|

市场调查报告书

商品编码

1810318

全球电线电缆管理市场(按产品、电缆类型、材料、安装、最终用户和地区划分)- 预测至 2030 年Wire and Cable Management Market by Cable Type, Material, Installation, End User, Product, and Region - Global Forecast to 2030 |

||||||

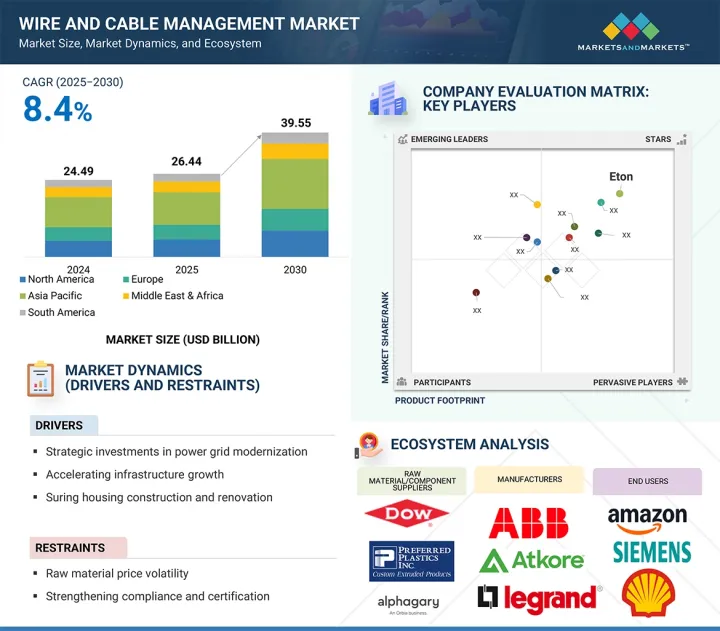

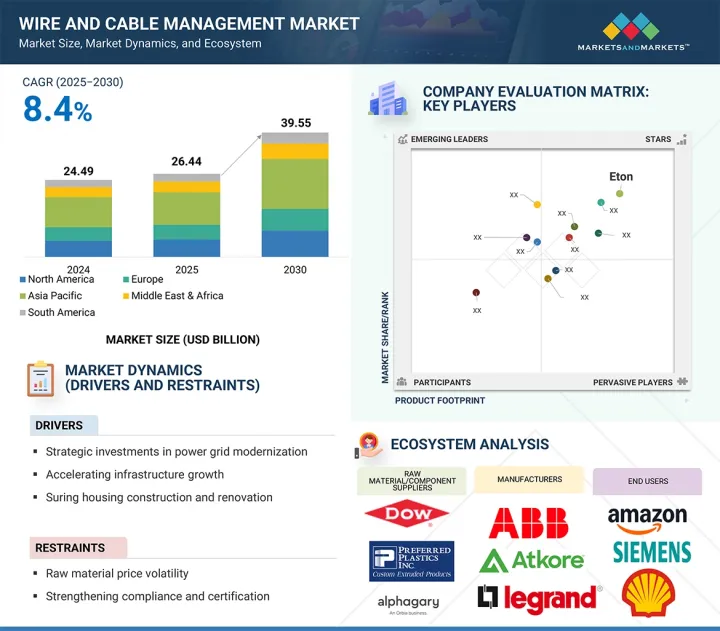

全球电线电缆管理市场预计将从 2025 年的 264.4 亿美元成长到 2030 年的 395.5 亿美元,预测期内复合年增长率为 8.4%。

全球主要市场对基础设施建设加速的需求是推动先进电线电缆管理解决方案需求的主要因素。印度正经历国家主导的基础设施投资的復苏,这体现在国家基础设施建设、资本支出增加、对电力和交通等成熟资产的再投资以及新数位相关基础设施的增长。这些工程涉及对电力和通讯系统的重大改造,而这些系统相关的电线数量众多且高度复杂,需要非常有效地处理它们,以确保灵活性并创建一个安全的环境。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元/十亿美元) |

| 部分 | 按产品、按电缆类型、按材料、按安装、按最终用户、按地区 |

| 目标区域 | 北美、欧洲、亚太地区、南美、中东和非洲 |

在美国,基础设施长期资金不足且老化严重,联邦基础设施投资政策旨在显着改善能源、交通和数位网络,其中包括透过标誌性的《基础设施投资与就业法案》投入1兆美元。先进的基础设施建设推动了对先进电缆管理的需求,以提高电网可靠性、简化安装并实现营运和维护。

电线电缆管理市场中最重要的部分是金属部分,因为该领域的电缆和电线极其坚固耐用,能够承受工业和户外应用的恶劣环境。金属导管和托盘具有高电磁场 (EMI) 屏蔽性能,在输送专用电力和电讯电缆的设备中至关重要。其坚固耐用的特性也使其适用于建筑工地和工业工作场所等高风险设施。由于结构稳定性和可靠性,金属材料被广泛采用,并已成为市场主流。

由于海底电缆的快速扩张,尤其是随着全球数据传输和电力互联(包括海上可再生能源计划和宽频通讯网路)的部署不断增加,预计安装业务将成为电线电缆管理市场中成长最快的领域。海底电缆是指在海底铺设专用电缆,连接各大洲、岛屿和偏远的海上设施,通常长达数千公里。电缆铺设船、先进的埋地技术和高压直流 (HVDC) 系统等技术进步正在推动海底电缆的成长,最大限度地减少远距传输损耗,并支援可再生能源併入国家电网。

北美电线电缆管理市场预计将成为全球第二大市场,这得益于其在基础设施开发和维护、风能和太阳能发电工程方面的巨额投资,以及包括5G部署在内的新兴通讯网路的兴起。该地区的技术创新,尤其是清洁能源和永续倡议,加上更换老化基础设施的需求,正在催生对高品质、耐用布线解决方案的需求。此外,住宅和商业建设活动的兴起以及电动车的普及也使市场受益。主要企业的高市场占有率和技术力也支撑了北美作为全球领先市场的地位。

ABB(瑞士)、罗格朗(法国)、Atkore(美国)、伊顿(爱尔兰)和 nVent(美国)是电线电缆管理市场的主要参与企业。该研究对这些主要企业进行了详细的竞争分析,包括他们的公司简介、最新发展和关键市场策略。

本研究报告按产品类型、电缆类型、材料、安装、最终用户和地区对全球电线电缆管理市场进行了定义、说明和预测。该报告还对市场进行了深入的定性和定量分析,并全面回顾了关键的市场驱动因素、限制因素、机会和挑战。报告还涵盖了市场的各个重要方面,包括竞争格局分析、市场动态、以金额为准的市场估值以及电线电缆管理市场的未来趋势。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 影响客户业务的趋势/中断

- 定价分析

- 价值链分析

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 关税和监管状况

- 2025-2026年主要会议和活动

- 波特五力分析

- 主要相关人员和采购标准

- 投资金筹措场景

- 案例研究分析

- 生成式人工智慧/人工智慧对电线电缆管理市场的影响

- 电线电缆管理市场的宏观经济展望

- 2025年美国关税的影响—概述

第六章电线电缆管理市场(依产品)

- 介绍

- 导管和主干线

- 电缆配线架和梯子

- 电缆电气管槽

- 密封套和连接器

- 盒子和盖子

- 线槽

- 领带、拉炼、夹子

- 其他的

7. 电线电缆管理市场(依电缆类型)

- 介绍

- 电源线

- 通讯电线电缆

第八章电线电缆管理市场(按材料)

- 介绍

- 金属

- 非金属

9. 配线电缆管理市场(依安装)

- 介绍

- 虚构的

- 地下

- 海底

第 10 章。电线电缆管理市场(按最终用户)

- 介绍

- 住房

- 商业的

- 工业

第 11 章。按地区分類的电线电缆管理市场

- 介绍

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他的

- 中东和非洲

- GCC

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他的

第十二章 竞争格局

- 概述

- 主要参与企业的策略/优势,2021-2025

- 2024年市场占有率分析

- 2020-2024年收益分析

- 估值和财务指标

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十三章:公司简介

- 主要参与企业

- ABB

- LEGRAND

- ATKORE

- EATON

- NVENT

- PANDUIT CORP.

- BELDEN INC.

- SCHNEIDER ELECTRIC

- HUBBELL

- HILTI

- TE CONNECTIVITY

- SALZER

- 3M

- ILLINOIS TOOL WORKS INC.

- NOVOFLEX

- 其他公司

- OBO BETTERMANN HOLDING GMBH & CO.KG

- FISCHER GROUP

- HELLERMANNTYTON

- NIEDAX GROUP

- CELO

- LAPP GROUP

- HELUKABEL

- MOLEX

- ICOTEK GMBH & CO. KG

- PACER GROUP

第十四章 附录

The global wire and cable management market is estimated to grow from USD 26.44 billion in 2025 to USD 39.55 billion by 2030, at a CAGR of 8.4% during the forecast period. The need to drive faster expansion of infrastructural development in the key markets worldwide is a major factor that is spurring the demand for advanced wire and cable management solutions. India is witnessing a resurgence of state-driven investment in infrastructure through the National Infrastructure Pipeline and increased capital expenditure, which is seeing renewed investment in mature assets like power and transportation, and the growth of new digital-related infrastructure. Such endeavors entail major overhauls in electrical and communication systems, and the number of wires involved in these systems is large and highly complex, and needs to be handled very efficiently to create a secure environment with a guarantee of expediency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Product, Cable Type, Material, Installation, and End User |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

In the United States, infrastructure continues to be chronically underfunded and deteriorated, and federal infrastructure investment policy is targeting greatly upgrading energy, transport, and digital networks, including trillion-dollar spending, with the signature legislation of the Infrastructure Investment and Jobs Act. This high level of infrastructure development increases the demand for high-level cable management to drive grid reliability, ease installation, and enable operations and maintenance.

"By material, the metallic segment is expected to be the largest material segment in the wire and cable management market during the forecast period."

The segments that are the most significant in the wire and cable management market include the metallic segment since cables and wires in this segment are very strong, durable, and able to withstand rough environments, which are characteristic of the industrial and outdoor applications. Metal conduits and trays provide high electromagnetic field (EMI) shielding, making them important in equipment transporting special power and telecom cables. They are also rugged and therefore suitable for high-stakes installations such as construction sites and industrial workplaces. Such a prevalence, facilitated by structural stability and reliability, makes metallic materials the market authority.

"By installation, the submarine segment is the fastest segment in the wire and cable management market during the forecast period."

The installation segment is projected to be the fastest-growing segment in the wire and cable management market, as submarines are experiencing rapid expansion with increasing deployment of undersea cables for global data transmission and power interconnection, particularly in offshore renewable energy projects and high-bandwidth telecommunications networks. Submarine installations involve laying specialized cables on the ocean floor, often spanning thousands of kilometers, to connect continents, islands, and remote offshore facilities. The growth is fueled by technological advancements in cable-laying vessels, sophisticated burial techniques, and high-voltage direct current (HVDC) systems, which minimize transmission losses over long distances and support the integration of renewable energy into national grids.

"By region, North America is estimated to be the second-largest market during the forecast period."

The wire and cable management market in North America is forecast to be the second biggest market because of the vast investments in infrastructure development and maintenance, wind and solar energy projects, and increasing telecommunication networks, such as the 5G implementation. Innovation in the region, especially clean energy and sustainable initiatives, combined with the need to update aging infrastructure, generates demand for high-quality, long-lasting cable solutions. Moreover, rising residential and commercial construction activities, as well as the mounting electric cars, are also beneficial to the market. The significant market share of major players and technology also promotes North America's positioning as a major global market.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 30%, Tier 2- 55%, and Tier 3 - 15%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

By Region: North America - 20%, Europe - 8%, Asia Pacific - 55%, Middle East & Africa - 13%, and South America - 4%

Notes: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Other designations include sales managers, engineers, and regional managers.

ABB (Switzerland), Legrand (France), Atkore (US), Eaton ( Ireland), and nVent (US) are some of the major players in the wire and cable management market. The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the global wire and cable management market by product, cable type, material, installation, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the wire and cable management market.

Key Benefits of Buying the Report

- It provides an analysis of key drivers (Strategic investments in power grid modernization are likely to propel the wire and cable management market; Accelerating infrastructure growth fueling demand for advanced wire and cable management solutions; Housing construction and renovation are major drivers of wiring and cable demand), restraints (Raw material price volatility; Strengthening compliance and certification to drive quality and innovation in the wire and cable management market), opportunities (Europe's investment in digital & submarine cable security; Clean cable and cybersecurity initiative), challenges (Counterfeit products and quality assurance are causing hindrance in the market) influencing the growth of the wire and cable management market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the wire and cable management market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the wire and cable management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), Legrand (France), Atkore (US), Eaton (Ireland), nVent (US), Panduit Corp (US), Belden Inc. (US), Schneider Electric (France), Hebbell (US), Hilti (Liechtenstein) and TE Connectivity (Ireland); among others in the wire and cable management market.

- Product Innovation/Development: The market is investigating large product introduction rates, especially with the incorporation of IoT-based systems and predictive maintenance functionality, including LS Cable & System's i-Check platform to monitor applications remotely to prevent fires and outages. With use cases increasing in areas like renewable energy, data centers, and telecommunications as observed in the 5G, smart grids, 3D-printed custom components, and sustainable materials such as biodegradable ties, recycled plastics, the nature of modular solutions is evolving with the likes of AWM with its Helios Beam Rod and Photon Kit to make installation simple and efficient, and Panduit with its Wire Basket Cable Tray Routing System that provides versatile fiber and power cabling baskets.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.4.1 YEARS CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-wise analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIRE AND CABLE MANAGEMENT MARKET

- 4.2 WIRE AND CABLE MANAGEMENT MARKET, BY REGION

- 4.3 WIRE AND CABLE MANAGEMENT MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- 4.4 WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT

- 4.5 WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE

- 4.6 WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL

- 4.7 WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION

- 4.8 WIRE AND CABLE MANAGEMENT MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging investments in clean energy

- 5.2.1.2 Emphasis on infrastructure modernization

- 5.2.1.3 Housing construction and renovations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Susceptibility of raw materials to fluctuations

- 5.2.2.2 Extensive documentation, training, and quality control measures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Substantial investments in submarine cable infrastructure

- 5.2.3.2 Growing emphasis on clean cable and cybersecurity initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to counterfeit products and quality assurance

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF WIRE AND CABLE MANAGEMENT, BY PRODUCT, 2021-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF WIRE AND CABLE MANAGEMENT, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Polyphenylene ether in cable accessories

- 5.7.1.2 Self-adhesive and flexible mounting clips

- 5.7.2 COMPLIMENTARY TECHNOLOGIES

- 5.7.2.1 Slip-on and cold-shrink

- 5.7.2.2 AI-driven cable management

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Hollow-core fiber optic cable

- 5.7.3.2 Science monitoring and reliable telecommunications (SMART) cables

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA (HS CODE 8547)

- 5.9.2 EXPORT DATA (HS CODE 8547)

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFF ANALYSIS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 BARGAINING POWER OF BUYERS

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 AFFORDABLE WIRE MANAGEMENT OPTIMIZES CABLE ROUTING AND REDUCES COSTS FOR MIDWEST SOLAR FARMS

- 5.15.2 ONESTOP CONTROLS AND PANDUIT SIMPLIFY CABLE MANAGEMENT AND ENHANCE ENCLOSURE PROTECTION FOR TEMPERATURE CONTROLLERS

- 5.15.3 EGAN COMPANY AND HELLERMANNTYTON CUT LABOR COSTS AND IMPROVE CABLE MANAGEMENT WITH RATCHET P-CLAMPS

- 5.16 IMPACT OF GEN AI/AI ON WIRE AND CABLE MANAGEMENT MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN WIRE AND CABLE MANAGEMENT MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON WIRE AND CABLE MANAGEMENT MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK FOR WIRE AND CABLE MANAGEMENT MARKET

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.4.4 South America

- 5.18.4.5 Middle East & Africa

- 5.18.5 IMPACT ON END USERS

6 WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 CONDUITS & TRUNKING

- 6.2.1 EMPHASIS ON MODERNIZING EXISTING WIRING INFRASTRUCTURE TO DRIVE MARKET

- 6.3 CABLE TRAYS & LADDERS

- 6.3.1 NEED TO COMPLY WITH SAFETY STANDARDS TO BOOST DEMAND

- 6.4 CABLE RACEWAYS

- 6.4.1 EASE OF INSTALLATION TO SUPPORT MARKET GROWTH

- 6.5 GLANDS & CONNECTORS

- 6.5.1 GROWING TECHNICAL COMPLEXITIES OF ELECTRONIC SYSTEMS TO DRIVE MARKET

- 6.6 BOXES & COVERS

- 6.6.1 REGULATORY EMPHASIS ON ACCIDENT PREVENTION AND WORKSPACE TIDINESS TO DRIVE MARKET

- 6.7 WIRING DUCTS

- 6.7.1 ORGANIZED CABLE ROUTING TO SUPPORT COMPLEX CONTROL SYSTEMS AND PANELS TO PROPEL MARKET GROWTH

- 6.8 TIES, FASTENERS, & CLIPS

- 6.8.1 EXPANDING TELECOMMUNICATION NETWORKS AND DIGITALIZATION ACROSS INDUSTRIES TO FUEL SEGMENTAL GROWTH

- 6.9 OTHER PRODUCTS

7 WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE

- 7.1 INTRODUCTION

- 7.2 POWER CABLES

- 7.2.1 RAPID URBANIZATION AND INFRASTRUCTURE MODERNIZATION TO DRIVE MARKET

- 7.3 COMMUNICATION WIRES & CABLES

- 7.3.1 EVOLVING DIGITAL ECOSYSTEM TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

8 WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 METALLIC

- 8.2.1 ONGOING ADVANCEMENTS IN ALLOY TECHNOLOGY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.3 NON-METALLIC

- 8.3.1 GROWING EMPHASIS ON SUSTAINABILITY AND RECYCLABLE MATERIALS TO DRIVE MARKET

9 WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION

- 9.1 INTRODUCTION

- 9.2 OVERHEAD

- 9.2.1 DEPLOYMENT IN REGIONS PRONE TO NATURAL DISASTERS TO FUEL SEGMENTAL GROWTH

- 9.3 UNDERGROUND

- 9.3.1 ABILITY TO WITHSTAND HARSH WEATHER CONDITIONS TO DRIVE MARKET

- 9.4 SUBMARINE

- 9.4.1 EXPANDING OFFSHORE ENERGY INFRASTRUCTURE TO FUEL MARKET GROWTH

10 WIRE AND CABLE MANAGEMENT MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 GROWING APPLICATION OF IOT DEVICES AND HOME AUTOMATION SYSTEMS TO FUEL MARKET GROWTH

- 10.3 COMMERCIAL

- 10.3.1 OFFICES

- 10.3.1.1 Increasing adoption of hybrid work models and smart office technologies to foster market growth

- 10.3.2 RETAIL STORES AND MALLS

- 10.3.2.1 Rising popularity of interactive kiosks and LED lighting to support market growth

- 10.3.3 OTHER COMMERCIAL END USERS

- 10.3.1 OFFICES

- 10.4 INDUSTRIAL

- 10.4.1 IT & TELECOMMUNICATIONS

- 10.4.1.1 Adoption of Industry 4.0 and smart manufacturing technologies to drive market

- 10.4.2 ENERGY & UTILITIES

- 10.4.2.1 Global shift toward renewable energy and grid modernization to boost demand

- 10.4.3 MANUFACTURING

- 10.4.3.1 Rise of automated production lines and robotic systems to fuel market growth

- 10.4.4 OIL & GAS

- 10.4.4.1 Global need to maintain energy production and enhance operational safety to drive market

- 10.4.5 METALS & MINING

- 10.4.5.1 Increasing demand for metals critical to renewable energy and electrification to support market growth

- 10.4.6 WAREHOUSING & LOGISTICS

- 10.4.6.1 Expanding e-commerce and automation in logistics to boost demand

- 10.4.7 OTHER INDUSTRIAL END USERS

- 10.4.1 IT & TELECOMMUNICATIONS

11 WIRE AND CABLE MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Growing investments in power grids to boost demand

- 11.2.2 INDIA

- 11.2.2.1 Expanding digital economy and telecom services to fuel market growth

- 11.2.3 JAPAN

- 11.2.3.1 Increasing focus on bridging urban-rural digital gap to support market growth

- 11.2.4 AUSTRALIA

- 11.2.4.1 Rise in natural gas production to drive market

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Growing shift toward Industry 4.0 and smart factories to offer lucrative growth opportunities

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Rising investments in energy infrastructure, renewable projects, and grid modernization to boost demand

- 11.3.2 CANADA

- 11.3.2.1 Rapid modernization of electricity grids and expansion of renewable energy capacity to drive market

- 11.3.3 MEXICO

- 11.3.3.1 Robust investments in grid modernization and renewable energy capacity to boost demand

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Rising emphasis on Industry 4.0 to fuel market growth

- 11.4.2 UK

- 11.4.2.1 Growing investments in electricity infrastructure to drive market

- 11.4.3 ITALY

- 11.4.3.1 Expansion of grid infrastructure to fuel market growth

- 11.4.4 FRANCE

- 11.4.4.1 Government-led initiatives to boost EV charging infrastructure to support market growth

- 11.4.5 SPAIN

- 11.4.5.1 Increasing demand for structured cable trays, conduits, and junction boxes to foster market growth

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Expanding smart city and giga-projects to offer lucrative growth opportunities

- 11.5.1.2 UAE

- 11.5.1.2.1 Rising demand for modular routing systems and robust containment in high-density IT environments to fuel market growth

- 11.5.1.3 REST OF GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Expanding power network to drive market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Rising focus on strengthening data centers to support market growth

- 11.6.2 ARGENTINA

- 11.6.2.1 Increasing emphasis on enhancing fiber backbone infrastructure to fuel market growth

- 11.6.3 COLOMBIA

- 11.6.3.1 Growing data center investments and enhanced fiber connectivity to support market growth

- 11.6.4 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Material footprint

- 12.7.5.5 Cable type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABB

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 LEGRAND

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 ATKORE

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 EATON

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 NVENT

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 PANDUIT CORP.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansions

- 13.1.7 BELDEN INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 SCHNEIDER ELECTRIC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 HUBBELL

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 HILTI

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 TE CONNECTIVITY

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Deals

- 13.1.12 SALZER

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 3M

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 ILLINOIS TOOL WORKS INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 NOVOFLEX

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.1 ABB

- 13.2 OTHER PLAYERS

- 13.2.1 OBO BETTERMANN HOLDING GMBH & CO.KG

- 13.2.2 FISCHER GROUP

- 13.2.3 HELLERMANNTYTON

- 13.2.4 NIEDAX GROUP

- 13.2.5 CELO

- 13.2.6 LAPP GROUP

- 13.2.7 HELUKABEL

- 13.2.8 MOLEX

- 13.2.9 ICOTEK GMBH & CO. KG

- 13.2.10 PACER GROUP

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 AVAILABLE CUSTOMIZATIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS, BY PRODUCT

- TABLE 2 INCLUSIONS AND EXCLUSIONS, BY CABLE TYPE

- TABLE 3 INCLUSIONS AND EXCLUSIONS, BY MATERIAL

- TABLE 4 INCLUSIONS AND EXCLUSIONS, BY INSTALLATION

- TABLE 5 INCLUSIONS AND EXCLUSIONS, BY END USER

- TABLE 6 WIRE AND CABLE MANAGEMENT MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 7 WIRE AND CABLE MANAGEMENT MARKET: RISK ANALYSIS

- TABLE 8 WIRE AND CABLE MANAGEMENT MARKET SNAPSHOT

- TABLE 9 ESTIMATED CUMULATIVE INVESTMENT NEEDS BY INFRASTRUCTURE SEGMENT

- TABLE 10 US CONSTRUCTION EXPENDITURE DATA, 2024-2025

- TABLE 11 AVERAGE SELLING PRICE TREND OF WIRE AND CABLE MANAGEMENT, BY PRODUCT, 2021-2024, (USD/UNIT)

- TABLE 12 AVERAGE SELLING PRICE TREND OF WIRE AND CABLE MANAGEMENT, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 13 ROLE OF COMPANIES IN WIRE AND CABLE MANAGEMENT ECOSYSTEM

- TABLE 14 LIST OF MAJOR PATENTS PERTAINING TO WIRE AND CABLE MANAGEMENT MARKET, 2020-2025

- TABLE 15 IMPORT DATA FOR HS CODE 8547- (INSULATING FITTINGS FOR ELECTRICAL MACHINES), 2022-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR HS CODE 8547- (INSULATING FITTINGS FOR ELECTRICAL MACHINES), 2022-2024 (USD THOUSAND)

- TABLE 17 IMPORT TARIFF FOR HS CODE 8547- (INSULATING FITTINGS FOR ELECTRICAL MACHINES), 2024

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 WIRE & CABLE MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 24 WIRE AND CABLE MANAGEMENT MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 25 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIAL END USERS (%)

- TABLE 26 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIAL END USERS

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 28 ANTICIPATED CHANGES IN PRICES AND POTENTIAL IMPACT ON END USERS DUE TO TARIFF

- TABLE 29 WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 30 WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 31 POWER CABLES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 POWER CABLES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 COMMUNICATION WIRES & CABLES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 COMMUNICATION WIRES & CABLES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 36 WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 37 WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 38 WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 39 WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 40 WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 41 RESIDENTIAL: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 RESIDENTIAL: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 COMMERCIAL: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 COMMERCIAL: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 OFFICES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 OFFICES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 RETAIL STORES AND MALLS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 RETAIL STORES AND MALLS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OTHER COMMERCIAL END USERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 OTHER COMMERCIAL END USERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 INDUSTRIAL: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 INDUSTRIAL: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 IT & TELECOMMUNICATIONS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 IT & TELECOMMUNICATIONS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 ENERGY & UTILITIES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ENERGY & UTILITIES: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MANUFACTURING: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 MANUFACTURING: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 OIL & GAS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 OIL & GAS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 METALS & MINING: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 METALS & MINING: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 WAREHOUSING & LOGISTICS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 WAREHOUSING & LOGISTICS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER INDUSTRIAL END USERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 OTHER INDUSTRIAL END USERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 68 WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 69 OVERHEAD: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 OVERHEAD: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 UNDERGROUND: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 UNDERGROUND: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 SUBMARINE: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 SUBMARINE: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 WIRE AND CABLE MANAGEMENT MARKET, BY MATERICAL TYPE, 2021-2024 (USD MILLION)

- TABLE 76 WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 77 METALLIC: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 METALLIC: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 NON-METALLIC: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 NON-METALLIC: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 82 WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 83 WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 84 WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 85 CONDUITS & TRUNKING: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 CONDUITS & TRUNKING: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 CONDUITS & TRUNKING: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 88 CONDUITS & TRUNKING: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 89 CABLE TRAYS & LADDERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 CABLE TRAYS & LADDERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 CABLE TRAYS & LADDERS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 92 CABLE TRAYS & LADDERS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 93 CABLE RACEWAYS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 CABLE RACEWAYS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 CABLE RACEWAYS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 96 CABLE RACEWAYS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 97 GLANDS & CONNECTORS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 GLANDS & CONNECTORS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 GLANDS & CONNECTORS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 100 GLANDS & CONNECTORS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 101 BOXES & COVERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 BOXES & COVERS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 BOXES & COVERS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 104 BOXES & COVERS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 105 WIRING DUCTS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 WIRING DUCTS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 WIRING DUCTS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 108 WIRING DUCTS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 109 TIES, FASTENERS, & CLIPS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 TIES, FASTENERS, & CLIPS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 TIES, FASTENERS, & CLIPS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 112 TIES, FASTENERS, & CLIPS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 113 OTHER PRODUCTS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 OTHER PRODUCTS: WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 OTHER PRODUCTS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 116 OTHER PRODUCTS: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 117 WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 WIRE AND CABLE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 120 WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 121 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 124 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 125 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 140 CHINA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 142 CHINA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 143 CHINA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 144 CHINA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 145 INDIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 INDIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 INDIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 148 INDIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 149 INDIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 150 INDIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 151 JAPAN: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 152 JAPAN: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 154 JAPAN: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 155 JAPAN: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 156 JAPAN: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 157 AUSTRALIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 158 AUSTRALIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 159 AUSTRALIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 160 AUSTRALIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 162 AUSTRALIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH KOREA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 164 SOUTH KOREA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH KOREA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH KOREA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 168 SOUTH KOREA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 175 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 176 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 178 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 179 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 180 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 182 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 184 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 186 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 188 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 190 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 191 US: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 192 US: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 193 US: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 194 US: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 195 US: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 196 US: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 197 US: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 198 US: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 199 CANADA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 200 CANADA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 201 CANADA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 202 CANADA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 203 CANADA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 204 CANADA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 205 MEXICO: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 206 MEXICO: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 207 MEXICO: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 208 MEXICO: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 209 MEXICO: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 210 MEXICO: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 211 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 212 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 214 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 215 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 216 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 217 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2021-2024

- TABLE 218 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2025-2030

- TABLE 219 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 220 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 221 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 222 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 223 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 224 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 225 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 226 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 227 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 228 SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 229 BRAZIL: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 230 BRAZIL: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 231 BRAZIL: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 232 BRAZIL: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 233 BRAZIL: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 234 BRAZIL: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 235 ARGENTINA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 236 ARGENTINA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 237 ARGENTINA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 238 ARGENTINA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 239 ARGENTINA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 240 ARGENTINA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 241 COLOMBIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 242 COLOMBIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 243 COLOMBIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 244 COLOMBIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 245 COLOMBIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 246 COLOMBIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 247 REST OF SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 248 REST OF SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 253 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 254 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 255 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 256 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 257 EUROPE: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 258 EUROPE: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 259 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2021-2024

- TABLE 260 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2025-2030

- TABLE 261 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 262 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 263 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 264 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 265 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 266 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 267 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 268 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 269 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 270 EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 271 GERMANY: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 272 GERMANY: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 273 GERMANY: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 274 GERMANY: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 275 GERMANY: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 276 GERMANY: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 277 UK: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 278 UK: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 279 UK: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 280 UK: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 281 UK: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 282 UK: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 283 ITALY: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 284 ITALY: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 285 ITALY: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 286 ITALY: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 287 ITALY: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 288 ITALY: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 289 FRANCE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 290 FRANCE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 291 FRANCE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 292 FRANCE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 293 FRANCE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 294 FRANCE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 295 SPAIN: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 296 SPAIN: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 297 SPAIN: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 298 SPAIN: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 299 SPAIN: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 300 SPAIN: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 301 REST OF EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 302 REST OF EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 303 REST OF EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 304 REST OF EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 305 REST OF EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 306 REST OF EUROPE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 312 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET VOLUME, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 313 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 323 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 325 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 326 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 327 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 328 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 329 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 330 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 331 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 332 GCC: WIRE AND CABLE MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 333 SAUDI ARABIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 334 SAUDI ARABIA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 335 SAUDI ARABIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 336 SAUDI ARABIA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 337 SAUDI ARABIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 338 SAUDI ARABIA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 339 UAE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 340 UAE: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 341 UAE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 342 UAE: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 343 UAE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 344 UAE: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 345 REST OF GCC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 346 REST OF GCC: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 347 REST OF GCC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 348 REST OF GCC: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 349 REST OF GCC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 350 REST OF GCC: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 351 SOUTH AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 352 SOUTH AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 353 SOUTH AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 354 SOUTH AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 355 SOUTH AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 356 SOUTH AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 357 REST OF MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 358 REST OF MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 359 REST OF MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2021-2024 (USD MILLION)

- TABLE 360 REST OF MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY COMMERCIAL END USER, 2025-2030 (USD MILLION)

- TABLE 361 REST OF MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2021-2024 (USD MILLION)

- TABLE 362 REST OF MIDDLE EAST & AFRICA: WIRE AND CABLE MANAGEMENT MARKET, BY INDUSTRIAL END USER, 2025-2030 (USD MILLION)

- TABLE 363 OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, FEBRUARY 2021-MAY 2025

- TABLE 364 WIRE AND CABLE MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 365 WIRE AND CABLE MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 366 WIRE AND CABLE MANAGEMENT MARKET: PRODUCT FOOTPRINT

- TABLE 367 WIRE AND CABLE MANAGEMENT MARKET: MATERIAL FOOTPRINT

- TABLE 368 WIRE AND CABLE MANAGEMENT MARKET: CABLE TYPE FOOTPRINT

- TABLE 369 WIRE AND CABLE MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 370 WIRE AND CABLE MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 371 WIRE AND CABLE MANAGEMENT MARKET: PRODUCT LAUNCHES, FEBRUARY 2021-MAY 2025

- TABLE 372 WIRE AND CABLE MANAGEMENT MARKET: DEALS, FEBRUARY 2021-MAY 2025

- TABLE 373 WIRE AND CABLE MANAGEMENT MARKET: EXPANSIONS, FEBRUARY 2021-MAY 2025

- TABLE 374 ABB: COMPANY OVERVIEW

- TABLE 375 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 ABB: DEALS

- TABLE 377 ABB: EXPANSIONS

- TABLE 378 LEGRAND: COMPANY OVERVIEW

- TABLE 379 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 LEGRAND: PRODUCT LAUNCHES

- TABLE 381 ATKORE: COMPANY OVERVIEW

- TABLE 382 ATKORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 ATKORE: DEALS

- TABLE 384 EATON: BUSINESS OVERVIEW

- TABLE 385 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 386 EATON: PRODUCT LAUNCHES

- TABLE 387 NVENT: COMPANY OVERVIEW

- TABLE 388 NVENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 NVENT: DEALS

- TABLE 390 PANDUIT CORP.: COMPANY OVERVIEW

- TABLE 391 PANDUIT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 PANDUIT CORP.: PRODUCT LAUNCHES

- TABLE 393 PANDUIT CORP.: DEALS

- TABLE 394 PANDUIT CORP.: EXPANSIONS

- TABLE 395 BELDEN INC.: COMPANY OVERVIEW

- TABLE 396 BELDEN INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 398 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 399 HUBBELL: COMPANY OVERVIEW

- TABLE 400 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 401 HILTI: COMPANY OVERVIEW

- TABLE 402 HILTI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 403 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 404 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 405 TE CONNECTIVITY: PRODUCT LAUNCHES

- TABLE 406 TE CONNECTIVITY: DEALS

- TABLE 407 SALZER: COMPANY OVERVIEW

- TABLE 408 SALZER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 409 3M: COMPANY OVERVIEW

- TABLE 410 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 411 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 412 ILLINOIS TOOL WORKS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 413 NOVOFLEX: COMPANY OVERVIEW

- TABLE 414 NOVOFLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 WIRE AND CABLE MANAGEMENT MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 WIRE AND CABLE MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR WIRE AND CABLE MANAGEMENT

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF WIRE AND CABLE MANAGEMENT

- FIGURE 7 WIRE AND CABLE MANAGEMENT MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 CONDUITS & TRUNKING SEGMENT HELD LARGEST MARKET SHARE IN 2024

- FIGURE 11 COMMUNICATION WIRES & CABLES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 METALLIC SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 13 SUBMARINE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 INDUSTRIAL SEGMENT TO LEAD MARKET IN 2030

- FIGURE 15 INCREASING INVESTMENTS IN POWER DISTRIBUTION AND 5G INTERNET INFRASTRUCTURE TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO EXPAND AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 18 CONDUITS & TRUNKING TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 19 POWER CABLES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 20 METALLIC SEGMENT TO SECURE LARGER MARKET SHARE IN 2030

- FIGURE 21 UNDERGROUND SEGMENT TO COMMAND LARGEST MARKET SHARE IN 2030

- FIGURE 22 INDUSTRIAL SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 23 WIRE AND CABLE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 GLOBAL INVESTMENTS IN CLEAN ENERGY, 2015-2025

- FIGURE 25 ENERGY INVESTMENTS, BY REGION AND SECTOR

- FIGURE 26 CAPITAL EXPENDITURE IN INFRASTRUCTURE SECTOR OF INDIA, 2024

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF WIRE AND CABLE MANAGEMENT, BY PRODUCT, 2021-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF WIRE AND CABLE MANAGEMENT, BY REGION, 2021-2024

- FIGURE 30 WIRE AND CABLE MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 WIRE AND CABLE MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 WIRE AND CABLE MANAGEMENT MARKET: PATENTS GRANTED AND APPLIED, 2014-2024

- FIGURE 33 IMPORT DATA FOR HS CODE 8547- (INSULATING FITTINGS FOR ELECTRICAL MACHINES), 2020-2024

- FIGURE 34 EXPORT SCENARIO FOR HS CODE 8547- (INSULATING FITTINGS FOR ELECTRICAL MACHINES), 2020-2024

- FIGURE 35 WIRE AND CABLE MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIAL END USERS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIAL END USERS

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO

- FIGURE 39 IMPACT OF GEN AI/AI ON WIRE AND CABLE MANAGEMENT MARKET, BY REGION

- FIGURE 40 WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2024

- FIGURE 41 WIRE AND CABLE MANAGEMENT MARKET, BY END USER, 2024

- FIGURE 42 WIRE AND CABLE MANAGEMENT MARKET, BY INSTALLATION, 2024

- FIGURE 43 WIRE AND CABLE MANAGEMENT MARKET, BY MATERIAL, 2024

- FIGURE 44 WIRE AND CABLE MANAGEMENT MARKET, BY CABLE TYPE, 2024

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 WIRE AND CABLE MANAGEMENT MARKET, BY REGION

- FIGURE 47 ASIA PACIFIC: WIRE AND CABLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 48 NORTH AMERICA: WIRE AND CABLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 49 MARKET SHARE ANALYSIS OF COMPANIES OFFERING WIRE AND CABLE MANAGEMENTS, 2024

- FIGURE 50 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN WIRE AND CABLE MANAGEMENT MARKET, 2020-2024

- FIGURE 51 COMPANY VALUATION

- FIGURE 52 FINANCIAL METRICS

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 WIRE AND CABLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 WIRE AND CABLE MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 56 WIRE AND CABLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 ABB: COMPANY SNAPSHOT

- FIGURE 58 LEGRAND: COMPANY SNAPSHOT

- FIGURE 59 ATKORE: COMPANY SNAPSHOT

- FIGURE 60 EATON: COMPANY SNAPSHOT

- FIGURE 61 NVENT: COMPANY SNAPSHOT

- FIGURE 62 BELDEN INC.: COMPANY SNAPSHOT

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 64 HUBBELL: COMPANY SNAPSHOT

- FIGURE 65 HILTI: COMPANY SNAPSHOT

- FIGURE 66 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 67 SALZER: COMPANY SNAPSHOT

- FIGURE 68 3M: COMPANY SNAPSHOT

- FIGURE 69 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT