|

市场调查报告书

商品编码

1811728

全球眼科影像市场(按技术、产品、应用、最终用户和地区划分)- 预测至 2030 年Ophthalmic Imaging Market by Product Type, Application, End User - Global Forecast to 2030 |

||||||

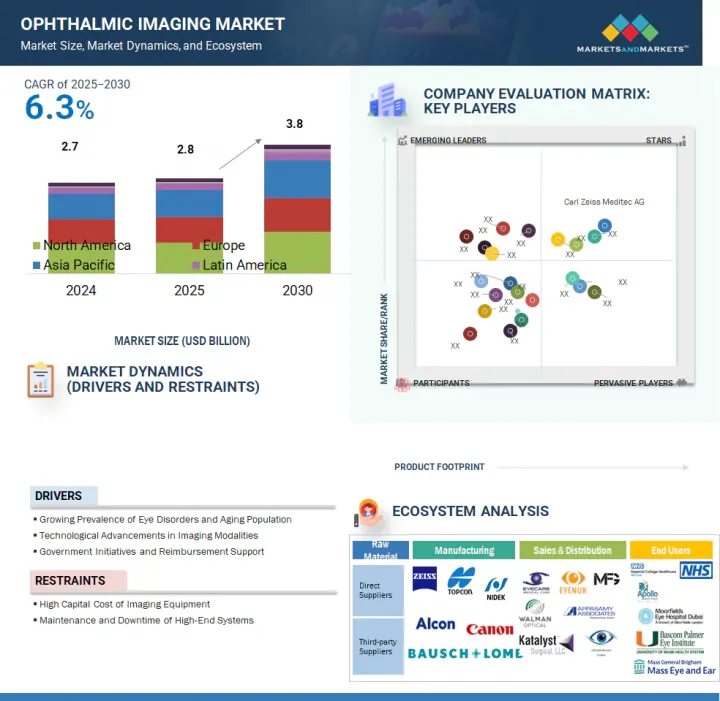

预计眼科影像市场将从 2025 年的 28.3 亿美元成长到 2030 年的 38.4 亿美元,预测期内的复合年增长率为 6.3%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按技术、产品、应用、最终用户和地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲、海湾合作委员会国家 |

随着全球人口老化,青光眼、糖尿病视网膜病变和老龄化黄斑部病变等眼科疾病的发生率不断上升,推动了眼科影像市场的发展。对早期准确诊断的需求不断增长、光学相干断层扫描 (OCT) 和眼底摄影机等成像技术的进步以及人们对预防性眼保健的认识不断提高,这些因素共同推动着市场的成长。此外,积极的政府措施和不断上涨的医疗成本也在推动市场扩张。然而,高昂的设备成本、某些地区的报销限制以及熟练专业人员的短缺限制了其应用,尤其是在低收入和农村地区。资料管理和临床工作流程整合的挑战进一步限制了一些医疗机构的效率。机会在于开发可携式、整合人工智慧的影像处理设备和扩展远端眼科服务以服务于服务不足的人群。

按产品划分,OCT 系统细分市场预计将在预测期内达到最高成长率。光同调断层扫瞄(OCT) 系统预计将在预测期内以最高的复合年增长率成长,因为它们提供非侵入性、超高解析度成像,这对于视网膜和视神经疾病的早期诊断至关重要。扫频源 OCT、OCT血管造影术和人工智慧主导分析等技术进步正在提高诊断能力和工作流程效率。紧凑型手持式 OCT 设备正在扩大其在初级保健和农村地区的普及。全球糖尿病、青光眼和老年黄斑部病变 (AMD) 盛行率的不断上升,加上医疗保健投资的增加和优惠的报销政策,进一步推动了 OCT 的普及和市场的快速扩张。

从终端用户来看,预计验光诊所细分市场将在整个预测期内实现最高成长率,这得益于消费者眼部健康意识的提升和定期视力筛检的推动。验光诊所作为基层医疗中心,提供方便且价格合理的眼科检查。随着可携式高解析度诊断设备(例如光学相干断层扫描 (OCT)、眼底摄影机和视野计)在诊所中的普及率不断提高,这一趋势也得到了进一步的推动。诊所正在增加对支援人工智慧的接近型设备的投资,以提高工作流程效率并加快诊断速度。此外,远端验光和远端筛检模式的成长支持可扩展的覆盖范围,尤其是在服务不足的地区,从而促进诊所规模的持续扩张。

预计亚太地区将在预测期内实现最高成长率,这得益于人口快速老化、青光眼、白内障和糖尿病视网膜病变等眼科疾病盛行率上升,以及中国和印度等主要国家对医疗基础设施的投资不断增加。各国政府正在透过远距眼科网路和行动诊所扩大服务覆盖范围,同时,区域技术创新和价格实惠的设备製造正在促进服务欠缺地区的普及。技术的采用,尤其是光学相干断层扫描 (OCT)、人工智慧工具和多模态平台,正在推动全部区域的成长。

本报告研究了全球眼科成像市场,并提供了技术、产品、应用、最终用户和地区的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 影响客户业务的趋势/中断

- 定价分析

- 价值链分析

- 供应链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 产业趋势

- 专利分析

- 贸易分析

- 2025-2026年主要会议和活动

- 案例研究分析

- 监管分析

- 波特五力分析

- 主要相关人员和采购标准

- 未满足的需求/最终用户期望

- 2025年美国关税对眼科影像诊断市场的影响

- 人工智慧/生成式人工智慧对眼科影像市场的影响

- 邻近市场分析

6. 眼科影像市场(按技术)

- 介绍

- 支援人工智慧的设备

- 非AI相容设备

第七章眼科影像市场(按产品)

- 介绍

- 光学同调断层扫描系统

- 眼科超音波系统

- 眼底摄影机

- 裂隙灯

- 镜面显微镜

- 眼压计

- 眼底镜

- 视网膜镜

- 其他的

第八章眼科影像市场(按应用)

- 介绍

- 青光眼

- 白内障

- 视网膜病变

- 屈光不正

- 老龄化黄斑部病变

- 其他的

9. 眼科影像市场(按最终用户)

- 介绍

- 医院

- 眼科诊所

- 视光诊所

- 其他的

第十章眼科影像市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 日本

- 中国

- 印度

- 韩国

- 澳洲

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 海湾合作委员会国家

第十一章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2020-2024年收益分析

- 2024年市场占有率分析

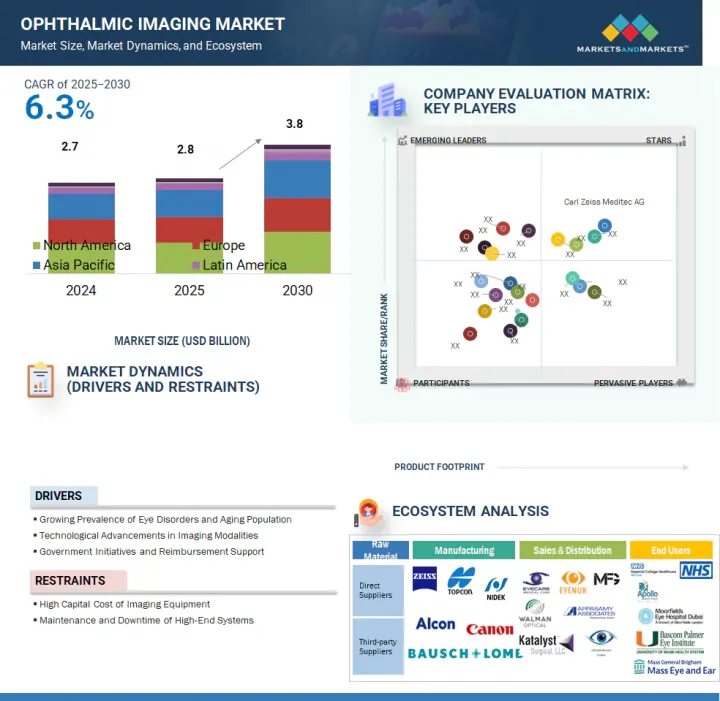

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 品牌/产品比较

- 竞争场景

第十二章:公司简介

- 主要参与企业

- CARL ZEISS MEDITEC AG

- TOPCON CORPORATION

- NIDEK CO., LTD.

- HALMA PLC

- ALCON

- HEIDELBERG ENGINEERING GMBH

- HAAG-STREIT GROUP

- CANON MEDICAL SYSTEMS CORPORATION

- ESSILORLUXOTTICA

- OCULUS

- VISIONIX

- SONOMED ESCALON

- COBURN TECHNOLOGIES, INC.

- DGH TECHNOLOGY, INC.

- SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.

- 其他公司

- VISUNEX MEDICAL SYSTEMS

- FORUS HEALTH PVT. LTD.

- ZIEMER OPHTHALMIC SYSTEMS AG

- EYENUK INC.

- COSTRUZIONE STRUMENTI OFTALMICI(CSO)

- HAI LABORATORIES, INC.

- CRYSTALVUE MEDICAL CORPORATION

- SUZHOU KANGJIE MEDICAL INC.

- KONAN MEDICAL USA, INC.

- REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.

第十三章 附录

The ophthalmic imaging market is projected to reach USD 3.84 billion by 2030 from USD 2.83 billion in 2025, at a CAGR of 6.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

The ophthalmic imaging market is driven by the growing prevalence of eye diseases such as glaucoma, diabetic retinopathy, and age-related macular degeneration, particularly among the aging global population. Increasing demand for early and accurate diagnosis, advancements in imaging technologies like OCT and fundus cameras, and rising awareness of preventive eye care are boosting market growth. Additionally, favorable government initiatives and rising healthcare expenditure support market expansion. However, high equipment costs, limited reimbursement in certain regions, and a shortage of skilled professionals restrain widespread adoption, especially in low-income and rural settings. Data management and integration challenges in clinical workflows further limit efficiency in some healthcare facilities. Opportunities lie in the development of portable, AI-integrated imaging devices and the expansion of teleophthalmology services to reach underserved populations.

Based on product, the OCT systems segment is expected to have the highest growth rate during the forecast year. Optical coherence tomography (OCT) systems are expected to grow at the highest CAGR during the forecast period because they offer non-invasive, ultra-high-resolution imaging essential for early diagnosis of retinal and optic nerve diseases. Technological advances-such as swept-source OCT, OCT-angiography, and AI-driven analytics-enhance diagnostic capability and workflow efficiency. Compact, handheld OCT devices are expanding access in primary care and rural settings. The growing global prevalence of diabetes, glaucoma, and AMD, combined with rising healthcare investments and favorable reimbursements, further drives OCT adoption and rapid market expansion.

Based on end user, the optometry clinics segment is expected to have the highest growth rate during the forecast year due to increasing consumer awareness of eye health and routine vision screenings. They serve as primary care hubs, offering accessible and affordable eye examinations. The rising adoption of portable, high-resolution diagnostic devices such as OCT, fundus cameras, and visual field analyzers in clinics further accelerates this trend. Clinics are increasingly investing in AI-enabled, compact equipment to enhance workflow efficiency and deliver rapid diagnostics. Additionally, growth in tele-optometry and remote screening models supports scalable reach, particularly in underserved regions, driving sustained clinic-based expansion.

Asia Pacific is expected to have the highest growth rate during the forecast period due to a rapidly aging population, rising prevalence of eye disorders like glaucoma, cataracts, and diabetic retinopathy, and increasing investment in healthcare infrastructure across key countries like China and India. Governments are expanding access via teleophthalmology networks and mobile clinics, while local innovation and affordable device production enhance adoption in underserved areas. Technological adoption, particularly OCT, AI tools, and multimodal platforms, is accelerating region-wide growth.

A breakdown of the primary participants (supply-side) for the ophthalmic imaging market referred to in this report is provided below:

- By Company Type: Tier 1:34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C-level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Prominent players in the ophthalmic imaging market are Carl Zeiss Meditec AG (Germany), Topcon Corporation (Japan), Nidek Co. Ltd. (Japan), Alcon Inc. (Switzerland), Optopol Technology Sp. z o.o (Poland), Essilor International S.A. (France), Bausch & Lomb Incorporated (US), and Halma Plc (UK), among others.

Research Coverage

The report evaluates the ophthalmic imaging market and estimates its size and future growth potential based on various segments, including products, applications, end users, and regions. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leader/new entrants in the market with data on the nearest approximations of the revenue numbers for the overall ophthalmic imaging market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gain further insights into better placing their businesses and making appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (Rising number of preterm and low-weight births, Public-private initiatives to strengthen patient care, Increasing incidence of HAIs among newborns, Changing clinical risks for congenital and obstetric complications, Rising number of neonatal care facilities worldwide), restraints (Premium pricing of advanced neonatal care equipment, Growing preference for refurbished devices across emerging countries), opportunities (Development of integrated and multifunctional neonatal care equipment, Market opportunities in emerging markets) and challenges (Limited access in low-income regions, Regulatory and compliance complexities)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global ophthalmic imaging market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, application, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global ophthalmic imaging market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global ophthalmic imaging market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 OPHTHALMIC IMAGING MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key sources of primary data

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.2.1.1 Company presentations and primary interviews

- 2.2.1.2 Demand-side analysis

- 2.2.1.3 Top-down approach

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPHTHALMIC IMAGING MARKET OVERVIEW

- 4.2 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY AND COUNTRY (2024)

- 4.3 OPHTHALMIC IMAGING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 OPHTHALMIC IMAGING MARKET, REGIONAL MIX, 2023-2030

- 4.5 OPHTHALMIC IMAGING MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing prevalence of chronic eye diseases among geriatric patients

- 5.2.1.2 Technological advancements in imaging modalities

- 5.2.1.3 Favorable government initiatives and better reimbursement support

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital cost of ophthalmic imaging equipment

- 5.2.2.2 High maintenance costs and increased downtime of high-end systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in emerging economies

- 5.2.3.2 Focus on AI-enabled screening and workflow optimization

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled ophthalmic technicians and clinicians

- 5.2.4.2 Data privacy and AI regulation challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF OPHTHALMIC IMAGING PRODUCTS, BY TYPE, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF OPTICAL COHERENCE TOMOGRAPHY SYSTEMS, BY REGION, 2022-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 ROLE IN ECOSYSTEM

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Fluorescein angiography

- 5.9.1.2 Ultrasound B-scan imaging

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Artificial intelligence and deep learning

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Smartphone-based retinal imaging

- 5.9.3.2 Gene therapy & retinal implants

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 RAPID SHIFT TOWARD MULTIMODAL AND AI-INTEGRATED IMAGING SYSTEMS

- 5.10.2 INCREASED PENETRATION OF PORTABLE AND HANDHELD IMAGING SOLUTIONS

- 5.10.3 PREMIUM IMAGING GROWTH TO GET HIGH CAPITAL INVESTMENTS IN HOSPITALS AND TERTIARY CARE CENTERS

- 5.10.4 OEM CONSOLIDATION AND SOFTWARE-DRIVEN ECOSYSTEMS TO RESHAPE COMPETITIVE LANDSCAPE

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 901850, 2020-2024

- 5.12.2 EXPORT DATA FOR HS CODE 901850, 2020-2024

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 ZEISS TO ENHANCE CIRRUS HD-OCT PLATFORM BY INTEGRATING AI-BASED TOOLS FOR DETECTING GLAUCOMA AND RETINAL DISEASES

- 5.14.2 INDIA'S NATIONAL PROGRAM FOR CONTROL OF BLINDNESS (NPCB) TO COLLABORATE WITH FORUS HEALTH FOR REDUCING AVOIDABLE BLINDNESS

- 5.14.3 UK NATIONAL HEALTH SERVICE TO DEPLOY HEIDELBERG ENGINEERING'S SPECTRALIS OCT PLATFORM FOR IMPROVING EARLY DETECTION OF CHRONIC DISEASES

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY FRAMEWORK

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.2.1 Germany

- 5.15.2.2.2 France

- 5.15.2.2.3 UK

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 China

- 5.15.2.3.2 Japan

- 5.15.2.3.3 India

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East & Africa

- 5.15.2.5.1 Saudi Arabia

- 5.15.2.5.2 UAE

- 5.15.2.5.3 South Africa

- 5.15.2.5.4 Nigeria

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 KEY BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 IMPACT OF 2025 US TARIFF ON OPHTHALMIC IMAGING MARKET

- 5.19.1 KEY TARIFF RATES

- 5.19.2 PRICE IMPACT ANALYSIS

- 5.19.3 KEY IMPACT ON COUNTRY/REGION

- 5.19.3.1 North America

- 5.19.3.1.1 US

- 5.19.3.2 Europe

- 5.19.3.3 Asia Pacific

- 5.19.3.1 North America

- 5.19.4 IMPACT ON END-USE INDUSTRIES

- 5.20 IMPACT OF AI/ GEN AI ON OPHTHALMIC IMAGING MARKET

- 5.21 ADJACENT MARKET ANALYSIS

6 OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 AI-ENABLED EQUIPMENT

- 6.2.1 RISING DEMAND FOR EARLY DIAGNOSIS, EFFICIENCY, AND STANDARDIZATION TO DRIVE MARKET

- 6.3 NON-AI-ENABLED EQUIPMENT

- 6.3.1 ESTABLISHED CLINICAL UTILITY AND COST-EFFECTIVENESS TO SUSTAIN DOMINANCE

7 OPHTHALMIC IMAGING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 OPTICAL COHERENCE TOMOGRAPHY SYSTEMS

- 7.2.1 SPECTRAL-DOMAIN OCT (SD-OCT)

- 7.2.1.1 Growing demand for high-resolution retinal imaging to accelerate market adoption

- 7.2.2 SWEPT-SOURCE OCT (SS-OCT)

- 7.2.2.1 Rising preference for deep tissue imaging and faster scanning to fuel market growth

- 7.2.3 HANDHELD OCT

- 7.2.3.1 Surging demand for portability and pediatric imaging to propel market growth

- 7.2.1 SPECTRAL-DOMAIN OCT (SD-OCT)

- 7.3 OPHTHALMIC ULTRASOUND SYSTEMS

- 7.3.1 OPHTHALMIC A-SCAN ULTRASOUND SYSTEMS

- 7.3.1.1 Rising prevalence of cataracts and increasing intraocular lens (IOL) implantation procedures to aid market growth

- 7.3.2 OPHTHALMIC B-SCAN ULTRASOUND SYSTEMS

- 7.3.2.1 Rising incidence of retinal disorders and opaque media cases to augment segment growth

- 7.3.3 OPHTHALMIC ULTRASOUND BIOMICROSCOPES

- 7.3.3.1 Demand for high-resolution anterior segment imaging to fuel market growth

- 7.3.4 OPHTHALMIC PACHYMETERS

- 7.3.4.1 Growing incidence of glaucoma and increasing demand for refractive surgery to support segment growth

- 7.3.5 OTHER OPHTHALMIC ULTRASOUND SYSTEMS

- 7.3.1 OPHTHALMIC A-SCAN ULTRASOUND SYSTEMS

- 7.4 FUNDUS CAMERAS

- 7.4.1 MYDRIATIC FUNDUS CAMERAS

- 7.4.1.1 Advancements in retinal disease diagnosis and imaging precision to boost market growth

- 7.4.2 NON-MYDRIATIC FUNDUS CAMERAS

- 7.4.2.1 Rising diabetic retinopathy screening and growing focus on primary eye care to augment market growth

- 7.4.3 HYBRID FUNDUS CAMERAS

- 7.4.3.1 Demand for versatile retinal imaging and workflow efficiency to fuel market adoption

- 7.4.4 ROP FUNDUS CAMERAS

- 7.4.4.1 Urgent need for early detection of retinal disorders in newborns to propel segment growth

- 7.4.1 MYDRIATIC FUNDUS CAMERAS

- 7.5 SLIT LAMPS

- 7.5.1 HANDHELD SLIT LAMPS

- 7.5.1.1 Portability, tele-ophthalmology, and field screening to fuel market demand

- 7.5.2 TABLE MOUNT SLIT LAMPS

- 7.5.2.1 Focus on precision diagnostics and need for better image clarity to augment market growth

- 7.5.1 HANDHELD SLIT LAMPS

- 7.6 SPECULAR MICROSCOPES

- 7.6.1 RISING NUMBER OF CORNEAL TRANSPLANTS AND CATARACT SURGERIES TO ACCELERATE MARKET DEMAND

- 7.7 TONOMETERS

- 7.7.1 APPLANATION TONOMETERS

- 7.7.1.1 Widespread clinical acceptance and diagnostic accuracy to aid market growth

- 7.7.2 REBOUND TONOMETERS

- 7.7.2.1 Adoption of rebound tonometers to gain preference for better portability and greater patient comfort

- 7.7.1 APPLANATION TONOMETERS

- 7.8 OPHTHALMOSCOPES

- 7.8.1 DIRECT OPHTHALMOSCOPES

- 7.8.1.1 Technological upgrades to sustain global demand for direct ophthalmoscopes

- 7.8.2 INDIRECT OPHTHALMOSCOPES

- 7.8.2.1 Growing demand in retinal care to increase product demand

- 7.8.1 DIRECT OPHTHALMOSCOPES

- 7.9 RETINOSCOPES

- 7.9.1 RISING DEMAND AMONG PEDIATRIC, NON-VERBAL, AND UNCOOPERATIVE PATIENTS TO SUSTAIN DEMAND

- 7.10 OTHER OPHTHALMIC IMAGING PRODUCTS

8 OPHTHALMIC IMAGING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 GLAUCOMA

- 8.2.1 NEED FOR EARLY DETECTION AND LONG-TERM MONITORING TO FUEL ADOPTION OF ADVANCED IMAGING MODALITIES

- 8.3 CATARACTS

- 8.3.1 INCREASING CATARACT SURGERIES AND PREOPERATIVE IMAGING TO SPUR DEMAND FOR DIAGNOSTIC OPHTHALMIC SYSTEMS

- 8.4 RETINOPATHIES

- 8.4.1 RISING DIABETIC AND HYPERTENSIVE POPULATION TO ACCELERATE DEMAND FOR ADVANCED RETINAL IMAGING SOLUTIONS

- 8.5 REFRACTIVE DISORDERS

- 8.5.1 RISING DEMAND FOR REFRACTIVE SURGERIES TO BOOST UPTAKE OF ADVANCED IMAGING SYSTEMS FOR PREOPERATIVE PLANNING

- 8.6 AGE-RELATED MACULAR DEGENERATION

- 8.6.1 AGING DEMOGRAPHICS AND INCREASED LIFESPAN TO PROPEL PREVALENCE OF AGE-RELATED MACULAR DEGENERATION

- 8.7 OTHER APPLICATIONS

9 OPHTHALMIC IMAGING MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 RISING ADOPTION OF ADVANCED OPHTHALMIC DIAGNOSTICS TO AUGMENT MARKET GROWTH

- 9.3 OPHTHALMOLOGY CLINICS

- 9.3.1 USE OF HIGH-THROUGHPUT, AI-INTEGRATED, AND PORTABLE IMAGING DEVICES TO FUEL MARKET GROWTH

- 9.4 OPTOMETRY CLINICS

- 9.4.1 INCREASING PREVALENCE OF MYOPIA AND LIFESTYLE-RELATED VISION DISORDERS TO AID MARKET GROWTH

- 9.5 OTHER END USERS

10 OPHTHALMIC IMAGING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate North American ophthalmic imaging market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Rising geriatric population with chronic eye diseases to propel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Strong clinical infrastructure and favorable healthcare policies to boost market growth

- 10.3.3 FRANCE

- 10.3.3.1 Government-funded eye screening programs and widespread insurance coverage to accelerate market growth

- 10.3.4 UK

- 10.3.4.1 Popularity on national screening programs and focus on NHS-backed digital adoption to stabilize market growth

- 10.3.5 ITALY

- 10.3.5.1 High geriatric population and expansion of regional eye care programs to boost demand for ophthalmic imaging

- 10.3.6 SPAIN

- 10.3.6.1 Increased public investment in health screening programs to aid market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Strong focus on preventive and advanced eye care infrastructure to augment market growth

- 10.4.3 CHINA

- 10.4.3.1 Popularity of large-scale eye screening programs and focus on advanced ophthalmic imaging infrastructure to drive market

- 10.4.4 INDIA

- 10.4.4.1 Rising diabetic population and increasing popularity of nationwide eye health programs to propel market growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 High-tech healthcare adoption and aging demographics to accelerate smart ophthalmic imaging integration

- 10.4.6 AUSTRALIA

- 10.4.6.1 Government-backed eye care programs and expanding teleophthalmology to propel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Focus on public tele-ophthalmology initiatives and diagnostics to boost market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing prevalence of diabetic eye disease and growing focus on digital health expansion to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASED HEALTHCARE MODERNIZATION AND FOCUS ON PUBLIC HEALTH INVESTMENTS TO AID MARKET GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.7 GCC COUNTRIES

- 10.7.1 GOVERNMENT-LED HEALTHCARE DIGITALIZATION AND INCREASED DIABETES-LINKED VISION DISORDERS TO DRIVE MARKET

- 10.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN OPHTHALMIC IMAGING MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End-user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of startups/SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 CARL ZEISS MEDITEC AG

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & upgrades

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 TOPCON CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 NIDEK CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 HALMA PLC

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses & competitive threats

- 12.1.5 ALCON

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses & competitive threats

- 12.1.6 HEIDELBERG ENGINEERING GMBH

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 HAAG-STREIT GROUP

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 CANON MEDICAL SYSTEMS CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 ESSILORLUXOTTICA

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 OCULUS

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.11 VISIONIX

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 SONOMED ESCALON

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 COBURN TECHNOLOGIES, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.14 DGH TECHNOLOGY, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 CARL ZEISS MEDITEC AG

- 12.2 OTHER PLAYERS

- 12.2.1 VISUNEX MEDICAL SYSTEMS

- 12.2.2 FORUS HEALTH PVT. LTD.

- 12.2.3 ZIEMER OPHTHALMIC SYSTEMS AG

- 12.2.4 EYENUK INC.

- 12.2.5 COSTRUZIONE STRUMENTI OFTALMICI (CSO)

- 12.2.6 HAI LABORATORIES, INC.

- 12.2.7 CRYSTALVUE MEDICAL CORPORATION

- 12.2.8 SUZHOU KANGJIE MEDICAL INC.

- 12.2.9 KONAN MEDICAL USA, INC.

- 12.2.10 REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 OPHTHALMIC IMAGING MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES FROM USD, 2020-2024

- TABLE 3 OPHTHALMIC IMAGING MARKET: STUDY ASSUMPTIONS

- TABLE 4 OPHTHALMIC IMAGING MARKET: RISK ANALYSIS

- TABLE 5 OPHTHALMIC IMAGING MARKET: IMPACT OF ANALYSIS OF MARKET DYNAMICS

- TABLE 6 AVERAGE SELLING PRICE OF OPHTHALMIC IMAGING PRODUCTS, BY TYPE, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF OPTICAL COHERENCE TOMOGRAPHY SYSTEMS, BY REGION, 2022-2024 (USD)

- TABLE 8 OPHTHALMIC IMAGING MARKET: ROLE IN ECOSYSTEM

- TABLE 9 IMPORT DATA FOR HS CODE 901850, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 OPHTHALMIC IMAGING MARKET: LIST OF KEY CONFERENCES & EVENTS, JANAURY 2025-DECEMBER 2026

- TABLE 12 CASE STUDY 1: ZEISS TO ENHANCE CIRRUS HD-OCT PLATFORM BY INTEGRATING AI-BASED TOOLS FOR DETECTING GLAUCOMA AND RETINAL DISEASES

- TABLE 13 CASE STUDY 2: INDIA'S NATIONAL PROGRAM FOR CONTROL OF BLINDNESS (NPCB) TO COLLABORATE WITH FORUS HEALTH FOR REDUCING AVOIDABLE BLINDNESS

- TABLE 14 CASE STUDY 3: UK NATIONAL HEALTH SERVICE TO DEPLOY HEIDELBERG ENGINEERING'S SPECTRALIS OCT PLATFORM FOR IMPROVING EARLY DETECTION OF CHRONIC DISEASES

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 OPHTHALMIC IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE OPHTHALMIC IMAGING PRODUCTS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE OPHTHALMIC IMAGING PRODUCTS

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR OPHTHALMIC IMAGING

- TABLE 25 OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 26 R&D ACTIVITIES IN AI-ENABLED OPHTHALMIC IMAGING EQUIPMENT

- TABLE 27 EXAMPLES OF AI-ENABLED OPHTHALMIC IMAGING EQUIPMENT AVAILABLE IN MARKET

- TABLE 28 AI-ENABLED OPHTHALMIC IMAGING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 EXAMPLES OF NON-AI-ENABLED OPHTHALMIC IMAGING EQUIPMENT AVAILABLE IN MARKET

- TABLE 30 NON-AI-ENABLED OPHTHALMIC IMAGING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 32 OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 33 OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 35 EXAMPLES OF SPECTRAL-DOMAIN OCT (SD-OCT) AVAILABLE IN MARKET

- TABLE 36 SPECTRAL-DOMAIN OCT (SD-OCT) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 EXAMPLES OF SWEPT-SOURCE OCT (SS-OCT) AVAILABLE IN MARKET

- TABLE 38 SWEPT-SOURCE OCT (SS-OCT) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 EXAMPLES OF HANDHELD OCT AVAILABLE IN MARKET

- TABLE 40 HANDHELD OCT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 42 OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 44 EXAMPLES OF OPHTHALMIC A-SCAN ULTRASOUND SYSTEMS AVAILABLE IN MARKET

- TABLE 45 OPHTHALMIC A-SCAN ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 EXAMPLES OF OPHTHALMIC B-SCAN ULTRASOUND SYSTEMS AVAILABLE IN MARKET

- TABLE 47 OPHTHALMIC B-SCAN ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 EXAMPLES OF OPHTHALMIC ULTRASOUND BIOMICROSCOPES AVAILABLE IN MARKET

- TABLE 49 OPHTHALMIC ULTRASOUND BIOMICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 EXAMPLES OF OPHTHALMIC PACHYMETERS AVAIALBLE IN MARKET

- TABLE 51 OPHTHALMIC PACHYMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 EXAMPLES OF OTHER OPHTHALMIC ULTRASOUND SYSTEMS AVAILABLE IN MARKET

- TABLE 53 OTHER OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 55 FUNDUS CAMERAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 FUNDUS CAMERAS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 57 EXAMPLES OF MYDRIATIC FUNDUS CAMERAS AVAILABLE IN MARKET

- TABLE 58 MYDRIATIC FUNDUS CAMERAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 EXAMPLES OF NON-MYDRIATIC FUNDUS CAMERAS AVAILABLE IN MARKET

- TABLE 60 NON-MYDRIATIC FUNDUS CAMERAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 EXAMPLES OF HYBRID FUNDUS CAMERAS AVAILABLE IN MARKET

- TABLE 62 HYBRID FUNDUS CAMERAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 EXAMPLES OF ROP FUNDUS CAMERAS AVAILABLE IN MARKET

- TABLE 64 ROP FUNDUS CAMERAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 SLIT LAMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 SLIT LAMPS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 68 EXAMPLES OF HANDHELD SLIT LAMPS AVAILABLE IN MARKET

- TABLE 69 HANDHELD SLIT LAMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 EXAMPLES OF TABLE MOUNT SLIT LAMPS AVAILABLE IN MARKET

- TABLE 71 TABLE MOUNT SLIT LAMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 SPECULAR MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 SPECULAR MICROSCOPES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 74 TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 TONOMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 TONOMETERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 77 EXAMPLES OF APPLANATION TONOMETERS AVAILABLE IN MARKET

- TABLE 78 APPLANATION TONOMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 EXAMPLES OF REBOUND TONOMETERS AVAILABLE IN MARKET

- TABLE 80 REBOUND TONOMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 OPHTHALMOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 OPHTHALMOSCOPES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 84 EXAMPLES OF DIRECT OPHTHALMOSCOPES AVAILABLE IN MARKET

- TABLE 85 DIRECT OPHTHALMOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 EXAMPLES OF INDIRECT OPHTHALMOSCOPES AVAILABLE IN MARKET

- TABLE 87 INDIRECT OPHTHALMOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 EXAMPLES OF RETINOSCOPES AVAILABLE IN MARKET

- TABLE 89 RETINOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 RETINOSCOPES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 91 EXAMPLES OF OTHER OPHTHALMIC IMAGING PRODUCTS AVAILABLE IN MARKET

- TABLE 92 OTHER OPHTHALMIC IMAGING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 94 OPHTHALMIC IMAGING MARKET FOR GLAUCOMA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 OPHTHALMIC IMAGING MARKET FOR CATARACTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 OPHTHALMIC IMAGING MARKET FOR RETINOPATHIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 OPHTHALMIC IMAGING MARKET FOR REFRACTIVE DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 OPHTHALMIC IMAGING MARKET FOR AGE-RELATED MACULAR DEGENERATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 OPHTHALMIC IMAGING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 101 OPHTHALMIC IMAGING MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 OPHTHALMIC IMAGING MARKET FOR OPHTHALMOLOGY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 OPHTHALMIC IMAGING MARKET FOR OPTOMETRY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 OPHTHALMIC IMAGING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 OPHTHALMIC IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: OPHTHALMIC IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 US: KEY MACROINDICATORS

- TABLE 118 US: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 119 US: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 120 US: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 US: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 US: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 US: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 US: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 US: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 US: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 127 US: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 CANADA: KEY MACROINDICATORS

- TABLE 129 CANADA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 130 CANADA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 131 CANADA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 CANADA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 CANADA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 CANADA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 CANADA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 CANADA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 CANADA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 138 CANADA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 EUROPE: OPHTHALMIC IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 EUROPE: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 141 EUROPE: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 142 EUROPE: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 EUROPE: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 EUROPE: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 EUROPE: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 EUROPE: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 EUROPE: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 GERMANY: KEY MACROINDICATORS

- TABLE 151 GERMANY: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 152 GERMANY: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 153 GERMANY: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 GERMANY: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 GERMANY: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 GERMANY: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 GERMANY: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 GERMANY: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 GERMANY: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 160 GERMANY: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 FRANCE: KEY MACROINDICATORS

- TABLE 162 FRANCE: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 163 FRANCE: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 164 FRANCE: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 FRANCE: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 FRANCE: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 FRANCE: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 FRANCE: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 FRANCE: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 FRANCE: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 171 FRANCE: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 172 UK: KEY MACROINDICATORS

- TABLE 173 UK: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 174 UK: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 175 UK: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 UK: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 UK: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 UK: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 UK: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 UK: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 UK: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 182 UK: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 ITALY: KEY MACROINDICATORS

- TABLE 184 ITALY: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 185 ITALY: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 186 ITALY: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 ITALY: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 ITALY: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 ITALY: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 ITALY: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 ITALY: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 ITALY: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 193 ITALY: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 194 SPAIN: KEY MACROINDICATORS

- TABLE 195 SPAIN: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 196 SPAIN: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 197 SPAIN: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 SPAIN: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 SPAIN: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 SPAIN: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 SPAIN: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 SPAIN: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 SPAIN: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 204 SPAIN: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 REST OF EUROPE: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 206 REST OF EUROPE: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 207 REST OF EUROPE: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 REST OF EUROPE: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 REST OF EUROPE: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 REST OF EUROPE: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 REST OF EUROPE: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 REST OF EUROPE: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 REST OF EUROPE: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 REST OF EUROPE: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 226 JAPAN: KEY MACROINDICATORS

- TABLE 227 JAPAN: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 228 JAPAN: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 229 JAPAN: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 JAPAN: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 JAPAN: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 JAPAN: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 JAPAN: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 JAPAN: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 JAPAN: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 236 JAPAN: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 237 CHINA: KEY MACROINDICATORS

- TABLE 238 CHINA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 239 CHINA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 240 CHINA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 CHINA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 CHINA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 CHINA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 CHINA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 CHINA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 CHINA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 248 INDIA: KEY MACROINDICATORS

- TABLE 249 INDIA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 250 INDIA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 251 INDIA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 INDIA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 INDIA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 INDIA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 INDIA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 INDIA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 INDIA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 258 INDIA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 259 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 260 SOUTH KOREA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 261 SOUTH KOREA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 262 SOUTH KOREA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 SOUTH KOREA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 SOUTH KOREA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 SOUTH KOREA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 SOUTH KOREA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 SOUTH KOREA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 SOUTH KOREA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 269 SOUTH KOREA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 270 AUSTRALIA: KEY MACROINDICATORS

- TABLE 271 AUSTRALIA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 272 AUSTRALIA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 273 AUSTRALIA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 AUSTRALIA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 AUSTRALIA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 AUSTRALIA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 AUSTRALIA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 AUSTRALIA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 AUSTRALIA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 280 AUSTRALIA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 292 LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 294 LATIN AMERICA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 LATIN AMERICA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 LATIN AMERICA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 LATIN AMERICA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 LATIN AMERICA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 302 BRAZIL: KEY MACROINDICATORS

- TABLE 303 BRAZIL: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 304 BRAZIL: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 305 BRAZIL: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 BRAZIL: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 BRAZIL: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 BRAZIL: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 BRAZIL: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 BRAZIL: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 BRAZIL: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 312 BRAZIL: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 313 MEXICO: KEY MACROINDICATORS

- TABLE 314 MEXICO: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 315 MEXICO: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 316 MEXICO: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 MEXICO: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 MEXICO: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 MEXICO: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 MEXICO: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 MEXICO: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 MEXICO: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 323 MEXICO: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 324 REST OF LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 325 REST OF LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 326 REST OF LATIN AMERICA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 REST OF LATIN AMERICA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 REST OF LATIN AMERICA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 REST OF LATIN AMERICA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 REST OF LATIN AMERICA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 REST OF LATIN AMERICA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 REST OF LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 333 REST OF LATIN AMERICA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 334 MIDDLE EAST & AFRICA: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 335 MIDDLE EAST & AFRICA: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 336 MIDDLE EAST & AFRICA: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 337 MIDDLE EAST & AFRICA: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 338 MIDDLE EAST & AFRICA: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 339 MIDDLE EAST & AFRICA: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 MIDDLE EAST & AFRICA: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 MIDDLE EAST & AFRICA: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 342 MIDDLE EAST & AFRICA: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 343 MIDDLE EAST & AFRICA: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 344 GCC COUNTRIES: OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 345 GCC COUNTRIES: OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 346 GCC COUNTRIES: OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 347 GCC COUNTRIES: OPHTHALMIC ULTRASOUND SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 GCC COUNTRIES: FUNDUS CAMERAS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 GCC COUNTRIES: SLIT LAMPS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 350 GCC COUNTRIES: TONOMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 351 GCC COUNTRIES: OPHTHALMOSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 GCC COUNTRIES: OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 353 GCC COUNTRIES: OPHTHALMIC IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 354 KEY STRATEGIES DEPLOYED BY MAJOR PLAYERS IN OPHTHALMIC IMAGING MARKET, JANUARY 2021-JULY 2025

- TABLE 355 OPHTHALMIC IMAGING MARKET: DEGREE OF COMPETITION

- TABLE 356 OPHTHALMIC IMAGING MARKET: REGION FOOTPRINT

- TABLE 357 OPHTHALMIC IMAGING MARKET: PRODUCT FOOTPRINT

- TABLE 358 OPHTHALMIC IMAGING MARKET: APPLICATION FOOTPRINT

- TABLE 359 OPHTHALMIC IMAGING MARKET: END-USER FOOTPRINT

- TABLE 360 OPHTHALMIC IMAGING MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 361 OPHTHALMIC IMAGING MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS, BY APPLICATION AND REGION

- TABLE 362 OPHTHALMIC IMAGING MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 363 OPHTHALMIC IMAGING MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 364 OPHTHALMIC IMAGING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 365 CARL ZEISS MEDITEC AG: COMPANY OVERVIEW

- TABLE 366 CARL ZEISS MEDITEC AG: PRODUCTS OFFERED

- TABLE 367 CARL ZEISS MEDITEC AG: PRODUCT LAUNCHES & UPGRADES, JANUARY 2021-JULY 2025

- TABLE 368 CARL ZEISS MEDITEC AG: DEALS, JANUARY 2021-JULY 2025

- TABLE 369 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 370 TOPCON CORPORATION: PRODUCTS OFFERED

- TABLE 371 TOPOCON CORPORATION: DEALS, JANUARY 2021-JULY 2025

- TABLE 372 TOPOCON CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 373 NIDEK CO., LTD.: COMPANY OVERVIEW

- TABLE 374 NIDEK CO., LTD.: PRODUCTS OFFERED

- TABLE 375 HALMA PLC: COMPANY OVERVIEW

- TABLE 376 HALMA PLC: PRODUCTS OFFERED

- TABLE 377 ALCON: COMPANY OVERVIEW

- TABLE 378 ALCON: PRODUCTS OFFERED

- TABLE 379 HEIDELBERG ENGINEERING GMBH: COMPANY OVERVIEW

- TABLE 380 HEIDELBERG ENGINEERING GMBH: PRODUCTS OFFERED

- TABLE 381 HAAG-STREIT GROUP: COMPANY OVERVIEW

- TABLE 382 HAAG-STREIT GROUP: PRODUCTS OFFERED

- TABLE 383 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 384 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 385 ESSILORLUXOTTICA: COMPANY OVERVIEW

- TABLE 386 ESSILORLUXOTTICA: PRODUCTS OFFERED

- TABLE 387 OCULUS: COMPANY OVERVIEW

- TABLE 388 OCULUS: PRODUCTS OFFERED

- TABLE 389 OCULUS: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 390 VISIONIX: COMPANY OVERVIEW

- TABLE 391 VISIONIX: PRODUCTS OFFERED

- TABLE 392 VISIONIX: DEALS, JANUARY 2021-JULY 2025

- TABLE 393 SONOMED ESCALON: COMPANY OVERVIEW

- TABLE 394 SONOMED ESCALON: PRODUCTS OFFERED

- TABLE 395 COBURN TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 396 COBURN TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 397 COBURN TECHNOLOGIES, INC.: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 398 DGH TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 399 DGH TECHNOLOGY, INC.: PRODUCTS OFFERED

- TABLE 400 SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 401 SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.: PRODUCTS OFFERED

- TABLE 402 VISUNEX MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 403 FORUS HEALTH PVT. LTD.: COMPANY OVERVIEW

- TABLE 404 ZIEMER OPHTHALMIC SYSTEMS AG: COMPANY OVERVIEW

- TABLE 405 EYENUK INC.: COMPANY OVERVIEW

- TABLE 406 COSTRUZIONE STRUMENTI OFTALMICI (CSO): COMPANY OVERVIEW

- TABLE 407 HAI LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 408 CRYSTALVUE MEDICAL CORPORATION: COMPANY OVERVIEW

- TABLE 409 SUZHOU KANGJIE MEDICAL INC.: COMPANY OVERVIEW

- TABLE 410 KONAN MEDICAL USA, INC.: COMPANY OVERVIEW

- TABLE 411 REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 OPHTHALMIC IMAGING MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 OPHTHALMIC IMAGING MARKET: YEARS CONSIDERED

- FIGURE 3 OPHTHALMIC IMAGING MARKET: RESEARCH DESIGN

- FIGURE 4 OPHTHALMIC IMAGING MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 OPHTHALMIC IMAGING MARKET: KEY PRIMARY DATA SOURCES

- FIGURE 6 OPHTHALMIC IMAGING MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 OPHTHALMIC IMAGING MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 11 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 12 REVENUE SHARE ANALYSIS ILLUSTRATION: CARL ZEISS MEDITEC AG (2024)

- FIGURE 13 OPHTHALMIC IMAGING SUPPLY-SIDE MARKET SIZE ESTIMATION (2024)

- FIGURE 14 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 15 OPHTHALMIC IMAGING MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 16 OPHTHALMIC IMAGING MARKET: TOP-DOWN APPROACH

- FIGURE 17 OPHTHALMIC IMAGING MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 18 OPHTHALMIC IMAGING MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 OPHTHALMIC IMAGING MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 OPHTHALMIC IMAGING MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 OPHTHALMIC IMAGING MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 22 REGIONAL SNAPSHOT OF OPHTHALMIC IMAGING MARKET

- FIGURE 23 RISING ADOPTION OF ADVANCED OPHTHALMIC DIAGNOSTICS IN HOSPITALS TO BOOST DEMAND FOR INTEGRATED IMAGING SYSTEMS

- FIGURE 24 CHINA AND NON-AI-ENABLED EQUIPMENT COMMANDED LARGEST ASIA PACIFIC MARKET SHARE IN 2024

- FIGURE 25 INDIA TO REGISTER HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 26 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 27 EMERGING MARKETS TO PROJECT HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 28 OPHTHALMIC IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 OPHTHALMIC IMAGING MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 AVERAGE SELLING PRICE TREND OF OPTICAL COHERENCE TOMOGRAPHY SYSTEMS, BY REGION, 2022-2024 (USD)

- FIGURE 31 OPHTHALMIC IMAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 OPHTHALMIC IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 33 OPHTHALMIC IMAGING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 OPHTHALMIC IMAGING MARKET: FUNDING AND NUMBER OF DEALS, 2019-2023 (USD MILLION)

- FIGURE 35 OPHTHALMIC IMAGING MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 36 OPHTHALMIC IMAGING MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (UNITS)

- FIGURE 37 OPHTHALMIC IMAGING MARKET: TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLIED/GRANTED, JANUARY 2015-JULY 2025

- FIGURE 38 OPHTHALMIC IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE OPHTHALMIC IMAGING PRODUCTS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE OPHTHALMIC IMAGING PRODUCTS

- FIGURE 41 IMPACT OF AI/GEN AI ON OPHTHALMIC IMAGING MARKET

- FIGURE 42 MARKETS ADJACENT TO OPHTHALMIC IMAGING MARKET

- FIGURE 43 NORTH AMERICA: OPHTHALMIC IMAGING MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: OPHTHALMIC IMAGING MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN OPHTHALMIC IMAGING MARKET, 2020-2024 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS IN OPHTHALMIC IMAGING MARKET (2024)

- FIGURE 47 OPHTHALMIC IMAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 OPHTHALMIC IMAGING MARKET: COMPANY FOOTPRINT

- FIGURE 49 OPHTHALMIC IMAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 OPHTHALMIC IMAGING MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 53 CARL ZEISS MEDITEC AG: COMPANY SNAPSHOT

- FIGURE 54 TOPCON CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 HALMA PLC: COMPANY SNAPSHOT

- FIGURE 56 ALCON: COMPANY SNAPSHOT

- FIGURE 57 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT