, technology, end user, and region. It also analyzes factors such as drivers, restraints, opportunities, and challenges that influence market growth, and outlines the competitive landscape of market leaders. Additionally, the report reviews micro markets and their individual growth trends, and forecasts the revenue of market segments across five major regions and their respective countries.

Reasons to Buy the Report

The report will help both established and smaller firms gauge the market pulse, which can, in turn, assist them in gaining a larger market share. Firms purchasing the report can use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing number of hospitals and surgeries, Increasing adoption of MIS over open surgeries, advantages of robot-assisted surgery & training in rehabilitation therapy), restraints (high cost of robotic systems), opportunities (emerging markets, increasing adoption of advanced robotics in ambulatory surgical centers), challenges (changing regulatory landscape in medical devices).

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the minimally invasive surgery market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the minimally invasive surgery market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the minimally invasive surgery industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Medtronic (Ireland), Johnson & Johnson (US), Stryker (US), Boston Scientific Corporation (US), Siemens Healthineers AG (Germany), Abbott (US), GE HealthCare (US), Koninklijke Philips N.V. (Netherland), Intuitive Surgical Operations, Inc. (US), FUJIFILM Corporation (Japan), and among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key objectives of secondary research

- 2.1.1.2 Key sources of secondary data

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 DEMAND-SIDE MODELLING

- 2.3 DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MINIMALLY INVASIVE SURGERY MARKET OVERVIEW

- 4.2 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER AND COUNTRY

- 4.3 MINIMALLY INVASIVE SURGERY MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 MINIMALLY INVASIVE SURGERY MARKET: REGIONAL MIX

- 4.5 MINIMALLY INVASIVE SURGERY MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising geriatric population and increasing number of surgeries

- 5.2.1.2 Growing adoption of minimally invasive surgeries over traditional open surgical procedures

- 5.2.1.3 Advantages of robot-assisted surgery and training in rehabilitation therapy

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of robotic systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in emerging markets

- 5.2.3.2 Increasing adoption of advanced robotics in ambulatory surgery centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Changing regulatory landscape in medical device industry

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Laparoscopy

- 5.3.1.2 Electrosurgery

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Robotic surgery

- 5.3.2.2 Medical and surgical imaging

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Artificial intelligence and machine learning

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 INTEGRATION OF ARTIFICAL INTELLIGENCE AND MACHINE LEARNING

- 5.4.2 TECHNOLOGICAL ADVANCEMENTS IN IMAGING

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 9018, 2019-2024

- 5.8.2 EXPORT SCENARIO FOR HS CODE 9018, 2019-2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 Japan

- 5.11.2.3.2 China

- 5.11.2.3.3 India

- 5.11.2.4 Latin America

- 5.11.2.5 Middle East & Africa

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF MINIMALLY INVASIVE SURGICAL PRODUCTS, BY KEY PLAYER

- 5.13.2 AVERAGE SELLING PRICE TREND OF MINIMALLY INVASIVE SURGICAL PRODUCTS, BY REGION, 2022-2024

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 ENDOSCOPY EQUIPMENT MARKET

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI ON MINIMALLY INVASIVE SURGERY MARKET

- 5.20 IMPACT OF 2025 US TARIFF ON MINIMALLY INVASIVE SURRGERY MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 KEY IMPACT ON COUNTRY/REGION

- 5.20.4.1 North America

- 5.20.4.1.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.1 North America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SURGICAL DEVICES

- 6.2.1 HANDHELD INSTRUMENTS

- 6.2.1.1 Tubular retractors

- 6.2.1.1.1 Minimized tissue trauma and better outcomes to support adoption

- 6.2.1.2 Dilators

- 6.2.1.2.1 Increased focus on safety and efficient surgical site access to boost segment growth

- 6.2.1.3 Suturing instruments

- 6.2.1.3.1 Rising demand and procedural volume for minimally invasive surgeries to drive market

- 6.2.1.4 Probes

- 6.2.1.4.1 Advancements in instrumentation to fuel adoption in diagnostic purposes

- 6.2.1.5 Laser fiber devices

- 6.2.1.5.1 Laser fiber devices to focus on precise and controlled procedures with minimal tissue trauma

- 6.2.1.1 Tubular retractors

- 6.2.2 LAPAROSCOPY DEVICES

- 6.2.2.1 Laparoscopes

- 6.2.2.1.1 Lower surgical infection risk to drive demand

- 6.2.2.2 Trocars & cannulas

- 6.2.2.2.1 Need to ensure accurate placement of medications during surgeries to support segment growth

- 6.2.2.3 Graspers & dissectors

- 6.2.2.3.1 Increased safety and better precision to fuel market growth

- 6.2.2.1 Laparoscopes

- 6.2.3 INFLATION SYSTEMS

- 6.2.3.1 Balloon catheters

- 6.2.3.1.1 Increasing prevalence of cardiovascular diseases to boost market growth

- 6.2.3.2 Balloon inflation systems

- 6.2.3.2.1 Growing adoption of minimally invasive coronary and peripheral procedures to accelerate market growth

- 6.2.3.1 Balloon catheters

- 6.2.4 GUIDING DEVICES

- 6.2.4.1 Guiding catheters

- 6.2.4.1.1 Rising demand for precise navigation and device placement in complex minimally invasive surgeries to drive demand

- 6.2.4.2 Guidewires

- 6.2.4.2.1 Rising PCTA and PTA procedural volumes to ensure demand growth

- 6.2.4.1 Guiding catheters

- 6.2.1 HANDHELD INSTRUMENTS

- 6.3 IMAGING & VISUALIZATION SYSTEMS

- 6.3.1 ULTRASOUND SYSTEMS

- 6.3.1.1 Rising chronic disease burden to drive demand for reliable, non-invasive ultrasound imaging

- 6.3.1.2 CT scanners

- 6.3.1.2.1 Rising demand for high-resolution imaging in complex minimally invasive surgeries to support market growth

- 6.3.2 MRI SYSTEMS

- 6.3.2.1 Rising cancer prevalence to increase reliance on MRI for early detection and image-guided surgeries

- 6.3.3 X-RAY SYSTEMS

- 6.3.3.1 Rapid, low-cost digital imaging and high patient throughput to favor market growth

- 6.3.4 OTHER IMAGING & VISUALIZATION SYSTEMS

- 6.3.1 ULTRASOUND SYSTEMS

- 6.4 ELECTROSURGAL DEVICES

- 6.4.1 ELECTROCAUTERY DEVICES

- 6.4.1.1 High demand for precise cutting and coagulation to boost electrocautery device use in minimally invasive procedures

- 6.4.2 ELECTROSURGICAL GENERATORS & ACCESSORIES

- 6.4.2.1 Growing use of disposables and reusable instruments to propel segment growth

- 6.4.1 ELECTROCAUTERY DEVICES

- 6.5 ENDOSCOPY DEVICES

- 6.5.1 RIGID ENDOSCOPES

- 6.5.1.1 Rising joint and urologic disorders to drive demand in high-volume minimally invasive surgeries

- 6.5.2 FLEXIBLE ENDOSCOPES

- 6.5.2.1 Increased preventive screening and early cancer detection to elevate flexible endoscope adoption

- 6.5.1 RIGID ENDOSCOPES

- 6.6 MEDICAL ROBOTICS

- 6.6.1 ROBOTIC SYSTEMS

- 6.6.1.1 Superior precision, enhanced control, and ability to perform complex procedures with greater dexterity to drive market

- 6.6.2 ROBOTIC INSTRUMENTS

- 6.6.2.1 Growing volume of robotic surgical procedures to augment market growth

- 6.6.3 ROBOTIC SOFTWARE & SERVICES

- 6.6.3.1 Rising robotic installations to increase demand for bundled training, maintenance, and technical support services

