|

市场调查报告书

商品编码

1819092

拉丁美洲输液帮浦市场(按产品、应用和最终用户划分)-预测至2030年Latin America Infusion Pump Market by Product (Accessories & Consumables, Devices (Volumetric, Insulin, Syringe, Ambulatory, PCA)), Application (Chemotherapy, Diabetes, Analgesia, Pediatrics, Hematology), End User (Hospitals) - Global Forecast to 2030 |

||||||

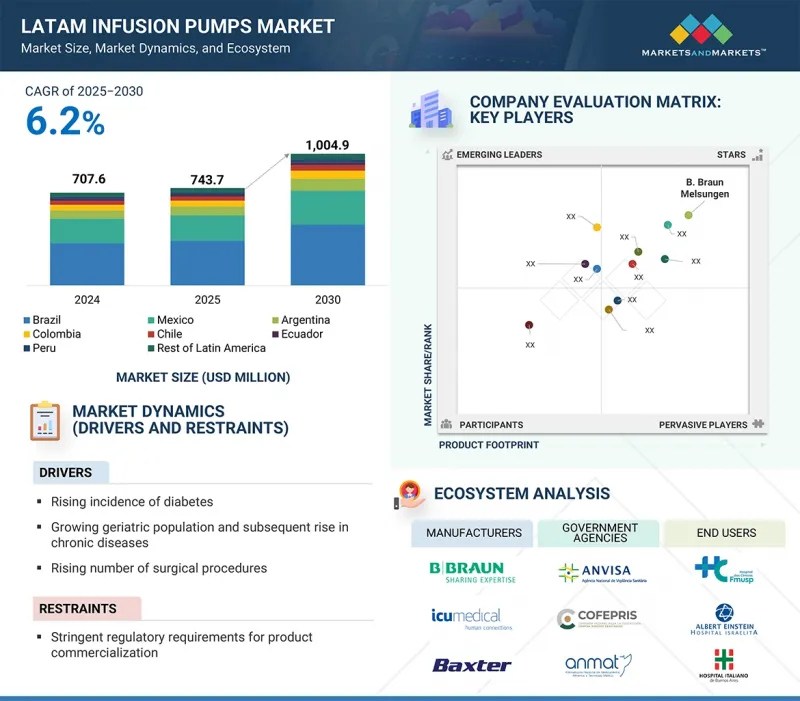

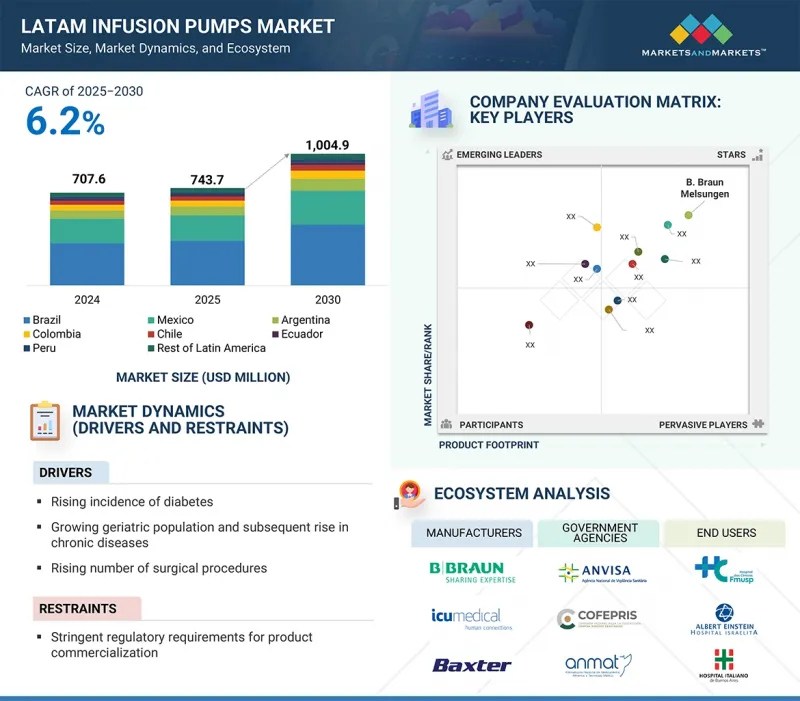

拉丁美洲输液帮浦市场预计将从 2025 年的 7.4 亿美元成长到 2030 年的 10 亿美元,预测期内的复合年增长率为 6.2%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 产品、应用程式和最终用户 |

| 目标区域 | 巴西、墨西哥、阿根廷、哥伦比亚、智利、厄瓜多、秘鲁等拉丁美洲国家 |

受慢性病发病率上升、人口结构变化以及医疗设施改善等因素的推动,拉丁美洲输液泵市场正稳步成长。糖尿病、癌症和心血管疾病等疾病在该地区较为常见,通常需要精准持续的药物传递。输液帮浦有助于医生提供精准治疗,尤其适用于需要长期照护的患者。老龄人口的成长也加剧了这项需求,因为老年患者通常需要更频繁、更精准的给药。再加上肿瘤科和重症监护需求的不断增长,输液帮浦已成为拉丁美洲各地医院和诊所的重要组成部分。

按产品划分,配件和耗材部门在 2024 年占据了最大的市场。

配件和耗材部分的成长动力来自于运作中的输液帮浦数量的增加以及对输液器、导管、管路等耗材的定期需求。长期治疗和住院治疗的增加也推动了对定期更换和维护零件的需求。

按产品(设备)划分,容积式输液帮浦在 2024 年占据了最大的市场份额。

拉丁美洲容积式输液帮浦市场的成长得益于全部区域需要精确输液的慢性疾病的发生率不断上升,以及医疗保健基础设施的不断扩大。此外,先进输液技术(包括具有增强安全功能的智慧型帮浦)的采用以及医疗保健成本的上升也促进了该市场的扩张。

按应用划分,糖尿病领域在 2024 年占据最大的市场。

由于糖尿病盛行率不断上升,以及用于精准持续胰岛素输送的胰岛素帮浦的普及率不断提高,糖尿病领域占据了最大的市场份额。人们对先进糖尿病管理的认识不断提高,以及医疗保健赋能措施的推进,进一步刺激了糖尿病领域的需求。

巴西患者人数众多,慢性病盛行率高,预计2024年将占最大市场份额,这将推动各大医院系统对肿瘤、糖尿病和重症监护输液治疗的需求。医院基础设施和IT技术的进步也推动了智慧输液帮浦和可携式输液帮浦的使用日益增多,从而加快了其采用和更换速度。此外,政府和私人医疗保健投资以及巴西补贴医疗体系的扩张,正在增强采购能力,并支持标准化工作,从而推动企业级输液平台和服务协议的建立。

本报告研究了拉丁美洲输液帮浦市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 拉丁美洲输液帮浦市场概况

- 拉丁美洲输液帮浦市场(按产品和国家划分)(2024 年)

- 拉丁美洲输液帮浦市场:区域细分

- 拉丁美洲输液帮浦市场:地理成长机会

第五章 市场概况

- 市场动态

- 市场驱动因素

- 抑制因素

- 机会

- 任务

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 波特五力分析

- 监管分析

- 监管格局

- 监管机构、政府机构和其他组织

- 专利分析

- 输液帮浦专利出版品的趋势

- 讨论:管辖权和主要申请人分析

- 贸易分析

- HS 编码 901890 的出口数据

- HS 编码 901890 的进口数据

- 报销分析

- 定价分析

- 主要企业设备平均售价趋势(2022-2024年)

- 各地区输液帮浦平均销售价格趋势(2022-2024年)

- 大型会议和活动(2025-2026)

- 主要相关利益者和采购标准

- 人工智慧/生成式人工智慧对拉丁美洲输液帮浦市场的影响

- 介绍

- 拉丁美洲输液帮浦生态系市场潜力

- 在输液帮浦中使用人工智慧的主要企业

- 拉丁美洲输液帮浦生态系中生成式人工智慧的未来

- 生态系分析

- 价值链分析

- 影响客户业务的趋势/中断

- 投资金筹措场景

- 川普关税对拉丁美洲输液帮浦市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对拉丁美洲的影响

- 对终端产业的影响

6. 拉丁美洲输液帮浦市场(依产品)

- 介绍

- 配件和耗材

- 专用配件和耗材

- 非专用配件和耗材

- 装置

- 设备市场:按产品

- 按技术分類的设备市场

- 按类型分類的设备市场

7. 拉丁美洲输液帮浦市场(依应用)

- 介绍

- 化疗/肿瘤学

- 糖尿病管理

- 胃肠病学

- 镇痛/疼痛管理

- 小儿科/新生儿科

- 血

- 其他用途

8. 拉丁美洲输液帮浦市场(依最终用户)

- 介绍

- 医院

- 居家照护环境

- 门诊护理设置

- 学术研究机构

- 癌症中心

- 其他最终用户

9. 拉丁美洲输液帮浦市场(依国家)

- 拉丁美洲

- 拉丁美洲输液帮浦设备市场(按产品划分)(2023-2030 年)

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 厄瓜多

- 秘鲁

- 其他拉丁美洲

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势(2022-2025)

- 收益分析(2022-2024)

- 市占率分析(2024年)

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 主要企业研发支出

- 公司估值及财务指标

- 品牌/产品比较分析

- 竞争场景

第十一章 公司简介

- 主要企业

- BECTON, DICKINSON AND COMPANY (BD)

- B. BRAUN MELSUNGEN AG

- BAXTER INTERNATIONAL INC.

- FRESENIUS KABI

- MEDTRONIC

- TERUMO CORPORATION

- ICU MEDICAL, INC.

- AVANOS MEDICAL, INC.

- NIPRO CORPORATION

- JMS CO., LTD.

- CARDINAL HEALTH, INC.

- ROCHE DIAGNOSTICS

- ABBOTT LABORATORIES

- DANAHER CORPORATION

- YPSOMED AG

- 其他公司

- TANDEM DIABETES CARE, INC.

- HARVARD BIOSCIENCE INC.

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- INTUVIE HOLDINGS LLC

- ANGIPLAST PVT. LTD.

- IRADIMED CORPORATION

- NEW ERA INSTRUMENTS

- EPIC MEDICAL

- SHENZHEN MEDRENA BIOTECH CO., LTD.

- CODAN COMPANIES

第十二章 附录

The Latin America infusion pumps market is projected to reach USD 1.00 billion by 2030 from USD 0.74 billion in 2025, at a CAGR of 6.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Product, Application, and End User |

| Regions covered | Brazil, Mexico, Argentina, Colombia, Chile, Ecuador, Peru, and the rest of Latin America |

The infusion pumps market in Latin America is growing steadily, supported by factors such as rising chronic diseases, changing demographics, and better healthcare facilities. Conditions like diabetes, cancer, and cardiovascular disorders are becoming more common in the region and often require precise and continuous delivery of medicines. Infusion pumps help doctors provide accurate treatment, especially for patients who need long-term care. The growing elderly population also adds to this demand, as older people usually need frequent and controlled drug administration. Along with this, the increasing need for oncology and critical care therapies makes infusion pumps essential for hospitals and clinics across Latin America.

By product, the accessories & consumables segment accounted for the largest share of the market in 2024.

By product, the Latin America infusion pumps market has been segmented into accessories & consumables and devices. The accessories & consumables segment accounted for the largest share of the infusion pumps market in 2024. The accessories & consumables segment is driven by the growing installed base of infusion pumps and the recurring need for disposables like IV sets, catheters, and tubing. The rise in long-term therapies and hospital admissions also increases demand for regular replacement and maintenance components.

By product (devices), the volumetric infusion pumps segment accounted for the largest market share in 2024.

Based on devices, the Latin America infusion pumps market is segmented into volumetric infusion pumps, insulin pumps, enteral infusion pumps, ambulatory infusion pumps, syringe infusion pumps, patient-controlled analgesia (PCA) pumps, and implantable infusion pumps. The volumetric infusion pumps segment accounted for the largest infusion pump devices market share in 2024. The growth of the volumetric infusion pumps segment in the LATAM market is driven by the rising prevalence of chronic diseases necessitating precise fluid administration and the expansion of healthcare infrastructure across the region. Additionally, adopting advanced infusion technologies, including smart pumps with enhanced safety features, and increased healthcare spending contribute to the segment's expansion.

By application, the diabetes segment accounted for the largest share of the market in 2024.

Based on application, the Latin America infusion pumps market is segmented into chemotherapy/oncology, diabetes management, gastroenterology, analgesia/pain management, pediatrics/neonatology, hematology, and other applications (includes infectious diseases, autoimmune diseases, and diseases of the heart, kidney, lung, and liver). The diabetes segment accounted for the largest market share owing to the rising prevalence of diabetes and the increasing adoption of insulin pumps for precise, continuous insulin delivery. Growing awareness of advanced diabetes management and supportive healthcare initiatives further accelerates demand.

By country, Brazil accounted for the largest share of the market in 2024.

The Latin America infusion pump market is divided by country, including Brazil, Mexico, Argentina, Colombia, Chile, Ecuador, Peru, and the Rest of Latin America. In 2024, Brazil accounted for the largest market share, driven by its large patient population and high prevalence of chronic diseases, fueling the demand for infusion therapies in oncology, diabetes, and critical care across leading hospital systems. The growing use of smart and ambulatory pumps, aided by advancements in hospital infrastructure and IT, accelerates adoption and replacement rates. Additionally, government and private healthcare investments and Brazil's expansive supplementary health plans are enhancing procurement capacity and supporting standardization efforts that promote enterprise-wide infusion platforms and service agreements.

A breakdown of the primary participants (supply-side) for the Latin America infusion pumps market referred to in this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-20%, and Tier 3-35%

- By Designation: C-level-35%, Director Level-25%, and Others-40%

- By Region: Brazil-40%, Mexico-25%, Argentina-20%, Colombia- 10%, and the Rest of Latin America- 5%.

The key players in the Latin America infusion pumps market include are Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Fresenius Kabi (Germany), Medtronic plc (Ireland), ICU Medical, Inc. (US), Terumo Corporation (Japan), Nipro Corporation (Japan), Avanos Medical, Inc. (US), JMS Co., Ltd. (Japan), Cardinal Health, Inc. (US), Roche Diagnostics (Switzerland), Abbott Laboratories (US), Danaher Corporation (US), Ypsomed Holding AG (Switzerland), and Tandem Diabetes Care, Inc. (US), Harvard Bioscience, Inc. (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), and Intuvie Holding LLC (US), among others.

Research Coverage:

The report analyzes the Latin America infusion pumps market and estimates the market size and future growth potential based on various segments such as devices & consumables, cancer type, procedure, end user, and region. The report also includes a competitive analysis of the key players in this market along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Latin America infusion pumps market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (rising incidence of diabetes, growing geriatric population and subsequent rise in chronic diseases, rising number of surgical procedures, and the increasing adoption of enteral feeding pumps due to surge in pre-term births), restraints (stringent regulatory requirements for product commercialization, increasing adoption of refurbished & rented infusion pumps), opportunities (high growth potential in emerging economies and the increasing adoption of specialty infusion systems), challenges (increasing incidence of medication errors and inadequate wireless connectivity across several hospitals)

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the Latin America infusion pumps market. The report analyzes this market by product, application, and end user.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the Latin America infusion pumps market

- Market Development: Comprehensive information on the lucrative emerging markets by product, application, and end user.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the Latin America infusion pumps market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the Latin America infusion pumps market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.2.4 CURRENCY CONSIDERED

- 1.3 MARKET STAKEHOLDERS

- 1.4 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 GROWTH FORECAST

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 KEY INDUSTRY INSIGHTS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.8 STUDY ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LATAM INFUSION PUMPS MARKET OVERVIEW

- 4.2 LATAM INFUSION PUMPS MARKET, BY PRODUCT & COUNTRY, 2024 (USD MILLION)

- 4.3 LATAM INFUSION PUMPS MARKET: REGIONAL MIX

- 4.4 LATAM INFUSION PUMPS MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 MARKET DRIVERS

- 5.1.1.1 Rising incidence of diabetes

- 5.1.1.2 Growing geriatric population and subsequent rise in chronic diseases

- 5.1.1.3 Rising number of surgical procedures

- 5.1.1.4 Increasing adoption of enteral feeding pumps due to surge in pre-term births

- 5.1.2 RESTRAINTS

- 5.1.2.1 Stringent regulatory requirements for product commercialization

- 5.1.2.2 Increasing adoption of refurbished & rented infusion pumps

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 High growth potential in emerging economies

- 5.1.3.2 Increasing adoption of specialty infusion systems

- 5.1.4 CHALLENGES

- 5.1.4.1 Increasing incidence of medication errors and inadequate wireless connectivity across several hospitals

- 5.1.1 MARKET DRIVERS

- 5.2 TECHNOLOGY ANALYSIS

- 5.2.1 KEY TECHNOLOGIES

- 5.2.1.1 Flow generation

- 5.2.1.2 Smart infusion systems

- 5.2.1.3 Closed-loop infusion control systems

- 5.2.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.2.1 Dose-error reduction systems

- 5.2.2.2 Wireless connectivity

- 5.2.2.3 AI-powered decision support systems

- 5.2.3 ADJACENT TECHNOLOGIES

- 5.2.3.1 Embedded software

- 5.2.3.2 Sensing technology

- 5.2.1 KEY TECHNOLOGIES

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY ANALYSIS

- 5.4.1 REGULATORY LANDSCAPE

- 5.4.1.1 Brazil

- 5.4.1.2 Mexico

- 5.4.1.3 Argentina

- 5.4.1.4 Colombia

- 5.4.1.5 Chile

- 5.4.1.6 Ecuador

- 5.4.1.7 Peru

- 5.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.1 REGULATORY LANDSCAPE

- 5.5 PATENT ANALYSIS

- 5.5.1 PATENT PUBLICATION TRENDS FOR INFUSION PUMPS

- 5.5.2 INSIGHTS: JURISDICTION & TOP APPLICANT ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT DATA FOR HS CODE 901890

- 5.6.2 IMPORT DATA FOR HS CODE 901890

- 5.7 REIMBURSEMENT ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND FOR DEVICES, BY KEY PLAYER, 2022-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF INFUSION PUMPS, BY REGION, 2022-2024

- 5.9 KEY CONFERENCES & EVENTS, 2025-2026

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 IMPACT OF AI/GENERATIVE AI ON LATAM INFUSION PUMPS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 MARKET POTENTIAL IN LATAM INFUSION PUMPS ECOSYSTEM

- 5.11.3 KEY COMPANIES IMPLEMENTING AI IN INFUSION PUMPS

- 5.11.4 FUTURE OF GENERATIVE AI IN LATAM INFUSION PUMPS ECOSYSTEM

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 TRUMP TARIFF IMPACT ON LATAM INFUSION PUMPS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON LATAM REGION

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 LATIN AMERICA INFUSION PUMPS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 ACCESSORIES & CONSUMABLES

- 6.2.1 DEDICATED ACCESSORIES & CONSUMABLES

- 6.2.1.1 Volumetric infusion pump dedicated disposables

- 6.2.1.1.1 High adoption across hospitals & clinical settings to fuel uptake

- 6.2.1.2 Insulin infusion pump dedicated disposables

- 6.2.1.2.1 Rising number of insulin-dependent diabetic patients to support market growth

- 6.2.1.3 Enteral infusion pump dedicated disposables

- 6.2.1.3.1 Precision & consistency in results to fuel uptake

- 6.2.1.4 Syringe infusion pump dedicated disposables

- 6.2.1.4.1 High demand in developed countries to aid market

- 6.2.1.5 Ambulatory infusion pump dedicated disposables

- 6.2.1.5.1 Growth in home healthcare market to boost demand

- 6.2.1.6 PCA pump dedicated disposables

- 6.2.1.6.1 Increasing demand for critical pain management to boost market

- 6.2.1.7 Implantable infusion pump dedicated disposables

- 6.2.1.7.1 High compatibility with pumps to fuel uptake

- 6.2.1.1 Volumetric infusion pump dedicated disposables

- 6.2.2 NON-DEDICATED ACCESSORIES & CONSUMABLES

- 6.2.2.1 Infusion catheters

- 6.2.2.1.1 Potential for recurrent use to drive demand

- 6.2.2.2 IV administration sets

- 6.2.2.2.1 Rising demand for use in various systems to propel market

- 6.2.2.3 Needleless connectors

- 6.2.2.3.1 Reduction in bloodstream infection risks to boost demand

- 6.2.2.4 Cannulas

- 6.2.2.4.1 Ability to ease patient discomfort to boost demand

- 6.2.2.5 Tubing & extension sets

- 6.2.2.5.1 Need for continuous & efficient connections to fuel uptake

- 6.2.2.6 Valves

- 6.2.2.6.1 Improvement in quality of infusion to drive market

- 6.2.2.7 Other non-dedicated accessories & consumables

- 6.2.2.1 Infusion catheters

- 6.2.1 DEDICATED ACCESSORIES & CONSUMABLES

- 6.3 DEVICES

- 6.3.1 DEVICES MARKET, BY PRODUCT

- 6.3.1.1 Volumetric infusion pumps

- 6.3.1.1.1 Technological improvements to boost market

- 6.3.1.2 Insulin pumps

- 6.3.1.2.1 High demand from diabetics to propel market

- 6.3.1.3 Ambulatory infusion pumps

- 6.3.1.3.1 Rising cancer prevalence and increasing patient awareness to fuel market

- 6.3.1.4 Syringe infusion pumps

- 6.3.1.4.1 Cost-effectiveness and portability to boost demand

- 6.3.1.5 Enteral infusion pumps

- 6.3.1.5.1 Technological advancements to bolster market

- 6.3.1.6 PCA pumps

- 6.3.1.6.1 Growth in pain management to fuel uptake

- 6.3.1.7 Implantable infusion pumps

- 6.3.1.7.1 Growing use of long-term delivery of opioid medication to boost market

- 6.3.1.1 Volumetric infusion pumps

- 6.3.2 DEVICES MARKET, BY TECHNOLOGY

- 6.3.2.1 Traditional infusion pumps

- 6.3.2.1.1 Growing use in long-term care settings to drive demand

- 6.3.2.2 Specialty infusion pumps

- 6.3.2.2.1 Rising adoption in home care settings to drive market

- 6.3.2.1 Traditional infusion pumps

- 6.3.3 DEVICES MARKET, BY TYPE

- 6.3.3.1 Stationary infusion pumps

- 6.3.3.1.1 High adoption in hospitals to drive market

- 6.3.3.2 Portable infusion pumps

- 6.3.3.2.1 Technological advancements to support market growth

- 6.3.3.1 Stationary infusion pumps

- 6.3.1 DEVICES MARKET, BY PRODUCT

7 LATIN AMERICA INFUSION PUMPS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CHEMOTHERAPY/ONCOLOGY

- 7.2.1 GROWING INCIDENCE OF CANCER TO DRIVE MARKET

- 7.3 DIABETES MANAGEMENT

- 7.3.1 RISING DEMAND FOR EFFECTIVE DIABETES TREATMENT TO BOOST MARKET

- 7.4 GASTROENTEROLOGY

- 7.4.1 GROWING UPTAKE IN GASTROINTESTINAL DISEASE TREATMENT TO FUEL MARKET

- 7.5 ANALGESIA/PAIN MANAGEMENT

- 7.5.1 RISING NUMBER OF SURGICAL PROCEDURES TO AID MARKET

- 7.6 PEDIATRICS/NEONATOLOGY

- 7.6.1 INCREASING INCIDENCE OF PEDIATRIC DIABETES TO SUPPORT MARKET GROWTH

- 7.7 HEMATOLOGY

- 7.7.1 INCREASING PREVALENCE OF BLOOD DISORDERS TO BOOST DEMAND

- 7.8 OTHER APPLICATIONS

8 LATIN AMERICA INFUSION PUMPS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 RISING INCIDENCE OF CHRONIC DISEASES AND GROWING FOCUS ON INFUSION THERAPY TO DRIVE MARKET

- 8.3 HOME CARE SETTINGS

- 8.3.1 RISING TECHNOLOGICAL ADVANCEMENTS IN PORTABLE & USER-FRIENDLY DEVICES TO PROPEL MARKET

- 8.4 AMBULATORY CARE SETTINGS

- 8.4.1 RISING NUMBER OF SURGICAL PROCEDURES TO BOOST MARKET

- 8.5 ACADEMIC & RESEARCH INSTITUTES

- 8.5.1 INCREASING MEDICAL RESEARCH ACTIVITIES TO SUPPORT MARKET GROWTH

- 8.6 ONCOLOGY CENTERS

- 8.6.1 GROWING FOCUS ON THERAPEUTICS TO FUEL UPTAKE

- 8.7 OTHER END USERS

9 LATIN AMERICA INFUSION PUMPS MARKET, BY COUNTRY

- 9.1 LATIN AMERICA

- 9.1.1 LATAM INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (THOUSAND UNITS)

- 9.1.2 MACROECONOMIC OUTLOOK FOR LATAM COUNTRIES

- 9.1.3 BRAZIL

- 9.1.3.1 Increasing number of chronic conditions to drive market

- 9.1.4 MEXICO

- 9.1.4.1 Favorable government initiatives for commercialization of medical devices to boost market

- 9.1.5 ARGENTINA

- 9.1.5.1 Rapid aging population and subsequent rise in chronic diseases to boost market

- 9.1.6 COLOMBIA

- 9.1.6.1 Integration of technological advancements in hospitals & infusion therapy settings to propel market

- 9.1.7 CHILE

- 9.1.7.1 Growing focus on local infusion-therapy product manufacturers to fuel uptake

- 9.1.8 ECUADOR

- 9.1.8.1 Digital health initiatives to support market growth

- 9.1.9 PERU

- 9.1.9.1 Increasing focus on oncology therapeutics to boost market

- 9.1.10 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Country footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.6.6.1 Competitive benchmarking of key startups/SMEs

- 10.7 R&D EXPENDITURE OF KEY PLAYERS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8.1 COMPANY VALUATION

- 10.8.2 FINANCIAL METRICS

- 10.9 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES & APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BECTON, DICKINSON AND COMPANY (BD)

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 B. BRAUN MELSUNGEN AG

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 BAXTER INTERNATIONAL INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 FRESENIUS KABI

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 MEDTRONIC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 TERUMO CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.7 ICU MEDICAL, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product approvals

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Other developments

- 11.1.8 AVANOS MEDICAL, INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 NIPRO CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.10 JMS CO., LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 CARDINAL HEALTH, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ROCHE DIAGNOSTICS

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.13 ABBOTT LABORATORIES

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 DANAHER CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 YPSOMED AG

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 BECTON, DICKINSON AND COMPANY (BD)

- 11.2 OTHER PLAYERS

- 11.2.1 TANDEM DIABETES CARE, INC.

- 11.2.2 HARVARD BIOSCIENCE INC.

- 11.2.3 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 11.2.4 INTUVIE HOLDINGS LLC

- 11.2.5 ANGIPLAST PVT. LTD.

- 11.2.6 IRADIMED CORPORATION

- 11.2.7 NEW ERA INSTRUMENTS

- 11.2.8 EPIC MEDICAL

- 11.2.9 SHENZHEN MEDRENA BIOTECH CO., LTD.

- 11.2.10 CODAN COMPANIES

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.3.1 PRODUCT ANALYSIS

- 12.3.2 GEOGRAPHIC ANALYSIS

- 12.3.3 COMPANY INFORMATION

- 12.3.4 MARKET SHARE ANALYSIS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LATAM INFUSION PUMPS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES (USD)

- TABLE 3 LATAM INFUSION PUMPS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 LATAM INFUSION PUMPS MARKET: STUDY ASSUMPTIONS

- TABLE 5 PORTER'S FIVE FORCES: IMPACT ANALYSIS

- TABLE 6 LATIN AMERICA: LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 INFUSION PUMPS MARKET: MAJOR PATENTS

- TABLE 8 EXPORT DATA FOR HS CODE 901890 (INCLUDING INFUSION PUMPS), BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 9 IMPORT DATA FOR HS CODE 901890 (INCLUDING INFUSION PUMPS), BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 AVERAGE SELLING PRICE TREND OF DEVICES, BY KEY PLAYER, 2022-2024

- TABLE 11 AVERAGE SELLING PRICE TREND, LATAM REGION, 2022-2024

- TABLE 12 LATAM INFUSION PUMPS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR INFUSION PUMPS (%)

- TABLE 14 KEY COMPANIES IMPLEMENTING AI IN INFUSION PUMPS

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 KEY PRODUCT-RELATED TARIFF EFFECTIVE INFUSION PUMPS

- TABLE 17 LATAM INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 18 KEY PLAYERS PROVIDING INFUSION PUMP ACCESSORIES & CONSUMABLES

- TABLE 19 ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 20 ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 21 KEY PLAYERS PROVIDING DEDICATED ACCESSORIES & CONSUMABLES

- TABLE 22 DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 KEY PLAYERS PROVIDING VOLUMETRIC INFUSION PUMP DEDICATED DISPOSABLES

- TABLE 25 VOLUMETRIC INFUSION PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 KEY PLAYERS PROVIDING INSULIN INFUSION PUMP DEDICATED DISPOSABLES

- TABLE 27 INSULIN INFUSION PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 KEY PLAYERS PROVIDING ENTERAL INFUSION PUMP DEDICATED DISPOSABLES

- TABLE 29 ENTERAL INFUSION PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 KEY PLAYERS PROVIDING SYRINGE INFUSION PUMP DEDICATED DISPOSABLES

- TABLE 31 SYRINGE INFUSION PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 KEY PLAYERS PROVIDING AMBULATORY INFUSION PUMP DEDICATED DISPOSABLES

- TABLE 33 AMBULATORY INFUSION PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 KEY PLAYERS PROVIDING PCA PUMP DEDICATED DISPOSABLES

- TABLE 35 PCA PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 KEY PLAYERS PROVIDING IMPLANTABLE INFUSION PUMP DEDICATED DISPOSABLES

- TABLE 37 IMPLANTABLE INFUSION PUMP DEDICATED DISPOSABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 KEY PLAYERS PROVIDING NON-DEDICATED ACCESSORIES & CONSUMABLES

- TABLE 39 NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 KEY PLAYERS PROVIDING INFUSION CATHETERS

- TABLE 42 INFUSION CATHETERS NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 KEY PLAYERS PROVIDING IV ADMINISTRATION SETS

- TABLE 44 IV ADMINISTRATION SETS NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 KEY PLAYERS PROVIDING NEEDLELESS CONNECTORS

- TABLE 46 NEEDLELESS CATHETERS NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 KEY PLAYERS PROVIDING CANNULAS

- TABLE 48 CANNULAS NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 KEY PLAYERS PROVIDING TUBING & EXTENSION SETS

- TABLE 50 TUBING & EXTENSION SETS NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 KEY PLAYERS PROVIDING VALVES

- TABLE 52 VALVES NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 KEY PLAYERS PROVIDING OTHER NON-DEDICATED ACCESSORIES & CONSUMABLES

- TABLE 54 OTHER NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 KEY PLAYERS PROVIDING INFUSION PUMP DEVICES

- TABLE 56 LATAM INFUSION PUMPS DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 LATAM INFUSION PUMPS DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 58 KEY PLAYERS PROVIDING VOLUMETRIC INFUSION PUMPS

- TABLE 59 VOLUMETRIC INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 KEY PLAYERS PROVIDING INSULIN PUMPS

- TABLE 61 INSULIN PUMPS DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 KEY PLAYERS PROVIDING AMBULATORY INFUSION PUMPS

- TABLE 63 AMBULATORY INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 KEY PLAYERS PROVIDING SYRINGE INFUSION PUMPS

- TABLE 65 SYRINGE INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 KEY PLAYERS PROVIDING ENTERAL INFUSION PUMPS

- TABLE 67 ENTERAL INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 KEY PLAYERS PROVIDING PCA PUMPS

- TABLE 69 PCA PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 KEY PLAYERS PROVIDING IMPLANTABLE INFUSION PUMPS

- TABLE 71 IMPLANTABLE INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 73 KEY PLAYERS PROVIDING TRADITIONAL INFUSION PUMPS

- TABLE 74 TRADITIONAL INFUSION PUMP TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 KEY PLAYERS PROVIDING SPECIALTY INFUSION PUMPS

- TABLE 76 SPECIALTY INFUSION PUMP TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 KEY PLAYERS PROVIDING STATIONARY INFUSION PUMPS

- TABLE 79 STATIONARY INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 KEY PLAYERS PROVIDING PORTABLE INFUSION PUMPS

- TABLE 81 PORTABLE INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 LATAM INFUSION PUMP MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 83 KEY PLAYERS PROVIDING INFUSION PUMPS FOR CHEMOTHERAPY/ONCOLOGY APPLICATIONS

- TABLE 84 LATAM INFUSION PUMPS MARKET FOR CHEMOTHERAPY/ONCOLOGY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 KEY PLAYERS PROVIDING INFUSION PUMPS FOR DIABETES MANAGEMENT

- TABLE 86 LATAM INFUSION PUMPS MARKET FOR DIABETES MANAGEMENT APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 DISEASES & DISORDERS OF DIGESTIVE SYSTEM

- TABLE 88 KEY PLAYERS PROVIDING INFUSION PUMPS FOR GASTROENTEROLOGY APPLICATIONS

- TABLE 89 LATAM INFUSION PUMPS MARKET FOR GASTROENTEROLOGY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 KEY PLAYERS PROVIDING INFUSION PUMPS FOR ANALGESIA/PAIN MANAGEMENT APPLICATIONS

- TABLE 91 LATAM INFUSION PUMPS MARKET FOR ANALGESIA/PAIN MANAGEMENT APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 KEY PLAYERS PROVIDING INFUSION PUMPS FOR PEDIATRICS/NEONATOLOGY APPLICATIONS

- TABLE 93 LATAM INFUSION PUMPS MARKET FOR PEDIATRIC/NEONATOLOGY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 KEY PLAYERS PROVIDING LATAM INFUSION PUMPS FOR HEMATOLOGY APPLICATIONS

- TABLE 95 LATAM INFUSION PUMPS MARKET FOR HEMATOLOGY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 KEY PLAYERS PROVIDING INFUSION PUMPS FOR OTHER APPLICATIONS

- TABLE 97 LATAM INFUSION PUMPS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 LATAM INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 LATAM INFUSION PUMPS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 LATAM INFUSION PUMPS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 LATAM INFUSION PUMPS MARKET FOR AMBULATORY CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 LATAM INFUSION PUMPS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 INFUSION PUMPS MARKET FOR ONCOLOGY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 INFUSION PUMPS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 LATAM INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (THOUSAND UNITS)

- TABLE 106 LATAM INFUSION PUMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 108 BRAZIL: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 109 BRAZIL: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 BRAZIL: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 BRAZIL: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 BRAZIL: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 BRAZIL: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 114 BRAZIL: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 BRAZIL: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 BRAZIL: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 MEXICO: MACROECONOMIC INDICATORS

- TABLE 118 MEXICO: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 119 MEXICO: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 MEXICO: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 MEXICO: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 MEXICO: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 123 MEXICO: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 124 MEXICO: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 MEXICO: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 MEXICO: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 ARGENTINA: MACROECONOMIC INDICATORS

- TABLE 128 ARGENTINA: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 129 ARGENTINA: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 ARGENTINA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 ARGENTINA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ARGENTINA: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 133 ARGENTINA: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 134 ARGENTINA: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 ARGENTINA: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 ARGENTINA: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 COLOMBIA: MACROECONOMIC INDICATORS

- TABLE 138 COLOMBIA: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 139 COLOMBIA: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 COLOMBIA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 COLOMBIA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 COLOMBIA: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 143 COLOMBIA: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 144 COLOMBIA: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 COLOMBIA: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 COLOMBIA: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 CHILE: MACROECONOMIC INDICATORS

- TABLE 148 CHILE: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 149 CHILE: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 CHILE: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 CHILE: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 CHILE: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 153 CHILE: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 154 CHILE: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 CHILE: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 CHILE: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 157 ECUADOR: MACROECONOMIC INDICATORS

- TABLE 158 ECUADOR: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 159 ECUADOR: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 ECUADOR: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 ECUADOR: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 ECUADOR: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 163 ECUADOR: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 164 ECUADOR: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 ECUADOR: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 166 ECUADOR: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 PERU: MACROECONOMIC INDICATORS

- TABLE 168 PERU: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 169 PERU: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 PERU: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 PERU: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 PERU: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 173 PERU: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 174 PERU: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 PERU: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 PERU: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 REST OF LATINA AMERICA: INFUSION PUMPS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 178 REST OF LATINA AMERICA: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 REST OF LATINA AMERICA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 REST OF LATINA AMERICA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 REST OF LATINA AMERICA: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 182 REST OF LATINA AMERICA: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 183 REST OF LATINA AMERICA: INFUSION PUMP DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF LATINA AMERICA: INFUSION PUMPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 185 REST OF LATINA AMERICA: INFUSION PUMPS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 186 LATAM INFUSION PUMPS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2025

- TABLE 187 LATAM INFUSION PUMPS MARKET: DEGREE OF COMPETITION

- TABLE 188 LATAM INFUSION PUMPS MARKET: COUNTRY FOOTPRINT

- TABLE 189 LATAM INFUSION PUMPS MARKET: PRODUCT FOOTPRINT

- TABLE 190 LATAM INFUSION PUMPS MARKET: APPLICATION FOOTPRINT

- TABLE 191 LATAM INFUSION PUMPS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 192 LATAM INFUSION PUMPS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 193 LATAM INFUSION PUMPS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 194 LATAM INFUSION PUMPS MARKET: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 195 LATAM INFUSION PUMPS MARKET: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 196 LATAM INFUSION PUMPS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 197 BD: COMPANY OVERVIEW

- TABLE 198 BD: PRODUCTS OFFERED

- TABLE 199 BD: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 200 BD: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 201 BD: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 202 BD: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 203 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

- TABLE 204 B. BRAUN MELSUNGEN AG: PRODUCTS OFFERED

- TABLE 205 B. BRAUN MELSUNGEN AG: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 206 B. BRAUN MELSUNGEN AG: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 207 B. BRAUN MELSUNGEN AG: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 208 BAXTER INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 209 BAXTER INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 210 BAXTER INTERNATIONAL INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 211 BAXTER INTERNATIONAL INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 212 BAXTER INTERNATIONAL INC.: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 213 FRESENIUS KABI: COMPANY OVERVIEW

- TABLE 214 FRESENIUS KABI: PRODUCTS OFFERED

- TABLE 215 FRESENIUS KABI: PRODUCT APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 216 FRESENIUS KABI: DEALS, JANUARY 2022-AUGUST 2025, JANUARY 2022-AUGUST 2025

- TABLE 217 FRESENIUS KABI: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 218 MEDTRONIC: COMPANY OVERVIEW

- TABLE 219 MEDTRONIC PLC: PRODUCTS OFFERED

- TABLE 220 MEDTRONIC PLC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 221 MEDTRONIC: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 222 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 223 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 224 TERUMO CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 225 TERUMO CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 226 TERUMO CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 227 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 228 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 229 ICU MEDICAL, INC.: PRODUCT APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 230 ICU MEDICAL, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 231 ICU MEDICAL, INC.: OTHER DEVELOPMENTS

- TABLE 232 AVANOS MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 233 AVANOS MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 234 NIPRO CORPORATION: COMPANY OVERVIEW

- TABLE 235 NIPRO CORPORATION: PRODUCTS OFFERED

- TABLE 236 NIPRO CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 237 JMS CO., LTD.: COMPANY OVERVIEW

- TABLE 238 JMS CO., LTD.: PRODUCTS OFFERED

- TABLE 239 CARDINAL HEALTH, INC.: COMPANY OVERVIEW

- TABLE 240 CARDINAL HEALTH, INC.: PRODUCTS OFFERED

- TABLE 241 ROCHE DIAGNOSTICS: COMPANY OVERVIEW

- TABLE 242 ROCHE DIAGNOSTICS: PRODUCTS OFFERED

- TABLE 243 ROCHE DIAGNOSTICS: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 244 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 245 ABBOTT LABORATORIES: PRODUCTS OFFERED

- TABLE 246 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 247 DANAHER CORPORATION: PRODUCTS OFFERED

- TABLE 248 YPSOMED AG: COMPANY OVERVIEW

- TABLE 249 YPSOMED AG: PRODUCTS OFFERED

- TABLE 250 TANDEM DIABETES CARE, INC.: COMPANY OVERVIEW

- TABLE 251 HARVARD BIOSCIENCE INC.: COMPANY OVERVIEW

- TABLE 252 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 253 INTUVIE HOLDINGS LLC: COMPANY OVERVIEW

- TABLE 254 ANGIPLAST PVT. LTD.: COMPANY OVERVIEW

- TABLE 255 IRADIMED CORPORATION: COMPANY OVERVIEW

- TABLE 256 NEW ERA INSTRUMENTS: COMPANY OVERVIEW

- TABLE 257 EPIC MEDICAL: COMPANY OVERVIEW

- TABLE 258 SHENZHEN MEDRENA BIOTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 259 CODAN COMPANIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LATAM INFUSION PUMPS MARKET & COUNTRY SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 6 LATAM INFUSION PUMPS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF LATAM INFUSION PUMPS MARKET, 2025-2030

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF LATAM INFUSION PUMPS MARKET (2025-2030)

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 KEY INDUSTRY INSIGHTS

- FIGURE 12 LATAM INFUSION PUMPS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 LATAM INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 LATAM INFUSION PUMP DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 LATAM INFUSION PUMP NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 LATAM INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 LATAM INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 LATAM INFUSION PUMP DEVICES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 LATAM INFUSION PUMPS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 LATAM INFUSION PUMPS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 GEOGRAPHIC SNAPSHOT: LATAM INFUSION PUMPS MARKET

- FIGURE 22 INCREASING INCIDENCE OF CHRONIC DISEASES TO PROPEL MARKET

- FIGURE 23 ACCESSORIES & CONSUMABLES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN BRAZIL IN 2024

- FIGURE 24 DEVELOPED COUNTRIES TO GROW AT HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 25 COLOMBIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 LATAM INFUSION PUMPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 PEOPLE WITH DIABETES (20-79 YEARS), BY COUNTRY, 2021 VS. 2045 (IN THOUSANDS)

- FIGURE 28 LATAM INFUSION PUMPS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 LATAM INFUSION PUMPS MARKET: NUMBER OF GRANTED PATENT APPLICATIONS (JANUARY 2014-AUGUST 2025)

- FIGURE 30 TOP APPLICANT COUNTRIES/REGIONS FOR INFUSION PUMPS PATENTS (JANUARY 2014-AUGUST 2025)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR INFUSION PUMPS

- FIGURE 32 KEY BUYING CRITERIA FOR INFUSION PUMPS, BY TOP 3 END USERS

- FIGURE 33 LATAM INFUSION PUMPS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 LATAM INFUSION PUMPS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 35 REVENUE SHIFTS & NEW REVENUE POCKETS FOR LATAM INFUSION PUMPS MARKET

- FIGURE 36 LATAM INFUSION PUMPS MARKET SNAPSHOT

- FIGURE 37 LATAM INFUSION PUMPS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022-2024

- FIGURE 38 MARKET SHARE ANALYSIS, 2024

- FIGURE 39 LATAM INFUSION PUMPS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS, 2024

- FIGURE 40 LATAM INFUSION PUMPS MARKET: COMPANY FOOTPRINT

- FIGURE 41 LATAM INFUSION PUMPS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 R&D EXPENDITURE OF KEY PLAYERS IN LATAM INFUSION PUMPS MARKET, 2022-2024

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 44 EV/EBITDA OF KEY VENDORS

- FIGURE 45 LATAM INFUSION PUMPS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 BD: COMPANY SNAPSHOT (2024)

- FIGURE 47 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2024)

- FIGURE 48 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 FRESENIUS KABI: COMPANY SNAPSHOT (2024)

- FIGURE 50 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 51 TERUMO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 52 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 AVANOS MEDICAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 54 NIPRO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 JMS CO., LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 56 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 57 ROCHE DIAGNOSTICS.: COMPANY SNAPSHOT (2024)

- FIGURE 58 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2024)

- FIGURE 59 DANAHER CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 60 YPSOMED AG: COMPANY SNAPSHOT (2024)