|

市场调查报告书

商品编码

1811762

全球玻璃纤维市场(按产品类型、玻璃类型、应用和地区划分)-预测至2030年Fiberglass Market by Glass Type (E-Glass, ECR Glass, S-Glass, Others), by Product Type (Glass Wool, Direct & Assembled Roving, Yarn, Chopped Strands, Milled Fibers), Application (Composites, Insulation), and Region - Global Forecast to 2030 |

||||||

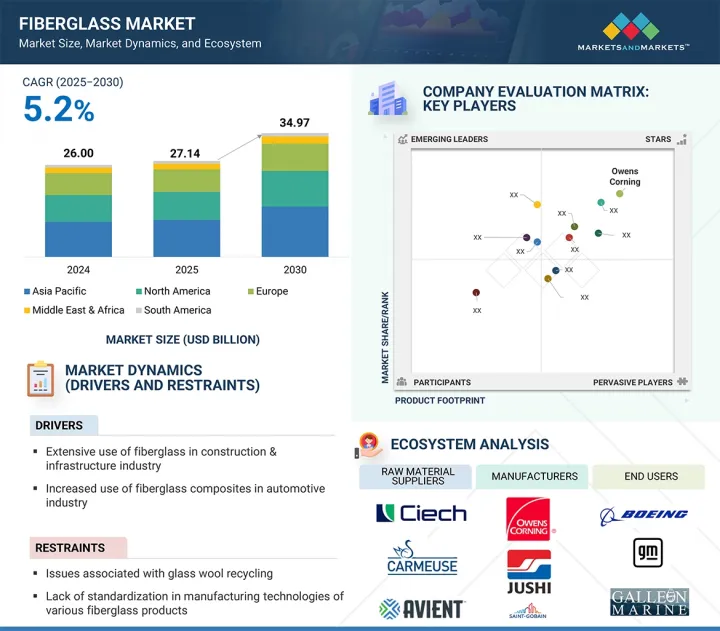

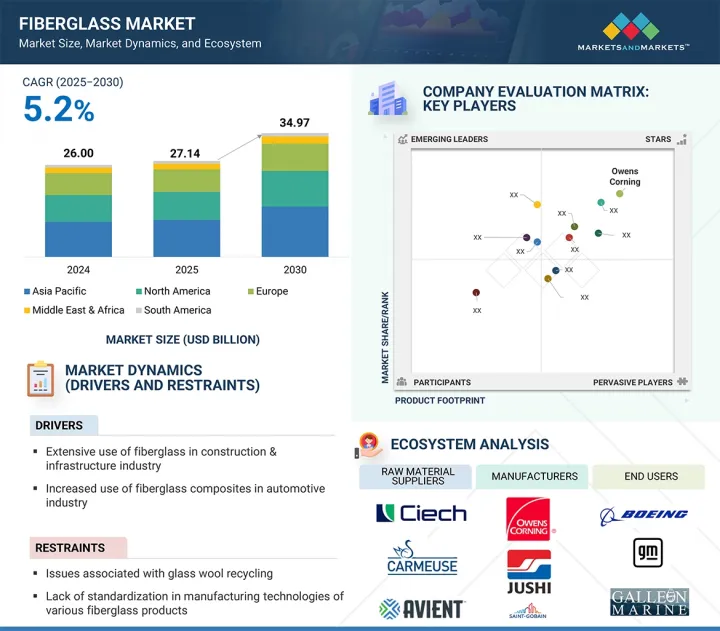

预计玻璃纤维市场将从 2025 年的 271.4 亿美元成长到 2030 年的 349.7 亿美元,预测期内的复合年增长率为 5.2%。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元)和数量(千吨) |

| 部分 | 按产品类型、玻璃类型、应用和地区 |

| 目标区域 | 欧洲、北美、亚太地区、中东和非洲、南美 |

S-玻璃纤维是一种高性能玻璃纤维,以其卓越的强度和刚性而闻名。它是透过从熔融玻璃池中拉製玻璃纤维,并经过纤维化处理后製成。 S-S-Glass的二氧化硅和氧化镁含量较高,使其性能优于其他玻璃纤维。这种先进材料适用于对强度和刚度要求较高的应用。

随着航太、国防和汽车等产业对更精密材料的需求不断增长,S玻璃的需求预计将持续成长。 S玻璃用于製造轻量、坚固耐用的复合材料。随着这些行业专注于轻量化以提高燃油效率并减少排放气体,S玻璃的使用量预计将持续成长。

玻璃纤维被用作混凝土的增强材料,以提高其强度和耐久性。由于玻璃纤维增强材料重量轻且耐腐蚀,因此通常比钢材更受青睐。此外,玻璃纤维隔热材料也常用于建筑施工,以提供隔热材料并提高能源效率。它是一种经济高效的选择,可以轻鬆安装在墙壁、地板和天花板上。玻璃纤维也用于製造各种用途的管道和储罐,包括用水和污水处理厂、化学处理设施以及石油和天然气作业。这些玻璃纤维管道和储罐重量轻、耐腐蚀,使用寿命长。在建筑和基础设施领域,玻璃纤维具有许多优势,包括重量轻、耐用和耐腐蚀。随着这些行业的持续发展和麵临新的挑战,玻璃纤维的使用预计将会增加。

预计亚太地区将成为预测期内玻璃纤维市场成长最快的地区。中国、印度和其他东南亚国家正在经历快速的工业成长和城市扩张。人口成长和经济扩张推动了各种应用领域对玻璃纤维复合材料的需求不断增长。支持永续建筑实践的倡议、新的基础设施计划(例如中国的「新基建」计划和印度的「智慧城市计画」)以及有利于国内製造业的政策正在刺激该地区的需求并提高产能。

风力发电和其他可再生产业的成长推动了对涡轮叶片和其他部件的玻璃纤维复合材料的需求。改进的製造流程提高了产品品质并降低了成本,进一步促进了市场扩张。除了建筑和汽车行业,航太、电子、船舶和体育用品等行业也促进了该地区玻璃纤维市场的成长。

本报告研究了全球玻璃纤维市场,并提供了按产品类型、玻璃类型、应用和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 供应链分析

- 生态系分析

- 定价分析

- 贸易分析

- 技术分析

- 人工智慧/生成式人工智慧对玻璃纤维市场的影响

- 宏观经济展望

- 专利分析

- 监管状况

- 2025-2026年主要会议和活动

- 案例研究分析

- 影响客户业务的趋势/中断

- 投资金筹措场景

- 2025年美国关税的影响-玻璃纤维市场

6. 玻璃纤维市场(依产品类型)

- 介绍

- 玻璃绒

- 直接组装粗纱

- 线

- 切碎的丝

- 磨碎纤维

第七章 玻璃纤维市场(依玻璃类型)

- 介绍

- 无碱玻璃

- ECR玻璃

- S-玻璃

- 其他的

第八章 玻璃纤维市场(依应用)

- 介绍

- 复合材料

- 绝缘

9. 玻璃纤维市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 俄罗斯

- 西班牙

- 其他的

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 澳洲

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 埃及

- 其他的

第十章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2019-2023年收益分析

- 2024年市占率分析

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 竞争场景

第十一章 公司简介

- 主要参与企业

- CHINA JUSHI CO., LTD.

- OWENS CORNING

- SAINT-GOBAIN

- TAISHAN FIBERGLASS INC.(CTG GROUP)

- CHONGQING POLYCOMP INTERNATIONAL CORP.(CPIC)

- NIPPON ELECTRIC GLASS CO., LTD.

- 3B-THE FIBREGLASS COMPANY

- TAIWAN GLASS IND. CORP.

- PFG FIBER GLASS CORPORATION

- JOHNS MANVILLE(A BERKSHIRE HATHWAY COMPANY)

- AGY

- ASAHI FIBERGLASS CO., LTD.

- KNAUF INSULATION

- KCC CORPORATION

- SISECAM

- 其他公司

- FIBTEX PRODUCTS

- DARSHAN SAFETY ZONE

- JIANGSU CHANGHAI COMPOSITE MATERIALS HOLDING CO., LTD.

- BGF INDUSTRIES

- ARABIAN FIBERGLASS INSULATION CO., LTD.(AFICO)

- SHREE LAXMI UDYOG

- CHONGQING DUJIANG COMPOSITES CO., LTD.(CQFIBERGLASS)

- ENVALIOR

- MONTEX GLASS FIBRE INDUSTRIES PVT. LTD.

第十二章 附录

The fiberglass market is expected to grow from USD 27.14 billion in 2025 to USD 34.97 billion by 2030, at a CAGR of 5.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) and volume (kiloton) |

| Segments | Glass Type, Product Type, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

S-glass is a high-performance type of fiberglass known for its exceptional strength and stiffness. It is produced by drawing glass fibers from a molten glass pool through fiberization. S-glass contains a high percentage of silica and magnesium oxide, which gives it superior properties compared to other fiberglass types. This advanced material is used in applications where strength and stiffness are crucial.

As industries like aerospace, defense, and automotive demand more sophisticated materials, the demand for S-glass is expected to increase. S-glass is lightweight and used to create composite materials that are strong and durable. As these industries focus more on lightweighting to boost fuel efficiency and reduce emissions, the use of S-glass is likely to grow.

"In terms of value, the construction & infrastructure end-use industry accounted for the largest share of the overall composite applications segment."

Fiberglass is used as a reinforcement material in concrete to enhance its strength and durability. Fiberglass reinforcement is often favored over steel because it is lightweight and resistant to corrosion. Additionally, fiberglass insulation is commonly employed in construction to provide thermal insulation and boost energy efficiency. It is a cost-effective option that can be easily installed in walls, floors, and ceilings. Fiberglass is also used to manufacture pipes and tanks for various applications, such as water and wastewater treatment plants, chemical processing facilities, and oil and gas operations. These fiberglass pipes and tanks are lightweight, corrosion-resistant, and have a long service life. In the construction and infrastructure sectors, fiberglass offers many advantages, including light weight, durability, and corrosion resistance. As these industries continue to grow and face new challenges, the use of fiberglass is expected to rise.

"The Asia Pacific region is projected to register the highest growth rate in the fiberglass market during the forecast period."

The Asia Pacific is projected to be the fastest-growing region in the fiberglass market during the forecast period. Countries like China, India, and other Southeast Asian nations are experiencing rapid industrial growth and urban expansion. Growing populations and expanding economies drive higher demand for fiberglass composites in various applications. Initiatives supporting sustainable building practices, new infrastructure projects (e.g., China's "New Infrastructure Plan" and India's "Smart Cities Mission"), and policies favoring domestic manufacturing boost demand and increase production capacity in the region.

Growth in wind energy and other renewable sectors fuels demand for fiberglass composites used in turbine blades and other components. Improvements in manufacturing processes enhance product quality and reduce costs, further enabling market expansion. Beyond construction and automotive, sectors like aerospace, electronics, marine, and sports goods also contribute to fiberglass market growth in the region.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group, China), Chongqing Polycomp International Corp. (CPIC, China), Nippon Electric Glass Co., Ltd. (Japan), 3B- The Fiberglass Company (Belgium), Taiwan Glass Ind. Corp. (Taiwan), PFG Fiber Glass Corporation (China), Johns Manville (US), AGY (US), Asahi Fiber Glass Co., Ltd. (Japan), Knauf Insulation (Belgium), KCC Corporation (South Korea), and Sisecam (Turkey).

Research coverage

This research report categorizes the fiberglass market by glass type (E Glass, ECR Glass, S Glass, other glasses), product type (glass wool, direct & assembled roving, yarn, chopped strand, milled fibers), application (composites, insulation), and region. The scope of the report includes detailed information about the major factors influencing the growth of the fiberglass market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the fiberglass market are all covered. This report includes a competitive analysis of upcoming startups in the fiberglass market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall fiberglass market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (extensive use of fiberglass in construction & infrastructure industry and increased use of fiberglass composites in automotive industry), restraints (issues associated with glass wool recycling and lack of standardization in manufacturing technologies), opportunities (increasing number of wind energy capacity installations and increasing demand for composite materials in construction & infrastructure industry in Middle East & Africa), and challenges (capital-intensive production and complex manufacturing process of fiberglass and competition from alternative materials) influencing the growth of the fiberglass market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the fiberglass market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the fiberglass market across several regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the fiberglass market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group, China), Chongqing Polycomp International Corp. (CPIC, China), Nippon Electric Glass Co., Ltd. (Japan), 3B- The Fiberglass Company (Belgium), Taiwan Glass Ind. Corp. (Taiwan), PFG Fiber Glass Corporation (China), Johns Manville (US), AGY (US), Asahi Fiber Glass Co., Ltd. (Japan), Knauf Insulation (Belgium), KCC Corporation (South Korea), and Sisecam (Turkey) in the fiberglass market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN FIBERGLASS MARKET

- 4.2 FIBERGLASS MARKET, BY PRODUCT TYPE AND REGION

- 4.3 FIBERGLASS MARKET, BY GLASS TYPE

- 4.4 FIBERGLASS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Extensive use of fiberglass in construction & infrastructure

- 5.2.1.2 Rising use of fiberglass composites in automotive applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues associated with glass wool recycling

- 5.2.2.2 Lack of standardization in fiberglass manufacturing technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased number of wind energy capacity installations

- 5.2.3.2 Rising demand for composite materials in MEA construction & infrastructure sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Capital-intensive production and complex manufacturing process

- 5.2.4.2 Competition from alternative materials

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 7019)

- 5.8.2 EXPORT SCENARIO (HS CODE 7019)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES (FIBERGLASS MANUFACTURING)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES (FIBERGLASS MANUFACTURING)

- 5.9.2.1 Hand Lay-up and Spray Lay-Up

- 5.10 IMPACT OF AI/GEN AI ON FIBERGLASS MARKET

- 5.10.1 TOP USE CASES AND MARKET POTENTIAL

- 5.10.2 CASE STUDIES OF AI IMPLEMENTATION IN FIBERGLASS MARKET

- 5.11 MACROECONOMIC OUTLOOK

- 5.11.1 INTRODUCTION

- 5.11.2 GDP TRENDS AND FORECAST

- 5.11.3 TRENDS IN AEROSPACE & DEFENSE INDUSTRY

- 5.11.4 TRENDS IN WIND ENERGY INDUSTRY

- 5.11.5 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.11.6 TRENDS IN CONSTRUCTION INDUSTRY

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 PATENT TYPES

- 5.12.3 INSIGHTS

- 5.12.4 LEGAL STATUS

- 5.12.5 JURISDICTION ANALYSIS

- 5.12.6 TOP APPLICANTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY 1L CHINA JUSHI AIMED TO EXTEND FIBERGLASS PRODUCT OFFERINGS FOR MULTIPLE END-USE INDUSTRIES

- 5.15.2 CASE STUDY 2: OWENS CORNING AND PULTRON COMPOSITES SIGNED AN AGREEMENT TO MANUFACTURE FIBERGLASS REBAR

- 5.15.3 CASE STUDY 3: SAINT-GOBAIN ACQUIRED U.P. TWIGA FIBERGLASS LTD.

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFFS-FIBERGLASS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USER INDUSTRIES

6 FIBERGLASS MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 GLASS WOOL

- 6.2.1 THERMAL INSULATION PROPERTIES DRIVING DEMAND IN RESIDENTIAL CONSTRUCTION

- 6.3 DIRECT & ASSEMBLED ROVINGS

- 6.3.1 HIGH DEMAND FROM CONSTRUCTION, INFRASTRUCTURE, AND WIND ENERGY SEGMENTS

- 6.4 YARNS

- 6.4.1 RISING DEMAND FOR ELECTRONICS AND CONSTRUCTION

- 6.5 CHOPPED STRANDS

- 6.5.1 RISING AUTOMOBILE PRODUCTION IN ASIA PACIFIC AND EUROPE FUELING GROWTH

- 6.6 MILLED FIBERS

- 6.6.1 RISING DEMAND FOR COMPOSITES PROPELLING MARKET GROWTH

7 FIBERGLASS MARKET, BY GLASS TYPE

- 7.1 INTRODUCTION

- 7.2 E-GLASS

- 7.2.1 MOST WIDELY USED GLASS TYPE IN FIBERGLASS MARKET

- 7.3 ECR-GLASS

- 7.3.1 ENHANCED CORROSION RESISTANCE PROPERTIES DRIVING DEMAND

- 7.4 S-GLASS

- 7.4.1 HIGH PERFORMANCE AT ELEVATED TEMPERATURES DRIVES GROWTH IN ADVERSE APPLICATIONS

- 7.5 OTHER GLASSES

8 FIBERGLASS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 COMPOSITES

- 8.2.1 FIBERGLASS COMPOSITES MARKET, BY REGION

- 8.2.2 FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- 8.2.2.1 Construction & infrastructure

- 8.2.2.1.1 Tensile strength and strength-to-weight ratio of fiberglass drives adoption

- 8.2.2.2 Automotive

- 8.2.2.2.1 Weight reduction, increased processing speed, and low VOC emissions encourage fiberglass adoption

- 8.2.2.3 Wind energy

- 8.2.2.3.1 High tensile strength of fiberglass composites driving demand in wind turbine blade manufacturing

- 8.2.2.4 Electronics

- 8.2.2.4.1 High thermal resistance and electrical conductivity of fiberglass fueling adoption in electronics applications

- 8.2.2.5 Aerospace

- 8.2.2.5.1 Aerodynamic design flexibility fueling demand in aerospace applications

- 8.2.2.6 Other end-use industries

- 8.2.2.1 Construction & infrastructure

- 8.3 INSULATION

- 8.3.1 FIBERGLASS INSULATION MARKET, BY REGION

- 8.3.2 FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- 8.3.2.1 Residential construction

- 8.3.2.1.1 Rapid urbanization in developing countries is creating demand

- 8.3.2.2 Non-residential construction

- 8.3.2.2.1 Urbanization and rising infrastructural development to drive market

- 8.3.2.3 Industrial applications

- 8.3.2.3.1 High demand for glass wool fiber to manufacture industrial pipes, power plant boilers, and smoke flues

- 8.3.2.4 Other end-use industries

- 8.3.2.1 Residential construction

9 FIBERGLASS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Presence of aerospace and automotive companies driving demand

- 9.2.2 CANADA

- 9.2.2.1 Growing energy sector to support market growth

- 9.2.3 MEXICO

- 9.2.3.1 Rising demand for fiberglass from automotive industry driving growth

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Growth of automotive and aerospace sectors driving demand

- 9.3.2 FRANCE

- 9.3.2.1 France boasts second-largest market for fiberglass due to strong presence of automobile manufacturers

- 9.3.3 UK

- 9.3.3.1 Rising demand for lightweight & high-performance materials

- 9.3.4 ITALY

- 9.3.4.1 Shift towards sustainability propelling demand

- 9.3.5 RUSSIA

- 9.3.5.1 Innovation in fiber-reinforced technologies driving growth

- 9.3.6 SPAIN

- 9.3.6.1 Demand from wind energy sector driving market

- 9.3.7 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Presence of major fiberglass manufacturers fueling market

- 9.4.2 INDIA

- 9.4.2.1 Construction industry fueling demand for fiberglass products

- 9.4.3 JAPAN

- 9.4.3.1 Demand for lightweight composites from automotive industry drives market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Presence of key electronics companies drives demand for fiberglass

- 9.4.5 INDONESIA

- 9.4.5.1 Growing urban population and rising disposable income to drive construction industry and fiberglass demand

- 9.4.6 MALAYSIA

- 9.4.6.1 Growing demand from transportation and aerospace industries

- 9.4.7 AUSTRALIA

- 9.4.7.1 Renewable energy expansion propelling fiberglass demand

- 9.4.8 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growth in automotive industry to fuel fiberglass demand

- 9.5.2 ARGENTINA

- 9.5.2.1 Increased public spending on construction activities to support market growth

- 9.5.3 COLOMBIA

- 9.5.3.1 Rapid urbanization fueling demand

- 9.5.4 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 UAE

- 9.6.1.1.1 Stringent regulations for energy efficiency to propel demand for fiberglass across end-use industries

- 9.6.1.2 Saudi Arabia

- 9.6.1.2.1 Increased investment in infrastructural development driving fiberglass market

- 9.6.1.3 Rest of GCC Countries

- 9.6.1.1 UAE

- 9.6.2 EGYPT

- 9.6.2.1 Increased spending on infrastructure projects driving growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 KEY STRATEGIES ADOPTED BY PLAYERS IN FIBERGLASS MARKET

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 CASICO (BOREALIS GMBH)

- 10.5.2 ACCUREL (EVONIK INDUSTRIES)

- 10.5.3 MULTIBASE (DUPONT)

- 10.5.4 SYNCURE (AVIENT CORPORATION)

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Glass Type footprint

- 10.6.5.4 Product Type footprint

- 10.6.5.5 Application footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CHINA JUSHI CO., LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 OWENS CORNING

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SAINT-GOBAIN

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TAISHAN FIBERGLASS INC. (CTG GROUP)

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 NIPPON ELECTRIC GLASS CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Expansions

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 3B-THE FIBREGLASS COMPANY

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 MnM view

- 11.1.7.3.1 Key strengths

- 11.1.7.3.2 Strategic choices

- 11.1.7.3.3 Weaknesses and competitive threats

- 11.1.8 TAIWAN GLASS IND. CORP.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 MnM view

- 11.1.8.3.1 Key strengths

- 11.1.8.3.2 Strategic choices

- 11.1.8.3.3 Weaknesses and competitive threats

- 11.1.9 PFG FIBER GLASS CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.4 MnM view

- 11.1.9.4.1 Key strengths

- 11.1.9.4.2 Strategic choices

- 11.1.9.4.3 Weaknesses and competitive threats

- 11.1.10 JOHNS MANVILLE (A BERKSHIRE HATHWAY COMPANY)

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.10.4 MnM view

- 11.1.10.4.1 Key strengths

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.11 AGY

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Expansions

- 11.1.11.4 MnM view

- 11.1.11.4.1 Key strengths

- 11.1.11.4.2 Strategic choices

- 11.1.11.4.3 Weaknesses and competitive threats

- 11.1.12 ASAHI FIBERGLASS CO., LTD.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.12.4 MnM view

- 11.1.12.4.1 Key strengths

- 11.1.12.4.2 Strategic choices

- 11.1.12.4.3 Weaknesses and competitive threats

- 11.1.13 KNAUF INSULATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Expansions

- 11.1.13.4 MnM view

- 11.1.13.4.1 Key strengths

- 11.1.13.4.2 Strategic choices

- 11.1.13.4.3 Weaknesses and competitive threats

- 11.1.14 KCC CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 MnM view

- 11.1.14.3.1 Key strengths

- 11.1.14.3.2 Strategic choices

- 11.1.14.3.3 Weaknesses and competitive threats

- 11.1.15 SISECAM

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 MnM view

- 11.1.15.3.1 Key strengths

- 11.1.15.3.2 Strategic choices

- 11.1.15.3.3 Weaknesses and competitive threats

- 11.1.1 CHINA JUSHI CO., LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 FIBTEX PRODUCTS

- 11.2.2 DARSHAN SAFETY ZONE

- 11.2.3 JIANGSU CHANGHAI COMPOSITE MATERIALS HOLDING CO., LTD.

- 11.2.4 BGF INDUSTRIES

- 11.2.5 ARABIAN FIBERGLASS INSULATION CO., LTD. (AFICO)

- 11.2.6 SHREE LAXMI UDYOG

- 11.2.7 CHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS)

- 11.2.8 ENVALIOR

- 11.2.9 MONTEX GLASS FIBRE INDUSTRIES PVT. LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 NEW WIND POWER INSTALLATIONS (ONSHORE), BY REGION, 2022-2027

- TABLE 2 FIBERGLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 FIBERGLASS MARKET: ROLE IN ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF FIBERGLASS IN TOP APPLICATIONS, BY KEY PLAYER, 2024 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND OF FIBERGLASS, BY REGION, 2023-2024 (USD/KG)

- TABLE 8 IMPORT DATA RELATED TO HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA RELATED TO HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 TOP USE CASES AND MARKET POTENTIAL

- TABLE 11 AI TECHNOLOGIES REVOLUTIONIZING FIBERGLASS MARKET

- TABLE 12 GDP PERCENTAGE (%) CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 13 FIBERGLASS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 14 LIST OF PATENTS BY OWENS CORNING INTELLECTUAL CAPITAL LLC

- TABLE 15 LIST OF PATENTS BY JOHNS MANVILLE

- TABLE 16 LIST OF PATENTS BY BOEING CO

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 FIBERGLASS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR FIBERGLASSS, 2024 VS. 2025

- TABLE 24 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO US TARIFFS

- TABLE 25 FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 26 FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 27 FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 28 FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 29 FIBERGLASS MARKET FOR GLASS WOOL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 FIBERGLASS MARKET FOR GLASS WOOL, BY REGION, 2021-2024 (KILOTONS)

- TABLE 31 FIBERGLASS MARKET FOR GLASS WOOL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 FIBERGLASS MARKET FOR GLASS WOOL, BY REGION, 2025-2030 (KILOTONS)

- TABLE 33 FIBERGLASS MARKET FOR DIRECT & ASSEMBLED ROVINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 FIBERGLASS MARKET FOR DIRECT & ASSEMBLED ROVINGS, BY REGION, 2021-2024 (KILOTONS)

- TABLE 35 FIBERGLASS MARKET FOR DIRECT & ASSEMBLED ROVINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 FIBERGLASS MARKET FOR DIRECT & ASSEMBLED ROVINGS, BY REGION, 2025-2030 (KILOTONS)

- TABLE 37 FIBERGLASS MARKET FOR YARNS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 FIBERGLASS MARKET FOR YARNS, BY REGION, 2021-2024 (KILOTONS)

- TABLE 39 FIBERGLASS MARKET FOR YARNS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 FIBERGLASS MARKET FOR YARNS, BY REGION, 2025-2030 (KILOTONS)

- TABLE 41 FIBERGLASS MARKET FOR CHOPPED STRANDS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 FIBERGLASS MARKET FOR CHOPPED STRANDS, BY REGION, 2021-2024 (KILOTONS)

- TABLE 43 FIBERGLASS MARKET FOR CHOPPED STRANDS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 FIBERGLASS MARKET FOR CHOPPED STRANDS, BY REGION, 2025-2030 (KILOTONS)

- TABLE 45 FIBERGLASS MARKET FOR MILLED FIBERS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 FIBERGLASS MARKET FOR MILLED FIBERS, BY REGION, 2021-2024 (KILOTONS)

- TABLE 47 FIBERGLASS MARKET FOR MILLED FIBERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 FIBERGLASS MARKET FOR MILLED FIBERS, BY REGION, 2025-2030 (KILOTONS)

- TABLE 49 FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 50 FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTONS)

- TABLE 51 FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 52 FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTONS)

- TABLE 53 E-GLASS FIBER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 E-GLASS FIBER MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 55 E-GLASS FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 E-GLASS FIBER MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 57 ECR-GLASS: FIBERGLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 ECR-GLASS: FIBERGLASS MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 59 ECR-GLASS: FIBERGLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ECR-GLASS: FIBERGLASS MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 61 S-GLASS: FIBERGLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 S-GLASS: FIBERGLASS MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 63 S-GLASS: FIBERGLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 S-GLASS: FIBERGLASS MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 65 OTHER GLASSES: FIBERGLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 OTHER GLASSES: FIBERGLASS MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 67 OTHER GLASSES: FIBERGLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 OTHER GLASSES: FIBERGLASS MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 69 FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (KILOTONS)

- TABLE 71 FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 73 FIBERGLASS COMPOSITES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 FIBERGLASS COMPOSITES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 75 FIBERGLASS COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 FIBERGLASS COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 77 FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 79 FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 FIBERGLASS MARKET IN COMPOSITES, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 81 FIBERGLASS COMPOSITES MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 FIBERGLASS COMPOSITES MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2021-2024 (KILOTONS)

- TABLE 83 FIBERGLASS COMPOSITES MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 FIBERGLASS COMPOSITES MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2025-2030 (KILOTONS)

- TABLE 85 FIBERGLASS COMPOSITES MARKET FOR AUTOMOTVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 FIBERGLASS COMPOSITES MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (KILOTONS)

- TABLE 87 FIBERGLASS COMPOSITES MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 FIBERGLASS COMPOSITES MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (KILOTONS)

- TABLE 89 FIBERGLASS COMPOSITES MARKET FOR WIND ENERGY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 FIBERGLASS COMPOSITES MARKET FOR WIND ENERGY, BY REGION, 2021-2024 (KILOTONS)

- TABLE 91 FIBERGLASS COMPOSITES MARKET FOR WIND ENERGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 FIBERGLASS COMPOSITES MARKET FOR WIND ENERGY, BY REGION, 2025-2030 (KILOTONS)

- TABLE 93 FIBERGLASS COMPOSITES MARKET FOR ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 FIBERGLASS COMPOSITES MARKET FOR ELECTRONICS, BY REGION, 2021-2024 (KILOTONS)

- TABLE 95 FIBERGLASS COMPOSITES MARKET FOR ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 FIBERGLASS COMPOSITES MARKET FOR ELECTRONICS, BY REGION, 2025-2030 (KILOTONS)

- TABLE 97 FIBERGLASS COMPOSITES MARKET FOR AEROSPACE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 FIBERGLASS COMPOSITES MARKET FOR AEROSPACE, BY REGION, 2021-2024 (KILOTONS)

- TABLE 99 FIBERGLASS COMPOSITES MARKET FOR AEROSPACE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 FIBERGLASS COMPOSITES MARKET FOR AEROSPACE, BY REGION, 2025-2030 (KILOTONS)

- TABLE 101 FIBERGLASS COMPOSITES MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 FIBERGLASS COMPOSITES MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (KILOTONS)

- TABLE 103 FIBERGLASS COMPOSITES MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 FIBERGLASS COMPOSITES MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (KILOTONS)

- TABLE 105 FIBERGLASS INSULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 FIBERGLASS INSULATION MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 107 FIBERGLASS INSULATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 FIBERGLASS INSULATION MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 109 FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 111 FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 113 FIBERGLASS INSULATION MARKET FOR RESIDENTIAL CONSTRUCTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 FIBERGLASS INSULATION MARKET FOR RESIDENTIAL CONSTRUCTION, BY REGION, 2021-2024 (KILOTONS)

- TABLE 115 FIBERGLASS INSULATION MARKET FOR RESIDENTIAL CONSTRUCTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 FIBERGLASS INSULATION MARKET FOR RESIDENTIAL CONSTRUCTION, BY REGION, 2025-2030 (KILOTONS)

- TABLE 117 FIBERGLASS INSULATION MARKET FOR NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 FIBERGLASS INSULATION MARKET FOR NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2021-2024 (KILOTONS)

- TABLE 119 FIBERGLASS INSULATION MARKET FOR NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 FIBERGLASS INSULATION MARKET FOR NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2025-2030 (KILOTONS)

- TABLE 121 FIBERGLASS INSULATION MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 FIBERGLASS INSULATION MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2021-2024 (KILOTONS)

- TABLE 123 FIBERGLASS INSULATION MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 FIBERGLASS INSULATION MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2025-2030 (KILOTONS)

- TABLE 125 FIBERGLASS INSULATION MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 FIBERGLASS INSULATION MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (KILOTONS)

- TABLE 127 FIBERGLASS INSULATION MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 FIBERGLASS INSULATION MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (KILOTONS)

- TABLE 129 FIBERGLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 FIBERGLASS MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 131 FIBERGLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 132 FIBERGLASS MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 133 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTONS)

- TABLE 135 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTONS)

- TABLE 137 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 139 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 141 NORTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 NORTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (KILOTONS)

- TABLE 143 NORTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 145 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 147 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 149 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 151 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 153 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 155 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 157 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 158 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 159 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 160 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 161 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 162 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 163 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 164 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 165 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 166 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 167 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 168 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 169 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 170 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTONS)

- TABLE 171 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 172 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTONS)

- TABLE 173 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 174 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 175 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 176 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 177 EUROPE: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 178 EUROPE: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (KILOTONS)

- TABLE 179 EUROPE: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 EUROPE: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 181 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 182 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 183 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 184 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 185 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 186 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 187 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 189 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 191 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 192 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 193 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 194 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 195 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 196 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 197 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 198 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 199 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 200 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 201 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 202 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 203 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 204 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 205 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 206 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 207 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 208 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 209 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 210 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 211 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 212 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 213 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 214 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 215 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 216 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 217 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 218 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 219 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 220 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 221 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 222 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTONS)

- TABLE 223 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTONS)

- TABLE 225 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 226 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 227 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 228 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 229 ASIA PACIFIC: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 230 ASIA PACIFIC: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (KILOTONS)

- TABLE 231 ASIA PACIFIC: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 232 ASIA PACIFIC: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 233 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 234 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 235 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 237 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 238 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 239 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 240 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 241 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 242 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 243 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 244 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 245 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 246 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 247 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 248 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 249 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 250 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 251 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 252 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 253 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 254 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 255 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 256 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 257 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 258 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 259 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 260 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 261 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 262 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 263 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 264 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 265 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 266 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 267 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 268 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 269 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 270 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 271 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 272 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 273 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 275 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 277 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 278 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTONS)

- TABLE 279 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 280 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTONS)

- TABLE 281 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 282 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 283 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 284 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 285 SOUTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 286 SOUTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (KILOTONS)

- TABLE 287 SOUTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 288 SOUTH AMERICA: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 289 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 290 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 291 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 292 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 293 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 294 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 295 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 296 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 297 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 298 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 299 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 300 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 301 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 302 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 303 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 304 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 305 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 306 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 307 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 308 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 309 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 310 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 311 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 312 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 313 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 314 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 315 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 316 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 317 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTONS)

- TABLE 319 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTONS)

- TABLE 321 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 323 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 325 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 326 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY APPLICATION, 2021-2024 (KILOTONS)

- TABLE 327 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 328 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 329 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 330 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 331 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 332 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 333 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 334 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTONS)

- TABLE 335 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 336 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 337 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 338 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 339 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 340 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 341 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 342 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 343 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 344 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 345 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 346 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 347 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 348 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 349 REST OF GCC COUNTRIES: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 350 REST OF GCC COUNTRIES: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 351 REST OF GCC COUNTRIES: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 352 REST OF GCC COUNTRIES: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 353 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 354 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 355 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 356 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 357 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 358 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTONS)

- TABLE 359 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 360 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTONS)

- TABLE 361 FIBERGLASS MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2020-JUNE 2025

- TABLE 362 FIBERGLASS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 363 FIBERGLASS MARKET: REGION FOOTPRINT

- TABLE 364 FIBERGLASS MARKET: GLASS TYPE FOOTPRINT

- TABLE 365 FIBERGLASS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 366 FIBERGLASS MARKET: APPLICATION FOOTPRINT

- TABLE 367 FIBERGLASS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 368 FIBERGLASS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 369 FIBERGLASS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 370 FIBERGLASS MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 371 FIBERGLASS MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 372 CHINA JUSHI CO., LTD.: COMPANY OVERVIEW

- TABLE 373 CHINA JUSHI CO., LTD.: PRODUCTS OFFERED

- TABLE 374 CHINA JUSHI CO., LTD.: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 375 CHINA JUSHI CO., LTD.: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 376 OWENS CORNING: COMPANY OVERVIEW

- TABLE 377 OWENS CORNING: PRODUCTS OFFERED

- TABLE 378 OWENS CORNING: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 379 OWENS CORNING: DEALS, JANUARY 2020-JUNE 2025

- TABLE 380 OWENS CORNING: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 381 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 382 SAINT-GOBAIN: PRODUCTS OFFERED

- TABLE 383 SAINT-GOBAIN: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 384 SAINT-GOBAIN: DEALS, JANUARY 2020-JUNE 2025

- TABLE 385 SAINT-GOBAIN: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 386 TAISHAN FIBERGLASS INC. (CTG GROUP): COMPANY OVERVIEW

- TABLE 387 TAISHAN FIBERGLASS INC. (CTG GROUP): PRODUCTS OFFERED

- TABLE 388 TAISHAN FIBERGLASS INC. (CTG GROUP): EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 389 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): COMPANY OVERVIEW

- TABLE 390 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): PRODUCTS OFFERED

- TABLE 391 CHONGQING POLYCOMP INTERNATIONAL CORPORATION (CPIC): PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 392 CHONGQING POLYCOMP INTERNATIONAL CORPORATION (CPIC): DEALS, JANUARY 2020-JUNE 2025

- TABLE 393 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 394 NIPPON ELECTRIC GLASS CO., LTD.: PRODUCTS OFFERED

- TABLE 395 NIPPON ELECTRIC GLASS CO., LTD.: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 396 3B: COMPANY OVERVIEW

- TABLE 397 3B: PRODUCTS OFFERED

- TABLE 398 TAIWAN GLASS IND. CORP.: COMPANY OVERVIEW

- TABLE 399 TAIWAN GLASS IND. CORP.: PRODUCTS OFFERED

- TABLE 400 PFG FIBER GLASS CORPORATION: COMPANY OVERVIEW

- TABLE 401 PFG FIBER GLASS CORPORATION: PRODUCTS OFFERED

- TABLE 402 PFG FIBER GLASS CORPORATION: DEALS, JANUARY 2020-JUNE 2025

- TABLE 403 JOHNS MANVILLE: COMPANY OVERVIEW

- TABLE 404 JOHNS MANVILLE: PRODUCTS OFFERED

- TABLE 405 JOHNS MANVILLE: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 406 AGY: COMPANY OVERVIEW

- TABLE 407 AGY: PRODUCTS OFFERED

- TABLE 408 AGY: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 409 ASAHI FIBER GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 410 ASAHI FIBER GLASS CO., LTD.: PRODUCTS OFFERED

- TABLE 411 ASAHI FIBER GLASS CO., LTD.: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 412 KNAUF INSULATION: COMPANY OVERVIEW

- TABLE 413 KNAUF INSULATION: PRODUCTS OFFERED

- TABLE 414 KNAUF INSULATION: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 415 KCC CORPORATION: COMPANY OVERVIEW

- TABLE 416 KCC CORPORATION: PRODUCTS OFFERED

- TABLE 417 SISECAM: COMPANY OVERVIEW

- TABLE 418 SISECAM: PRODUCTS OFFERED

- TABLE 419 FIBTEX PRODUCTS: COMPANY OVERVIEW

- TABLE 420 DARSHAN SAFETY ZONE: COMPANY OVERVIEW

- TABLE 421 JIANGSU CHANGHAI COMPOSITE MATERIALS HOLDING CO., LTD.: COMPANY OVERVIEW

- TABLE 422 BFG INDUSTRIES: COMPANY OVERVIEW

- TABLE 423 ARABIAN FIBERGLASS INSULATION CO., LTD.: COMPANY OVERVIEW

- TABLE 424 SHREE LAXMI UDYOG: COMPANY OVERVIEW

- TABLE 425 CHONGQING DUJIANG COMPOSITES CO., LTD.: COMPANY OVERVIEW

- TABLE 426 ENVALIOR: COMPANY OVERVIEW

- TABLE 427 MONTEX GLASS FIBRE INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FIBERGLASS MARKET: RESEARCH DESIGN

- FIGURE 2 FIBERGLASS MARKET: BOTTOM-UP APPROACH

- FIGURE 3 FIBERGLASS MARKET: TOP-DOWN APPROACH

- FIGURE 4 FIBERGLASS MARKET: DATA TRIANGULATION

- FIGURE 5 GLASS WOOL AND DIRECT & ASSEMBLED ROVINGS TO HOLD LARGEST MARKET SHARES THROUGHOUT FORECAST PERIOD

- FIGURE 6 COMPOSITES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 7 E-GLASS TO DOMINATE FIBERGLASS MARKET, BY GLASS TYPE, TILL 2030

- FIGURE 8 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE AND GROW AT HIGHEST RATE

- FIGURE 9 FIBERGLASS MARKET TO WITNESS HIGH GROWTH IN ASIA PACIFIC DURING 2025 TO 2030

- FIGURE 10 GLASS WOOL AND ASIA PACIFIC MARKETS HELD LARGEST MARKET SHARE IN 2024, BY VOLUME

- FIGURE 11 E-GLASS TO DOMINATE OVERALL FIBERGLASS MARKET, BY VOLUME

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 FIBERGLASS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 FIBERGLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 16 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 17 FIBERGLASS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 18 FIBERGLASS MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 19 FIBERGLASS MARKET: ECOSYSTEM

- FIGURE 20 AVERAGE SELLING PRICE TREND OF FIBREGLASS, BY REGION, 2023-2024

- FIGURE 21 IMPORT DATA FOR HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 22 EXPORT DATA FOR HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 23 PATENT ANALYSIS, BY PATENT TYPE

- FIGURE 24 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 25 FIBERGLASS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 26 CHINA REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 27 OWENS CORNING INTELLECTUAL CAPITAL LLC REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 28 FIBERGLASS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 29 FIBERGLASS MARKET: DEALS AND FUNDING SOARED IN 2021

- FIGURE 30 YARNS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 E-GLASS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 32 COMPOSITES SEGMENT TO REGISTER HIGHEST CAGR TILL 2030

- FIGURE 33 CHINA TO REGISTER HIGHEST CAGR IN FIBERGLASS MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: FIBERGLASS MARKET SNAPSHOT

- FIGURE 35 EUROPE: FIBERGLASS MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: FIBERGLASS MARKET SNAPSHOT

- FIGURE 37 FIBERGLASS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 38 FIBERGLASS MARKET SHARE ANALYSIS, 2024

- FIGURE 39 FIBERGLASS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 FIBERGLASS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 FIBERGLASS MARKET: COMPANY FOOTPRINT

- FIGURE 42 FIBERGLASS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 FIBERGLASS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 45 FIBERGLASS MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 46 CHINA JUSHI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 OWENS CORNING: COMPANY SNAPSHOT

- FIGURE 48 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 49 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 TAIWAN GLASS IND. CORP.: COMPANY SNAPSHOT

- FIGURE 51 KCC CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 SISECAM: COMPANY SNAPSHOT