|

市场调查报告书

商品编码

1819102

全球兽用单株抗体市场(按动物类型、产品、给药途径、治疗领域、最终用户和地区划分)- 预测至 2030 年Veterinary Monoclonal Antibodies Market by Animal Type (Canine, Feline, Swine), Product (Cytopoint, Librela, Solensia), Therapy Area (Dermatology, Infectious, Osteoarthritis, Pain, Oncology, Others), Route of Administration - Global Forecast to 2030 |

||||||

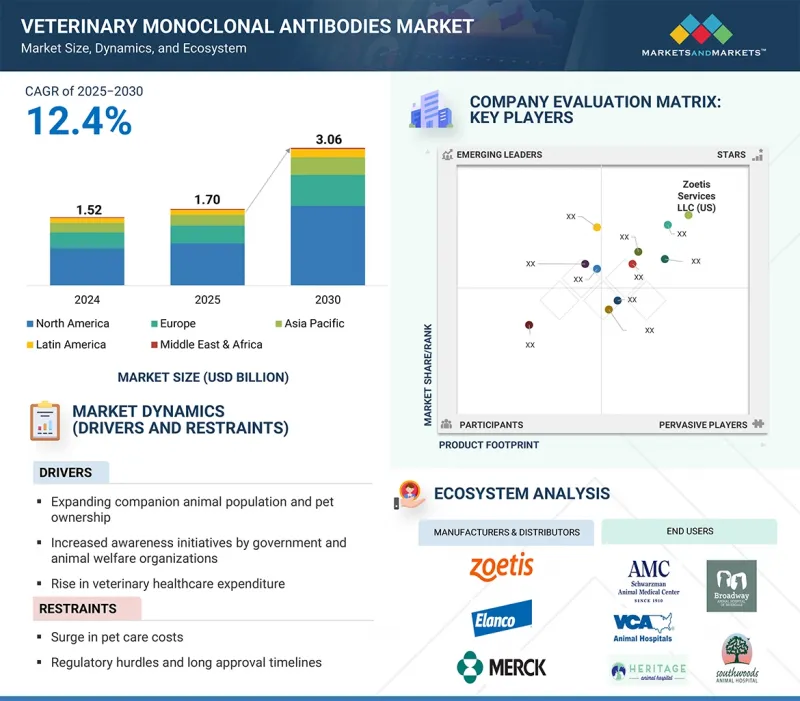

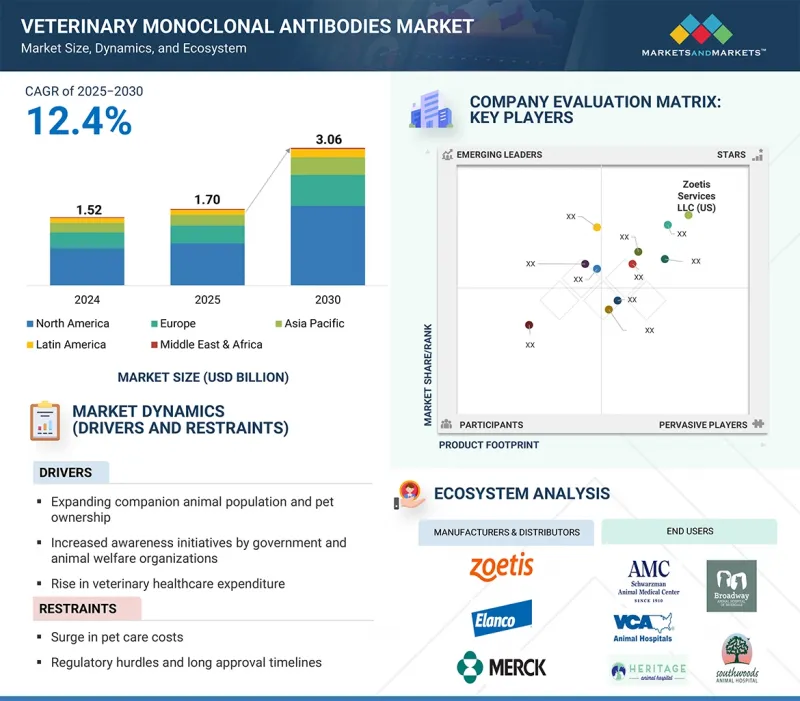

全球兽用单株抗体市场预计将从 2025 年的 17 亿美元成长到 2030 年的 30.6 亿美元,复合年增长率为 12.4%。

受伴侣动物数量增长和宠物拥有率上升的推动,这个市场正在经历显着增长。人们对慢性疾病的日益担忧进一步推动了兽医治疗的需求。各国政府和动物福利组织正在积极推动提高公众意识的宣传活动,鼓励对宠物和牲畜的皮肤病进行早期诊断和治疗。

| 调查范围 | |

|---|---|

| 调查年份 | 2023-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元/十亿美元) |

| 部分 | 依动物类型、产品、给药途径、治疗领域、最终使用者和地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

然而,市场面临许多挑战,例如宠物医疗成本上涨限制了治疗方案的采用。此外,严格的监管准则和漫长的药品核准週期进一步限制了市场成长。儘管存在这些障碍,但治疗适应症在皮肤病和骨关节炎以外的扩展仍在持续创造新的市场机会。

预计犬类市场将在2024年占据最大市场份额,这得益于宠物犬拥有率的上升和动物保健支出的增加。犬类容易罹患皮肤病,如过敏、真菌感染疾病和体外寄生虫感染疾病,需频繁进行皮肤病治疗。宠物人性化趋势和对高端兽医护理的需求进一步支撑了市场的成长。此外,包括生物製药和标靶单株抗体疗法在内的皮肤病治疗领域的进步,正在改善犬类的治疗效果,并巩固该领域在市场上的主导地位。

由于给药简便且饲主依从性良好,预计皮下注射给药领域将在预测期内以最快的速度成长。越来越多的兽医建议全身治疗而非局部治疗,以及针对感染疾病的新型单株抗体的持续开发,推动了需求的成长。此外,针对感染疾病的单株抗体技术创新也进一步推动了兽用单株抗体市场中该领域的成长。

Cytopoint 预计将在 2024 年占据最大的市场份额,因为它是首个也是唯一一个获得 FDA 和 EMA核准的用于治疗犬类异位性皮肤炎的单株抗体疗法。此外,犬类异位性皮肤炎的高发生率也增加了 Cytopoint 的需求,因为它疗效可靠、安全性高,且兽医采用率不断提高。饲主投资先进兽医治疗的意愿日益增强,进一步推动了市场成长。

随着犬类异位性皮肤炎等慢性疾病的盛行率不断上升,皮肤病学领域在2024年占据了最大的市场份额。此外,人们对先进治疗方案的认识日益加深,例如硕腾公司(美国)的Cytopoint,因其疗效持久、副作用极小,在治疗犬类过敏性皮肤炎和异位性皮肤炎方面获得了显着的关注。人们在宠物医疗保健方面支出意愿的增强,进一步推动了该市场的成长。

预计兽医医院/专科中心将以最快的速度成长,这得益于兽医就诊量的成长以及专业宠物医疗服务的普及。这些机构提供全面的治疗方案,包括先进的诊断、处方药以及针对各种疾病的手术。此外,宠物保险涵盖皮肤病治疗,鼓励饲主主人寻求兽医护理,从而推动了该领域的需求。

预计北美将在2024年占据最大的市场份额,这得益于其完善的动物保健基础设施和较高的宠物拥有率。该地区拥有众多大型市场参与企业,他们正在投资创新单株抗体疗法的研发。宠物健康意识的增强和兽医支出的增加也推动了市场的成长。对高端宠物照护产品的需求不断增长,也推动了北美在全球动物单株抗体市场的主导地位。

本报告研究了全球兽医单株抗体市场,提供了按动物类型、产品、给药途径、治疗领域、最终用户、区域趋势和公司简介分類的市场资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 影响客户业务的趋势/中断

- 定价分析

- 供应链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 专利分析

- 贸易分析

- 2025-2026年主要会议和活动

- 监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 未满足的需求/最终用户期望

- 报销分析

- 管道分析

- AI/GEN AI对动物单株抗体市场的影响

- 2025年美国关税的影响

6. 动物单株抗体市场(依动物类型)

- 介绍

- 犬科

- 猫科动物

- 其他的

第七章动物单株抗体市场(依产品)

- 介绍

- Lokivetmab(Cytopoint)

- bedinvetomab(Librera)

- furunevetomab(Sorrencia)

- 犬小病毒单株抗体(CPMA)

- 吉尔贝特马布

- 其他的

第 8 章:动物单株抗体市场(依给药途径)

- 介绍

- 皮下给药

- 静脉注射

- 口服

9. 动物单株抗体市场(依治疗领域)

- 介绍

- 皮肤科

- 疼痛管理

- 感染疾病

- 瘤

- 其他的

第 10 章。动物单株抗体市场(按最终用户)

- 介绍

- 兽医院/专科中心

- 兽医诊所

- 兽医研究和学术机构

- 其他的

第 11 章:动物单株抗体市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 荷兰

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 纽西兰

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 宠物和食用动物数量的增加推动了市场

- 中东和非洲宏观经济展望

第十二章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2022-2024年收益份额分析

- 2024年市占率分析

- 品牌/产品比较

- 估值和财务指标

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十三章:公司简介

- 主要参与企业

- ZOETIS SERVICES LLC

- ELANCO

- MERCK & CO., INC.

- ANIMAB

- 其他公司

- VAXXINOVA INTERNATIONAL BV

- CEVA LOGISTICS

- MABGENESIS INC.

- DECHRA

- BIOGENESIS BAGO

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- VIRBAC

- BIOVETA, AS

- NIPPON ZENYAKU KOGYO CO., LTD.

第十四章 附录

The global veterinary monoclonal antibodies market is projected to reach USD 3.06 billion by 2030, from USD 1.70 billion in 2025, with a CAGR of 12.4%. The market is experiencing significant growth, driven by the expanding companion animal population and rising pet ownership. Growing concerns about chronic diseases have further boosted the demand for veterinary treatments. Government and animal welfare organizations actively promote awareness campaigns, encouraging early diagnosis and treatment of dermatological conditions in both pets and farm animals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million/billion) |

| Segments | Animal Type, Product, Therapy Area, Route of Administration, End user |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

However, the market faces challenges such as rising pet care costs, which can limit treatment adoption. Furthermore, strict regulatory guidelines and lengthy approval times for drugs further restrain market growth. Despite these hurdles, expanding therapeutic indications beyond dermatology and osteoarthritis continues to create new market opportunities.

"By animal type, the canine segment held the highest share in 2024."

The canine segment held the largest market share in 2024, driven by rising pet dog ownership and increasing spending on animal healthcare. Dogs are highly prone to skin conditions such as allergies, fungal infections, and ectoparasitic infestations, which require frequent dermatological treatments. The growing trend of pet humanization and the demand for premium veterinary care further support market growth. Additionally, advancements in dermatological treatments, including biologics and targeted monoclonal antibody therapies, improve treatment outcomes for dogs, solidifying the segment's dominance in the market.

"By route of administration, the subcutaneous segment is projected to record the highest CAGR between 2025 and 2030."

The subcutaneous segment is expected to grow at the fastest rate during the forecast period due to its ease of administration and better pet owner compliance. Rising veterinary recommendations for systemic treatments over topical solutions and the ongoing development of new monoclonal antibodies targeting infectious diseases are increasing demand. Moreover, innovations in monoclonal antibodies targeting infectious diseases further support the segment's growth in the veterinary monoclonal antibodies market.

"By product, cytopoint was the leading segment in 2024."

The cytopoint segment held the largest market share in 2024, driven by its status as the first and only FDA- and EMA-approved monoclonal antibody therapy for treating canine atopic dermatitis. Additionally, the high prevalence of atopic dermatitis in dogs has increased demand for cytopoint due to its proven efficacy, safety profile, and rising adoption by veterinarians. The growing willingness of pet owners to invest in advanced veterinary treatments has further fueled market growth.

"By therapy type, dermatology surpassed other segments in 2024."

The dermatology segment held the largest market share in 2024 due to the rising prevalence of chronic diseases such as atopic dermatitis in dogs. Additionally, growing awareness of advanced treatment options like Cytopoint by Zoetis (US) has gained significant traction due to its long-lasting relief and minimal side effects in treating allergic and atopic dermatitis in dogs. The willingness to spend on pet healthcare has further driven this market growth.

"By end user, veterinary hospitals/specialty centers are expected to exhibit the fastest growth during the forecast period."

Veterinary hospitals/specialty centers are expected to grow at the fastest rate, fueled by the rise in veterinary visits and the availability of specialized pet healthcare services. These facilities offer comprehensive treatment options, including advanced diagnostics, prescription medications, and surgical procedures for various conditions. Additionally, pet insurance coverage for dermatological treatments encourages pet owners to seek veterinary care, boosting demand in this segment.

"North America accounted for the largest share in 2024."

North America held the largest market share in 2024, supported by a well-established veterinary healthcare infrastructure and high pet ownership rates. The region has a strong presence of leading market players investing in R&D for innovative monoclonal antibody therapies. Rising awareness about pet health, along with increasing spending on veterinary care, also drives market growth. The growing demand for premium pet care products further contributes to North America's dominance in the global veterinary monoclonal antibodies market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 - 75%, Tier 2 - 15%, and Tier 3 - 10%

- By Designation: C-level - 30%, D-level - 23%, and Other Designations - 47%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 25%, Latin America - 13%, and Middle East & Africa - 7%

The major players operating in the veterinary monoclonal antibodies market are Zoetis Services LLC (US), Elanco (US), and Merck & Co., Inc. (US).

Research Coverage

This report examines the veterinary monoclonal antibodies market based on animal type, product, therapy area, route of administration, end user, and region. It also considers factors such as drivers and restraints that influence market growth. The report highlights opportunities and challenges within the market and offers details about the competitive landscape for market leaders. Additionally, it analyzes micro markets concerning their individual growth trends and forecasts the revenue of market segments across five main regions and their respective countries.

Reasons to Buy this Report

The report can assist both established firms and new or smaller companies in understanding the market dynamics, which can help them increase their market share. Companies purchasing the report may employ one or a combination of the five strategies listed below.

This report provides insights into the following points:

- Analysis of key drivers (increased prevalence of chronic diseases in animals, innovation in monoclonal antibodies targeting infectious diseases, rise in companion animal population and pet ownership, growth in veterinary healthcare expenditure), restraints (regulatory hurdles and long approval timelines, high cost of development and treatment), opportunities (expanding therapeutic indications beyond dermatology and osteoarthritis, novel administration routes for monoclonal antibodies, rising strategic developments among market players in development of veterinary monoclonal antibodies), and challenges (emerging safety concerns and adverse events reporting, and limited species-specific knowledge) influencing the growth of veterinary monoclonal antibodies market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the veterinary monoclonal antibodies market

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of monoclonal antibody treatments across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the veterinary monoclonal antibodies market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the veterinary monoclonal antibodies market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 EPIDEMIOLOGY-BASED APPROACH

- 2.2.3 COMPANY INVESTOR PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.2.5 BOTTOM-UP APPROACH

- 2.2.6 PRIMARY INTERVIEWS

- 2.3 GROWTH RATE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VETERINARY MONOCLONAL ANTIBODIES MARKET OVERVIEW

- 4.2 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE AND COUNTRY

- 4.3 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2025 VS. 2030

- 4.4 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- 4.5 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2025 VS. 2030 (USD MILLION)

- 4.6 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2025 VS. 2030 (USD MILLION)

- 4.7 VETERINARY MONOCLONAL ANTIBODIES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases in animals

- 5.2.1.2 Innovations in monoclonal antibodies targeting infectious diseases

- 5.2.1.3 Rise in companion animal population and pet ownership

- 5.2.1.4 Growth in veterinary healthcare expenditure

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory hurdles and long approval timelines

- 5.2.2.2 High cost of development and treatment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding therapeutic indications beyond dermatology and osteoarthritis

- 5.2.3.2 Novel administration routes for monoclonal antibodies

- 5.2.3.3 Evolving landscape of strategic collaborations and acquisitions

- 5.2.4 CHALLENGES

- 5.2.4.1 Emerging safety concerns and adverse event reporting

- 5.2.4.2 Limited species-specific knowledge

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE SELLING PRICE, BY KEY PLAYER

- 5.4.2 INDICATIVE SELLING PRICE, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Hybridoma technology

- 5.8.1.2 Recombinant antibody production

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Long-acting injectables

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 RNA-based therapies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TREND

- 5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY FRAMEWORK

- 5.12.1.1 North America

- 5.12.1.2 Europe

- 5.12.1.3 Asia Pacific

- 5.12.1.4 Latin America

- 5.12.1.5 Middle East & Africa

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1 REGULATORY FRAMEWORK

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.15 UNMET NEEDS/END-USER EXPECTATIONS

- 5.16 REIMBURSEMENT ANALYSIS

- 5.17 PIPELINE ANALYSIS

- 5.18 IMPACT OF AI/GEN AI IN VETERINARY MONOCLONAL ANTIBODIES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN VETERINARY MONOCLONAL ANTIBODIES

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.19 IMPACT OF 2025 US TARIFF

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE

- 6.1 INTRODUCTION

- 6.2 CANINES

- 6.2.1 INCREASING PREVALENCE OF OSTEOARTHRITIS AND CANINE ATOPIC DERMATITIS TO BOLSTER GROWTH

- 6.3 FELINES

- 6.3.1 GROWING RECOGNITION OF OSTEOARTHRITIS IN CATS AND SUCCESSFUL LAUNCH OF SOLENSIA TO FUEL MARKET

- 6.4 OTHER ANIMALS

7 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 LOKIVETMAB (CYTOPOINT)

- 7.2.1 INCREASING PREVALENCE OF ATOPIC DERMATITIS IN DOGS TO PROMOTE GROWTH

- 7.3 BEDINVETMAB (LIBRELA)

- 7.3.1 NEED FOR BETTER PAIN MANAGEMENT SOLUTIONS TO EXPEDITE GROWTH

- 7.4 FRUNEVETMAB (SOLENSIA)

- 7.4.1 ABILITY TO IMPROVE MOBILITY AND COMFORT IN AGING CATS TO AID GROWTH

- 7.5 CANINE PARVOVIRUS MONOCLONAL ANTIBODY (CPMA)

- 7.5.1 INCREASING ADOPTION OF CPMA BY VETERINARY CLINICS, SHELTERS, AND PET OWNERS TO SPUR MARKET

- 7.6 GILVETMAB

- 7.6.1 GROWING TREND TOWARD PERSONALIZED, TARGETED TREATMENTS TO FUEL MARKET

- 7.7 OTHER PRODUCTS

8 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION

- 8.1 INTRODUCTION

- 8.2 SUBCUTANEOUS ROUTE OF ADMINISTRATION

- 8.2.1 EASE OF ADMINISTRATION AND LOWER RISK OF TISSUE DAMAGE TO FACILITATE GROWTH

- 8.3 INTRAVENOUS ROUTE OF ADMINISTRATION

- 8.3.1 GROWING USE OF IV IN EMERGENCY CASES AND ONCOLOGY TO BOOST MARKET

- 8.4 ORAL ROUTE OF ADMINISTRATION

- 8.4.1 RISING INNOVATIONS IN LIVESTOCK APPLICATIONS TO ENCOURAGE GROWTH

9 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA

- 9.1 INTRODUCTION

- 9.2 DERMATOLOGY

- 9.2.1 FAVORABLE SAFETY PROFILE AND IMPROVED EFFICACY TO FOSTER GROWTH

- 9.3 PAIN MANAGEMENT

- 9.3.1 RISING NEED FOR ALTERNATIVE DRUG DELIVERY TO AUGMENT GROWTH

- 9.4 INFECTIOUS DISEASES

- 9.4.1 GROWING FOCUS ON REDUCED HOSPITALIZATION TO DRIVE MARKET

- 9.5 ONCOLOGY

- 9.5.1 INCREASING ADVANCEMENTS IN MONOCLONAL ANTIBODY THERAPIES TO ACCELERATE GROWTH

- 9.6 OTHER THERAPY AREAS

10 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 VETERINARY HOSPITALS/SPECIALTY CENTERS

- 10.2.1 RISE IN NUMBER OF VETERINARY SPECIALISTS TO SPEED UP GROWTH

- 10.3 VETERINARY CLINICS

- 10.3.1 GROWING PET OWNERSHIP AND PET CARE SPENDING TO FUEL MARKET

- 10.4 VETERINARY RESEARCH & ACADEMIC INSTITUTES

- 10.4.1 INCREASING COLLABORATIVE RESEARCH EFFORTS TO EXPEDITE GROWTH

- 10.5 OTHER END USERS

11 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Strong R&D and early commercial adoption of monoclonal antibodies to drive market

- 11.2.3 CANADA

- 11.2.3.1 Growing pet adoption to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Established veterinary infrastructure and high rate of pet ownership to aid growth

- 11.3.3 FRANCE

- 11.3.3.1 Growing companion animal population to drive market

- 11.3.4 UK

- 11.3.4.1 Increasing pet ownership to drive the market

- 11.3.5 ITALY

- 11.3.5.1 Strong demand for advanced therapies for companion animals and livestock to augment growth

- 11.3.6 SPAIN

- 11.3.6.1 Ongoing research in veterinary biologics to spur growth

- 11.3.7 NETHERLANDS

- 11.3.7.1 Emerging pet care sector to contribute to growth

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Increasing awareness about pet health and well-established pet insurance system to drive market

- 11.4.3 CHINA

- 11.4.3.1 Expanding pet market to fuel market

- 11.4.4 INDIA

- 11.4.4.1 Growing pet adoption and veterinary shortage to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increased spending on veterinary care to support growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing awareness and adoption of preventive healthcare measures to drive market

- 11.4.7 NEW ZEALAND

- 11.4.7.1 Rising awareness of skin disorders to expedite growth

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Expanding large-scale livestock operations to boost market

- 11.5.3 MEXICO

- 11.5.3.1 Increasing demand for targeted biologics in livestock and pets to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GROWING NUMBER OF COMPANION AND FOOD-PRODUCING ANIMALS TO PROPEL MARKET

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN VETERINARY MONOCLONAL ANTIBODIES MARKET

- 12.3 REVENUE SHARE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6.1 COMPANY VALUATION

- 12.6.2 FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Animal type footprint

- 12.7.5.4 Route of administration footprint

- 12.7.5.5 Therapy area footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ZOETIS SERVICES LLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and approvals

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ELANCO

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches and approvals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MERCK & CO., INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches and approvals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 ANIMAB

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.1 ZOETIS SERVICES LLC

- 13.2 OTHER PLAYERS

- 13.2.1 VAXXINOVA INTERNATIONAL B.V.

- 13.2.2 CEVA LOGISTICS

- 13.2.3 MABGENESIS INC.

- 13.2.4 DECHRA

- 13.2.5 BIOGENESIS BAGO

- 13.2.6 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 13.2.7 VIRBAC

- 13.2.8 BIOVETA, A.S.

- 13.2.9 NIPPON ZENYAKU KOGYO CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.3.1 PRODUCT ANALYSIS

- 14.3.2 COMPANY INFORMATION

- 14.3.3 GEOGRAPHIC ANALYSIS

- 14.3.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 14.3.5 COUNTRY-LEVEL VOLUME ANALYSIS

- 14.3.6 BY PRODUCT TYPE MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 14.3.7 ANY CONSULTS/CUSTOM REQUIREMENTS AS PER CLIENT REQUEST

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 VETERINARY MONOCLONAL ANTIBODIES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 VETERINARY MONOCLONAL ANTIBODIES MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 VETERINARY MONOCLONAL ANTIBODIES MARKET: RISK ANALYSIS

- TABLE 4 PET (DOGS AND CATS) OWNERSHIP IN US, 2024

- TABLE 5 INDICATIVE SELLING PRICE OF VETERINARY MONOCLONAL ANTIBODIES, BY KEY PLAYER, 2024 (USD)

- TABLE 6 INDICATIVE SELLING PRICE OF VETERINARY MONOCLONAL ANTIBODIES, BY REGION, 2022-2024 (USD)

- TABLE 7 VETERINARY MONOCLONAL ANTIBODIES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 VETERINARY MONOCLONAL ANTIBODIES MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 9 IMPORT DATA FOR HS CODE 300214, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 300214, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 11 VETERINARY MONOCLONAL ANTIBODIES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 VETERINARY MONOCLONAL ANTIBODIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 17 KEY BUYING CRITERIA, BY END USER

- TABLE 18 VETERINARY MONOCLONAL ANTIBODIES MARKET: CURRENT UNMET NEEDS

- TABLE 19 VETERINARY MONOCLONAL ANTIBODIES MARKET: PIPELINE ANALYSIS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR VETERINARY MONOCLONAL ANTIBODIES MARKET

- TABLE 22 IMPACT ON COUNTRY/REGION DUE TO US TARIFFS

- TABLE 23 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 24 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR CANINES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR FELINES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR OTHER ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 28 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR LOKIVETMAB, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR BEDINVETMAB, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR FRUNEVETMAB, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR CANINE PARVOVIRUS MONOCLONAL ANTIBODY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR GILVETMAB, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 35 COMMERCIALLY AVAILABLE MONOCLONAL ANTIBODIES WITH SUBCUTANEOUS ROUTE OF ADMINISTRATION

- TABLE 36 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 COMMERCIALLY AVAILABLE MONOCLONAL ANTIBODIES WITH INTRAVENOUS ROUTE OF ADMINISTRATION

- TABLE 38 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR ORAL ROUTE OF ADMINISTRATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 41 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR PAIN MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR OTHER THERAPY AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 47 AVERAGE TOTAL AMOUNT SPENT PER HOUSEHOLD ON PETS IN US, 2023-2024 (USD)

- TABLE 48 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR VETERINARY HOSPITALS/SPECIALTY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR VETERINARY RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 VETERINARY MONOCLONAL ANTIBODIES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (UNIT)

- TABLE 54 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 60 US: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 61 US: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 62 US: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 63 US: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 64 US: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 CANADA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 66 CANADA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 67 CANADA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 68 CANADA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 69 CANADA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (UNIT)

- TABLE 71 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION

- TABLE 72 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 77 GERMANY: KEY MACROECONOMIC INDICATORS

- TABLE 78 GERMANY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 79 GERMANY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 80 GERMANY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 81 GERMANY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 82 GERMANY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 83 FRANCE: KEY MACROECONOMIC INDICATORS

- TABLE 84 FRANCE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 85 FRANCE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 86 FRANCE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 87 FRANCE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 88 FRANCE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 89 UK: KEY MACROECONOMIC INDICATORS

- TABLE 90 UK: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 91 UK: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 92 UK: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 93 UK: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 94 UK: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 ITALY: KEY MACROECONOMIC INDICATORS

- TABLE 96 ITALY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE 2023-2030 (USD MILLION)

- TABLE 97 ITALY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 98 ITALY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 99 ITALY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 100 ITALY: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 101 SPAIN: KEY MACROECONOMIC INDICATORS

- TABLE 102 SPAIN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE 2023-2030 (USD MILLION)

- TABLE 103 SPAIN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 104 SPAIN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 105 SPAIN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 106 SPAIN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 NETHERLANDS: KEY MACROECONOMIC INDICATORS

- TABLE 108 NETHERLANDS: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 109 NETHERLANDS: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 110 NETHERLANDS: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 111 NETHERLANDS: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 112 NETHERLANDS: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 114 REST OF EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 115 REST OF EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 116 REST OF EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (UNIT)

- TABLE 119 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION

- TABLE 120 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 125 JAPAN: KEY MACROECONOMIC INDICATORS

- TABLE 126 JAPAN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 127 JAPAN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 128 JAPAN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 129 JAPAN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 130 JAPAN: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 CHINA: KEY MACROECONOMIC INDICATORS

- TABLE 132 CHINA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 133 CHINA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 134 CHINA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 135 CHINA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 136 CHINA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 INDIA: KEY MACROECONOMIC INDICATORS

- TABLE 138 INDIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 139 INDIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 140 INDIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 141 INDIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 142 INDIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 AUSTRALIA: KEY MACROECONOMIC INDICATORS

- TABLE 144 AUSTRALIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 145 AUSTRALIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 146 AUSTRALIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 147 AUSTRALIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 148 AUSTRALIA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: KEY MACROECONOMIC INDICATORS

- TABLE 150 SOUTH KOREA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 151 SOUTH KOREA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 152 SOUTH KOREA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 NEW ZEALAND: KEY MACROECONOMIC INDICATORS

- TABLE 156 NEW ZEALAND: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 157 NEW ZEALAND: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 158 NEW ZEALAND: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 159 NEW ZEALAND: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 160 NEW ZEALAND: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (UNIT)

- TABLE 167 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 BRAZIL: KEY MACROECONOMIC INDICATORS

- TABLE 174 BRAZIL: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 175 BRAZIL: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 176 BRAZIL: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 177 BRAZIL: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 178 BRAZIL: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 179 MEXICO: KEY MACROECONOMIC INDICATORS

- TABLE 180 MEXICO: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 181 MEXICO: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 182 MEXICO: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 183 MEXICO: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 184 MEXICO: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 REST OF LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 186 REST OF LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 187 REST OF LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (UNIT)

- TABLE 191 MIDDLE EAST & AFRICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN VETERINARY MONOCLONAL ANTIBODIES MARKET

- TABLE 197 VETERINARY MONOCLONAL ANTIBODIES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 198 VETERINARY MONOCLONAL ANTIBODIES MARKET: REGION FOOTPRINT

- TABLE 199 VETERINARY MONOCLONAL ANTIBODIES MARKET: ANIMAL TYPE FOOTPRINT

- TABLE 200 VETERINARY MONOCLONAL ANTIBODIES MARKET: ROUTE OF ADMINISTRATION FOOTPRINT

- TABLE 201 VETERINARY MONOCLONAL ANTIBODIES MARKET: THERAPY AREA FOOTPRINT

- TABLE 202 VETERINARY MONOCLONAL ANTIBODIES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 203 VETERINARY MONOCLONAL ANTIBODIES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 204 VETERINARY MONOCLONAL ANTIBODIES MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 205 VETERINARY MONOCLONAL ANTIBODIES MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 206 VETERINARY MONOCLONAL ANTIBODIES MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 207 ZOETIS SERVICES LLC: COMPANY OVERVIEW

- TABLE 208 ZOETIS SERVICES LLC: PRODUCTS OFFERED

- TABLE 209 ZOETIS SERVICES LLC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 210 ZOETIS SERVICES LLC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 211 ELANCO: COMPANY OVERVIEW

- TABLE 212 ELANCO: PRODUCTS OFFERED

- TABLE 213 ELANCO: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 214 ELANCO: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 215 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 216 MERCK & CO., INC.: PRODUCTS OFFERED

- TABLE 217 MERCK & CO., INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 218 MERCK & CO., INC.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 219 ANIMAB: COMPANY OVERVIEW

- TABLE 220 ANIMAB: PRODUCTS OFFERED

- TABLE 221 ANIMAB: DEALS, JANUARY 2022-JUNE 2025

- TABLE 222 VAXXINOVA INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 223 CEVA LOGISTICS: COMPANY OVERVIEW

- TABLE 224 MABGENESIS INC.: COMPANY OVERVIEW

- TABLE 225 DECHRA: COMPANY OVERVIEW

- TABLE 226 BIOGENESIS BAGO: COMPANY OVERVIEW

- TABLE 227 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 228 VIRBAC: COMPANY OVERVIEW

- TABLE 229 BIOVETA, A.S.: COMPANY OVERVIEW

- TABLE 230 NIPPON ZENYAKU KOGYO CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 VETERINARY MONOCLONAL ANTIBODIES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 VETERINARY MONOCLONAL ANTIBODIES MARKET: YEARS CONSIDERED

- FIGURE 3 VETERINARY MONOCLONAL ANTIBODIES MARKET: RESEARCH DESIGN

- FIGURE 4 VETERINARY MONOCLONAL ANTIBODIES MARKET: KEY PRIMARY SOURCES

- FIGURE 5 VETERINARY MONOCLONAL ANTIBODIES MARKET: INSIGHTS FROM PRIMARIES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY-SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND-SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 9 VETERINARY MONOCLONAL ANTIBODIES MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS, 2024

- FIGURE 10 MONOCLONAL ANTIBODIES IN ANIMAL HEALTH: MARKET SIZE ESTIMATION

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 BOTTOM-UP APPROACH

- FIGURE 13 VETERINARY MONOCLONAL ANTIBODY MARKET: CAGR PROJECTIONS

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF VETERINARY MONOCLONAL ANTIBODIES MARKET

- FIGURE 21 INCREASING PREVALENCE OF CHRONIC AND ACUTE DISEASES TO DRIVE MARKET

- FIGURE 22 CANINES SEGMENT AND US LED NORTH AMERICA MARKET IN 2024

- FIGURE 23 CANINES SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 24 LOKIVETMAB (CYTOPOINT) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 25 SUBCUTANEOUS ROUTE OF ADMINISTRATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 26 DERMATOLOGY SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 27 FRANCE TO REGISTER HIGHEST GROWTH IN VETERINARY MONOCLONAL ANTIBODIES MARKET FROM 2025 TO 2030

- FIGURE 28 VETERINARY MONOCLONAL ANTIBODIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 NEW REVENUE POCKETS FOR PLAYERS IN VETERINARY MONOCLONAL ANTIBODIES MARKET

- FIGURE 30 VETERINARY MONOCLONAL ANTIBODIES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 VETERINARY MONOCLONAL ANTIBODIES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 VETERINARY MONOCLONAL ANTIBODIES MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 33 VETERINARY MONOCLONAL ANTIBODIES MARKET: PATENT ANALYSIS, JANUARY 2014-MAY 2025

- FIGURE 34 TOP APPLICANTS FOR VETERINARY MONOCLONAL ANTIBODIES PATENTS, JANUARY 2014-MAY 2025

- FIGURE 35 VETERINARY MONOCLONAL ANTIBODIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 37 KEY BUYING CRITERIA, BY END USER

- FIGURE 38 VETERINARY MONOCLONAL ANTIBODIES MARKET: AI USE CASES

- FIGURE 39 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: DOG POPULATION GROWTH, BY COUNTRY, 2024

- FIGURE 41 ASIA PACIFIC: CAT POPULATION GROWTH, BY COUNTRY, 2024

- FIGURE 42 REVENUE SHARE ANALYSIS OF TOP THREE PLAYERS IN VETERINARY MONOCLONAL ANTIBODIES MARKET, 2023-2024

- FIGURE 43 VETERINARY MONOCLONAL ANTIBODIES MARKET SHARE ANALYSIS, 2024

- FIGURE 44 US: VETERINARY MONOCLONAL ANTIBODIES MARKET SHARE ANALYSIS, 2024

- FIGURE 45 RANKING OF KEY PLAYERS IN VETERINARY MONOCLONAL ANTIBODIES MARKET, 2024

- FIGURE 46 VETERINARY MONOCLONAL ANTIBODIES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 VETERINARY MONOCLONAL ANTIBODIES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 VETERINARY MONOCLONAL ANTIBODIES MARKET: COMPANY FOOTPRINT

- FIGURE 51 VETERINARY MONOCLONAL ANTIBODIES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 ZOETIS SERVICES LLC: COMPANY SNAPSHOT (2024)

- FIGURE 53 ELANCO: COMPANY SNAPSHOT (2024)

- FIGURE 54 MERCK & CO., INC.: COMPANY SNAPSHOT (2024)