- 6.6.1 ROBOTIC SYSTEMS

7 MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 GASTROINTESTINAL & ABDOMINAL SURGERY

- 7.2.1 RISING GLOBAL BURDEN OF GASTROINTESTINAL CANCERS AND DIGESTIVE DISORDERS TO DRIVE MARKET

- 7.3 CARDIOTHORACIC SURGERY

- 7.3.1 INCREASING CARDIOVASCULAR AND THORACIC CONDITIONS TO INCREASE PRECISION-BASED MINIMALLY INVASIVE PROCEDURES

- 7.4 ORTHOPEDIC SURGERY

- 7.4.1 RISING BURDEN OF MUSCULOSKELETAL DISORDERS AND GROWING GERIATRIC POPULATION TO AID MARKET GROWTH

- 7.5 VASCULAR SURGERY

- 7.5.1 MINIMALLY INVASIVE VASCULAR SURGERY PRODUCTS TO REPLACE CONVENTIONAL SUTURE-BASED METHODS

- 7.6 GYNECOLOGICAL SURGERY

- 7.6.1 HIGH INCIDENCE OF GYNECOLOGICAL DISORDERS TO FUEL SEGMENT GROWTH

- 7.7 ONCOLOGICAL SURGERY

- 7.7.1 HIGH CANCER INCIDENCE AND ADOPTION OF ADVANCED PRECISION SURGICAL TECHNOLOGIES TO BOOST MARKET GROWTH

- 7.8 NEUROLOGICAL SURGERY

- 7.8.1 INCREASING GERIATRIC POPULATION AND RISING OCCURRENCE OF NEURODEGENERATIVE DISORDERS TO PROPEL MARKET GROWTH

- 7.9 UROLOGICAL SURGERY

- 7.9.1 INCREASING PREVALENCE OF UROLOGICAL CANCERS TO AUGMENT MARKET GROWTH

- 7.10 ENT & RESPIRATORY SURGERY

- 7.10.1 GROWING GLOBAL BURDEN OF COPD AND HEAD & NECK CANCERS TO DRIVE MARKET

- 7.11 COSMETIC SURGERY

- 7.11.1 HIGH DEMAND FOR AESTHETIC ENHANCEMENT WITH MINIMAL DOWNTIME TO PROPEL MARKET GROWTH

- 7.12 DENTAL SURGERY

- 7.12.1 RISING PATIENT DEMAND FOR LESS PAINFUL AND TISSUE-PRESERVING TREATMENTS TO FAVOR MARKET GROWTH

- 7.13 OTHER SURGERIES

8 MINIMALLY INVASIVE SURGERY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 RISING CHRONIC DISEASE BURDEN TO DRIVE PATIENT PREFERENCE FOR ADVANCED MINIMALLY INVASIVE SURGERIES IN HOSPITALS

- 8.3 AMBULATORY SURGERY CENTERS

- 8.3.1 GROWING PATIENT PREFERENCE FOR QUICKER DISCHARGE AND LOWER COSTS TO BOOST MARKET GROWTH

- 8.4 CLINICS

- 8.4.1 PREFERENCE FOR OUTPATIENT AND COST-EFFECTIVE MINIMALLY INVASIVE SURGICAL PROCEDURES TO AID MARKET GROWTH

- 8.5 EMERGENCY & TRAUMA CENTERS

- 8.5.1 INCREASING DEMAND FOR SAME-DAY SURGERIES TO AUGMENT MARKET GROWTH

- 8.6 OTHER END USERS

9 MINIMALLY INVASIVE SURGERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American minimally invasive surgery market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 High geriatric population with chronic diseases to propel market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Increased cancer incidence and strong healthcare infrastructure to fuel market growth

- 9.3.3 UK

- 9.3.3.1 Increasing geriatric population and rising need for oncological surgeries to stimulate market growth

- 9.3.4 FRANCE

- 9.3.4.1 High burden of non-communicable diseases to accelerate demand for minimally invasive procedures

- 9.3.5 ITALY

- 9.3.5.1 Increasing geriatric population to support adoption of minimally invasive procedures in degenerative conditions

- 9.3.6 SPAIN

- 9.3.6.1 Robust public healthcare and focus on reduced post-operative complications to augment market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Growing need for less invasive and high-precision surgical interventions to drive market

- 9.4.3 INDIA

- 9.4.3.1 Need for cost-effective and efficient surgical options in resource-constrained healthcare system to drive adoption

- 9.4.4 JAPAN

- 9.4.4.1 Advanced medical technology adoption and strong focus on patient-centric care to accelerate market growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 High demand for plastic surgeries and adoption of advanced robotics to aid market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Increasing chronic disease burden and booming cosmetic surgery rates to fuel market expansion

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Substantial public health investment and advanced dual public-private healthcare system to favor market growth

- 9.5.3 MEXICO

- 9.5.3.1 Rising obesity across age groups to fuel demand for minimally invasive surgical procedures in Mexican healthcare system

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Increased government healthcare investments and adoption of advanced medical technologies to spur market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MINIMALLY INVASIVE SURGERY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND APPROVALS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 MEDTRONIC

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product approvals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 JOHNSON & JOHNSON

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product approvals

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 STRYKER

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 BOSTON SCIENTIFIC CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 ABBOTT

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 ZIMMER BIOMET

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.7 B. BRAUN SE

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 GLOBUS MEDICAL

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 INTEGRA LIFESCIENCES CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 SIEMENS HEALTHINEERS AG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Expansions

- 11.1.11 FUJIFILM CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches and approvals

- 11.1.11.3.2 Deals

- 11.1.12 KONINKLIJKE PHILIPS N.V.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches and approvals

- 11.1.12.3.2 Deals

- 11.1.13 INTUITIVE SURGICAL OPERATIONS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product approvals

- 11.1.14 KARL STORZ SE & CO. KG

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.14.3.2 Expansions

- 11.1.15 GE HEALTHCARE

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.15.3.2 Deals

- 11.1.1 MEDTRONIC

- 11.2 OTHER PLAYERS

- 11.2.1 NIPRO

- 11.2.2 SMITH+NEPHEW

- 11.2.3 GETINGE

- 11.2.4 CONMED CORPORATION

- 11.2.5 TELEFLEX INCORPORATED

- 11.2.6 OLYMPUS CORPORATION

- 11.2.7 COOPERSURGICAL, INC.

- 11.2.8 APPLIED MEDICAL RESOURCES CORPORATION

- 11.2.9 OTU MEDICAL

- 11.2.10 ATMOS MEDIZINTECHNIK GMBH & CO. KG

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MINIMALLY INVASIVE SURGERY MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 MINIMALLY INVASIVE SURGERY MARKET: STUDY ASSUMPTIONS

- TABLE 4 MINIMALLY INVASIVE SURGERY MARKET: RISK ANALYSIS

- TABLE 5 IMPORT DATA FOR HS CODE 9018, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 6 EXPORT DATA FOR HS CODE 9018, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 7 MINIMALLY INVASIVE SURGERY MARKET: PORTER'S FIVE FORCES

- TABLE 8 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR MINIMALLY INVASIVE SURGICAL PRODUCTS

- TABLE 9 KEY BUYING CRITERIA FOR MAJOR MINIMALLY INVASIVE SURGICAL PRODUCTS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

- TABLE 16 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 17 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 18 CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES IN JAPAN

- TABLE 19 NMPA MEDICAL DEVICES CLASSIFICATION

- TABLE 20 AVERAGE SELLING PRICE TREND OF MINIMALLY INVASIVE SURGICAL PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND OF MINIMALLY INVASIVE SURGICAL PRODUCTS, BY REGION, 2022-2024 (USD)

- TABLE 22 MINIMALLY INVASIVE SURGERY MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 23 MINIMALLY INVASIVE SURGERY MARKET: UNMET NEEDS/END-USER EXPECTATIONS

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR ORTHODONTIC SUPPLIES

- TABLE 26 MINIMALLY INVASIVE SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 30 HANDHELD INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 TUBULAR RETRACTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 DILATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 SUTURING INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 PROBES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 LASER FIBER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 37 LAPAROSCOPY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LAPAROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 TROCARS & CANNULAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 GRASPERS & DISSECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 42 INFLATION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 BALLOON CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 BALLON INFLATION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 GUIDING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 GUIDING CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 GUIDEWIRES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 CT SCANNERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 MRI SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 X-RAY SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 OTHER IMAGING & VISUALIZATION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 57 MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ELECTROCAUTERY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 ELECTROSURGICAL GENERATORS & ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 RIGID ENDOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 FLEXIBLE ENDOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 65 MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 ROBOTIC SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 ROBOTIC INTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 ROBOTIC SOFTWARE & SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 MINIMALLY INVASIVE GASTROINTESTINAL & ABDOMINAL SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 MINIMALLY INVASIVE CARDIOTHORACIC SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 MINIMALLY INVASIVE ORTHOPEDIC SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 MINIMALLY INVASIVE VASCULAR SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 MINIMALLY INVASIVE GYNECOLOGICAL SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 MINIMALLY INVASIVE ONCOLOGICAL SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 MINIMALLY INVASIVE NEUROLOGICAL SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 MINIMALLY INVASIVE UROLOGICAL SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 MINIMALLY INVASIVE ENT & RESPIRATORY SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 MINIMALLY INVASIVE COSMETIC SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 MINIMALLY INVASIVE DENTAL SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 MINIMALLY INVASIVE OTHER SURGERIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 83 MINIMALLY INVASIVE SURGERY MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 MINIMALLY INVASIVE SURGERY MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 MINIMALLY INVASIVE SURGERY MARKET FOR CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 MINIMALLY INVASIVE SURGERY MARKET FOR EMERGENCY & TRAUMA CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 MINIMALLY INVASIVE SURGERY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 MINIMALLY INVASIVE SURGERY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 MINIMALLY INVASIVE SURGERY MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 90 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY TYPE, 2023-2030 (THOUSAND UNITS)

- TABLE 92 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 104 US: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 105 US: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 US: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 US: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 US: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 US: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 US: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 US: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 US: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 US: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 US: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 US: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 116 CANADA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 117 CANADA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 CANADA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 CANADA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 CANADA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 CANADA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 CANADA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 CANADA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 CANADA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 CANADA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 CANADA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 127 CANADA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 130 EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 131 EUROPE: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 EUROPE: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 EUROPE: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 EUROPE: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 EUROPE: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 EUROPE: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 EUROPE: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 141 EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 142 GERMANY: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 143 GERMANY: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 GERMANY: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 GERMANY: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 GERMANY: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 GERMANY: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 GERMANY: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 GERMANY: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 GERMANY: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 GERMANY: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 GERMANY: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 GERMANY: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 154 UK: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 155 UK: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 UK: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 UK: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 UK: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 UK: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 UK: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 UK: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 UK: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 UK: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 UK: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 165 UK: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 166 FRANCE: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 167 FRANCE: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 FRANCE: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 FRANCE: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 FRANCE: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 FRANCE: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 FRANCE: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 FRANCE: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 FRANCE: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 FRANCE: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 FRANCE: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 FRANCE: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 ITALY: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 179 ITALY: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 ITALY: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 ITALY: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 ITALY: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 ITALY: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ITALY: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 ITALY: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 ITALY: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 ITALY: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 ITALY: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 189 ITALY: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 SPAIN: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 191 SPAIN: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 SPAIN: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 SPAIN: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 SPAIN: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 SPAIN: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 SPAIN: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 SPAIN: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 SPAIN: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 SPAIN: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 SPAIN: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 201 SPAIN: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 202 REST OF EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 203 REST OF EUROPE: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF EUROPE: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF EUROPE: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF EUROPE: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF EUROPE: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 REST OF EUROPE: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 REST OF EUROPE: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 REST OF EUROPE: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 REST OF EUROPE: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 REST OF EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 213 REST OF EUROPE: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (THOUSAND UNITS)

- TABLE 216 ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 ASIA PACIFIC: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 228 CHINA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 229 CHINA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 CHINA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 CHINA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 CHINA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 CHINA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 CHINA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 CHINA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 CHINA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 CHINA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 CHINA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 239 CHINA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 240 INDIA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 241 INDIA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 INDIA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 INDIA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 INDIA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 INDIA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 INDIA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 INDIA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 INDIA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 INDIA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 INDIA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 251 INDIA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 252 JAPAN: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 253 JAPAN: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 JAPAN: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 JAPAN: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 JAPAN: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 JAPAN: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 JAPAN: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 JAPAN: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 JAPAN: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 JAPAN: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 JAPAN: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 263 JAPAN: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 264 SOUTH KOREA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 265 SOUTH KOREA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 SOUTH KOREA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 SOUTH KOREA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 SOUTH KOREA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 SOUTH KOREA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 SOUTH KOREA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 SOUTH KOREA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 SOUTH KOREA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 SOUTH KOREA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 SOUTH KOREA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 275 SOUTH KOREA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 276 AUSTRALIA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 277 AUSTRALIA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 AUSTRALIA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 AUSTRALIA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 AUSTRALIA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 AUSTRALIA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 AUSTRALIA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 AUSTRALIA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 AUSTRALIA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 AUSTRALIA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 AUSTRALIA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 287 AUSTRALIA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 REST OF ASIA PACIFIC: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 REST OF ASIA PACIFIC: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 REST OF ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 299 REST OF ASIA PACIFIC: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 300 LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (THOUSAND UNITS)

- TABLE 302 LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 303 LATIN AMERICA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 304 LATIN AMERICA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 LATIN AMERICA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 LATIN AMERICA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 LATIN AMERICA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 LATIN AMERICA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 LATIN AMERICA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 LATIN AMERICA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 LATIN AMERICA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 313 LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 314 BRAZIL: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 315 BRAZIL: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 BRAZIL: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 BRAZIL: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 BRAZIL: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 BRAZIL: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 BRAZIL: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 BRAZIL: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 BRAZIL: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 BRAZIL: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 BRAZIL: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 325 BRAZIL: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 326 MEXICO: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 327 MEXICO: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 MEXICO: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 MEXICO: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 MEXICO: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 MEXICO: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 MEXICO: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 MEXICO: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 MEXICO: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 MEXICO: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 MEXICO: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 337 MEXICO: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 339 REST OF LATIN AMERICA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 REST OF LATIN AMERICA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 REST OF LATIN AMERICA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 342 REST OF LATIN AMERICA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 343 REST OF LATIN AMERICA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 REST OF LATIN AMERICA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 REST OF LATIN AMERICA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 REST OF LATIN AMERICA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 347 REST OF LATIN AMERICA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 REST OF LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 349 REST OF LATIN AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 352 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 357 MIDDLE EAST & AFRICA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 359 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 360 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 361 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 362 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 363 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 364 GCC COUNTRIES: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 365 GCC COUNTRIES: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 366 GCC COUNTRIES: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 367 GCC COUNTRIES: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 368 GCC COUNTRIES: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 369 GCC COUNTRIES: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 370 GCC COUNTRIES: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 371 GCC COUNTRIES: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 372 GCC COUNTRIES: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 GCC COUNTRIES: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 374 GCC COUNTRIES: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 375 GCC COUNTRIES: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 378 REST OF MIDDLE EAST & AFRICA: HANDHELD INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 379 REST OF MIDDLE EAST & AFRICA: LAPAROSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 380 REST OF MIDDLE EAST & AFRICA: INFLATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 381 REST OF MIDDLE EAST & AFRICA: GUIDING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 382 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE IMAGING & VISUALIZATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 383 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE ELECTROSURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 384 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE ENDOSCOPY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 385 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE MEDICAL ROBOTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 386 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 387 REST OF MIDDLE EAST & AFRICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 388 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MINIMALLY INVASIVE SURGERY MARKET

- TABLE 389 MINIMALLY INVASIVE SURGERY MARKET: DEGREE OF COMPETITION

- TABLE 390 MINIMALLY INVASIVE SURGERY MARKET: REGION FOOTPRINT

- TABLE 391 MINIMALLY INVASIVE SURGERY MARKET: PRODUCT FOOTPRINT

- TABLE 392 MINIMALLY INVASIVE SURGERY MARKET: APPLICATION FOOTPRINT

- TABLE 393 MINIMALLY INVASIVE SURGERY MARKET: END-USER FOOTPRINT

- TABLE 394 MINIMALLY INVASIVE SURGERY MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 395 MINIMALLY INVASIVE SURGERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY PRODUCT AND REGION

- TABLE 396 MINIMALLY INVASIVE SURGERY MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JULY 2025

- TABLE 397 MINIMALLY INVASIVE SURGERY MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 398 MEDTRONIC: COMPANY OVERVIEW

- TABLE 399 MEDTRONIC: PRODUCTS OFFERED

- TABLE 400 MEDTRONIC: PRODUCT APPROVALS, JANUARY 2022-JULY 2025

- TABLE 401 MEDTRONIC: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 402 JOHNSON & JOHNSON: COMPANY OVERVIEW

- TABLE 403 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 404 JOHNSON & JOHNSON: PRODUCT APPROVALS, JANUARY 2022-JULY 2025

- TABLE 405 JOHNSON & JOHNSON: DEALS, JANUARY 2022-JULY 2025

- TABLE 406 STRYKER: COMPANY OVERVIEW

- TABLE 407 STRYKER: PRODUCTS OFFERED

- TABLE 408 STRYKER: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JULY 2025

- TABLE 409 STRYKER: DEALS, JANUARY 2022-JULY 2025

- TABLE 410 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 411 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 412 BOSTON SCIENTIFIC CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 413 ABBOTT: COMPANY OVERVIEW

- TABLE 414 ABBOTT: PRODUCTS OFFERED

- TABLE 415 ABBOTT: DEALS, JANUARY 2022-JULY 2025

- TABLE 416 ZIMMER BIOMET: COMPANY OVERVIEW

- TABLE 417 ZIMMER BIOMET: PRODUCTS OFFERED

- TABLE 418 ZIMMER BIOMET: PRODUCT APPROVALS, JANUARY 2022-JULY 2025

- TABLE 419 ZIMMER BIOMET: DEALS, JANUARY 2022-JULY 2025

- TABLE 420 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 421 B BRAUN SE: PRODUCTS OFFERED

- TABLE 422 GLOBUS MEDICAL: COMPANY OVERVIEW

- TABLE 423 GLOBUS MEDICAL: PRODUCTS OFFERED

- TABLE 424 GLOBUS MEDICAL: DEALS, JANUARY 2022-JULY 2025

- TABLE 425 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 426 INTEGRA LIFESCIENCES CORPORATION: PRODUCTS OFFERED

- TABLE 427 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 428 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 429 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 430 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 431 FUJIFILM CORPORATION: COMPANY OVERVIEW

- TABLE 432 FUJIFILM CORPORATION: PRODUCTS OFFERED

- TABLE 433 FUJIFILM CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JULY 2025

- TABLE 434 FUJIFILM CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 435 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 436 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 437 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JULY 2025

- TABLE 438 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-JULY 2025

- TABLE 439 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY OVERVIEW

- TABLE 440 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCTS OFFERED

- TABLE 441 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCT APPROVALS, JANUARY 2022-JULY 2025

- TABLE 442 KARL STORZ SE & CO. KG: COMPANY OVERVIEW

- TABLE 443 KARL STORZ SE & CO. KG: PRODUCTS OFFERED

- TABLE 444 KARL STORZ SE & CO. KG: DEALS, JANUARY 2022-JULY 2025

- TABLE 445 KARL STORZ SE & CO. KG: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 446 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 447 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 448 GE HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 449 GE HEALTHCARE: DEALS, JANUARY 2022-JULY 2025

- TABLE 450 NIPRO: COMPANY OVERVIEW

- TABLE 451 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 452 GETINGE: COMPANY OVERVIEW

- TABLE 453 CONMED CORPORATION: COMPANY OVERVIEW

- TABLE 454 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 455 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 456 COOPERSURGICAL, INC.: COMPANY OVERVIEW

- TABLE 457 APPLIED MEDICAL RESOURCES CORPORATION: COMPANY OVERVIEW

- TABLE 458 OTU MEDICAL: COMPANY OVERVIEW

- TABLE 459 ATMOS MEDIZINTECHNIK GMBH & CO. KG: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MINIMALLY INVASIVE SURGERY MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 MINIMALLY INVASIVE SURGERY MARKET: YEARS CONSIDERED

- FIGURE 3 MINIMALLY INVASIVE SURGERY MARKET: RESEARCH DESIGN

- FIGURE 4 MINIMALLY INVASIVE SURGERY MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 MINIMALLY INVASIVE SURGERY MARKET: KEY PRIMARY SOURCES

- FIGURE 6 MINIMALLY INVASIVE SURGERY MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 MINIMALLY INVASIVE SURGERY MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 MINIMALLY INVASIVE SURGERY MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 10 MINIMALLY INVASIVE SURGERY MARKET: TOP-DOWN APPROACH

- FIGURE 11 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MINIMALLY INVASIVE SURGERY MARKET (2025-2030)

- FIGURE 12 MINIMALLY INVASIVE SURGERY MARKET: CAGR PROJECTIONS

- FIGURE 13 MINIMALLY INVASIVE SURGERY MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 14 MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 MINIMALLY INVASIVE SURGERY MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 MINIMALLY INVASIVE SURGERY MARKET: REGIONAL SNAPSHOT

- FIGURE 18 HIGH VOLUME OF SURGICAL PROCEDURES AND PREFERENCE FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO DRIVE MARKET

- FIGURE 19 US AND HOSPITALS SEGMENT COMMANDED LARGEST MARKET SHARE IN 2024

- FIGURE 20 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA TO GROW AT HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 22 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 23 MINIMALLY INVASIVE SURGERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 MINIMALLY INVASIVE SURGERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 MINIMALLY INVASIVE SURGERY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 MINIMALLY INVASIVE SURGERY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 MINIMALLY INVASIVE SURGERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR MINIMALLY INVASIVE SURGICAL PRODUCTS

- FIGURE 29 KEY BUYING CRITERIA FOR MAJOR MINIMALLY INVASIVE SURGICAL PRODUCTS

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST PATENT OWNERSHIPS/APPLICATIONS AND NUMBER OF PATENTS GRANTED (JANUARY 2015-JULY 2025)

- FIGURE 31 TOP APPLICANT COUNTRIES/REGIONS FOR MINIMALLY INVASIVE SURGERY PATENTS (JANUARY 2014-MAY 2025)

- FIGURE 32 ENDOSCOPY EQUIPMENT MARKET OVERVIEW

- FIGURE 33 MINIMALLY INVASIVE SURGERY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 34 MINIMALLY INVASIVE SURGERY MARKET: FUNDING AND NUMBER OF DEALS (2019-2023)

- FIGURE 35 IMPACT OF AI/GEN AI ON MINIMALLY INVASIVE SURGERY MARKET

- FIGURE 36 MINIMALLY INVASIVE SURGERY MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 37 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET SNAPSHOT

- FIGURE 38 EUROPE: MINIMALLY INVASIVE SURGERY MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN MINIMALLY INVASIVE SURGERY MARKET (2022-2024)

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MINIMALLY INVASIVE SURGERY MARKET (2024)

- FIGURE 41 MINIMALLY INVASIVE SURGERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 MINIMALLY INVASIVE SURGERY MARKET: COMPANY FOOTPRINT

- FIGURE 43 MINIMALLY INVASIVE SURGERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 EV/EBITDA OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 MINIMALLY INVASIVE SURGERY MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS