|

市场调查报告书

商品编码

1822293

全球感测器贴片市场(按技术、穿戴式装置类型、产品类型、应用、最终用途产业和地区划分)- 预测至 2030 年Sensor Patch Market by Wearable Type (Bodywear, Neckwear, Footwear, Wristwear), Product Type (Temperature, Blood Glucose, Blood Pressure, Heart Rate, ECG, Blood Oxygen, and Others), Application, End-use Industry and Region - Global Forecast to 2030 |

||||||

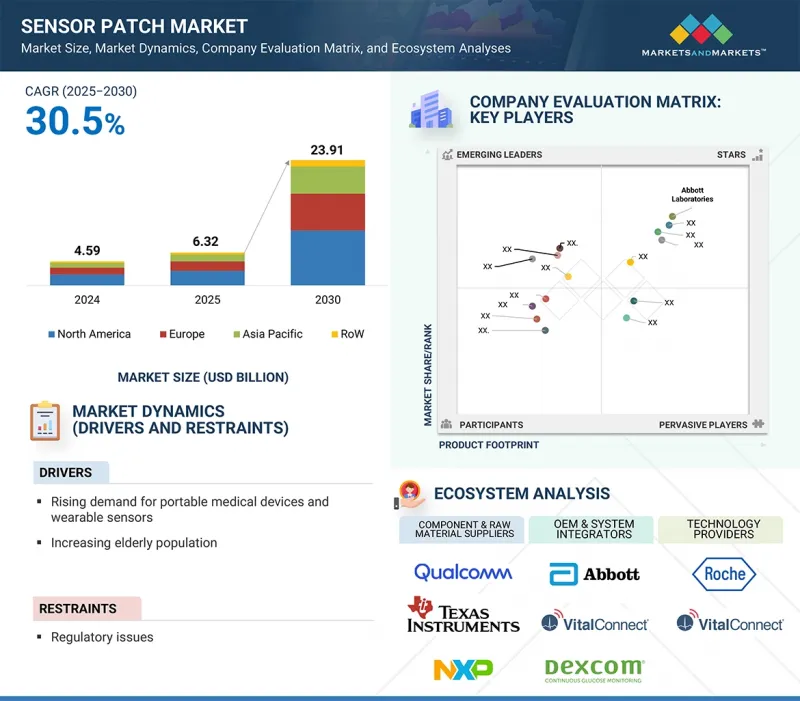

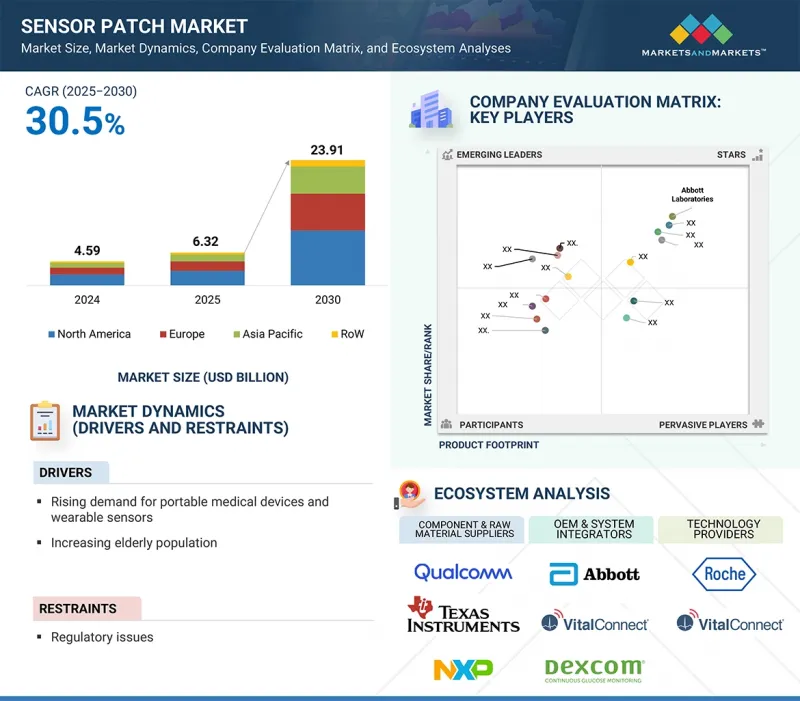

全球感测器贴片市场预计将从 2025 年的 63.2 亿美元成长到 2030 年的 239.1 亿美元,复合年增长率为 30.5%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 按细分市场 | 按技术、按穿戴设备类型、按产品类型、按应用、按最终用途行业、按地区 |

| 目标区域 | 北美、欧洲、亚太地区和其他地区 |

市场成长归因于糖尿病患者越来越多地使用感测器贴片监测血糖浓度、老年人口的增长以及无线行动医疗医疗系统的普及。此外,远端医疗的兴起也推动了市场的成长。穿戴式感测器贴片越来越多地被用于持续监测患者、早产儿、儿童、运动员、健身爱好者以及远离医疗卫生服务的偏远地区的个人的生命体征。

血糖感测器贴片可测量血液或汗水中的血糖值。这些贴片专为糖尿病患者、跑步者、骑乘者、运动员和竞技者设计,用于追踪血糖值。使用胰岛素的糖尿病患者会监测血糖水平,以确定是否需要下次注射胰岛素。血糖感测器贴片可用于血糖值和胆固醇检测,以及药物滥用、感染疾病和怀孕筛检。主要的血糖监测仪和感测器製造商包括美敦力公司(美国)、雅培实验室(美国)和 DexCom, Inc.(美国)。

贴身衣物包括臂饰、胸贴和配备感应器的隐形眼镜。臂饰用于各种医疗保健应用,例如测量和监测血压、体温和心率。这些装置可以透过蓝牙连接到 iOS 或 Android 手机。胸带佩戴在胸部,可在跑步时监测心率。运动员和健身爱好者使用这些设备。其他设备则配备感测器,可以测量汗液中的钠含量并直接透过皮肤测量汗液的产生量。糖尿病患者可以使用由无线晶片组成的智慧隐形眼镜。这些镜片用于监测泪液中的血糖浓度。谷歌公司(美国)和诺华公司(瑞士)正在合作开发可以监测血糖值和矫正视力的智慧隐形眼镜。

中国庞大的人口基数以及政府致力于发展现代医疗体系和相应报销机制的倡议,是推动中国感测器贴片市场成长的关键因素。其他推动中国感测器贴片市场成长的因素包括快速的经济成长、人口老化以及政府致力于改善医疗服务的努力。许多在中国的跨国公司(MNCs)、出口商和製造商正在采取收购和合作等策略,以建立可靠的国内分销和服务基础设施。随着人口老化,包括心臟病在内的各种疾病的发生率预计将大幅上升。

本报告研究了全球感测器贴片市场,并按技术、可穿戴类型、产品类型、应用、最终用途行业、区域趋势和公司概况对市场进行了细分。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 价值链分析

- 生态系分析

- 影响客户业务的趋势/中断

- 定价分析

- 技术分析

- 案例研究分析

- 投资金筹措场景

- 生成式人工智慧/人工智慧对感测器贴片市场的影响

- 专利分析

- 贸易分析

- 主要相关人员和采购标准

- 波特五力分析

- 2025-2026年主要会议和活动

- 监管现状和标准

- 2025年美国关税对感测器贴片市场的影响

6. 感测器贴片市场(按技术)

- 介绍

- 电流测量

- 电导率测量

- 电位器

7. 感测器贴片市场(依穿戴式装置类型)

- 介绍

- 腕饰

- 鞋类

- 领带

- 贴身衣物

第八章感测器贴片市场(依产品类型)

- 介绍

- 体温感光元件贴片

- 血糖感测器贴片

- 血压/血流感测器贴片

- 心率感测器贴片

- ECG 感测器贴片

- 氧气感测器贴片

- 其他的

第九章感测器贴片市场(按应用)

- 介绍

- 监控

- 诊断

- 治疗

第 10 章。感测器贴片市场(按最终用途行业)

- 介绍

- 卫生保健

- 健身与运动

第 11 章感测器贴片市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他的

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他的

- 其他地区

- 南美洲

- 中东

- 非洲

第十二章 竞争格局

- 概述

- 主要参与企业所采用的策略(2021 年 1 月 - 2025 年 8 月)

- 2024年市占率分析

- 2022-2024年收益分析

- 估值和财务指标

- 品牌比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争情境和趋势

第十三章:公司简介

- 主要参与企业

- ABBOTT LABORATORIES

- MEDTRONIC

- DEXCOM, INC.

- IRHYTHM INC.

- TEXAS INSTRUMENTS INCORPORATED

- MASIMO

- GENTAG, INC.

- KONINKLIJKE PHILIPS NV

- SENSEONICS, INC.

- BOSTON SCIENTIFIC CORPORATION

- 其他公司

- LIFESIGNALS

- VITALCONNECT

- BIOLINQ INCORPORATED

- NANOSONIC, INC.

- G TECH MEDICAL

- SMARTCARDIA INC.

- VIVALNK, INC.

- EPICORE BIOSYSTEMS, INC.

- VPATCH CARDIO PTY LTD

- WEAROPTIMO

- MAKANISCIENCE.NET

- LIEF THERAPEUTICS

- COVESTRO AG

- BIOINTELLISENSE, INC.

- THERANICA BIO-ELECTRONICS LTD.

第十四章 附录

The global sensor patch market is projected to grow from 6.32 billion in 2025 to USD 23.91 billion by 2030, at a CAGR of 30.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product Type, Wearable Type, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth in the market is attributed to the increasing use of sensor patches to monitor glucose levels in individuals with diabetes, the increasing elderly population, and the rising adoption of wireless mobile healthcare systems. Additionally, the growing trend of telehealth is boosting market growth. Wearable sensor patches find increasing opportunities for continuously monitoring patients' vital signs, premature infants, children, athletes, or fitness buffs, and individuals in remote areas far from medical and health services.

"Blood glucose sensor patch segment to account for significant market share in 2030"

Blood glucose sensor patches measure glucose concentration in blood or sweat. These patches are designed for diabetic patients, runners, cyclists, athletes, and players to keep track of their blood glucose levels. Diabetic patients who use insulin monitor their glucose levels in their blood to determine the requirement for the next insulin dose. Blood glucose sensor patches find applications in blood glucose and cholesterol testing, as well as for testing drug abuse, infectious diseases, and pregnancy. Some major manufacturers of blood glucose monitors and blood glucose sensors include Medtronic (US) and Abbott Laboratories. (US), and DexCom, Inc. (US).

"Bodywear segment to capture largest share of sensor patch market throughout forecast period"

Bodywear includes armwear, chest patches, and sensor-based contact lenses. Armwear patches are used for various healthcare applications, such as measuring and monitoring blood pressure, body temperature, and heart rate. These devices can be connected to iOS or Android phones via Bluetooth. Chest straps are worn on the chest to monitor the heart rate while running. Athletes and fitness-conscious people use these devices. Also, some sensors can measure the sodium level in sweat and determine the sweat rate directly from the skin. Smart contact lenses consist of a wireless chip, which diabetes patients use. These lenses are used to monitor the glucose level in tears. Google Inc. (US) and Novartis AG (Switzerland) are working to manufacture smart contact lenses that monitor blood sugar levels and correct vision.

"China to hold largest share of Asia Pacific sensor patch market in 2030"

The presence of a vast population base in China and the implementation of government initiatives focusing on developing a modern healthcare system and corresponding reimbursement facilities are the major factors promoting the growth of the sensor patch market in the country. Other factors driving the sensor patch market in China include fast economic growth, a growing aging population, and government efforts to create better healthcare services. Many multinational corporations (MNCs) exporters and producers in China have adopted strategies such as acquisitions or partnerships that help in reliable domestic distribution and service infrastructure. With the aging population, there would be a considerable increase in the incidence rates of various disorders, including heart diseases.

Extensive primary interviews were conducted with key industry experts in the sensor patch market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to tier 1

companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives, researchers, and members of various sensor patch organizations.

Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), Texas Instruments Incorporated (US), Masimo (US), GENTAG, Inc. (US), Koninklijke Philips N.V. (Netherlands), Senseonics, Inc. (US), and Boston Scientific Corporation (US) are some key players in the sensor patch market.

The study includes an in-depth competitive analysis of these key players in the sensor patch market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the sensor patch market based on wearable type (bodywear, neckwear, footwear, wristwear), product type (temperature, blood glucose, blood pressure, heart rate, ECG, blood oxygen, and other product types (stress monitoring patches, sweat monitoring sensor patches, and position and motion sensor patches), technology (amperometric, potentiometric, conductometric) application (monitoring, diagnostics, medical therapeutics), end-use industry (healthcare, fitness & sports), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the sensor patch market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all companies in the sensor patch ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall sensor patch market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of market dynamics: The report includes drivers (rising demand for portable medical devices and wearable sensors, increasing elderly population, and surging use of sensor patches to monitor glucose levels in individuals with diabetes) restraints (regulatory issues), opportunities (growing adoption of telehealth and high-growth opportunities in the wearable device market), and challenges (issues related to data security due to connected medical devices and design complexities and thermal considerations) influencing the growth of the sensor patch market.

- Product Development/Innovation: The report detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the sensor patch market.

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the sensor patch market across varied regions.

- Market Diversification: It includes exhaustive information about new products and services, untapped geographies, recent developments, and investments in the sensor patch market.

- Competitive Assessment: Details regarding In-depth assessment of market shares, growth strategies of players, and service offerings of leading players, such as Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), Texas Instruments Incorporated (US), Masimo (US), GENTAG, Inc. (US), Koninklijke Philips N.V. (Netherlands), Senseonics, Inc. (US), Boston Scientific Corporation (US) are included in the sensor patch market report.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down approach (supply side)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN SENSOR PATCH MARKET

- 4.2 SENSOR PATCH MARKET FOR HEALTHCARE APPLICATIONS

- 4.3 SENSOR PATCH MARKET IN NORTH AMERICA, BY COUNTRY AND BY PRODUCT

- 4.4 SENSOR PATCH MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for portable medical devices and wearable sensors

- 5.2.1.2 Increasing elderly population

- 5.2.1.3 Increasing use of sensor patches to monitor glucose levels in individuals with diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of telehealth

- 5.2.3.2 High-growth opportunities in wearable device market

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to data security due to connected medical devices

- 5.2.4.2 Design complexities and thermal considerations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF SENSOR PATCHES, BY APPLICATION (USD)

- 5.6.2 AVERAGE SELLING PRICE OF MONITORING & DIAGNOSTICS SENSOR PATCH OFFERED BY THREE KEY PLAYERS (USD)

- 5.6.3 INDICATIVE SELLING PRICE TREND OF SENSOR PATCHES, BY REGION, 2021-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Multiplexed sensor patches

- 5.7.1.2 AI-integrated sensor patch platforms

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Cloud-based data analytics platforms

- 5.7.2.2 Nanotechnology in sensing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Drug delivery systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 COVESTRO COLLABORATES WITH MEDTECH COMPANIES TO DEVELOP SENSOR-BASED WEARABLE PATCHES TO MONITOR VITAL SIGNS

- 5.8.2 MEDHERANT COLLABORATES WITH BAYER TO LEVERAGE TEPI PATCH TECHNOLOGY FOR IMPROVED DRUG DELIVERY

- 5.8.3 DEXCOM PARTNERS WITH QUALCOMM TO ENABLE SEAMLESS DATA TRANSMISSION FROM PATIENTS' HOMES

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 IMPACT OF GEN AI/AI ON SENSOR PATCH MARKET

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE AND STANDARDS

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 2025 US TARIFF IMPACT ON SENSOR PATCH MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.5 EUROPE

- 5.17.6 ASIA PACIFIC

- 5.17.7 IMPACT ON APPLICATION

- 5.17.7.1 Healthcare

- 5.17.7.2 Fitness & sports

6 SENSOR PATCH MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 AMPEROMETRIC

- 6.2.1 AMPEROMETRIC TECHNIQUE-BASED SENSOR PATCH SOLUTIONS: COST-EFFECTIVE AND EASY TO MASS-PRODUCE

- 6.3 CONDUCTOMETRIC

- 6.3.1 CONDUCTOMETRIC TECHNIQUE-BASED SOLUTIONS: SUITABLE FOR BLOOD GLUCOSE MONITORING DEVICES

- 6.4 POTENTIOMETRIC

- 6.4.1 POTENTIOMETRIC-BASED SENSOR PATCHES: MAINLY USED TO MONITOR TOTAL ION CONTENT IN PERSPIRATION

7 SENSOR PATCH MARKET, BY WEARABLE TYPE

- 7.1 INTRODUCTION

- 7.2 WRISTWEAR

- 7.2.1 HIGH DEMAND FOR MEDICAL AND FITNESS PURPOSES - KEY DRIVERS

- 7.3 FOOTWEAR

- 7.3.1 USE IN TRACKING POSITION FOR FITNESS AND MEDICAL PURPOSES TO BOOST MARKET

- 7.4 NECKWEAR

- 7.4.1 USE IN DIAGNOSIS AND TREATMENT OF APHASIA TO BOOST MARKET

- 7.5 BODYWEAR

- 7.5.1 CAN BE USED FOR VARIOUS HEALTHCARE AND FITNESS APPLICATIONS TO BOOST MARKET

8 SENSOR PATCH MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 TEMPERATURE SENSOR PATCHES

- 8.2.1 ADOPTION FOR PATIENT MONITORING AND DIAGNOSTICS PROPELS MARKET GROWTH

- 8.3 BLOOD GLUCOSE SENSOR PATCHES

- 8.3.1 NEED FOR SELF-MONITORING OF GLUCOSE LEVELS TO FUEL DEMAND

- 8.4 BLOOD PRESSURE/FLOW SENSOR PATCHES

- 8.4.1 INCREASING NEED FOR BLOOD PRESSURE MONITORING IN HOSPITALS TO BOOST MARKET

- 8.5 HEART RATE SENSOR PATCHES

- 8.5.1 GROWING INCIDENCES OF HEART-RELATED DISEASES PROPEL DEMAND

- 8.6 ECG SENSOR PATCHES

- 8.6.1 INCREASING DEMAND FOR ECG SENSOR PATCHES FOR QUICK DIAGNOSIS TO BOOST MARKET GROWTH

- 8.7 BLOOD OXYGEN SENSOR PATCHES

- 8.7.1 BLOOD OXYGEN SENSORS FOR ANESTHESIA MONITORING APPLICATION TO WITNESS STEADY GROWTH

- 8.8 OTHERS

- 8.8.1 NEED TO MONITOR STRESS AND ANXIETY SYMPTOMS OF PATIENTS TO BOOST MARKET

9 SENSOR PATCH MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MONITORING

- 9.2.1 RISING ADOPTION OF PORTABLE PATIENT MONITORING DEVICES TO PROPEL MARKET GROWTH

- 9.3 DIAGNOSTICS

- 9.3.1 INCREASING DEMAND FOR IMPROVED DIAGNOSIS TO LEAD TO GROWTH OF MARKET

- 9.4 MEDICAL THERAPEUTICS

- 9.4.1 USE FOR INSULIN DELIVERY TO BOOST MARKET

10 SENSOR PATCH MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 HEALTHCARE

- 10.2.1 HOSPITALS & CLINICS

- 10.2.1.1 Large patient volume and high demand from hospitals to propel adoption

- 10.2.2 HOME CARE

- 10.2.2.1 Growing geriatric population and increasing number of diabetic patients to drive adoption in home care settings

- 10.2.3 DIAGNOSTIC LABORATORIES

- 10.2.3.1 Growing volume of clinic data and rising need to modernize imaging workflows to drive segment

- 10.2.1 HOSPITALS & CLINICS

- 10.3 FITNESS & SPORTS

- 10.3.1 GROWING AWARENESS OF HEALTH AND FITNESS BOOSTS DEMAND FOR SENSOR PATCHES

11 SENSOR PATCH MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Presence of key players that offer sensor patch-based PoC applications to boost market growth

- 11.2.2 CANADA

- 11.2.2.1 Increasing government support likely to escalate growth of market

- 11.2.3 MEXICO

- 11.2.3.1 Use to detect cardiovascular disorders propels market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Monitoring of chronic diseases to accelerate sensor patch market growth

- 11.3.2 FRANCE

- 11.3.2.1 Technological advancements in healthcare systems to drive growth

- 11.3.3 UK

- 11.3.3.1 Rising cardiac diseases and aging population to drive market growth

- 11.3.4 ITALY

- 11.3.4.1 Growing private sector to result in increasing demand for sensor patch

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government initiatives for better healthcare products and services likely to propel market growth

- 11.4.2 JAPAN

- 11.4.2.1 Improved standard of living, rise in health awareness, and surge in aging population - key market drivers

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Improving health infrastructure drives market

- 11.4.4 INDIA

- 11.4.4.1 Growing population accelerates demand for sensor patches for healthcare services

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Emerging economies present significant opportunities for market growth

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Significant government and financial support for adoption of POC testing kits to drive market

- 11.5.2.2 GCC

- 11.5.2.2.1 Saudi Arabia

- 11.5.2.2.2 UAE

- 11.5.2.2.3 Rest of GCC

- 11.5.2.3 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Increasing penetration in medical devices to boost market

- 11.5.1 SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-AUGUST 2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2022-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Type footprint

- 12.7.5.5 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Sensor patch market: Detailed list of startups/SMEs

- 12.8.5.2 Sensor patch market: Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABBOTT LABORATORIES

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 MEDTRONIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 DEXCOM, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 IRHYTHM INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 TEXAS INSTRUMENTS INCORPORATED

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 MASIMO

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 GENTAG, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 KONINKLIJKE PHILIPS N.V.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 SENSEONICS, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 BOSTON SCIENTIFIC CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 ABBOTT LABORATORIES

- 13.2 OTHER PLAYERS

- 13.2.1 LIFESIGNALS

- 13.2.2 VITALCONNECT

- 13.2.3 BIOLINQ INCORPORATED

- 13.2.4 NANOSONIC, INC.

- 13.2.5 G TECH MEDICAL

- 13.2.6 SMARTCARDIA INC.

- 13.2.7 VIVALNK, INC.

- 13.2.8 EPICORE BIOSYSTEMS, INC.

- 13.2.9 VPATCH CARDIO PTY LTD

- 13.2.10 WEAROPTIMO

- 13.2.11 MAKANISCIENCE.NET

- 13.2.12 LIEF THERAPEUTICS

- 13.2.13 COVESTRO AG

- 13.2.14 BIOINTELLISENSE, INC.

- 13.2.15 THERANICA BIO-ELECTRONICS LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SENSOR PATCH MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 COMPANIES AND THEIR ROLE IN SENSOR PATCH ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND OF SENSOR PATCHES, BY APPLICATION (USD)

- TABLE 4 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEMS, BY REGION, 2021-2024 (USD)

- TABLE 5 SENSOR PATCH MARKET: MAJOR PATENTS

- TABLE 6 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 SENSOR PATCH MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATION (%)

- TABLE 9 SENSOR PATCH MARKET: KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 10 SENSOR PATCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 SENSOR PATCH MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 17 EUROPE: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 18 ASIA PACIFIC: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 19 ROW: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 SENSOR PATCH MARKET, BY WEARABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 22 SENSOR PATCH MARKET, BY WEARABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 23 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 24 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 25 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (MILLION UNITS)

- TABLE 26 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION UNITS)

- TABLE 27 TEMPERATURE SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 TEMPERATURE SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 30 NORTH AMERICA: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 31 EUROPE: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 EUROPE: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 ASIA PACIFIC: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 BLOOD GLUCOSE SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 BLOOD GLUCOSE SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 EUROPE: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 EUROPE: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 EUROPE: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 EUROPE: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 HEART RATE SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 HEART RATE SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 EUROPE: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 EUROPE: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 ASIA PACIFIC: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 ECG SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 ECG SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: ECG SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: ECG SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: ECG SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 EUROPE: ECG SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: ECG SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: ECG SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 BLOOD OXYGEN SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 BLOOD OXYGEN SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 EUROPE: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 ASIA PACIFIC: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 OTHER SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OTHER SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 EUROPE: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 84 SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 MONITORING: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 MONITORING: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 DIAGNOSTICS: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 DIAGNOSTICS: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 MEDICAL THERAPEUTICS: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 MEDICAL THERAPEUTICS: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 92 SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 HEALTHCARE: SENSOR PATCH MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 94 HEALTHCARE: SENSOR PATCH MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 HEALTHCARE: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 HEALTHCARE: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: HEALTHCARE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: HEALTHCARE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 FITNESS & SPORTS: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 FITNESS & SPORTS: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: NORTH AMERICA: FITNESS & SPORTS SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: FITNESS & SPORTS SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 SENSOR PATCH MARKET BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 SENSOR PATCH MARKET BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 US: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 US: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 CANADA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 CANADA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 MEXICO: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 MEXICO: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 GERMANY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 FRANCE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 UK: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 UK: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 ITALY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 REST OF EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 CHINA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 JAPAN: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 148 JAPAN: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 ROW: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 ROW: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 ROW: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 158 ROW: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 159 ROW: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 ROW: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 ROW: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ROW: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 SOUTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 GCC: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 GCC: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 AFRICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 SENSOR PATCH MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 174 SENSOR PATCH MARKET SHARE ANALYSIS, 2024

- TABLE 175 SENSOR PATCH MARKET: REGION FOOTPRINT

- TABLE 176 SENSOR PATCH MARKET: PRODUCT FOOTPRINT

- TABLE 177 SENSOR PATCH MARKET: WEARABLE TYPE FOOTPRINT

- TABLE 178 SENSOR PATCH MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 179 SENSOR PATCH MARKET: KEY STARTUPS/SMES

- TABLE 180 SENSOR PATCH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 181 SENSOR PATCH MARKET: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 182 SENSOR PATCH MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 183 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 184 ABBOTT LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ABBOTT LABORATORIES: DEALS

- TABLE 186 MEDTRONIC: COMPANY OVERVIEW

- TABLE 187 MEDTRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 MEDTRONIC: DEALS

- TABLE 189 DEXCOM, INC.: COMPANY OVERVIEW

- TABLE 190 DEXCOM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 DEXCOM, INC.: PRODUCT LAUNCHES

- TABLE 192 IRHYTHM INC.: COMPANY OVERVIEW

- TABLE 193 IRHYTHM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 IRHYTHM INC.: PRODUCT LAUNCHES

- TABLE 195 IRHYTHM TECHNOLOGIES, INC.: DEALS

- TABLE 196 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 197 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 198 MASIMO: COMPANY OVERVIEW

- TABLE 199 MASIMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 MASIMO: DEALS

- TABLE 201 GENTAG, INC.: COMPANY OVERVIEW

- TABLE 202 GENTAG, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 204 KONINKLIJKE PHILIPS N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 KONINKLIJKE PHILIPS N.V.: DEALS

- TABLE 206 SENSEONICS, INC.: COMPANY OVERVIEW

- TABLE 207 SENSEONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 SENSEONICS, INC.: DEALS

- TABLE 209 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 210 BOSTON SCIENTIFIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 BOSTON SCIENTIFIC CORPORATION: DEALS

List of Figures

- FIGURE 1 SENSOR PATCH MARKET SEGMENTATION

- FIGURE 2 SENSOR PATCH MARKET: RESEARCH DESIGN

- FIGURE 3 SENSOR PATCH MARKET: BOTTOM-UP APPROACH

- FIGURE 4 SENSOR PATCH MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 SENSOR PATCH MARKET: TOP-DOWN APPROACH

- FIGURE 6 SENSOR PATCH MARKET: DATA TRIANGULATION

- FIGURE 7 BLOOD GLUCOSE SENSOR PATCHES LEADS MARKET IN 2025

- FIGURE 8 HEALTHCARE TO BE DOMINANT END-USE INDUSTRY OF SENSOR PATCHES IN 2025

- FIGURE 9 SENSOR PATCH MARKET FOR BODYWEAR TO HOLD LARGEST SHARE IN 2030

- FIGURE 10 SENSOR PATCH MARKET FOR DIAGNOSTICS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 SENSOR PATCH MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 12 RISING DEMAND FOR PORTABLE MEDICAL DEVICES AND WEARABLE SENSORS TO BOOST SENSOR PATCH MARKET DURING FORECAST PERIOD

- FIGURE 13 HOMECARE TO HOLD LARGEST SHARE OF SENSOR PATCH MARKET DURING FORECAST PERIOD

- FIGURE 14 US AND NON-WEARABLE DEVICES EXPECTED TO ACCOUNT FOR MAJOR SHARE OF NORTH AMERICAN MARKET IN 2025

- FIGURE 15 SENSOR PATCH MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 SENSOR PATCH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 SENSOR PATCH MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 SENSOR PATCH MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 19 SENSOR PATCH MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 SENSOR PATCH MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 21 SENSOR PATCH MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 SENSOR PATCH MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 SENSOR PATCH MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE OF MONITORING & DIAGNOSTICS SENSOR PATCH OFFERED BY THREE KEY PLAYERS (USD)

- FIGURE 25 INDICATIVE SELLING PRICE TREND OF SENSOR PATCHES, BY REGION, 2021-2024

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2023 TO 2025

- FIGURE 27 SENSOR PATCH MARKET: PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 28 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 901890, BY COUNTRY, 2020-2025 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 SENSOR PATCH MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 31 SENSOR PATCH MARKET: KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 32 SENSOR PATCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 NECKWEAR MARKET TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 34 MARKET FOR HEART RATE SENSOR PATCHES EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 35 MONITORING APPLICATIONS LEAD SENSOR PATCH MARKET IN 2025

- FIGURE 36 SENSOR PATCH MARKET FOR HEALTHCARE TO LEAD IN 2025 AND 2030

- FIGURE 37 NORTH AMERICA TO LEAD SENSOR PATCH MARKET IN 2025

- FIGURE 38 SNAPSHOT: SENSOR PATCH MARKET IN NORTH AMERICA

- FIGURE 39 SNAPSHOT: SENSOR PATCH MARKET IN EUROPE

- FIGURE 40 SNAPSHOT: SENSOR PATCH MARKET IN ASIA PACIFIC

- FIGURE 41 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 42 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022-2024

- FIGURE 43 COMPANY VALUATION

- FIGURE 44 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 45 BRAND COMPARISON

- FIGURE 46 SENSOR PATCH MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 47 SENSOR PATCH MARKET: COMPANY FOOTPRINT

- FIGURE 48 SENSOR PATCH MARKET: COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 49 ABBOTT LABORATORIES: COMPANY SNAPSHOT

- FIGURE 50 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 51 DEXCOM, INC.: COMPANY SNAPSHOT

- FIGURE 52 IRHYTHM INC.: COMPANY SNAPSHOT

- FIGURE 53 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 54 MASIMO: COMPANY SNAPSHOT

- FIGURE 55 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 56 SENSEONICS, INC.: COMPANY SNAPSHOT

- FIGURE 57 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT