|

市场调查报告书

商品编码

1816004

全球农业物联网市场:自动化和控制系统、感测和监控设备、可变速率控制器、RFID 标籤和阅读器、LED 生长灯、暖通空调系统、灌溉系统,预测至 2030 年Agriculture IoT Market by Automation & Control Systems (Drones/UAVs, Guidance & Steering), Sensing & Monitoring Devices, Variable Rate Controllers, RFID Tags & Readers, LED Grow Lights, HVAC Systems, Irrigation Systems Global Forecast to 2030 |

||||||

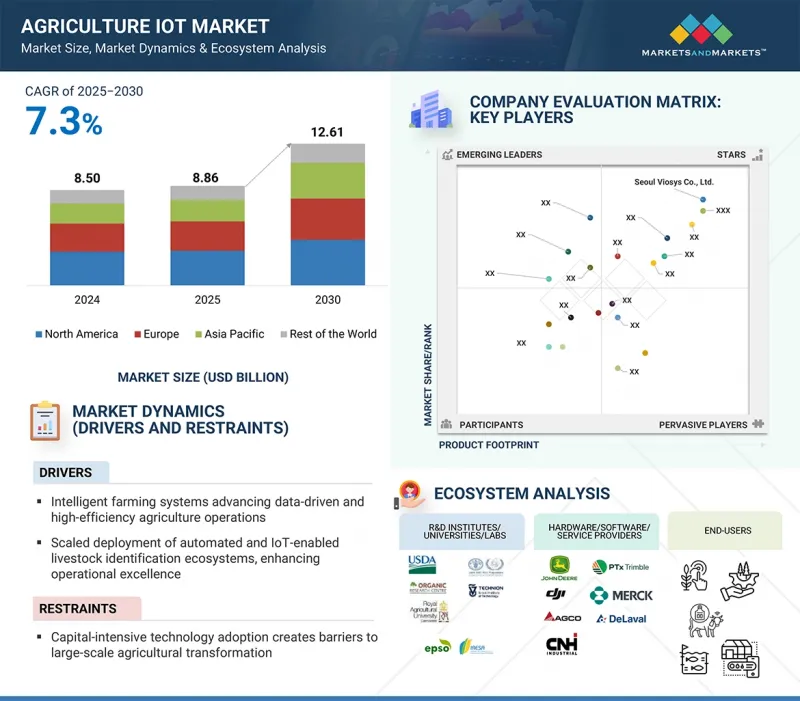

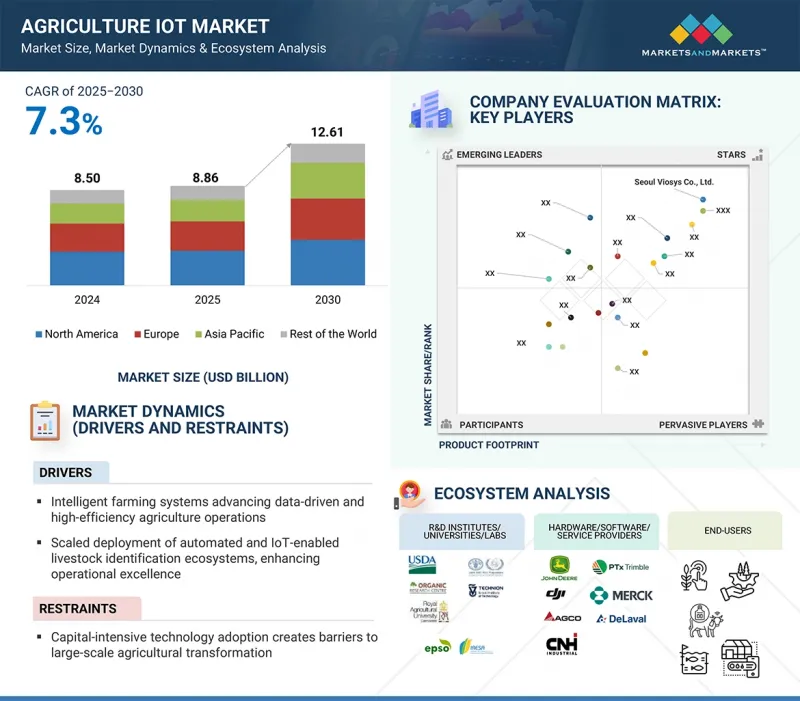

预计到 2025 年全球农业物联网市场规模将达到 88.6 亿美元,到 2030 年将达到 126.1 亿美元,预测期内复合年增长率为 7.3%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 五金、农场规模、农场生产计画、用途、地区 |

| 目标区域 | 北美、欧洲、亚太地区和其他地区 |

精密农业、即时监控和自动化的需求不断增长、政府倡议、无线连接的进步以及为持续满足日益增长的粮食需求而进行的资源优化的需求推动了农业物联网的发展。

“预计自动化和控制系统部门在预测期内将以更高的复合年增长率增长。”

由于无人机/无人驾驶飞行器、智慧灌溉控制器、GPS导航和转向系统等先进自动化工具的日益普及,自动化和控制系统预计将在预测期内成为农业物联网市场中复合年增长率最高的领域。人们对永续农业和高效资源管理的日益关注,正在加速这些技术的整合。此外,政府的大力支持以及主要企业的持续研发和创新正在推动市场扩张。领先的农业技术製造商的不断涌现以及联网机械的使用日益增多,使得农业物联网成为全球农业转型的主要驱动力。

“预计在预测期内,RFID标籤和阅读器部分将占据农业物联网市场的很大份额。”

预计在预测期内,RFID 标籤和读取器领域将在农业物联网市场占据显着份额,这得益于其能够实现实时牲畜追踪、高效牛管理需求不断增长以及在牧场监测和自动饲餵系统中的应用日益广泛。 RFID 标籤读取器使农民能够监测牲畜的健康状况、行为和位置,从而确保最佳生产力和疾病控制。对准确且无化学物质的牲畜识别的需求正在加速普及,因为这些解决方案提供了一种比传统手动方法更安全、更永续的替代方案。此外,由于其体积小巧、数据准确且易于使用,与 GPS、物联网平台和自动称重系统的整合也日益增加。这些特性确保了可靠且有效率的牲畜管理,从而推动了 RFID 技术在各种农业应用中的广泛应用。

“预计在预测期内,中国农业物联网市场的复合年增长率最高。”

中国的成长得益于智慧农业解决方案的快速应用,这得益于政府为农业现代化和改善粮食安全所做的努力。对优化肥料、农药和水资源管理的强劲需求,以及精准农业技术的日益普及,正在推动物联网的普及。感测器、无人机和GPS等先进技术实现了本地化投入,从而提高了作物产量并减少了对环境的影响。这些因素,加上中国对永续资源管理和数位农业政策的重视,显着加速了作物的普及,并促进了中国市场的强劲成长。

本报告研究了全球农业物联网市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 农业物联网市场为企业带来诱人机会

- 精密农业的农业物联网市场:依硬体类型

- 精密农业应用的农业物联网市场(按地区)

- 农业物联网市场牲畜监控硬体类型

第五章 市场概况

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 主要企业农业物联网无人机/无人飞行器价格趋势(2024年)

- 无人机/无人驾驶飞机(UAV)各地区平均销售价格趋势(2021-2024)

- 无人机/无人驾驶飞机(UAV)各地区平均销售价格趋势(2021-2024)

- 价值链分析

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 专利分析

- 贸易分析

- 进口资料(HS编码843280)

- 出口资料(HS编码843280)

- 大型会议和活动(2025-2026)

- 案例研究分析

- 投资金筹措场景

- 关税和监管格局

- 海关分析

- 监管机构、政府机构和其他组织

- 规定

- 波特五力分析

- 主要相关利益者和采购标准

- 人工智慧/生成式人工智慧对农业物联网市场的影响

- 2025年美国关税对农业物联网市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对使用的影响

第六章:农业物联网市场(按硬体)

- 介绍

- 精密农业硬体

- 牲畜监控硬体

- 精密林业硬体

- 精准水产养殖硬件

- 智慧温室硬体

- 其他硬体

第七章农业物联网市场:依应用

- 介绍

- 精密农业

- 牲畜监测

- 精准林业

- 精准水产养殖

- 智慧温室

- 其他用途

8.农业物联网市场(依农场生产计画)

- 介绍

- 前期製作

- 生产

- 后製

第九章农业物联网市场:依农场规模

- 介绍

- 小的

- 中等的

- 大的

第 10 章农业物联网市场:按地区

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 波兰

- 北欧的

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 澳洲

- 印度

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济前景

- 南美洲

- 中东

- 非洲

第十一章 竞争格局

- 概述

- 主要参与企业的策略/优势(2020-2025)

- 市占率分析(2024年)

- 收益分析(2021-2024)

- 公司估值与财务指标(2025年)

- 比较品牌

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十二章:公司简介

- 主要企业

- DEERE & COMPANY

- AGCO CORPORATION

- RAVEN INDUSTRIES, INC.

- DELAVAL

- MERCK & CO., INC.

- AKVA GROUP

- KUBOTA CORPORATION

- INNOVASEA SYSTEMS INC.

- TOPCON

- SCALEAQ

- 其他公司

- TEEJET TECHNOLOGIES

- DICKEY-JOHN

- DJI

- AGEAGLE AERIAL SYSTEMS INC

- HEXAGON AGRICULTURE

- FARMERS EDGE

- ARGUS CONTROL SYSTEMS LIMITED

- EC2CE

- AGRI SPRAY DRONES

- CROPX INC.

- ERUVAKA TECHNOLOGIES

- TEKTELIC COMMUNICATIONS INC.

- ORBCOMM

- GROWFLUX

- PRIVA

第十三章 附录

The agriculture IoT market is expected to be valued at USD 8.86 billion in 2025 and is projected to reach USD 12.61 billion by 2030; it is expected to register a CAGR of 7.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By hardware, farm size, farm production planning, application, and region |

| Regions covered | North America, Europe, APAC, RoW |

The growth of agriculture IoT is driven by rising demand for precision farming, real-time monitoring, and automation, supported by government initiatives, wireless connectivity advancements, and the need for resource optimization to meet increasing food demand sustainably.

"Automation & control systems segment is expected to grow at a higher CAGR during the forecast period."

The automation & control systems are expected to witness the highest CAGR in the agriculture IoT market during the forecast period due to rising adoption of advanced automation tools such as drones/UAVs, smart irrigation controllers, GPS-based guidance, and steering systems. Increasing focus on sustainable farming and efficient resource management has accelerated the integration of these technologies. Additionally, strong government support, coupled with ongoing R&D and innovations by key players, is boosting market expansion. The presence of leading agri-tech manufacturers and the growing use of connected machinery are positioning agriculture IoT as a major driver of global farming transformation.

"RFID tags & readers segment is expected to hold a significant share of the agriculture IoT market during the forecast period."

RFID tags & readers segment is expected to hold a significant share of the agriculture IoT market during the forecast period due to their ability to enable real-time livestock tracking, rising demand for efficient herd management, and growing adoption in pasture monitoring and automated feeding systems. RFID tags & readers allow farmers to monitor animal health, behavior, and location, ensuring optimal productivity and disease control. The demand for accurate and chemical-free livestock identification is accelerating adoption, as these solutions offer a safer and more sustainable alternative to traditional manual methods. Furthermore, integration with GPS, IoT platforms, and automated weighing systems is increasing due to their compact size, data accuracy, and ease of use. These features ensure reliable and efficient livestock management, contributing to the growing adoption of RFID technology in diverse agricultural applications.

"China is expected to register the highest CAGR in the agriculture IoT market during the forecast period."

China is expected to register the highest CAGR in the agriculture IoT market during the forecast period. This growth in China is driven by the rapid adoption of smart farming solutions, supported by government initiatives to modernize agriculture and improve food security. Increasing use of precision farming practices, coupled with strong demand for optimized fertilizer, pesticide, and water management, is fueling IoT adoption. Advanced technologies such as sensors, drones, and GPS are enabling site-specific input applications that enhance crop yield and reduce environmental impact. These factors, along with China's focus on sustainable resource management and digital agriculture policies, are significantly accelerating adoption and contributing to the country's strong market growth.

Extensive primary interviews were conducted with key industry experts in the agriculture IoT market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type- Tier 1 - 20%, Tier 2 - 35%, Tier 3 - 45%

- By Designation- C-level Executives - 35%, Directors - 25%, Others - 40%

- By Reion- North America- 45%, Europe - 25%, Asia Pacific - 20%, and RoW - 10%

The agriculture IoT market is dominated by a few globally established players, such as Deere & Company (US), AGCO Corporation (US), Raven Industries, Inc. (US), DeLaval (Sweden), Merck & Co., Inc. (US).

The study includes an in-depth competitive analysis of these key players in the agriculture IoT market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the agriculture IoT market and forecasts its size by application (Precision farming, precision forestry, smart greenhouse, livestock monitoring, precision aquaculture, other applications), hardware (Precision farming hardware, precision forestry hardware, livestock monitoring hardware, precision aquaculture hardware, smart greenhouse hardware, other agriculture hardware), farm size (Small farms, medium- sized farms, large farms), Farm Production Planning (Pre-production planning, production planning, post-production planning). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across Region (North America, Europe, Asia Pacific, RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the agriculture IoT ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Intelligent Farming Systems Advancing Data-Driven and High-Efficiency Agriculture Operations, Scaled Deployment of Automated and IoT-Enabled Livestock Identification Ecosystems Enhancing Operational Excellence, Robust Policy Frameworks and Regulatory Tailwinds Catalyzing AgriTech Expansion), restraint (Capital-Intensive Technology Adoption Creating Barriers to Large-Scale Agricultural Transformation, Talent and Capability Gaps Hindering Advanced Farming Technology Deployment at Scale, Sustainability Risks Arising from Environmental Durability Limitations in Agricultural Innovations), opportunities (Capital-Intensive Technology Adoption Creating Barriers to Large-Scale Agricultural Transformation, Talent and Capability Gaps Hindering Advanced Farming Technology Deployment at Scale, Sustainability Risks Arising from Environmental Durability Limitations in Agricultural Innovations), challenges (Capital-Intensive Technology Adoption Creating Barriers to Large-Scale Agricultural Transformation, Talent and Capability Gaps Hindering Advanced Farming Technology Deployment at Scale, Sustainability Risks Arising from Environmental Durability Limitations in Agricultural Innovations)

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product launches in the agriculture IoT market

- Market Development: Comprehensive information about lucrative markets - the report analyses the agriculture IoT market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the agriculture IoT market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the agriculture IoT market, such as Deere & Company (US), AGCO Corporation (US), Raven Industries, Inc. (US), DeLaval (Sweden), and Merck & Co., Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Breakdown of primaries

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURE IOT MARKET

- 4.2 AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY HARDWARE TYPE

- 4.3 AGRICULTURE IOT MARKET FOR PRECISION FARMING APPLICATION, BY REGION

- 4.4 AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING HARDWARE, BY TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid advances in digital technologies, automation, and data analytics

- 5.2.1.2 Adoption of automation technology and IoT-enabled devices

- 5.2.1.3 Regulations focusing on agriculture digitization, building data infrastructure, and adopting climate-responsive budgeting

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront capital expenditure

- 5.2.2.2 Lack of technical expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of VRA technology

- 5.2.3.2 Shift toward hyper-localized and data-validated decision making

- 5.2.3.3 Advent of nanotechnology in precision agriculture

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns regarding agricultural data privacy

- 5.2.4.2 Limited digital infrastructure in rural areas

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING TREND OF AGRICULTURE IOT DRONES/UAVS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF DRONES/UAVS, BY REGION, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF DRONES/UAVS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Satellite imaging & GPS

- 5.7.1.2 Agricultural drones

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Blockchain technology

- 5.7.2.2 Digital twin

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Climate tech & agri-climate modeling

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA (HS CODE 843280)

- 5.9.2 EXPORT DATA (HS CODE 843280)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SYNGENTA ADVANCES PRECISION FARMING WITH SATELLITE INSIGHTS VIA PLANET LABS PBC PARTNERSHIP

- 5.11.2 TELNYX IOT SENSORS OPTIMIZE FRUIT YIELD AND MINIMIZE WASTE THROUGH REAL-TIME DATA IN AGRICULTURE

- 5.11.3 FARMONAUT TECHNOLOGIES PVT. LTD. EMPOWERS CALIFORNIA AGRICULTURE WITH DRONE-ENABLED PRECISION FARMING FOR ENHANCED CROP HEALTH AND EFFICIENCY

- 5.11.4 PRECISION AGRICULTURE ENHANCES COTTON YIELDS IN PARBHANI THROUGH DIGITAL INNOVATION

- 5.11.5 DJI AGRAS T40 TRANSFORMS SUGARCANE WEED MANAGEMENT

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON AGRICULTURE IOT MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF ON AGRICULTURE IOT MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 AGRICULTURE IOT MARKET, BY HARDWARE

- 6.1 INTRODUCTION

- 6.2 PRECISION FARMING HARDWARE

- 6.2.1 AUTOMATION & CONTROL SYSTEMS

- 6.2.1.1 Drones/UAVs

- 6.2.1.1.1 Ability to offer aerial data for crop health assessment to boost demand

- 6.2.1.2 Irrigation controllers

- 6.2.1.2.1 Limited water availability and depleted aquifers to foster segmental growth

- 6.2.1.3 GPS/GNSS trackers

- 6.2.1.3.1 Increasing demand for precise navigation and positioning for farming equipment to fuel market growth

- 6.2.1.4 Guidance & steering

- 6.2.1.4.1 Growing pressure to cut fuel and input costs to boost demand

- 6.2.1.5 Other automation & control systems

- 6.2.1.1 Drones/UAVs

- 6.2.2 SENSING & MONITORING DEVICES

- 6.2.2.1 Yield monitors

- 6.2.2.1.1 Rising demand for real-time data on crop yields and moisture content during harvest to boost demand

- 6.2.2.2 Soil sensors

- 6.2.2.2.1 Increasing need to monitor moisture, temperature, and pH to foster market growth

- 6.2.2.3 Climate sensors

- 6.2.2.3.1 Rising frequency of extreme weather events to fuel market growth

- 6.2.2.4 Water sensors

- 6.2.2.4.1 Need for efficient water management and reduced water waste to boost demand

- 6.2.2.1 Yield monitors

- 6.2.1 AUTOMATION & CONTROL SYSTEMS

- 6.3 LIVESTOCK MONITORING HARDWARE

- 6.3.1 RFID TAGS & READERS

- 6.3.1.1 Need to monitor livestock behavior and health to boost demand

- 6.3.2 SENSORS

- 6.3.2.1 Growing need to track animals' location, temperature, and blood pressure to drive market

- 6.3.3 CAMERAS

- 6.3.3.1 Integration with AI to offer lucrative growth opportunities

- 6.3.4 GPS TRACKERS

- 6.3.4.1 Ability to track spatial movements and activities to fuel market growth

- 6.3.1 RFID TAGS & READERS

- 6.4 PRECISION FORESTRY HARDWARE

- 6.4.1 HARVESTERS & FORWARDERS

- 6.4.1.1 Increasing demand for efficient harvesting and transportation of trees to fuel market growth

- 6.4.2 UAVS/DRONES

- 6.4.2.1 Government-led initiatives for reforestation to support segmental growth

- 6.4.3 GPS TRACKERS

- 6.4.3.1 Ability to provide real-time sub-meter or centimeter-level positioning to boost demand

- 6.4.4 CAMERAS

- 6.4.4.1 Advancements and reduced costs of imaging sensors to support market growth

- 6.4.5 RFID SENSORS

- 6.4.5.1 Increasing demand for growth and health data of trees and environmental conditions to drive market

- 6.4.6 VARIABLE RATE CONTROLLERS

- 6.4.6.1 Integration with advanced ground-based machinery to offer lucrative growth opportunities

- 6.4.7 OTHER PRECISION FORESTRY HARDWARE

- 6.4.1 HARVESTERS & FORWARDERS

- 6.5 PRECISION AQUACULTURE HARDWARE

- 6.5.1 SENSORS

- 6.5.1.1 Enhanced fish health and optimized production processes to drive market

- 6.5.1.2 Temperature & environmental monitoring devices

- 6.5.1.3 pH & dissolved oxygen sensors

- 6.5.1.4 Electricity conductivity sensors

- 6.5.2 CAMERAS

- 6.5.2.1 Need to monitor feeding response, feeding rates, and fish behavior to boost demand

- 6.5.3 CONTROL SYSTEMS

- 6.5.3.1 Streamlined management of camera operations to drive market

- 6.5.4 OTHER PRECISION FORESTRY HARDWARE

- 6.5.1 SENSORS

- 6.6 SMART GREENHOUSE HARDWARE

- 6.6.1 HVAC SYSTEMS

- 6.6.1.1 Rising demand for sustainable and cost-effective agricultural practices to fuel market growth

- 6.6.2 LED GROW LIGHTS

- 6.6.2.1 Ability to offer enhanced crop yields to foster market growth

- 6.6.3 IRRIGATION SYSTEMS

- 6.6.3.1 Growing emphasis on sustainable water management to drive market

- 6.6.4 CONTROL SYSTEMS

- 6.6.4.1 Minimized environmental fluctuations and reduced crop damage risks to boost demand

- 6.6.5 SENSORS & CAMERAS

- 6.6.5.1 Reduced farming costs and time to boost demand

- 6.6.1 HVAC SYSTEMS

- 6.7 OTHER HARDWARE

7 AGRICULTURE IOT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PRECISION FARMING

- 7.2.1 GROWING NEED TO OPTIMIZE AGRICULTURAL PRODUCTION TO DRIVE MARKET

- 7.2.2 YIELD MONITORING

- 7.2.2.1 On-farm yield monitoring

- 7.2.2.2 Off-farm yield monitoring

- 7.2.3 CROP SCOUTING

- 7.2.4 FIELD MAPPING

- 7.2.4.1 Boundary mapping

- 7.2.4.2 Drainage mapping

- 7.2.5 VARIABLE RATE APPLICATION

- 7.2.5.1 Precision irrigation

- 7.2.5.2 Precision seeding

- 7.2.5.3 Precision fertilization

- 7.2.5.4 Pesticide VRA

- 7.2.6 WEATHER TRACKING & FORECASTING

- 7.2.6.1 Inventory management

- 7.2.6.2 Farm labor management

- 7.2.6.3 Financial management

- 7.2.7 OTHER PRECISION FARMING APPLICATIONS

- 7.3 LIVESTOCK MONITORING

- 7.3.1 RISING EMPHASIS ON ENHANCING FARM ANIMALS' HEALTH AND PRODUCTIVITY TO FUEL MARKET GROWTH

- 7.3.2 MILK HARVESTING MANAGEMENT

- 7.3.3 FEEDING MANAGEMENT

- 7.3.4 BEHAVIOR MONITORING & CONTROL

- 7.3.5 OTHER LIVESTOCK MONITORING APPLICATIONS

- 7.4 PRECISION FORESTRY

- 7.4.1 INTEGRATION WITH REMOTE SENSING DATA TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.4.2 GENETICS & NURSERIES

- 7.4.3 SILVICULTURE & FIRE MANAGEMENT

- 7.4.4 HARVESTING MANAGEMENT

- 7.4.5 INVENTORY & LOGISTICS MANAGEMENT

- 7.5 PRECISION AQUACULTURE

- 7.5.1 GROWING APPLICATION OF ADVANCED TECHNOLOGY AND DATA ANALYTICS TO DRIVE MARKET

- 7.5.2 FEEDING MANAGEMENT

- 7.5.3 MONITORING, CONTROL, & SURVEILLANCE

- 7.5.4 OTHER PRECISION AQUACULTURE APPLICATIONS

- 7.6 SMART GREENHOUSE

- 7.6.1 RISING NEED TO REGULATE CRITICAL ENVIRONMENTAL FACTORS TO FUEL SEGMENTAL GROWTH

- 7.6.2 HVAC MANAGEMENT

- 7.6.3 YIELD MONITORING & HARVESTING

- 7.6.4 WATER & FERTILIZER MANAGEMENT

- 7.6.5 OTHER SMART GREENHOUSE APPLICATIONS

- 7.7 OTHER APPLICATIONS

8 AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING

- 8.1 INTRODUCTION

- 8.2 PRE-PRODUCTION

- 8.2.1 NEED TO ANALYZE SOIL MOISTURE AND NUTRIENT LEVELS TO BOOST DEMAND

- 8.3 PRODUCTION

- 8.3.1 REDUCED DOWNTIME DURING HARVESTING PERIOD TO FOSTER MARKET GROWTH

- 8.4 POST-PRODUCTION

- 8.4.1 RISING DEMAND FOR ON-TIME DELIVERY WHILE REDUCING FUEL COSTS TO DRIVE MARKET

9 AGRICULTURE IOT MARKET, BY FARM SIZE

- 9.1 INTRODUCTION

- 9.2 SMALL

- 9.2.1 RISE OF PLUG-AND-PLAY IOT KITS AND PAY-AS-YOU-GO SERVICE MODELS TO DRIVE MARKET

- 9.3 MEDIUM

- 9.3.1 INCREASING ADOPTION OF PREDICTIVE ANALYTICS TO MANAGE CROP CYCLES TO FUEL MARKET GROWTH

- 9.4 LARGE

- 9.4.1 DEPLOYMENT OF COMPREHENSIVE SENSOR NETWORKS FOR SOIL, WEATHER, AND CROP HEALTH MONITORING TO FOSTER MARKET GROWTH

10 AGRICULTURE IOT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Emphasis on advancing engineering and agronomy practices to boost demand

- 10.2.2.2 Canada

- 10.2.2.2.1 Growing demand for advanced livestock identification and monitoring solutions to foster market growth

- 10.2.2.3 Mexico

- 10.2.2.3.1 Government-backed financial support to encourage adoption of agriculture IoT technologies to fuel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing funding to improve livestock farming practices to drive market

- 10.3.3 UK

- 10.3.3.1 Strong political and commercial support for precision farming to fuel market growth

- 10.3.4 FRANCE

- 10.3.4.1 Growing need for environmental conservation to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Financial aid for farmers to invest in modern technologies to fuel market growth

- 10.3.6 NETHERLANDS

- 10.3.6.1 Emphasis on standardizing agricultural practices across different technologies to drive market

- 10.3.7 POLAND

- 10.3.7.1 Focus on complying with EU standards and offering cost-effective solutions to drive market

- 10.3.8 NORDICS

- 10.3.8.1 Strong commitment to environmental sustainability to drive market

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Shift from subsistence farming to market-oriented model to offer lucrative growth opportunities

- 10.4.3 JAPAN

- 10.4.3.1 Expanding aging population to boost demand

- 10.4.4 AUSTRALIA

- 10.4.4.1 Emphasis on obtaining data-driven decisions to improve field productivity to fuel market growth

- 10.4.5 INDIA

- 10.4.5.1 Emergence of startups that support site-specific management of agriculture and livestock to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing investments in aquaculture industry to support market growth

- 10.4.7 INDONESIA

- 10.4.7.1 Rising popularity of agritech platforms with affordable and IoT-driven services to fuel market growth

- 10.4.8 MALAYSIA

- 10.4.8.1 Growing adoption of smart farming technologies to foster market growth

- 10.4.9 THAILAND

- 10.4.9.1 Increasing application of drones for crop monitoring and precision spraying to drive market

- 10.4.10 VIETNAM

- 10.4.10.1 Deployment of sensor networks to monitor water quality to support market growth

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Brazil

- 10.5.2.1.1 Presence of fertile soil and skilled labor to favor market growth

- 10.5.2.2 Argentina

- 10.5.2.2.1 Relaxed government export regulations and production innovations to boost demand

- 10.5.2.3 Rest of South America

- 10.5.2.1 Brazil

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Bahrain

- 10.5.3.1.1 Growing popularity of vertical farming and hydroponics to drive market

- 10.5.3.2 Kuwait

- 10.5.3.2.1 Increasing investment in plant and protein production to boost demand

- 10.5.3.3 Oman

- 10.5.3.3.1 Emphasis on achieving long-term food security and sustainability to offer lucrative growth opportunities

- 10.5.3.4 Qatar

- 10.5.3.4.1 Adoption of smart agriculture technologies to drive market

- 10.5.3.5 Saudi Arabia

- 10.5.3.5.1 Increasing investments to boost sustainable food production to drive market

- 10.5.3.6 UAE

- 10.5.3.6.1 Growing focus on commercializing technologies for arid climates to fuel market growth

- 10.5.3.7 Rest of Middle East

- 10.5.3.1 Bahrain

- 10.5.4 AFRICA

- 10.5.4.1 South Africa

- 10.5.4.1.1 Rising need to optimize irrigation and manage crop health to drive market

- 10.5.4.2 Rest of Africa

- 10.5.4.1 South Africa

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2021-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Farm production planning footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 Farm size footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DEERE & COMPANY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 AGCO CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 RAVEN INDUSTRIES, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 DELAVAL

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 MERCK & CO., INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 AKVA GROUP

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Expansions

- 12.1.6.3.3 Other developments

- 12.1.7 KUBOTA CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 INNOVASEA SYSTEMS INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 TOPCON

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 SCALEAQ

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 DEERE & COMPANY

- 12.2 OTHER PLAYERS

- 12.2.1 TEEJET TECHNOLOGIES

- 12.2.2 DICKEY-JOHN

- 12.2.3 DJI

- 12.2.4 AGEAGLE AERIAL SYSTEMS INC

- 12.2.5 HEXAGON AGRICULTURE

- 12.2.6 FARMERS EDGE

- 12.2.7 ARGUS CONTROL SYSTEMS LIMITED

- 12.2.8 EC2CE

- 12.2.9 AGRI SPRAY DRONES

- 12.2.10 CROPX INC.

- 12.2.11 ERUVAKA TECHNOLOGIES

- 12.2.12 TEKTELIC COMMUNICATIONS INC.

- 12.2.13 ORBCOMM

- 12.2.14 GROWFLUX

- 12.2.15 PRIVA

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 AGRICULTURE IOT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 AGRICULTURE IOT MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 AGRICULTURE IOT MARKET: RISK ANALYSIS

- TABLE 4 PRICING TREND OF AGRICULTURE IOT DRONES/UAVS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF DRONES/UAVS, BY REGION, 2021-2024 (USD)

- TABLE 6 ROLE OF KEY PLAYERS IN AGRICULTURE IOT ECOSYSTEM

- TABLE 7 LIST OF KEY PATENTS, 2023-2025

- TABLE 8 IMPORT DATA FOR HS CODE 843280-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 9 EXPORT DATA HS CODE 843280-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 MFN TARIFF FOR HS CODE 843280-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2025

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 AGRICULTURE IOT MARKET: REGULATIONS

- TABLE 17 AGRICULTURE IOT MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 AGRICULTURE IOT MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 22 AGRICULTURE IOT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 23 PRECISION FARMING HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 PRECISION FARMING HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 PRECISION FARMING HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 PRECISION FARMING HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 AUTOMATION & CONTROL SYSTEMS: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 AUTOMATION & CONTROL SYSTEMS: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 AUTOMATION & CONTROL SYSTEMS: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY DRONES/UAVS, 2021-2024 (THOUSAND UNITS)

- TABLE 30 AUTOMATION & CONTROL SYSTEMS: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY DRONES/UAVS, 2025-2030 (THOUSAND UNITS)

- TABLE 31 SENSING & MONITORING DEVICES: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 SENSING & MONITORING DEVICES: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 LIVESTOCK MONITORING HARDWARE, AGRICULTURE IOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 LIVESTOCK MONITORING HARDWARE, AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 LIVESTOCK MONITORING HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 LIVESTOCK MONITORING HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 PRECISION FORESTRY HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 PRECISION FORESTRY HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 PRECISION FORESTRY HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 PRECISION FORESTRY HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 PRECISION AQUACULTURE HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 PRECISION AQUACULTURE HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 PRECISION AQUACULTURE HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 PRECISION AQUACULTURE HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SMART GREENHOUSE HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 SMART GREENHOUSE HARDWARE: AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 SMART GREENHOUSE HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 SMART GREENHOUSE HARDWARE: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OTHER HARDWARE, AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 OTHER HARDWARE, AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 52 AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 PRECISION FARMING: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 PRECISION FARMING: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 EUROPE: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 EUROPE: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 ROW: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 ROW: AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 LIVESTOCK MONITORING: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 LIVESTOCK MONITORING: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 EUROPE: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 EUROPE: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 ROW: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 ROW: AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 PRECISION FORESTRY: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 PRECISION FORESTRY: AGRICULTURE IOT MARKET, BY REGIONPRECISION AQUACULTURE, AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION), 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 ROW: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 ROW: AGRICULTURE IOT MARKET FOR PRECISION FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 PRECISION AQUACULTURE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 PRECISION AQUACULTURE: AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 ROW: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 ROW: AGRICULTURE IOT MARKET FOR PRECISION AQUACULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 SMART GREENHOUSE: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 SMART GREENHOUSE: AGRICULTURE IOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 ROW: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 ROW: AGRICULTURE IOT MARKET FOR SMART GREENHOUSE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 OTHER APPLICATIONS: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 ROW: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 ROW: AGRICULTURE IOT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING, 2021-2024 (USD MILLION)

- TABLE 114 AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING, 2025-2030 (USD MILLION)

- TABLE 115 PRECISION FARMING: AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING, 2021-2024 (USD MILLION)

- TABLE 116 PRECISION FARMING: AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING, 2025-2030(USD MILLION)

- TABLE 117 PRECISION FORESTRY: AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING, 2021-2024 (USD MILLION)

- TABLE 118 PRECISION FORESTRY: AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING, 2025-2030(USD MILLION)

- TABLE 119 AGRICULTURE IOT MARKET, BY FARM SIZE, 2021-2024 (USD MILLION)

- TABLE 120 AGRICULTURE IOT MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 121 PRECISION FARMING: AGRICULTURE IOT MARKET, BY FARM SIZE, 2021-2024 (USD MILLION)

- TABLE 122 PRECISION FARMING: AGRICULTURE IOT MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 123 PRECISION FORESTRY: AGRICULTURE IOT MARKET, BY FARM SIZE, 2021-2024 (USD MILLION)

- TABLE 124 PRECISION FORESTRY: AGRICULTURE IOT MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 125 AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: AGRICULTURE IOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: AGRICULTURE IOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: AGRICULTURE IOT MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 130 NORTH AMERICA: AGRICULTURE IOT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 131 US: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 US: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 CANADA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 CANADA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 MEXICO: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 MEXICO: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: AGRICULTURE IOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: AGRICULTURE IOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: AGRICULTURE IOT MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: AGRICULTURE IOT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 141 GERMANY: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 GERMANY: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 UK: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 UK: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 FARNCE: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 FARNCE: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 ITALY: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 ITALY: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 NETHERLANDS: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 NETHERLANDS: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 POLAND: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 152 POLAND: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 NORDICS: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 NORDICS: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 REST OF EUROPE: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 REST OF EUROPE: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AGRICULTURE IOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AGRICULTURE IOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AGRICULTURE IOT MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AGRICULTURE IOT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 161 CHINA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 162 CHINA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 JAPAN: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 164 JAPAN: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 AUSTRALIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 166 AUSTRALIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 INDIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 168 INDIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 SOUTH KOREA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 INDONESIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 INDONESIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 MALAYSIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 MALAYSIA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 THAILAND: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 176 THAILAND: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 VIETNAM: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 178 VIETNAM: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 ROW: AGRICULTURE IOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 182 ROW: AGRICULTURE IOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 183 ROW: AGRICULTURE IOT MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 184 ROW: AGRICULTURE IOT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: AGRICULTURE IOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: AGRICULTURE IOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST: AGRICULTURE IOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST: AGRICULTURE IOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 AFRICA: AGRICULTURE IOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 194 AFRICA: AGRICULTURE IOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 AFRICA: AGRICULTURE IOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 196 AFRICA: AGRICULTURE IOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 AGRICULTURE IOT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, MARCH 2020-JUNE 2025

- TABLE 198 AGRICULTURE IOT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 199 AGRICULTURE IOT MARKET: REGION FOOTPRINT

- TABLE 200 AGRICULTURE IOT MARKET: FARM PRODUCTION PLANNING FOOTPRINT

- TABLE 201 AGRICULTURE IOT MARKET: APPLICATION FOOTPRINT

- TABLE 202 AGRICULTURE IOT MARKET: FARM SIZE FOOTPRINT

- TABLE 203 AGRICULTURE IOT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 204 AGRICULTURE IOT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 205 AGRICULTURE IOT MARKET: PRODUCT LAUNCHES, MARCH 2020-JUNE 2025

- TABLE 206 AGRICULTURE IOT MARKET: DEALS, MARCH 2020-JUNE 2025

- TABLE 207 AGRICULTURE IOT MARKET: OTHER DEVELOPMENTS, MARCH 2020-JUNE 2025

- TABLE 208 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 209 DEERE & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 211 DEERE & COMPANY: DEALS

- TABLE 212 AGCO CORPORATION: COMPANY OVERVIEW

- TABLE 213 AGCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 AGCO CORPORATION: PRODUCT LAUNCHES

- TABLE 215 AGCO CORPORATION: DEALS

- TABLE 216 RAVEN INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 217 RAVEN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 RAVEN INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 219 RAVEN INDUSTRIES, INC.: DEALS

- TABLE 220 DELAVAL: COMPANY OVERVIEW

- TABLE 221 DELAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 DELAVAL: PRODUCT LAUNCHES

- TABLE 223 DELAVAL: DEALS

- TABLE 224 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 225 MERCK & CO., INC.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 226 MERCK & CO., INC.: PRODUCT LAUNCHES

- TABLE 227 MERCK & CO., INC.: DEALS

- TABLE 228 AKVA GROUP: COMPANY OVERVIEW

- TABLE 229 AKVA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 AKVA GROUP: DEALS

- TABLE 231 AKVA GROUP: EXPANSIONS

- TABLE 232 AKVA GROUP: OTHER DEVELOPMENTS

- TABLE 233 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 234 KUBOTA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 KUBOTA CORPORATION: DEALS

- TABLE 236 INNOVASEA SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 237 INNOVASEA SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 INNOVASEA SYSTEMS INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 239 INNOVASEA SYSTEMS INC.: DEALS

- TABLE 240 TOPCON: COMPANY OVERVIEW

- TABLE 241 TOPCON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 TOPCON: DEALS

- TABLE 243 SCALEAQ: COMPANY OVERVIEW

- TABLE 244 SCALEAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 AGRICULTURE IOT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AGRICULTURE IOT MARKET: RESEARCH DESIGN

- FIGURE 3 AGRICULTURE IOT MARKET: RESEARCH APPROACH

- FIGURE 4 REVENUE GENERATED FROM SALES OF AGRICULTURE IOT SERVICES

- FIGURE 5 AGRICULTURE IOT MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 6 AGRICULTURE IOT MARKET: BOTTOM-UP APPROACH

- FIGURE 7 AGRICULTURE IOT MARKET: TOP-DOWN APPROACH

- FIGURE 8 AGRICULTURE IOT MARKET: DATA TRIANGULATION

- FIGURE 9 AGRICULTURE IOT MARKET, 2021-2030 (USD BILLION)

- FIGURE 10 MEDIUM SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 PRECISION FARMING HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 PRECISION AQUACULTURE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 PRE-PRODUCTION SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA TO DOMINATE MARKET IN 2025

- FIGURE 15 GOVERNMENT INCENTIVES FOR SMART FARMING AND ADVANCEMENTS IN AI AND ML TO FOSTER MARKET GROWTH

- FIGURE 16 AUTOMATION & CONTROL SYSTEMS TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 17 NORTH AMERICA TO SECURE LARGEST MARKET SHARE IN 2025

- FIGURE 18 GPS TRACKER TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 AGRICULTURE IOT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 DRIVERS: AGRICULTURE IOT MARKET

- FIGURE 21 RESTRAINTS: AGRICULTURE IOT MARKET

- FIGURE 22 OPPORTUNITIES: AGRICULTURE IOT MARKET

- FIGURE 23 CHALLENGES: AGRICULTURE IOT MARKET

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 PRICING TREND OF AGRICULTURE IOT DRONES/UAVS, BY KEY PLAYER, 2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF DRONES/UAVS, BY REGION, 2021-2024

- FIGURE 27 AGRICULTURE IOT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 AGRICULTURE IOT ECOSYSTEM

- FIGURE 29 PATENTS APPLIED AND GRANTED IN AGRICULTURE IOT MARKET, 2015-2024

- FIGURE 30 IMPORT DATA HS CODE 843280-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 31 EXPORT SCENARIO FOR HS CODE 843280-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 33 AGRICULTURE IOT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 36 IMPACT OF GEN AI/AI ON AGRICULTURE IOT MARKET

- FIGURE 37 PRECISION FARMING HARDWARE TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 38 DRONES/UAVS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 39 RFID TAGS & READERS TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 40 NORTH AMERICA TO CAPTURE LARGEST MARKET SHARE OF PRECISION FORESTRY SEGMENT IN 2030

- FIGURE 41 PRECISION FARMING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 42 NORTH AMERICA TO CLAIM LARGEST MARKET SHARE FOR PRECISION FARMING APPLICATIONS IN 2030

- FIGURE 43 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE IN LIVESTOCK MONITORING APPLICATIONS IN 2030

- FIGURE 44 NORTH AMERICA TO DOMINATE PRECISION FORESTRY APPLICATIONS IN 2025

- FIGURE 45 ASIA PACIFIC TO RECORD HIGHEST CAGR FOR PRECISION AQUACULTURE APPLICATIONS DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA TO CAPTURE LARGEST MARKET SHARE FOR SMART GREENHOUSE APPLICATIONS IN 2025

- FIGURE 47 NORTH AMERICA TO LEAD OTHER APPLICATIONS SEGMENT IN 2030

- FIGURE 48 PRE-PRODUCTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 MEDIUM-SIZED SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 51 NORTH AMERICA: AGRICULTURE IOT MARKET SNAPSHOT

- FIGURE 52 PRECISION FARMING TO ACCOUNT FOR LARGEST SHARE IN NORTH AMERICAN MARKET IN 2025

- FIGURE 53 EUROPE: AGRICULTURE IOT MARKET SNAPSHOT

- FIGURE 54 PRECISION AQUACULTURE HARDWARE SEGMENT TO REGISTER HIGHEST CAGR IN EUROPE DURING FORECAST PERIOD

- FIGURE 55 ASIA PACIFIC: AGRICULTURE IOT MARKET SNAPSHOT

- FIGURE 56 PRECISION AQUACULTURE HARDWARE SEGMENT TO REGISTER HIGHEST CAGR IN ASIA PACIFIC AGRICULTURE IOT MARKET

- FIGURE 57 PRECISION FARMING HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN ROW IN 2030

- FIGURE 58 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 59 AGRICULTURE IOT MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2021-2024

- FIGURE 60 COMPANY VALUATION, 2025

- FIGURE 61 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 62 BRAND COMPARISON

- FIGURE 63 AGRICULTURE IOT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 64 AGRICULTURE IOT MARKET: COMPANY FOOTPRINT

- FIGURE 65 AGRICULTURE IOT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 66 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 67 AGCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 RAVEN INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 69 DELAVAL (TETRA PAK INTERNATIONAL S.A.): COMPANY SNAPSHOT

- FIGURE 70 MERCK & CO., INC.: COMPANY SNAPSHOT

- FIGURE 71 AKVA GROUP: COMPANY SNAPSHOT

- FIGURE 72 KUBOTA CORPORATION: COMPANY SNAPSHOT